- Real Estate Brokerage Industry Sharply Cut Costs To Survive Elevated Rates

- Industry Is Placing Hopes On Surge In Demand From Anticipated Rate Cuts

- Redfin Emerges From Pandemic With Residential Real Estate Leadership Role

That memorable quote is from Glenn Kelman, CEO of Redfin, on their recent Q2 earnings call. Founded two decades ago, Kelman took over the reins at the firm in 2006 and has always been a very quotable talking head and affable voice of the real estate brokerage industry, filling a void that NAR assumed they always owned. He has been particularly adept at navigating well enough to survive as a “new” brokerage business model while it morphs into a traditional model. I once heard him speak in person after I presented at an MLS board meeting in Philadelphia years ago, and he’s very good at that, too. His quote says a lot about the real estate brokerage business right now. Even though he followed up with, ‘Actually, I wish I just hadn’t said that,’ it made the off-colour quote even more authentic.

Every real estate brokerage firm I can think of has endured significant cost-cutting measures over the past several years as the Fed pivot in early 2022 caused mortgage rates to surge to multi-decade highs, slowing home sales significantly. Brokerage firms across the nation have been clutching worry beads the entire time, praying for interest rates to come down enough to normalize sales.

Kelmann’s firm has cut costs like everyone else and is hoping for better days ahead. It’s been a frantic time for his firm as they grappled to settle on the right business model since the pandemic era began.

Redfin was reluctantly dragged into the iBuyer wars with Opendoor and Zillow Offers, which ended badly for the latter, and they, too, dropped out. Redfin entered mortgages following Zillow’s path but got out of the intensive risk in 2022 by purchasing a lender.

Despite record earnings in their latest analyst call, Rich Barton, CEO and co-founder of Zillow (and Expedia) stepped down as CEO last week (still on the board). Despite Zillow’s performance, I wonder if he sees some storm clouds ahead with the NAR settlement fallout. Most of Zillow’s revenue comes from dependence on their lead generation business for the buy side. Buyer agent revenue is the biggest unanswered question in the aftermath of the NAR settlement now that sellers are aware they don’t necessarily have to pay for the buy side commission (even though such an action is probably against their best interest).

Despite its reputation as an innovator, Redfin has morphed from a discount commission firm to a traditional firm, with their agents moving to a commission pay structure called Redfin Next:

Rolling out Next across 2024 is lowering second and now third-quarter real estate services margins due to one-time transition pay for Redfin agents losing their salaries. The increasing variability of our agents’ income will also dampen the seasonality of our margins. Next agents can earn more than before in busy summer months and less than before in the winter. Getting similar full-year margins with less seasonal volatility should have been easier to run.

Redfin Q2 Earnings Call

Redfin Is Taking Over Zillow’s Industry Leadership

Post-pandemic, Redfin has done a better job than Zillow of releasing relevant research and commenting on important issues of the day. NAR never seemed to do anything but push out their regular reports. The new generation of “tech” real estate firms tend to be the spokespersons for the industry in the eyes of the media. I find Redfin’s website to have more reliable listing data and more usable information than either Zillow or Realtor.com. A decade ago, I left Trulia’s industry advisory board when Zillow effectively acquired Trulia and went public. I had been in that role before Trulia even had a website, and I learned a lot about the portal industry from that perspective. Zillow took over the leadership role from NAR in recent years, which effectively had no relevant leadership. Now, it looks like, in the context of optics, that Redfin is in the process of moving ahead of Zillow as a leader.

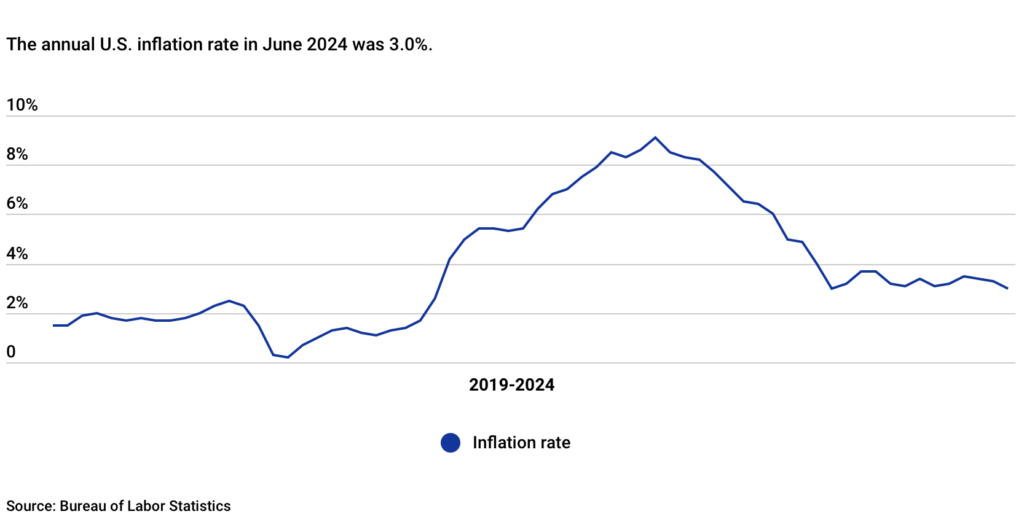

Real Estate Industry Took A Disproportionate Economic Beating From Fed Rate Management

When the Fed kept interest rates too low for too long during the pandemic, listing inventory was wiped clean from the frenzied demand of the market. Nearly everything that wasn’t tied down was sold off. Housing-related industries account for more than one-third of the inflation calculation (36% to 41%). Since two-thirds of housing is owned, it is converted to OER or owner’s equivalent rent to be consistent with renters. This is why housing is such a big part of the inflation calculation, which is generally, well, inflated. For example, if someone owns a home at a low mortgage rate, their rent estimate is probably higher than their actual monthly payments.

So, if you think about it, more than one-third of inflation is based on housing market numbers that don’t actually exist – they’re just hypotheticals. Here’s a good explainer by NPR. My non-economist wild guess is that inflation has a new benchmark closer to 3% than 2% because wages have been deflationary for decades. Wages have been a deflationary force in the economy since the 1960s, with outsourcing and improvements in productivity. Today, with higher wages, consumers have more money to spend within the economy, so the middle class is not getting as badly hammered (falling behind) as it had been decades ago.

But I really digress…

The only description in my life that included the topic of “urine” was in the 1980s when I became the sales director of a new condo in Manhattan at age 24 (6 months into my move to Manhattan, sleeping on the floor of my parents 1-bedroom) after the sales director (my mentor) suddenly became seriously ill. Hank Sopher of JI Sopher pitched me in person to the developers at their weekly meeting at Tower 49, the Solomons built (across from Saks 5th Avenue) as being young but full of “piss & vinegar.” I tried not to roll my eyes in front of all the partners in embarrassment. However, I did get to inform the partners every week about the nuances of the contract activity in the new Manhattan condo we were selling (Astor Terrace at 245 East 93rd Street) and provide feedback on the market for another year until I left to co-found Miller Samuel, our long time real estate appraisal and consulting firm. In fact, that particular developer, Solomon Equities, offered me a job when I announced I was leaving Sopher in 1986, but I passed on the opportunity.

Talking Heads Are Often Talking About What’s Good For Them

In light of Glen Kelmann’s description of Plan B, it came across as authentic, which is an important skill in a press-release, business-news-driven world.

Justin Wolfers is one of a handful of economists I regularly listen to, and he just made a significant point about not listening to Wall Street talking heads. That’s why Glen has been so effective.

While Jim Cramer of Mad Money and I used to share dentists on the Upper East Side of Manhattan, I don’t get the hype and don’t listen to what he has to say about the economy (and this is from 2007!) for the very reason, Wolfers stated (up above).

When those Talking Heads stop making sense, I suggest you listen to this.

Did you miss Friday’s Housing Notes?

Housing Notes Reads

- Redfin (RDFN) Q2 2024 Earnings Call Transcript [The Motley Fool]

- Redfin CEO promises to ‘drink our own urine’ if mortgage rates don’t fall [TechCrunch]

- Who Knows How Much Rent You Can Afford? Hank Sopher, That's Who (Published 1979) [NY Times]

- Everyone Knew About the A-Team [Curbed]

- The Most Expensive Home in America Could be This Mystery $300 Million Malibu Mansion [Architectural Digest]

- Fed Rate Cuts Could Trigger Housing Demand, Rent Drop [Bloomberg]

- ☔ It's Raining Rentals! [Highest & Best]

Market Reports

- Elliman Report: Manhattan, Brooklyn & Queens Rentals 7-2024 [Miller Samuel]

- Elliman Report: Florida New Signed Contracts 7-2024 [Miller Samuel]

- Elliman Report: New York New Signed Contracts 7-2024 [Miller Samuel]

![[Podcast] Episode 4: What It Means With Jonathan Miller](https://millersamuel.com/files/2025/04/WhatItMeans.jpeg)