- A Manhattan Townhouse Set The Record For Time On Market [21 Years]

- The List Prices Of The Past 15 Years Trended Lower While Market Trended Higher

- The Housing Market Is Heartless And Doesn’t Care What Price You Need

A couple of decades ago, a townhouse on one of my favorite Upper East Side blocks was listed for sale. It has been on and off the market on a regular basis since 2003. At one point, around 2001, I was brought in for a second appraisal by the owner, presumably to provide additional credibility for the first appraiser’s value. After seeing the first report, I realized the square footage used in the first appraisal included the basement. In fact, the total measurement made by the first appraiser was impossible to reach even after counting the basement as a floor above grade and using the lot dimensions. Even today, the square footage appears to include the basement, a potential ±20% exaggeration. As a result, my opinion of value back then wasn’t nearly as high as the first appraiser’s, and the owner wasn’t pleased. It also makes clear how essential it is to get paid for services in advance on these assignments so we are not subjected to client pressure. The property was placed on the market two years later, in 2003, at an above-market price, as evidenced by its inability to sell.

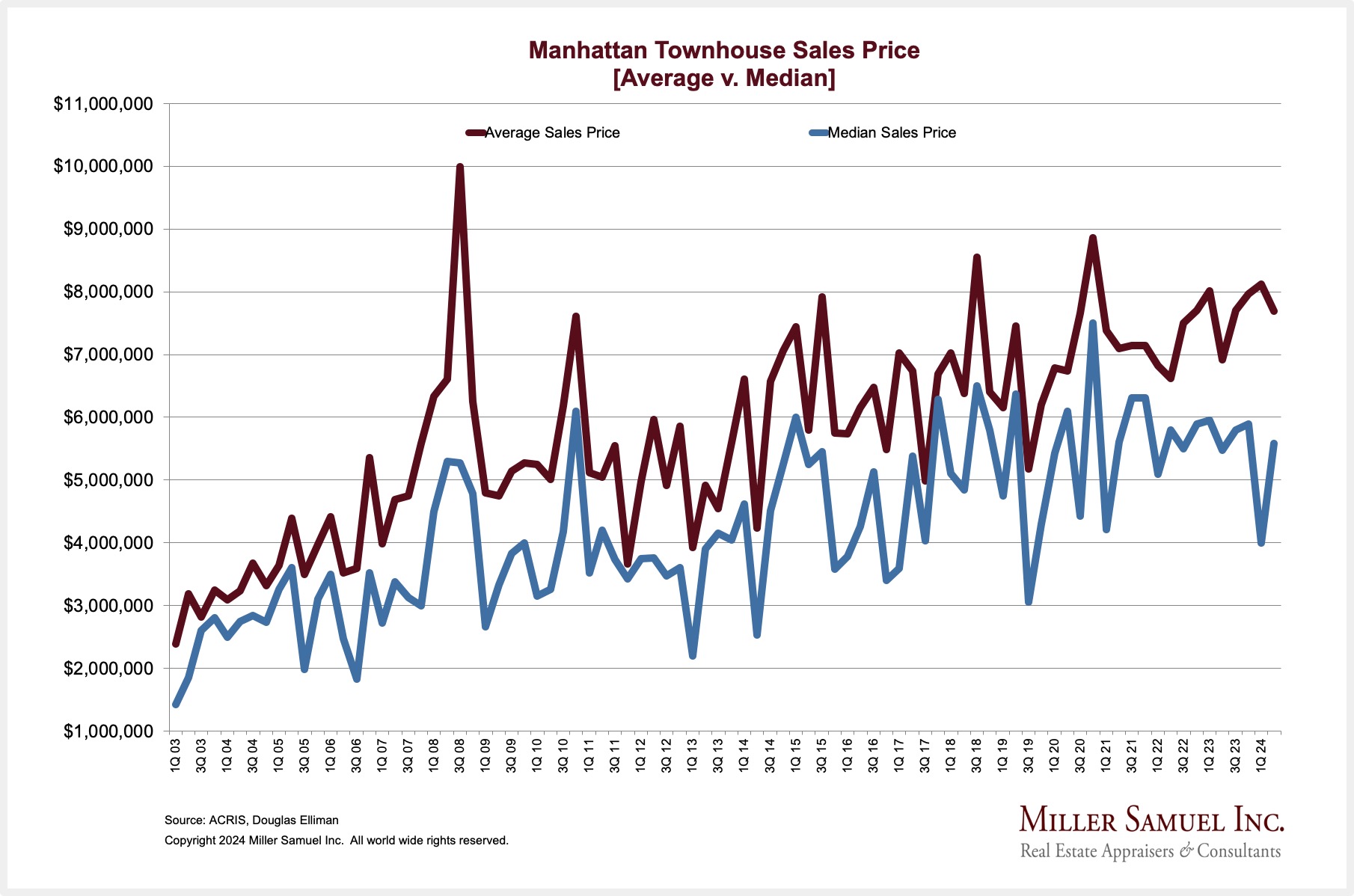

Manhattan Townhouse Price Trend

It’s clear from the above chart that the Manhattan townhouse price trend has been rising for the past few decades.

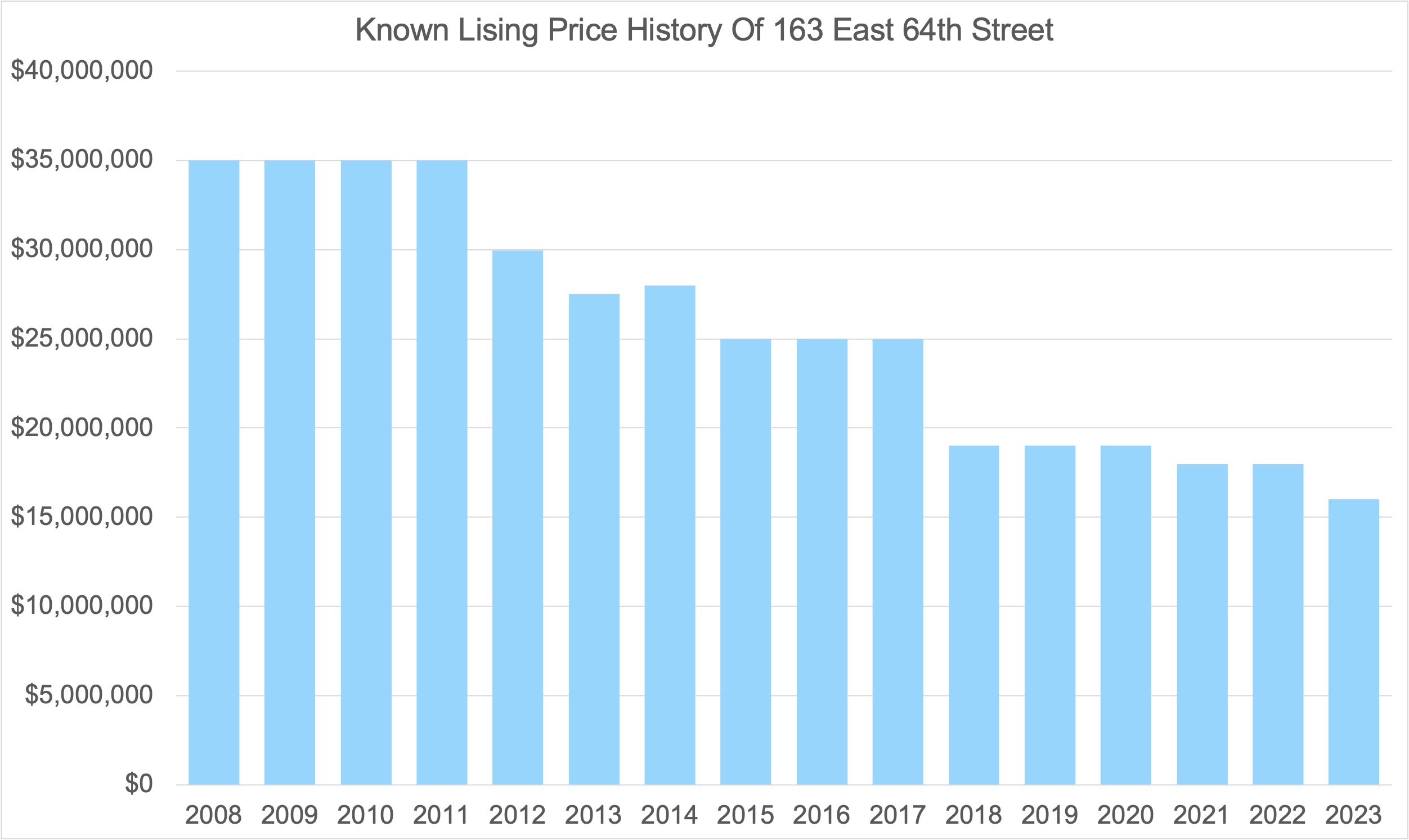

163 East 64th Street Listing Price Trends Many earlier listing records have been lost, as most online services began after the property was initially listed. The history was rebuilt partly with the help of news coverage.

- 1986 – $4,000,000 purchase price ($11.5M inflation-adjusted per NYPost)

- 2003 – Unknown asking price when listed for sale

- 2008 – $35,000,000

- 2009 – $35,000,000

- 2012 – $29,950,000

- 2013 – $27,500,000

- 2014 – $28,000,000

- 2014 – $27,500,000

- 2015 – $25,000,000

- 2017 – $25,000,000 (ninth time listed)

- 2018 – $19,000,000

- 2021 – $17,995,000

- 2023 – $15,995,000

The direction of the subject property’s listing prices has been counter to the market price trend, inferring just how wildly overpriced the subject property has been. One of the reasons for the pricing disconnect appears to be the square footage. The listings continue to show the square footage at 8,000, which I believe includes the basement. The average square footage of an East Side townhouse sale averaged 4,352 square feet from 2003-2023, making the subject property nearly twice as large. The following photo of the subject (brick facade on the right) and the townhouses on the block, which are representative of townhouses in the neighborhood, appear similar in size to 163 East 64th Street not half the size as the listing suggests.

Reputational Damage – The ‘Versailles’ Moniker Is Now A Negative

We last visited Versailles back in 2009, and it is clearly unforgettable. It was a family vacation to Paris. After all, what could be more romantic than going to Paris on our 25th wedding anniversary with our four sons, aged 11-20? Ha. We took a train from Paris to see it and stood in an extremely long line on a bright, sunny day. The tourist family in front of us was with their son, who had gone to camp with one of our sons the previous summer. What are the odds?

But I digress…

But I also think about the 2012 documentary hit The Queen of Versailles, chronicling the vast mansion under construction as the owners’ financial fortunes collapsed. That seems more suitable, and the “Versailles” branding is no longer the flex it once was.

Final Thoughts

Here’s a list:

- Looking back at all the flowery prose pushed out about this property for decades, it hasn’t enabled a sale.

- After cycling through all the brokerage companies, the seller of an overpriced listing develops a reputation for not being serious about selling, and agents stop showing it.

- The property appeared wildly overpriced back as early as 2008, as evidenced by the fact it never sold and the steady stream of declining list price cuts in contrast to rising sales prices in the market.

- The property was reported to have one offer over the decades and fell through – that doesn’t mean the pricing was correct at the time because the offer fell through.

- Based on the foreclosure activity on the property, it sounds like it was used as collateral for other matters, and that might explain the irrational price-setting early on.

The big takeaway here is:

The Housing Market Is Heartless And Doesn’t Care What Price You Need.

Roc360 Webcast TODAY 1 PM ET: Tackling Big Problems in Residential Real Estate with Jonathan Miller

Join Eric Abramovich, Brandon Dunn of Roc360, and Jonathan Miller of HousingNotes for an in-depth and insightful discussion on the ever-changing residential real estate market.

You can sign up and watch the recorded version here if you missed it.

Did you miss yesterday’s Housing Notes?

September 17, 2024

Fool For The City: NYC Is One Of The Safest Places To Live In U.S.

Image: ChatGPT

Housing Notes Reads

- Exclusive | Why the ‘Versailles in Manhattan’ townhouse has been on the market for 21 years [2024 NY Post]

- Trophy Townhouse Is The Wonder Of The Upper East Side [2021 PR Newswire]

- Nobody can sell this $19M ‘Versailles in Manhattan’ [2018 NY Post]

- Will the ninth time be the charm for this $25M UES townhouse? [2017 The Real Deal]

- Upper East Side’s ‘Versailles in Manhattan’ townhouse gets another price cut [2017 Curbed]

![[Podcast] Episode 4: What It Means With Jonathan Miller](https://millersamuel.com/files/2025/04/WhatItMeans.jpeg)