- OBBB Raises The SALT Deduction To $40,000, Reducing Cost Of Homeownership

- The $750 Cap On Mortgage Interest Deductions Is Made Permanent For 1st/2nd Loans

- Those Who Put Less Than 20% Down Can Deduct Mortgage Insurance

The federal government’s One Big Beautiful Bill (OBBB) became law on July 4th, resulting in the most significant transfer of wealth from lower- and middle-income Americans to the wealthy in history. A few weeks ago, I wrote about how the higher end of the housing market is likely to outperform the remainder of the market in the future. Giving the top 20% the most significant tax breaks defies logic because “trickle down economics” has long been wildly overrated. So, as some of my loyal Housing Notes readers might say, “Jonathan, quit being such a downer since this is a housing market newsletter and I don’t need you pontificating about the inherent irresponsibility of OBBB.” Fair enough. Let’s discuss how the OBBB benefits the housing market.

Temporarily Expanded SALT Deduction Cap

The SALT tax, enacted on January 1, 2018, capped the deduction for the combined state and local taxes and property taxes at $10,000. Imagine owning a luxury home in Westchester County, just north of NYC, where annual property taxes of $75,000 are not unusual. That’s an additional $65,000 in exposure on top of SALT, which is not as high as property taxes. The impact of the SALT Tax there was quickly baked into lower housing prices back in 2018-2019, so the expansion of the SALT Tax by an additional $30,000 will bring more homebuyers into the market. It’s not a panacea for reviving housing demand, but in the era of elevated mortgage rates and low inventory, it will help demand by pulling more buyers and sellers into the market.

$750K Cap On Mortgage Interest Deductions Permanent

For years, there has been concern that the federal government would eliminate the tax deduction on mortgage interest rates. The OBBB makes it permanent, which helps clarify the financial picture for consumers. The deduction applies to both first and second mortgages, but not to home equity loans. This is good for promoting stability of the asset.

Mortgage Insurance Deductions Permanent

This deduction was a surprise to me. Most people I know, including my kids, who have owned a total of five homes, did not put down 20% when they bought their homes. Subject to caps on income, borrowers can now deduct mortgage insurance premiums, such as PMI (also including FHA MIP, VA funding fees, and USDA guarantee fees), when they put down less than 20% on their home. The deduction is especially beneficial for first-time buyers, who account for 24% of home purchases, down from the long-term average of 38%.

Final Thoughts

Obligatory disclaimer: When it comes down to it, my Housing Notes readers should consult with their tax attorneys, accountants, and/or mortgage professionals, as I’m not an expert in those realms.

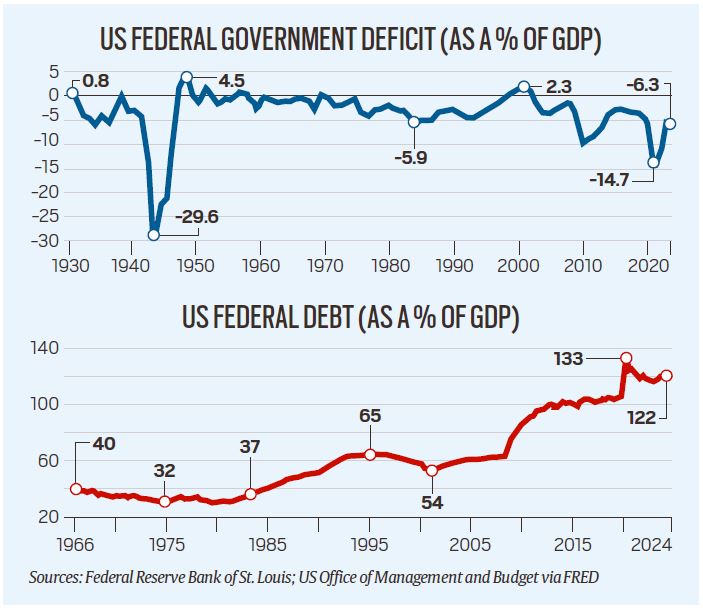

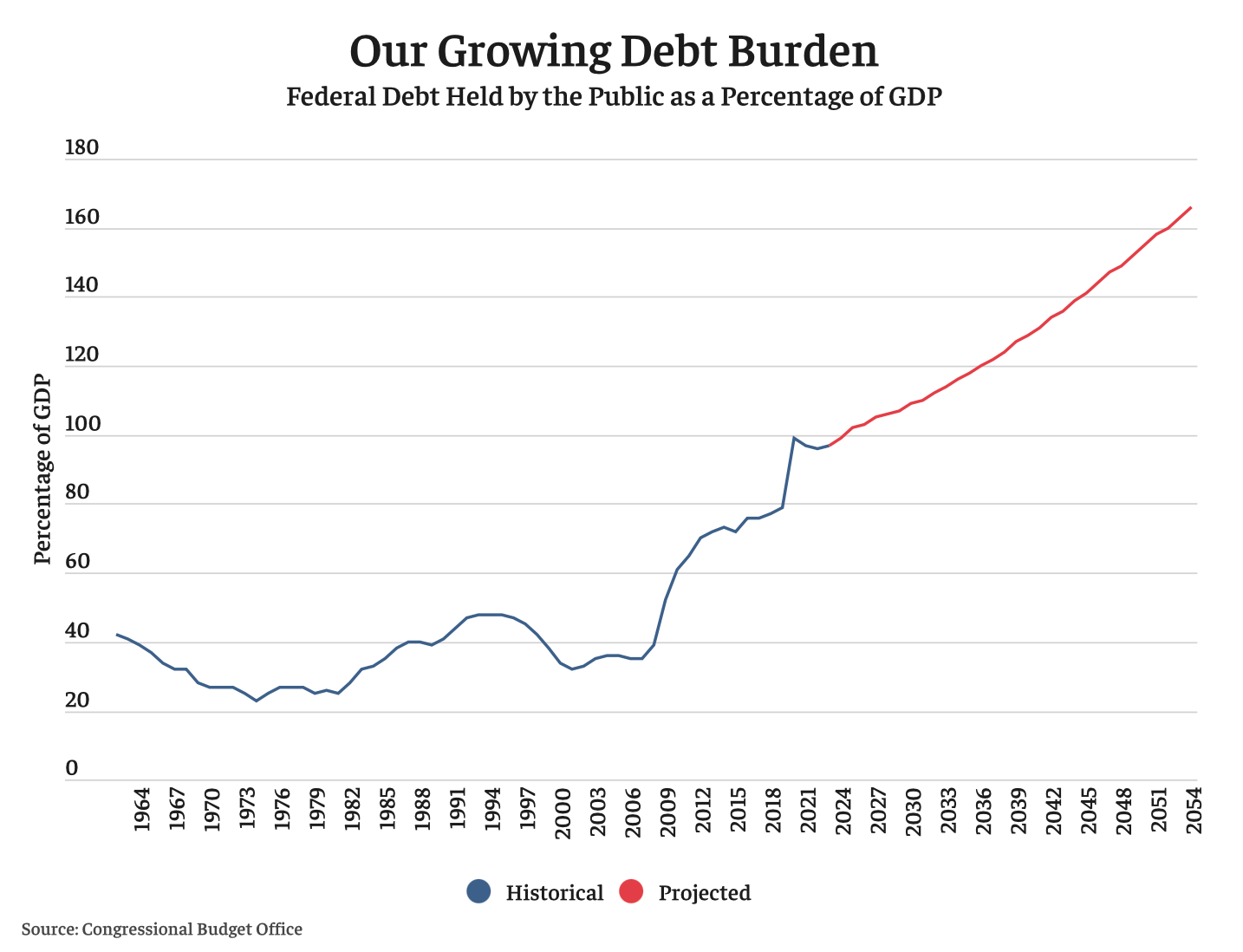

The July 4 OBBB is a doozy that raises taxes on lower and middle-income families but deducts them from high-income families. Trillions will be added to the national debt, with some lower and middle-class voters, who have vague notions that this will benefit them, thinking that it will do so through trickle-down economics. Of course, in the last tax bill in 2017 that saved businesses a significant amount of money, a substantial portion of the savings went to corporate stock buybacks, which do little to benefit the economy. Buybacks surged 52% from the prior year after passage of the 2017 tax law. Companies didn’t hire more workers or make more investments as was promised. This new law will undoubtedly provide benefits to the housing market, but it will likely help keep mortgage rates elevated for an extended period.

The Actual Final Thought – Irregardless of the impact of the Big, Beautiful Tax Bill, it’s still good to celebrate for no real reason whatsoever.

[Podcast] What It Means With Jonathan Miller

The latest episode [Oh, Canada] is just a click away on the prior link or the image below. The podcast feed can be found below for the three platforms we use:

Apple (Douglas Elliman feed) Soundcloud Youtube

[CRE] Lessons Learned: 5 Years After The Pandemic

I’m looking forward to participating in this one – it should be a great discussion, especially with Jonathan Schein as moderator.

Monday Tuesday Mailboxes, Etc. – Sharing reader feedback on Housing Notes.

July 3, 2025: Despite Real Estate’s NYC Election Despondency, Manhattan Sales Continued To Thrive

- Do you have a breakdown on how the final “big beautiful bill” will affect the nyc RE market?

- Jonathan what happened to you? Your new voice is more empathetic, clearer and easier to understand. This is the voice and the guide that many of us will appreciate. Bravo to you for changing up the format and rhe voice to something more easily digestible and understandable.

- You always have the best opening headlines

Did you miss the previous Housing Notes?

July 3, 2025

Despite Real Estate’s NYC Election Despondency, Manhattan Sales Continued To Thrive

Image: Miller Samuel

Housing Notes Reads

- Job loss fears, mortgage rates weigh on housing sentiment [Inman]

- First-Time Home Buyers Are MIA. Landlords Are the Winners [Wall Street Journal]

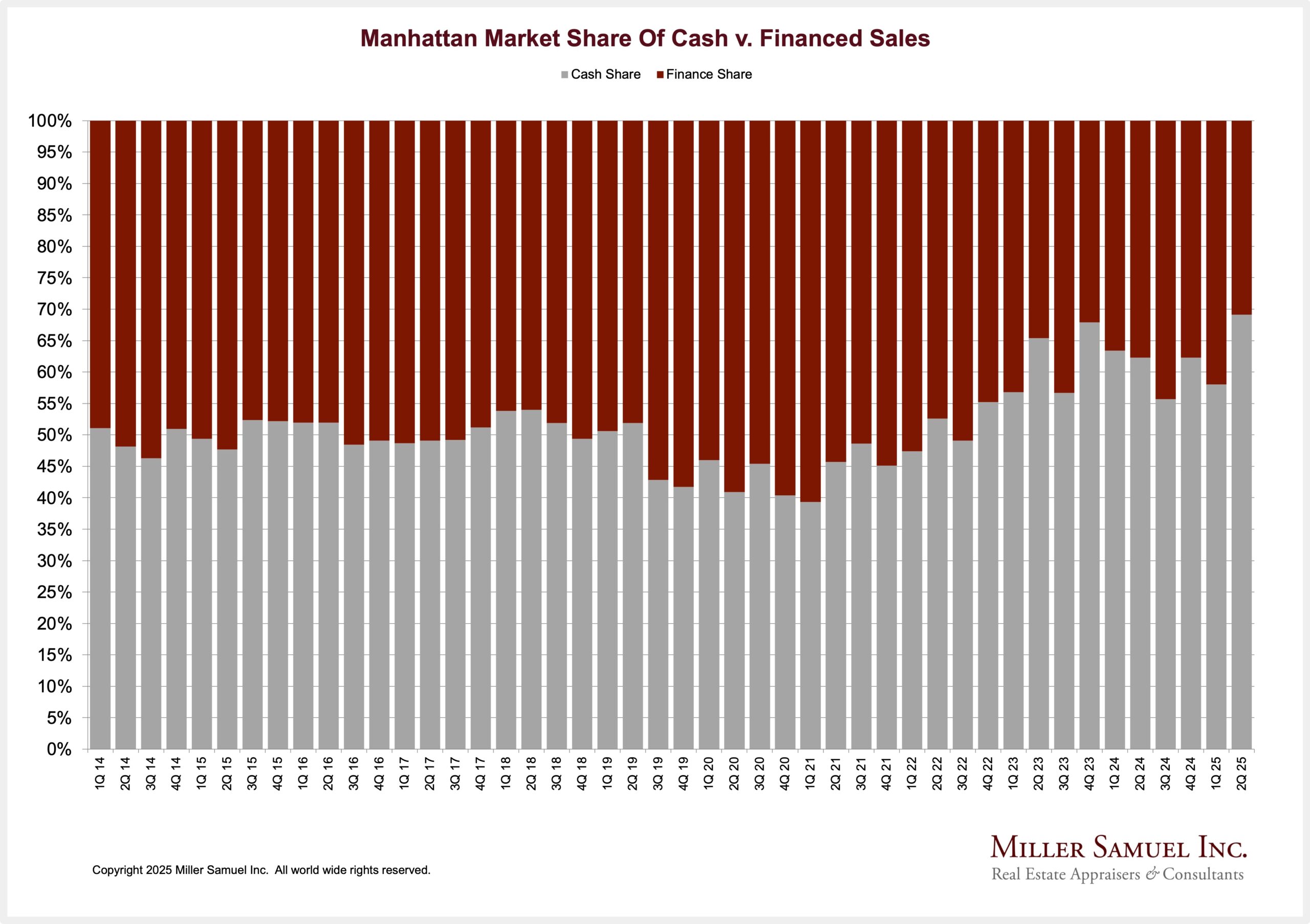

- There’s One Elite Group Propping Up the Manhattan Real Estate Market Right Now—Everyone Else Is Sitting on Their Hands [Realtor.com]

- Indies flex their muscle as the big brokerages get bigger [Real Estate News]

- President Trump Signs Big Beautiful Bill — Here's What It Means For Mortgage And Housing [NMP]

Market Reports

- Elliman Report: Manhattan Sales 2Q 2025 [Miller Samuel]

- Elliman Report: Florida New Signed Contracts 6-2025 [Miller Samuel]

- Elliman Report: New York New Signed Contracts 6-2025 [Miller Samuel]

- Elliman Report May 2025 Manhattan, Brooklyn and Queens Rentals [Douglas Elliman]

- Elliman Report: Florida New Signed Contracts 5-2025 [Miller Samuel]

![[Podcast] Episode 4: What It Means With Jonathan Miller](https://millersamuel.com/files/2025/04/WhatItMeans.jpeg)