- NYC Tourism Is Expected To Drop By 800,000 Visitors In 2025, Mostly Canadians

- The Florida Gulf Coast Is Experiencing A Sharp Drop In Visits By Canadians

- International Tourism To The US Has Plummeted In 2025 From Harsh And Inconsistent Immigration Policies

I’ve always felt a strong connection to Canada. My Mom was born in Montreal and became a US citizen when she was thirteen. When our four kids were young, we always went skiing there on school breaks, and they loved seeing KFCs as PFKs and all those stop signs. I was even flown by a Canadian bank to Ottowa to be pitched to author a market study on their national housing market. Recently, I testified as an expert witness at the Canadian House of Commons Standing Committee on Government Operations and Estimates. I also love Canadian bacon. Many of the most popular US home reality shows were filmed in Canada (such as Property Brothers and Love It or List It). I am a big fan of their “B” movies– I actually saw Strange Brew at the theatre during college (here’s a free full movie link). The film barely holds up, but it did earn 75% on Rotten Tomatoes. However, my vocabulary has never recovered, so take off hoser, eh?

Now I digress to a more serious tone.

PRESCIENT UPDATE

The Wall Street Journal posted an announcement on the US Trade War with Canada only five minutes after this post was published: Trump Says He Has Terminated Trade Talks With Canada [gift link]

From Tourism To Home Buying

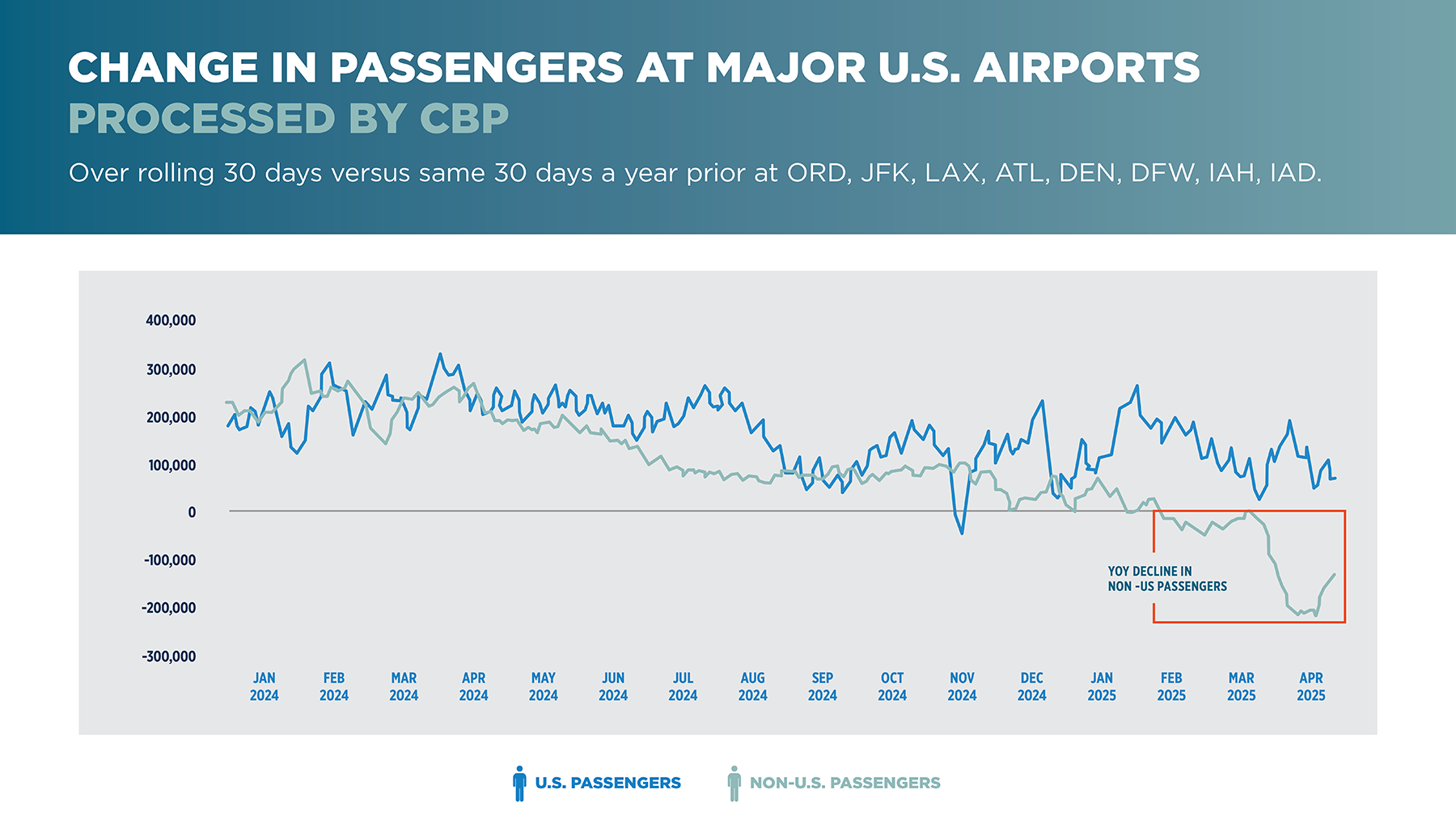

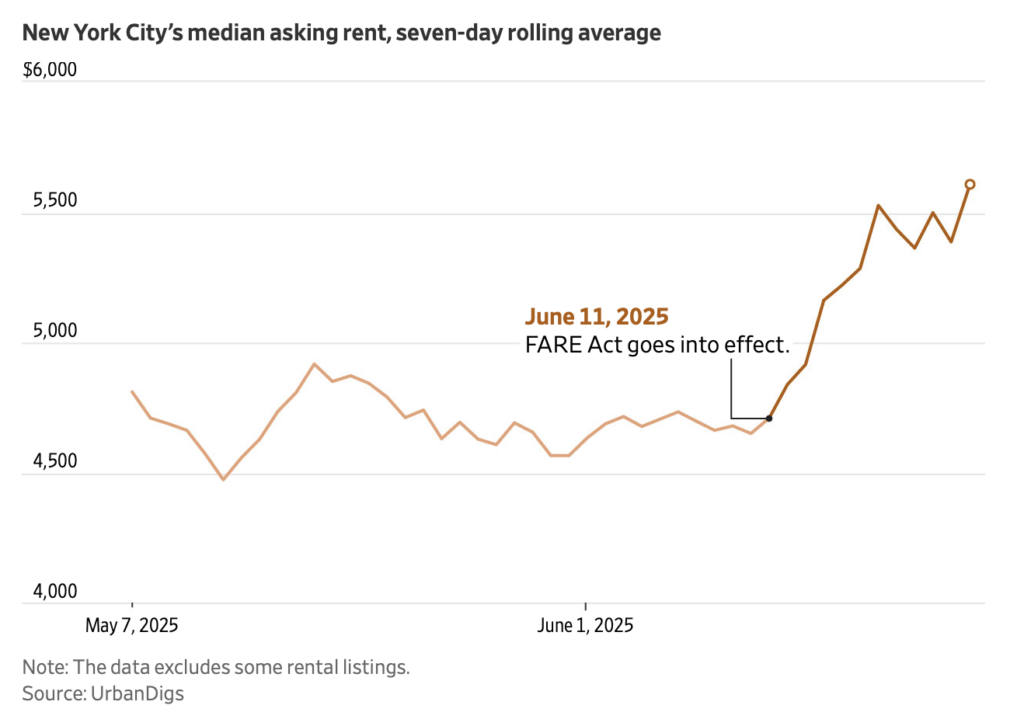

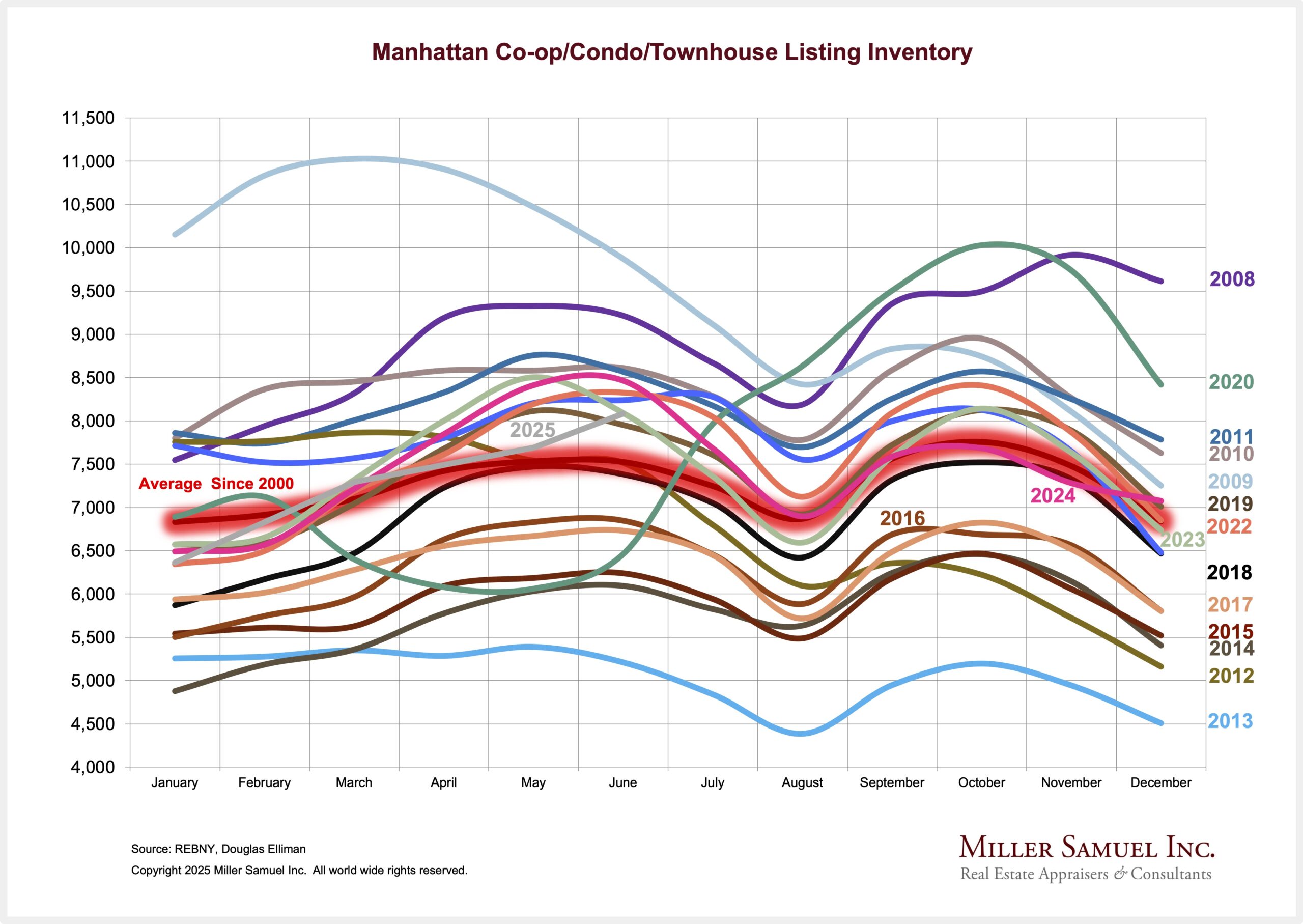

I’ve long correlated international tourism with housing demand, so the US attacks on Canadian trade are quite concerning to me. The damage will be long-term and structural as Canada looks to expand its trade relationship with Europe. I’ve long focused on tourism stats because their rankings tend to correlate with the ranking of foreign buyers of US real estate. The sharp drop in the US dollar hasn’t provided the typical boost to housing demand, likely due to the onerous, highly litigated, and inconsistent immigration policies that frequently emerge from Washington, DC. I care about the trade war’s implications because I can see that it directly reduces home-buying demand in locations Canadians often visit in the US. Canadians are the largest source of tourists in the US, accounting for 13% of foreign buyers of US real estate, the highest share. And it’s not just Canadians who are pulling back from visiting the US, as evidenced by the following chart from the US Travel Association.

Canadians To NYC

NYC tourism had nearly recovered to pre-pandemic highs in 2024, with 65 million visitors, but 2025 is looking a lot weaker. The 2025 expectation is a 17% drop below 2024 or 800,000 fewer tourists. Most of the decline is accounted for by the drop in Canadians [free link] who have pulled back from visiting US destinations in response to the US trade war.

Canadians To The Gulf Coast Of Florida

Canadian tourists have long favored the Gulf Coast of Florida, particularly in markets like St. Petersburg, Clearwater, Naples, and Fort Myers. Like NYC, 2024 was a banner year for Gulf Coast tourism, but 2025 is going to see a significant drop in visits. For example, international tourism is declining, as the number of Canadian tourists visiting by car dropped 35.2% in April compared to the same month the previous year. Wow. Throw in a few direct Hurricane hits last year on the Gulf side, and with weaker sales demand with elevated mortgage rates, listing inventory is way up.

Final Thoughts

The weaker US dollar should have resulted in a spike in home sales from international buyers enabled by the currency play. The disrespect we have shown our long-time trading partners to the north with the Tariff Tantrums is beginning to take a toll on international demand. Canada accounts for more than 14% of our global exports and nearly 11% of our imports, and to date, there has been no benefit to the US for this unforced error. Canadians have responded quickly with increased anti-American sentiment and a decline in tourism, likely resulting in a future drop in international housing demand.

The Actual Final Thought – Canadians, when deciding whether they should stay or should they go. They seem to be staying home.

Collateral Risk Network 2.0 Meeting August 6-7, 2025

My friend, colleague, and former director of the Appraisal Subcommittee, Jim Park, is bringing his talents to revitalize the Collateral Risk Network(CRN). For more information on CRN, please visit this link. He asked me to share this event announcement with my readers. The event is being held this summer in Washington, DC, at the NAHB HQ. I hope to attend, schedule permitting.

[Podcast] What It Means With Jonathan Miller

The latest episode: Thinking About Housing and Bitcoin is just a click away. The podcast feed can be found on all three platforms we use:

Apple (within the Douglas Elliman feed) Soundcloud Youtube

Did you miss the previous Housing Notes?

Housing Notes Reads

- Exclusive | A $250 Million Real-Estate Mystery Is Unfolding in Palm Beach [Wall Street Journal]

- Housing market at risk of "sustained downturn" as price growth cools [Axios]

- Common Appraisal Misconceptions: What You Think You Know Might Be Wrong [Birmingham Appraisal Blog]

- San Francisco’s Luxury Housing Market Is Booming Again Thanks to AI Wealth [Bloomberg]

- NYC Developers Gripped by Hysteria After Mamdani’s Sudden Rise [WSJ]

![[Podcast] Episode 4: What It Means With Jonathan Miller](https://millersamuel.com/files/2025/04/WhatItMeans.jpeg)