- NYC Rents Are Past Peak And With Fed Cuts, Will Likely Weaken This Fall

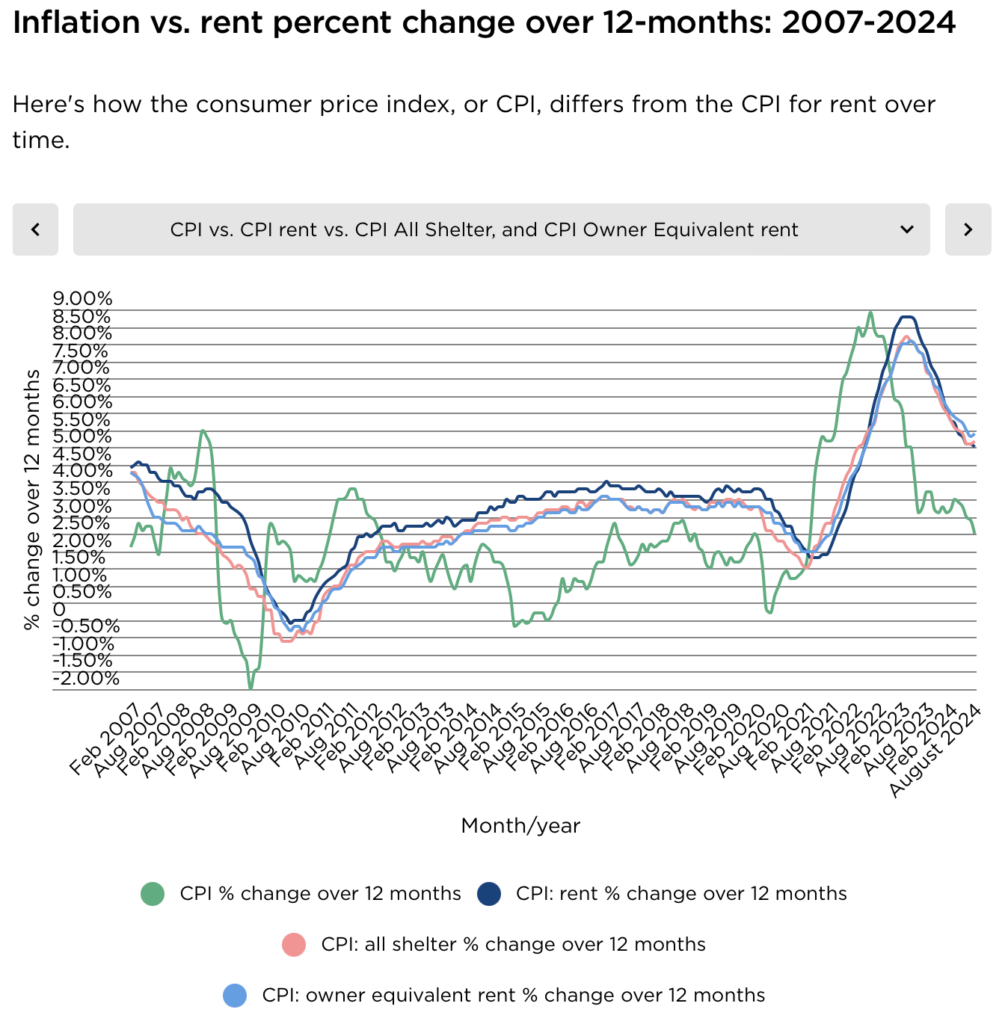

- U.S. Rents Growth Is Cooling, Likely To Soften with Fed Cuts

- The Annual Surge In NYC Sales Contracts Is The Precursor To Fed Cuts

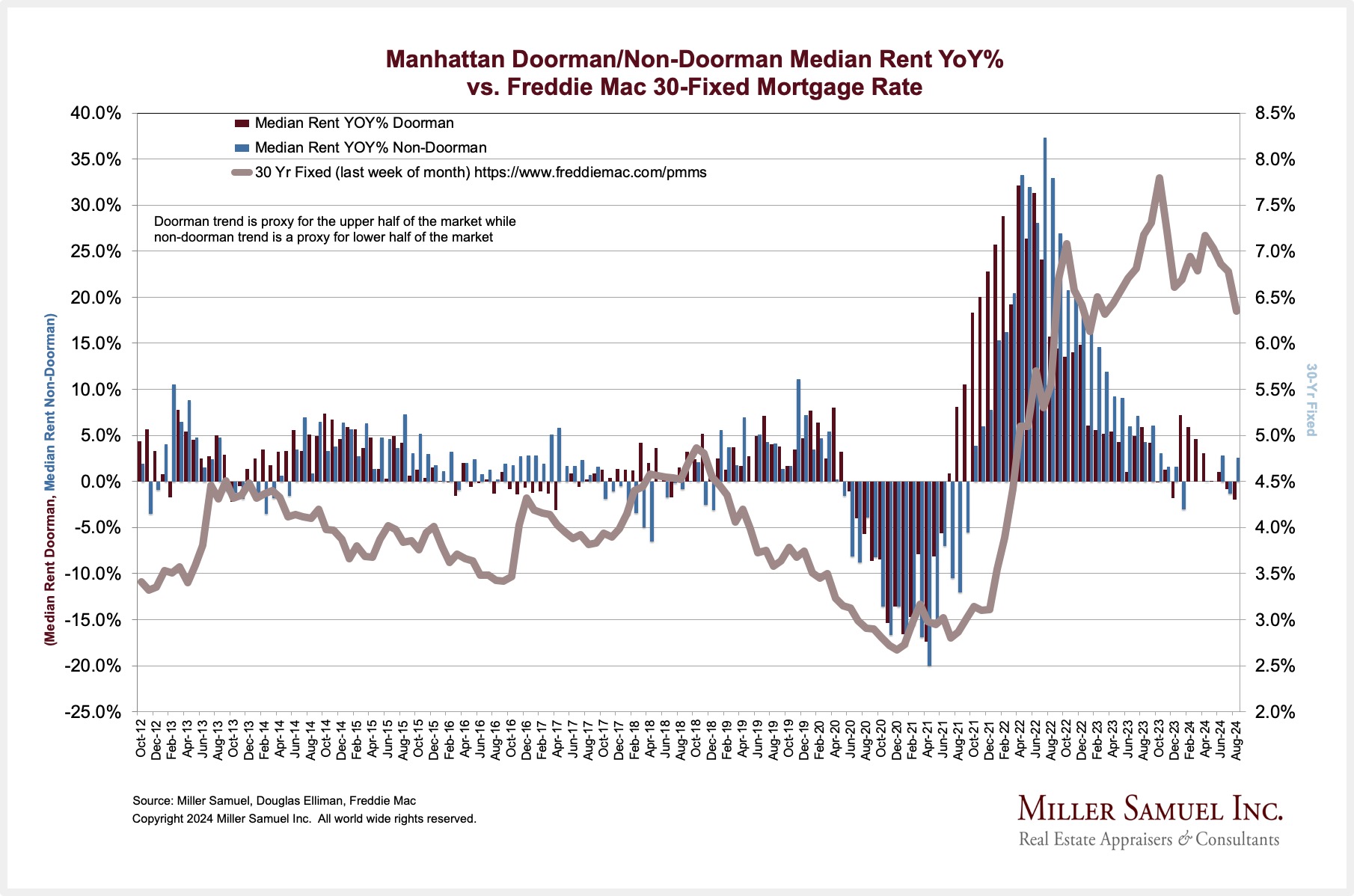

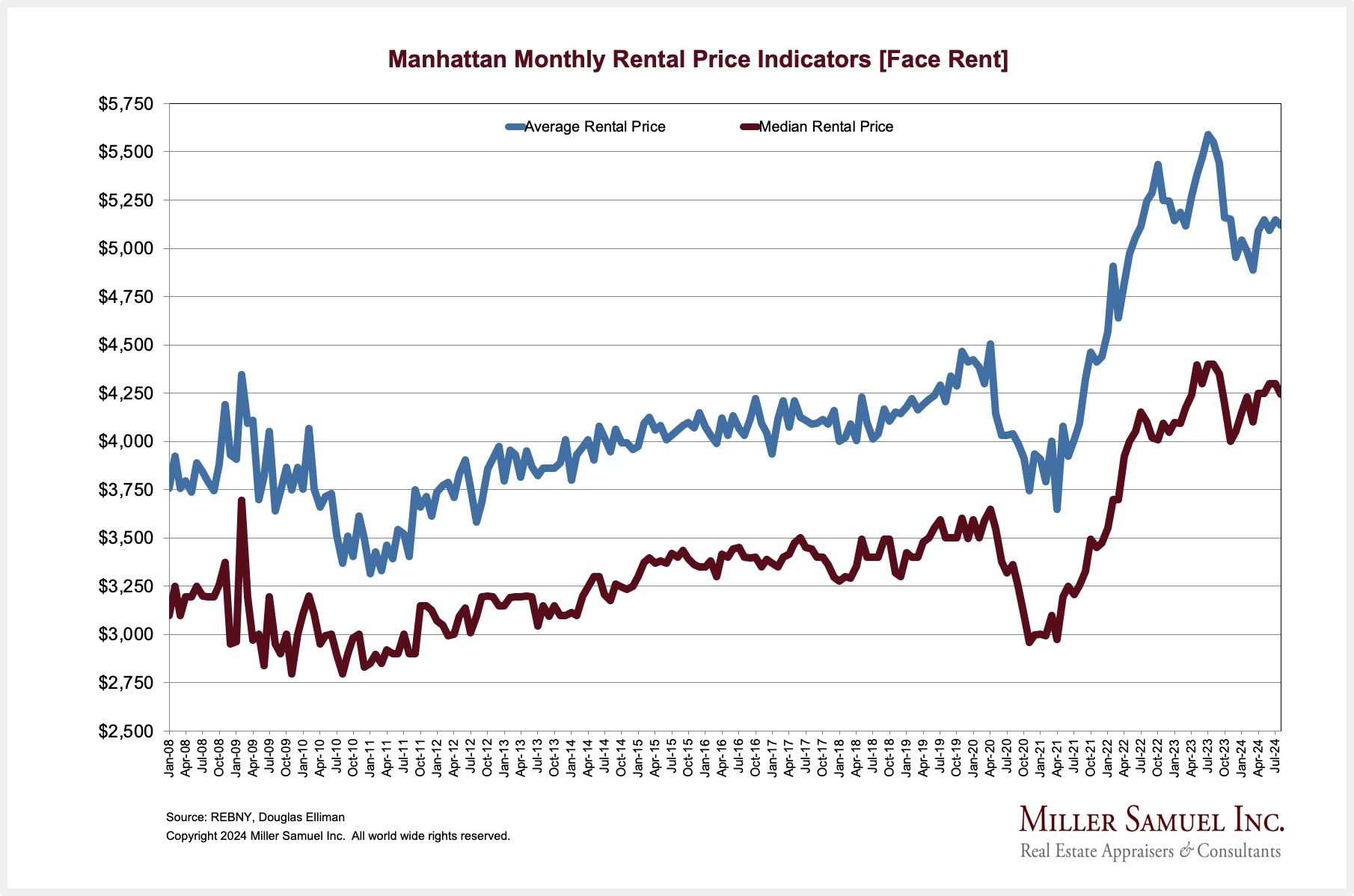

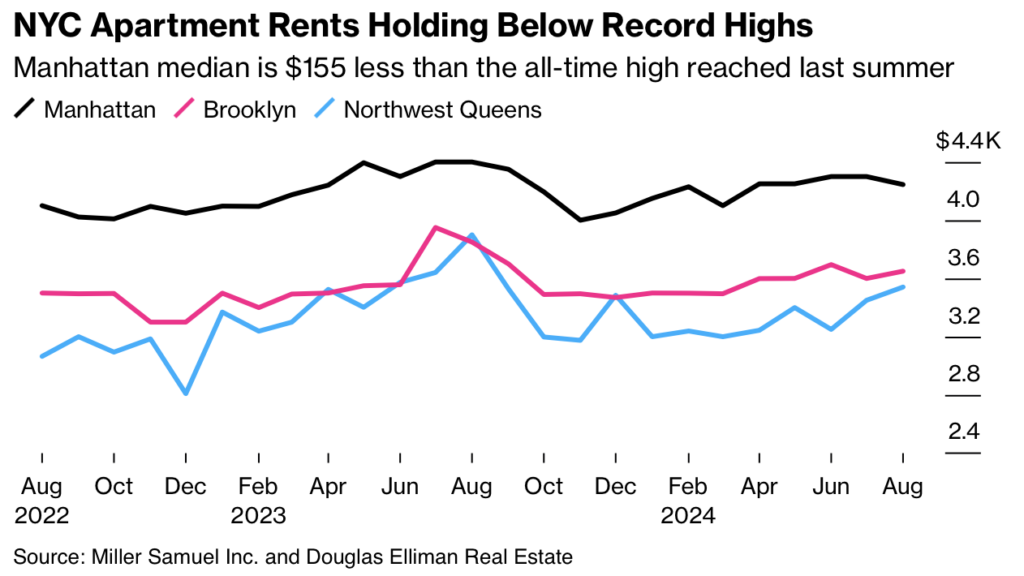

Our New York City rental market report for August was published today, and its results are consistent with expectations for rental markets across the U.S. NYC rents likely won’t reach last year’s record levels in 2024, especially with mortgage rates sliding.

Elliman Report: August 2024 Manhattan Brooklyn and Queens Rentals

Last week, our August new signed contract reports were published, and they showed a year-over-year surge of 30.3% in Manhattan and 94.8% in Brooklyn, likely reflecting the anticipation of imminent rate cuts. U.S. rents remain elevated, but growth is slowing. Consumers expect mortgage rates to continue to fall, especially with the anticipated Fed cuts in September, November, and December. This is a new wrinkle on future expectations that didn’t exist in July. The largely symbolic improvement in affordability after 2.5 years of waiting should shift some excess demand from the rental market to the purchase market.

NYC media coverage on our August NYC rental results:

Bloomberg reported:

“In Manhattan, new leases were signed at a median of $4,245, down 3.5% from the previous August, when costs were at an all-time high, according to appraiser Miller Samuel Inc. and brokerage Douglas Elliman Real Estate. Median prices also fell annually in Brooklyn and Queens.”

The Real Deal reported:

“The Federal Reserve’s moves over the next several months could turn the downslide into a trend.”

Crain’s New York Business reported:

“It looks as if New York will avoid a second consecutive year of record-high rents.”

Bisnow reported:

“Some buyers have gotten into the game early, expecting home prices, as well as competition, to increase once the Federal Reserve reduces interest rates. That is widely expected to happen at the Fed’s meeting next week.”

Brick Underground reported:

“Sliding mortgage rates—they’ve fallen for six, consecutive weeks—are spurring sidelined buyers, who have been parked in the rental market for nearly two years, to finally make a move. New signed contracts for Manhattan and Brooklyn co-ops and condos jumped in July and August, according to a different edition of the Elliman Report.”

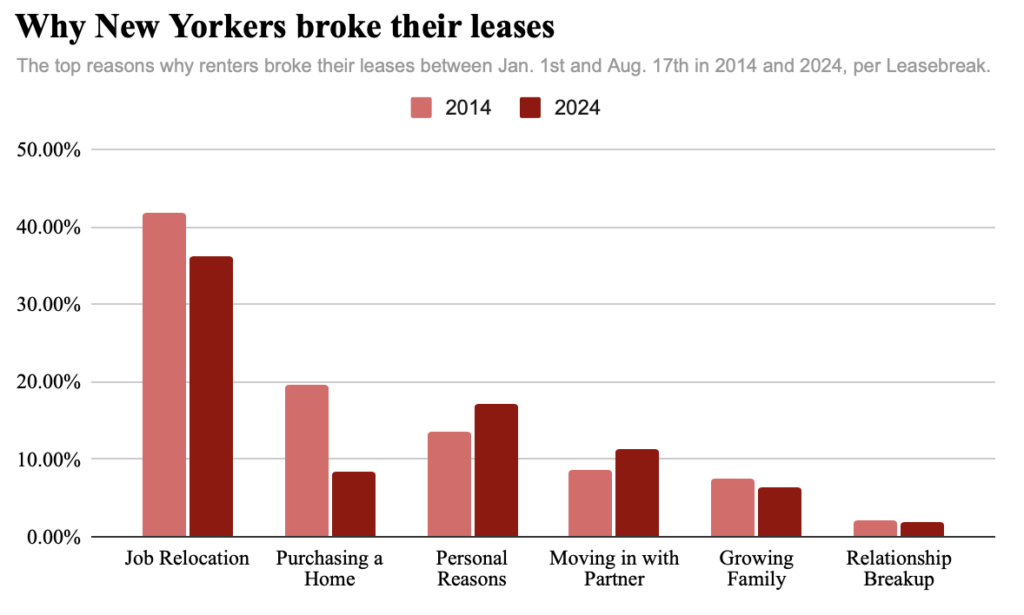

Most Renters Break Leases For New Job Opportunities, Not To Buy A Home

Brick Underground has a great piece on why NYC renters break their leases using data from Leasebreak. This pattern doesn’t quite compute for me unless I think of the renters in two different ways: on the fence about purchasing and as perpetual renters, of which the latter is a much larger group. Those renters who are camping out in the rental market until they are ready to buy were the cohort that made a tight rental market a lot tighter.

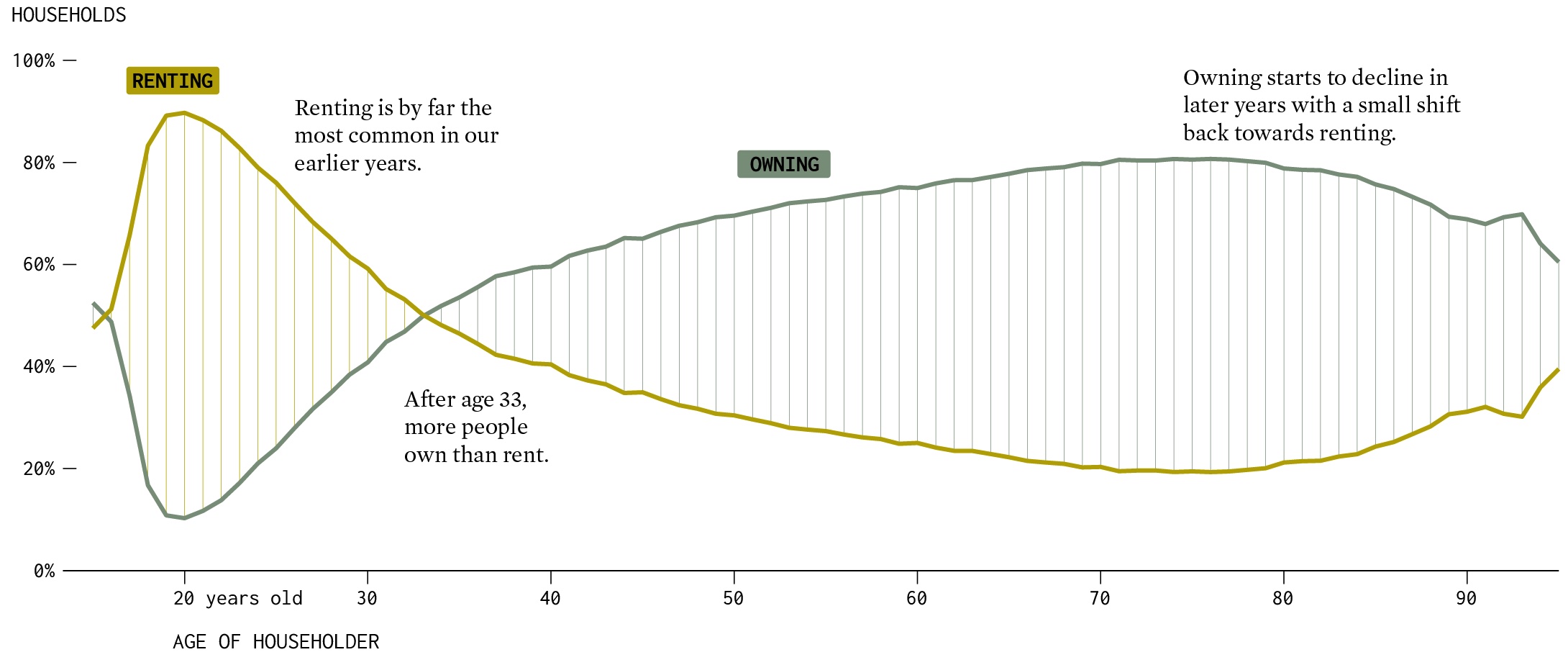

Renting Skews To The Young

We all know this, but this visual on rentals illustrates how they skew heavily to the younger population.

Roc360 Webcast 9/18: Tackling Big Problems in Residential Real Estate with Jonathan Miller

Join Eric Abramovich, Brandon Dunn of Roc360, and Jonathan Miller of HousingNotes for an in-depth and insightful discussion on the ever-changing residential real estate market.

You can sign up here for the September 18th event.

[Sidebar] Here’s My Recent Interview Covering Current Real Estate Brokerage Topics

Did you miss yesterday’s Housing Notes?

September 11, 2024

9/11 Was 23 Years Ago, But Sometimes It Feels Like Yesterday

Image: Chat & Ask AI

Housing Notes Reads

- NYC Apartment Renters Get Some Relief From Record-High Prices [Bloomberg]

- City rents fall again, likely ending chance of another annual record [Crain's New York]

- NYC Rents Dip Again As More Tenants Reenter Homebuying Market [Bisnow]

- The number one reason why NYC renters break a lease may surprise you [Brick Underground]

- Former Realtor Employee Files Sexual Harassment Suit Against Trade Group

- Renting vs. Owning a Home as We Get Older [Flowing Data]

- 👀 Office Ditch, Mansion Switch [Highest & Best]

- Why Long Island homebuyers can't catch a break in a market where prices are up 86% in 10 years [Newsday]

- Industry leader Clark Halstead dies at 83 [Inman]

Market Reports

- Elliman Report: Manhattan, Brooklyn & Queens Rentals 8-2024 [Miller Samuel]

- Elliman Report: New York New Signed Contracts 8-2024 [Miller Samuel]

- Elliman Report: Florida New Signed Contracts 8-2024 [Miller Samuel]

![[Podcast] Episode 4: What It Means With Jonathan Miller](https://millersamuel.com/files/2025/04/WhatItMeans.jpeg)