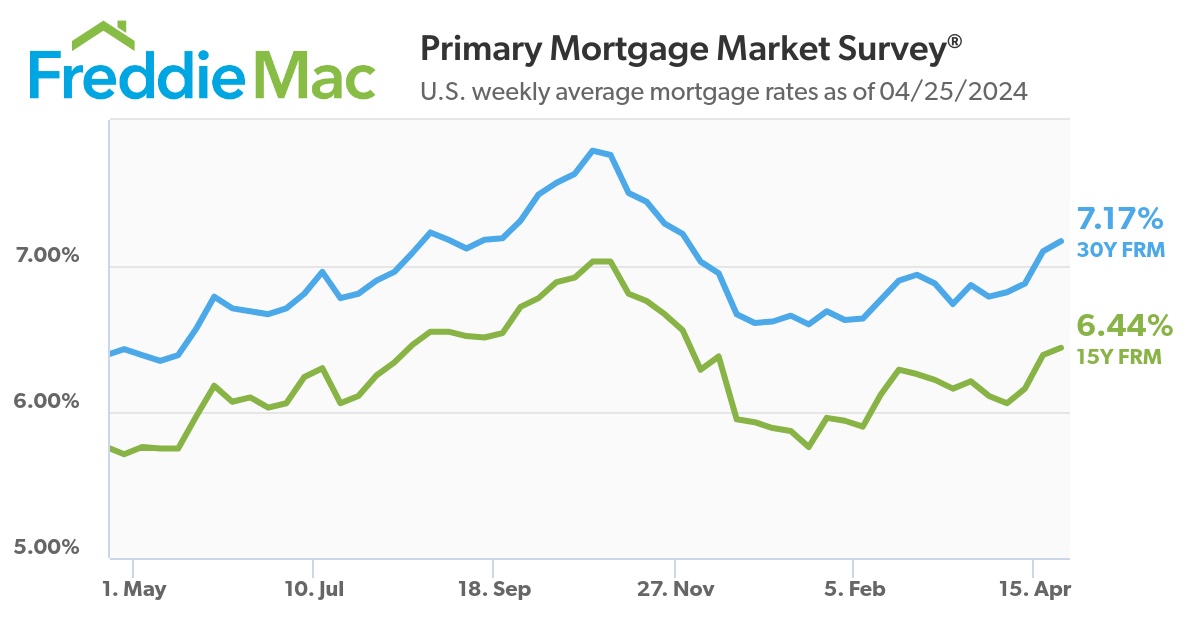

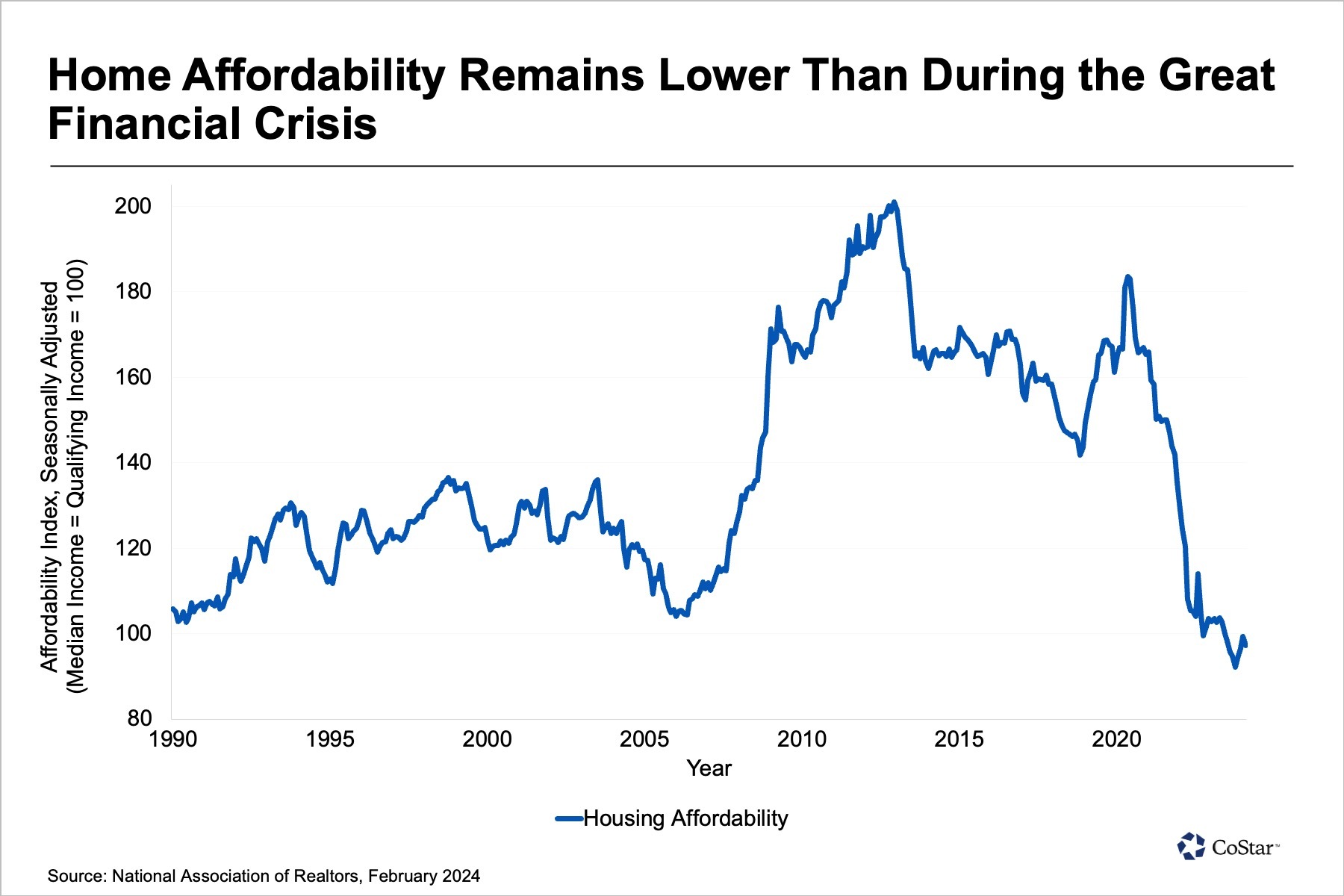

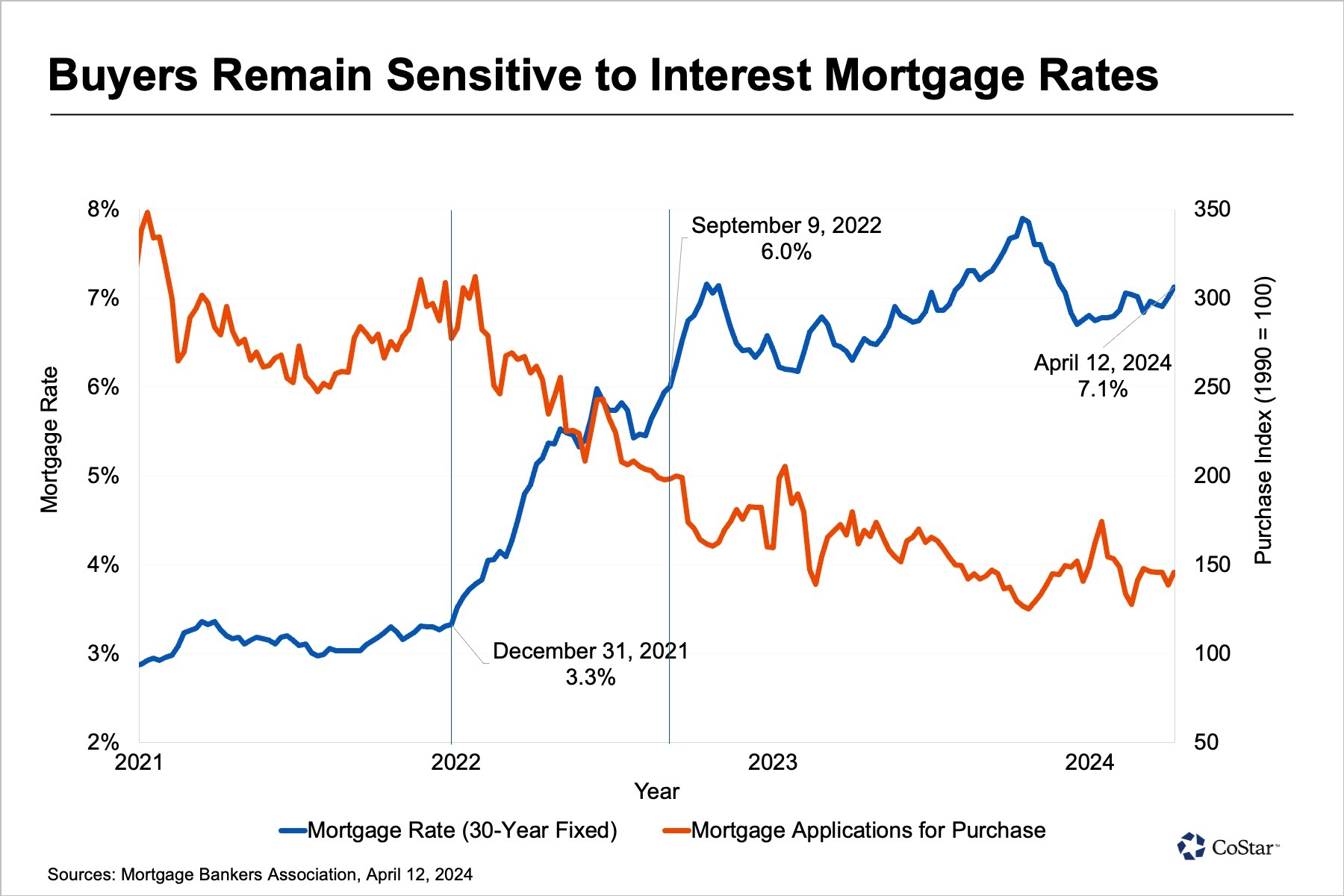

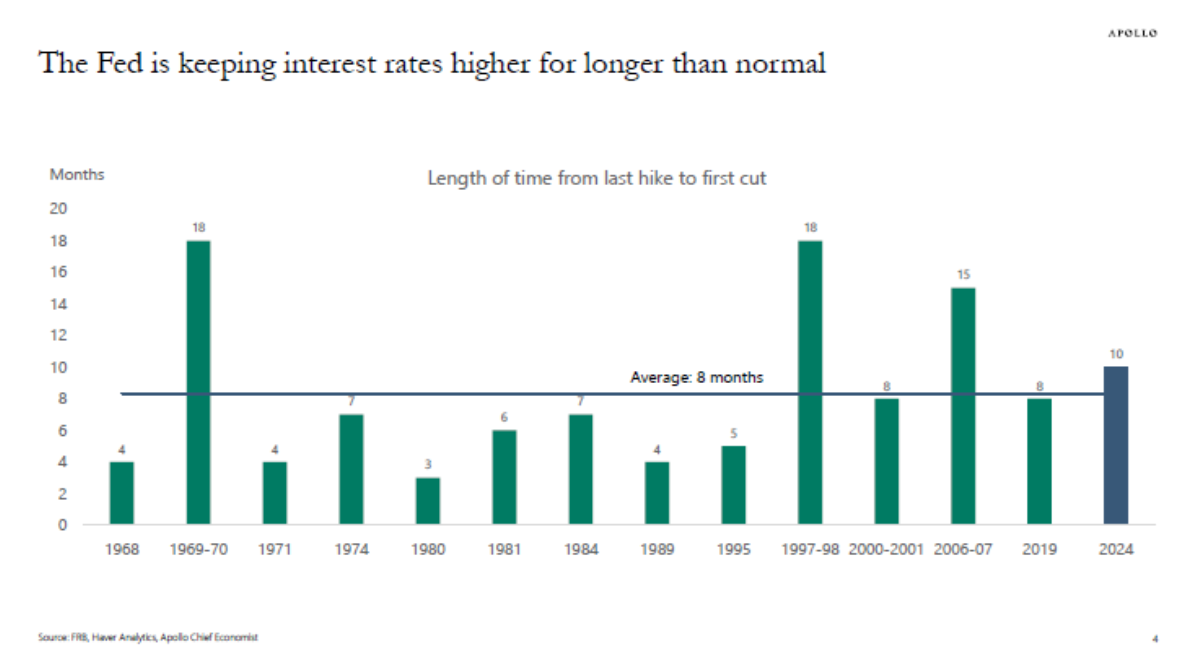

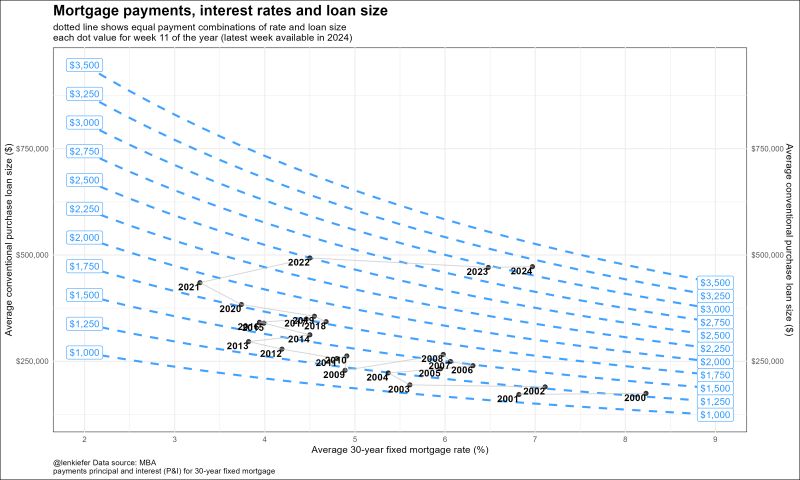

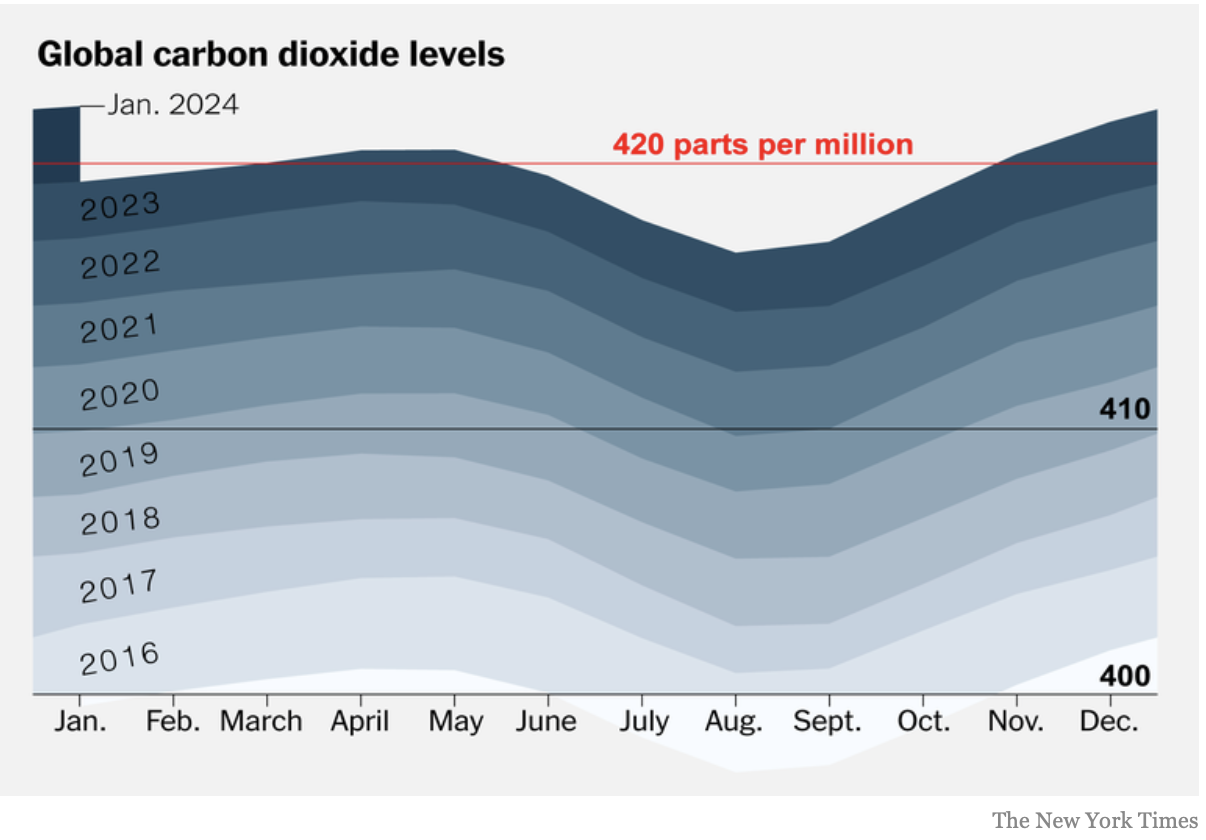

Since we are in the middle of a date palindrome this month, I thought it would be helpful to compare this phenomenon against the backdrop of the housing market. Mortgage rates have remained elevated in the New Year and are expected to remain similar over the next several months despite the Fed pivot last December.

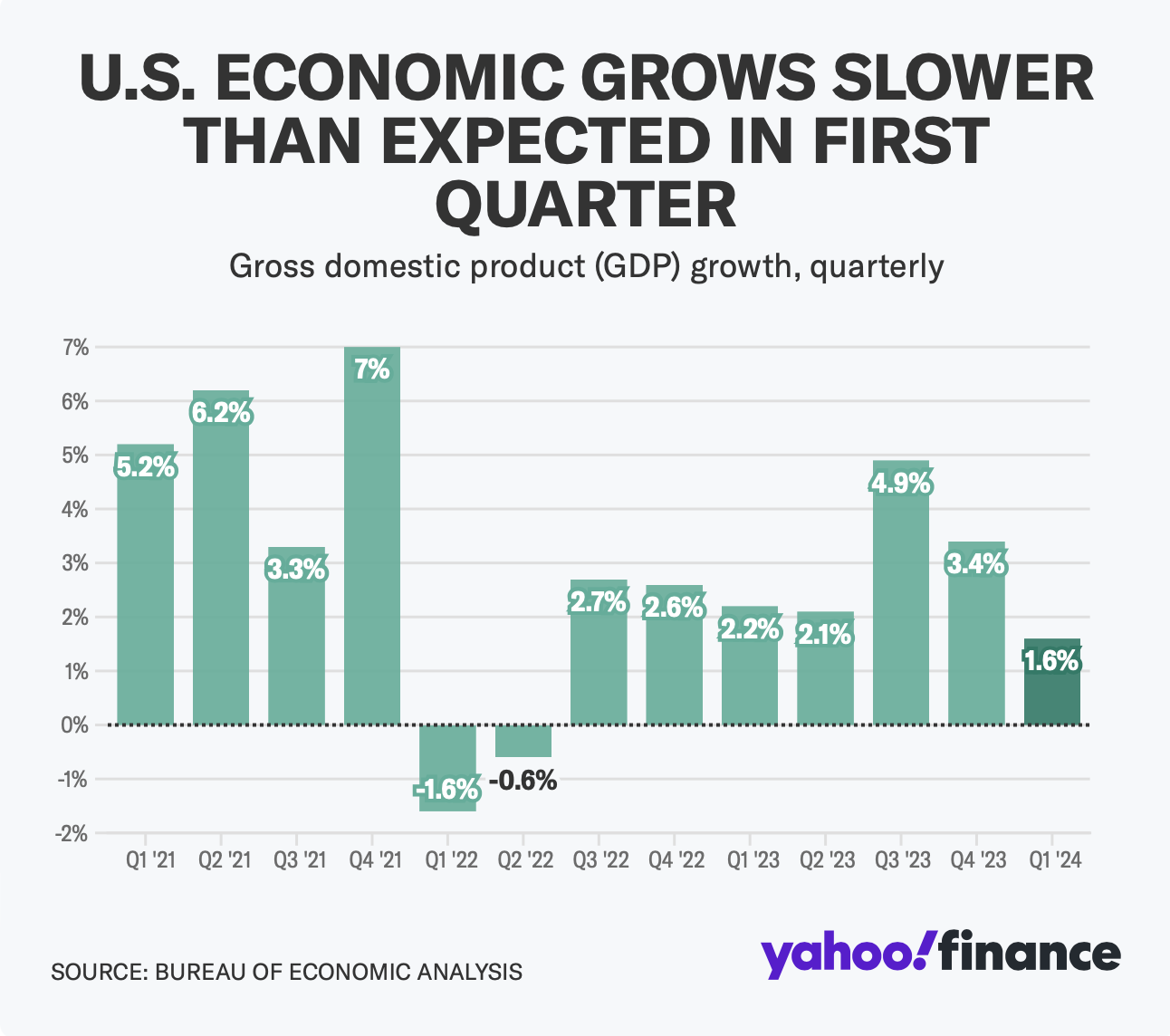

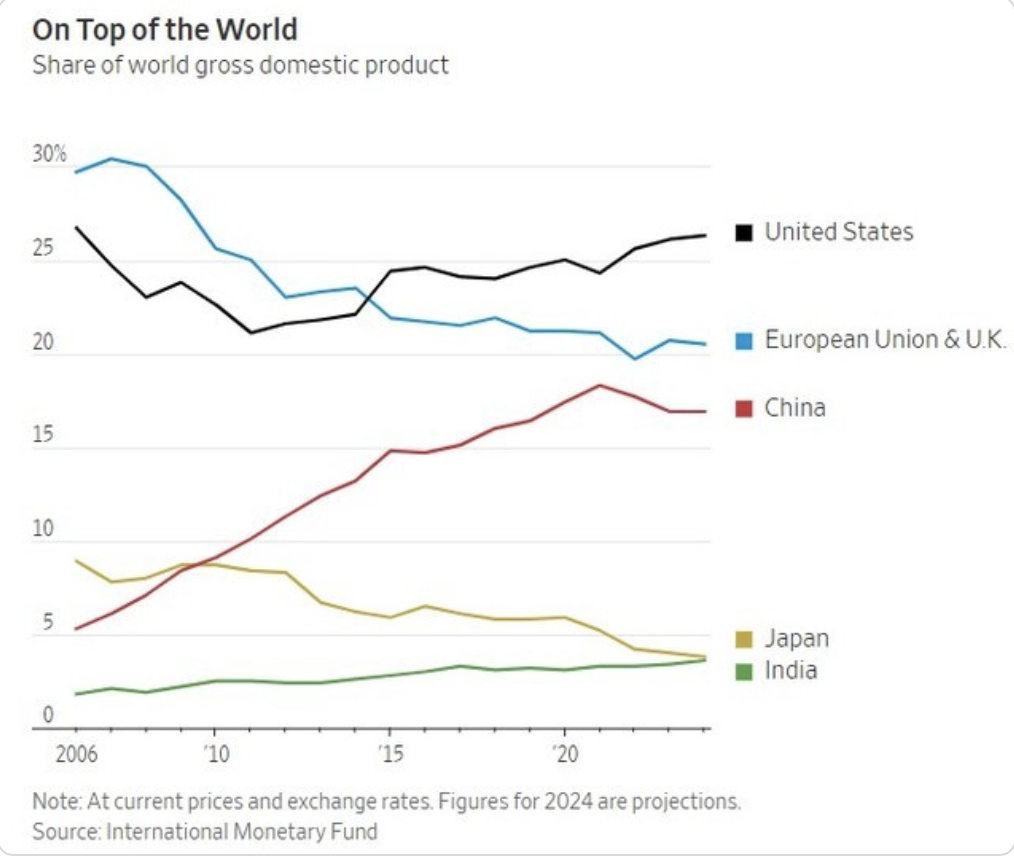

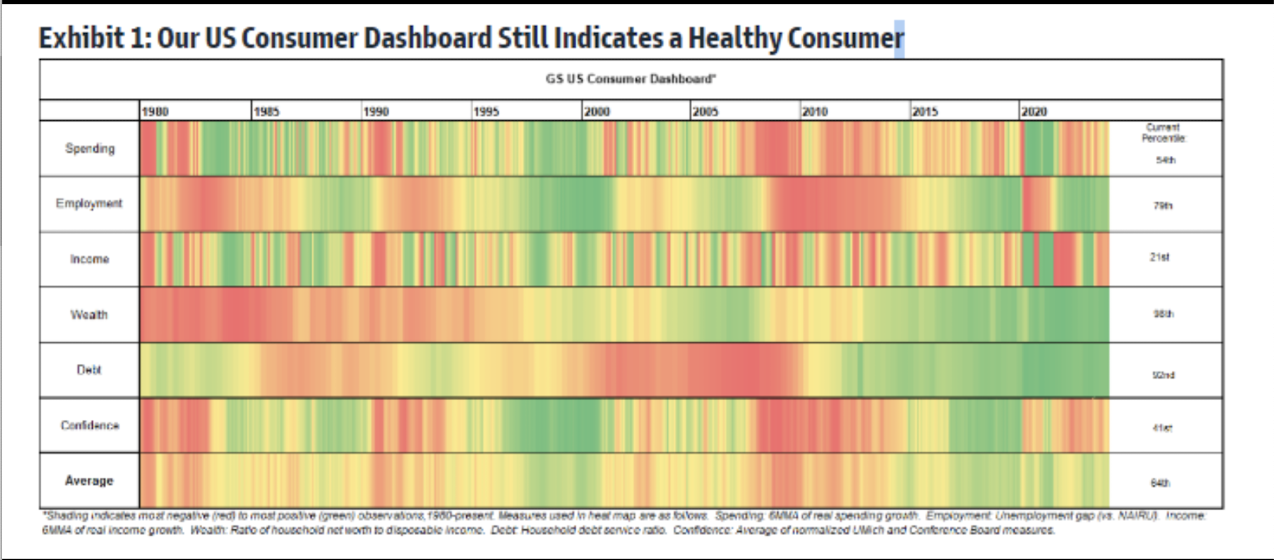

With rate cut expectations being pushed out to the end of 2024, if not 2025, the noticeable drop in GDP for Q1 announced on Thursday that provides more potential fodder for a Fed rate cut earlier than December. It won’t stop the current palindrome effect, but it is beneficial to the housing economy, which has been harder hit than other segments of the economy by rising rates.

My palindrome depiction of the housing market is loosely tied up by the They Might Be Giants song “I Palindrome I” I dub an “effect.” Ok. Not really. I just wanted to share a band I love with my readers below. Who doesn’t love palindromes? Think of the town of ‘Level‘ located in Ohio. Not only is the name a palindrome but it infers “stability” in its name, both backwards and forwards.

Did you miss last Friday’s Housing Notes?

April 19, 2024: Mortgage Rates Not Falling Feels Like The Papyrus Font Controversy In The Avatar Movies

But I digress…

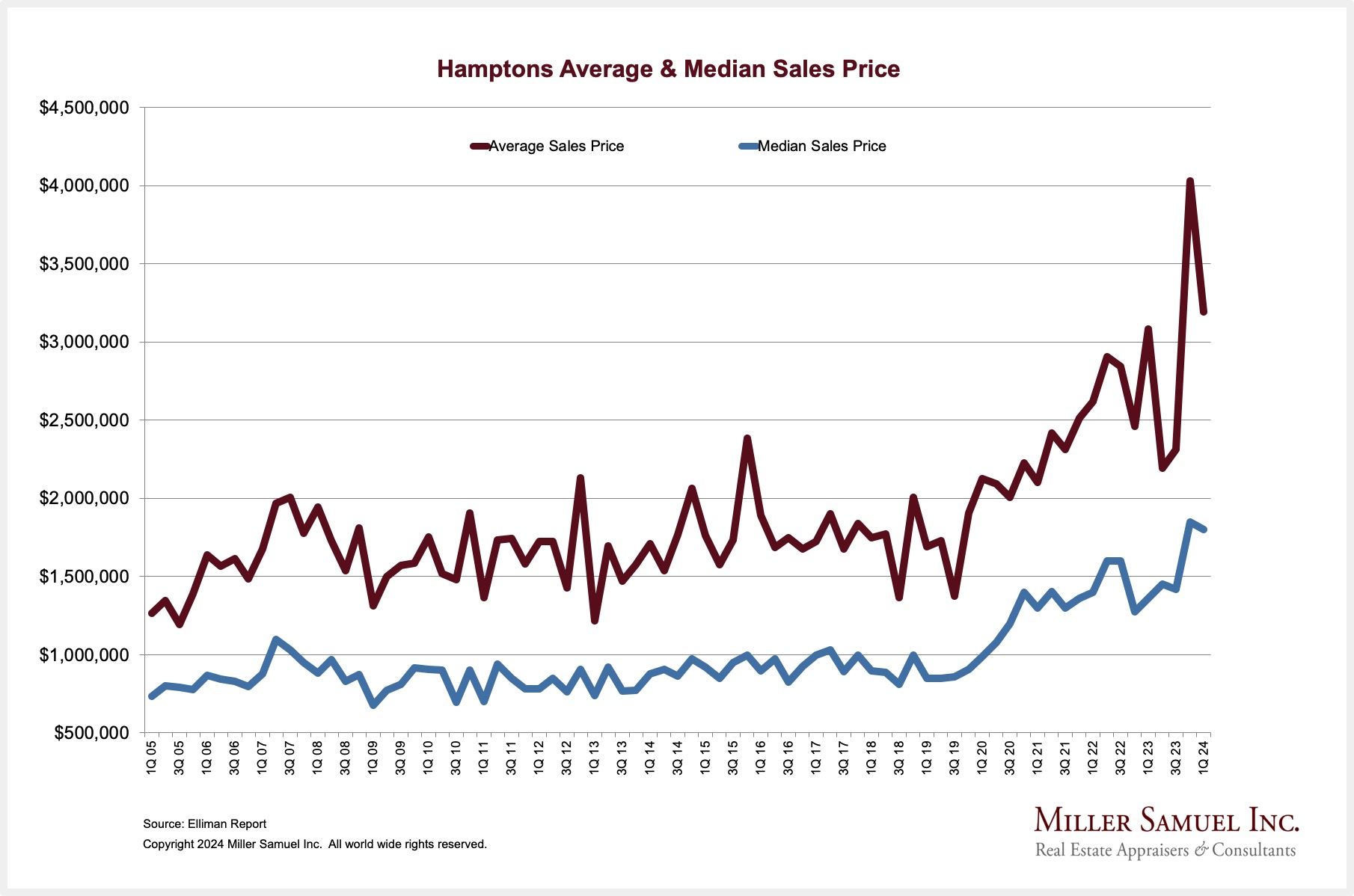

The Hamptons Is Staging A Sales Comeback

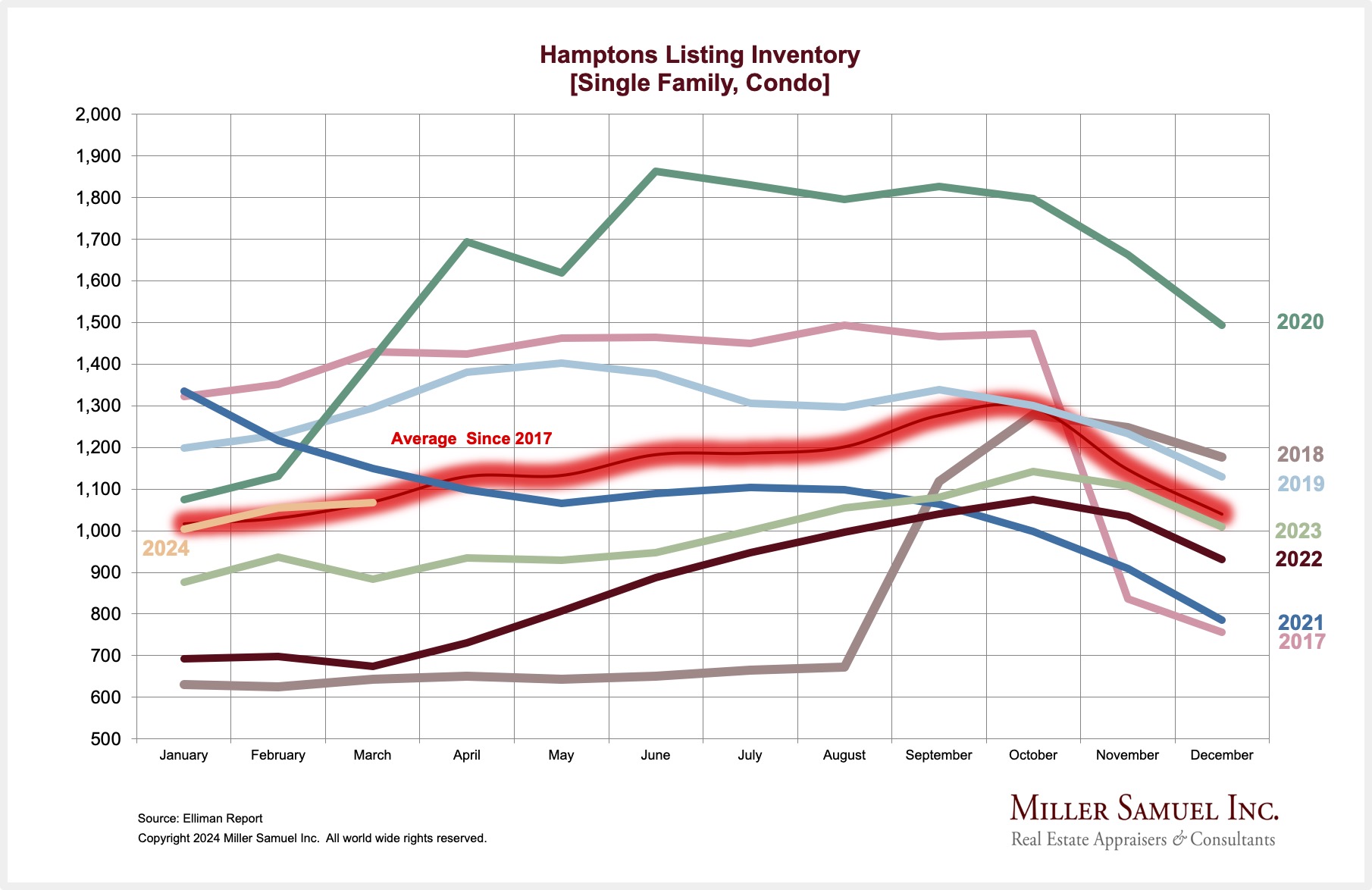

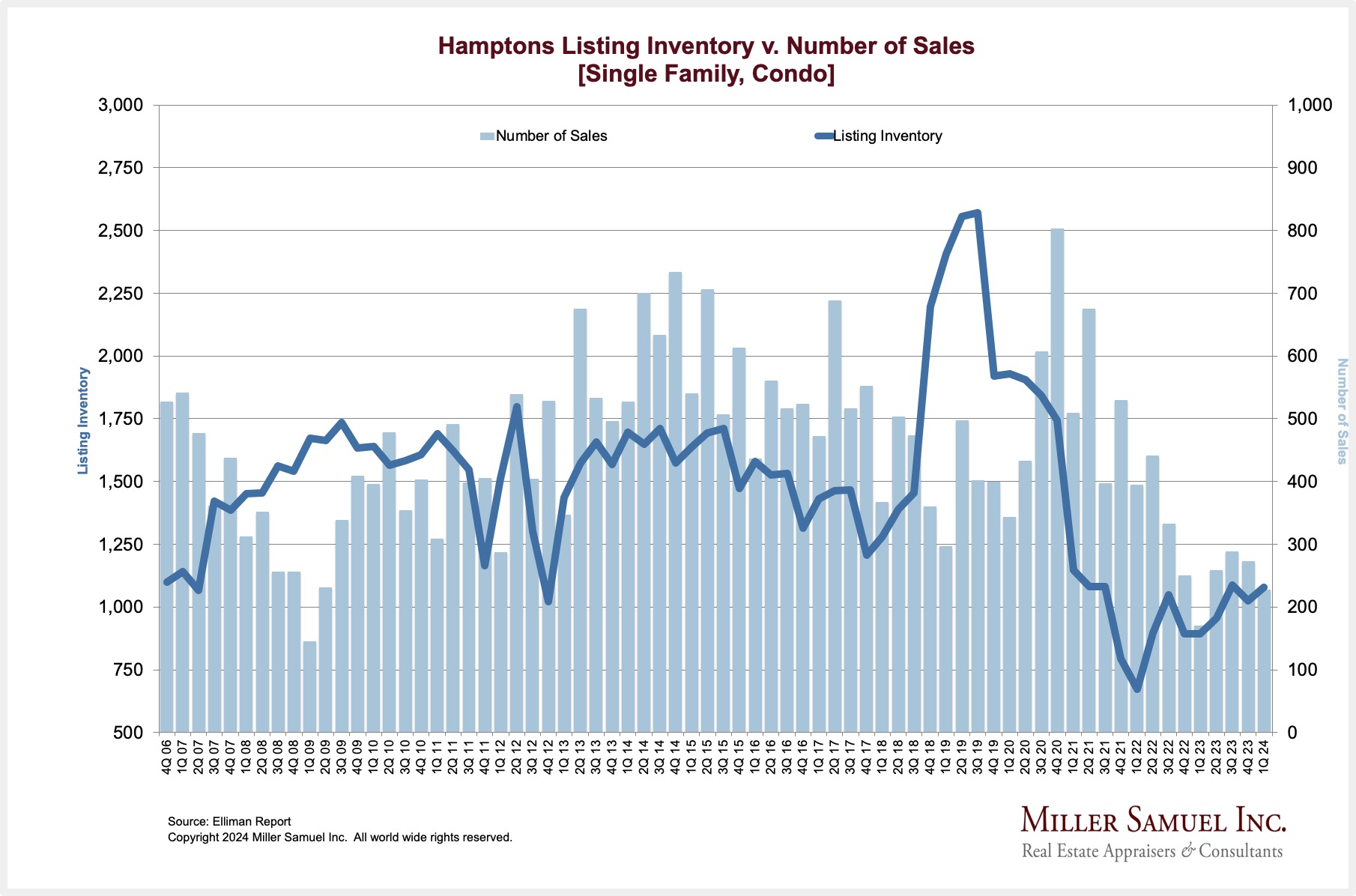

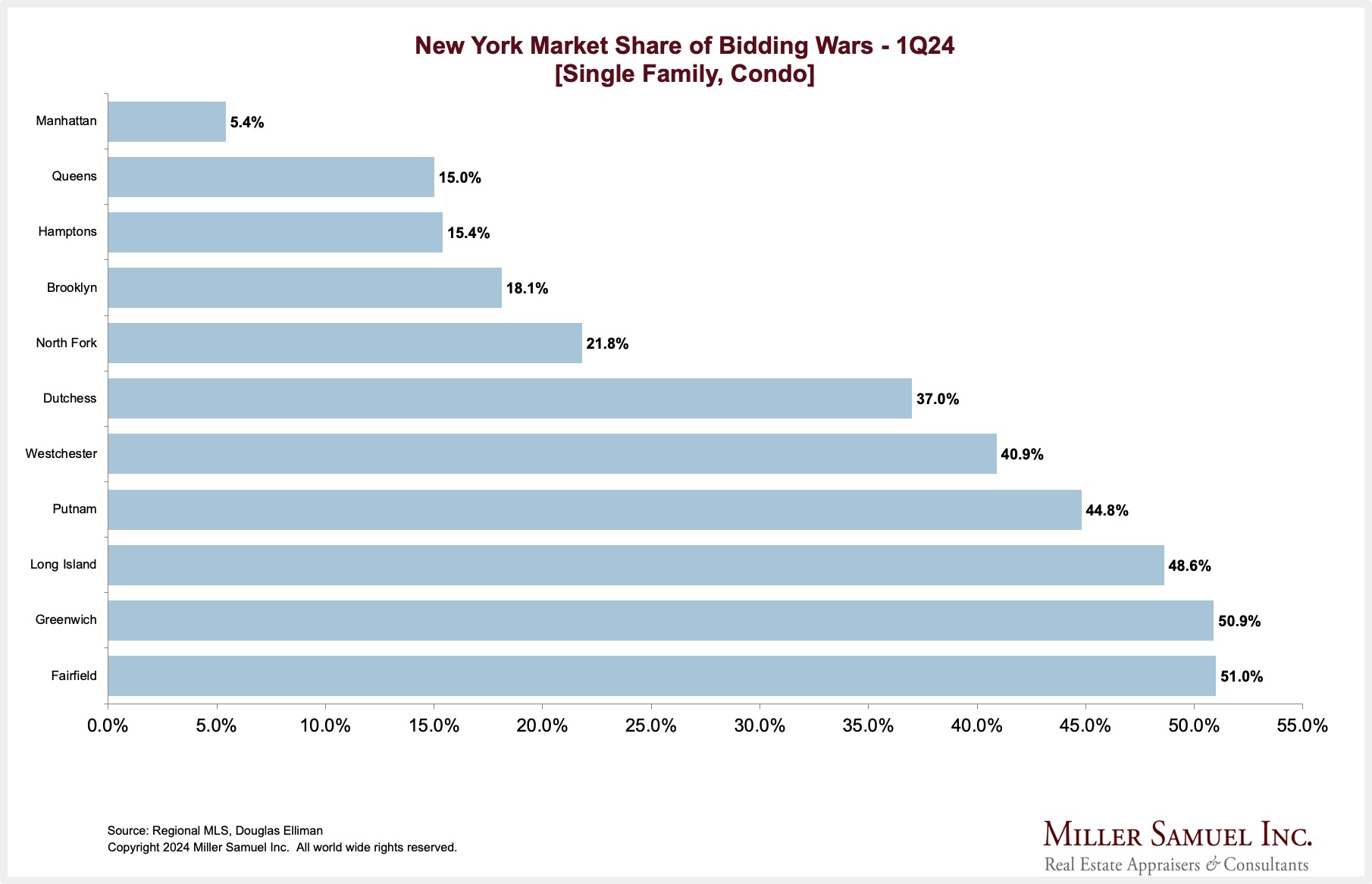

I’ve been the author of a series of market reports over the past thirty years for Douglas Elliman Real Estate. The Hamptons, on the eastern end of Long Island, was one of the first residential housing markets to boom when the pandemic lockdowns occurred in the NYC metro area. The same conditions exist in the North Fork, but to a lesser degree. Listing inventory was eviscerated and is only now beginning to climb back, enabling more sales.

HAMPTONS HIGHLIGHTS

Elliman Report: Q1-2024 Hamptons Sales

Sales and price trend indicators expanded annually.

- Price trend indicators increased annually to their second-highest on record

- Sales surged annually, rising for the second time, enabled by more supply

- Listing inventory rose annually for the sixth time but remained at half-pre-pandemic levels

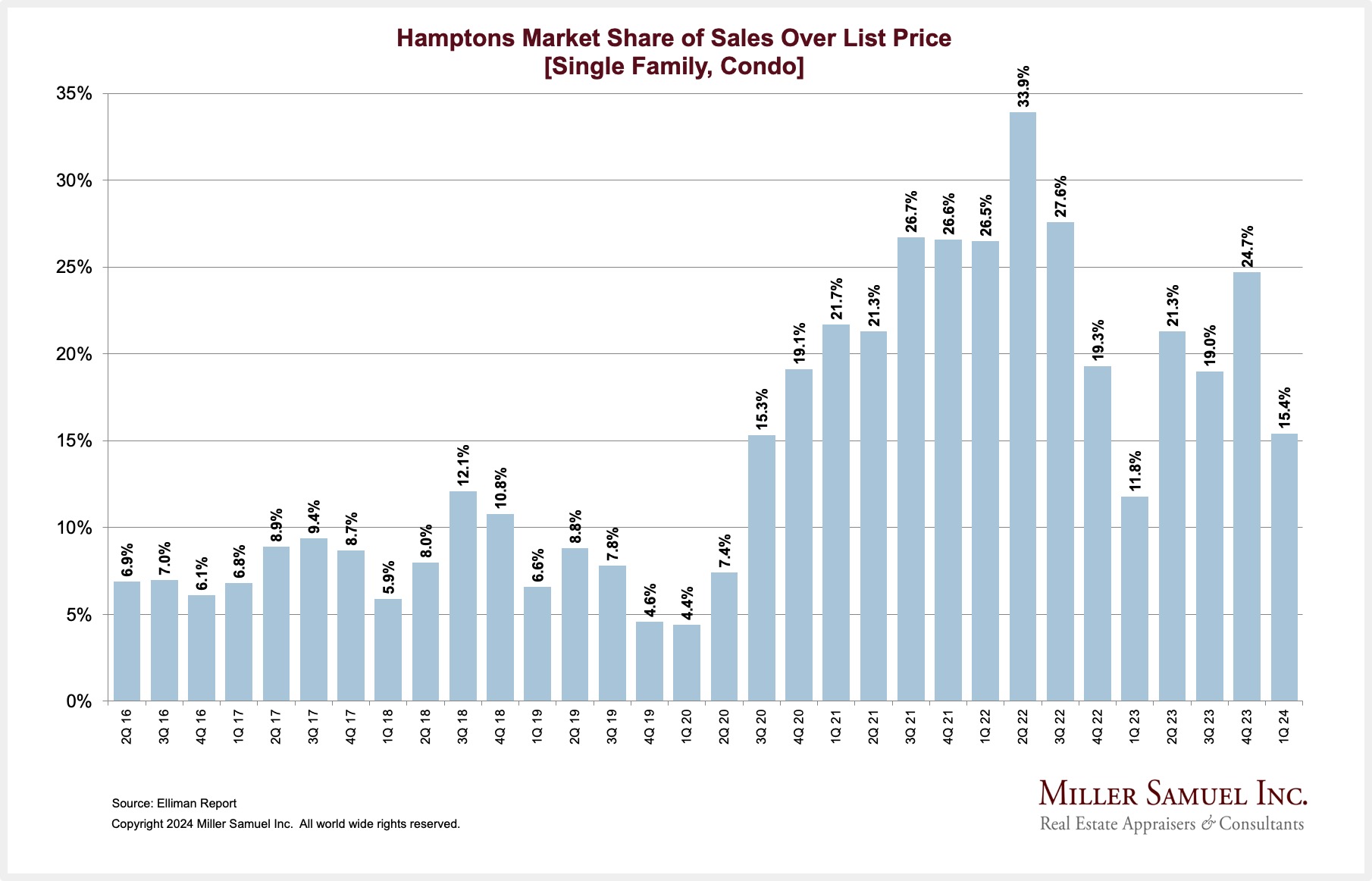

- Bidding war market share was the lowest level in a year at one out of seven sales

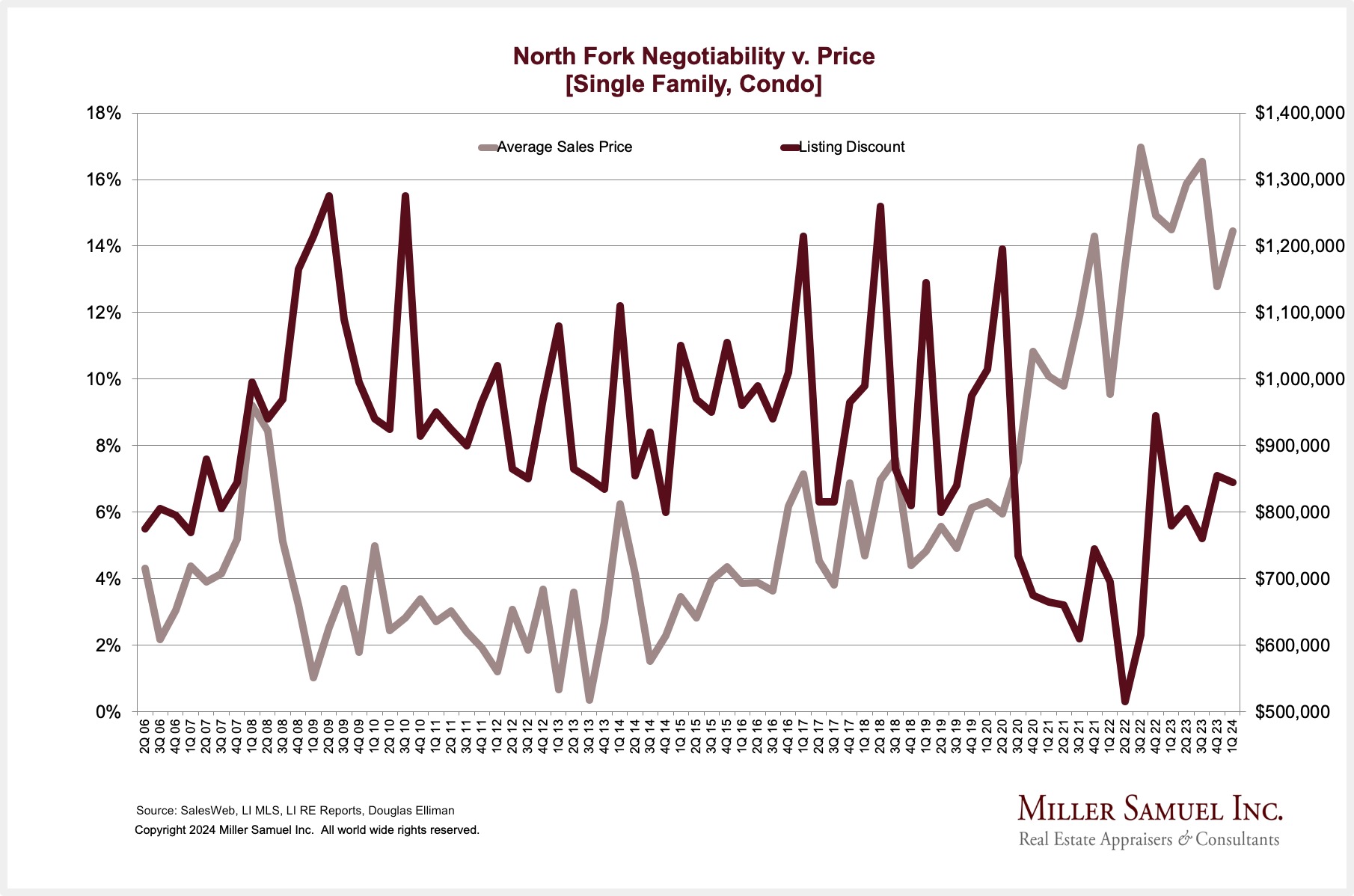

NORTH FORK HIGHLIGHTS

Elliman Report: Q1-2024 North Fork Sales

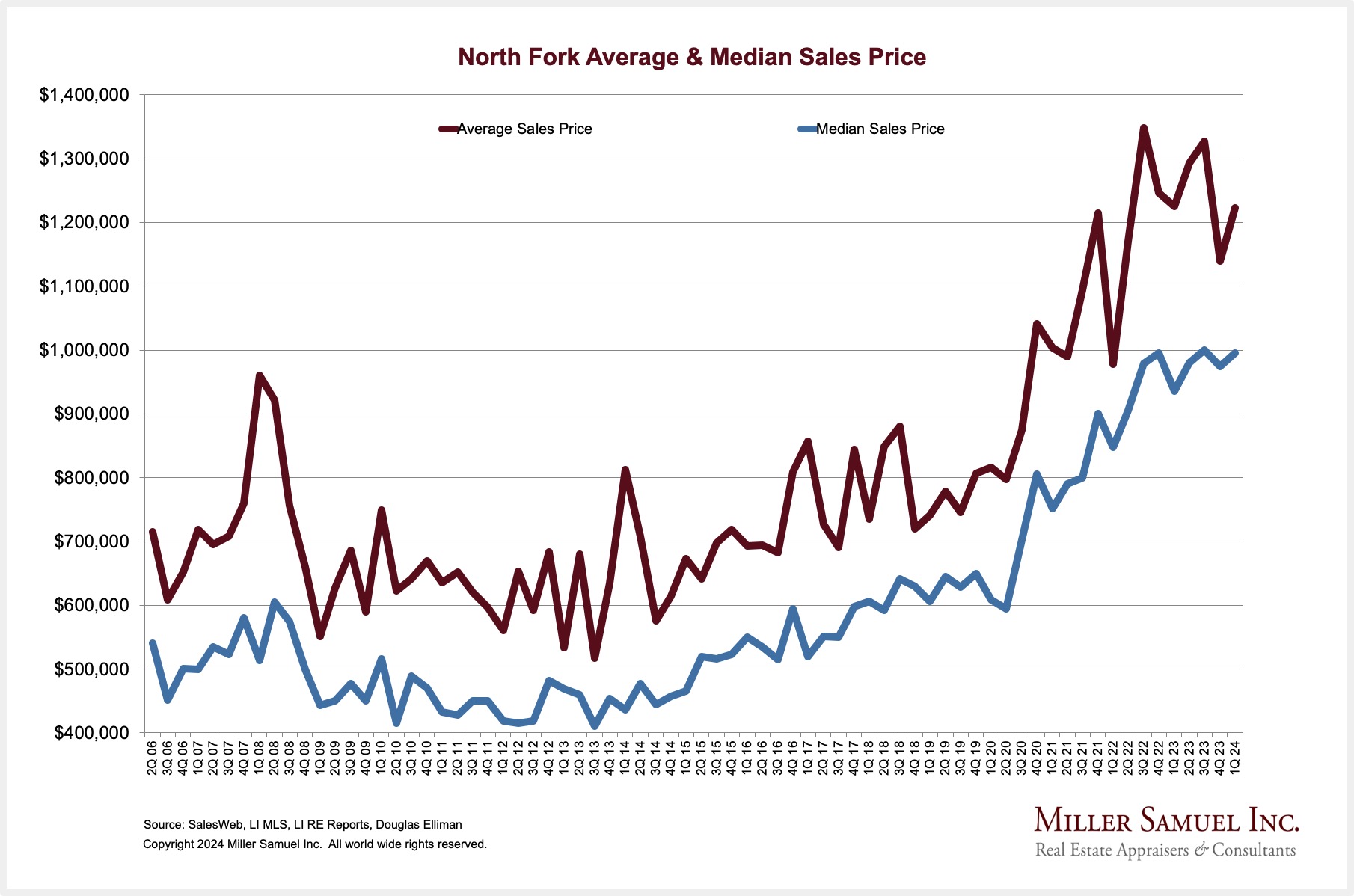

Sales expanded annually for the third consecutive quarter, enabled by the increase in supply.

- Median sales price rose annually to the second-highest level on record

- Sales increased annually, rising for the third time, enabled by more supply

- Listing inventory increased annually for the first time in three quarters

- Bidding war market share fell year over year to roughly one in five sales

NAR Settlement Reverberations Continue To Cost An Arm And A Leg While The Market Remains Slow And DOJ Hasn’t Weighed In Yet

Berkshire Hathaway just settled for $250 million in the Sitzer-Burnett case in Missouri. The judge in that class action gave preliminary approval to the NAR settlement, of which BH was not part.

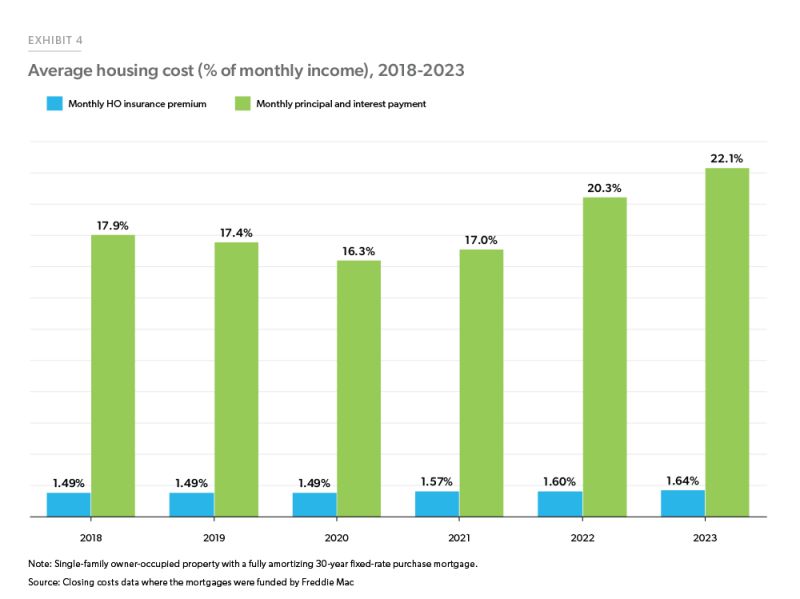

Settlement announcements like these send mixed messages to the brokerage community and the consumer. When does this get resolved? The consumer and the industry want to know what to do and what to expect. Many other copycat class actions and private cases are out there, with more being filed, so this week’s events don’t provide any closure. In addition to mortgage rates being stuck at a high level along with the inflationary impact on real estate taxes and insurance, it becomes obvious that the industry has a tough road ahead. Now, think hard about NAR as a trade group that has not addressed this issue for decades, yet there was a constant murmur at every NAR-related event I attended. This is a disservice to the industry they represent. When the sun sets on this issue, NAR needs to go.

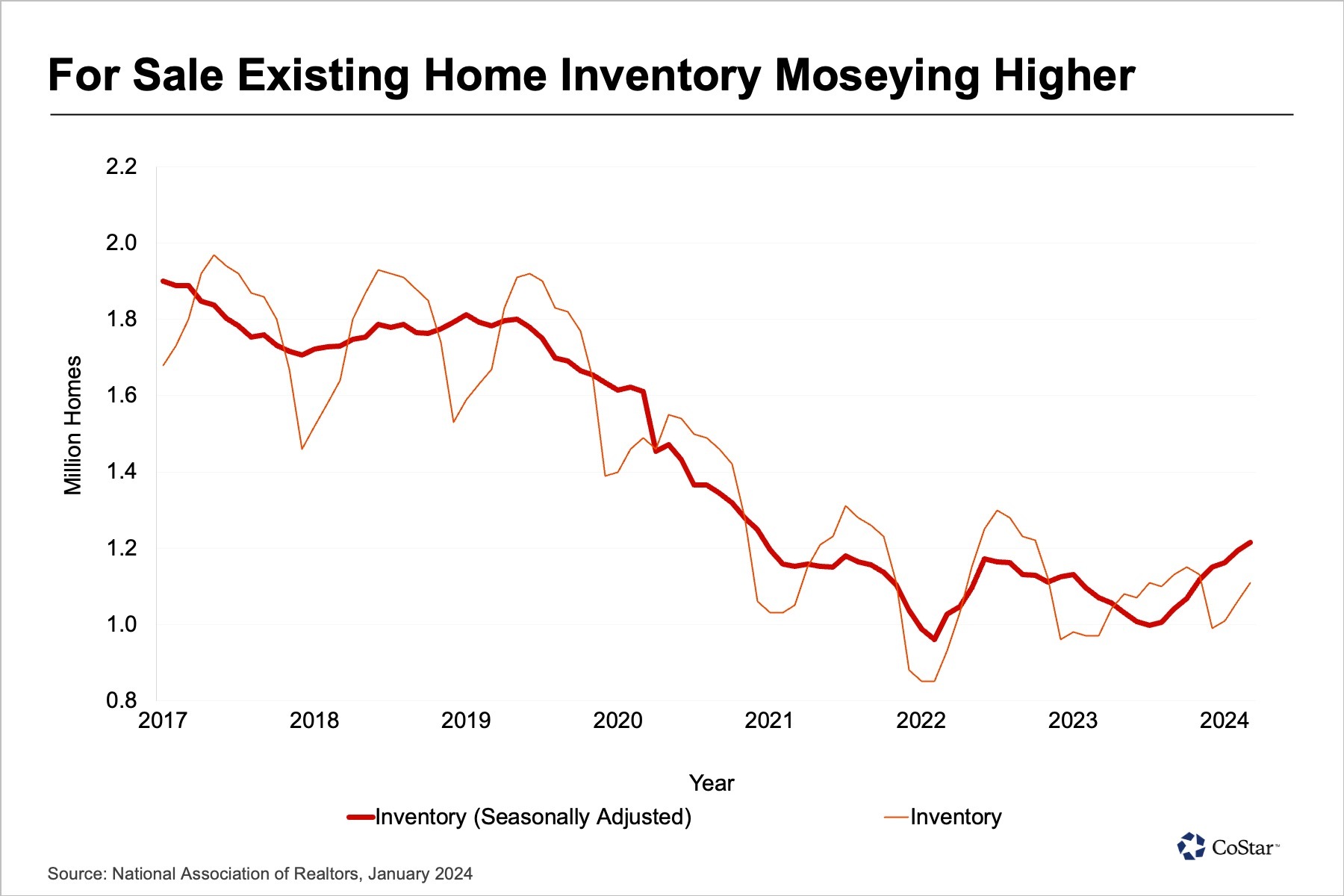

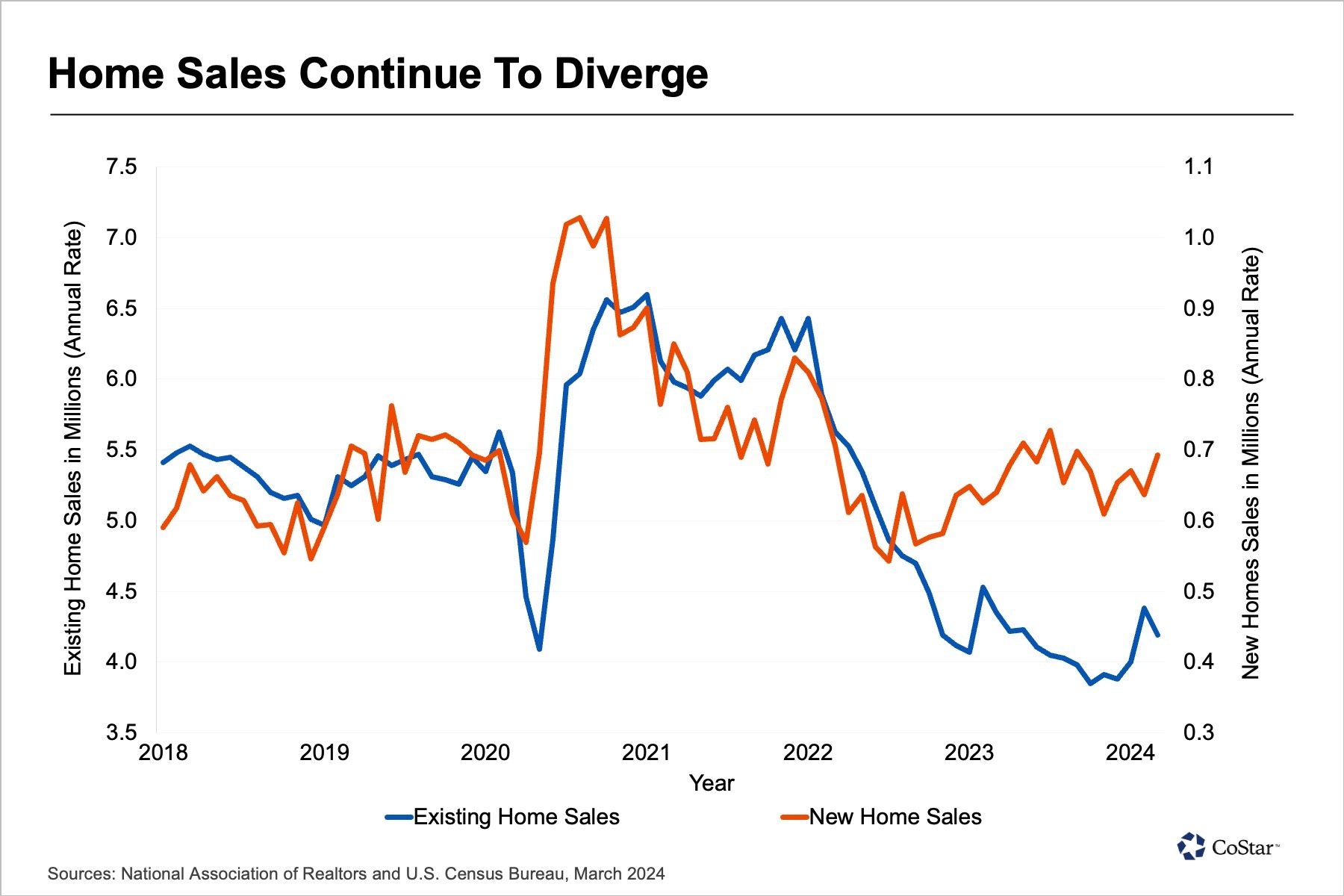

Housing Market Charts That Demonstrate Moseying, Crisis, Divergence, and Sensitivity

Note the chart headlines, ha.

NPR – The Rising Cost Of Home Insurance

I enjoyed the insurance information shared in this episode; The Indicator is one of my regular podcast listens.

The Best Kind Of Marketing

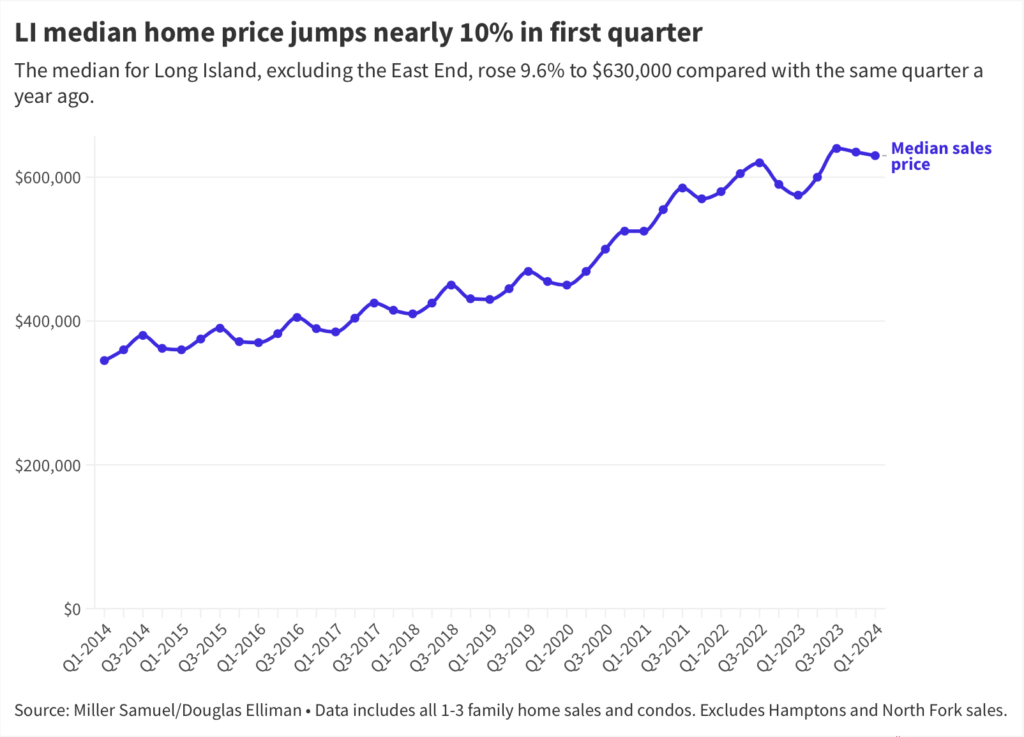

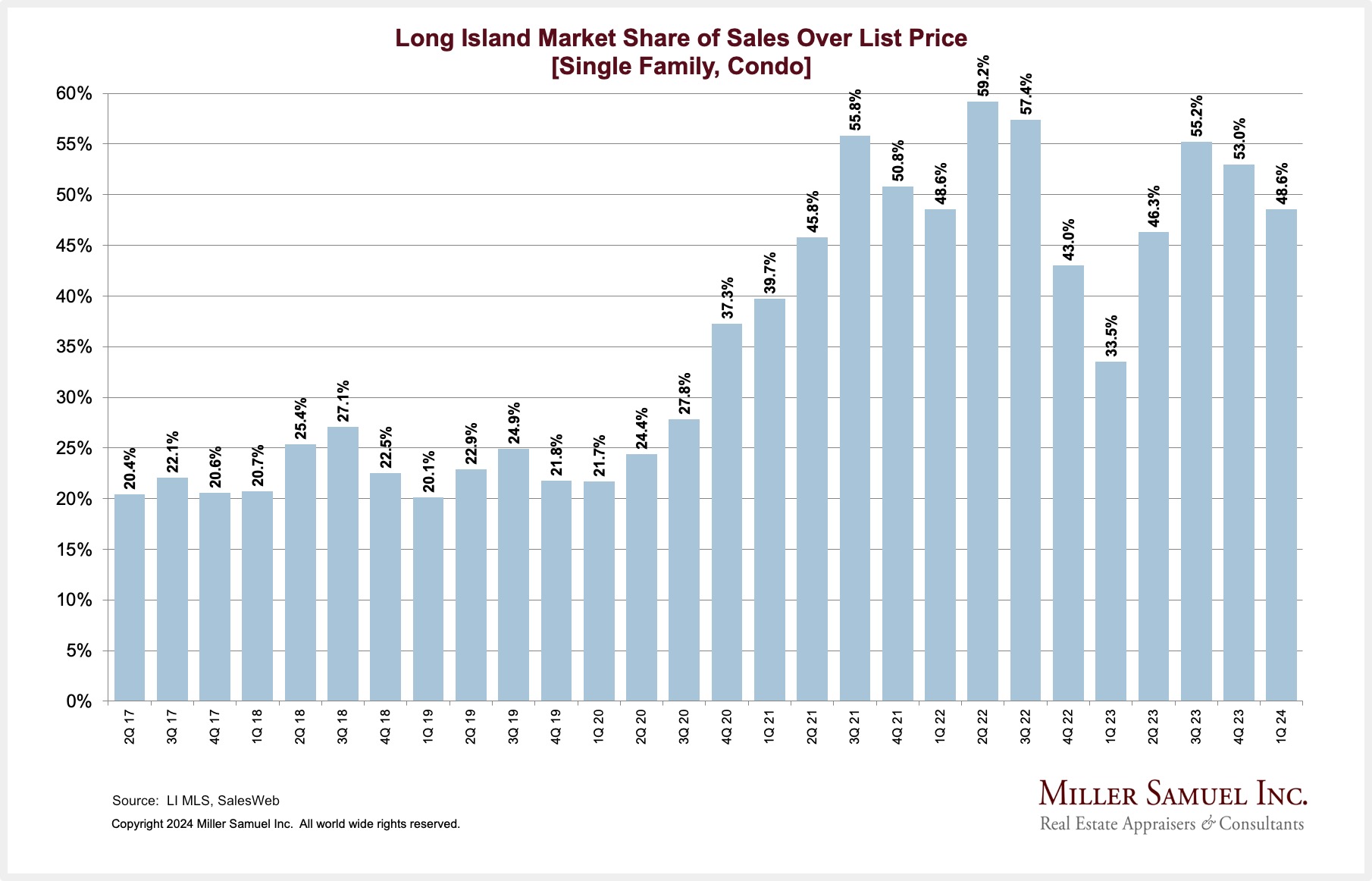

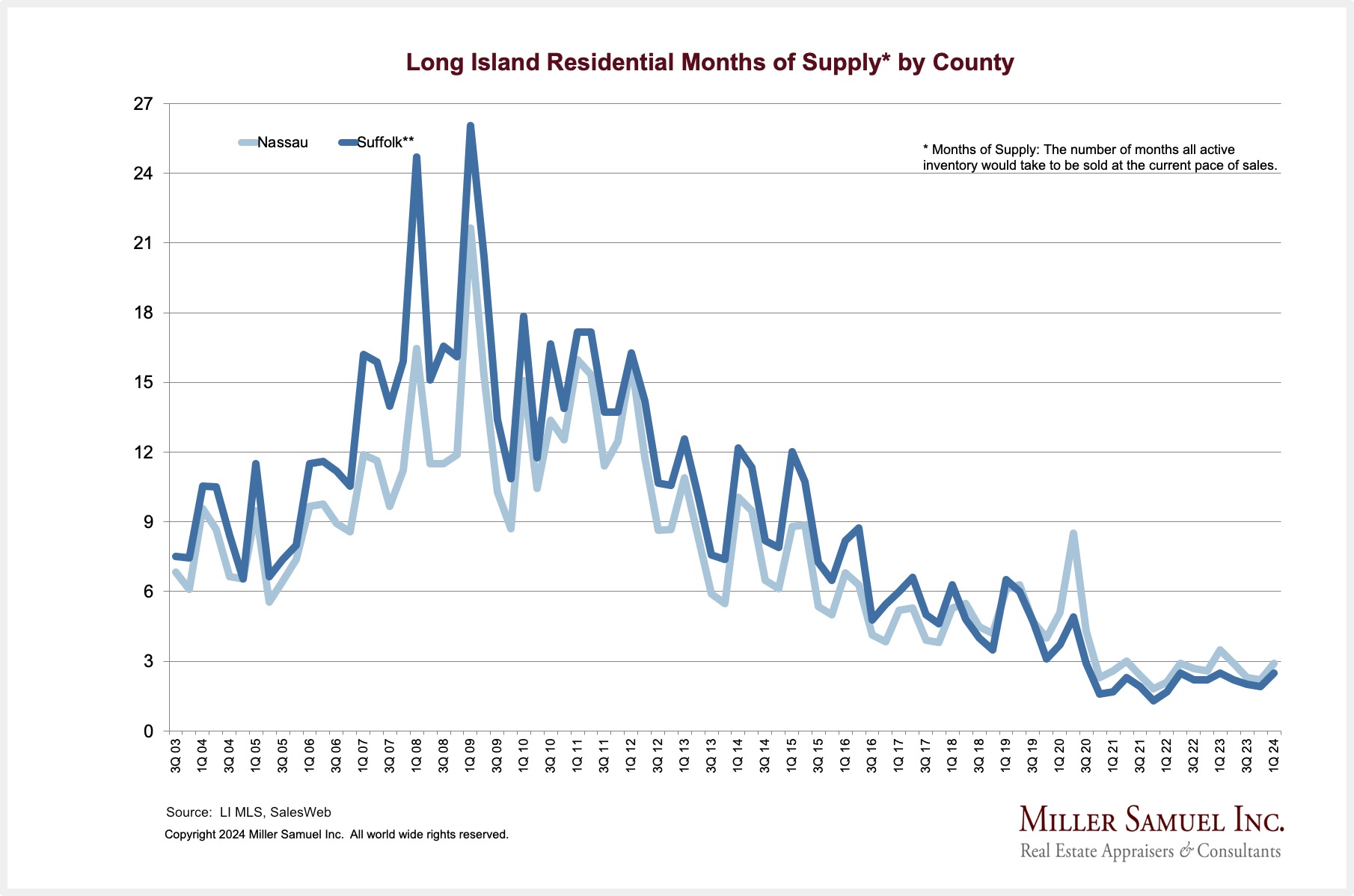

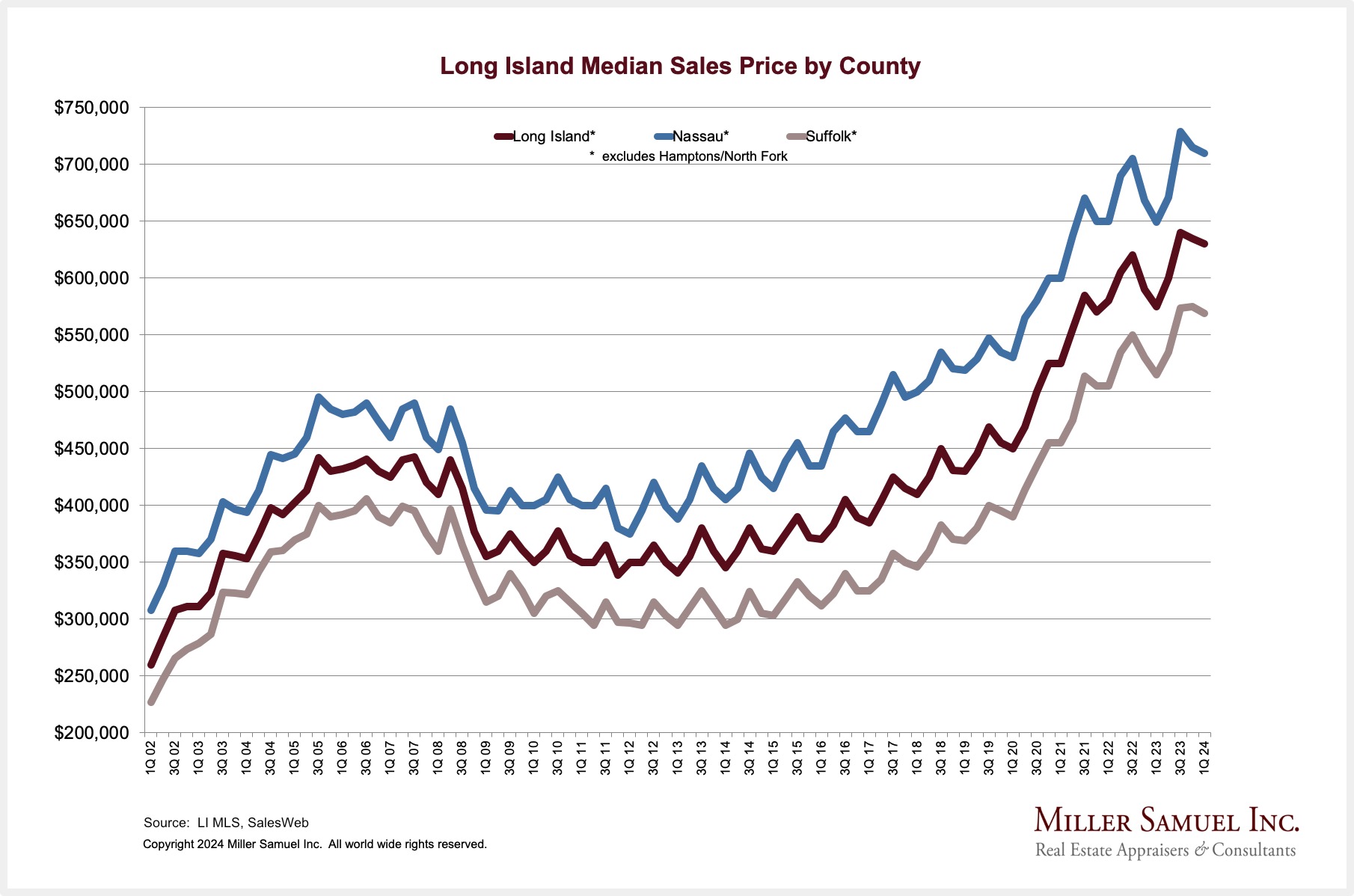

Long Island Prices Continue To Rise

The median sales price is up 9.6% year over year, as prices have been rising significantly for more than a decade. In our market report series, I separate Long Island from the east end, which includes Hamptons and North Fork, because they are completely different markets. Newsday, Long Island’s primary news source, provided thorough coverage of the report results.

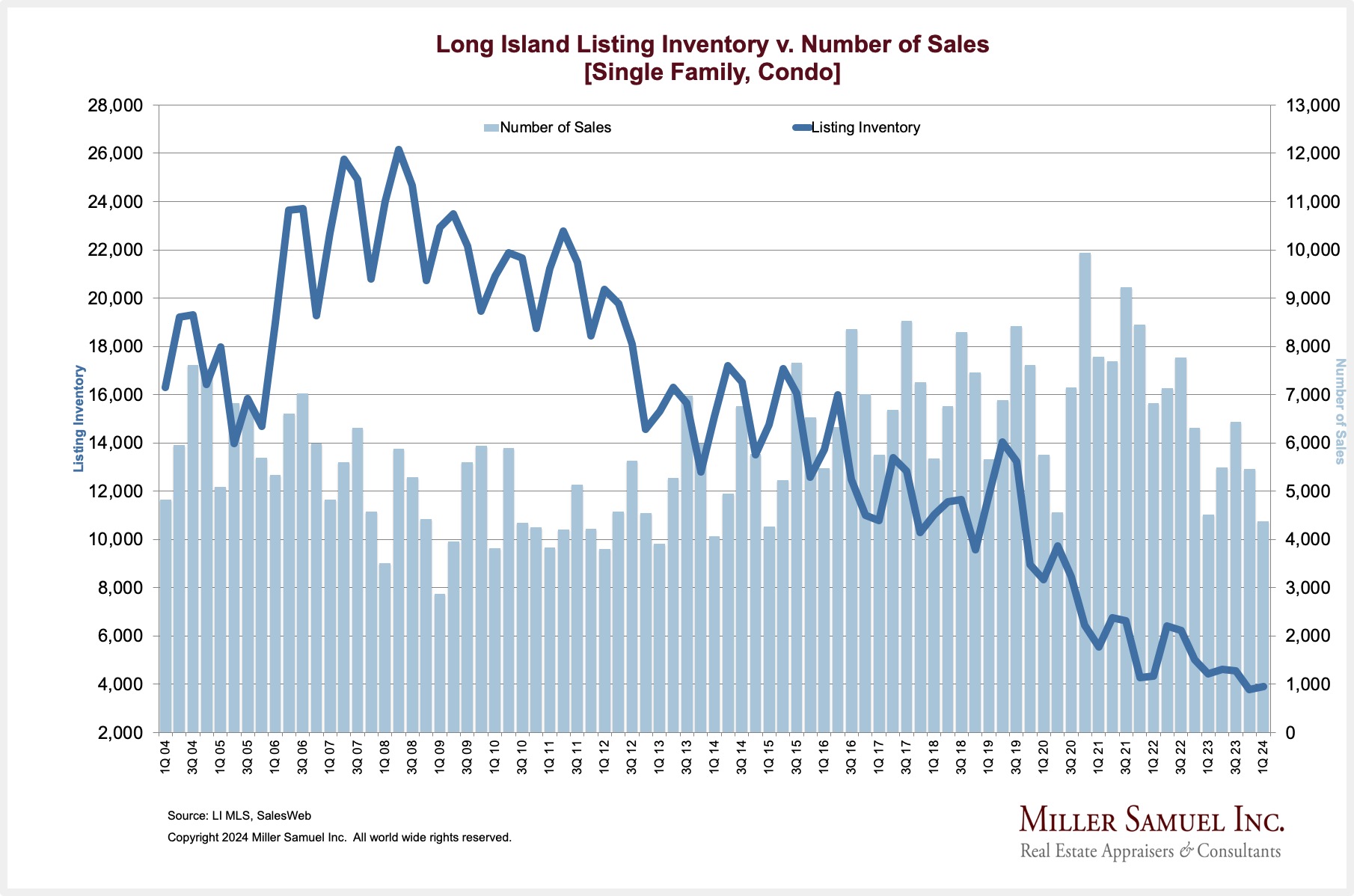

LONG ISLAND HIGHLIGHTS

Elliman Report: Q1-2024 Long Island Sales

Listing inventory continued to fall, keeping price trend indicators elevated.

- Price trend indicators rose collectively year over year for the third time

- Listing inventory declined annually to the second lowest level on record

- Sales fell year over year for the past two years, at a diminishing rate for the past year

- Single family median sales price increased annually for the third time to the third-highest on record

- Condo median sales price increased annually for the eleventh time to the second-highest on record

- Luxury average and median sales prices jumped to their second-highest levels on record

- Luxury listing inventory rose year over year for the first time in four quarters

- Luxury bidding war market share surged annually to more than one out of four sales

Highest & Best Newsletter: 🚫 No Apocalypse Now

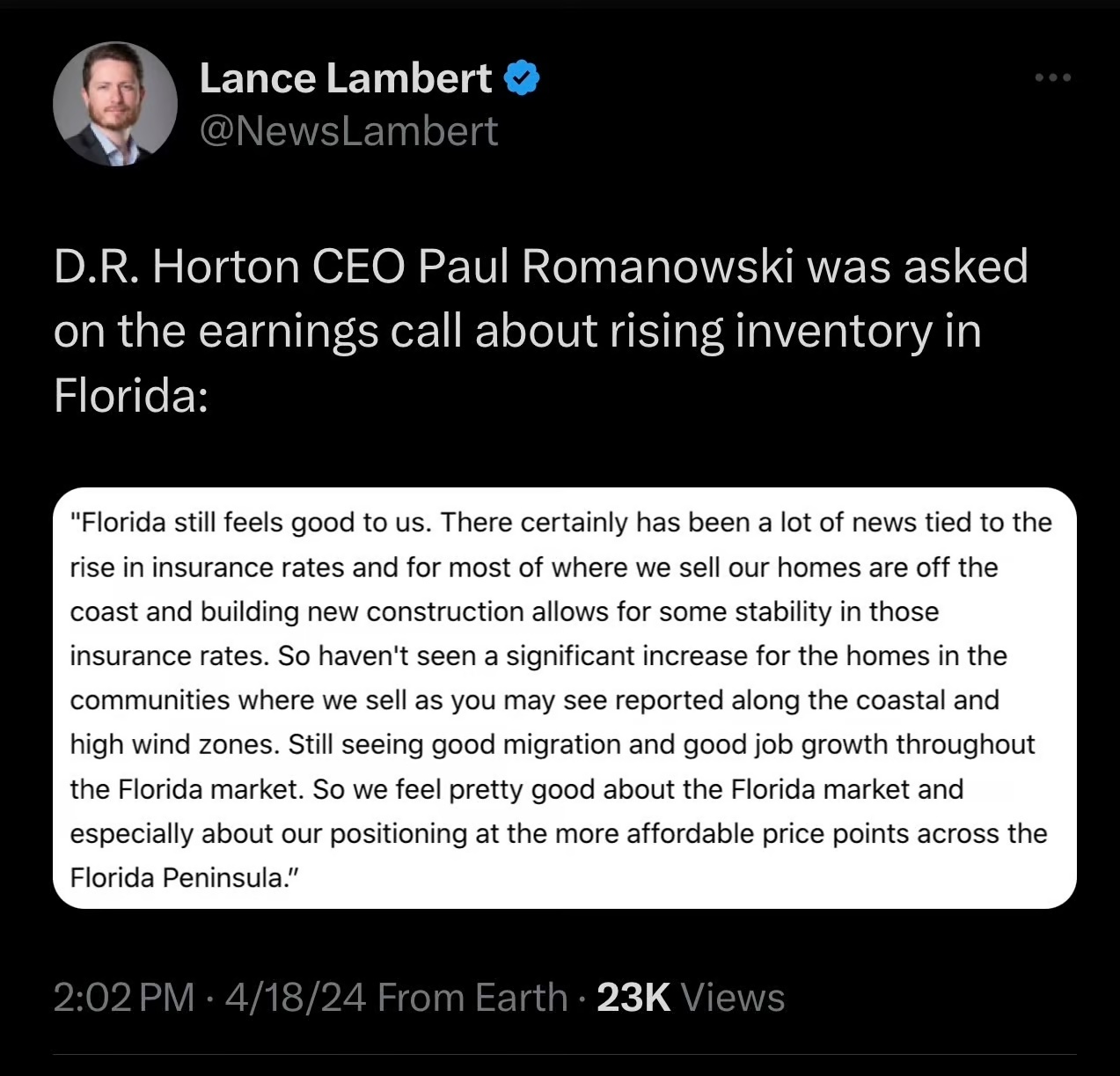

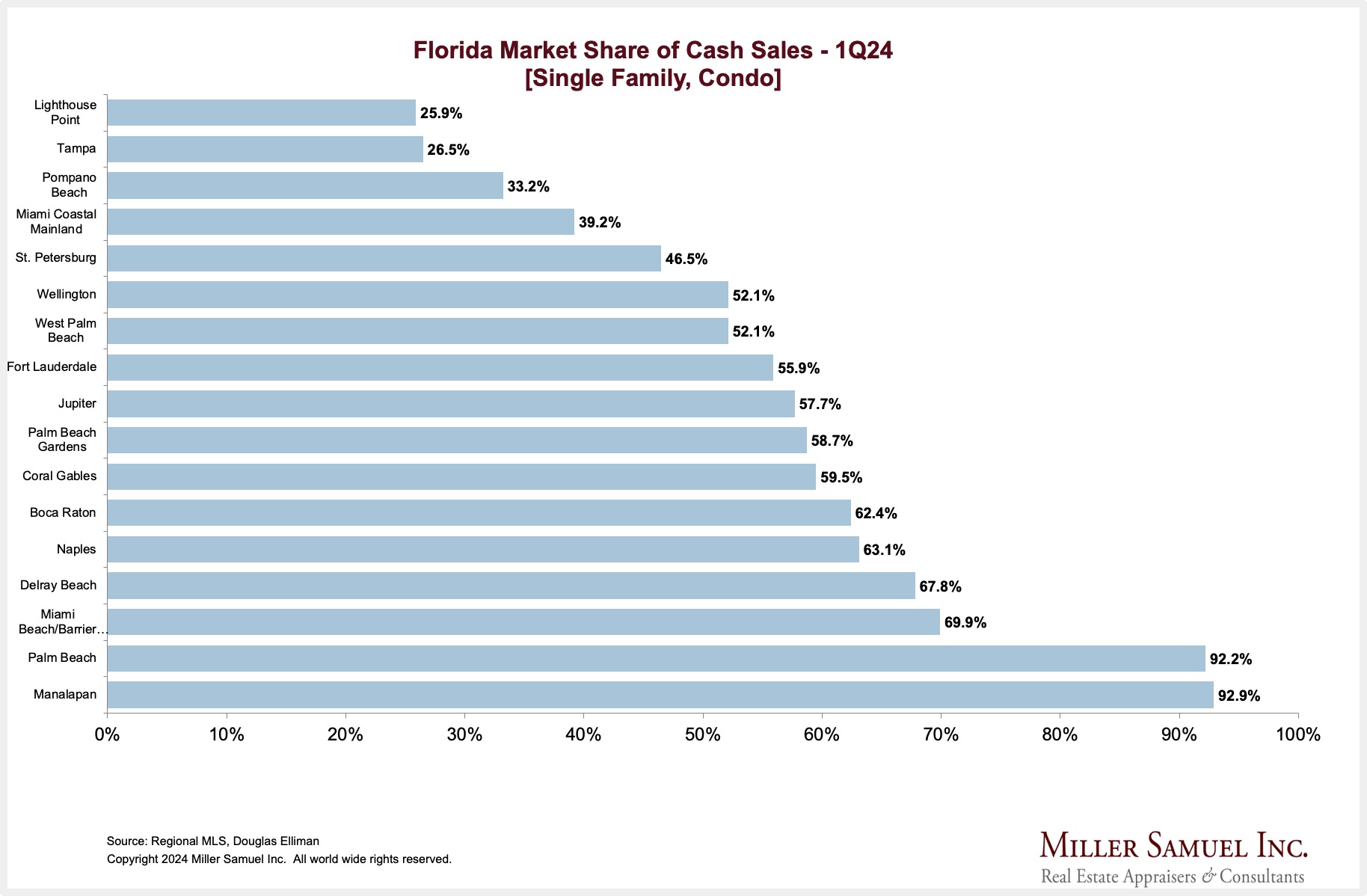

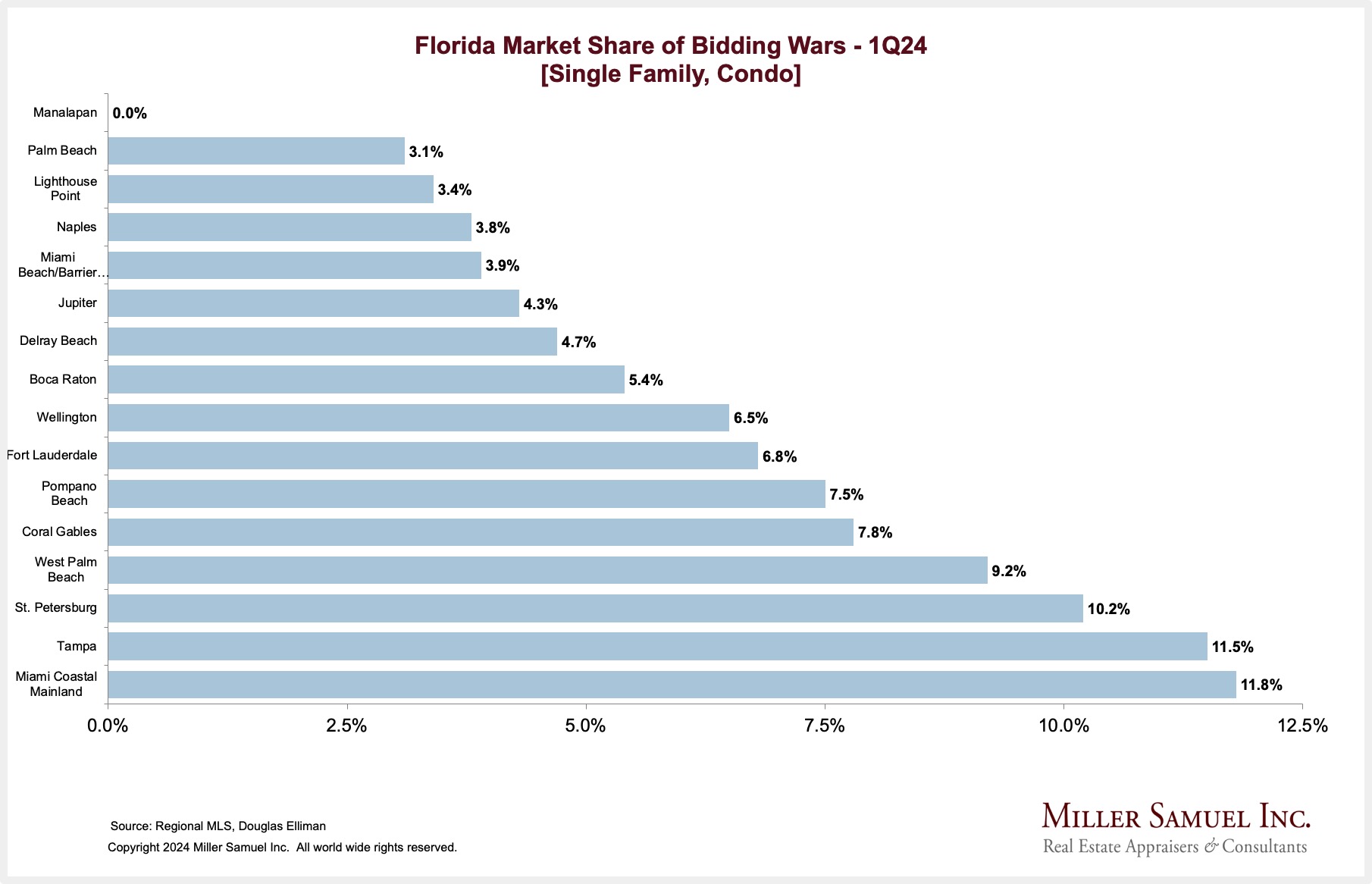

If you’re interested in the Florida housing market, you should sign up for this Florida newsletter, Highest & Best, from Oshrat Carmiel, formerly of Bloomberg News…

This week’s post:

THIS WEEK’S POST 🚫 No Apocalypse Now – Florida home listings climb–but in a good way?

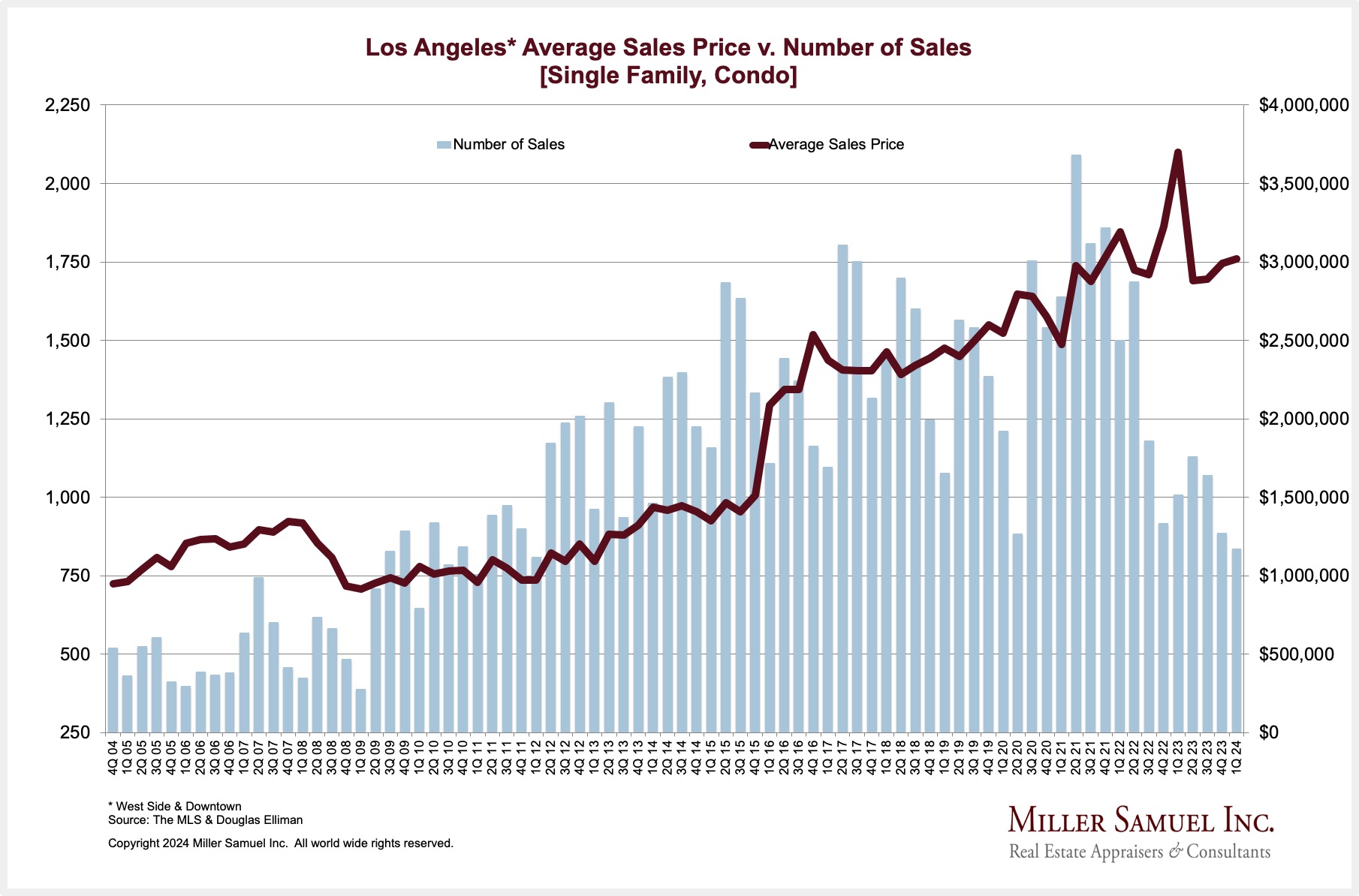

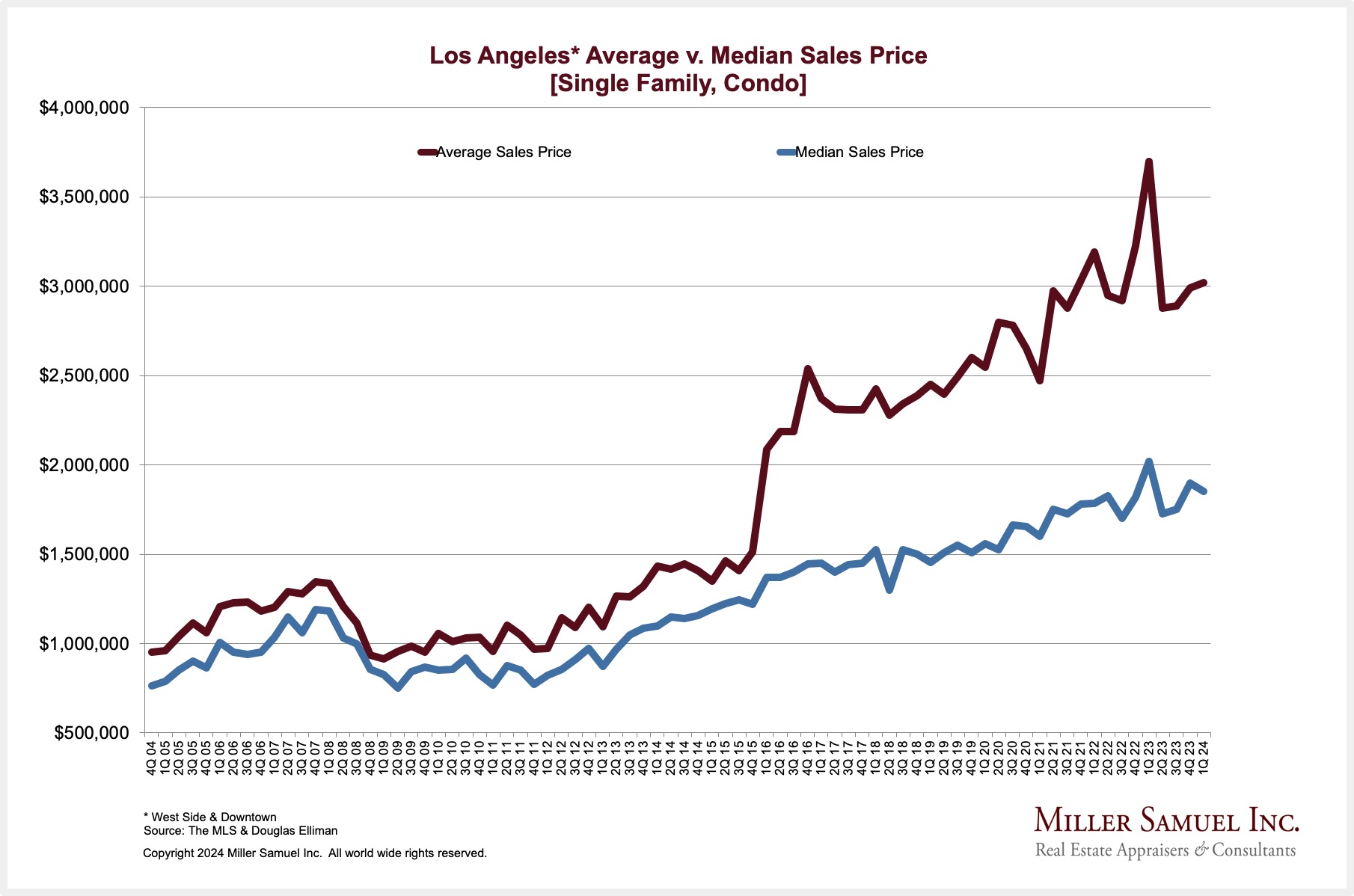

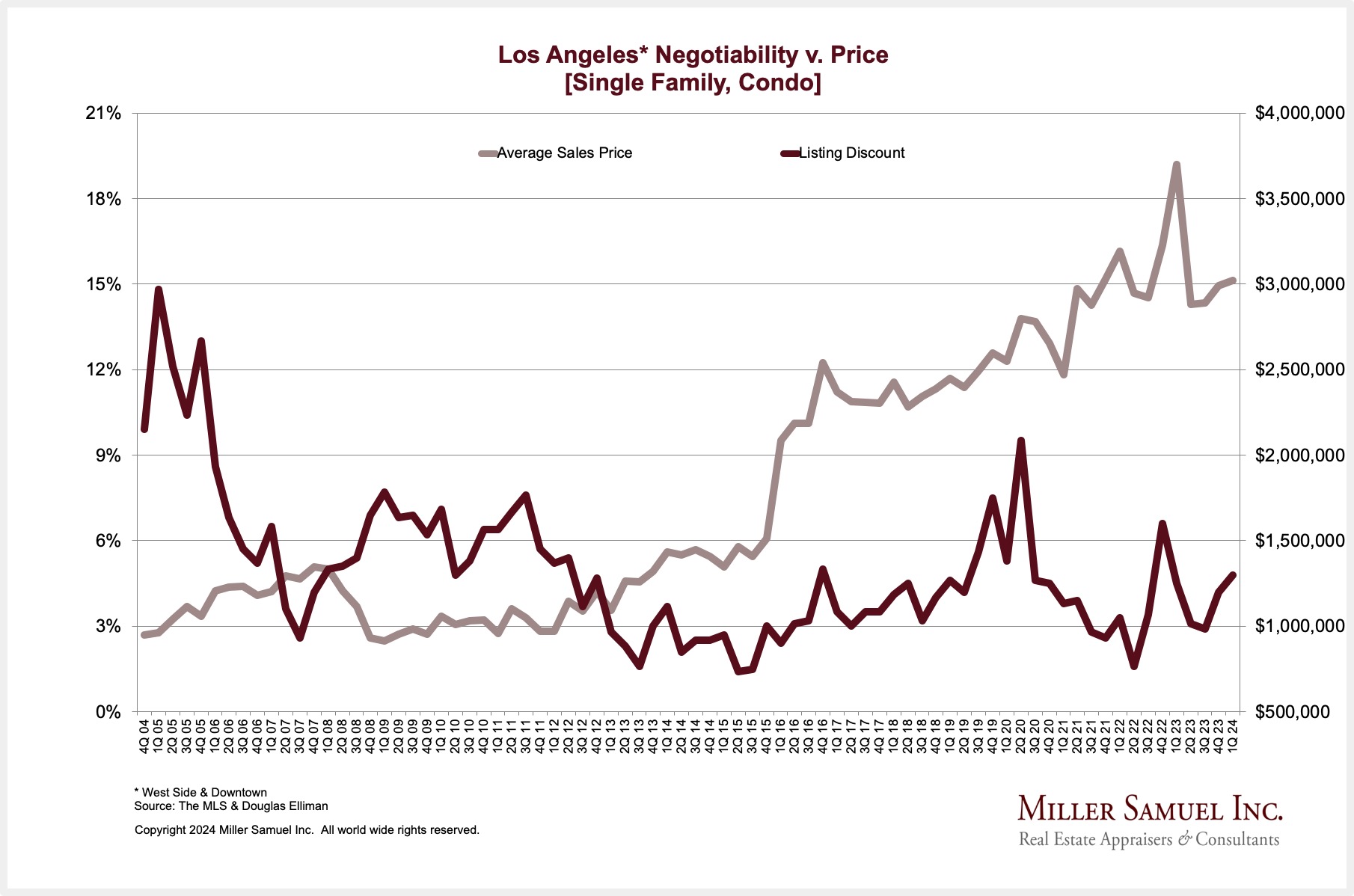

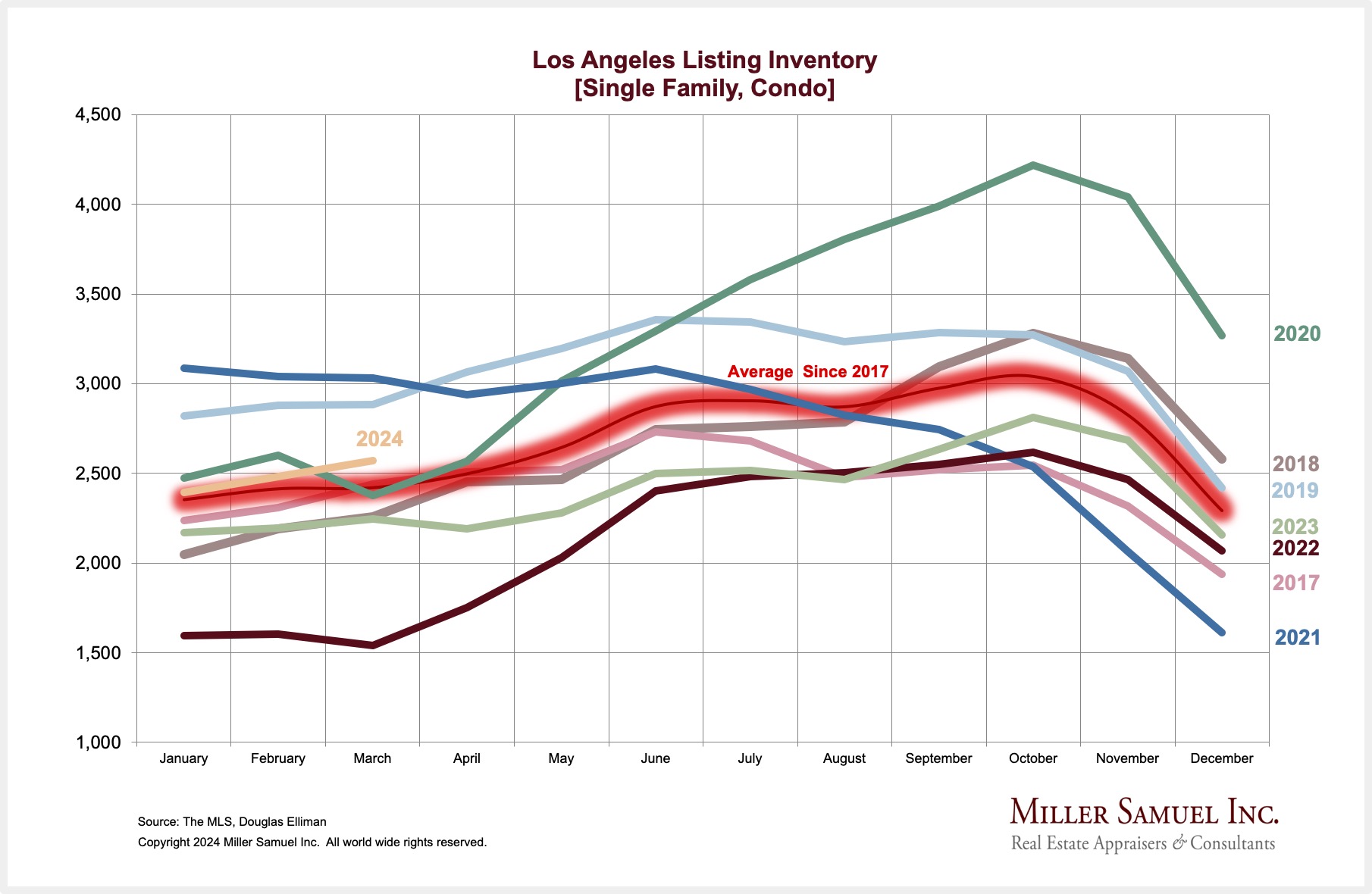

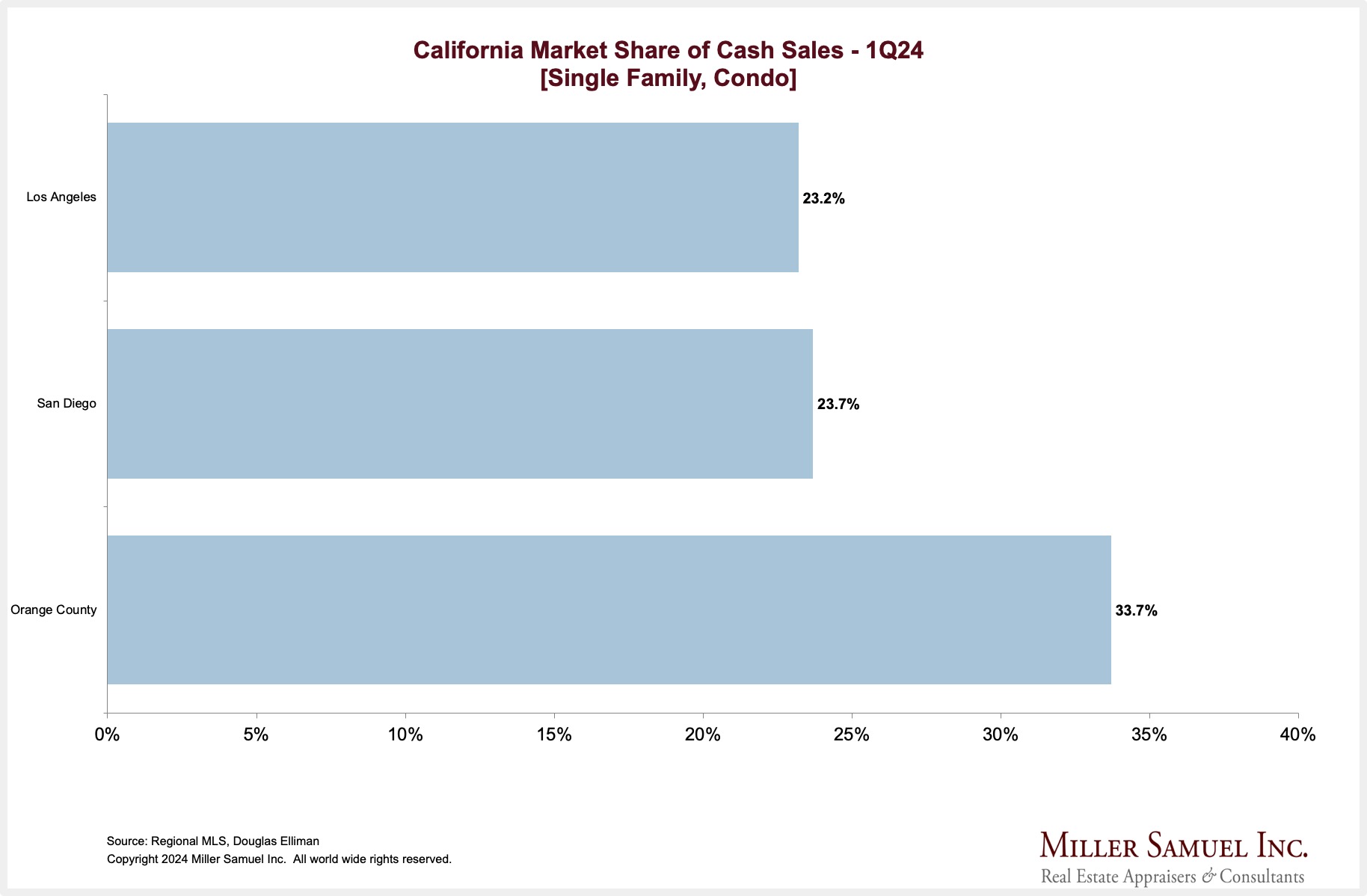

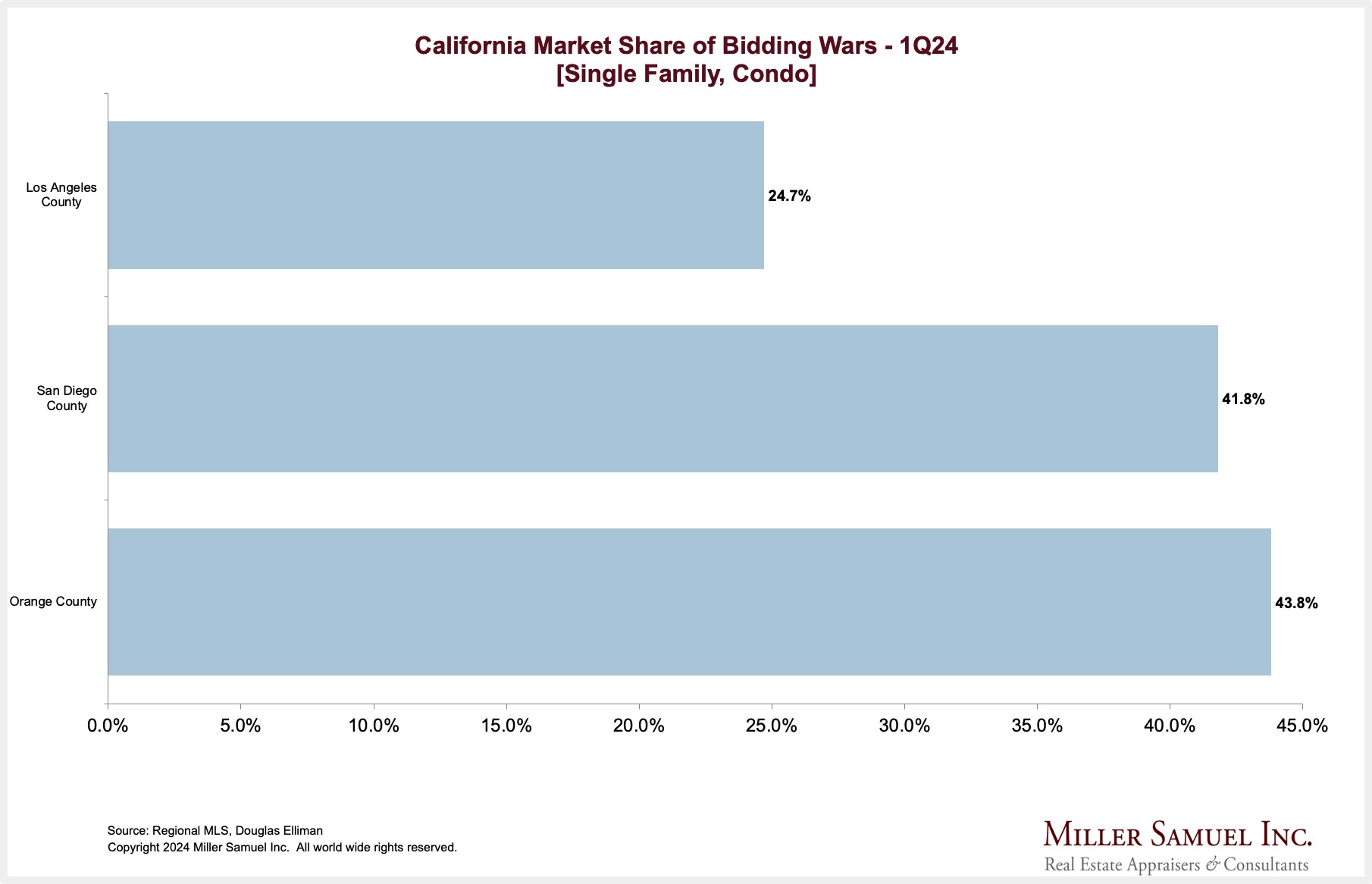

SoCal Housing Market Remains Slow

GREATER LOS ANGELES, INCLUDING WESTSIDE AND DOWNTOWN SALES HIGHLIGHTS

Elliman Report: Q1-2024 Los Angeles Sales

Average sales size slid across the region, skewing price trends lower.

- Price trend indicators declined annually as the market shifted to smaller-sized sales

- Listing inventory rose year over year for the sixth time

- Average sales size declined annually for the past four quarters

- Listing inventory for luxury single families increased year over year for the fifth time in six quarters

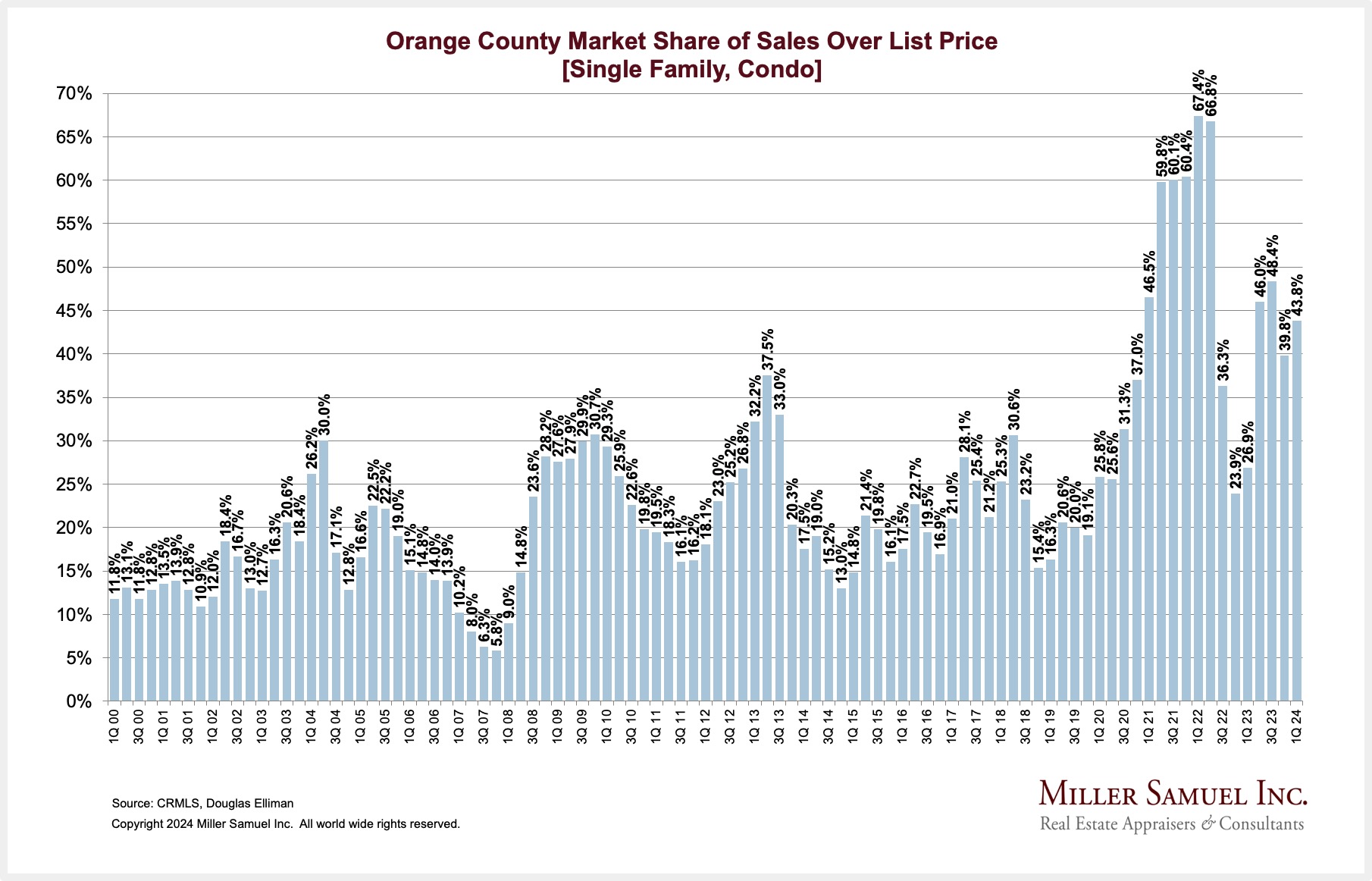

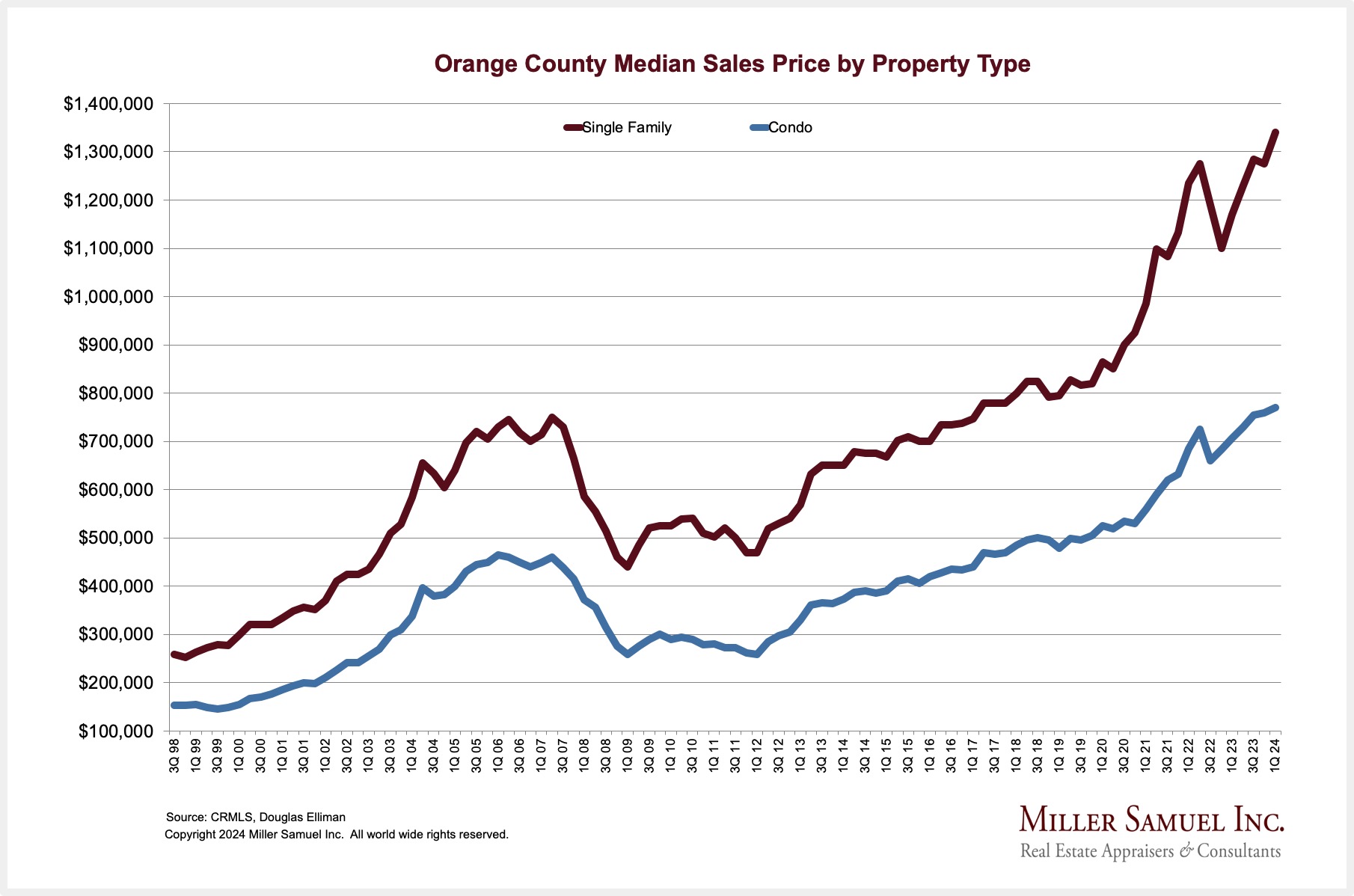

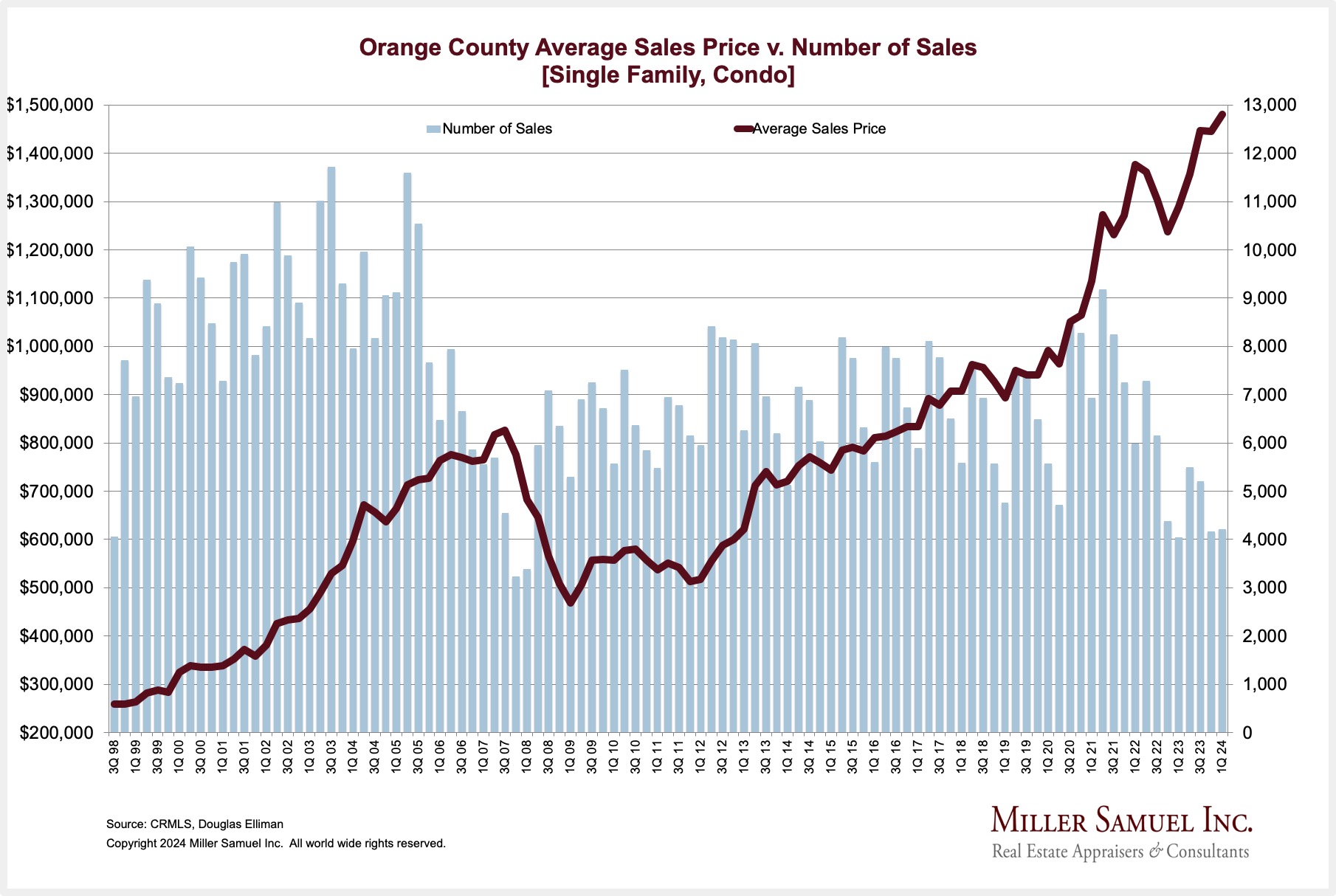

ORANGE COUNTY SALES HIGHLIGHTS

Elliman Report: Q1-2024 Orange County Sales

Price trend indicators reached record highs as sales increased for the first time in nearly three years.

- The overall price trend indicators rose to all-time highs

- Sales increased annually for the first time in eleven quarters

- Listing inventory declined year over year at a diminishing rate over the past year

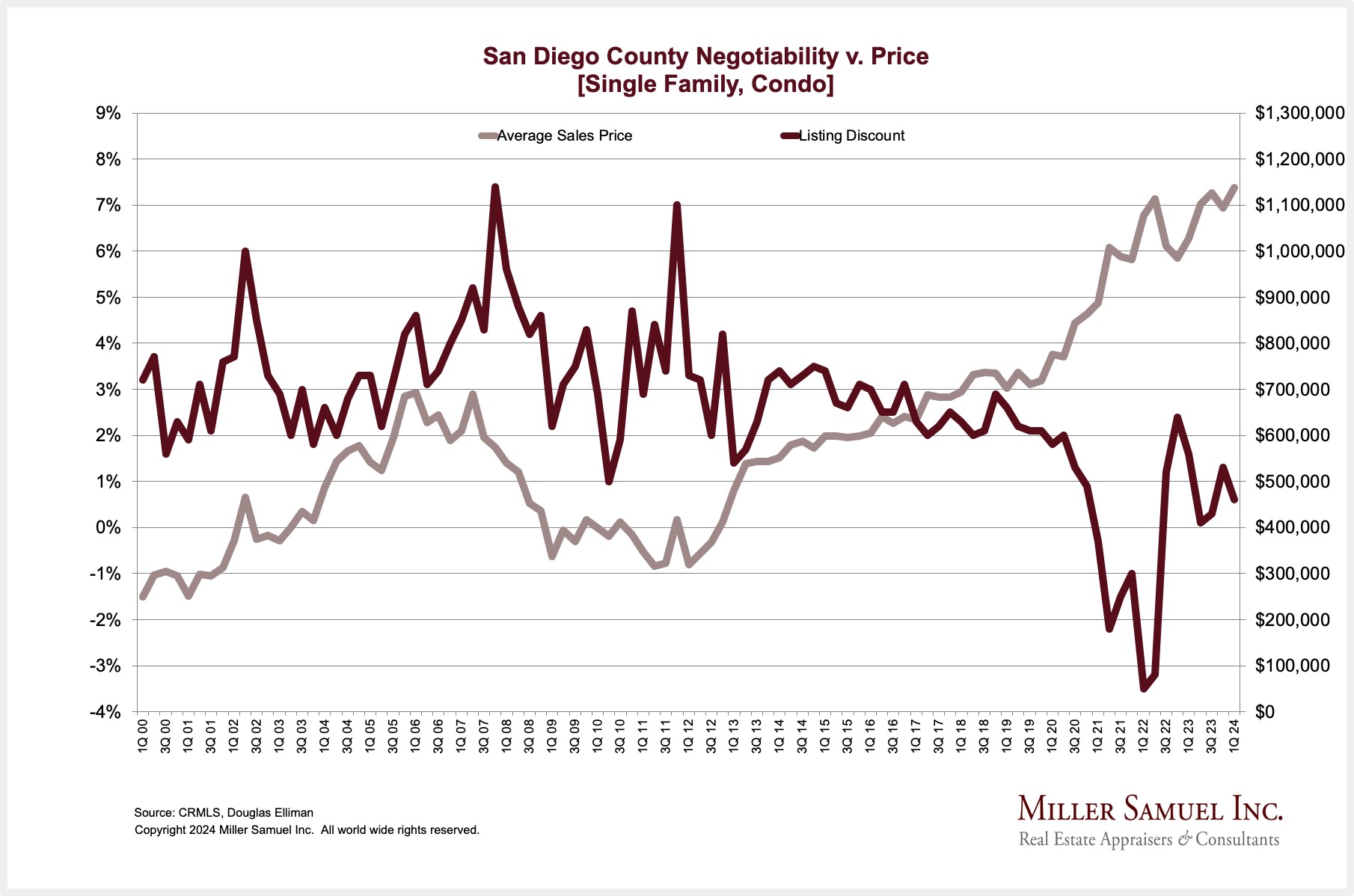

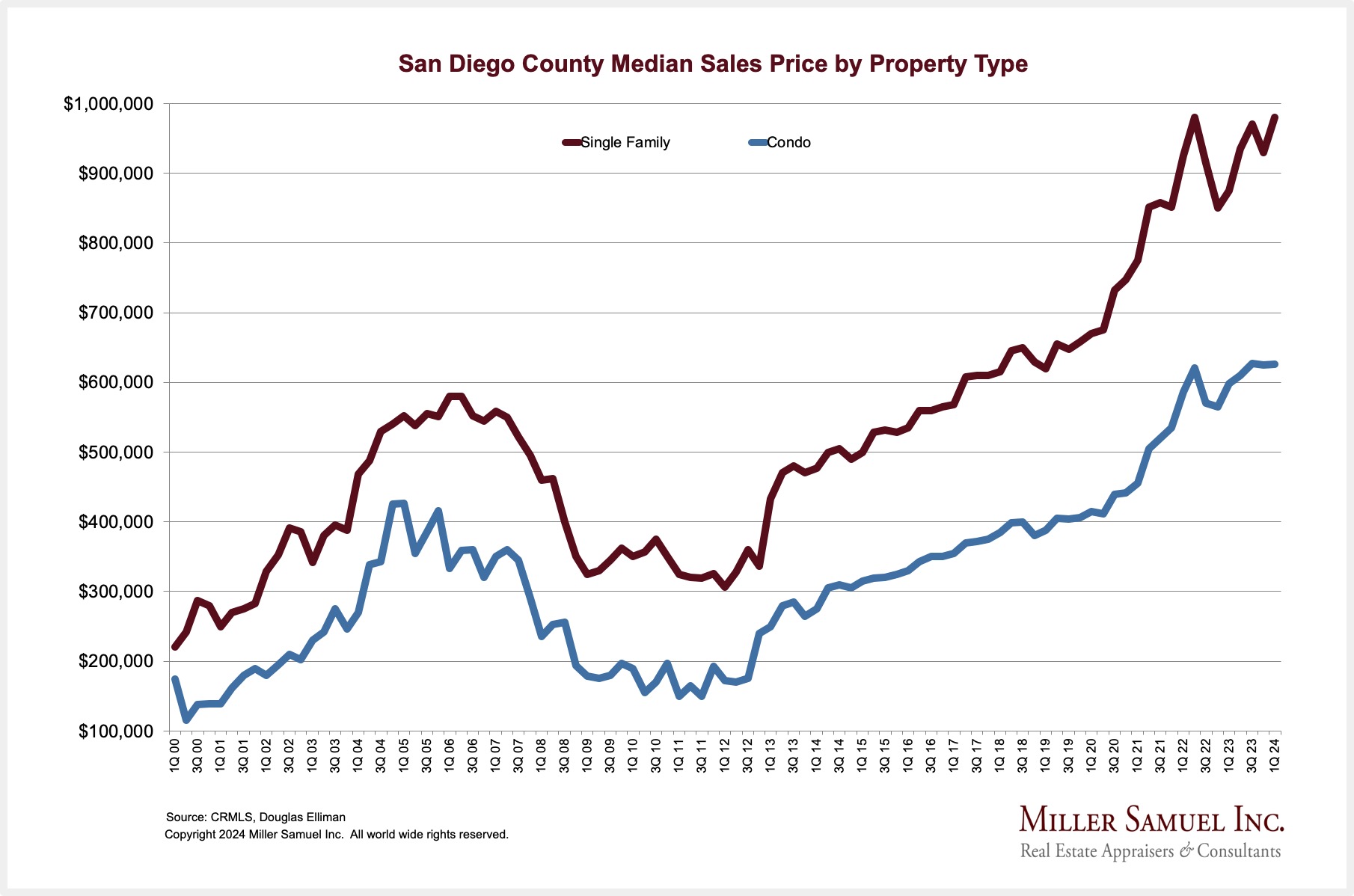

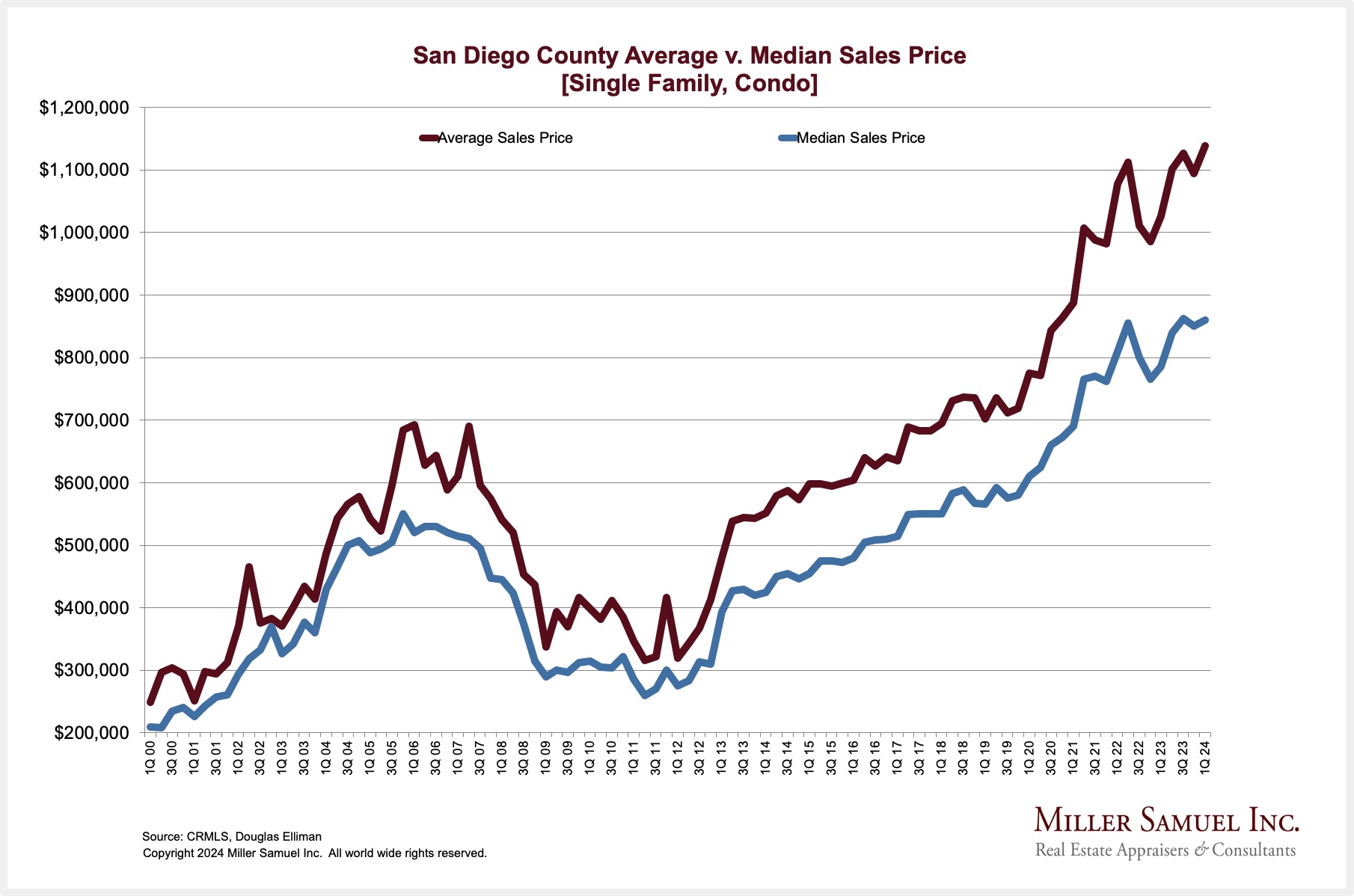

SAN DIEGO COUNTY SALES HIGHLIGHTS

Elliman Report: Q1-2024 San Diego County Sales

Prices pushed towards new highs as sales rose for the first time in nearly three years.

- Average and average price per square foot rose to all-time highs

- Sales increased annually for the first time in eleven quarters

- Listing inventory expanded year over year for the first time in four quarters

Central Bank Central Interview: “Higher for Longer” Fed May Stress Emerging Markets“

Here’s a new substack I’m excited about – Kathleen Hays Presents Central Bank Central. I highly recommend it. A long-time friend and journalist, Kathleen Hays has extensive experience interviewing economic experts in Fedworld from her time at CNBC and Bloomberg Television.

Central Bank Central: Higher for Longer” Fed May Stress Emerging Markets

Speaking Events

It’s been a busy week for housing discussions. I spoke in Miami with developer David Martin of Terra Group at his Park 5 development and a hybrid event in Manhattan at Douglas Elliman. I spoke to a live audience and simultaneously on Zoom.

Getting Graphic

Favorite housing market charts of the week of our OWN making

Favorite housing market/economic charts of the week made by OTHERS

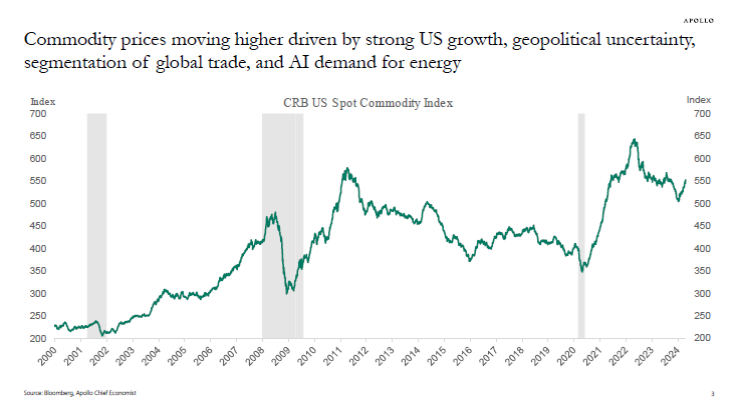

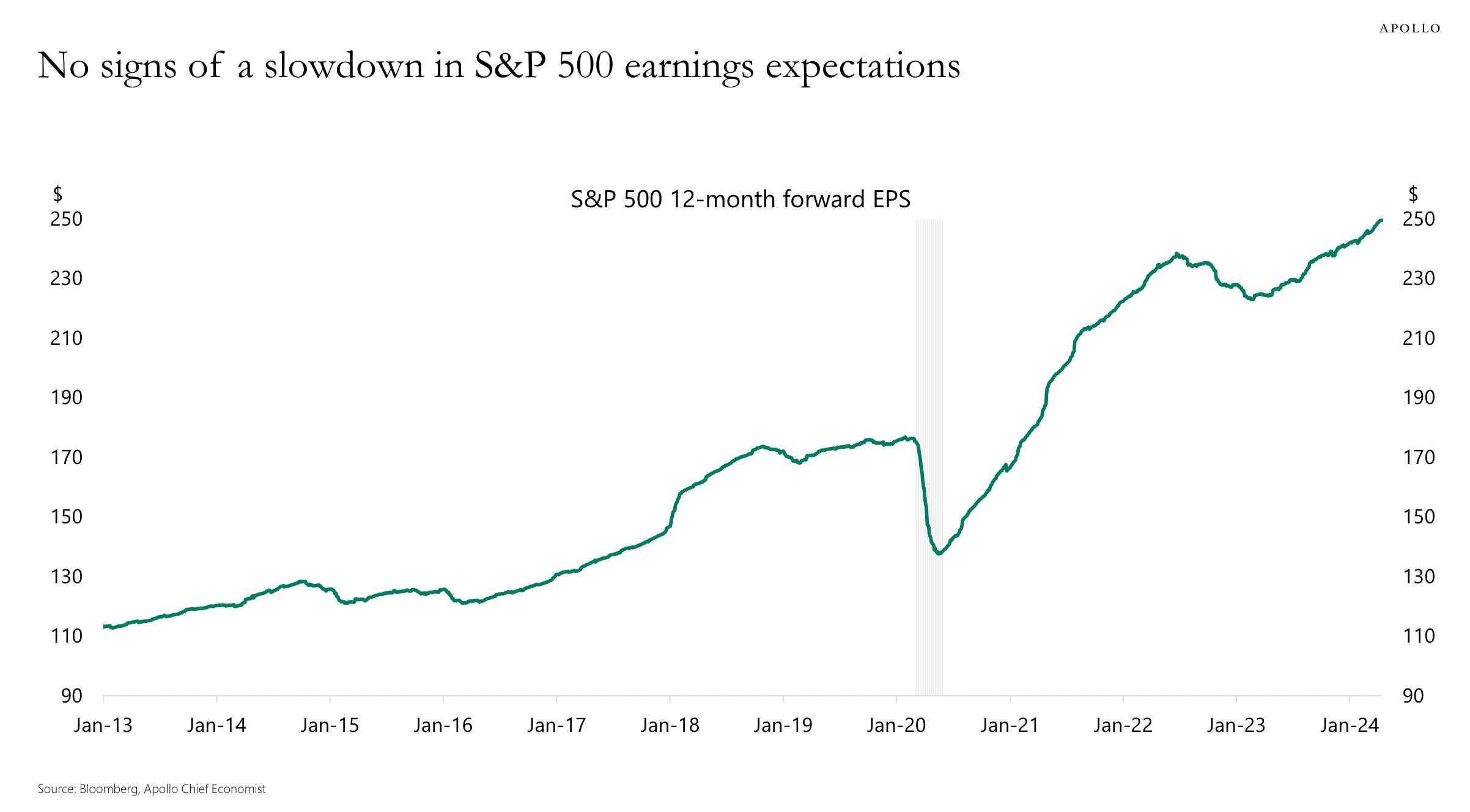

Apollo’s Torsten Slok‘s amazingly clear charts

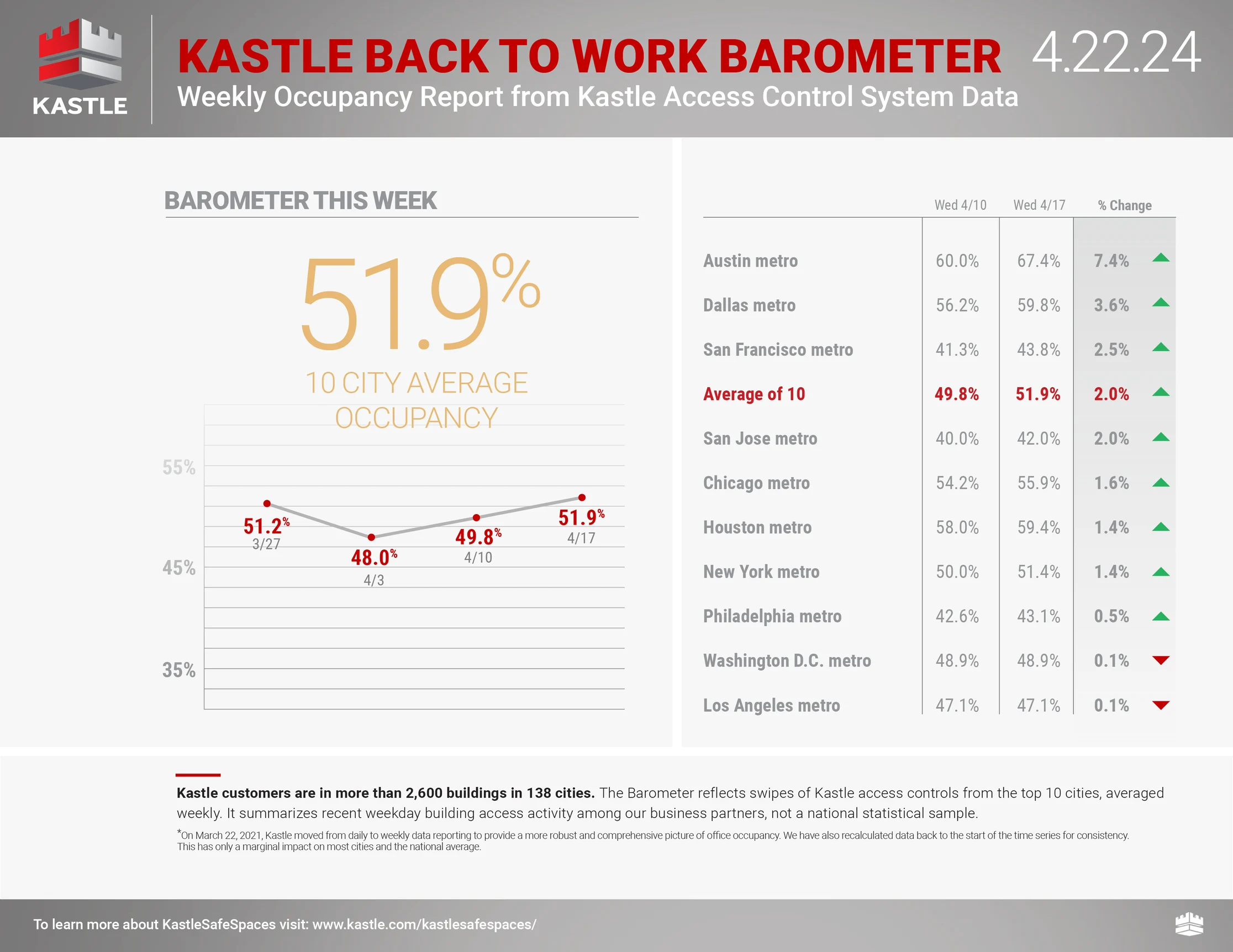

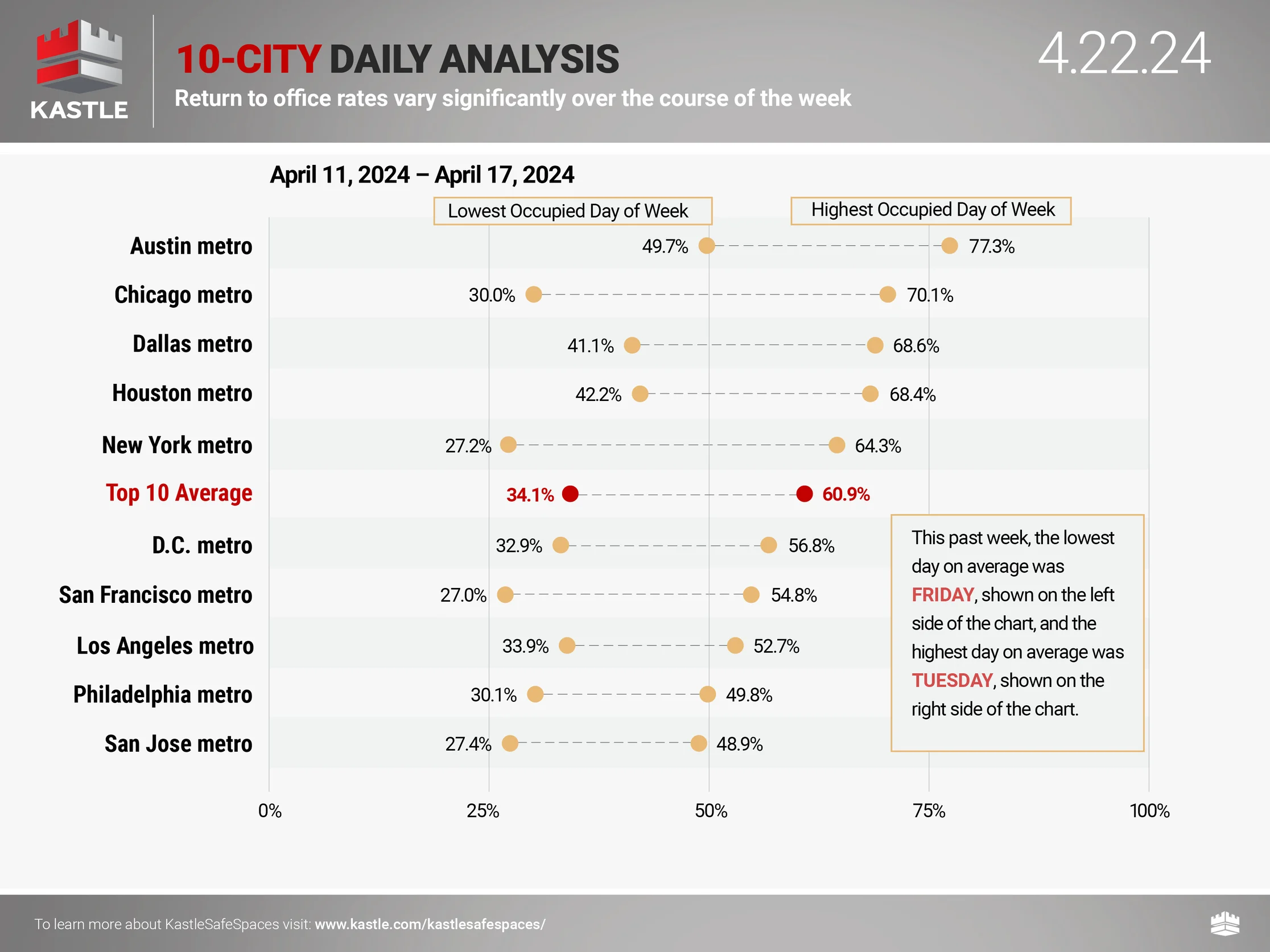

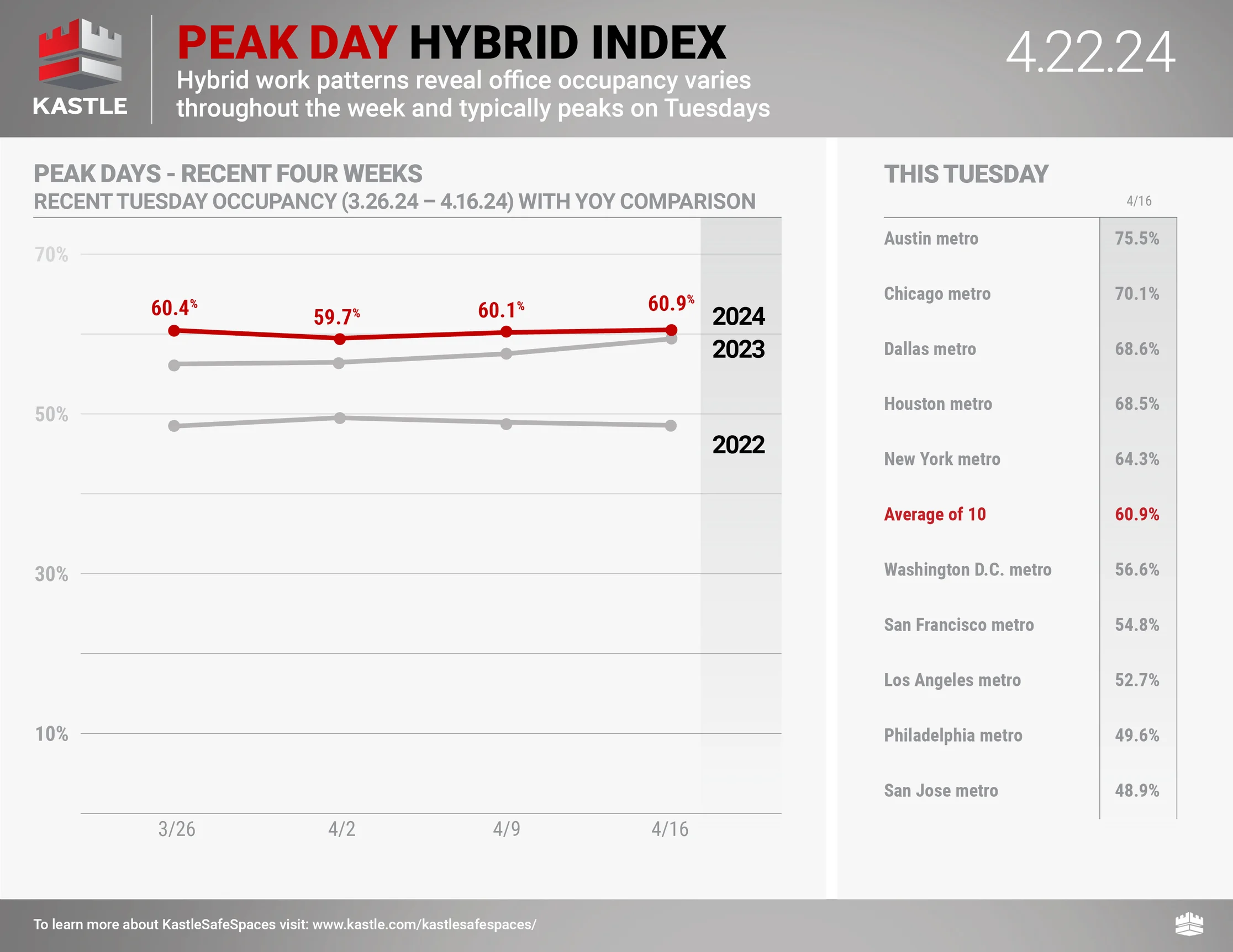

Kastle card swipe data

Remember that Kastle charts are overstating occupancy* because their pre-pandemic occupancy benchmark was 100%, which is incorrect (*measures card swipe activity as a proxy for occupancy). Still, they’ve become the standard benchmark for occupancy rates.

Len Kiefer‘s chart handiwork

Favorite RANDOM charts of the week made by others

Appraiserville

Phil Crawford Broadcasts Live From The Kelly Coronation at Washington’s National Cathedral

This week’s Voice of Appraisal podcast is Peak Phil’s fantasy-as-reality as he provides the play-by-play at the National Cathedral in DC (incidentally, my sister worked in the NC gift shop in high school – it’s quite a beautiful place). Lyin’ Dave passes the crown to Kelly, Queen of Davids, while CFPD Director Chopra bangs on the locked door calling out “No Role,” confirming LD’s testimony that he played “no role” in finding his replacement but was lying. Phil’s artistic effort is timely as the new TAF president is glad-handing around DC while Lyin’ Dave collects his new big consulting check while still calling the shots at TAF.

For the uninitiated, TAF is the organization that wrote the bat-shit crazy letter, the chickenshit letter, and is the subject of an active investigation by HUD on whether USPAP promotes a lack of diversity in the appraisal profession (400th out of 400 occupations, according to BLS in 2021). As a reminder, former TAF president Dave Bunton called me a liar in a public forum in Washington, D.C., as he was lying (not under oath) – hence his new nickname “Lyin’ Dave,” a.k.a. “LD.”

Please listen to this poetic Oscar-worthy radio-like show’s interpretation of the state of appraisal industry governance. Apparently, data alcoholics like Fannie Mae love data cancer (inserting bloated, non-appraised data into the pool) and are now ratcheting up appraisal waivers on cash-out refi mortgages. Insanity.

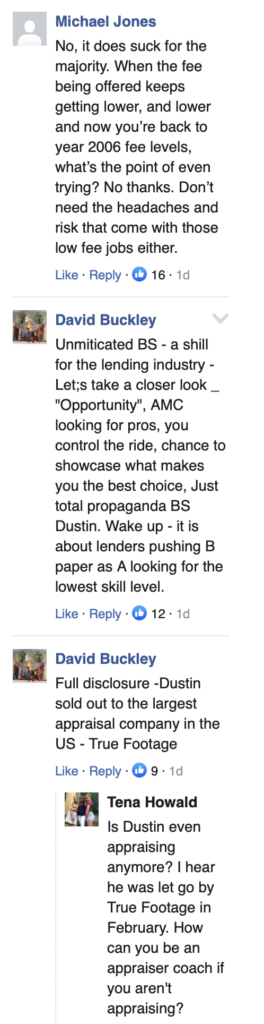

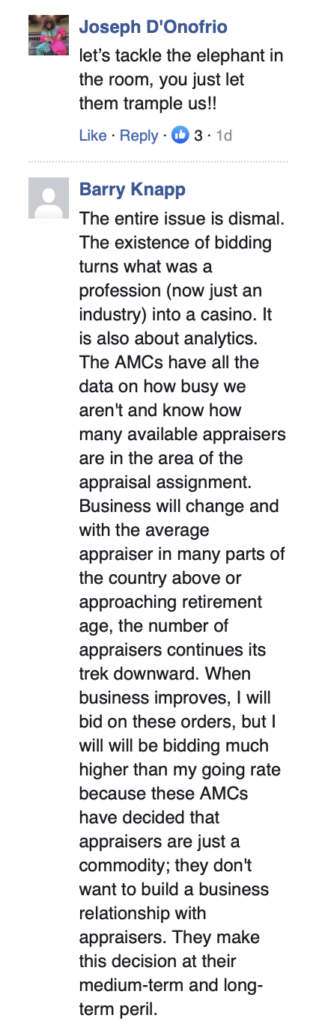

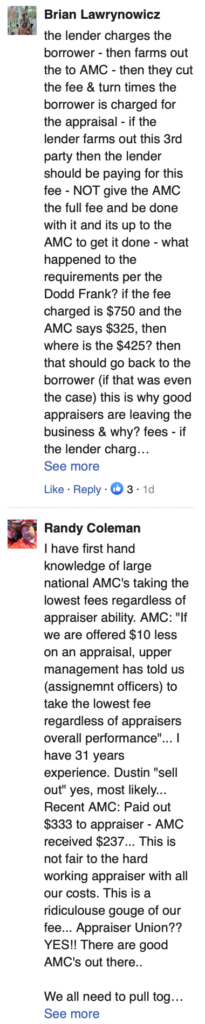

Oof. Dustin Harris Seems Out Of Touch With Appraiser Reality

Dustin’s “thought” piece on Appraisal Buzz Bidding For Appraisal Assignments Doesn’t Have to Suck was an attempt to mix it up to get attention but failed. Nothing personal but the conditions that practicing real estate appraisers are currently experiencing contrast with those of someone who doesn’t do appraisals anymore after they sold their company. I wouldn’t have bothered calling this piece out, but the volume of negative appraiser feedback was quite unusual. Please don’t take my word for it; read some of the appraisers’ comments on the piece. In housing nomenclature, I call this industry feedback a shellacking. Do better Dustin.

Cosmic Cobra Guy Points Out Fannie’s Stunning Lack Of Understanding About Appraisal Independence

Fannie Mae advocates an AVM-based world in which appraisers are relegated to data collectors, and machines analyze markets so Fannie retains control of the values. I even got to chime in on Jeremy’s release:

| Contact: Jeremy Bagott, MAI, AI-GRS Tel: 805-794-0555 email: jbagott@gmail.com *** FOR IMMEDIATE RELEASE *** FANNIE WANTS TO SCRIPT CONCLUSIONS OF OUTSIDE ANALYST VENTURA, Calif. (April 26, 2024) – “[The corporation] was created by the government, is controlled by the government, and operates for the government’s benefit,” wrote Justice Anthony Kennedy in a unanimous Supreme Court ruling in 2015. He was describing passenger rail hegemon Amtrak, but he could easily have been describing government-sponsored mortgage giant Fannie Mae. The Roberts Court held the National Railroad Passenger Corporation – known more commonly as Amtrak – was a government entity for the purposes of the Constitution’s separation of powers provisions. That may be key when it comes to Fannie and her reprobate twin brother, Freddie Mac. Both are overdue for a bolt of karmic comeuppance. Unfortunately, the public always pays. Fannie and Freddie – both in conservatorship with the Federal Housing Finance Agency – became bullies during the Biden administration, particularly against a vulnerable class of truth-tellers uniquely engaged for their independence. Fannie wants one such truth-teller in Upstate New York to doctor an appraisal report with exhibits of its own choosing – or else. It’s leaning on a regional bank to do the arm-twisting. Fans of old-timey notions like the First Amendment smell government-compelled speech. A for-hire real estate appraiser, who has asked to remain anonymous, tells of having received a letter from a regional bank’s legal department. The bank had received an ultimatum from Fannie: Either the bank or the appraiser must buy back a mortgage originated by the bank and later sold to Fannie Mae. Fannie offered a third option: The appraiser could simply doctor the long-since approved appraisal by inserting a couple of comparables selected by Fannie Mae after the fact. Take your pick. One problem: Fannie’s comparables, which were generated by an algorithm in the dank basement of its mirror-and-glass ziggurat in Plano, Texas, more than 1,600 miles away, were all wrong. They would make the appraisal misleading, jeopardizing the appraiser’s state license and his status as a disinterested and independent third-party. The redo could also open the appraiser up to liability from the borrower, and even from the bank if the loan went south. One former Fannie Mae employee was surprised to hear about it. “This does not sound like something Fannie Mae would do,” said Brian Jarrard, a former subject-matter expert in collateral valuations at the mortgage giant. “I have no knowledge of Fannie Mae ever telling appraisers to change their comps after the fact.” But that seems to be exactly what’s happening. One observer speculated that the workload at the mortgage giant may have dried up to the point that its in-house analysts have little to do other than scrutinize past mortgage transactions to simply look busy, even if it means tainting an appraisal and browbeating a private individual Fannie has no direct connection to. (The appraiser’s client was always the bank, never Fannie or any other aggregator of mortgages.) Fannie’s threats to the Upstate New York bank and its outside appraiser – explicit and implicit – have real teeth. Mortgage lenders understand Fannie can, at any time, place them on a ruinous “do not use” list. Fannie can also blacklist an appraiser, with little promise of due process or accountability. This possibility lurks in the background of all interactions with the mortgage giant. In 2022, it was reported that Fannie was attempting to strong-arm lenders to buy back early Covid-era loans. Fannie appeared to view these loans as too risky for its portfolio – which is really saying something. As a ploy, say observers, Fannie was generating automated valuations similar to Zillow’s “Zestimates” and using them to undermine appraisals on loans it wanted to offload, with the appraiser and/or the lender the fall-guy. Fannie’s automated system later generated unsigned boilerplate complaints and sent them to state appraiser licensing boards – a scorched-earth tactic that required appraisers in some states to spend years clearing their names after the often-baseless complaints. Fannie reportedly then cited the ongoing investigations, which Fannie itself triggered, as further evidence of the need for the lender buybacks. The “robo-complaints” were reported to be arriving at such velocity that some state appraiser boards were in fight-or-flight mode, having to decide whether to ignore the complaints outright or staff up to deal with them. A few self-serving state bureaucracies learned to harness the complaint influx for featherbedding purposes – a full-employment program for appraiser regulators. A regulator in Ohio told one appraiser in 2022 that the Ohio state board alone was receiving about 40 new complaints monthly from the mortgage giant, each one requiring a separate investigation that could last up to one year. In the use of Fannie’s own comparables, the public is harmed because Fannie’s algorithm is being used to override the appraiser’s local expertise, onsite inspection and interviews with the participants in the comparable transaction, said a Texas-based residential appraiser. “Fannie uses sketchy data that is unvetted. There is no legitimate review being done here,” he said. Something similar was recently observed by the chief appraiser at a Texas regional bank. “Fannie Mae is essentially forcing banks to repurchase any loan it wants if [the appraiser] refuses to use the comparables Fannie has selected,” said the chief appraiser, who asked to remain anonymous. “In doing so, Fannie is claiming it is more familiar with local markets than the local appraisers. It bases this on an algorithm that has not been publicly tested or disclosed.” “That Fannie Mae would coerce an appraiser to use the government-sponsored enterprise’s [own] sales selection is a stark reminder of how this independence can be compromised, leading to potential distortions in value,” said Jonathan Miller, President of Miller Samuel, Real Estate Appraisers & Consultants in New York. “Appraiser independence is essential to maintaining the integrity of property valuations.” Said Jarrard, the former Fannie Mae employee, “The appraiser’s independence is being compromised by a party who doesn’t have geographic competency and who hasn’t had discussions with brokers about the comparable transactions. Forcing an appraiser to select sales from an algorithm eliminates the appraiser’s independence and the appraiser’s local market expertise. Dictating what is or is not comparable should be left to the local professional. Otherwise, what do you have other than a mass appraisal?” Since the beginning of November 2023, Fannie’s twin, Freddie Mac, has been screening appraisal reports for a lengthy list of forbidden words and phrases. Offending reports have been kicked back to the appraiser through the lender. Many of the censored words and phrases bear not-so-subtle DEI and reality-masking telltales. They include “crime,” “school district” “student,” “preferred,” “up-and-coming,” “well-kept,” “desirable” “high,” “low,” and many puzzlingly innocuous phrases like “convenient to.” The Supreme Court held Amtrak is a government entity. And what else would it be? Freddie and Fannie are spitting images. When employees of these entities violate a random analyst’s due process via blacklisting or censor the free expression of a party hired by another party or compel speech through coercion, then it’s the government violating first principles. Try dislodging any of these people at the ballot box.# # # Jeremy Bagott, a licensed appraiser and former newspaperman, sends up a warning flare in his 2019 book “Dispatches from the Cosmic Cobra Breeding Farm.” He takes the reader deep inside a tiny Washington, D.C., foundation that has managed to have its copyrighted code of conduct enshrined in federal and state law. All 50 states, even the U.S. territories of Guam and the Northern Mariana Islands, now enforce it. The nonprofit, known as the Appraisal Foundation, has parlayed the arrangement into a lucrative publishing cartel. In his journey, the author uncovers a troubling trend deep in the plumbing of government. # # # If you’d like to be on this mailing list but at a different email address, please go to the sign-up page here.-END-Copyright © 2024 Jeremy Bagott, All rights reserved. You are receiving this email because you opted in via our website. Our mailing address is: Jeremy Bagott2674 E Main St # E-504Ventura, CA 93003-2820Add us to your address book Want to change how you receive these emails? You can update your preferences or unsubscribe from this list. |

[Rumormill] GSEs Plan To Remove ~25K Appraisers From Approval List This Fall

At a recent appraisal event, a GSE executive, after a few drinks, privately told his nearby colleagues that we suck as an industry. Last year, Phil Crawford and I reported on GSE efforts to send unsigned complaints to state boards at scale. Appraisers had no recourse but to defend themselves from the state boards without knowing who their accusers were. The public pressure became real, and the GSEs backed off from their anonymous letter-sending campaign (see Cosmic Cobra Guy’s reference above). The exercise showed how little they think of us as professionals because it’s easier to generate AVMs by pressing a button than to deal with a human being with professional insight.

That GSE jackass at the conference bragged that they plan to remove a considerable swath of the nation’s residential appraisers from their approved lists (they call it “de-populating”). I couldn’t find a secondary verification, hence “rumormill” but this is no surprise if it turns out to be true and the potential impact made it important enough to share. The Fannie Mae culture, and to a lesser extent, Freddie Mac, think they have it all figured out and don’t need a human being to tell them whether 500 feral cats occupy a house when estimating value. I was told by an appraiser at the 2018 Appraiserfest in San Antonio who worked in their Dallas offices that they adjust the dials on Desktop Underwriter whenever conditions slow down loan volume. That appraiser was livid about this practice. The GSEs don’t want appraisers to restrain loan volume by providing concerns about a specific property. The GSEs have been emboldened because their moral hazard was backstopped during the housing bubble as a near bail-out.

This action supports the bizarre bifurcated approach the GSEs have been championing for years. When they propose combining property inspectors, an unlicensed industry with no standards, with appraisers, hybrids become less accurate, slower, and more expensive than traditional appraisals. AKA Data Cancer. So, how is this a good thing? This hybrid product removes the appraiser’s eyes from the property, which is inextricably linked to the valuation process. I’ve always wondered why institutions in our industry constantly push more expensive, less accurate approaches to appraisals. It makes more sense to me now because the appraiser is being relegated to data collectors, as Lyle Radke told us. Thus, working with an inspector without standards and dumping that information into an AVM enables Fannie Mae to control the appraisal process fully, to hell with data cancer.

This “culling the herd” action by the GSEs would dramatically reduce the size of the appraiser ecosystem, which other entities like banks, lawyers, and private citizens also rely on for appraisal services. What happens to appraisal fees when appraiser supply becomes significantly constrained outside the GSE world as tens of thousands of us are forced to retire? Appraisal fees could skyrocket, pissing off the rest of the users of appraisal services, especially banks, who are often at odds with the GSEs.

What a fustercluck.

OFT (One Final Thought)

Forget the Super Bowl, Master Chef, or Cake Boss…I give you German Even Splitting of Pretzels. [make sure sound is on to enjoy the drama]

Brilliant Idea #1

If you need something rock solid in your life – particularly on Friday afternoons at 2:00 PM, Eastern Time (ET) – and someone forwarded this to you, you can sign up here for these weekly Housing Notes. And be sure to share with a friend or colleague if you enjoy them because:

– They’ll give you a palindrome;

– You’ll say “racecar” backwards and forwards;

– And I’ll cut pretzels in half.

Brilliant Idea #2

You’re clearly full of insights and ideas as a reader of Housing Notes. Consider sharing them with me early and often. I appreciate every email I receive, as it helps me craft future Housing Notes.

See you next week!

Jonathan J. Miller, CRE®, Member of RAC

President/CEO

Miller Samuel Inc.

Real Estate Appraisers & Consultants

Matrix Blog @jonathanmiller

Reads, Listens and Visuals I Enjoyed

- Warren Buffett’s Real Estate Brokerage Agrees to $250 Million Settlement [NY Times]

- "Higher for Longer" Fed May Stress Emerging Markets [Central Bank Central]

- GDP: US economy grows at 1.6% annual pace in first quarter, falling short of estimates [Yahoo Finance]

- Housing Will Get More Expensive Because of the Fed [Bloomberg]

- US Real Estate Brokers Could See Exit of Noncompetes With FTC's New Ruling [CoStar]

- Rise in New Home Listings Projected to Boost Sales Despite Recent Run-up in Mortgage Rates [Fannie Mae]

- Sitzer judge grants preliminary approval to NAR settlement [Inman]

- Survey: Feds question the ‘why’ behind return-to-office push [Federal News Network]

- Facing record housing shortage, New York Democrats finally take action [Politico]

- Rooftop solar panels are flooding California’s grid. That’s a problem. [Washington Post]

- 'Big Bang Of Housing': N.Y. Passes Budget Deal With Development Tax Break, Good Cause Eviction Protection [Bisnow]

- 🏝 Lux, Loss and Leasing [Highest & Best]

- 50 years of tax cuts for the rich failed to trickle down, economics study says [CBS News]

- Here's what it actually costs to build a single-family home, as told by one pie chart [Fast Company]

- Housing Market Slumps as Mortgage Rates Top 7% [Wall Street Journal]

- Big Tech Is Downsizing Workspace in Another Blow to Office Real Estate [Wall Street Journal]

- The Real Estate Nightmare Unfolding in Downtown St. Louis [Wall Street Journal]

- Overview [NYC Comptroller]

- Teranet-National Bank House Price Index continues to rise in March [House Price Index]

My New Content, Research and Mentions

- 🚫 No Apocalypse Now [Highest & Best]

- ‘Must love dogs and rude roommates’: the scramble to get around New York’s Airbnb crackdown [The Guardian]

- East End home sales see year-over-year gains in Q1 [Long Island Business News]

- Long Island median home price rose nearly 10% in the first quarter [Newsday]

- Contrasting Real Estate Markets: Booming Luxury Sector vs. Struggling Rest [Analyzing Market]

- Luxury real estate prices just hit an all-time record [CNBC Chicago]

Recently Published Elliman Market Reports

- Elliman Report: San Diego County Sales 1Q 2024 [Miller Samuel]

- Elliman Report: Orange County Sales 1Q 2024 [Miller Samuel]

- Elliman Report: Los Angeles Sales 1Q 2024 [Miller Samuel]

- Elliman Report: North Fork Sales 1Q 2024 [Miller Samuel]

- Elliman Report: Hamptons Sales 1Q 2024 [Miller Samuel]

- Elliman Report: Long Island Sales 1Q 2024 [Miller Samuel]

- Elliman Report: Weston Sales 1Q 2024 [Miller Samuel]

- Elliman Report: West Palm Beach Sales 1Q 2024 [Miller Samuel]

- Elliman Report: Wellington Sales 1Q 2024 [Miller Samuel]

- Elliman Report: Vero Beach Sales 1Q 2024 [Miller Samuel]

That One Big Thing

Appraisal Related Reads

- Has the Birmingham Real Estate Market Changed Since 2023? [Birmingham Appraisal Blog]

- The insurance crisis is affecting the housing market [Sacramento Appraisal Blog]

- FNMA Census Block Grid Adjustment Raises Redlining Concerns [Appraisers Blog]

- Adam Johnston joins Candescent Capital Ventures [EIN News]

- Voice of Appraisal E266 The Coronation Before The Culling [Voice of Appraisal]

- Consumer Financial Protection Bureau Outlines Options To Prevent Algorithmic Bias In Home Valuations [Consumer Financial Protection Bureau]

![[27 Speaks Podcast] Jonathan Miller Provides A 2024 Hamptons Outlook](https://millersamuel.com/files/2024/02/27eastlogo-600x314.jpg)