- 9/11 Imagery Is Obviously Seared Into The Memories Of People That Were There

- NYC Outbound Migration After 9/11 Reversed Within 3 Years

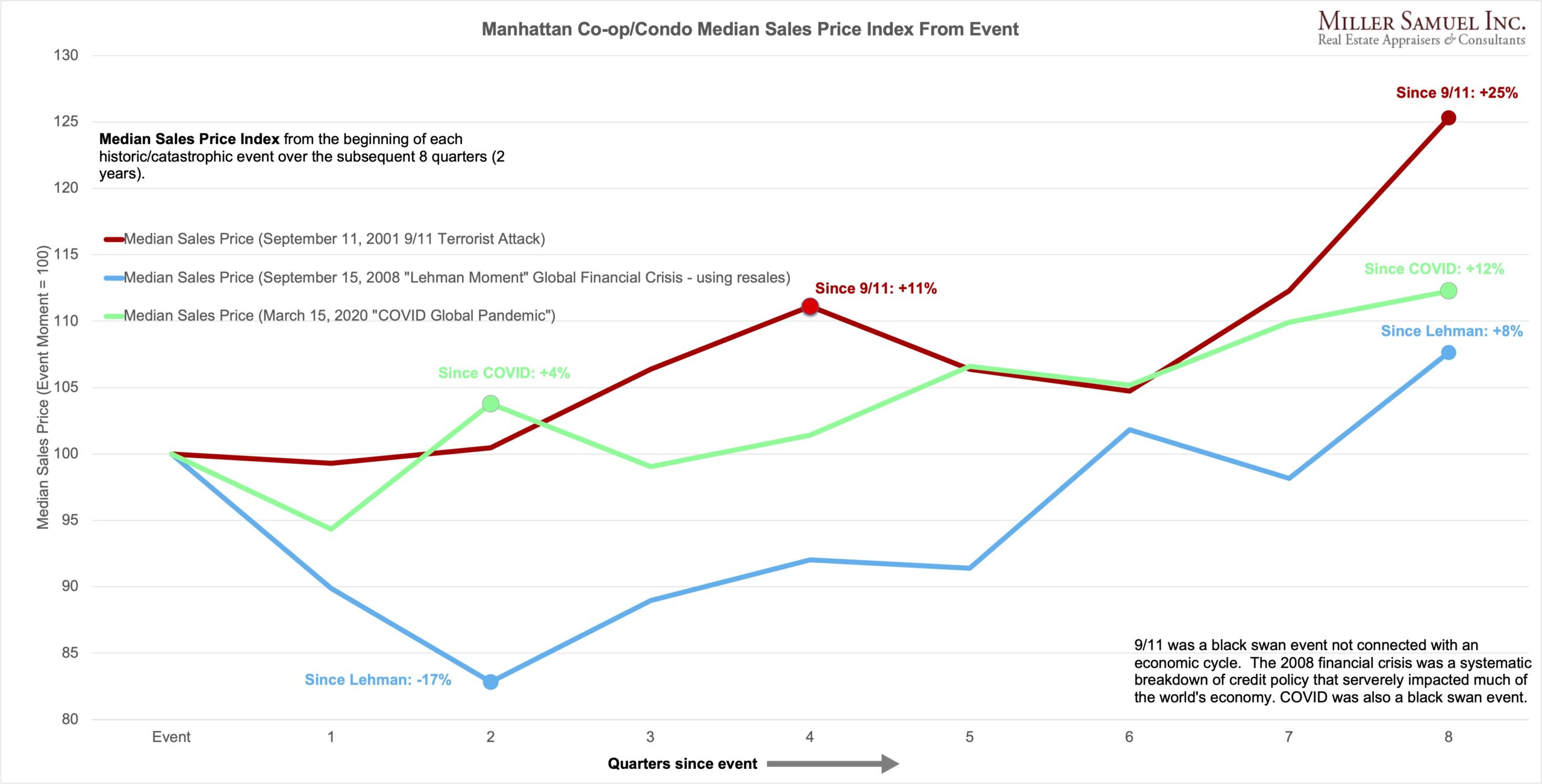

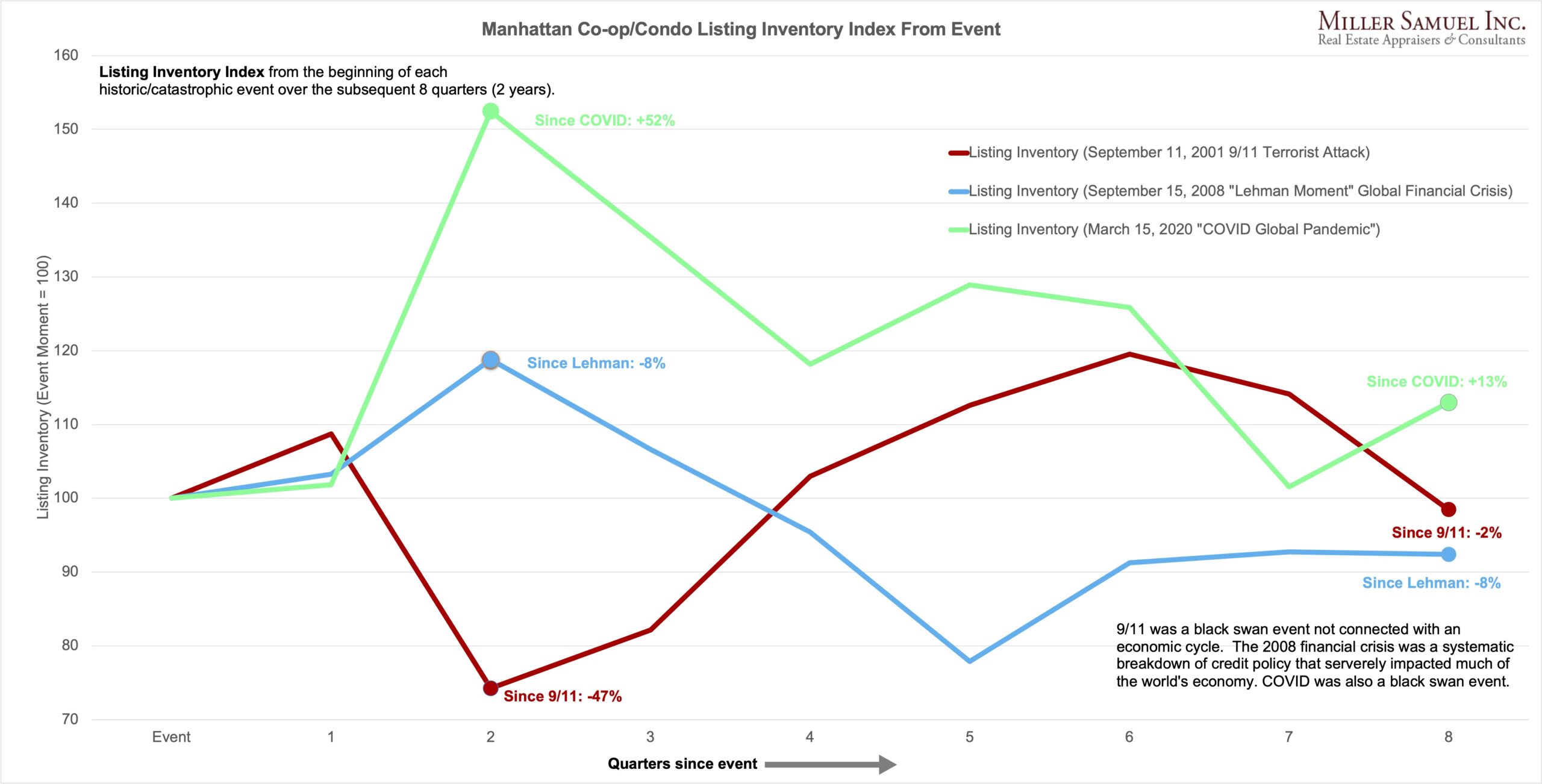

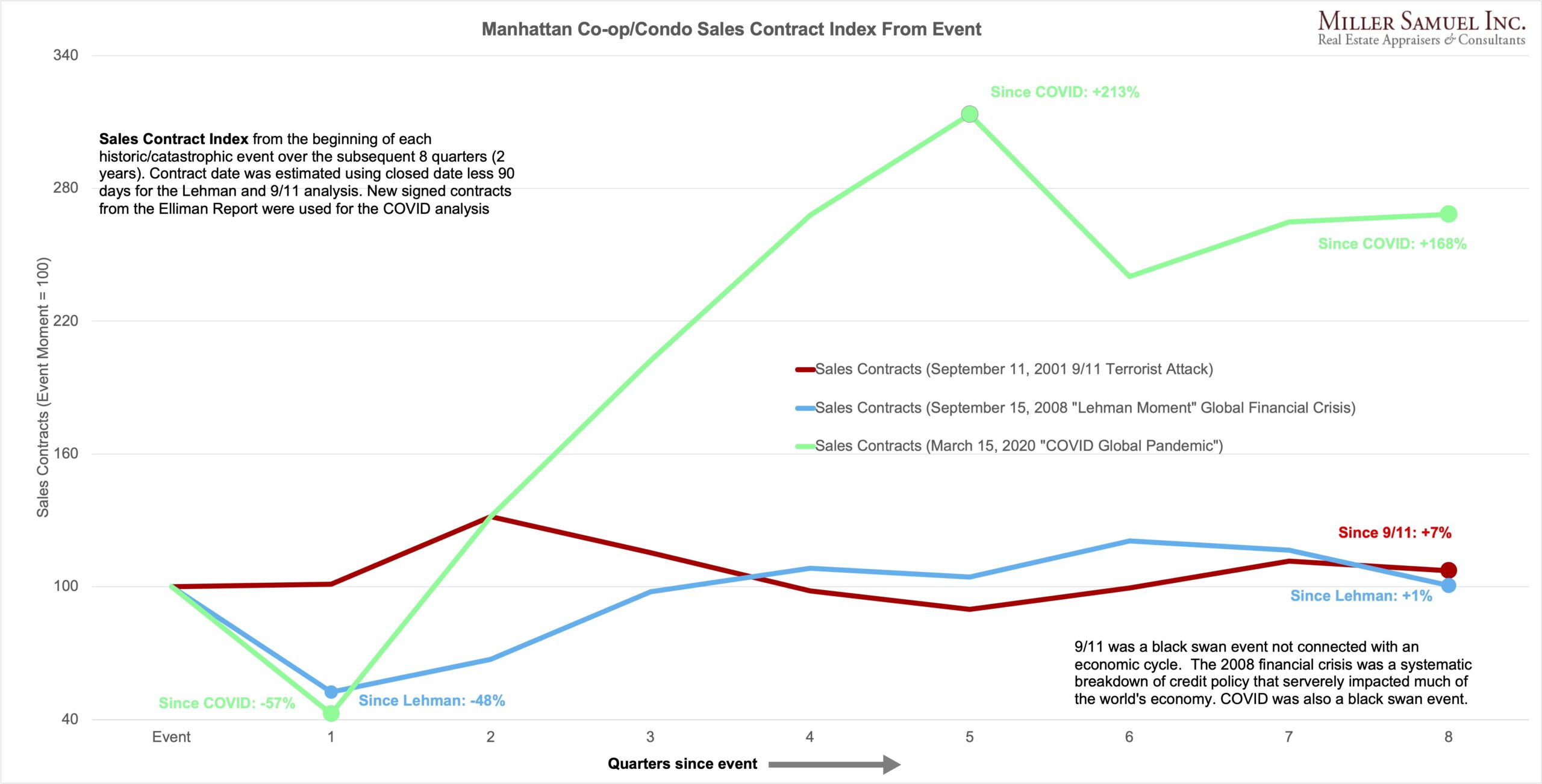

- Manhattan Housing Tends To Recover Within 2 Years After A Catastrophic Event

I happen to be in our then Midtown Manhattan office on the morning of 9/11/01 by about 8 am. At the time, electronics stores would display the latest televisions in their windows on our West 45th Street block between Fifth and Sixth Avenues. When the first tower fell, I got a call from my wife, who was crying because there was now only one World Trade Tower left. Then I got a disturbing but heartfelt email from a friend in the Midwest asking if I was still alive. I ran out of the office and watched the replays of planes flying into the towers and the first tower falling in store windows. We didn’t have access to digital media on our phones back then. I ran down to the corners at either end of our block with a direct view of the World Trade Center on fire. And when I returned to the television storefront, I saw the second tower fall.

I returned to our office as the staff was trying to account for all of our appraisers who were out on inspections, including two downtown in Tribeca. It was hard to do because the Trade Center Towers had the critical cell tower for the city, and soon after the collapse, there was basically no cell service. I remember the only phone service that seemed to work was the Nextel phones with “walkie-talkie” service. All trains, buses, and subway service stopped, and a mass of humanity walked north, away from the towers. I got a ride from the mom of one of our appraisers on the Upper West Side, and we dropped off the people in Westchester County. I borrowed the car and drove home. All the families on our block were telling stories of what happened to them that day. Conversations cut off with individuals and friends when the planes hit, watching the planes hit from a vantage point across the Hudson River in New Jersey, the loss of six people’s lives in our town, and how the schools gracefully handled getting the kids home without panic. It was surreal. I had friends and colleagues who perished.

Here are some photos taken by myself, our staff, and friends on 9/11, as well as photos that made the public rounds in the days and months that followed.

The site smoldered for months, and breathing the air in the financial district felt like sandpaper.

Feel free to share your experiences.

The Aftermath In The Manhattan Housing Sector

I was going to write about a completely separate housing market topic today instead of this event, but it wasn’t in me to do so. I hope you don’t mind.

One of the outcomes for the residential housing market was the fact that residents who left the city after the event largely came back within 3 years. A while back, I looked at three catastrophic events in Manhattan, tracking what happened to the residential housing market in the ensuing eight quarters by looking at the median price, listing inventory, and contracts:

Monday (but on Wednesday) Mailboxes, Etc. – Sharing recent reader feedback.

Note to my readers: I had intended to add this reader feedback on Mondays regularly, but I literally forgot about it with all the effort put into the daily posts! Apologies. I threw in feedback from three recent posts. I will try to get back on track for “Monday Mailboxes, Etc.” beginning this coming Monday if there is enough commentary to share. I always keep the commentary anonymous.

September 10, 2024 7/11 Age Inflation: Homebuying Is Becoming An Older Person’s Game

- Could the surge in the media age of repeat home buyers be attributed to the appreciation of home values coupled with the equity gained (and able to be used) towards the purchase of house #2 – and that they keep both vs selling the first?

- 70 year old baby boomer bought first house in 1977. It was 50 years old and vintage, and small 1100 square feet, 3/1, and no countertops much less stone. No dishwasher. One ungrounded outlet in each room, antiquated gravity furnace. Hung my laundry to dry in basement in winter and back yard in summer. If I put no capital upgrades into the house and paid no taxes or maintenance my rate of return would be under 5%. Land is the only thing that appreciates hence location location location. The folks preaching generational wealth will be sadly disappointed that housing is for a roof over your head, not a fantastic investment opportunity. Contrast with today’s expectations and monthly money suck subscriptions and you’d have a significant down payment for a modest house. Owning a house wasn’t a given right but a sacrifice to own. And yes, I’ve seen the stats that housing is so much more expensive than it was in the 70s.

September 9, 2024 NYC Enforcement Of The Rental Law Crushed Airbnb Listings. Weaker Rent Trends And High Cleaning Costs Are Next.

- [Commenter 1] Yes, but it is unfair to the other owners to have a non-resident turning it into a motel. It also violates the Proprietary Lease in a co-op where the Board has the right to approve sub-lets and in condos where the Board has a ROFR. I don’t care about single family home owners using their homes for temporary stays, but the situation in multi family housing is very different.

- [Jonathan] Yes that would apply to someone renting – but I am also referring to an owner of a co-op or condo apartment. They own it.

- [Commenter 1] The problem with your Airbnb analysis is that the person moving to a house in the suburbs should not continue to rent the apartment in NYC; the apartment should go back into the pool for someone who needs it to be able to lease it from the landlord. I have no sympathy for the original tenant because he cannot make more profit from Airbnb The 10 Most Inspiring Legal Advisors to Follow in 2024 1 or 2 year lease. He does not own the apartment and should not be able to continue renting it.

September 5, 2024 Rethinking Teardowns If You Can Afford Them

- Great ‘Notes’ today, Jonathan. I just completed an appraisal on a home in Pentwater – a very nice little Lake MIchigan beach town near me – that in any other municipality in Oceana County would truly be a teardown. Even given its many problems, in Pentwater it will be bought by a contractor, or an individual with deep pockets and a contractor on a short leash, because it has strong bones – a brick Federal-style home – and its location, architectural style, and history will enhance the value upon renovation. It was a very difficult assignment, I must say!

- In our semi-rural community in Northern California (100,000 population) a typical vacant lot would cost you about $50,000 10 years ago. That same/similar lot will now cost you around $60,000 to $75,000. A typical house on a typical lot in our area has gone from about $250,000 five years ago to about $400,000 now. Most of that $150,000 appreciation is the result of building costs for a typical house going from around $125 SF then to about $220 SF now. The house has appreciated, while depreciating from wear and tear at the same time. Your thoughts?

Did you miss yesterday’s Housing Notes?

September 10, 2024

7/11 Age Inflation: Homebuying Is Becoming An Older Person’s Game

Image: Chat & Ask AI

Housing Notes Reads

- Why Long Island homebuyers can't catch a break in a market where prices are up 86% in 10 years [Newsday]

- Industry leader Clark Halstead dies at 83 [Inman]

- Teuerster Mietmarkt in den USA: New York ist wieder verrückt geworden [FAZ]

- What comes next for NAR’s Clear Cooperation policy? [Real Estate News]

- Rare Westhampton Beach condos hit market, starting at $990k [The Real Deal]

Market Reports

- Elliman Report: New York New Signed Contracts 8-2024 [Miller Samuel]

- Elliman Report: Florida New Signed Contracts 8-2024 [Miller Samuel]

- Elliman Report: Manhattan, Brooklyn & Queens Rentals 7-2024 [Miller Samuel]

![[Podcast] Episode 4: What It Means With Jonathan Miller](https://millersamuel.com/files/2025/04/WhatItMeans.jpeg)