The Stanhope: Ground Leases Are Often Misunderstood

During The Housing Boom, Manhattan Developers Discovered Potential Of Leased Land As Development Sites

Ground Lease Payments Can Push HOA Fees Significantly Higher

Battery Park City Multi-Families Are All Subject To Ground Leases

Before the great financial crisis, I remember a major Manhattan developer, Extell (named initially “Intel” until the tech giant pushed back, so they renamed it), ran out of available development sites, so they got interested in sites with “hair on them.” Developers have to keep building until they can’t build anymore as they amass talent, offices, contacts, funding sources, and momentum. In other words, these development sites encumbered by ground leases were the bottom of the barrel. Still, if a developer wanted to keep laying tracks in front of their locomotive, they had to keep developing. There are estimated to be about 100 such buildings encumbered by a ground lease in Manhattan. The Stanhope at 995 Fifth Avenue was one of those properties. A former hotel, the conversion is located in a premium location on the Upper East Side of Manhattan. Multi-family developments built on leased land took the form of cond-ops since condos require fee simple ownership, and that can’t be accomplished on leased land. The annual ground lease under the property becomes part of the monthly maintenance paid by each unit owner and tends to be significant. Unfortunately, developers often make the mistake of thinking that wealthy homebuyers don’t care about high monthly maintenance fees (HOA).

Here’s A Ground Lease Scenario At The Stanhope

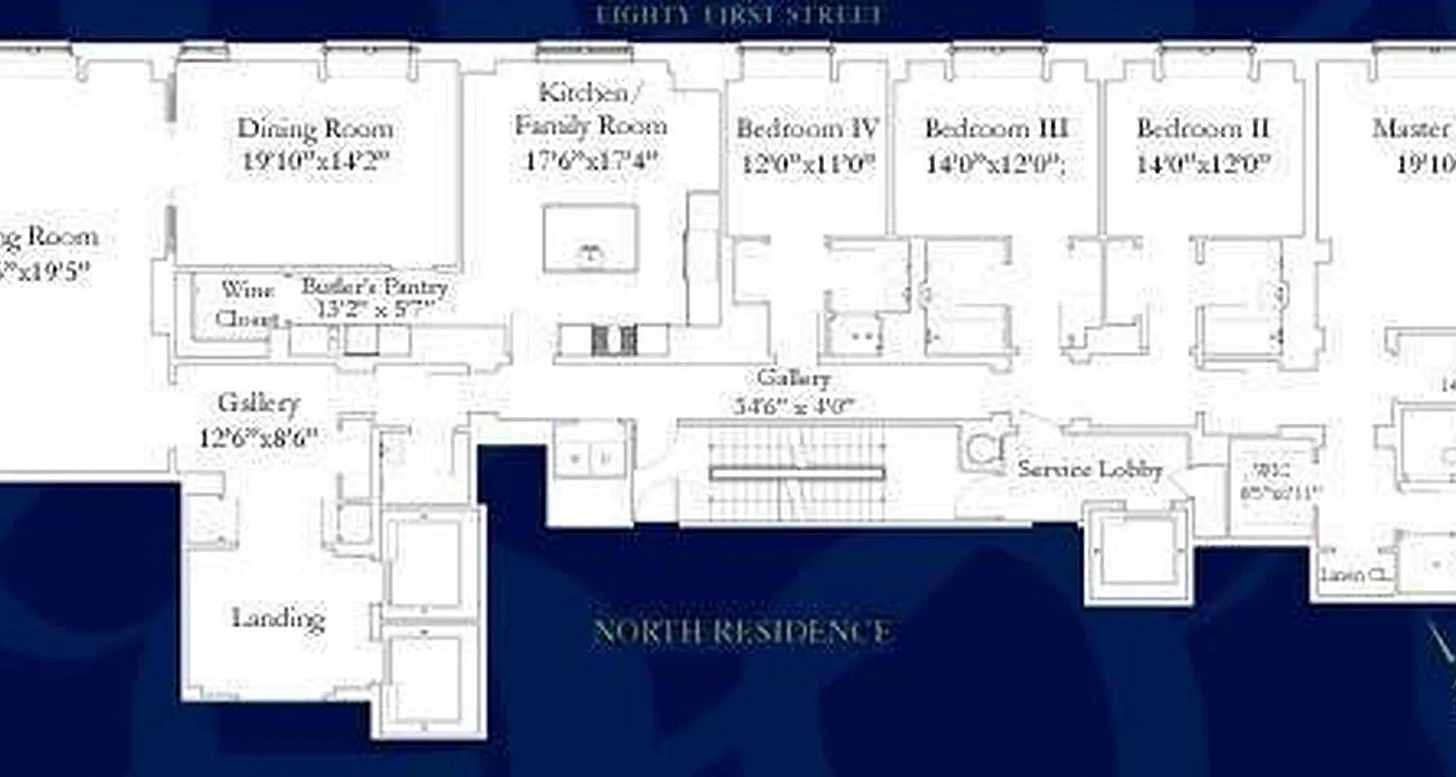

Apartment 12N was sold in 2008 for $16,750,000, with 4,118 square feet for $4,067 per square foot sold by the developer. The apartment had a monthly maintenance of $16,483 in 2008 because of the ground lease expense of $4 per square foot. Back then, the average Manhattan condo had an average monthly common charge and real estate tax combined of $1.35 per square foot. The average price per square foot for a luxury Manhattan property (the top 10% of all sales) in 2008 was $2,556. In other words, apartment 12N sold for 59% more than the average luxury price per square foot because of its direct views of Central Park over the Museum of Modern Art as well as its premium Fifth Avenue location.

Apartment 16, a listing twice as large as the 12N with similar Central Park views, has gone to contract in May after nearly a year on the market with a list price of $24,250,000. This apartment has been renovated with 8,360 square feet, asking $2,900 per square foot. Because of the one-year marketing time before it went to contract, the contract price is probably at least 10% below the listing price or roughly $22,000,000 or $2,632 per square foot. The estimated asking price per square foot of $2,632 is 17% below the current $3,173 luxury price per square foot found in our Manhattan Q1-2025 Market Report. The fact that a park view unit sold in the building for 17% below the Manhattan luxury price per square foot in 2025 while in 2008 a unit sale went for 59% more and larger size suggests that units in this ground lease building have not kept pace with the overall luxury market. I suspect the ground lease is probably part of the reason (but so is the low ceiling height of apartments in the building). In fact, I seem to remember a lot of mirrors and small furniture used in the model to make the apartment look “taller.” The monthly common charges + real estate taxes of the apartment is $45,715 or a modest (cough, cough) $550,000 per year, rounded, before principal, interest, and insurance (taxes included in the monthly already).

Battery Park City Is On A Ground Lease

Here’s more than you’ll ever need to know about Battery Park City In Manhattan.

Battery Park City is a newly constructed neighborhood built on land reclaimed from the Hudson River, using the fill from the World Trade Center site to its immediate east. Each Battery Park City project leases its land from the Battery Park City Authority (BPCA), and the initial duration of the ground lease was 99 years. The BPCA is a non-profit public benefit corporation created in 1966 under special state legislation for the purpose of developing the 91 acres of landfill now known as Battery Park City. The governor appoints its officers and board. The BPCA was authorized to issue bonds covered by the state’s obligation to create the landfill and infrastructure required for the BPCA’s commercial and residential development. Several condo developments in the neighborhood have experienced disproportionately high escalations of common charges over the years because of their leased fee ownership. The jump in cost is mainly attributable to an increase in ground lease payments, negotiated initially between the original sponsor (developer) and the BPCA at the development’s inception. Reportedly, each sponsor negotiated individually with the BPCA, resulting in a lack of consistency in these escalations between projects. The BPCA owns the land but is a governmental body that cannot be billed for real estate taxes. In order for NYC to collect property taxes, the PILOT (Payment in Lieu of Taxes) program was created. PILOTs enable the city to collect payments roughly equivalent to property taxes paid for simple condominium fees elsewhere in the city. The individual unit owners are allowed to treat these payments as though they were actual real estate tax payments for income tax purposes.

On a price-per-square-foot basis, the neighborhood rose 31.7% from 2008 to 2025, while Manhattan co-ops and condos increased 32.2% over the same period. In other words, the ground lease factor doesn’t seem to have a significant impact on price growth in Manhattan. The growth of Manhattan condos without co-ops surged 75% over the same period, but this is attributable primarily to the shift in new development products to super luxury.

I suspect the price weakness observed in the Stanhope example has more to do with luxury market resistance to low ceiling height and perhaps other amenities rather than laying the blame solely on the existence of a ground lease.

Trump Plaza’s Ground Lease Odyssey

If you have a little time on your hands, I urge you to read this story on how the owners of apartments in Trump Plaza bought out the ground lease in Rising Costs a Concern for Land-Lease Building Owners [gift link]. The board hired me to value the apartments with and without the ground lease and speak at a shareholder’s meeting. Because of the way the sponsor initially configured the lease, the ground lease payment was scheduled to skyrocket, making the monthly HOA payments surge, which would make the apartments worthless in a few years. The monthly payments would end up being significantly higher than what the apartments would rent for, curtailing any interest by investors. The condo across the street, known as the Savoy, was the perfect comp and proved out that the removal of the ground lease punished shareholders at Trump Plaza by about 50% of their value. I won’t give away how he did it, but the board president was a gifted dealmaker and made it happen.

Final Thoughts

Ground leases add another layer of homeownership cost to consumers, which restrains sellers from achieving a price as high as property unencumbered by a ground lease. This is due to the higher monthlies, tougher financing terms, and overcoming buyer uncertainty. Some mortgage lenders are very uncomfortable with properties subject to ground leases, especially with their potential to reset the ground lease payments much higher down the road. The financing limitations ebb and flow with access to credit. In other words, unusual financial attributes to a development project make financing more difficult in down markets. However, as the analysis of Battery Park City showed, a ground lease automatically restrain price gains, but they are definitely not for everyone. They keep prices lower than a property that is unencumbered but may not actually impact price growth.

The Actual Final Thought – When properties compete for buyers on the open market, sometimes innovation can help.

Voice Of Appraisal Podcast

My friend and appraiser colleague Phil Crawford brings in John Russell, formerly of ASA to talk about the lack of appraisal industry leadership today in John Russell to Center Stage Spotlight!

Speaking Engagements

I was invited to speak about the Long Island housing market by One Key MLS on behalf of the Long Island Board of Realtors on June 11th in Woodbury, New York.

Did you miss the previous Housing Notes?

May 23, 2025

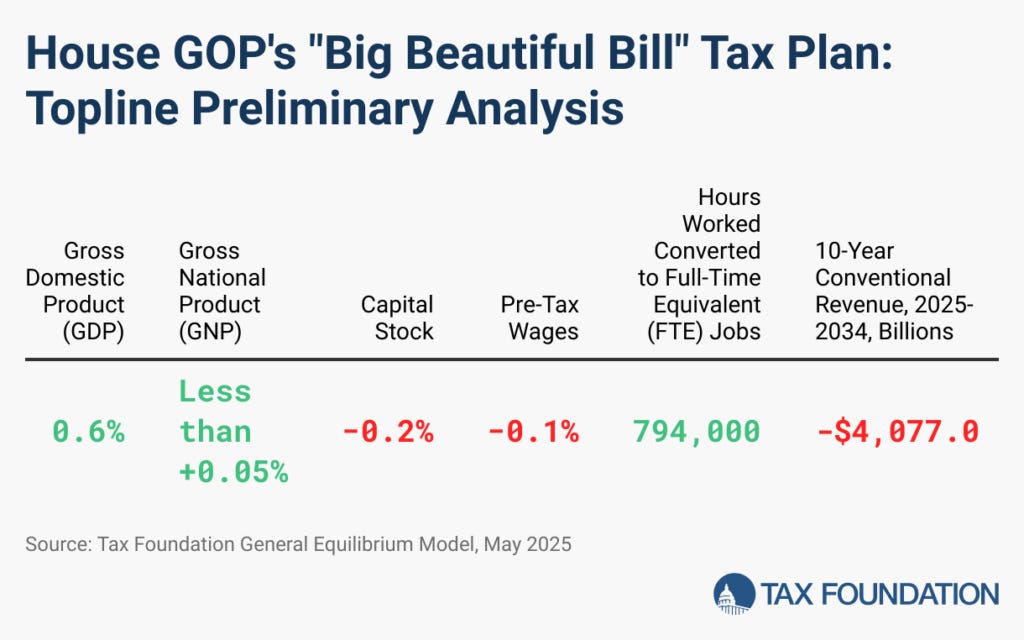

House Passes Massive Tax Bill Expanding Deduction On SALT Tax (Without Using A Semicolon)

Image: Tax Foundation