This Is No Irish Carpenter Syndrome: The US Dollar Is Too Darn Strong

The US Dollar Is So Strong That Europeans Don’t See Discount In Our Real Estate

In 2006, The Weak Dollar Brought In Many Irish Condo Investors

Manhattan Always Tends To See A Base Level Of International Demand

Back in 2006, Manhattan saw a flurry of international demand from Europe, especially Ireland. The US dollar was so weak that buyers from Europe were able to purchase US real estate at +50% discounts. There is a condo built next to Rockefeller Center that overlooks the famous Christmas tree and skating rink known as the Centria, where 100% of the buyers were from Ireland. I’m told that 75% of the original sales were made by working and middle-class buyers from Ireland who never saw them in person. I nicknamed this buying frenzy at the time the “Irish Carpenter Syndrome.” The opposite is happening for Americans who are buying real estate in Europe right now. Incidentally, there is nothing more amazing than going for a skate late at night in Rockefeller Center (it opens this Saturday). European marketing companies would sell these condos in bulk in Europe for a New York developer. The Midtown central business district was a preferred location for its proximity to restaurants and cultural attractions. The Irish and Germans were common users of this type of marketing during this economic period.

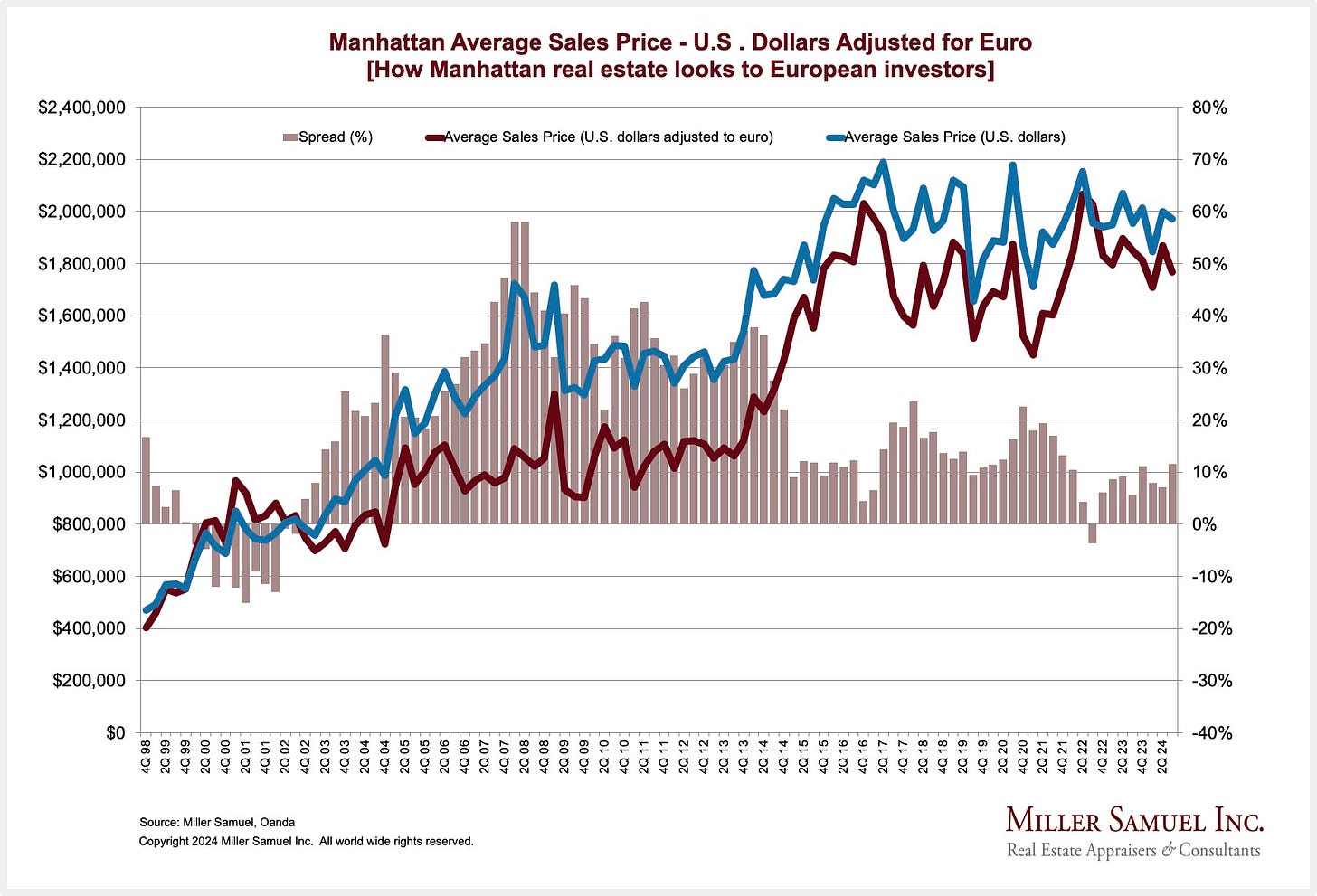

The following chart illustrates the significant discounts (look at the columns from 2006 to 2011). In many ways, the weak US dollar extended the New York housing market boom to 2014 because of the significant international demand.

The Euro was launched in 1999, and subsequently, there were two distinct periods of solid Manhattan new development condo sales as a result of the weak US dollar: The mid-aughts to mid-teens and the late teens to 2021. When we launched our appraisal firm in 1986, before the Euro, we would see condo buyers appear from various European countries when there was a potential currency play (weak USD against their currency. In real estate circles, there would be conversations about the latest “hot” country. I remember sales bursts from the UK, Germany, and Italy, specifically pre-Euro. Since then I estimate a base level of transactions hovers at around 15% of Manhattan sales and surges during periods when the US dollar is weak.

Discussions On How To Weaken The USD

A strong US dollar means that there is strong global demand for what the US has to sell, and US consumers benefit from cheap import prices. I’m way out over my skis here, but that seems to be the goal of managing US currency. That’s probably why we have trade deficits. Also, many international providers of cheap goods to U.S. consumers peg their currency to the US dollar. In order to weaken the US dollar, we have to save a lot more to bring investments into the US instead of foreigners buying our goods and services.

Final Thoughts

I bring up the currency as it relates to residential sales only because I am asked all the time whether we are seeing a pickup in international demand for Manhattan real estate. While we always see some base level of demand, we are not seeing the surplus demand we saw coming after the great financial crisis (GFC) began. Those periods of currency imbalance tend to ramp up residential new development as international buyers seek out a currency play (big discount).

AN ASIDE

“Is this the right room for an argument?” Yes, it is.

Monday Mailboxes, Etc. – Sharing reader feedback on Housing Notes.

October 4, 2024, Inland Hurricane Insurance Coverage Was Ignored Or Maladjusted

I shared a picnic table in Scottsdale waiting for 4th of July fireworks to start shortly after Hurricane Sandy. A couple from Staten Island asked to share our table. They had just moved to Arizona and had a doozy of a story. They sold their house on Staten Island and had a several month leaseback. Hurricane Sandy decimated the house and a lawsuit ensued. Who was responsible? My husband is an attorney and assured them it wouldn’t have been tenant damage, obviously. But whose fault? They said that local authorities had successfully lobbied to keep the neighborhood out of the flood zone maps. This local lobbying happens elsewhere. We moved from Edina MN where the wealthy suburban first ring suburb had spent $80k to lobby to keep a neighborhood out of the flood zone map (2010 era). I also lived in Orlando and owned a house in Sarasota for a while and know this “gerrymandering” goes on in many places. Look at any flood map and see the revisions and requests to keep properties out of the bad spots. It all comes home to roost. I bought inexpensive flood insurance for my Orlando lake front property in the early 90s and had to bend my agent’s arm to get me the policy since “it was unnecessary” and years later scrounged for a realistic insurance bid for a house 5 door from Sarasota Bay in the dreaded AE classification. Also of note are insurance agents who unwittingly or knowingly write policies that fail the coinsurance clause. I know someone who is proud of an inexpensive policy which wouldn’t come close to covering a total rebuild. The insurance companies want an inflated total rebuild cost which pads their profits in good years. I’m not surprised that Carolinans living in mountain communities lack flood insurance. There is little awareness of flood zones outside coastal properties. Even Phoenix, where I currently own, has vast areas of flood zoned properties. Minor rainfalls here cause as much damage as 6 inches in Florida due to clay soils. Fortunately the MLS has a check off for flood zones so buyer beware.

Did you miss Friday’s Housing Notes?

October 4, 2024

Inland Hurricane Insurance Coverage Was Ignored Or Maladjusted

Image: ChatGPT