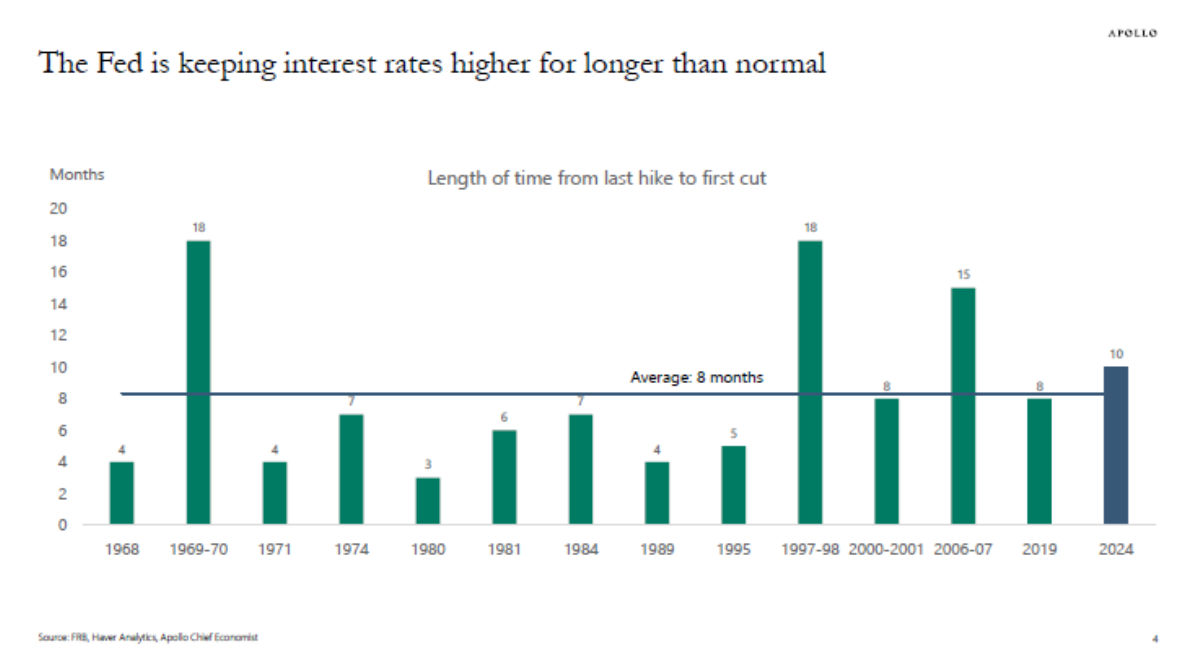

The pain of the Papyrus font remains with all of us, just like the Fed’s inability to cut rates because the economy roars ahead, unemployment remains very low, inflation threatens, as do rising insurance costs and property taxes, so the housing market suffers just as if it were Times New Roman.

The controversy is real. Ok, not really, but when can we ever have a discussion about fonts?

Did you miss last Friday’s Housing Notes?

April 12, 2024: Our Eyes Hurt After Watching Mortgage Rates Eclipse Our Expectations For Cicadas

But I digress…

I headed down to Miami for a presentation on Friday, so I wrote these Housing Notes well into the evening on Thursday: an abbreviated edition of Housing Notes. But my goodness, grappling with the Papyrus font issue is already overwhelming enough.

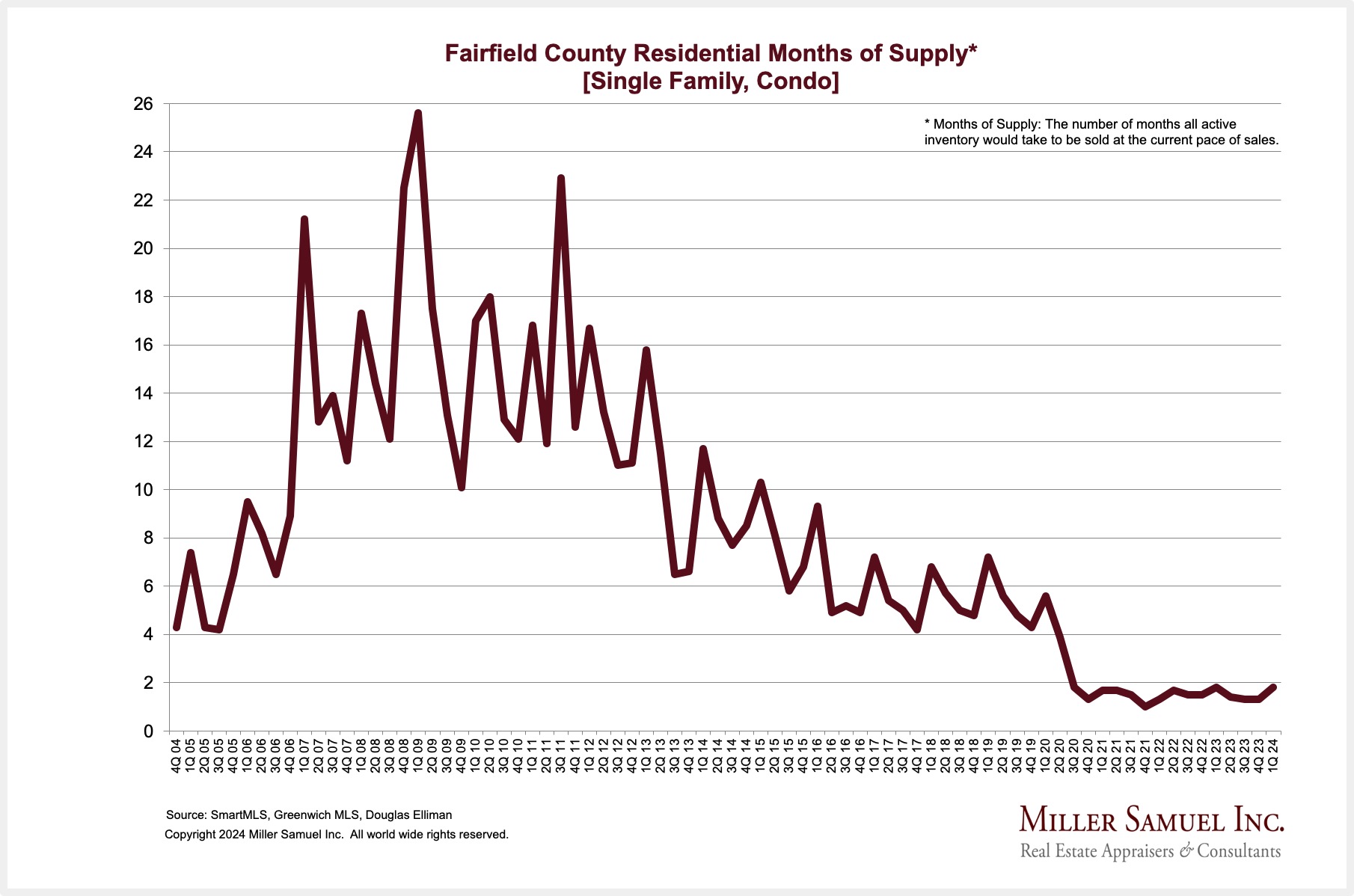

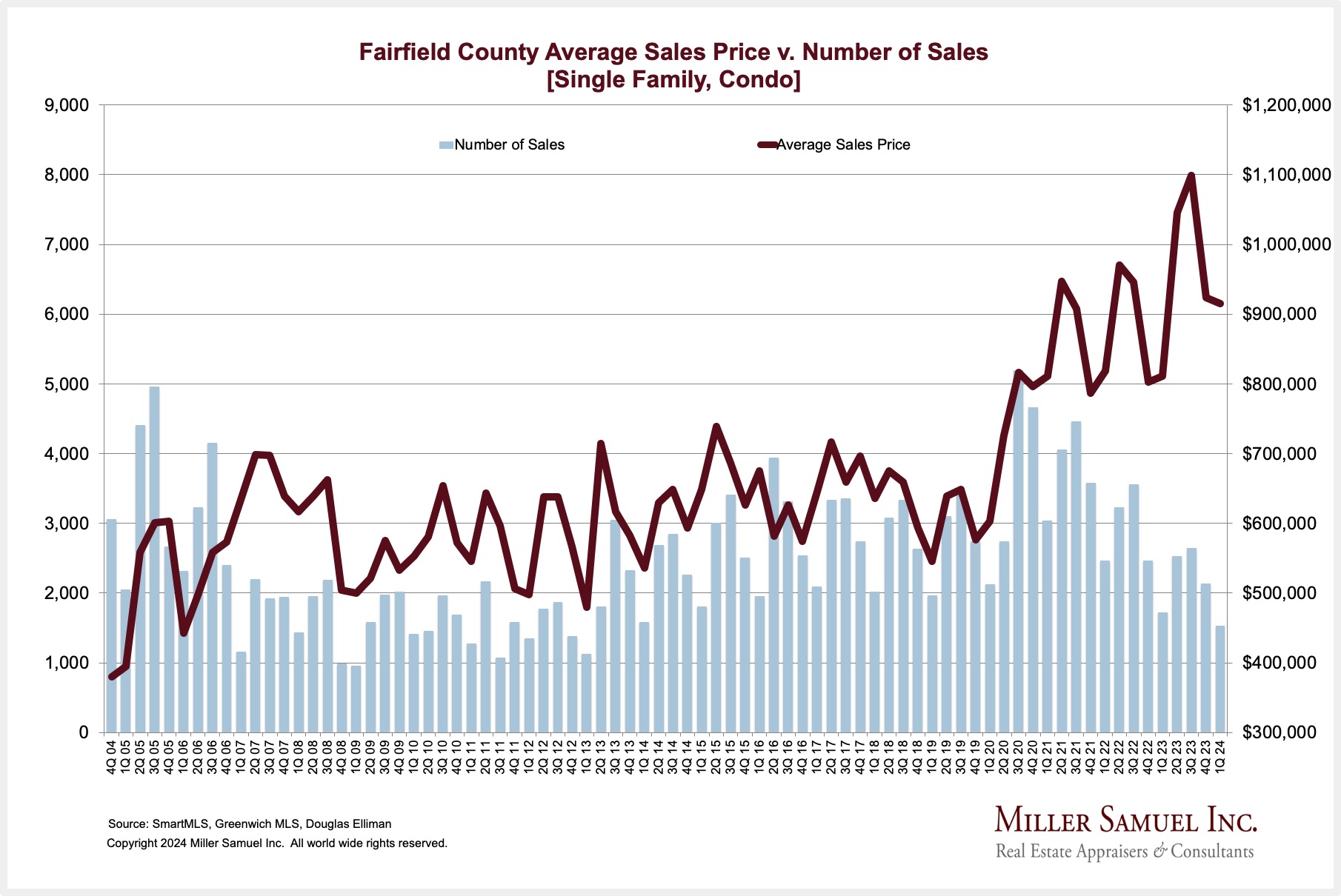

Fairfield County, Greenwich, and New Canaan Continue To See New Price Records

I’ve been the author of a series of market reports for Douglas Elliman since 1994. Connecticut markets have been affluent north of the city housing market we’ve covered for a while (and I live there).

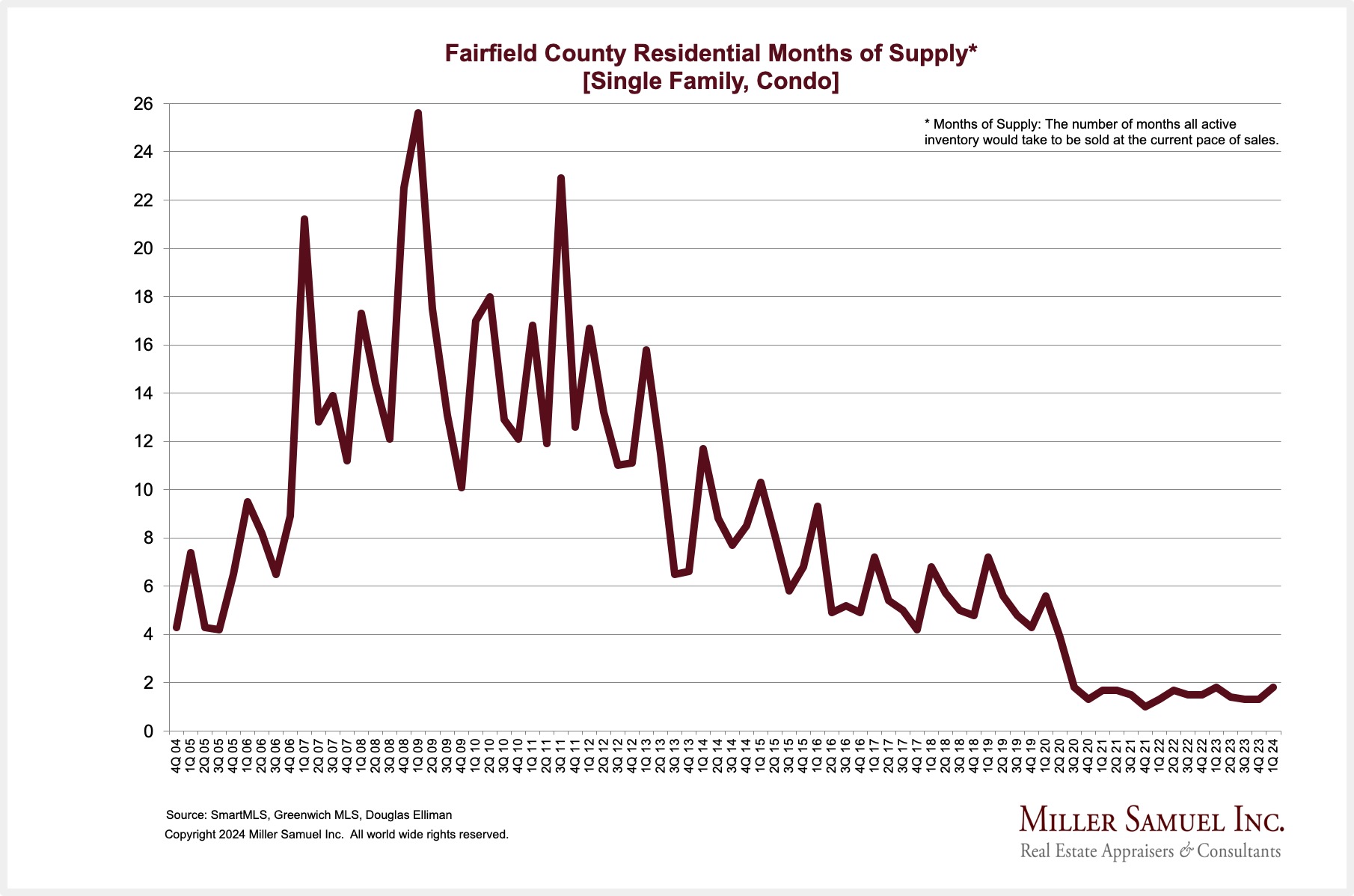

FAIRFIELD COUNTY SALES HIGHLIGHTS

Elliman Report: Q1-2024 Fairfield County Sales

Prices moved higher as listing inventory remained near record lows.

- All price trend indicators collectively increased annually for the fourth time

- Listing inventory declined sharply from the year-ago quarter for the fourth time

- Sales fell year over year for the eleventh time, restrained by the chronic lack of listing inventory

- Luxury price trend indicators collectively increased annually for the fourth time

- Luxury listing inventory declined annually for the fourth time to the second lowest on record

- The luxury entry price threshold rose year over year for the fourth straight quarter

Fairfield County Chart Gallery

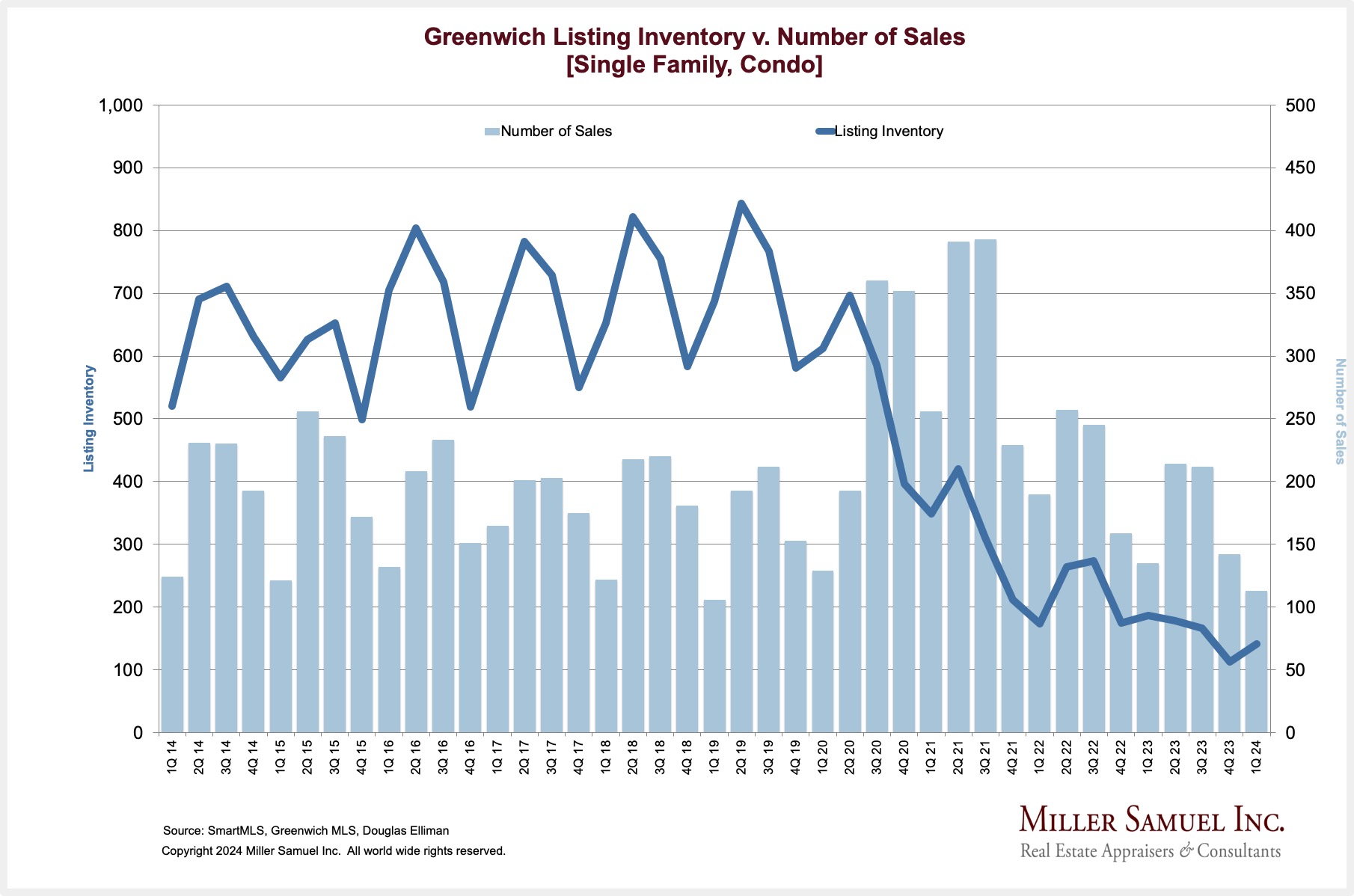

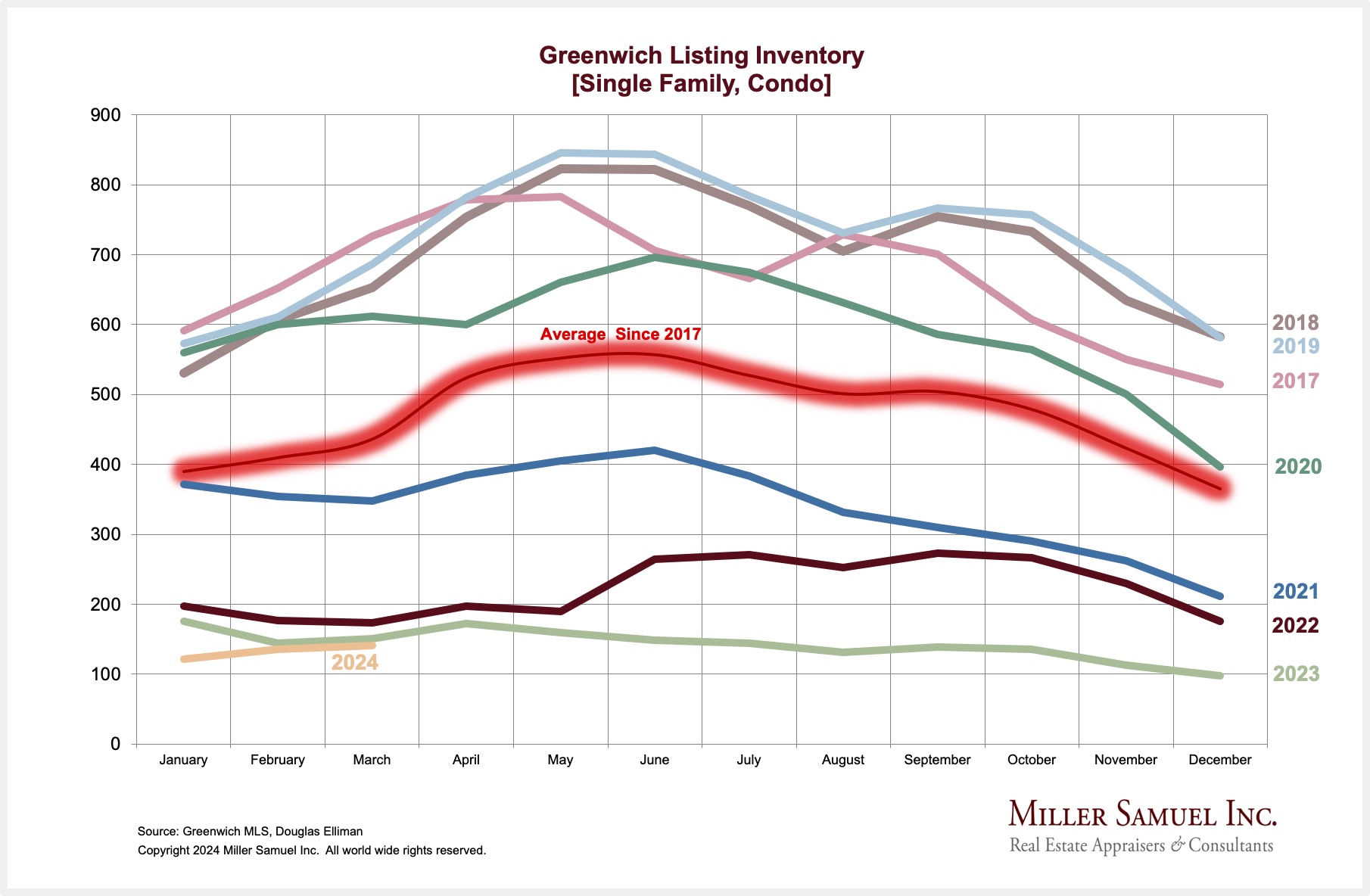

GREENWICH SALES HIGHLIGHTS

Elliman Report: Q1-2024 Greenwich Sales

The chronic lack of listing inventory has continued to push price trends higher.

- Single family price trend indicators rose annually as sales declined

- Single family listing inventory declined year over year for the fourth time

- Condo listing inventory fell to its second-lowest level on record

- Luxury price trend indicators continued to rise year over year

- Luxury listing inventory fell annually to their third lowest level on record

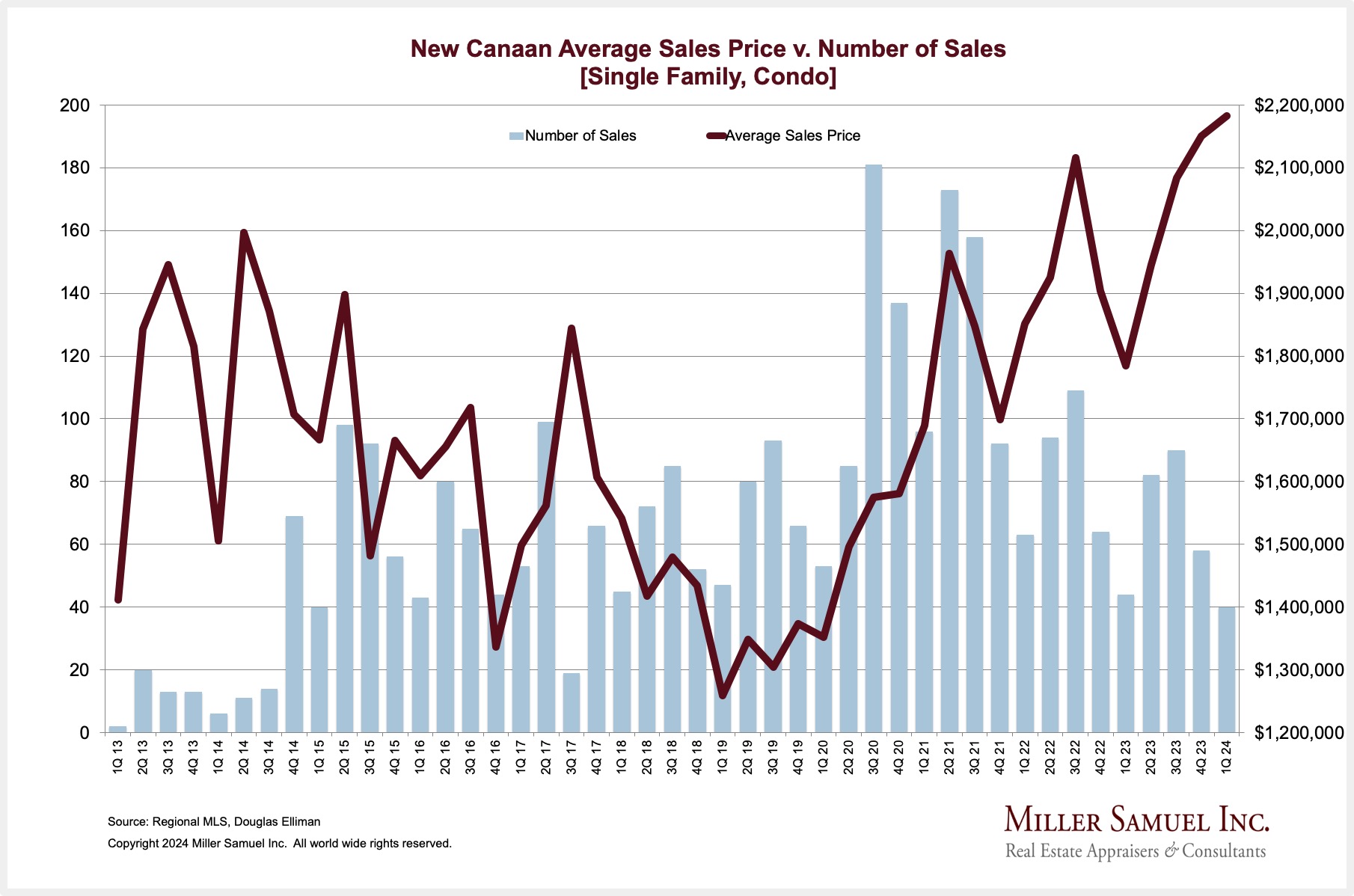

NEW CANAAN SALES HIGHLIGHTS

Elliman Report: Q1-2024 New Canaan Sales

Listing inventory continued to fall, pressing prices higher.

- Single family median sales price rose year over year for the fourth time

- Single family listing inventory fell annually for the fourth time to the second-lowest on record

- Condo price trend indicators posted annual gains as listing inventory fell sharply

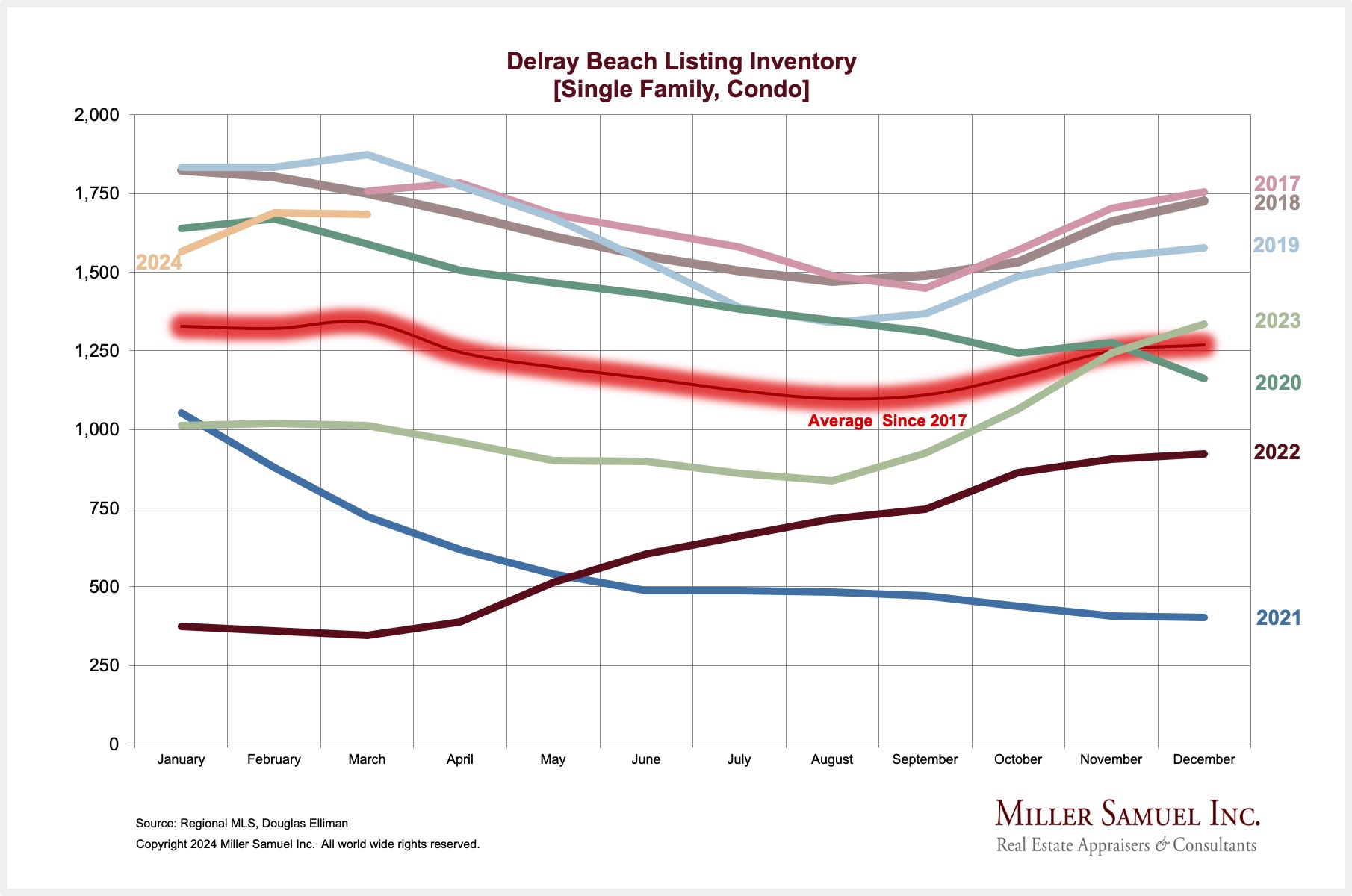

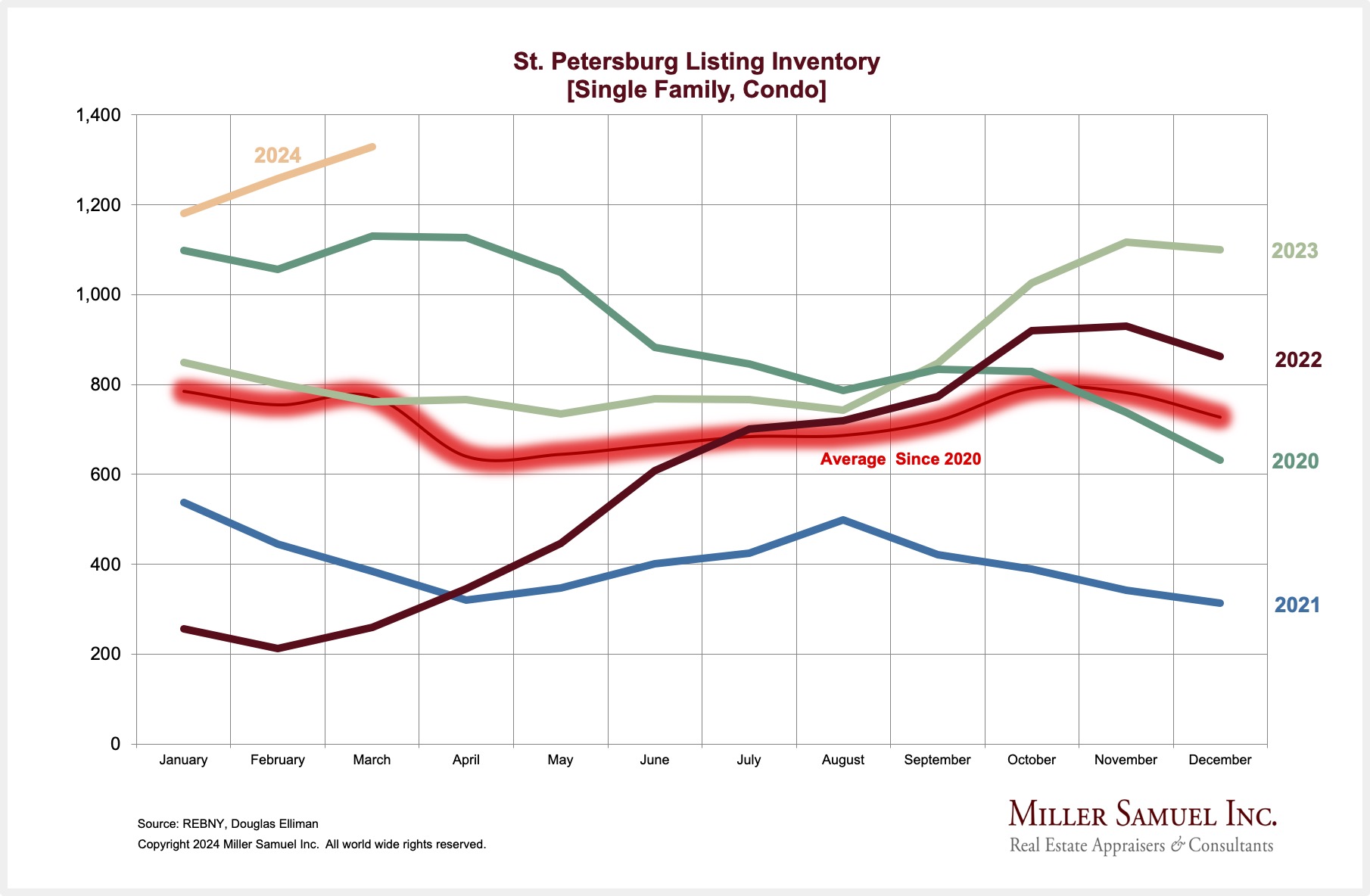

Florida Weathers High Rates With A Lot Of Cash And Expanding Listing Inventory

Listing inventory remains tight even thought it has been rising from a very low point in most markets so price trends keep rising and records keep being set. Cash is playing a bigger role these days as consumers, skewing to the higher end, are paying with cash to bypass elevated mortgage rates.

The Florida market reports can be found here.

There are charts to review, but feel explore our chart gallery to find more.

Most Q1-2024 Florida markets we cover are seeing the following results:

- Use of cash continues to dominate the purchase market as buyers bypass rising mortgage rates

- While listing inventory is expanding, it remains below market norms and continues to restrain sales

- Most housing markets saw rising prices reaching new highs or near-records

- Most markets are seeing sales fall short of prior year levels

- Mortgage rates remain elevated instead of seeing declines, as economic conditions remain vibrant

- Bidding wars remain a factor in the market but rising inventory has reduced their dominance

The Police Building: Now The Monthly Maintenance Doesn’t Look So Bad

I was looking at my Instagram feed and came across this broker tour of a co-op apartment in the Police Building. In 1988, the building was converted from the city’s former police headquarters to a co-op.

I listen to many old-time radio shows because I am fascinated with old New York, and many shows centered around this building. After it was converted, every apartment had a different layout, and some, like the former “muster room,” were as amazing as was the former gym.

What always concerned me was how high the monthly maintenance seemed to be compared to typical co-ops at the time. I haven’t appraised in the building personally in years (my firm has), but I noticed something. Co-op maintenance fees in the market seem to have caught up and, in some respects, based on a cursory look, exceeded the levels in the building. The Police Building’s monthly maintenance now seems typical for the market, in the low two-dollar per square foot range.

Getting Graphic

Favorite housing market/economic charts of the week made by OTHERS

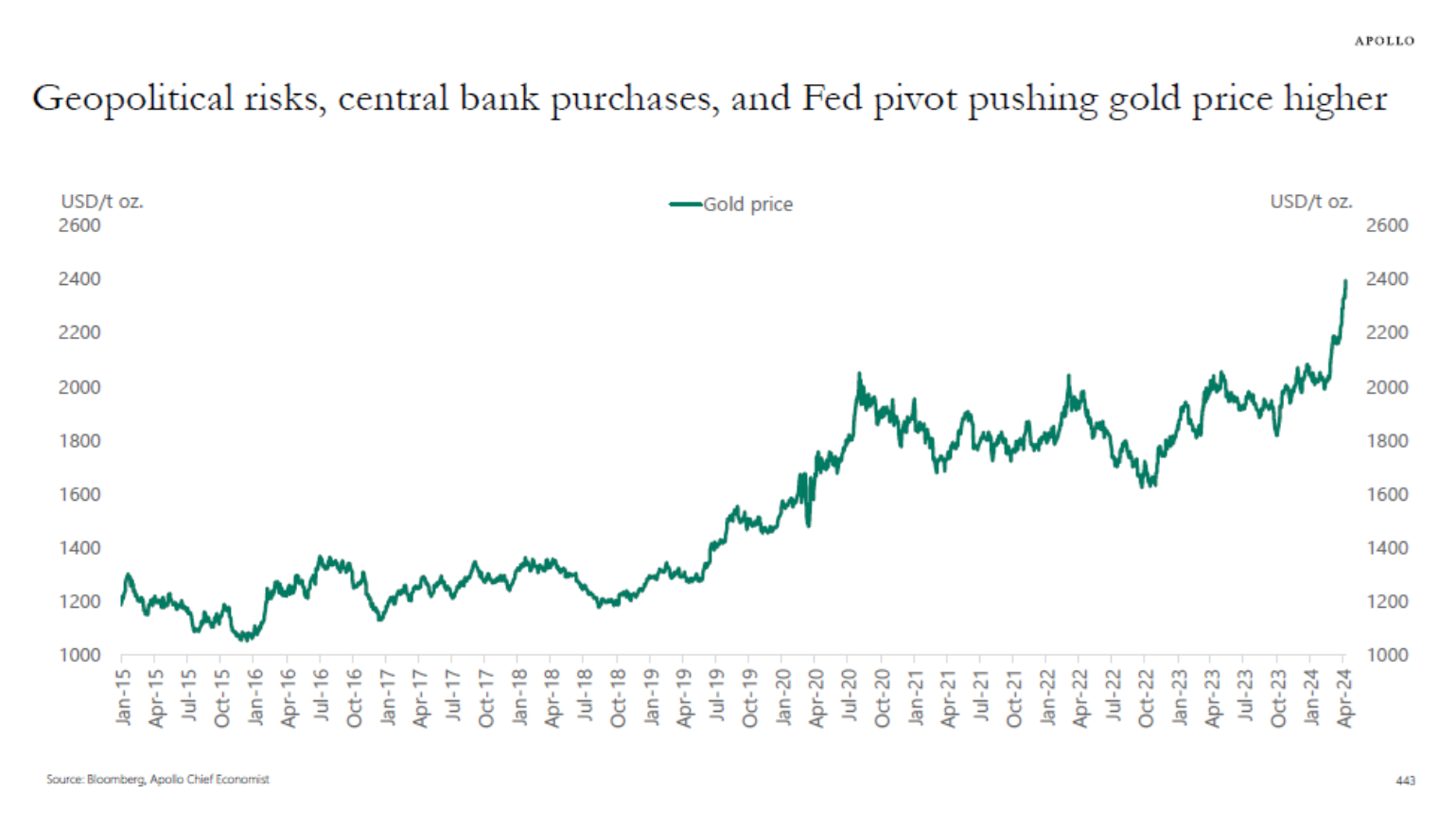

Apollo’s Torsten Slok‘s amazingly clear charts

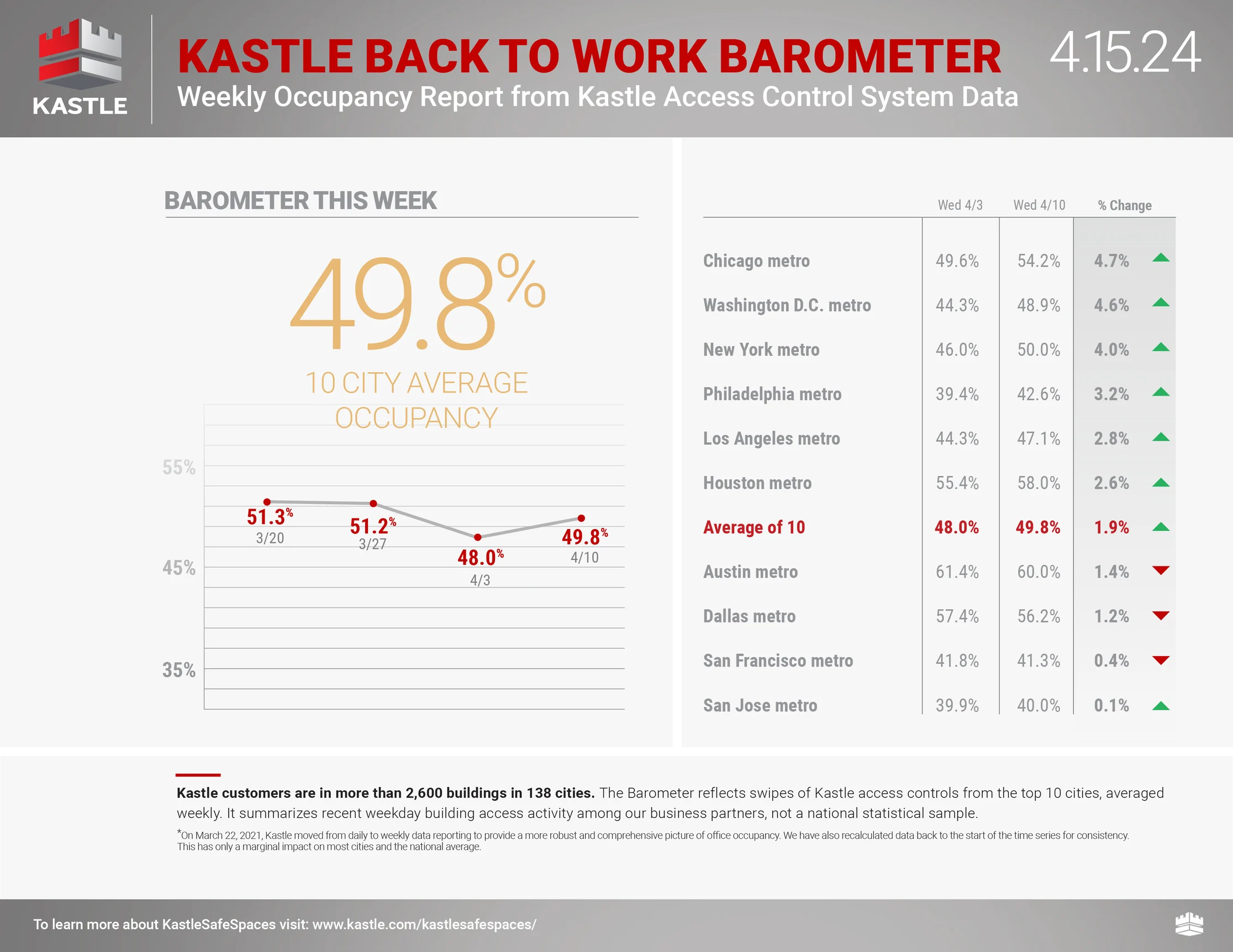

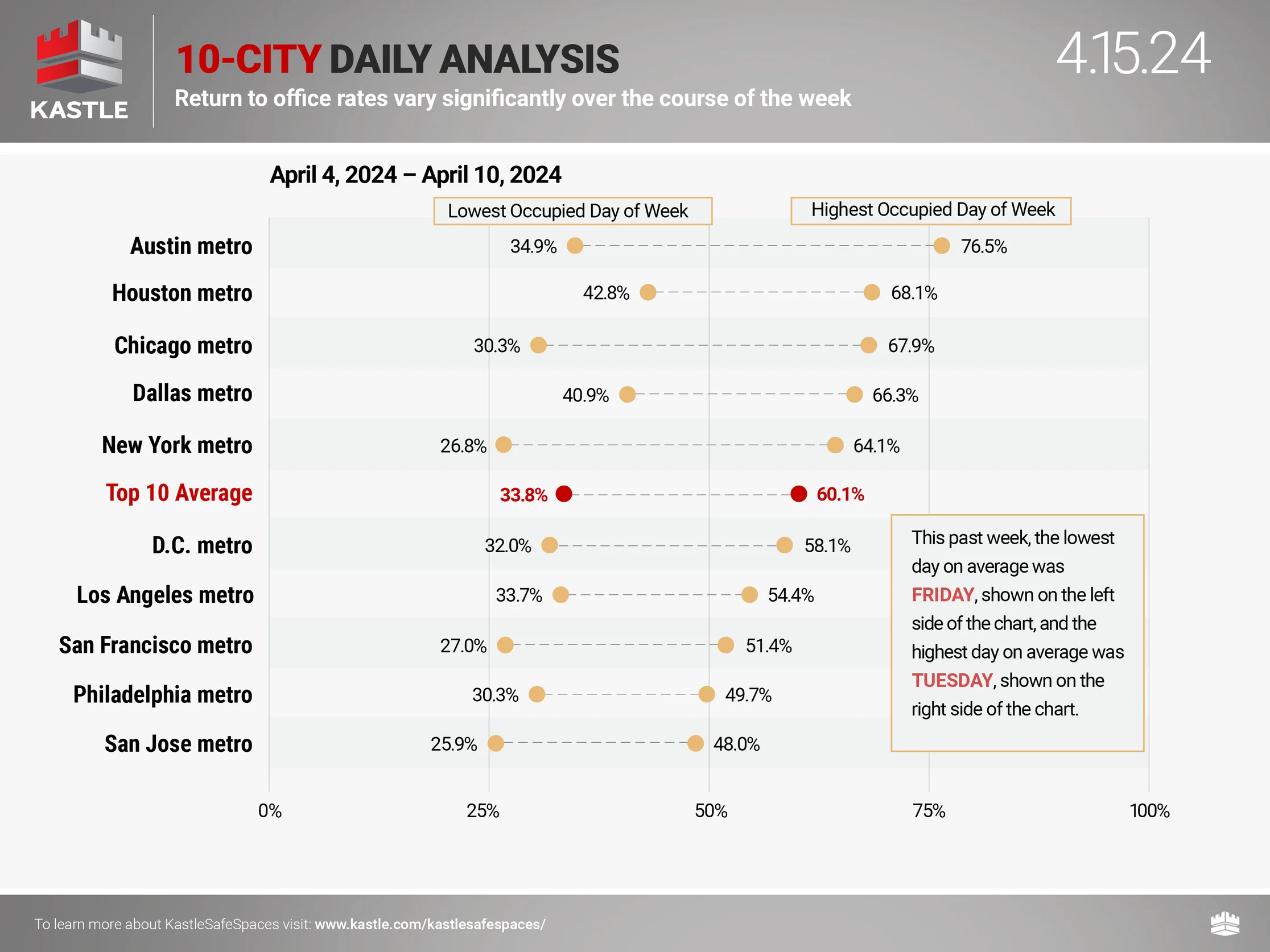

Kastle card swipe data

Remember that Kastle charts are overstating occupancy* because their pre-pandemic occupancy benchmark was 100%, which is incorrect (*measures card swipe activity as a proxy for occupancy). Still, they’ve become the standard benchmark for occupancy rates.

Favorite RANDOM charts of the week made by others

Appraiserville

Standing On The Ledge: Let’s Not Allow AI To Go The Path Of Grift And Self-Dealing Again

Attention AI Membership: This May Election is the moment that determines whether AI Has A Fighting Chance Of Future Relevance. Please Pressure Your Board To Be Responsible And Move AI Forward.

The May AI Election Is Fast Approaching!

If you vote for Tank, he’s shown that he’s all about moving AI backward to the days of grift to all the friends of JA (FOJs). He is a faithful JA sycophant and stands for the past. He is not a leader; he’s a follower (a follower of JA). Who in membership doesn’t get this unless you are an FOJ?

If you vote for Craig, he’s already proven as President that he’s all about moving AI forward and refocusing the institution away from the self-dealing that defined AI for the past two decades. When the sham petition process was defeated with the election of Craig over Tank in 2020, AI began to get fixed, moving away from the grifting and entitlement, and leadership began to behave better, eventually causing JA to resign.

VOTE FOR CRAIG AS IF YOUR CAREER DEPENDED ON IT

The Cosmic Cobra Guy Waxes Poetic About The GSEs’ Love Of AVMs And Their Plans To Remove Appraisers

| Contact: Jeremy Bagott, MAI, AI-GRS Tel: 805-794-0555 email: jbagott@gmail.com *** FOR IMMEDIATE RELEASE *** FANNIE MAE TO MARYLAND: DROP DEAD VENTURA, Calif. (April 12, 2024) – Mortgage giant Fannie Mae and her twin, Freddie Mac, have a message for the State of Maryland: Kindly disintegrate. A snubbed Maryland task force is close to filing its report to the governor. It attempted, in vain, to obtain detailed information about the government-sponsored twins’ valuation algorithms – tools that have replaced many home appraisals in the Old-Line State and resulted, some contend, in a feedback loop and run-up in home prices. The task force was formed on the reasonable premise that the state has an interest in the twins’ activities, since Marylanders will be left with the clean-up costs, hard-luck stories and urban blight of another 2007-2008-style housing collapse. In its quest for information from the twins, the governor’s panel was doomed from the outset. Its committee tasked with monitoring the twins’ alternative property valuation methods initially couldn’t get telephone calls or emails returned. It endured months of stonewalling as key risk managers and valuation officials with the twins went silent. The ghosting set the stage for future disappointments. The panel had – and still has – many questions about base parameters used by the twins’ algorithmic models, along with information about the developers of the tools and general information about ongoing system management. The panelists believe the twins are generating automated appraisals similar to Zillow’s “Zestimates” – but likely much more inaccurate. They fear these so-called “black-box appraisals” are at best incompetent, at worst being manipulated to inflate appraised values in the state, dialed up to make a greater number of transactions “work.” The beneficiary? The nonbank lenders, fintechs, home builders and Realtors, the twins’ traditional allies. Panelists fear the models have been gradually inserting risk into Maryland’s economy and making homes there increasingly unaffordable and putting home buyers immediately underwater. Fannie, for one, maintains its automated valuation tool has been tested and found reliable for generating property values. The panelists aren’t so sure. The mortgage giants have a history of earnings manipulation, mismanagement and infiltration by bad actors. Beginning in the late 1990s, executive pay at Fannie and Freddie became tied almost exclusively to earnings growth. To maximize bonus payouts, top management at the twins cooked the books. In 2006, the Securities and Exchange Commission accused Fannie of securities fraud from at least 1998 through 2004. Then, in 2011, the commission charged six former top executives at Fannie and Freddie with securities fraud, including former Fannie Mae CEO Daniel Mudd and former Freddie Mac CEO Richard Syron, alleging they knew and approved of misleading statements claiming the mortgage giants had only minimal holdings of subprime loans. It was later revealed that in 2006, Freddie and Fannie insured 70% of all subprime loans. The duo nearly destroyed the U.S. economy, requiring a combined $200 billion bailout in 2008. Both are still in federal conservatorship. But back to the Maryland task force. In its investigation, the task force discovered two risk-analysis products were used originally to evaluate appraisal reports and then to replace appraisals in a widespread appraisal waiver policy that was later renamed “value acceptance.” According to a draft report provided to appraiser-author Jeremy Bagott, the committee’s recommendations to the governor will include the requirement that if an automated valuation model is used for a valuation waiver in the State of Maryland, then the parametric data and risk-analysis information must be released to the public. Also, any waiver of a traditional appraisal must be followed by a written, detailed document with a fixed value. There is no precedent for a computer model correctly mimicking Adam Smith’s invisible hand of the market. In 2021, Zillow abruptly shuttered its once-promising Zillow Offers division. Its iBuying business had purchased thousands of homes, buttressed by its valuation algorithms, for prices higher than it could sell them for. The move sent the company’s stock tumbling and erased hundreds of millions of dollars in investor value overnight. One of the frequently cited causes of the 2007-2008 financial crisis was the corrupted valuation models used by S&P, Fitch and Moody’s. Their models assigned investment-grade ratings to junk-quality mortgage-backed securities and collateralized debt obligations. The investment-grade ratings were prized by Fannie, Freddie and the private-label investment banks, since they allowed the mortgage-backed securities these actors created to be sold to pension funds. The Maryland panel rightly worries the same hubris, dishonesty and incompetence are now at play at Fannie and Freddie. The task force believes the models are caught in a feedback loop, one in which output is based on the use of derivative data that is influenced from sales relying on other derivative data. Appraiser-podcaster Phil Crawford calls it “data cancer.” The tool being used at Fannie Mae is known as Collateral Underwriter. At Freddie Mac, it is called Loan Collateral Advisor. A similar tool, known as VeroScore, is in use at the Veterans Administration. When a channel of communication was finally opened by the Maryland committee, the twins contended their computer models are proprietary, and that they are not required to share any of their parameters with the State of Maryland. Fannie officials reported the mortgage giant’s self-managed appraisal waiver process is not a process that results in an appraisal report, so no number is generated. You’ll just have to trust ‘em. The task force has concluded that Maryland homeowners often have no idea what “value” is being assigned to the property the latter are putting up as collateral for six- and seven-figure mortgage transactions. The state isn’t sold on the idea. # # # Jeremy Bagott is a real estate appraiser and former newspaperman. His most recent book, “The Ichthyologist’s Guide to the Subprime Meltdown,” is a concise almanac that distills the cataclysmic financial crisis of 2007-2008 to its essence. This pithy guide to the upheaval includes essays, chronologies, roundups and key lists, weaving together the stories of the politics-infused Freddie and Fannie; the doomed Wall Street investment banks Lehman and Bear Stearns; the dereliction of duty by the Big Three credit-rating services; the mayhem caused by the shadowy nonbank lenders; and the massive government bailouts. It provides a rapid-fire succession of “ah-hah” moments as it lays out the meltdown, convulsion by convulsion. # # # If you’d like to be on this mailing list but at a different email address, please go to the sign-up page here.-END- |

| Copyright © 2024 Jeremy Bagott, All rights reserved. You are receiving this email because you opted in via our website. |

OFT (One Final Thought)

Steve was known as a visionary and, of course, an asshole. As someone once said, he didn’t need to be that way, but he was.

I have always loved the concept of his “reality distortion field,” and I melted into that warm cocoon every time there was a new product launch. I had read all the trade mags and was up on new products that were coming. Nothing was cooler than going to a MacWorld trade show in Boston, NYC or LA with my Dad or my sons. It was a phenomenon that had to be experienced.

But he created excellent products, for which I am forever thankful. They were intuitive to use (without a manual), and we built our business with them. It is just incredible that he foresaw ChatGPT back in 2011.

Brilliant Idea #1

If you need something rock solid in your life – particularly on Friday afternoons at 2:00 PM, Eastern Time (ET) – and someone forwarded this to you, you can sign up here for these weekly Housing Notes. And be sure to share with a friend or colleague if you enjoy them because:

– They’ll use the Papyrus font;

– You’ll go with Times New Roman;

– And I’ll bet Steve could have made a better ChatGPT.

Brilliant Idea #2

You’re clearly full of insights and ideas as a reader of Housing Notes. Consider sharing them with me early and often. I appreciate every email I receive, as it helps me craft future Housing Notes.

See you next week!

Jonathan J. Miller, CRE®, Member of RAC

President/CEO

Miller Samuel Inc.

Real Estate Appraisers & Consultants

Matrix Blog @jonathanmiller

Reads, Listens and Visuals I Enjoyed

- Elliman settles broker commission lawsuits – The Real Deal

- ‘It was heaven. It’s gone.’ Grove Isle residents say Miami broke laws to let tower rise [Miami Herald]

- Florida’s Home Insurance Industry May Be Worse Than Anyone Realizes [Bloomberg]

- Exclusive | Regulators Set to Seize Troubled Philadelphia Bank Republic First [Wall Street Journal]

- Warren Buffett’s Real Estate Brokerage Agrees to $250 Million Settlement [NY Times]

- "Higher for Longer" Fed May Stress Emerging Markets [Central Bank Central]

- GDP: US economy grows at 1.6% annual pace in first quarter, falling short of estimates [Yahoo Finance]

- Housing Will Get More Expensive Because of the Fed [Bloomberg]

- US Real Estate Brokers Could See Exit of Noncompetes With FTC's New Ruling [CoStar]

- Rise in New Home Listings Projected to Boost Sales Despite Recent Run-up in Mortgage Rates [Fannie Mae]

- Sitzer judge grants preliminary approval to NAR settlement [Inman]

- Survey: Feds question the ‘why’ behind return-to-office push [Federal News Network]

- Facing record housing shortage, New York Democrats finally take action [Politico]

- Rooftop solar panels are flooding California’s grid. That’s a problem. [Washington Post]

My New Content, Research and Mentions

- 🚫 No Apocalypse Now [Highest & Best]

- ‘Must love dogs and rude roommates’: the scramble to get around New York’s Airbnb crackdown [The Guardian]

- East End home sales see year-over-year gains in Q1 [Long Island Business News]

- Long Island median home price rose nearly 10% in the first quarter [Newsday]

- Contrasting Real Estate Markets: Booming Luxury Sector vs. Struggling Rest [Analyzing Market]

- Luxury real estate prices just hit an all-time record [CNBC Chicago]

- Luxury real estate prices just hit an all-time record [CNBC New York]

- Luxury Home Prices Spike in Palm Beach, Florida, While Dipping in Miami Beach [Mansion Global]

- How Hudson Yards Went From Ghost Town to Office Success Story [NY Times]

- Jay Powell just made buying a home this spring even more challenging [Yahoo Finance]

- Palm Beach Daily News Subscription Offers, Specials, and Discounts [Palm Beach Daily News]

- Even doctors earning up to $350K/year are struggling to find homes in this wealthy part of New York — and it's causing trouble for the local hospitals [Moneywise]

- Where did South Florida homebuyers go? Sales fall by double digits in March [Miami Herald]

- 5-story residential project to rise in Astoria [Crain's New York]

- Inventory, Median Prices Up as South Florida Resi Sales Fall [The Real Deal]

- Rents Are the Fed’s ‘Biggest Stumbling Block’ in Taming US Inflation [Bloomberg]

Recently Published Elliman Market Reports

- Elliman Report: San Diego County Sales 1Q 2024 [Miller Samuel]

- Elliman Report: Orange County Sales 1Q 2024 [Miller Samuel]

- Elliman Report: Los Angeles Sales 1Q 2024 [Miller Samuel]

- Elliman Report: North Fork Sales 1Q 2024 [Miller Samuel]

- Elliman Report: Hamptons Sales 1Q 2024 [Miller Samuel]

- Elliman Report: Long Island Sales 1Q 2024 [Miller Samuel]

- Elliman Report: Weston Sales 1Q 2024 [Miller Samuel]

- Elliman Report: West Palm Beach Sales 1Q 2024 [Miller Samuel]

- Elliman Report: Wellington Sales 1Q 2024 [Miller Samuel]

- Elliman Report: Vero Beach Sales 1Q 2024 [Miller Samuel]

- Elliman Report: St. Petersburg Sales 1Q 2024 [Miller Samuel]

- Elliman Report: South & Greater Downtown Tampa Sales 1Q 2024 [Miller Samuel]

- Elliman Report: Royal Palm/Boca Raton 1Q 2024 [Miller Samuel]

- Elliman Report: Pompano Beach Sales 1Q 2024 [Miller Samuel]

- Elliman Report: Palm Beach Sales 1Q 2024 [Miller Samuel]

- Elliman Report: Naples Sales 1Q 2024 [Miller Samuel]

- Elliman Report: Lighthouse Point Beach Sales 1Q 2024 [Miller Samuel]

- Elliman Report: Jupiter + Palm Beach Gardens Sales 1Q 2024 [Miller Samuel]

- Elliman Report: Fort Lauderdale Sales 1Q 2024 [Miller Samuel]

- Elliman Report: Delray Beach Sales 1Q 2024 [Miller Samuel]

Appraisal Related Reads

- Has the Birmingham Real Estate Market Changed Since 2023? [Birmingham Appraisal Blog]

- The insurance crisis is affecting the housing market [Sacramento Appraisal Blog]

![[Podcast] Episode 4: What It Means With Jonathan Miller](https://millersamuel.com/files/2025/04/WhatItMeans.jpeg)