Time to read [6 minutes]

- Wall Street profits have surged for the second year in a row, fueling high-end housing demand in NYC, the Hamptons, the North Shore of Long Island, and affluent suburbs like Greenwich, CT

- The NYC real estate industry is anxious about the incoming mayor’s “freeze rents” platform, with some pushing misleading narratives of wealthy residents fleeing the city—a claim contradicted by actual data

- Evidence shows that luxury housing markets remain robust across the region, supported by record Wall Street compensation and financial market activity

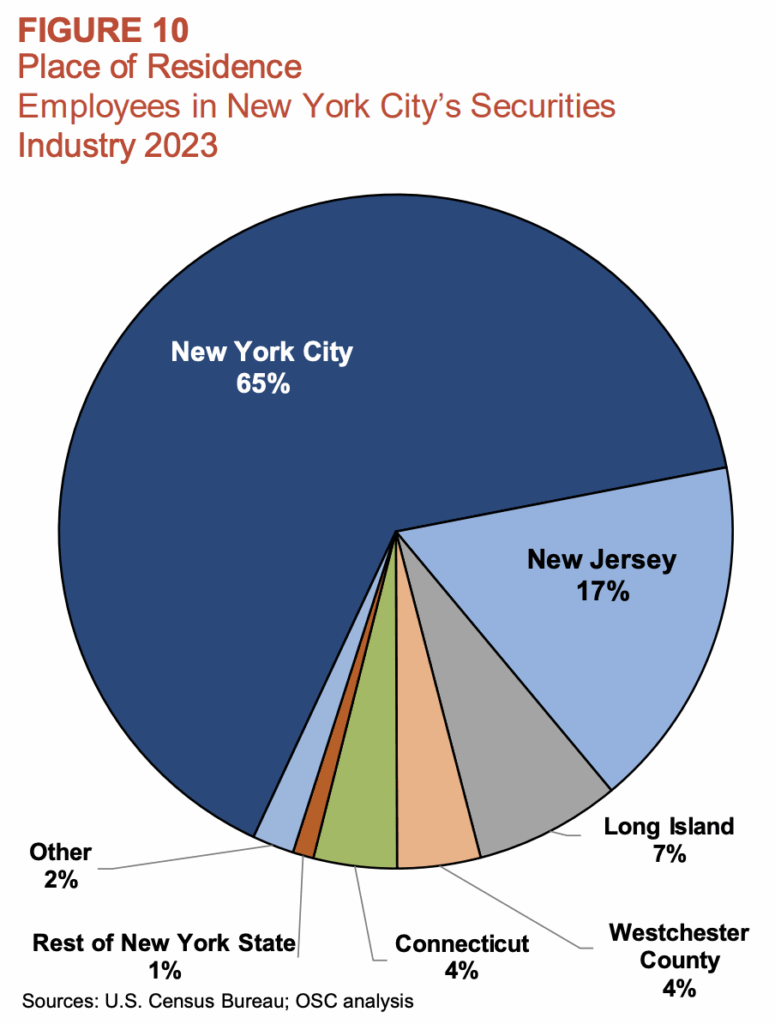

I usually report on Wall Street’s performance in March when the dust settles on the prior year, but these 2025 mid-year results were startling. It’s been a banner year for Wall Street after a banner year in 2024, a significant driver of NYC wages and high-end real estate demand. Affluent market segments in Manhattan, as well as the Hamptons and the North Shore of Long Island, are expected to sustain a high level of demand, as are high-end suburban markets like Greenwich, CT. In 2024, Wall Street profits surged 90% annually to $49.9 billion, and the first half of 2025 suggests a $60 billion record if the first-half pace continues through the end of the year.

New Mayor Stokes Irrational Logic Of Real Estate Industry

Despite the good news from the financial markets for the housing market, there is a mayoral election next week, and the real estate industry is falling somewhere between depressed and panicked about the likely winner, who has a “freeze rents” platform. I have been struck by the amount of misleading narratives pushed by the real estate community that New Yorkers are “fleeing the city” because of the policies of the incoming mayor. Let’s break it down:

The high end is overpowering the region because Wall Street had near-record profits and compensation last year, and even more is expected this year. The expanding wealth gap is a key driver. Mortgage rates have been stuck, while financial markets have been active—both good for Wall Street. It makes the high-end market stand out as a result. All good for high-end home buyers. Mamdani was unknown before he became the highly likely next mayor in early July. Yet Greenwich has seen more high-end activity for a year, before Mamdani was a household name in the region.

Evidence-Based Research Wins The Day About The New Mayor

Manhattan has seen rising housing prices and sales in the first three quarters of 2025. That doesn’t suggest the narrative of “fleeing the city” is accurate. For all the wealthy people that the real estate industry observes moving to Greenwich, they are selling their apartments to people moving into the city. We are seeing the same high-end strength in the Hamptons, which is joined at the hip with Manhattan/Wall Street, and the former is essentially a luxury second-home market—not a primary housing market like Greenwich. A little more inventory and more consumers able to pay cash skews the performance of the high-end housing market higher across the region.

Plus, if someone is afraid of the likely new mayor’s impact on the city (who hasn’t won yet), would they really “flee” to Greenwich now and then commute back to their jobs in the city every day? Weird, right? Especially since Wall Street is a leader in RTO policy. Greenwich housing prices have always been disproportionately supported by the securities industry in New York City. If the new mayor was so bad for the city, moving to Greenwich would only be a lateral move since it is tethered to New York City. Wall Streeters would likely flee somewhere else in the US, like Florida (or Guam), if the next mayor was a driver of migration claim was accurate. We’re seeing similar exaggerated claims from Florida agents, too.

Final Thoughts

Wall Street is experiencing another outstanding year following a record-setting 2024, with profits projected to reach $60 billion in 2025 if current trends hold—boosting NYC wages and driving strong demand in high-end real estate markets like Manhattan, the Hamptons, and Greenwich, CT. Despite this robust performance, the real estate industry is anxious about the likely new mayor, using misleading narratives about affluent New Yorkers fleeing the city. Evidence-based research shows that housing prices and sales continue to climb in Manhattan and other luxury markets, that current high-end market strength is fueled more by Wall Street’s prosperity than by local political shifts.

When it comes to market trends, the plural of anecdotal is not data.

The Actual Final Thought – Drawing the line on misinformation is best explained this way.

Home Value Lock, Powered By StreetMatrix

The StreetMatrix housing index platform that we have created powers the Home Value Lock product that Josh Altman talked about today. We are fortunate to have Josh join our team.

StreetMatrix Arrives In California

Here’s the latest newsletter with links to all our resources. More specifics on this effort to come!

[Podcast] What It Means With Jonathan Miller

The How Retail Follows, Not Fuels, Housing episode is just a click away. The podcast feeds can be found here:

Apple (Douglas Elliman feed) Soundcloud Youtube

Did you miss the previous Housing Notes?

October 27, 2025

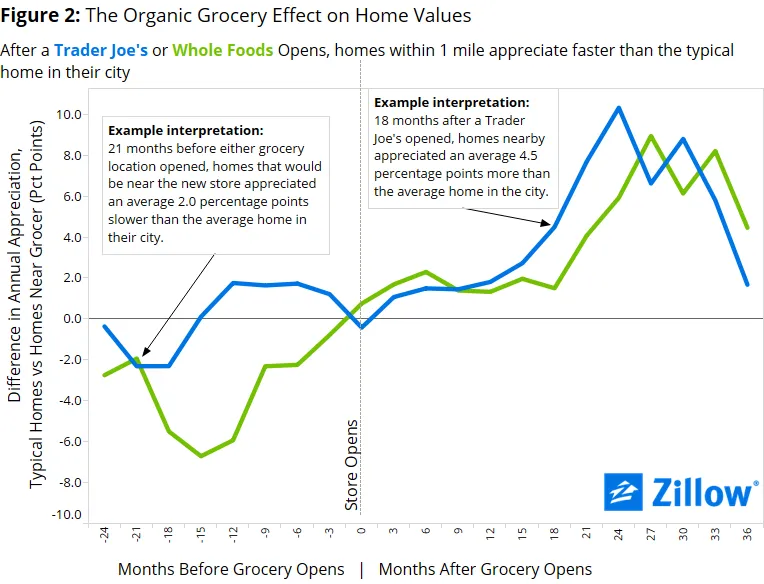

Starbucks Didn’t Cause Your Rent Hike: How Retail Follows, Not Fuels, Housing

Image: Zillow

Housing Notes Reads

- New Tech, Old Attitudes Bring Appraisers To Brink Of Existential Crisis [Bisnow]

- This Gross Practice Might Make Your Next Home Search Even More Annoying

- Wall Street's bumper year to boost tax collections, NY state comptroller says [Reuters]

- The Securities Industry Of NYC 2025 [OSC.NY]

- The Whole Foods Effect: Does the Green Grocery Increase Home Values? [6sqft]

- The Impact of Grocery Stores on the Housing Market [Realty Times]

- Controversial rezoning plan in LIC gets closer to being done deal [NY1]

- Change is Constant: 100 Years of New York Real Estate [Matrix]

- The ‘Whole Foods Effect’ on apartment rents and absorption [IREI]

- AN ASSESSMENT OF THE MARGINAL IMPACT OF URBAN AMENITIES ON RESIDENTIAL PRICING [Reconnecting America]

- Premium Grocer Effect Means Higher Rents, Study Finds [CandysDirt.com]

- Coffee Wars: Market Share Battles and Investment Opportunities from [Northmarq]

- Hundreds of Starbucks Stores Are Shutting Down—Here's How It Affects Home Values Across the U.S. [Realtor.com]

- Private Jets and Car Washes Are the Latest Tax Shields for the Ultrarich [Bloomberg]

- Lower Interest Rates Fail to Offset Effects of High Home Prices [Joint Center for Housing Studies]

- A Shortage Of Supply: The Housing Market Explained [J.P. Morgan]

- ‘Million Dollar Listing’ star makes bold move to safeguard first-time buyers from market drops [Fox Business]

- An open letter to overpriced sellers [Sacramento Appraisal Blog]

Market Reports

- Elliman Report: Orange County Sales 3Q 2025 [Miller Samuel]

- Elliman Report: Los Angeles Sales 3Q 2025 [Miller Samuel]

- Elliman Report: Hamptons Sales 3Q 2025 [Miller Samuel]

- Elliman Report: North Fork Sales 3Q 2025 [Miller Samuel]

- Elliman Report: Long Island Sales 3Q 2025 [Miller Samuel]

- Elliman Report: St. Petersburg Sales 3Q 2025 [Miller Samuel]

- Elliman Report: Miami Beach Sales 3Q 2025 [Miller Samuel]

- Elliman Report: West Palm Beach Sales 3Q 2025 [Miller Samuel]

- Elliman Report: Weston Sales 3Q 2025 [Miller Samuel]

- Elliman Report: Wellington Sales 3Q 2025 [Miller Samuel]

- Elliman Report: Vero Beach Sales 3Q 2025 [Miller Samuel]

- Elliman Report: Sarasota County Sales 3Q 2025 [Miller Samuel]

- Elliman Report: Palm Beach Sales 3Q 2025 [Miller Samuel]

- Elliman Report: Naples Sales 3Q 2025 [Miller Samuel]

- Elliman Report: Lee County Sales 3Q 2025 [Miller Samuel]

- Elliman Report: Fort Lauderdale Sales 3Q 2025 [Miller Samuel]

- Elliman Report: Delray Beach Sales 3Q 2025 [Miller Samuel]

- Elliman Report: Coral Gables Sales 3Q 2025 [Miller Samuel]

- Elliman Report: Boca Raton Sales 3Q 2025 [Miller Samuel]

- Elliman Report: Manhattan, Brooklyn & Queens Rentals 9-2025 [Miller Samuel]