- Home sales slow during federal election years, from added uncertainty in the market

- Party or candidate doesn’t matter – just another decision for markets to process

- Sales slow from the July 4 holiday to election day and then rebound immediately

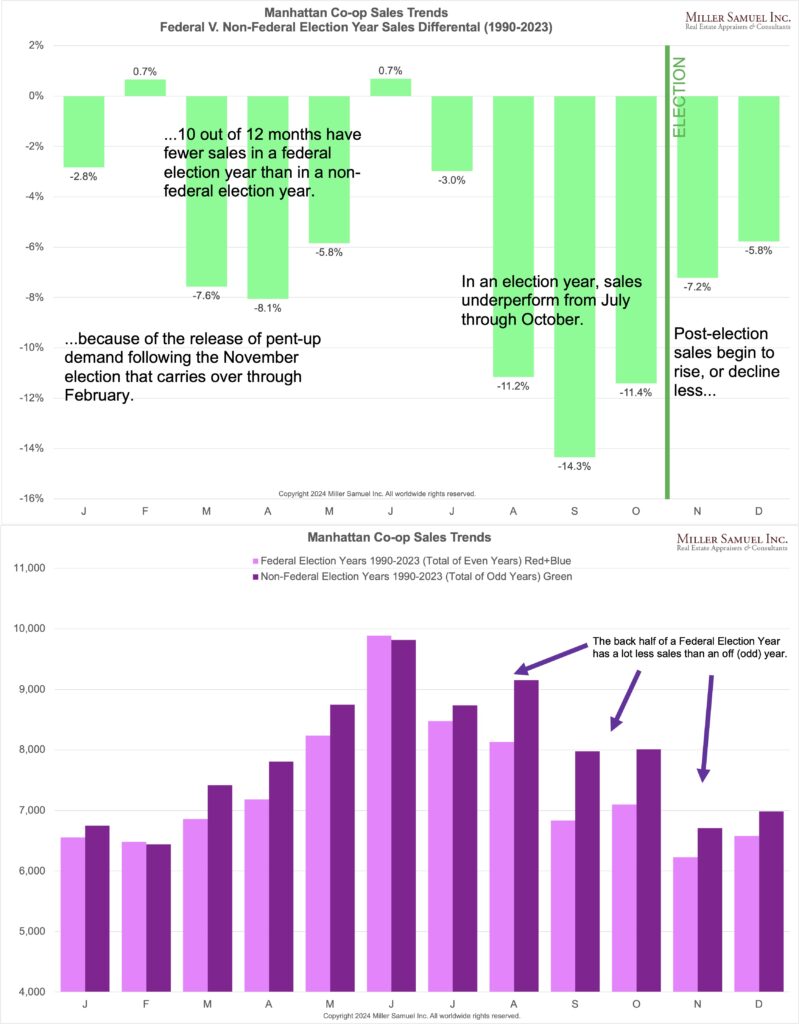

For most of my career, real estate professionals have often said that real estate sales are usually lighter during a federal election year (even years) than in an off-year (odd years).

A few years ago, I set out to confirm this in Manhattan, my local market, by looking at sales patterns back to the financial crisis. At the end of 2023, I decided to go back further circa 1990. The following charts show the result. I selected co-ops for convenience since they don’t suffer the skew seen in condos that tend to be the primary (get it?) focus of new development. Co-op housing stock outnumbers condos 3:1 in Manhattan. Here’s what the results of my effort looked like:

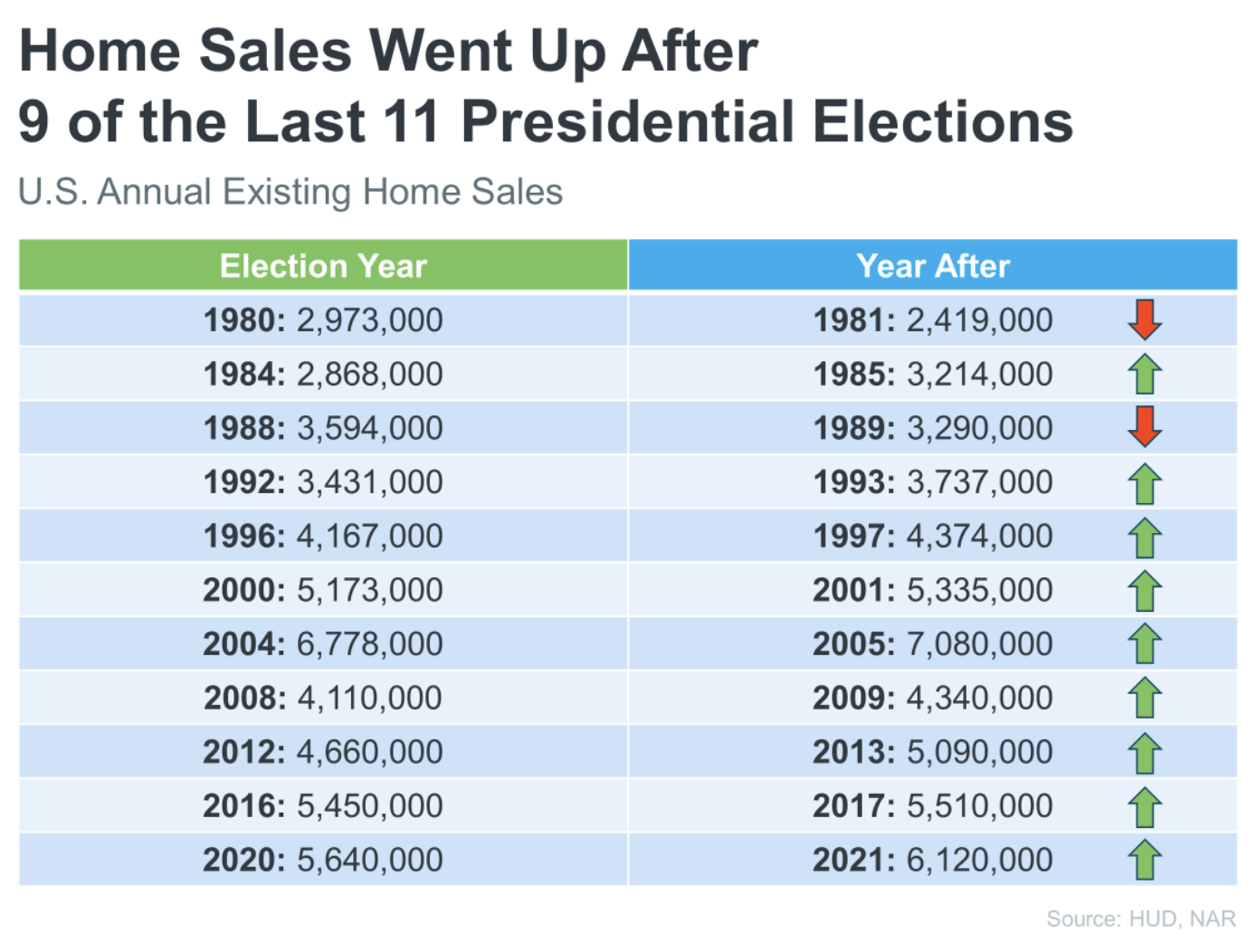

Inman News had an interesting piece provided by the real estate broker marketing site Keeping Current Matters (KCM). They analyzed housing data around election years: Home sales tend to rise after big elections. Can it happen in 2025? When I saw this piece it prompted me to dig out my election analysis as well as share some of their charts.

Sales trends tend to be informative about future price trends and their first chart was compelling. They used existing home sale data by year and found that in 9 of the last 11 presidential elections, sales rose. Their efforts focused on the four-year federal election cycle while I included the midterms for my Manhattan co-op analysis.

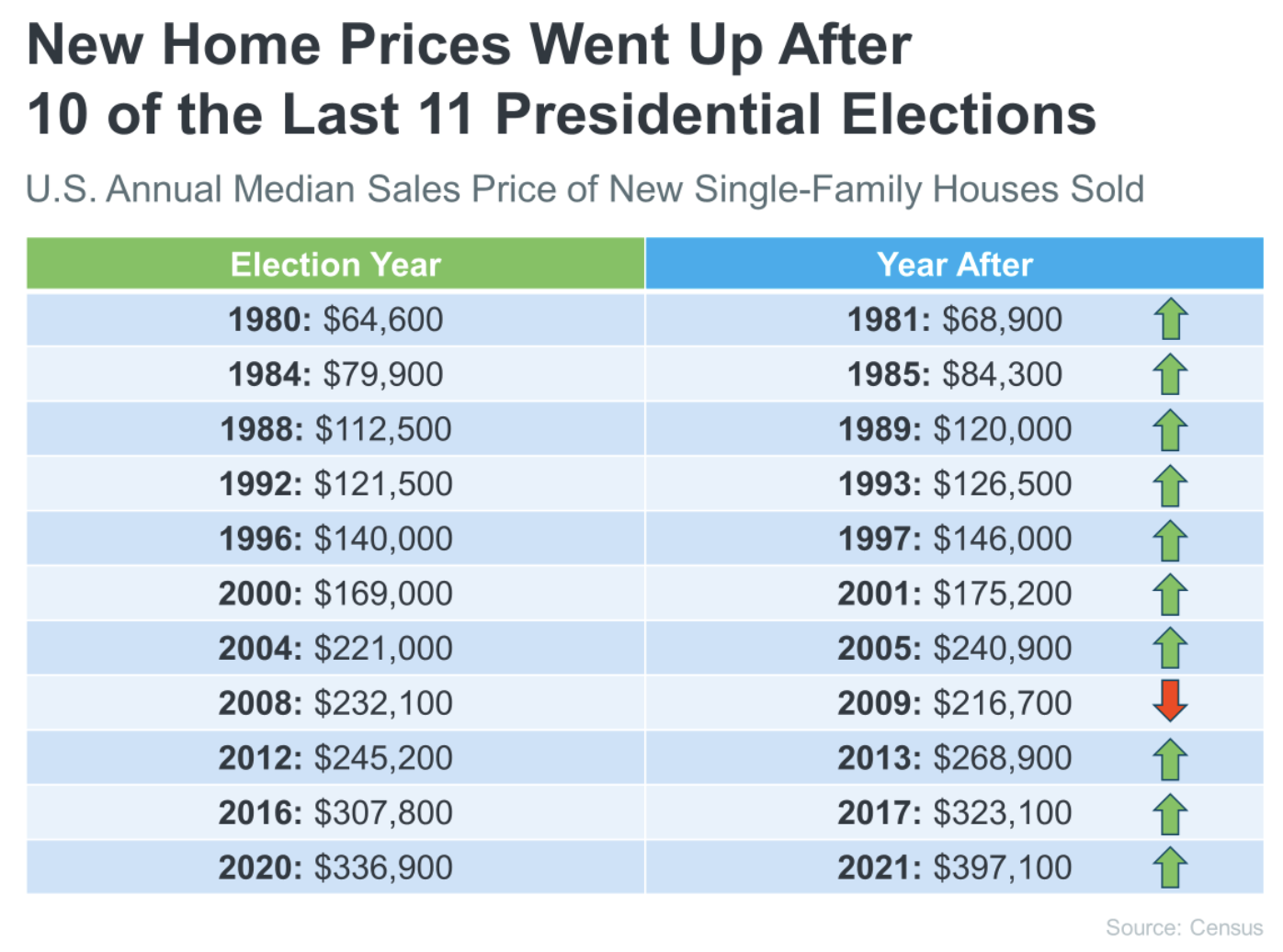

They also looked at price trends for new home sales. However, new home sales only represent about 10% of all sales and supply.

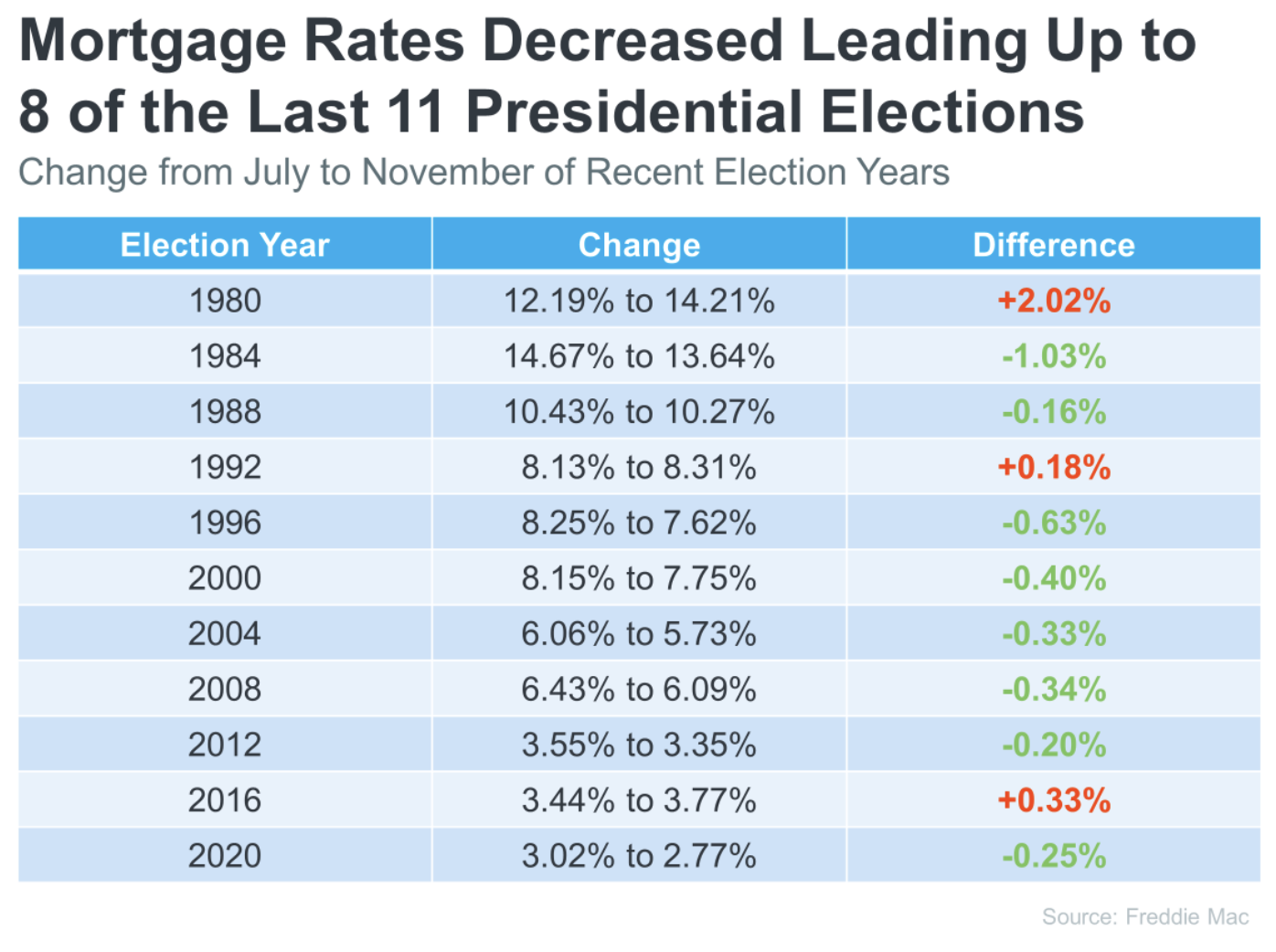

For aspiring conspiracy theorists, it sure looks like there is some substance to the belief that declining mortgage rates tend to occur in election years. This is yet another reason to believe that the Federal Reserve will cut rates this September as two-thirds of economists believe.

What does this mean for the housing market? In the most extreme sense, we are at peak misery as entire real estate-related industries lie dormant waiting for Fed rate cuts. As I said before, even a modest 25-basis point cut is expected to release more than two years of pent-up demand.

I plan to vote early and often for a Fed rate cut.

Did you miss Friday’s Housing Notes?

June 28, 2024

Housing Notes Reads

- BOE Open to August Rate Cut, Sticky Services Prices May be Key: Davies [Central Bank Central]

- 💸 Ruthless Rental Reality [Highest & Best]

- Sales tend to rise after big elections. Can it happen again? [Inman]

![[Podcast] Episode 4: What It Means With Jonathan Miller](https://millersamuel.com/files/2025/04/WhatItMeans.jpeg)