Time to read [5 minutes]

Takeways

- Falling enrollment and rising costs are closing small private colleges, leaving excess housing and weak degree ROI.

- Universities overbuilt upscale dorms with loan-driven spending, now facing underuse.

- Underused campus housing is being converted into workforce, affordable, and multifamily units in major cities.

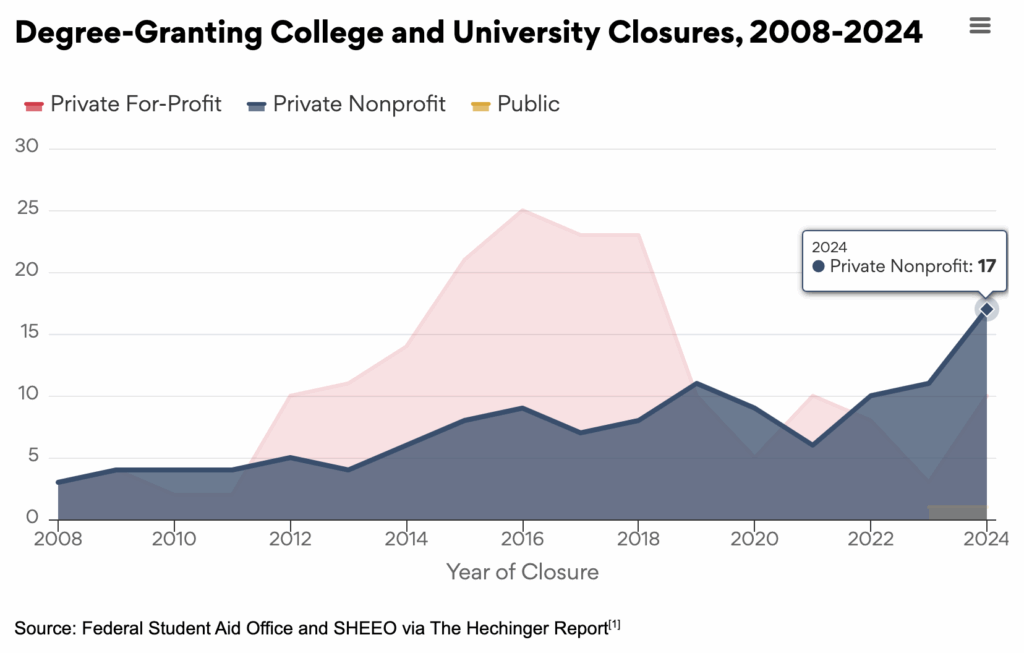

Today’s piece is pushing the envelope for Housing Notes, but please stick with me. Two years ago, a large university reached out to explore alternatives for its anticipated increase in unused campus housing. The housing market was cooling but still retained some momentum coming out of the pandemic, so the conversation was a little unexpected. Usually, during an economic slowdown, we tend to see college enrollment rise as workers retool for the next economy, but not this time. The declining birth rate and the surging cost of a college degree have led to enrollment declines at not-for-profit universities. The number of not-for-profit private campus closures has been rising since before the pandemic. Private for-profit colleges saw a surge in closures before the pandemic (think lots of tv ads for those institutions), but were given a temporary respite with the normalization of remote work following the pandemic. As an aside, the private for-profits account for almost half of the bad student loans despite their tiny segment of the market. There is an expected sharp decline in college attendance beginning in 2025, especially among small private not-for-profits in the Northeast and Midwest.

College Housing Development Cycle Has Been Excessive

Due to students’ easy access to readily available loans, universities have spent a significant amount of money, time, and effort on creating amenities to attract college students. Think rock climbing walls. My proof of this was the average time it takes a college student to graduate. One of my sons attended a four-year university, and at the campus orientation, the administration boasted that the average completion time was just under six years. Then watch this Wall Street Journal video on Resort Living Comes To College Campuses. The presentation at his orientation blatantly suggested students should have double majors and a few minors (think macro economics and basket weaving). Of course, this meant the students would take many more classes. Nationally, the average college student takes more than six years to graduate. It was shocking to learn this. Of course, my son worked hard and finished in four years. But good grief! We paid off our college debt a few years ago, but many people aren’t so fortunate.

We are left with an average return on investment that takes more than a decade (on average) to justify. About 39% of US residents aged 18-24 go to college. With inflation pressures making it more challenging, college enrollment is about to fall off a cliff.

Its Not Just Office Conversions: College Campuses Provide Housing Opportunity

With the proliferation of work from home (WFH) and a US shortage of 5 million housing units, a lot of office space is being converted into residential rentals. But what about overbuilt housing on college campuses? We are seeing efforts that include:

- Workforce housing

- Affordable housing is another solution

- Multi-family developers acquiring off-campus student housing

- Co-Living housing

Final Thoughts

With college admissions expected to drop sharply this year, and residential housing supply challenged, a solution at the intersection of these two trends is a valid solution. New York City, Washington, DC, and Los Angeles are the leaders in conversions (both office and campus), which is a promising trend. The housing supply conversation has been centered on office conversions, but there are other opportunities, such as college campus conversions, as well. As a friend of mine from Kentucky once told me when I was about to teach a class, “learn ’em good.”

The Actual Final Thought – To infinity and beyond (infinity).

Upcoming Presentations

• September 16, 11 am ET / In-Person =================================

• September 18, 3 pm ET / Zoom ====================================

• September 29 / In-Person ========================================

HGAR’s IMPACT: The Member Experience

I’m excited to speak at IMPACT: The HGAR Member Experience on September 29. I’ll be joining real estate professionals from across the region to explore what’s next in the housing market, economic opportunities and building community. Join me and be part of the conversation that’s shaping what’s next. Learn more and register.

Monday Mailboxes, Etc. – Sharing reader feedback on Housing Notes.

September 8, 2025: Two Years Later, Airbnb Law In NYC Solves Privacy, But Not Affordability

- Stinks for families with kids who want more than a hotel room but don’t want to pay for two! I haven’t stayed at a hotel with my kids since they were 12 and 8 (boy/girl so sharing is more complicated). It’s almost always cheaper to get a house/apartment than a hotel.

- I wonder if the towns in the Hamptons will ever start issuing fines for stays less than 14 days, that would be no bueno.

- The pizza thing is big on Reddit first time homebuyers

- What does your crystal ball say about housing prices over the next year or so in Westchester and Connecticut?

[Podcast] What It Means With Jonathan Miller

The Ugly Signs Can Be A Good Thing episode is just a click away. The podcast feeds can be found here:

Apple (Douglas Elliman feed) Soundcloud Youtube

Did you miss the previous Housing Notes?

Housing Notes Reads

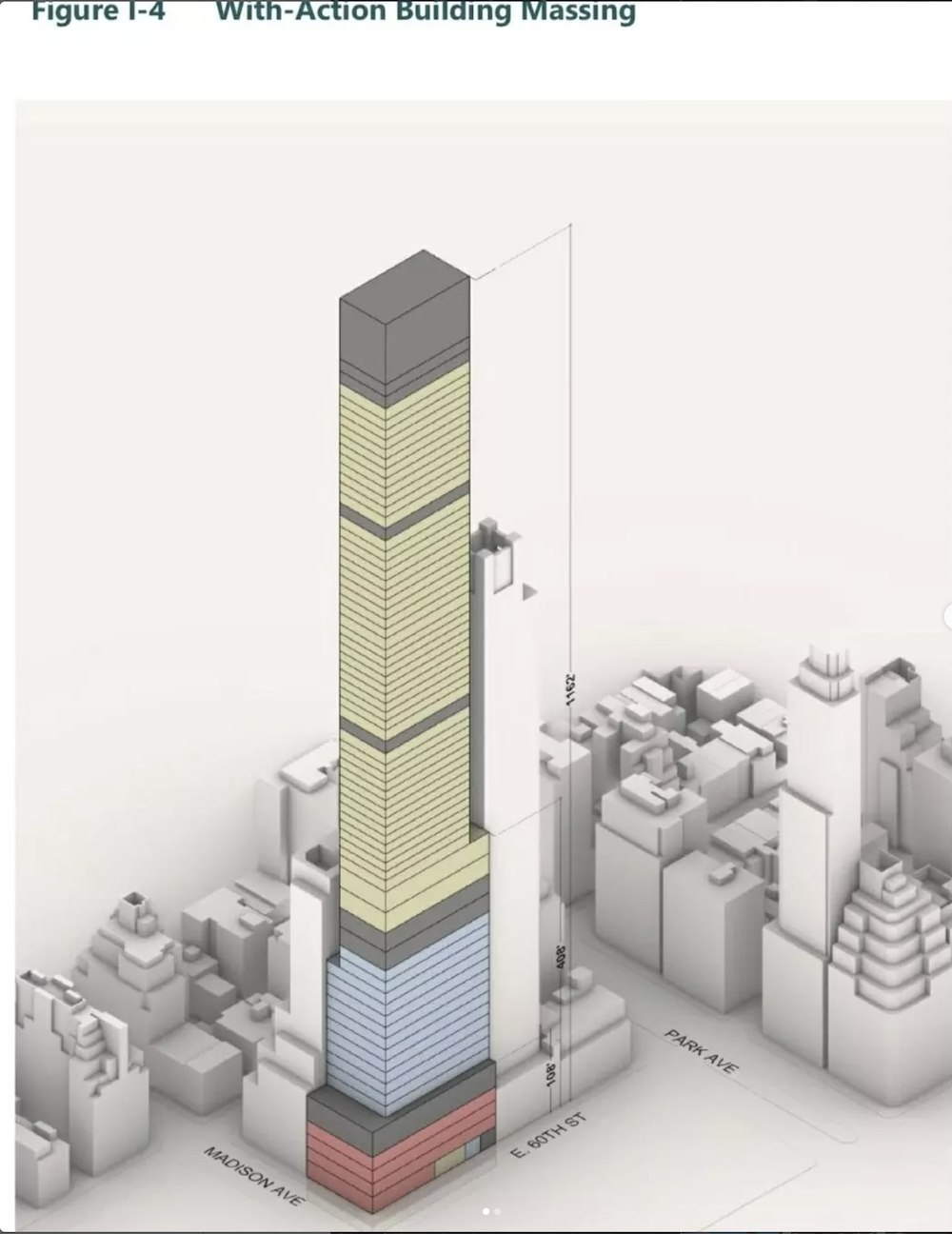

- A Park Avenue Scuffle Over an $80 Million View [Curbed]

- Zeckendorfs out billionaire as unhappy buyer of $80M penthouse [The Real Deal]

- Sellers are struggling to listen to the market [Sacramento Appraisal Blog]

- What Is By-Right Development? [Planopedia]

- US Housing Outlook [Apollo Academy]

- Trump’s Commerce Secretary Loves Tariffs. His Former Investment Bank Is Taking Bets Against Them [Wired]

- How CEOs are responding to geopolitical uncertainty [McKinsey]

![[Podcast] Episode 4: What It Means With Jonathan Miller](https://millersamuel.com/files/2025/04/WhatItMeans.jpeg)