- Listing Inventory Skewing Much Higher In Price, As Prices Have Surged Over Five Years

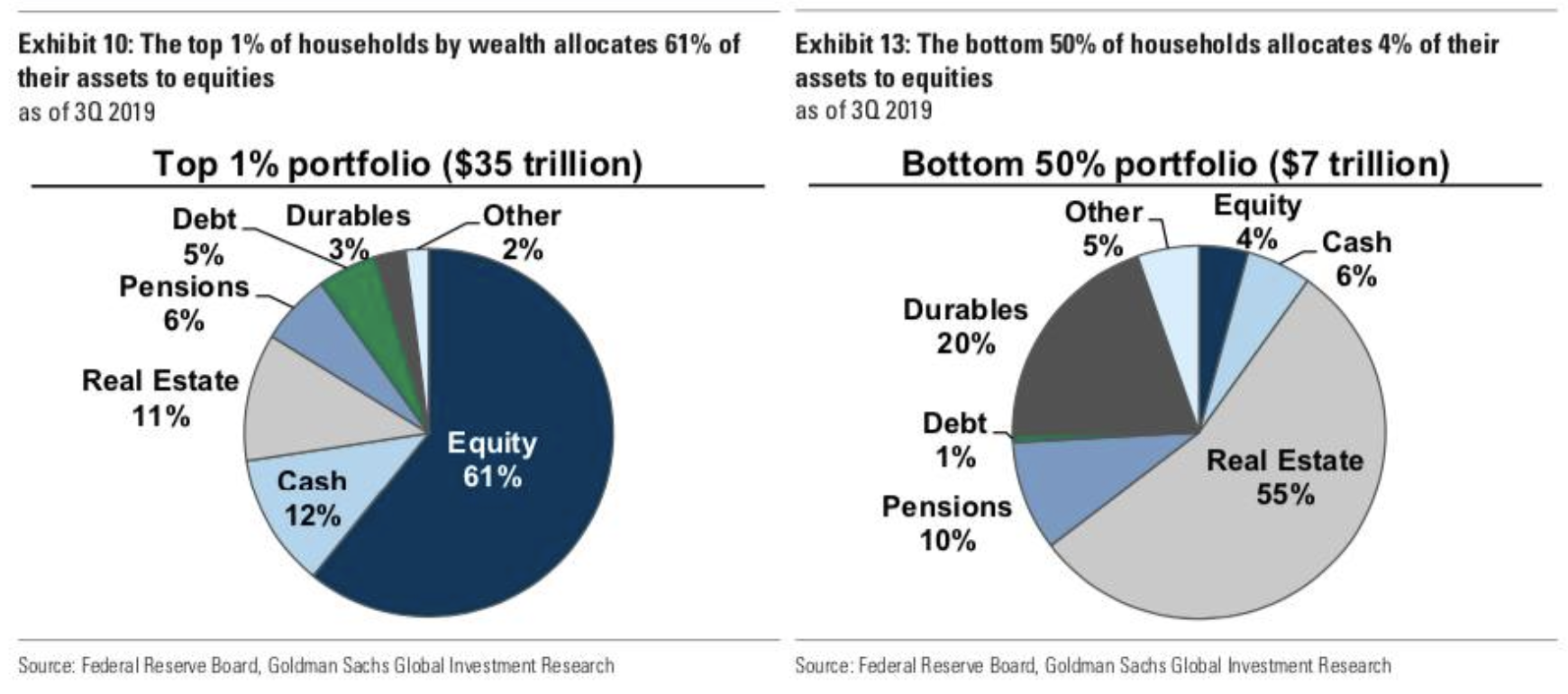

- Portfolios Of Wealthy Skew To Stocks While The Middle Class Skews To Real Estate

- Wealthy Better Suited For This Economic Cycle Of Real Estate

There was a great Wall Street Journal piece (free link) on the decline in available lower priced Miami home sales. It’s the result of prices rising so quickly and a shift in the mix to larger more high-end new product flowing into the market. The high-end market seems better equipped to weather the current economic environment as the chasm between the wealthy and the rest of us continues to widen. The rich own stocks and the middle class own real estate.

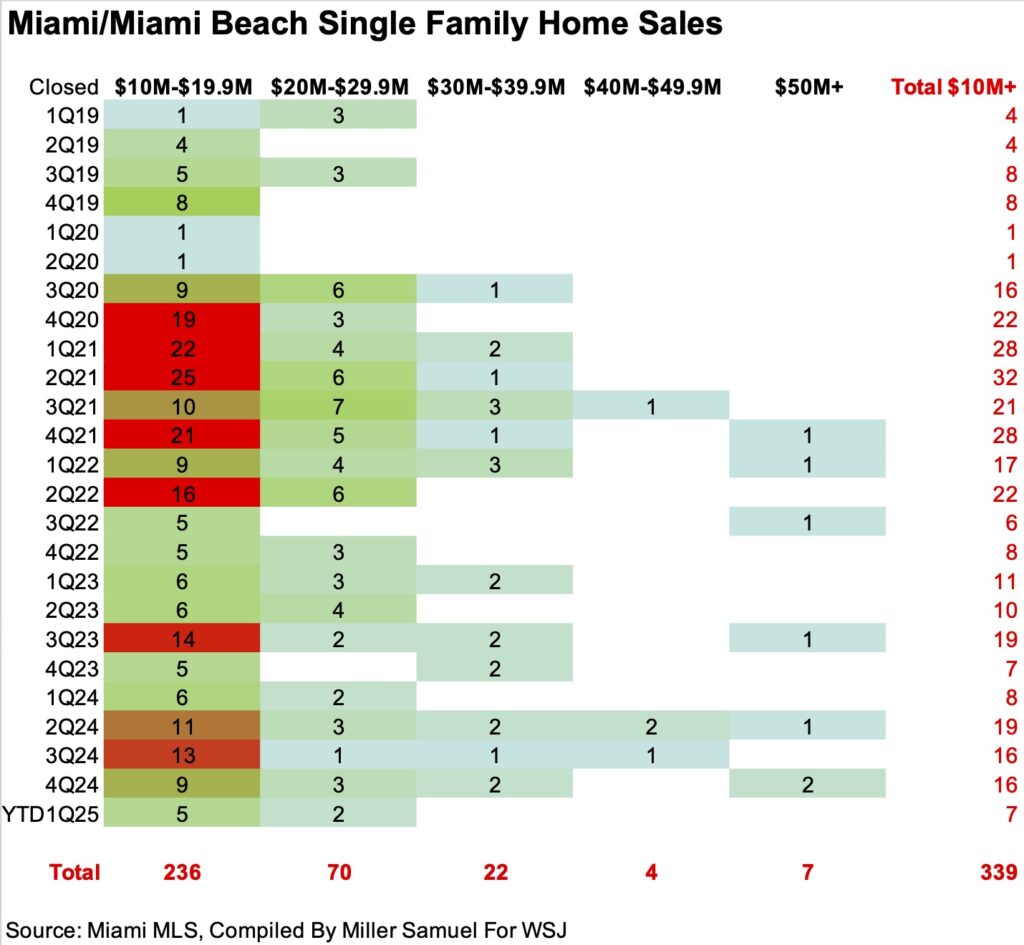

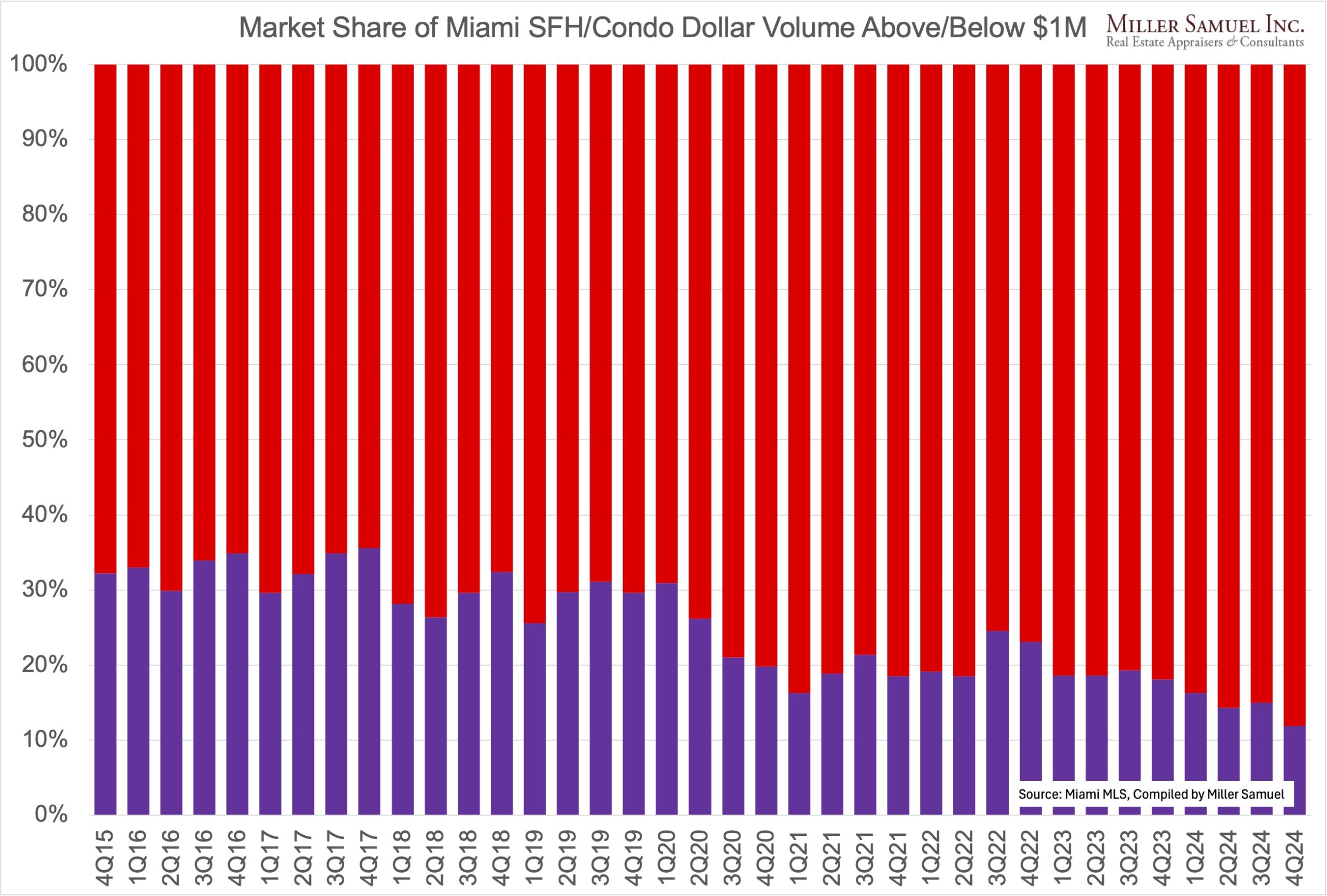

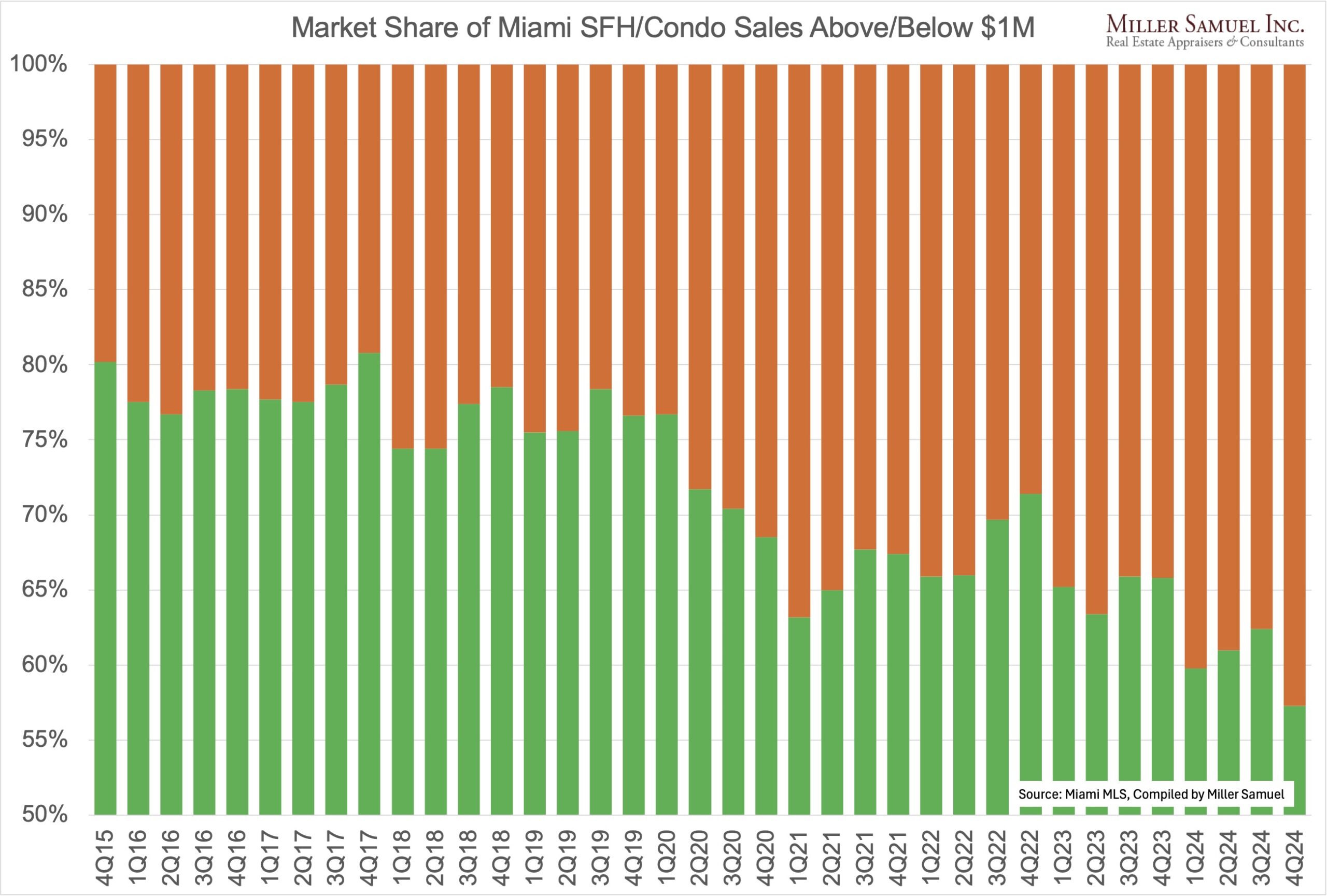

Miami Real Estate Is Shifting To The High-End

You can see that pattern in the table below I whipped up. The market has been growing and widening in the $10M+ single family subset over the past five years.

High-end sales boomed in the pandemic era and continued to be elevated coming out of the frenzied market, seeing many higher priced sales above $20 million becoming commonplace.

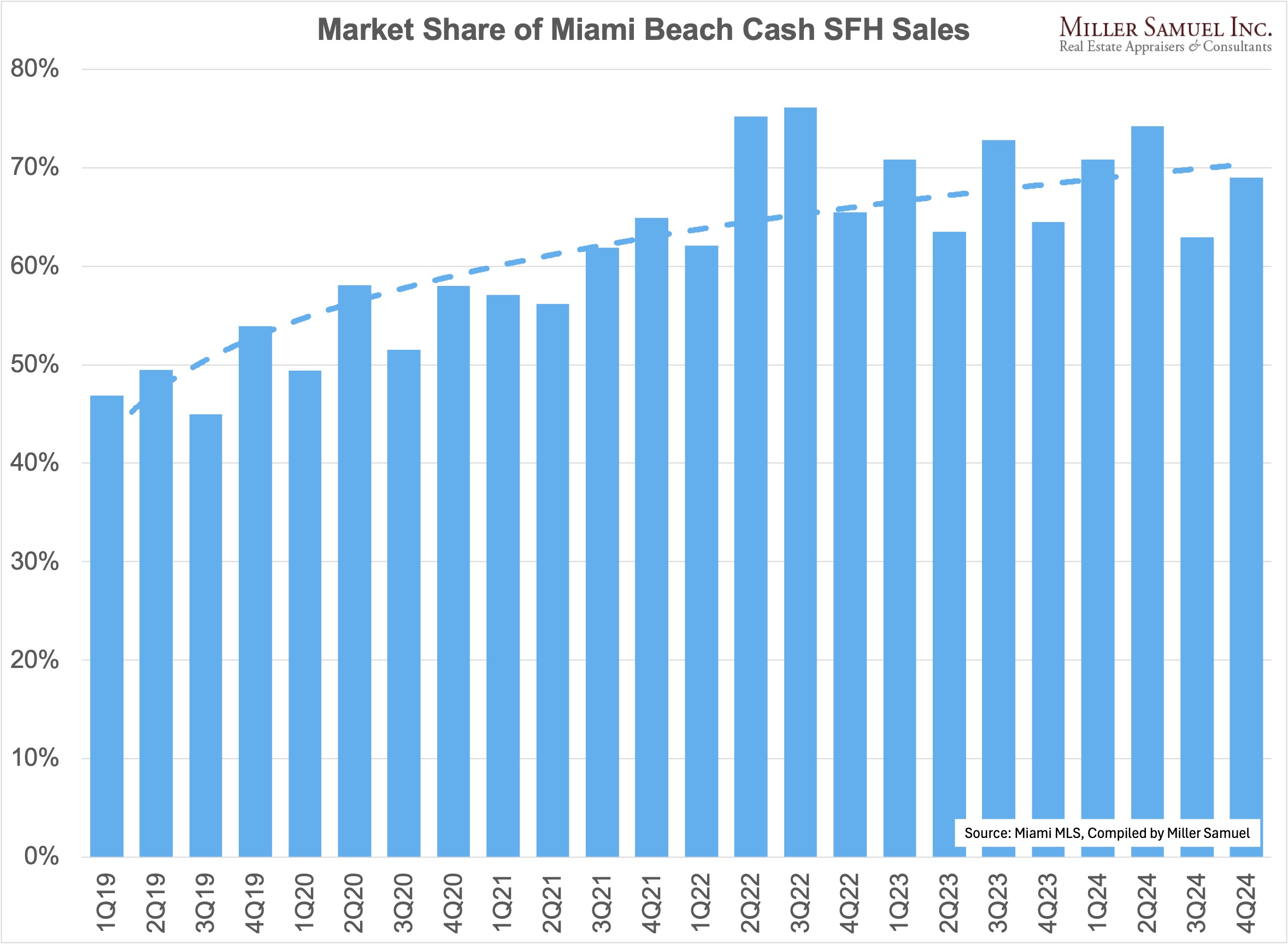

Cash & Strong Financial Markets Favor The Wealthy

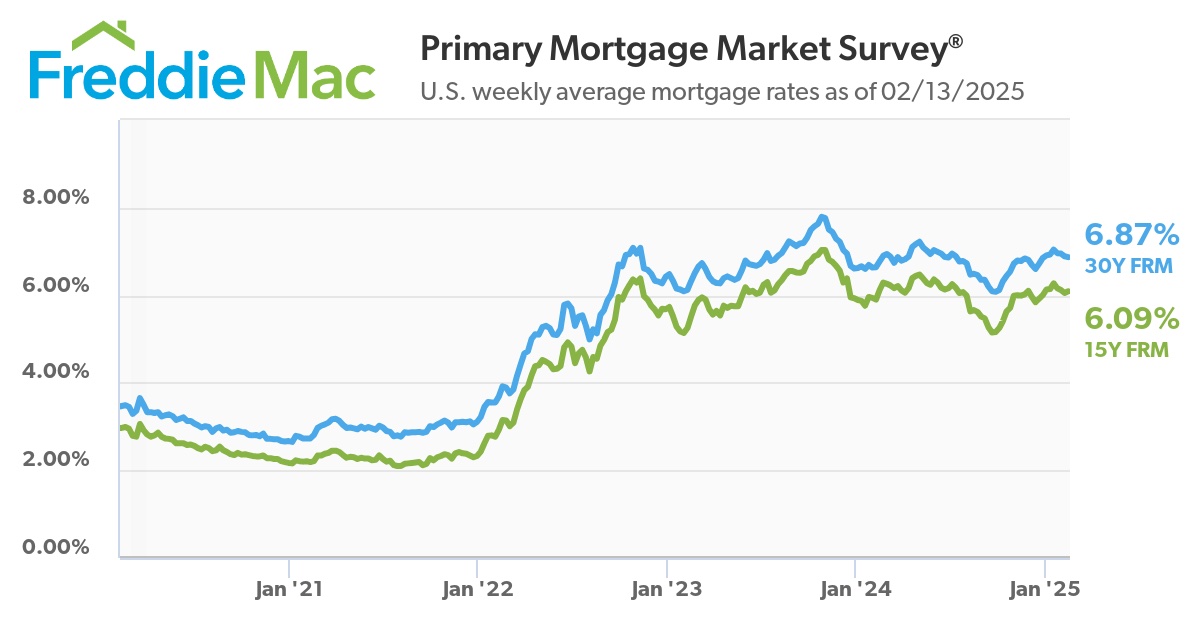

With mortgage rates stuck at elevated levels, consumers with higher wages and/or greater net worth have been able to take advange of financial markets and finding ways of bypassing higher mortgage rates via cash.

The financial markets remain robust with outsized returns.

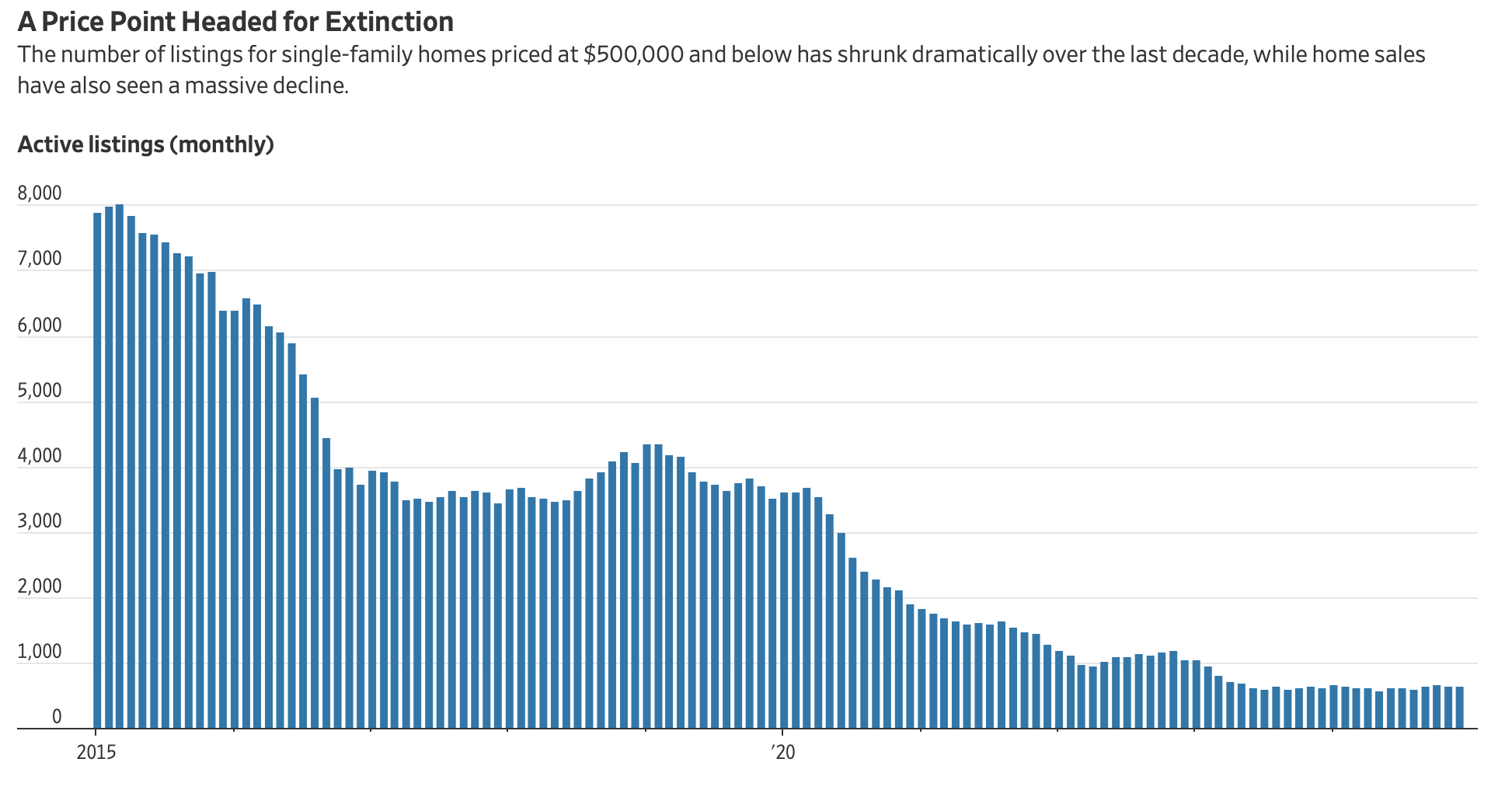

Affordable Listing Inventory In Miami Has Collapsed

Supply of affordable listing inventory has disappeared because prices have risen a lot. It’s not that there isn’t demand for sub-$500 thousand properties, but rather the price points have surged to much higher levels so the supply has moved to a higher price category. The discount that buyers once enjoyed coming to Miami from more expensive markets like the northeastern U.S., have evaperated in a hot market (pun intended).

The shift in the mix to higher end homes has been occuring for the past decade as reflected in the number of sales and the volume of sales.

Final Thoughts

Most U.S. housing markets I’m familiar with are seeing the same pattern we see in Miami – lack of listing inventory is driving prices upward, despite much higher mortgage rates. Affordable listings are becoming rare because prices have surged and new development product is much further in price from the existing market product while the existing market product is where the supply is more chronically low.

This market “will rip your lungs out Jim, I’d like to meet his tailor.” Wow, I feel fortunate that I saw him in concert back in college. Howoo!

Monday Mailboxes, Etc. – Sharing reader feedback on Housing Notes.

February 12, 2025: Peanut Butter In Your Chocolate: Commercial Office Mortgage Distress For Office To Resi Conversions

- I LOVE your Housing Notes! I read it every day!

- Peanut butter in my chocolate is honestly my favorite thing ever. Maybe i should consider a career in office to resi conversions.

February 12, 2025: Return To Work Mandates Are Just A Flex

- I know you know this and I think you have written about it but I believe that the largest factor is the loss in commercial real estate values. When/if these office leases renew, the flood of office space will devalue commercial buildings. Jamie Dimon has loans on these properties on his books. He doesn’t want to own these buildings and all of the impacts that would have for the banking industry and his empire. It’s easy for him to tout the RTO for his own staff in order to join the herd in trying to save the commercial real estate office market from collapse. In addition, when these buildings reassess, tax revenue will plummet. Cities will not be able to provide the support services that businesses and property owners expect and a spiral of urban decline could ensue. I think this spiral is already occurring here on the west coast. The cities of L.A., San Francisco, Portland and Seattle are all in trouble. It may be too late for them to avoid a crash especially without the D.C. strategy of propping them up that has been pervasive since the pandemic. But, cities have crashed in the past and come back and so shall these.

- Speaking of McKinsey, this is a must watch: https://www.instagram.com/consultingcomedy/reel/Cy8B5alLorZ/?hl=en

February 7, 2025: Of Tariffs And Mortgage Rates

- True. True. Can’t wait to see the impacts of shutting down the CFPB! Thanks for writing on the other side of the white-washed wall of propaganda. It will impact housing…among other major aspects of our lives

Did you miss the previous Housing Notes?

February 14, 2025

Peanut Butter In Your Chocolate: Commercial Office Mortgage Distress For Office To Resi Conversions

Image: Gemini

Housing Notes Reads

- ⏰ Closing Time [Highest & Best]

- What bubble? Outrageous $100M+ homes are the new normal in South Florida, experts say [NY Post]

- Entry-Level Homes in Miami Are Going Extinct [Wall Street Journal]

![[Podcast] Episode 4: What It Means With Jonathan Miller](https://millersamuel.com/files/2025/04/WhatItMeans.jpeg)