Understanding Rising NYC Rental Prices Isn’t Exactly Brain Surgery

While US Rental Market Prices Remain High But Stable, NYC Rental Prices Reached New Highs

Tariff Policy Sharply Reduced The Likelihood Of Lower Mortgage Rates

FARE Act Passes, Shifting Agent Commissions From Tenant To Landlord

While I closely track the NYC rental market, it’s getting harder to find words to rhyme with “rental” after overusing “mental” and “dental” in previous posts. While finding words to rhyme isn’t exactly brain surgery, I couldn’t find a good word to rhyme, so I gave up. With the massive NYC rental price surge from 2021 through 2023 coming out of the pandemic era, both high and low-end price growth cooled by 2024. By “cooled,” I really mean that the rate of rental price gains eased. However, US consumers expected mortgage rates to slide in 2025, that would boost sales but poach demand from the rental market. But Liberation Day came, and everything about the Tariff Tantrums reduced the chances of lower mortgage rates. It’s been fascinating to watch a few economists struggling to use Pretzel Logic to make the tariff storyline sound good for the economy. Businesses say they are raising prices on goods without tariffs, just because. Mortgage rates remain tucked just under 7% and don’t seem to be going anywhere. As an aside, mortgage rate stability is probably the second-best thing for the housing market if mortgage rates remain where they are.

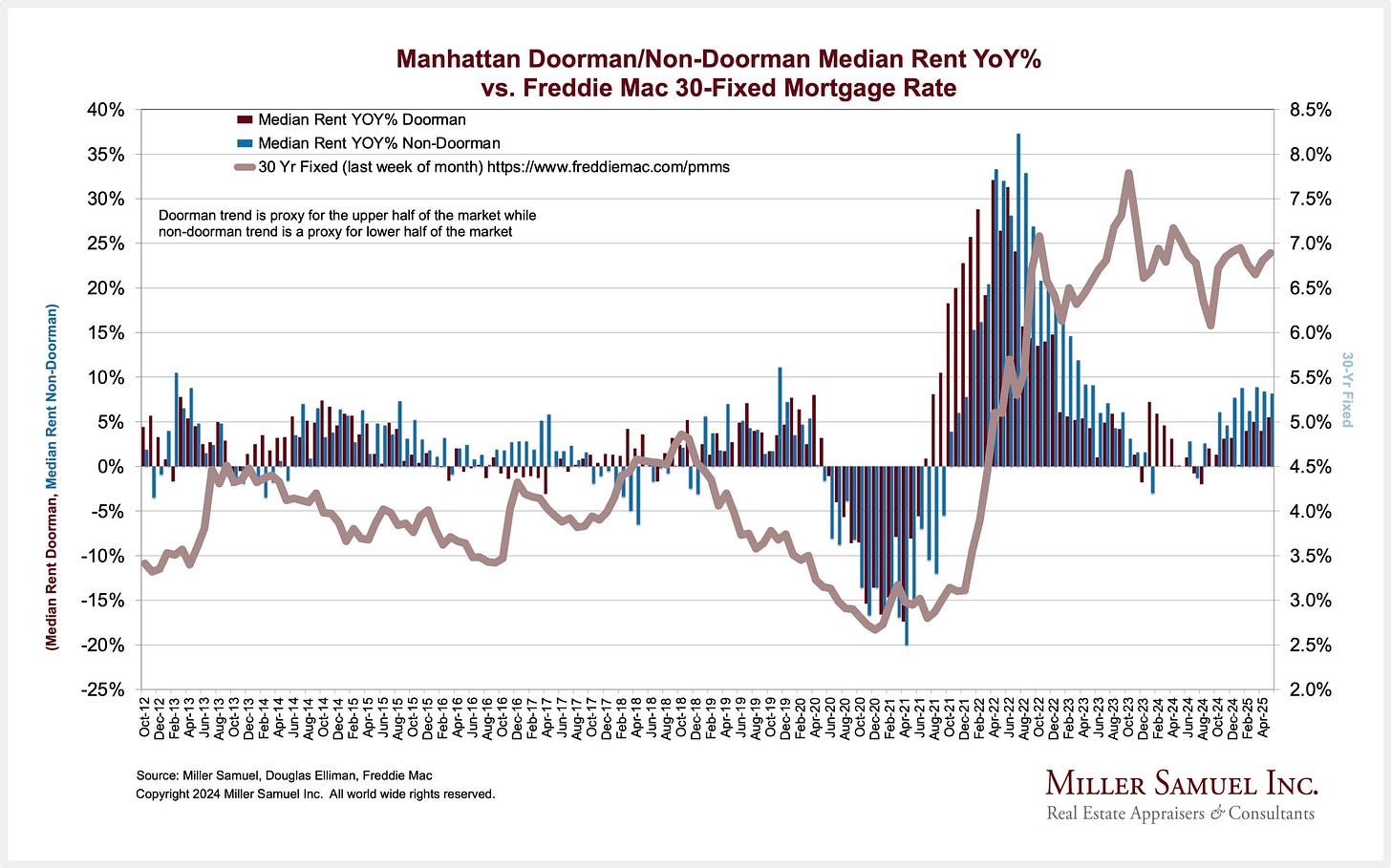

For the past year, mortgage rates have remained just below 7%, while expectations for falling rates remained a fixture of the housing discussion by residential housing participants in early 2025. The below-normal sales levels are partially a product of homebuyers waiting for mortgage rates to fall, but it’s probably going to be a long wait.

US Rents Are High And Moving Sideways

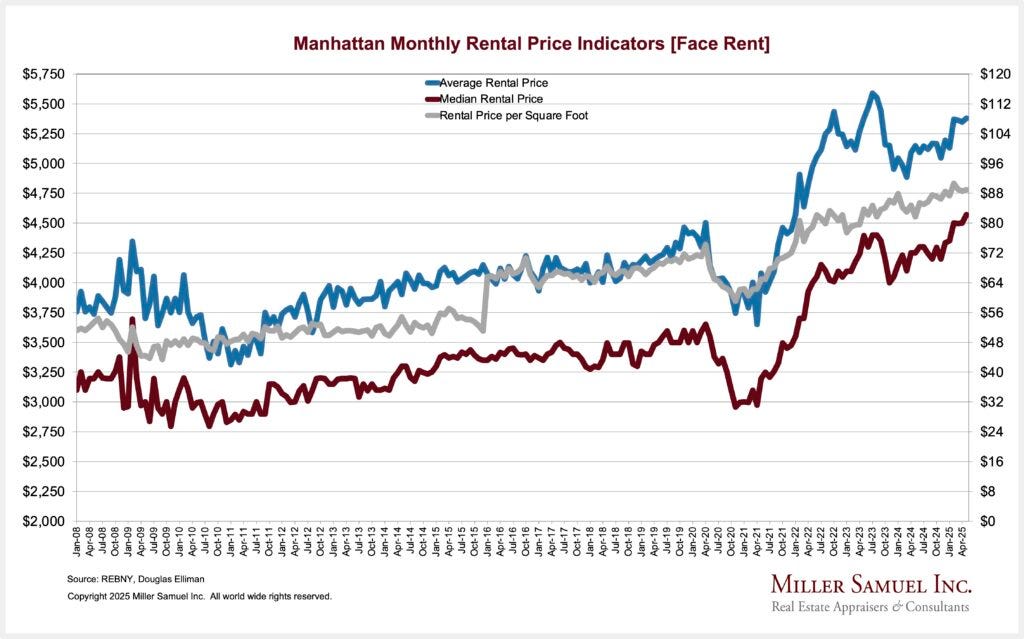

Rental prices have stabilized nationally after surging in 2021, coming out of the pandemic. Mortgage rates began to press higher after the early 2022 Fed policy pivot to higher interest rates to combat inflation. NYC rental trends appear much more volatile than national trends.

High Mortgage Rates Equals High Rents

Manhattan rental prices continue to trend higher as sales volume is held back by higher mortgage rates, even within a market that is 60% cash. Manhattan’s median rent reached a record high for the third month in four. I want to suggest that housing participants obsess too much over the level of mortgage rates, with a prognosis of potentially lower rates in a few years after the damage caused by tariffs takes hold.

REBNY Market Pulse

The Real Estate Board of New York invites me to speak every quarter on the state of the NYC housing market at an event called Residential Market Pulse. I also get to hear insights from other brilliant people and take on great questions from an audience of mainly real estate agents and brokers.

The big topic of discussion was the passing of the FARE Act, which just passed. I wrote about it solely from a simple economic point of view, namely, who pays for the agents. REBNY has been vigorously fighting this in court. One of the most significant issues that it resolves is how inbound renters won’t have to pay massive charges because the broker fee will likely be wrapped into a higher monthly rent and therefore spread out over time. The media coverage seemed to suggest that tenants would save thousands of dollars of agent commissions, which is quite misleading. Still, the law does tidy up who-pays-for-what-service in a rental transaction. REBNY will continue to fight the decision.

Final Thoughts

While national rents seem to be moving sideways, NYC rents have been rising since early this year, especially in Manhattan, Tariff policy, the trade war and tax bill are all inflationary. I suggest real estate participants get used to this idea barring a significant change in current direction. Half of the consumer battle is not changing policies nearly every day which is keeping the US economy operating at peak uncertainty, which slows the pace of sales and the amount of sales. My goodness.

The Actual Final Thought – Apparently, understanding the rental market isn’t exactly “brain surgery” or even “rocket science.”

Here’s My Podcast: What It Means

The latest episode [Finding Certainty] is a click away as well as the podcast feeds for all the “What It Means with Jonathan Miller (WIM).”

Apple (within the Douglas Elliman feed) Soundcloud Youtube

Monday Mailboxes, Etc. – Sharing reader feedback on Housing Notes.

June 10, 2025: FARE ACT: A Tenant Is More Likely To Be Bitten By A New Yorker Than A Shark

Super interesting piece. It should reduce moving frictions which may change a bit the way landlords try to retain existing tenants — if all of the broker fee is averaged into the rent, it would be a step up in rent but without the 15% up front. I imagine we’ll see larger discounts on 2-year leases, as well as steeper lease-break penalties built into new leases.

I agree with your assessment that net costs will be the same for the tenant, based on landlords passing along the costs over the term of the lease. But I don’t think it’s so simple. On the one hand, it still helps tenants overcome the barriers by spreading that cost over a year, rather than an additional chunk of cash they need to come up with at the same time as first month’s rent security deposit, and application fees (and potentially their own broker’s fee). While I don’t think that’s the law’s intent, and certainly not the way the media is describing it, that would in fact be a worthwhile benefit. On the other hand, brokers fees are paid for the first year’s rent, no matter how many years the tenancy ends up lasting. If the fee is now hidden as increased rent, wouldn’t that be a net positive to the landlord and negative to tenants for any period beyond the first year?

Didn’t realize you are sort of a DC local. Still visit Rehoboth? Nice headline btw

Did you miss the previous Housing Notes?

June 10, 2025

That Sinking (And Leaning) Feeling In San Francisco Is Fading

Image: Nathan Pyle