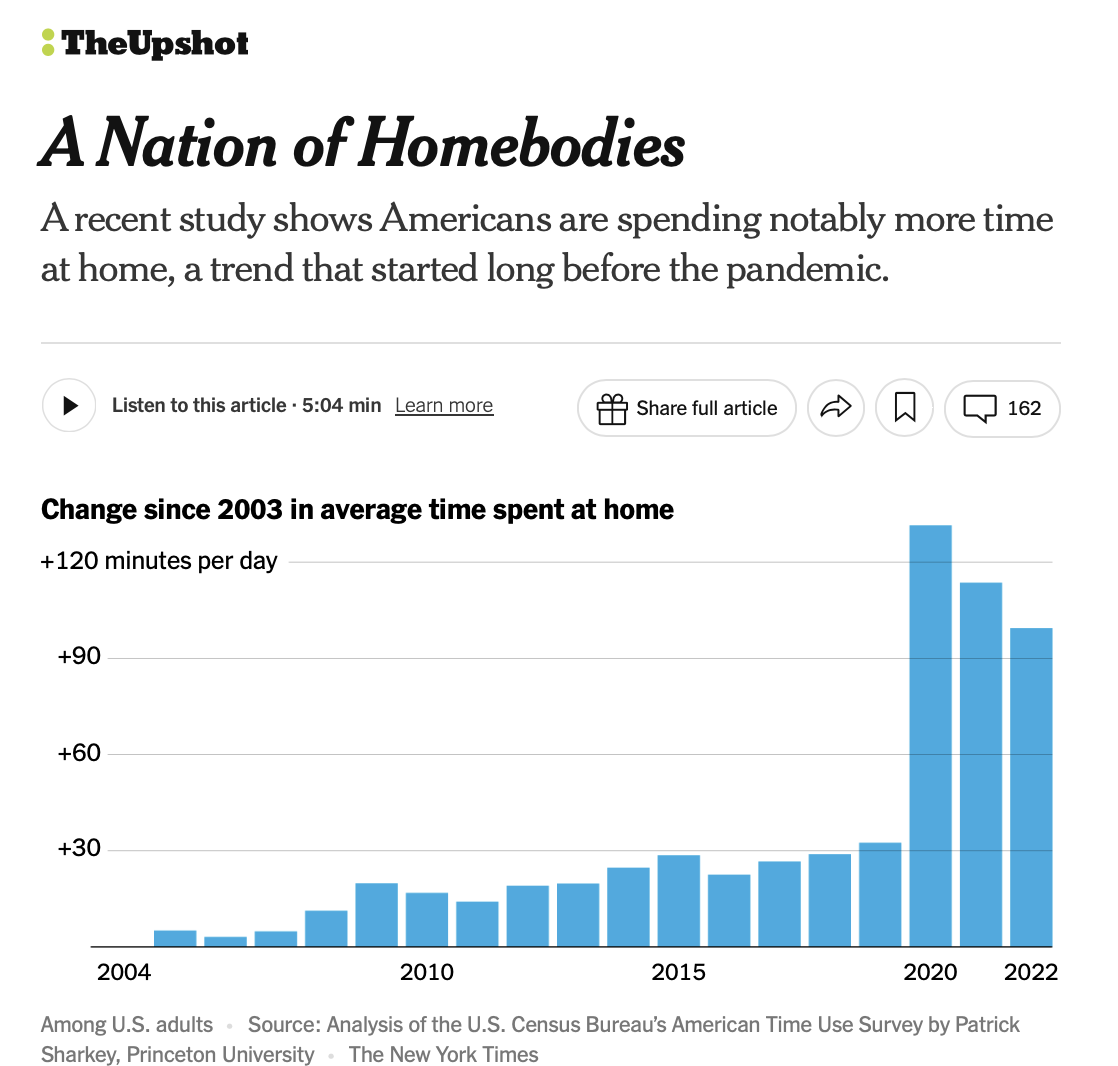

- The Need To Stay Home Accelerated During Pandemic But Is A Two-Decade Trend

- Work From Home Is Not Going Away Because Amazon Says So

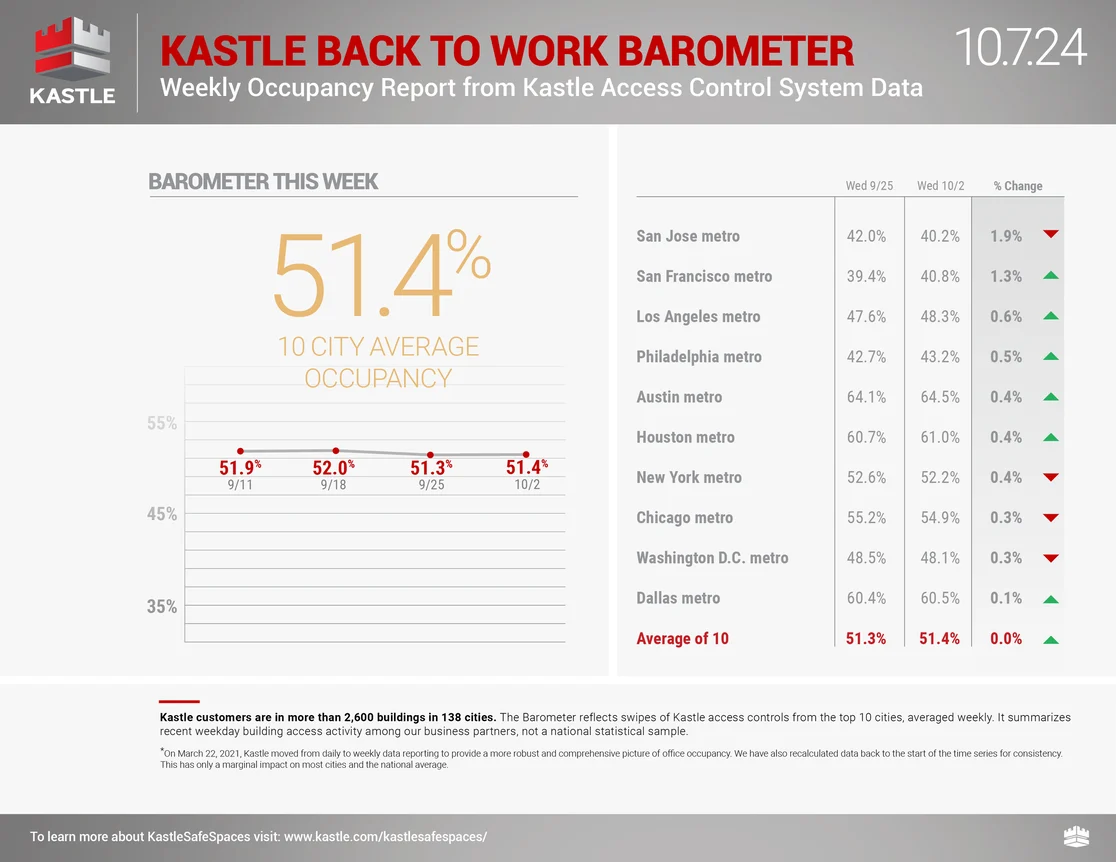

- U.S. Office Use Has Been Stuck At 50% For About Five Years

Before the pandemic, I craved going out all the time, seeing plays and concerts, meeting someone for dinner, seeing friends, and other activities. These events were basically an excuse to leave the house. During the pandemic, we were forced to reduce those activities, and a lot of them were no longer available temporarily. As the timeline extends from the pandemic era, I find myself placing more importance on staying home. While in danger of not sounding appreciative, we have traveled a ton in recent years, like the rest of the world, and we go out to dinner and see Broadway shows, podcasts, and concerts. Still, after the pandemic, the level of this activity for us is tapering off, feeling like we got the excess demand out of our system. However, I clearly am more discerning about the decision to leave my home to go to an event. Apparently, I’m not the only one.

Apparently, it is not accurate to think of the staying-at-home phenomenon as beginning with the pandemic. This social pattern has been established for two decades, according to the white paper Homebound: The Long-Term Rise in Time Spent at Home Among U.S. Adults, which was covered by the New York Times in a recent and excellent Upshot piece: A Nation of Homebodies.

Work From Home (WFH) Helped Accelerate Focus On The Home

According to the “Homebound” study,

“The rise in working at home during the pandemic has been a big chunk of that, taking up 29 percent of all work activity in 2022. But even before then, from 2003 to 2019, the share of work time at home had crept up to 17 percent from 13 percent. ”

We can see this clearly in office occupancy within the Kastle data, which tracks security card scans in office buildings. Their ten-market analysis seems stuck at around 50% occupancy. This is more realistic than straight occupancy metrics since those include the leased space, but the issue is the large amount of unused lease space as workers have shifted away from coming into the office every day. I noticed after Amazon announced their 5-day per week office occupancy requirement my peers in Manhattan are assuming office use is going to normalize. I contend that will not be the reality. Workers have had five years to get used to a hybrid or remote scenario, and I don’t think that is going to be undone. Sure, there will be companies and industries that will require it. Still, as senior executives age out and it becomes evident the policy restrains the available talent pool, I don’t believe full-time office occupancy will be a thing again in our lifetimes. Housingwire also has a great piece on this topic: The great stay: Why homeowners are staying put.

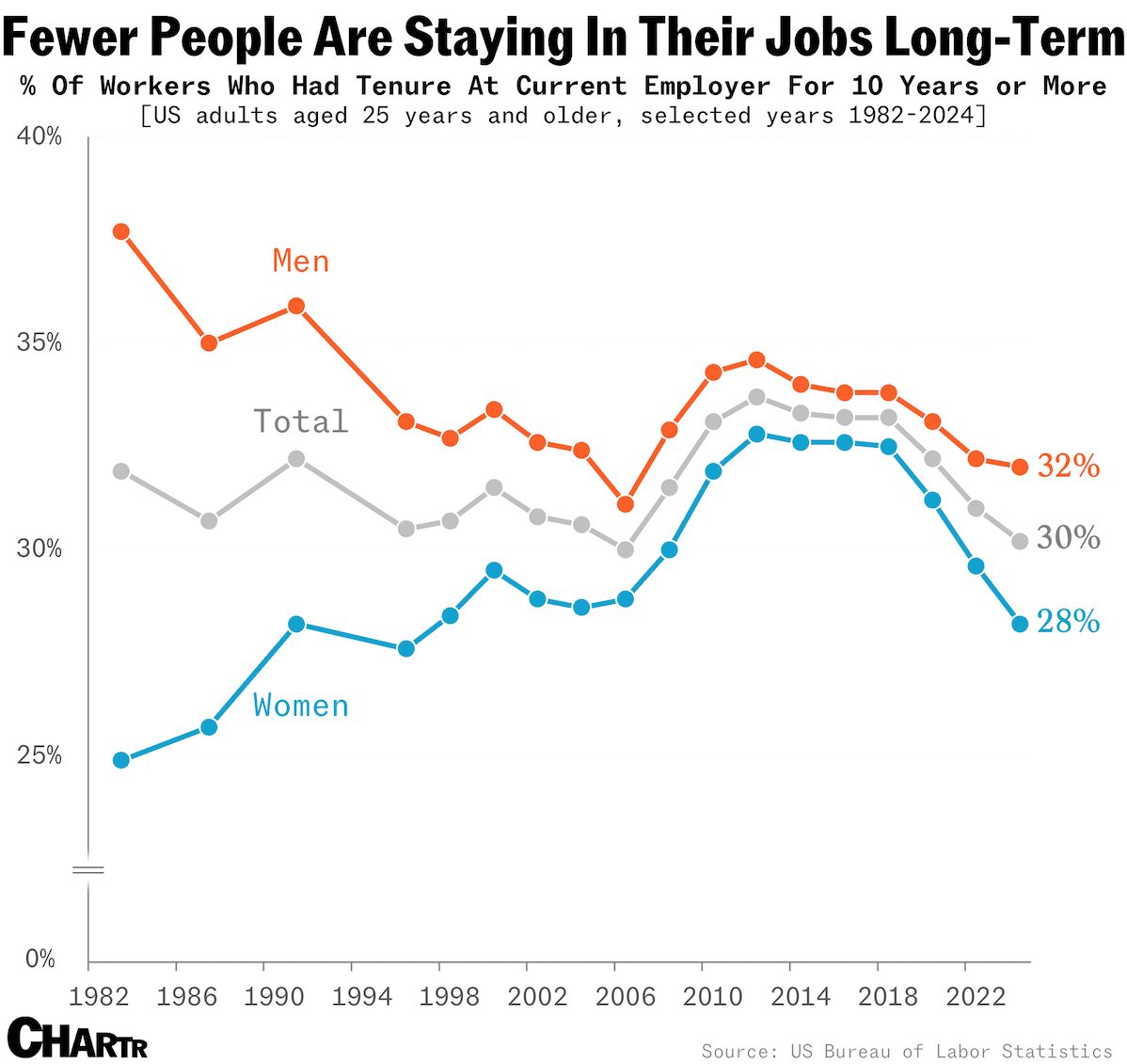

One of the reasons WFH is going to persevere is that companies have showed a lot less loyalty to their employees for the past 40 years (thank Jack Welch for that), so employees are not as loyal to their employers either. With remote or hybrid as an employee benefit and considered a key characteristic like compensation, forcing five-day work weeks is more likely to push workers to leave for greener pastures unless there is a lot more compensation offered or other perks that are too good to reject.

Final Thoughts

Our nation’s obsession with housing doesn’t seem in danger. We are spending more time in our homes and less time in our offices. We can also see how commercial landlords are now defaulting on their debt after levering up in the low-rate era.

I’ve shared this before, and its a little NSFW but it gets me everytime.

Did you miss Friday’s Housing Notes?

October 15, 2024

No One Is Talking About The Housing-Related Policies Of The Presidential Candidates

Image: ChatGPT

Housing Notes Reads

- NYC renters got some relief in September as median rents drop again [Brick Underground]

- What a Trump or Harris Presidency Could Mean for Luxury Real Estate [Mansion Global]

- UBS Investor Watch: U.S. investors and business owners divided on the presidential candidate best suited to manage the economy; majority of investors looking for portfolio adjustments before elections [UBS Global]

- 🌀Milton and Milestones [Highest & Best]

- All-Transactions House Price Index for Detroit-Dearborn-Livonia, MI (MSAD) [Federal Reserve Bank of St. Louis]