- Brooklyn Is Going Through A Global Rebranding, So Housing Prices Continue To Soar

- Brooklyn Listing Inventory Is Consistent With Long-Term Norms, Inadequate For Years

- The Often-Cited “One Quarter Of Americans Have An Ancestor Born In Brooklyn” Is Not Confirmable.

The Brooklyn housing market has remained vibrant relative to the rest of New York City in good and bad economic times, and it remains personal to me. My grandfather was born there and my uncle died there (in the Clark Street subway station). One out of four Americans supposedly have an ancestor born in Brooklyn. About a decade ago, press coverage about residents being priced out of Brooklyn and moving to Manhattan (gift link) crept up on my radar. The Brooklyn housing market morphed from “cheaper than Manhattan” to a global brand. A couple of trips to China back in 2015 and 2016 revealed a slew of “Brooklyn” labeled apparel worn, with not one mention of “Manhattan.” Although I was unable to find the picture of my favorite t-shirt that listed “Paris, Rome, London, Brooklyn” in bold letters, I found the following photo below. Brooklyn mentions were everywhere we went in Shanghai and Beijing.

When A Housing Market Is Undefined, It’s Hard To See The Top

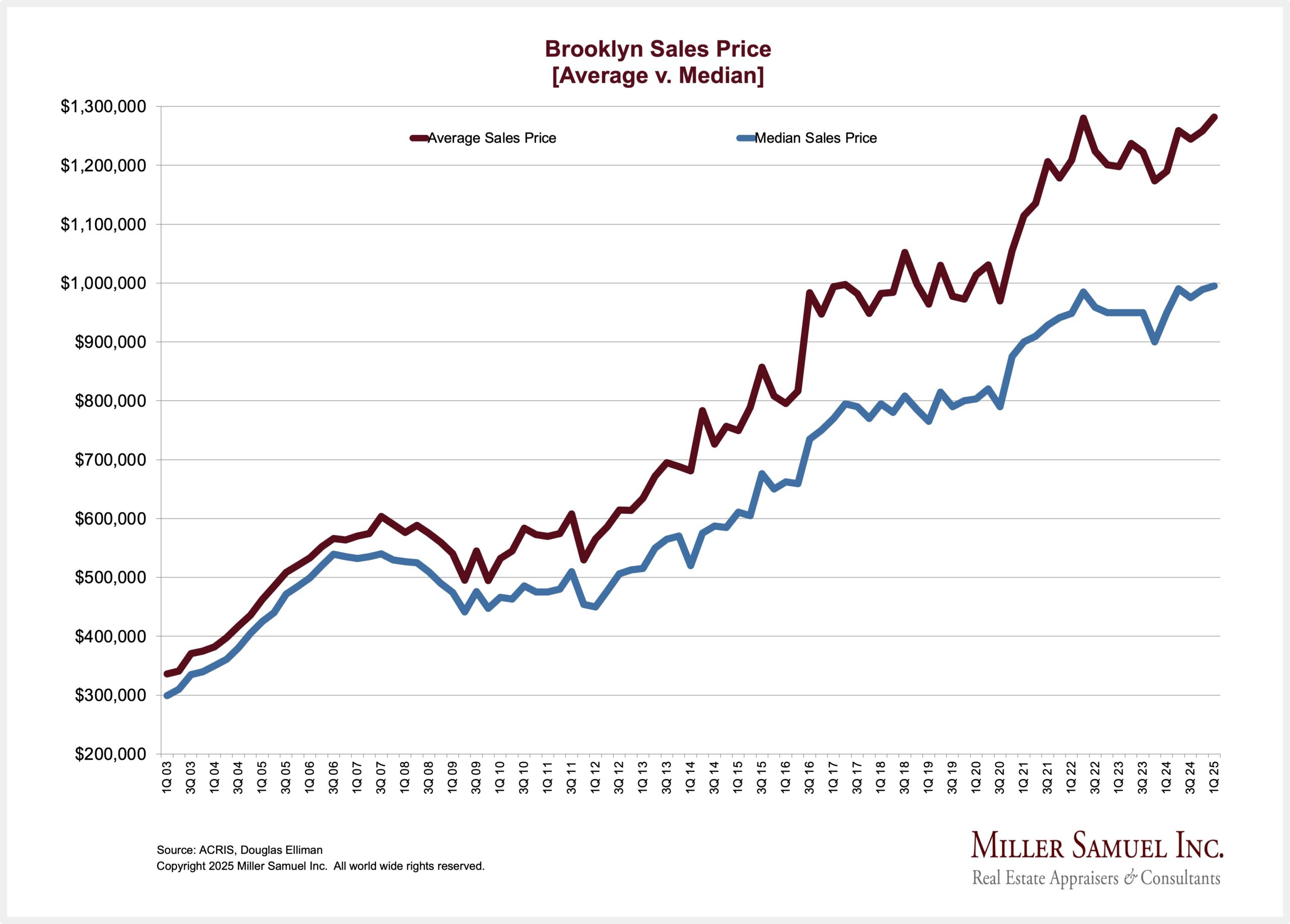

More than a decade ago, Brooklyn began to change, as evidenced by the widening gap between average sales prices and median sales price trends. That’s tangible evidence that more higher-end properties are being built and entering the market. There is no basis established to understand when the “top” of the market occurs or how far current conditions can continue. That’s because the market has become a global brand and is going through a period of discovery.

Hot Off The Presses: Q1-2025 Results

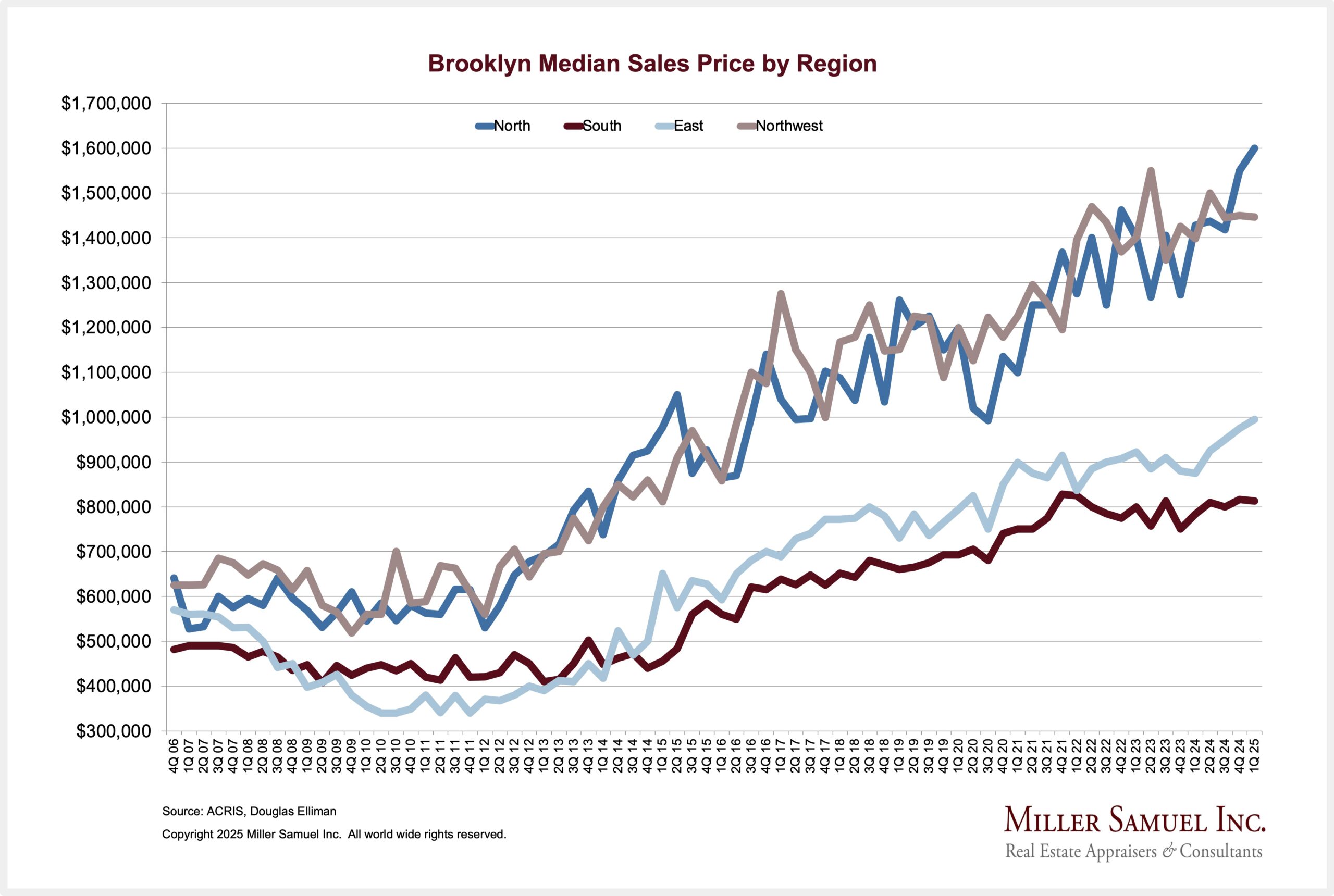

Our Brooklyn market research for Q1-2025 was published this month and there continues to be a steady upward trend in housing prices despite the surge in mortgage rates. The intensity of price growth continues, but the most significant gains are being experienced in the North and Northwest regions where the largest share of new development is occurring outside of the rental market.

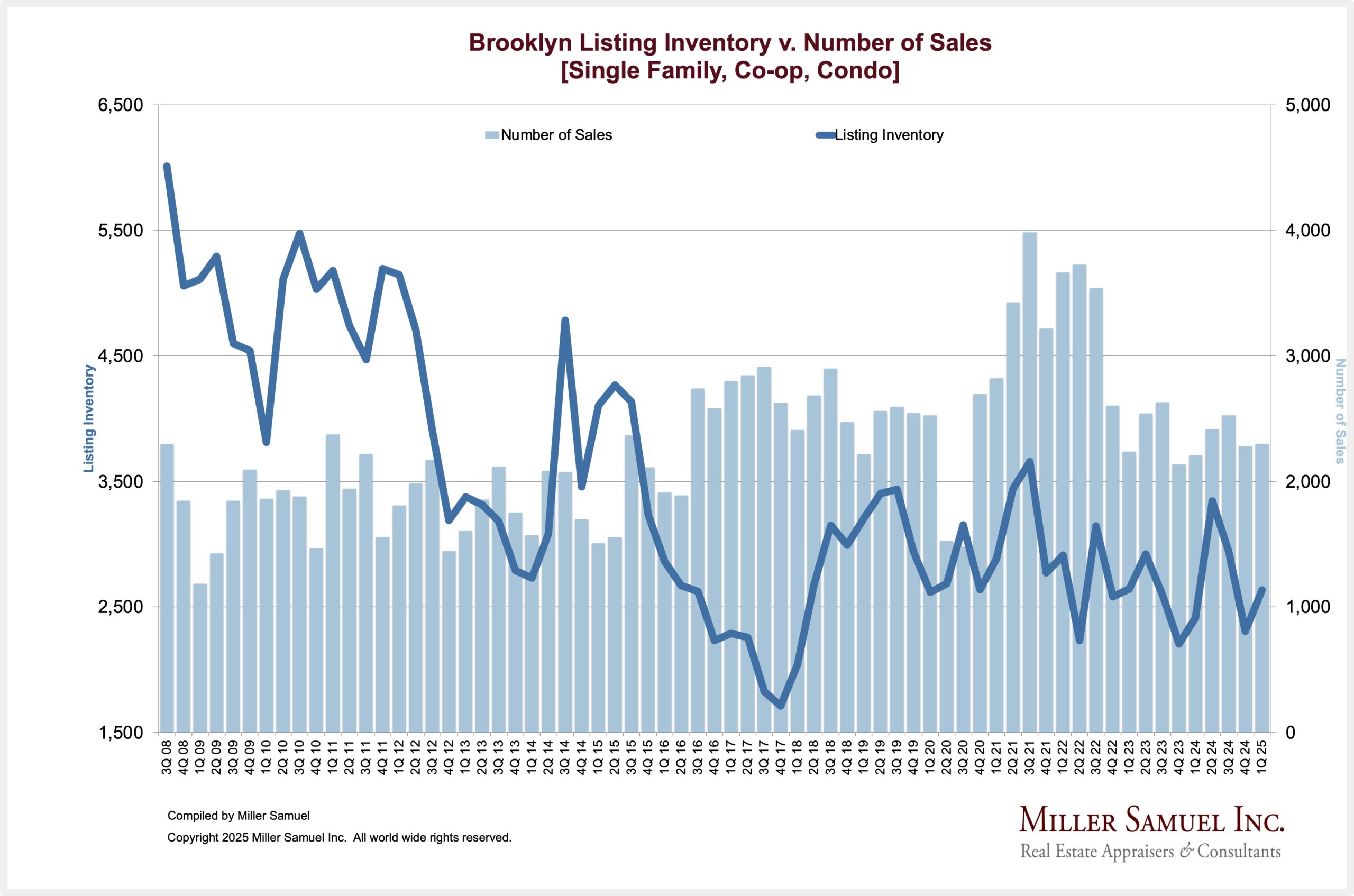

What’s most interesting about the Brooklyn market results is not price trends. It is the idea that listing inventory has normalized, which suggests it is at a reasonable level. Yet, normal listing inventory in Brooklyn is defined as inadequate. Otherwise, we wouldn’t be seeing median sales price in 32 of the past 40 quarters rising to the first, second, or third-highest level in history as of that period. Normal inventory for Brooklyn has been structurally inadequate for at least a decade.

Final Thoughts

I periodically cite the metric that one out of four Americans have an ancestor born in Brooklyn whenever I give a talk there. Nearly everyone I’ve mentioned this to who lives in NYC has confirmed this is true in their family. Yet the plural of anecdotal isn’t data and most of the story around this factoid isn’t confirmable but it feels reasonable. So, I’m going with it since Brooklyn would be the third largest city after Chicago and Los Angeles if the five city boroughs were separate cities. At one point, Brooklyn felt like the world.

In the meantime, the Brooklyn housing market continues to soar, trying to figure out what it will become.

The Actual Final Thought – Forget “Houston” – at least I can say “Brooklyn” correctly. And of course a Brooklyn accent is hard to miss (NSFW).

PahrooZings: Appraisers On Purpose Podcast: Jonathan Miller

My friend and Chicago appraiser colleague Michael Hobbs interviewed me for a two-part podcast: “The PahrooZings Podcast showcases inspiring appraisers and professionals who are field-leaders.”

I met Michael through our membership in RAC, a group of the best residential appraisers in the US. I’m a past president (2017-2018) and very much appreciate the knowledge and insights my membership has given me.

Part I: Building an Appraisal Business Without an MLS

Part II: Why Appraisers Understand the Market Better Than Economists

Monday Mailboxes, Etc. – Sharing reader feedback on Housing Notes.

April 17, 2025: Amid Housing Economy Confusion, Perhaps Compass Is Purchasing BHHS After All?

- Thanks for the gift link to the WSJ article. Good stuff. I’m interviewing local agents and uncertainty seems to be affecting the move up buyer market somewhat while the entry tier and top tier are holding up. At least for now.

Did you miss the previous Housing Notes?

Housing Notes Reads

- Naftali’s One Williamsburg Wharf rides Brooklyn new dev wave [The Real Deal]

- Resi sales plunge in Miami Beach and barrier islands, as inventory grows across South Florida [The Real Deal]

- Fewer buyers, steeper rents, and costlier renovations: How tariffs could impact NYC real estate [Brick Underground]

- MBA Chart of the Week [MBA]

Market Reports

- Elliman Report: Coral Gables Sales 1Q 2025 [Miller Samuel]

- Elliman Report: Palm Beach Sales 1Q 2025 [Miller Samuel]

- Elliman Report: Sarasota County Sales 1Q 2025 [Miller Samuel]

- Elliman Report: Weston Sales 1Q 2025 [Miller Samuel]

- Elliman Report: Wellington Sales 1Q 2025 [Miller Samuel]

![[Podcast] Episode 4: What It Means With Jonathan Miller](https://millersamuel.com/files/2025/04/WhatItMeans.jpeg)