Time to read [5 minutes]

Takeways

- Ugly Sign Marketing Works Despite Unprofessionalism

- iBuyers As A More Polished Platform To Get Cash For A House

- Risks and Tradeoffs Are Numerous In The Ugly Sign World

Every so often, I see amateurish signs with catch phrases like “We Buy Houses” or “We Pay CASH For Houses” planted at intersections around my region. The one below that I snapped has a typo, which tests credibility. What makes this rough marketing work, and is the typo on the sign intentional? There is currently so much emphasis on branding and professionalism in the traditional full-service real estate brokerage industry that it makes me wonder if this is a reaction. Especially after my recent post on Devo, who believe the world is “de-evolving” (getting dumber despite more information).

Here’s an excellent Businessweek cover from a while ago that included a mock “CA$H for Houses” ad. This type of sign usually appears more frequently when housing market uncertainty rises.

The Wonder Of It All

To repeat myself, I really wonder how this type of marketing lures people to buy or sell a home through this unprofessional signage. Aren’t they a warning sign? (pun intended). Brands like “Homevestors” and “We Buy Ugly Houses” have purchased more than 100,000 houses since 1996, and they’re one of many franchises that rely on “ugly signage.”

Opendoor Has The Same Idea

Opendoor is an iBuyer platform where property owners can sell their homes without the hassle of traditional marketing. iBuying was wildly overhyped coming out of the pandemic and but cooled off a bit. However, there will always be a niche for cashing out of a home quickly. Opendoor recently dug itself out of a hole from a few years ago when the market pivoted from high mortgage rates, prices leveled off, and sales slowed down. Zillow Offers was crushed by relying on its incredibly inaccurate Zestimate tool. Redfin exited the business after reluctantly joining it and Opendoor, recalibrated to stop hemorrhaging but still can’t reliably post a profit.

During the hype cycle, the real estate brokerage industry expected iBuyers to become 50% of all home sales quickly, yet now they are closer to 1% of home sales. The cruder “We Buy Houses” approach is in the same space. Buy homes for cash so homeowners avoid the hassle of the sales process and can move on with their lives.

The various iBuyer platforms are much more vulnerable when the market pivots to weakness, as it did in 2022 after peaking in 2021, when mortgage rates began to rise sharply. The consumer is probably just as vulnerable when the housing market pivots to strength.

Some Of The Risks

While Opendoor appears to be in the same “buy for cash” space, its approach is more data-driven, and as a publicly traded company, it is subject to heightened scrutiny. The “We Buy House” platform is a franchise play, and the market is fraught with fraud. Here are some of the problems often reported:

- Lowball offers

- Reduce the offer at the last minute

- Manipulate the contract

- Upfront fees and deposit scams

- Equity skimming

- Little oversight and no regulatory protection

Final Thoughts

When a buyer wants to cash out of their home and not go through the selling process, they are at the mercy of the buyer platform that wants to write them a check. The avoidance of the selling process is often a tradeoff for a lower price and greater convenience. Because the home value is not vetted in the market, a buyer can get shortchanged when the market is rising or not understand what their home is worth in the current market. The iBuyer platform, a gussied-up version of “We Buy Houses,” tried to professionalize this space. However, when the market pivoted back in 2022, with mortgage rates beginning to spike, all iBuyers were crushed and many ceased operations.

But cash still remains king.

The Actual Final Thought – When trying to raise some quick cash from the sale of their home, the homeowner has their senses working overtime to filter out the fraud.

Upcoming Presentations

• September 16, 11 am ET / In-Person =================================

• September 18, 3 pm ET / Zoom ====================================

• September 29 / In-Person ========================================

HGAR’s IMPACT: The Member Experience

I’m excited to speak at IMPACT: The HGAR Member Experience on September 29. I’ll be joining real estate professionals from across the region to explore what’s next in the housing market, economic opportunities and building community. Join me and be part of the conversation that’s shaping what’s next. Learn more and register.

[Podcast] What It Means With Jonathan Miller

The Lowest or Highest on Record episode is just a click away. The podcast feeds can be found here:re:

Apple (Douglas Elliman feed) Soundcloud Youtube

Did you miss the previous Housing Notes?

Housing Notes Reads

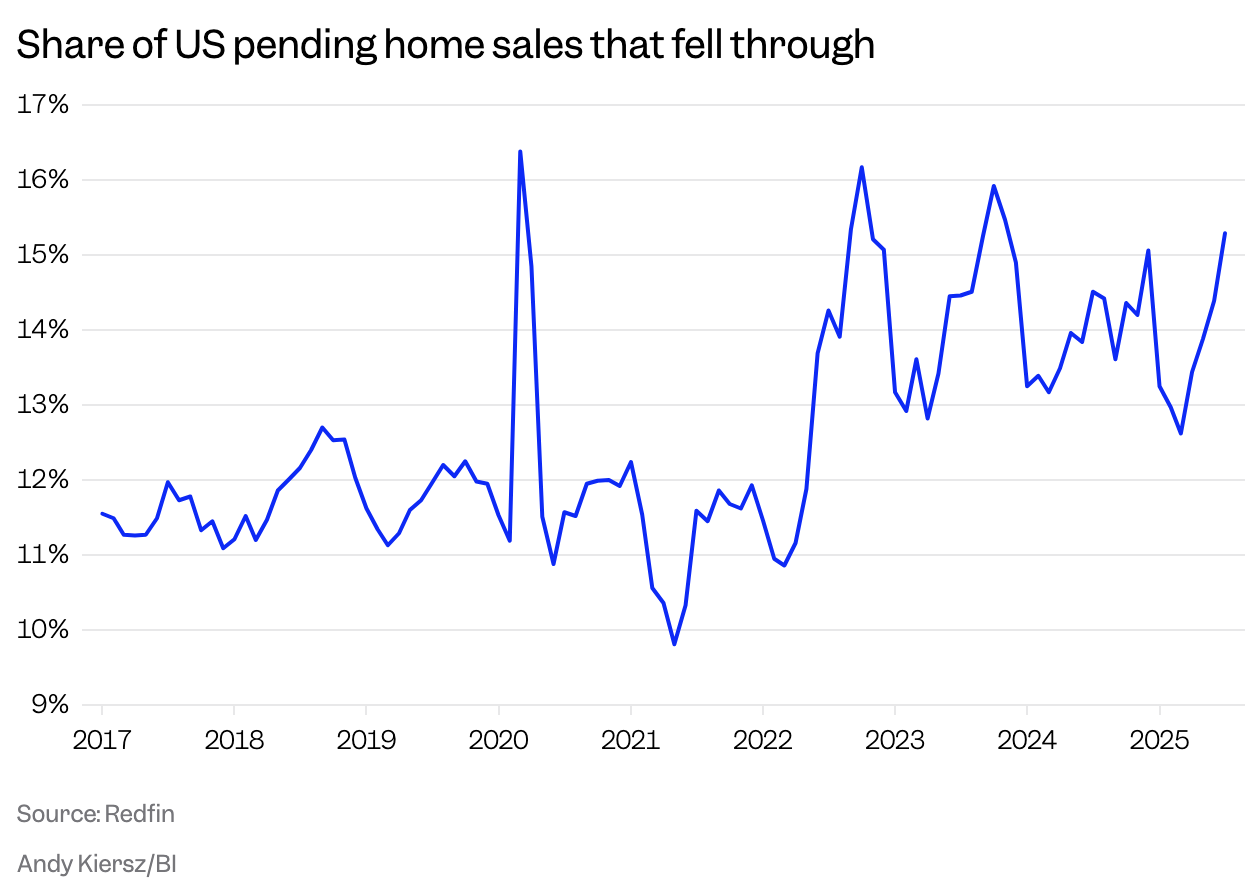

- Seller beware [Business Insider]

- Home Purchases Are Getting Canceled at a Record Rate [Redfin]

- Mortgage Activity Picks Up Despite Affordability Concerns [Attom]

- Hamptons housing crunch forcing even wealthy buyers to settle for less-glamorous LI spot — where sales are surging [MSN News]

Market Reports

- Elliman Report: Florida New Signed Contracts 8-2025 [Miller Samuel]

- Elliman Report: New York New Signed Contracts 8-2025 [Miller Samuel]

- Elliman Report: New York New Signed Contracts 7-2025 [Miller Samuel]