- The Fed Gives Housing Sales A Lift With Unexpected 50-Basis Point Cut

- The Fed’s First Rate Cut In Four Years Expected To Pull Mortgage Rates Lower

- It is A New Era With Six More Rate Cuts In The Forecast Through 2025

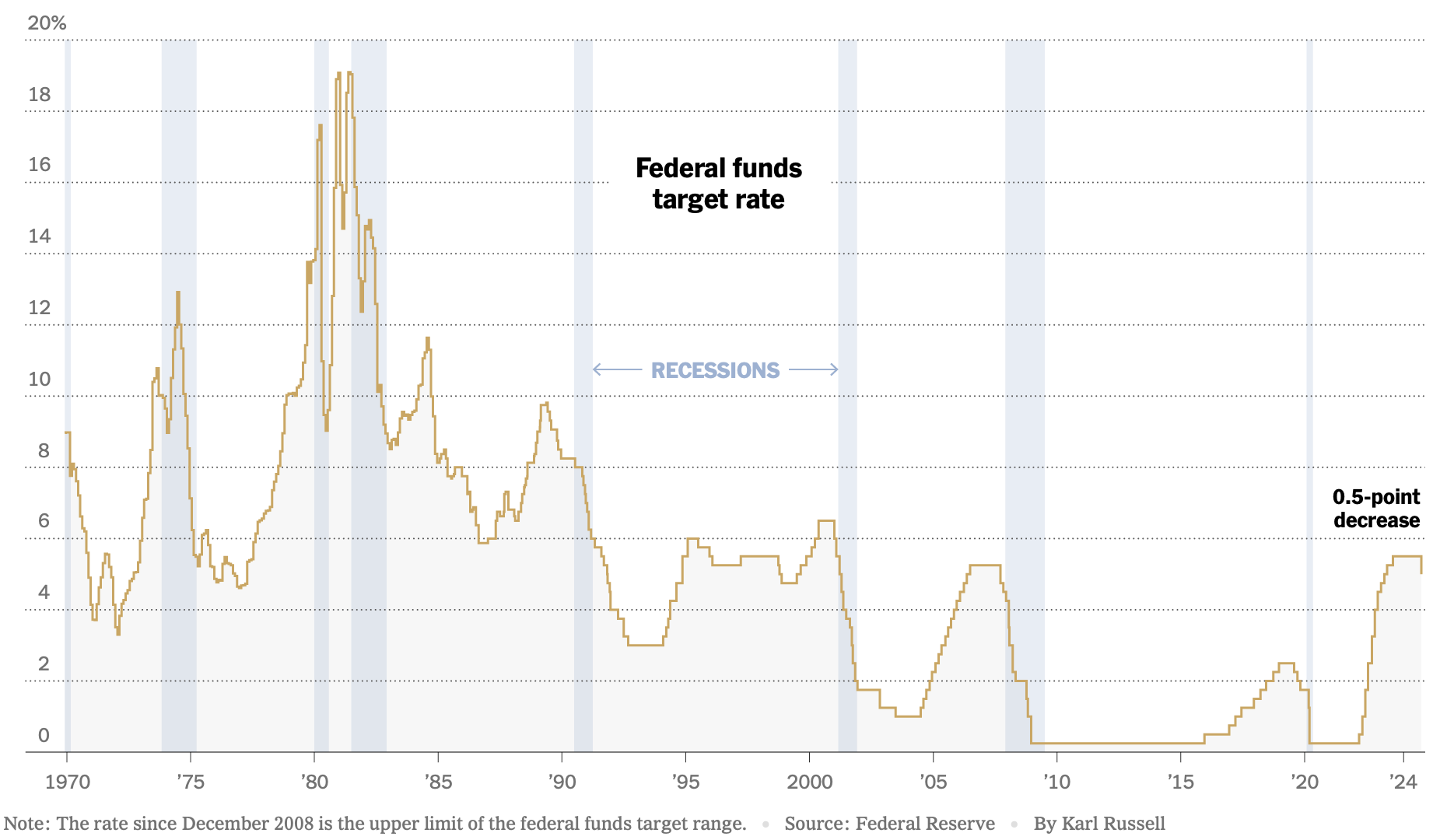

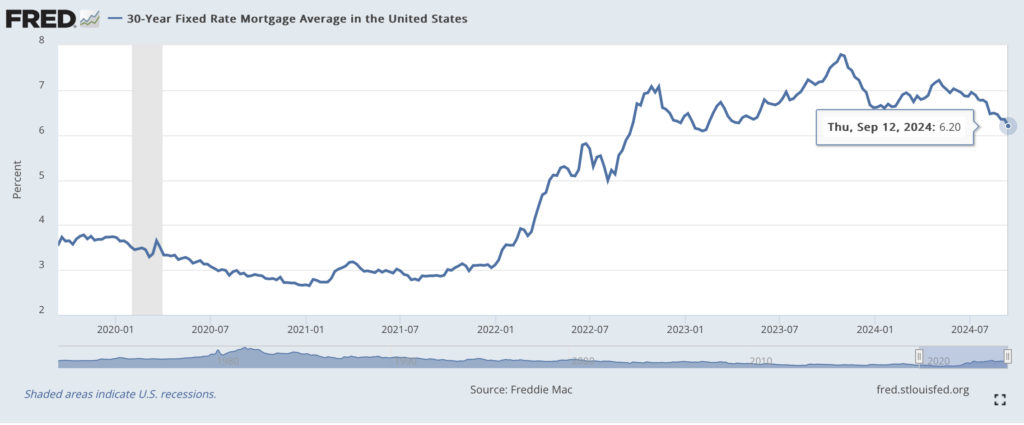

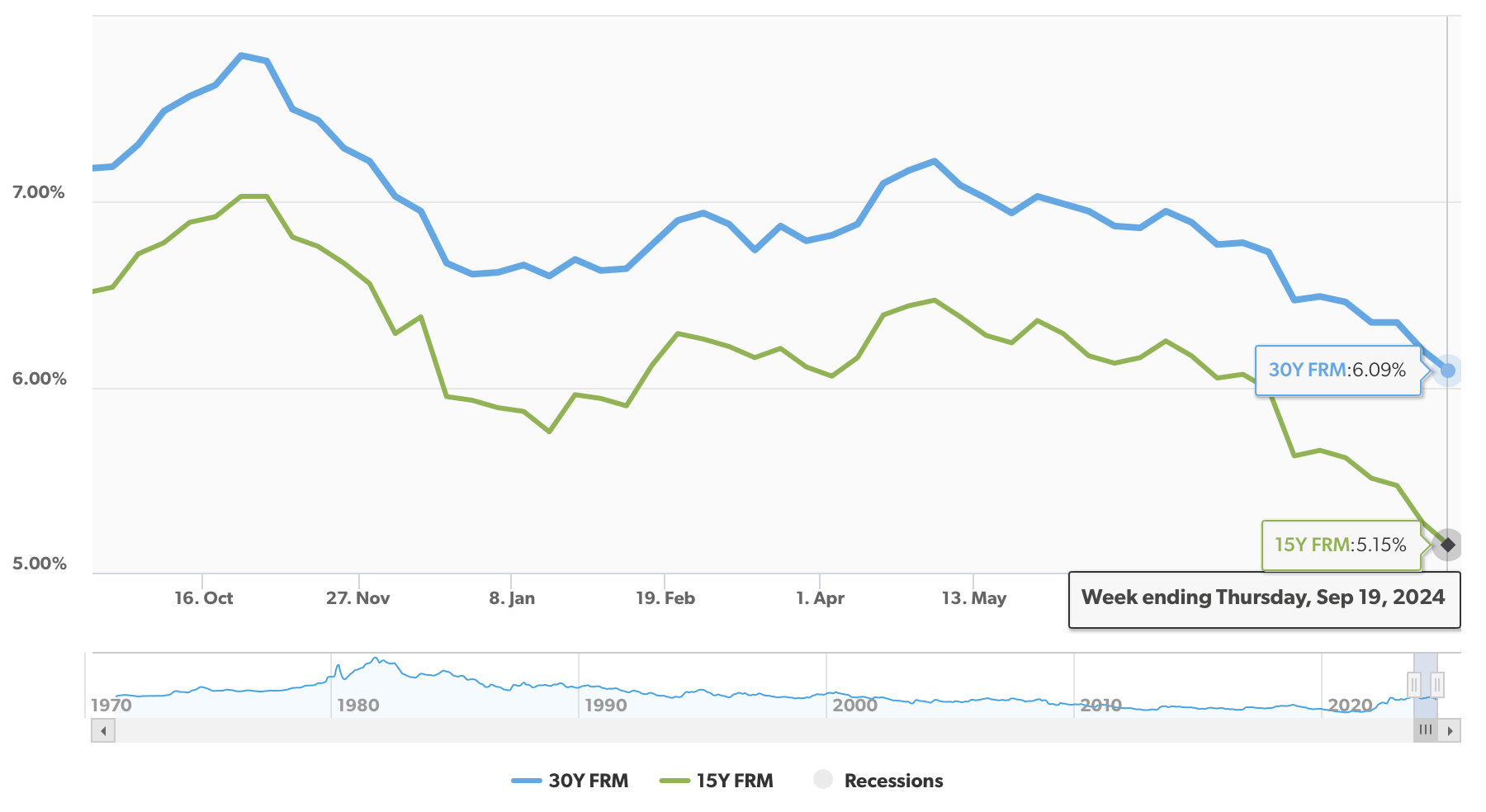

I was watching my news feed on my iPhone while on a call as the Fed announced at 2 PM ET 50 basis point cut. My first thought was, “Wow!” Today, with more time to think about the impact, AND since it is Talk Like A Pirate Day, I thought, “Arrrr!” Admittedly, it was exciting to see the Fed be proactive, and a 50 basis point cut seems proactive to me. As discussed here many times, the housing market distortion on metrics like sales, prices, and inventory was caused by the Fed keeping rates too low for too long in the dark days of the pandemic. And then, in the first week of August, the Japan “yen carry trade” blew up the financial markets, making everyone somehow worry a lot more about the risk of a potential recession (it’s 35%), even if the initial concerns seemed overblown. Immediately, historical housing market analysis became suspect when gauging the outlook for the rest of the year. This concept is like a heart valve analogy of blood being pumped only one way, hence my 2006 theory of negative milestones. It’s the idea that major economic events reduce the reliability of looking behind that moment for trends. We see that in past events like the Great Financial Crisis, 9/11, and Covid. Wednesday’s 50-basis point rate cut by the Fed with the yen carry trade moment was another such milestone, as mortgage rates, sitting at 6.2%, are expected to drop below 6% in the near future to prevent the economy from slipping into a recession.

Bankrate has an excellent explanation of how the federal funds rate influences mortgage rates. Wednesday’s cut is expected to influence mortgage rates to fall further eventually.

Going from nearly 8% to almost 6% over the past year is quite a drop in mortgage rates, but it’s essential to remember that rates are still double the levels seen during the 2020-2021 pandemic. That’s why we aren’t expecting another housing sales frenzy this fall, but we definitely should expect an uptick in sales because consumers have been waiting for a rate cut for 2.5 years.

The Pent-up Demand For Home Sales Is Real

While the 30-year Freddie Mac rate fell to 6.09% from 6.2% the previous week, that’s not from yesterday’s Fed cut. The actual drop in rates from the cut may not be immediate, and that’s not the point. We’ve already seen this pent-up demand released in Manhattan and Brooklyn over July and August, with year-over-year increases reported in our New Signed Contract Reports with surging sales in New York and a modest rise in Florida. After lackluster NYC sales levels during the first half of 2024, this past summer’s sales surge in NYC seems ahead of the national market and probably occurred in anticipation of rate cuts and higher housing prices over the next year. Recent national results occurred before the yen carry trade event in the first week of August, such as NAR’s last Pending Home Sale Index.

Last month, I talked here about how the three big banks (Citi, JP Morgan, and Wells Fargo) were forecasting 125 basis point cuts through the end of 2024. That’s a 50, 50, and 25 cut through the end of the year. The next meeting is in November, and a 25-point basis cut seems to be on the table (it was projected to be 25 for yesterday, yet we got a 50). Whether the next cut is a 50 or 25, who really cares? We have entered a period of declining rates, which should help housing emerge from its pseudo-recession (defined by below-normal sales levels) relative to the remainder of the economy.

Who got Wednesday’s Fed cut call, right? Bill Dudley, former New York Fed Chair, got it right with this highly confident headline: The Fed Should Go Big Now. I Think It Will: An aggressive 50-basis-point reduction in interest rates makes sense.

On Wednesday, Goldman Sachs forecasted another 50 basis point cut over the last two meetings of 2024, as well as at least four more 25 basis point cuts in 2025 for a total of 150 plus the 50 that just happened. 200 points of cuts in this pivot. Wow. Back in July, we were expecting one 25 basis point cut in September if we were lucky, and that would be it for cuts in 2024. The outlook for increased housing sales seemed very bleak for the foreseeable future back in July. GS is also forecasting a 4% increase in housing prices for 2025.

What I loved about the Fed initiating a 50 basis point first cut on Wednesday was its shock value. With more weak economic news expected over the month, the markets would assume that the Fed didn’t do enough with a 25 basis point cut and would be playing catch up going forward. Dudley made this point clear. This big move indicates the Fed is taking the reigns and, perhaps, further reducing the odds of a recession. Why should we be concerned about a potential recession in the context of housing? Job loss is a crucial attribute of a recession and is highly detrimental to housing demand, no matter how low mortgage rates are.

How Does The Rate Cut Impact Housing Specifically?

The lock-in effect continues to weaken buyers’ and sellers’ resolve to stay put – homeowners who have a much lower rate today than the prevailing rate are more likely to sit. However, given the pent-up demand of a 2.5-year wait from early 2022 through today and falling mortgage rates, the lock-in effect is weaker. As the spread between the low rates of the pandemic era, while prevailing mortgage rates continue to compress, more people will tip into the purchase market, especially if they were interrupted by rising rates in 2022. Life keeps moving forward.

So, what should happen to the housing market now (with caveats)?

- Home sales rise (but not boom)

- Mortgage rates eventually fall (don’t expect a knee-jerk reaction to Wednesday’s Fed move)

- Listing inventory rises (but does not surge)

- Prices rise somewhat (but do not jump)

- Rent growth flattens or even slips (but does not plunge)

Here’s what I shared with Crains New York Business and Brick Underground on the Fed decision (see above list).

ASIDE Do you want real change? Here’s the bank to frequent. It’s all about volume.

Roc360 Webcast (Recorded): Tackling Big Problems in Residential Real Estate with Jonathan Miller

Join Eric Abramovich, Brandon Dunn of Roc360, and Jonathan Miller of HousingNotes for an in-depth and insightful discussion on the ever-changing residential real estate market.

You can sign up and watch the recorded version here if you missed it.

Did you miss yesterday’s Housing Notes?

September 18, 2024

The Housing Market Doesn’t Care What You Want. 21 Years On The Market Is Proof.

Image: ChatGPT

Housing Notes Reads

- The Fed cuts interest rates by half a percent in a big move for buyers and sellers [Brick Underground]

- The Fed Should Go Big Now. I Think It Will. [Bloomberg]

- US house prices are forecast to rise more than 4% next year [Goldman Sachs]

- 30-Year Fixed Rate Mortgage Average in the United States [St. Louis Fed]

- What the interest rate cut will mean for New York real estate [Crains New York]

- What the Fed’s rate cut means for consumers, businesses and investors [Washington Post]

- The Fed Makes a Large Rate Cut and Forecasts More to Come [NY Times]

Market Reports

- Elliman Report: Manhattan, Brooklyn & Queens Rentals 8-2024 [Miller Samuel]

- Elliman Report: New York New Signed Contracts 8-2024 [Miller Samuel]

- Elliman Report: Florida New Signed Contracts 8-2024 [Miller Samuel]

![Brooklyn Rental Listing Inventory by Month [Average from 2010]](https://millersamuel.com/files/2024/07/Aug24BKLYNrent-invBYmo-1200x786.jpg)