The Mansion Tax Has A Short Term Impact On Homebuyer Behavior

After Mansion Tax Implementation, Sales Recovered Within 1-2 Years

Whether Required By Buyer Or Seller, The Seller Currently Pays

Implementation Of New Taxes Immediately Modifies Consumer Behavior

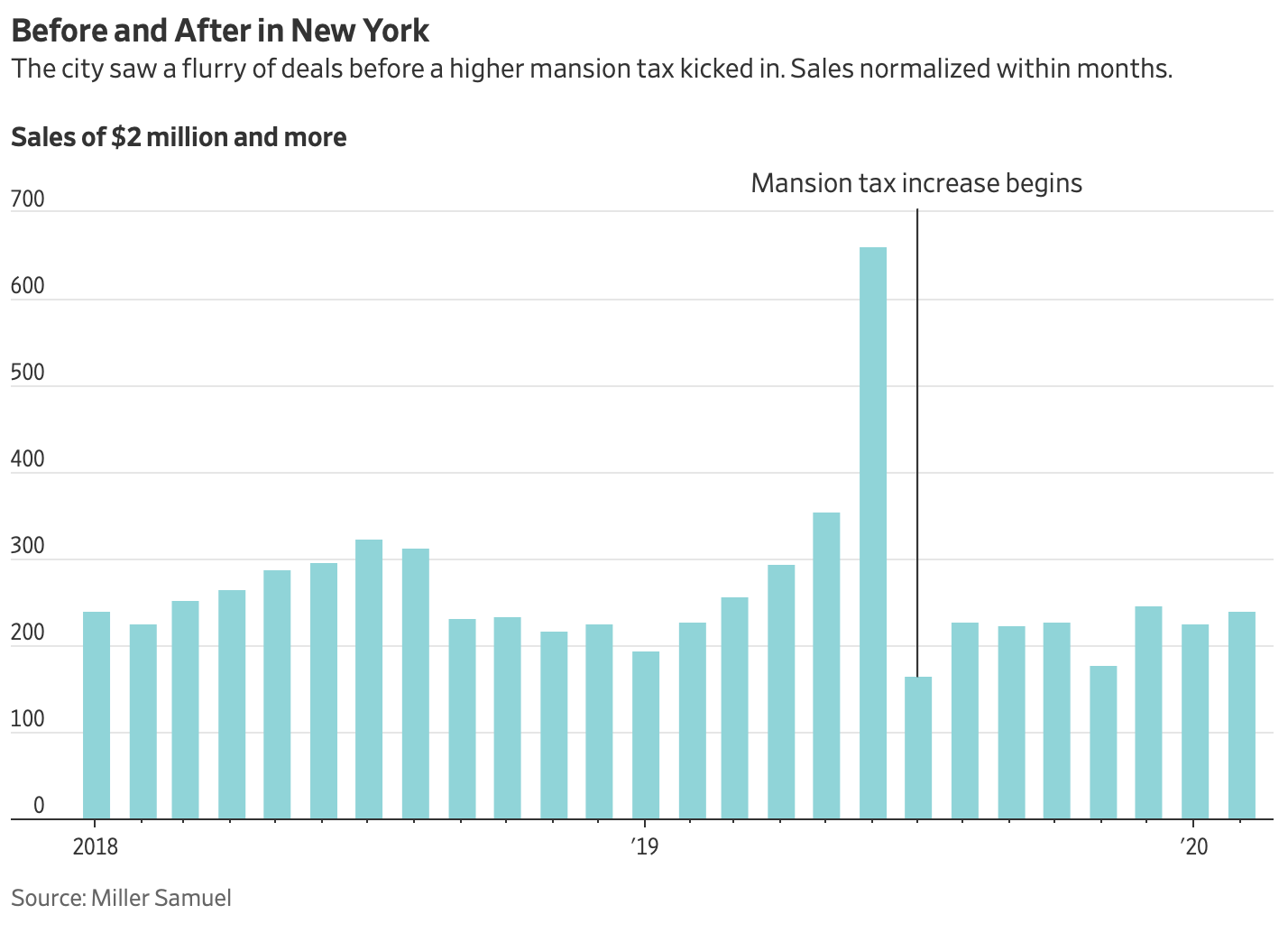

We saw significant housing market distortions when the $5 million Mansion Tax was introduced in Los Angeles in 2023. In 2019, New York City introduced an update to the original 1989 Mansion State Tax that starts at $2 million. No matter whether the buyer or seller is required to pay the tax, the amount is ultimately taken out of the market value of the property. As this Wall Street Journal article chronicles, sales initially plunged when the new tax went into effect until the seller adjusted to the lower market value.

Q: What’s one thing that is better than having a major news publication create a couple of big charts with your data?

A: Only ice cream.

The Los Angeles Mansion Tax (ULA) is 4% on home sales from $5 million to $10 million and 5.5% on home sales from $10 million or higher. These thresholds are adjusted for Inflation. By 2024, Los Angeles sales at or above the $5 million threshold began to normalize after considering the spike in interest rates. The seller is responsible for paying the tax.

The 2019 New York City Mansion Tax was supplemental to the original New York State Mansion Tax that was created in 1989 as a flat tax on the amount over $1 million. In 2019, the mansion tax was updated to supplement the original tax but only applies to New York City properties and is paid by the seller. It begins at $2 million for residential and commercial properties. The commercial component makes the argument that the “Mansion Tax” moniker is inaccurate and should be referred to as a supplemental tax.

Final Thoughts

In both Los Angeles and New York City, the Mansion Tax significantly impacts consumer behavior in the short term. Transactions soared in the year before the tax was implemented, “poaching sales from the future” as buyers and sellers tried to beat the tax. However, in both markets, sales eventually normalized within one to two years.

Technically, the laws usually require the seller to pay the tax, but in reality, the market determines who pays the tax. The municipality gets its revenue either way. Ultimately, the seller ends up paying the tax as they will sell their properties for less than they could before the tax was implemented. The one to two year period for sales to recover was mainly attributable to the time it takes the sellers to adjust to the downward revisions in market value to the achievable sales price for their property.

ASIDE – A recent presentation I participated in on the 65th Floor of 53 West 53rd Street enabled insanely cool angles for photos – and it is likely all of the sales in these Billionaire’s Row Manhattan supertalls were subject to the Mansion Tax and Supplemental Tax. Click each to expand for maximum coolness.

On APM Marketplace Radio Yesterday

On Wednesday, I wrote about home renovations here on Housing Notes: Limited Inventory + Lower Interest Rates = More Home Renovations after the release of Harvard’s JCHS study. APM Marketplace got a similar idea from commentary in the Beige Book release by the Richmond Fed on home renovations. I was asked to chime in on their interesting piece: In a tight housing market, fixer-uppers are having a moment – note my quip about immediate gratification. Ha.

Luxury Agent Forum – October 30th

I’m looking forward to speaking at Luxury Roundtable’s exclusive summit in New York on Oct. 30 on the outlook for luxury real estate. Topics include global luxury real estate demand and supply, inventory, feeder markets, regulation, market analysis, design, décor and architecture, HNW and UHNW buying and selling behavior, marketing, developments, best practices in lead gen and referrals, AI and tech, and what works for luxury brands and retailers—experts from the leading luxury real estate networks, brokerages, and brands worldwide. Expect plenty of networking and knowledge sharing. I also have a special speaker discount that gives you 20 percent off the registration fee. Please type in LUX20 when you register for the event:

Did you miss yesterday’s Housing Notes?

October 23, 2024

Limited Inventory + Lower Interest Rates = More Home Renovations

Image: ChatGPT