Why ‘Work From Home’ Is Not A Blip

Office building values have fallen by 70% or more as office rents plummet

Vacancy rates of 20% do not nearly reflect the actual amount of vacant office space

WFH pushed housing costs higher by enabling less compromise on location choices

The Bureau of Labor Statistics (BLS) tracks the amount of time an employee works at home. It’s been four years since WFH became ubiquitous within 24 hours after the COVID lockdowns began.

Four years of commuting habits have been formed

New single family housing often includes office space in its layouts

Many employees have moved farther from their workplace

‘Zooming’ has been added to the office nomenclature

Office building valuations have consistently fallen by ~70%

More than two-thirds of employees prefer WFH

Despite the changes in the workplace, 90% of companies still say they’ll require workers to come back to the office soon.

Corporate leaders are older than the average employee and less willing to adapt

Corporations have invested in office buildings and long-term leases

Companies maintain concern over worker productivity at home

As economy weakens, the thinking that employees want in-person time with bosses

Assumption that corporate culture accounts for one-third of company value

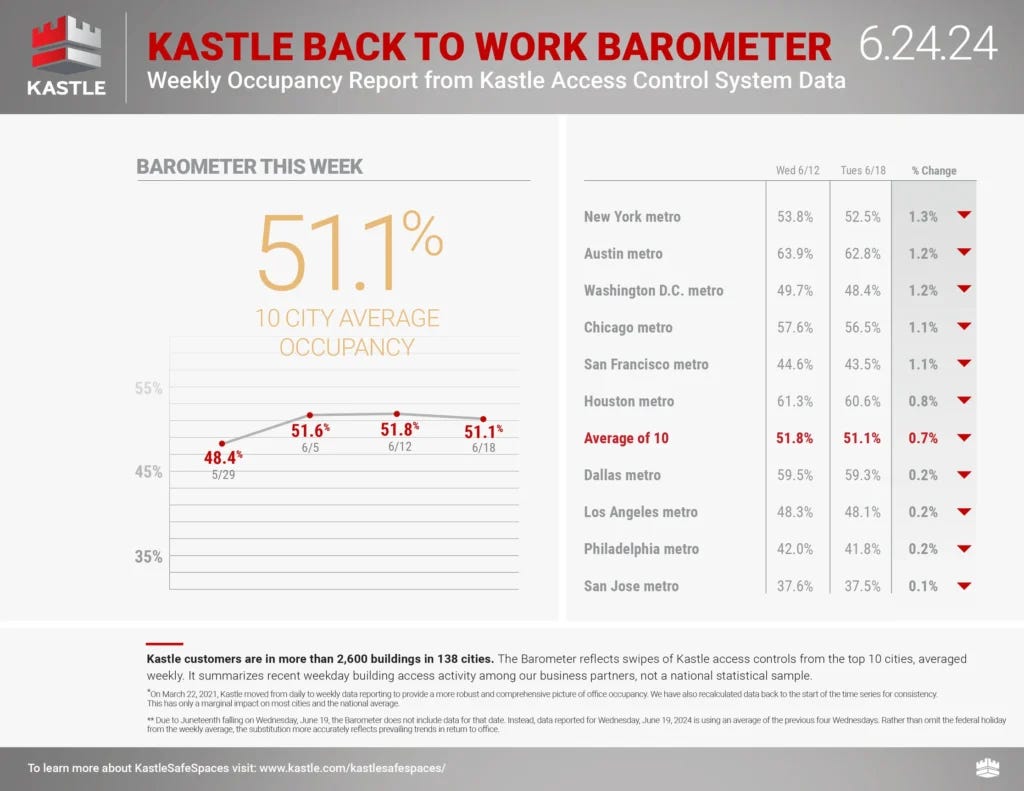

Return To Office (RTO) Is Losing To Reality Of Plunging Commercial Real Estate Values

Commercial office values are in freefall so why do some think that RTO is imminent? The 20% vacancy rate doesn’t reflect the actual picture since many landlords have time left on existing leases where companies no longer occupy the space. If many company executives are determined to change workforce rules commanding a return to the office, the asset class sure isn’t anticipating that as values plunge.

Here’s a terrific white paper on COVID’s impact on real estate:

NOVEMBER 2022 – THE REMOTE WORK REVOLUTION: IMPACT ON REAL ESTATE VALUES AND THE URBAN ENVIRONMENT

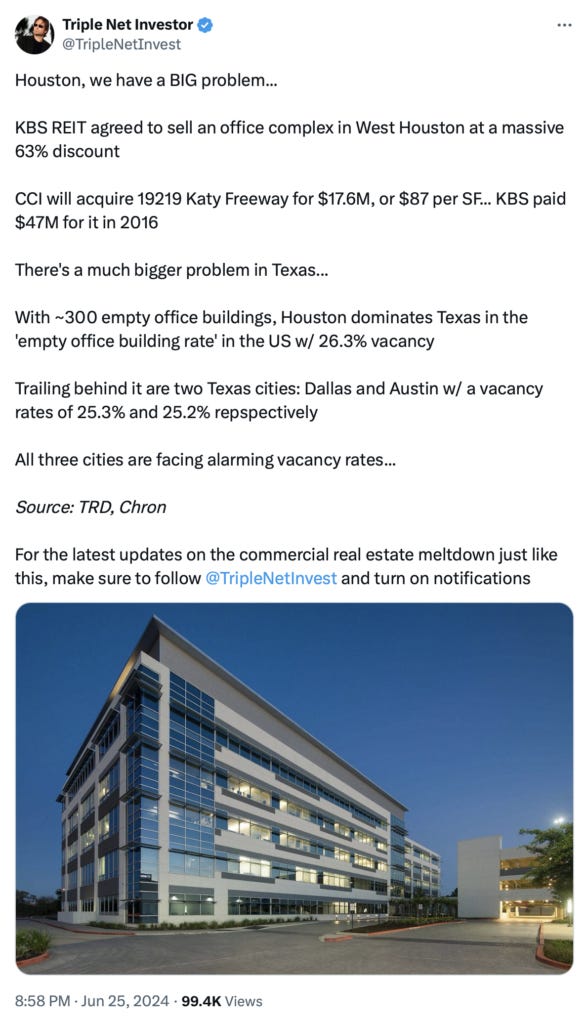

Why would asset managers be willing to dump properties for +70% discounts? As landlords are squeezed by market rent levels falling to below adequate levels to cover debt service, they are offloading commercial office assets. This will snowball as more properties shed their debt and can thrive at much lower rent levels. This process will likely take 3-5 years are longer.

Here are some examples.

WFH has increased housing values

The commercial office market correction has not adversely impacted the residential housing market. In fact, it has played a role in enhancing market value. The ability for consumers to have greater flexibility where they live enables them to pay more for their homes.

Once we entered the COVID lockdown in Manhattan, I remember immediately saying that the tether between work and home became infinitely longer overnight. The meaning of “location” immediately pivoted from a convenient commute to I’ve always wanted to live here.

Did you miss yesterday’s Housing Notes?

June 27, 2024

Landmarking Real Estate “Is A Beautiful Thing, There Is So Much To Smile About”