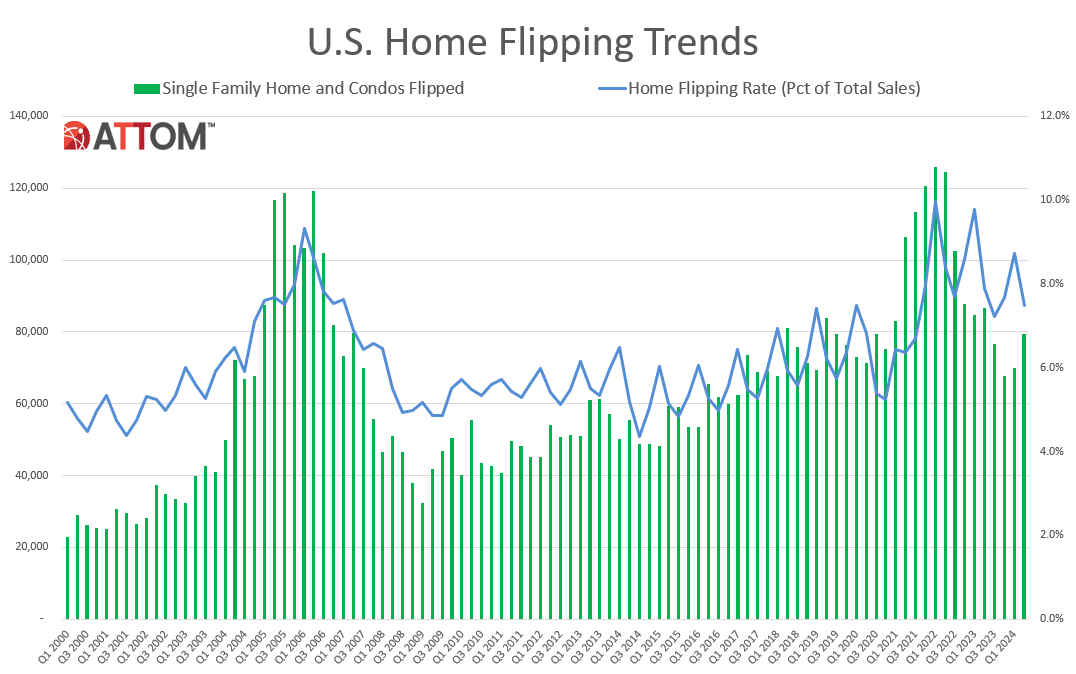

- One Of Thirteen Sales, Or 7.5% Of All Sales, Is A Flip

- A Flip Is Defined As A Single Family Or Condo That Resells In One Year

- Flips Provide A Necessary Service To Maintain The Existing Housing Stock

Last week, I came across the latest ATTOM home flipping report and was surprised by how much of that activity is supposedly going on despite high mortgage rates and low sales. I’ve had a number of relatives talk about getting into the flipping space over the years but had mixed results. This national data provider defined a flip as a single family or condo arm’s length sale that was resold within twelve months. In the second quarter, the 79,540 flips they recorded amounted to one in every thirteen sales or 7.5% of all sales. That’s seasonally less than the 8.7% tracked in the previous quarter, but that’s not why I am bringing this topic up.

Are Flips Really Still A Thing? Let’s Look At The Data

Let’s break it down.

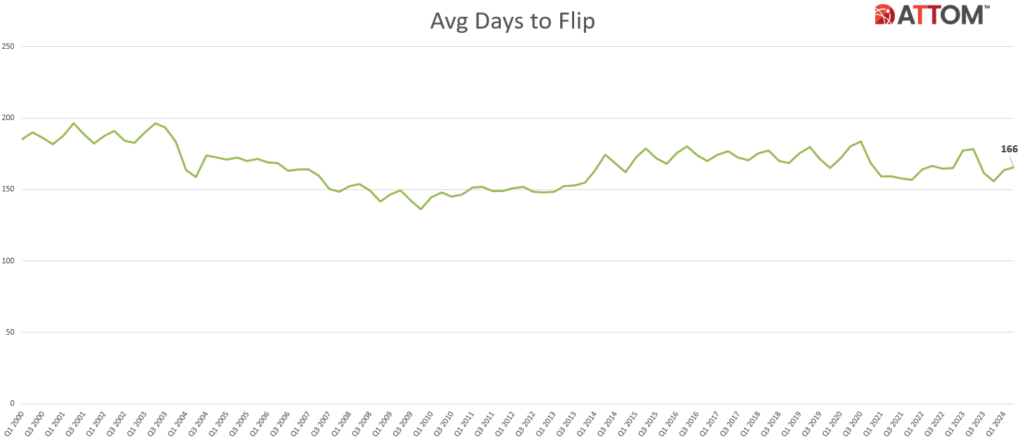

Days on Market – The average marketing time of a flip is about 166 days, so their one-year turnover definition for flips seems ok to me. As I discuss below, there are a lot of investors acquiring flips with mortgages, which the scale surprised me.

Cash Purchases – Investors who are active in the flipping space pay with cash an average of 63% of the time (same as the Manhattan market for all sales!). Flippers skew towards cash, given the length of time banks take to close a mortgage and the higher rates charged to investors (on top of already high mortgage rates). Over the past decade, there has been a new category of lenders that specialize in fix and flip and are doing quite well, filling a niche that traditional mortgage lenders won’t service.

Hidden Motivation – It’s hard to analyze the motivations of each buyer at scale, so designing a study to track flippers as someone who resells within 365 days is pretty arbitrary. Still, I can’t think of a better way to capture the data.

Reality Television – It all started with Flip This House in 2005, not to be confused with Flip That House, which also began in 2005. The 2005 start dates are fascinating since that was the peak year for sales during the housing bubble, followed by the 2006 peak for prices during the housing bubble. Fueled by a bubble mentality that prices always go up, the TV-flipping genre is still going strong. I think the concept of flipping was stereotyped during this era as “fast and loose,” but times have clearly changed, and lending in this space is responsible.

A few months ago, I wrote about the reality show genre in “World’s Worst Kept Housing Market Secret: Real Estate Reality Shows Aren’t,” in which house flipping remains a substantial subset. The reality genre still drives the flipping stereotype, which has become very dated.

Repairing The Housing Stock – Beyond the hype, upgrading existing housing stock is a service that remains needed. Improvements deteriorate over time, so anything done to maintain the stock, especially with limited supply, is reasonably necessary.

Final Thoughts

The housing bubble of twenty years ago continues to influence today’s housing market mentality as it remains all over cable television. We love to watch flipping on tv. I suspect the flipper home buyer phenomenon remains a little overhyped but is an essential component of maintaining the existing housing stock. There are plenty of challenges to making a profit in a world of record-high pricing for acquisition, construction materials and labor constraints, higher mortgage rates, and tight credit conditions since the Fed pivoted to higher rates in 2022. Despite all those headwinds, one out of thirteen home sales was a flip last year. Amazing.

So, flipping remains a thing and provides a service that restores existing housing stock. With the high price of new construction, flipping remains a necessary force in the housing economy.

MARKET AWAKENING FROM HIBERNATION? | A live interview with appraiser extraordinaire Jonathan Miller on the current state of the NYC market

CLICK HERE OR THE IMAGE BELOW TO REGISTER FOR THIS LIVE WEBINAR

Did you miss Friday’s Housing Notes?

September 19, 2024

Full-Time Agents Are Less Than Half The Industry While Mandatory Dues Paying Is Getting Unpopular

Image: ChatGPT

![[Podcast] Episode 4: What It Means With Jonathan Miller](https://millersamuel.com/files/2025/04/WhatItMeans.jpeg)