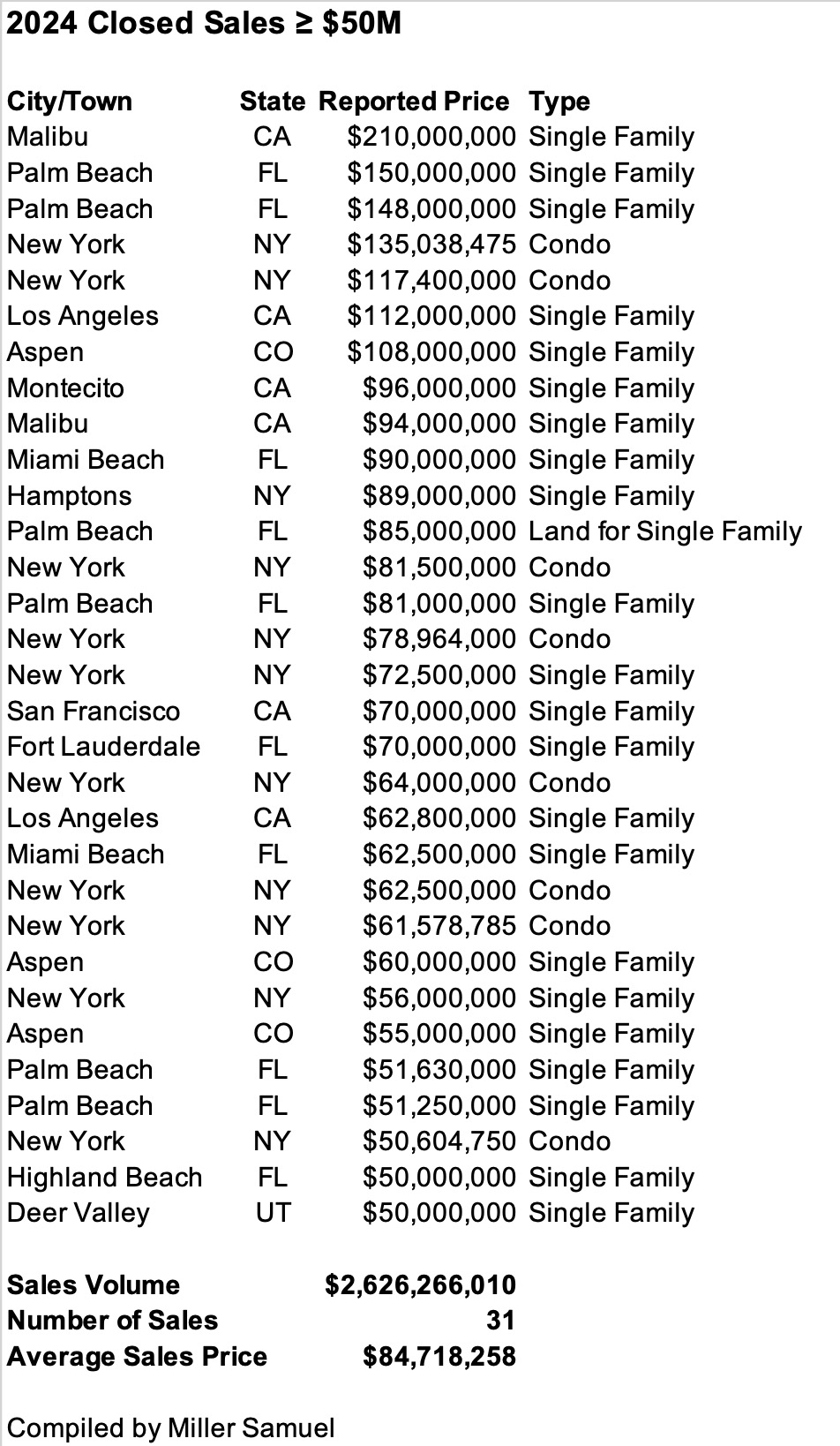

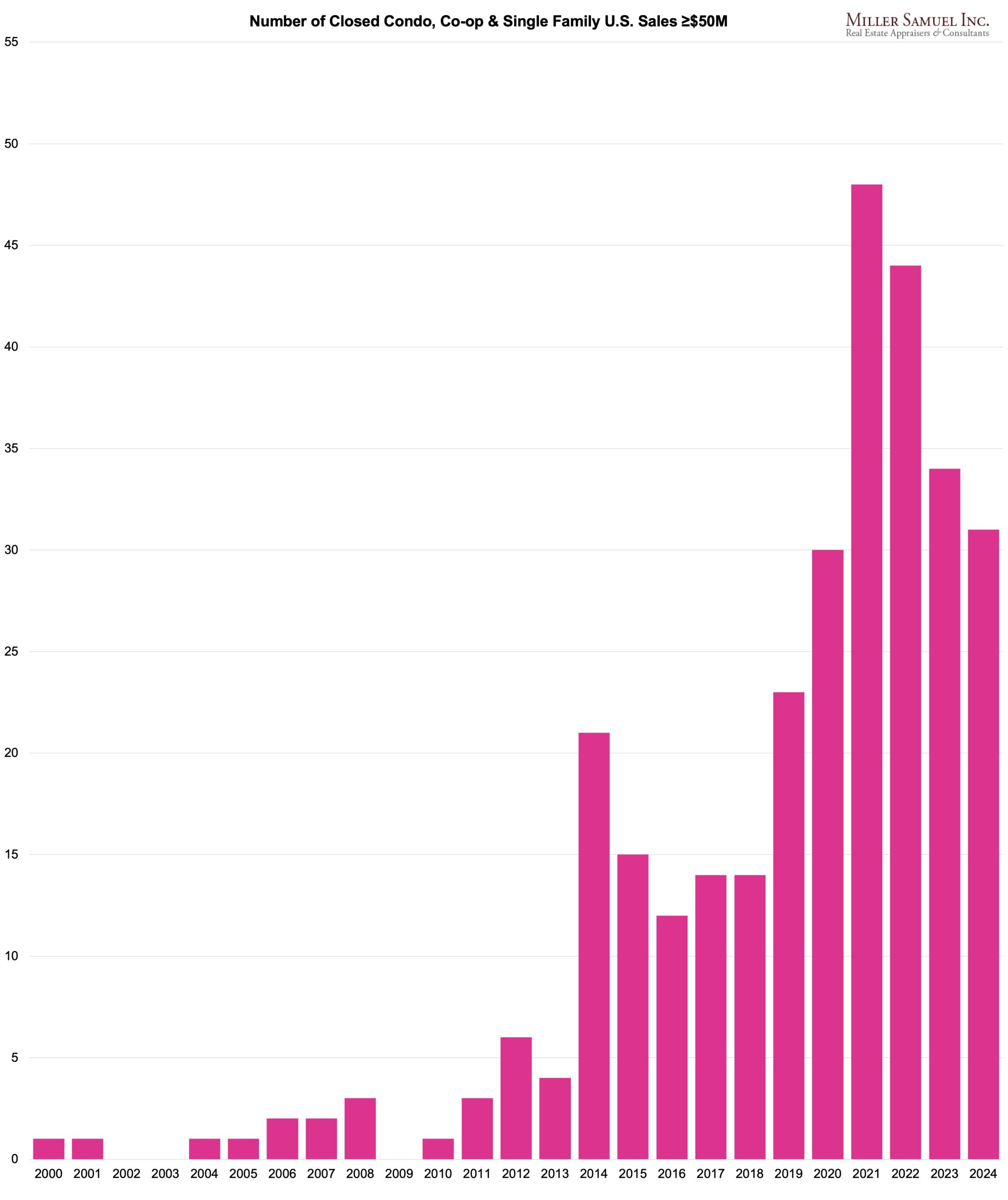

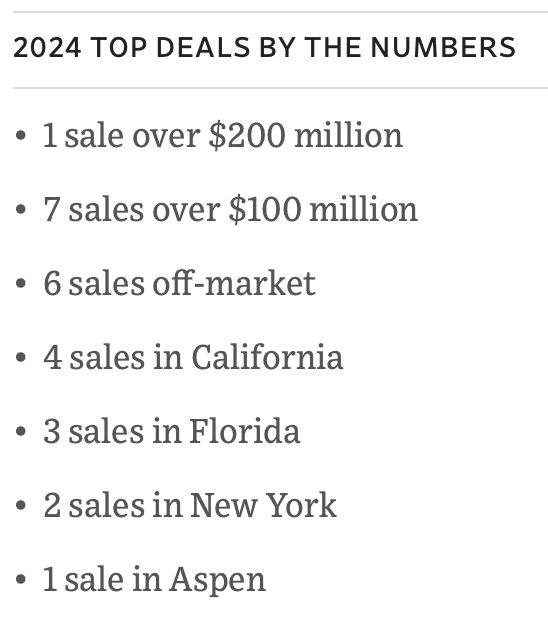

- U.S. Sales At Or Above $50 Million Was Fourth Highest In History

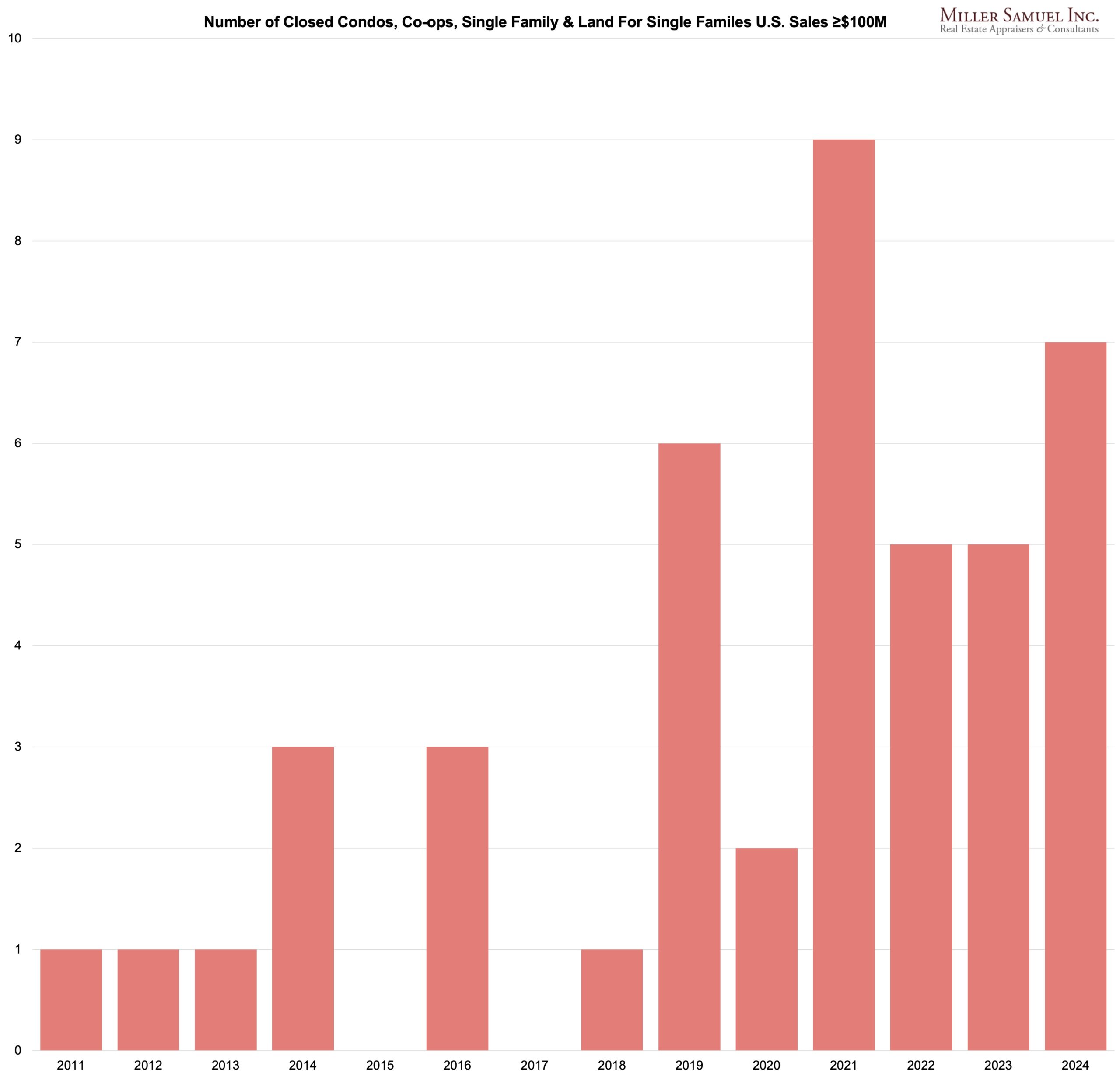

- U.S. Sales At Or Above $100 Million Was Second Highest In History

- Average Price Of U.S. Super Luxury Rose 7% Year Over Year

Get it? Like a ship…The confusing housing market of 2024 is behind us, but not much has changed a few days into 2025, except perhaps our expectations are a little more realistic. Mortgage rates are unlikely to fall by much, if at all; listing inventory will rise but remain inadequate in many markets, and prices will increase. As a self-identified listkeeper, I have been tracking the super luxury U.S. sales market for about a decade. It takes a lot of work and, somehow, has turned into a housing category. But before I get into the weeds, I started making lists long before I tracked the housing market.

I use the app “Evernote” so I can add to my lists on the fly. Here are a few list examples:

A list of outdoor toilets I’ve collected during appraisal inspections…

- Royal Flush

- Johnny on the Spot

- Jiffy John

- Gotta Go

- Call a Head

- Mr. John

- Don’s Johns

- GI John’s: it’s go time

- Ron’s Johns

- Sweet Pee

- L’il Willies

- Scottie’s Potties – we’re no 1 in the no 2 business

Potential high school band names (abbreviated). I tend to use an average of 3-word names.

- Band of Investment

- Bane of My Existence

- Hunks of Bread

- Non Fungible Tokens

- The Shards

- Gas Station Sushi

- The Cap Rates

- The Cash Cows

- Both Ends Burning

- Add To Cart

Executive Dining Rooms Of Manhattan Banks I’ve Visited (wait staff and linen napkins required)

- U.S. Trust

- JP Morgan Chase

- Citigroup

- Bank of New York

- Morgan Stanley

- HSBC

Favorite Acronyms (abbreviated). EMG is my most used – I got it from Wired Mag’s “wired v. tired” column

- EMG (empty magnanimous gesture)

- FOMO (fear of missing out)

- YOLO (you only live once)

- TINA (there is no alternative)

- PATTY (pay attention to the yield)

- OG (original gangster)

- RTFM (read the f****** manual)

But I digress…

2024’s Highest Priced U.S. Home Sales “The List”

I began tracking this sales price category in 2014, going back to 2000, and it morphed into a hobby of mine as a “dull and boring numbers guy.” (???) “Dull and Boring” would be a great high school band name!

Media Coverage Of “The List”

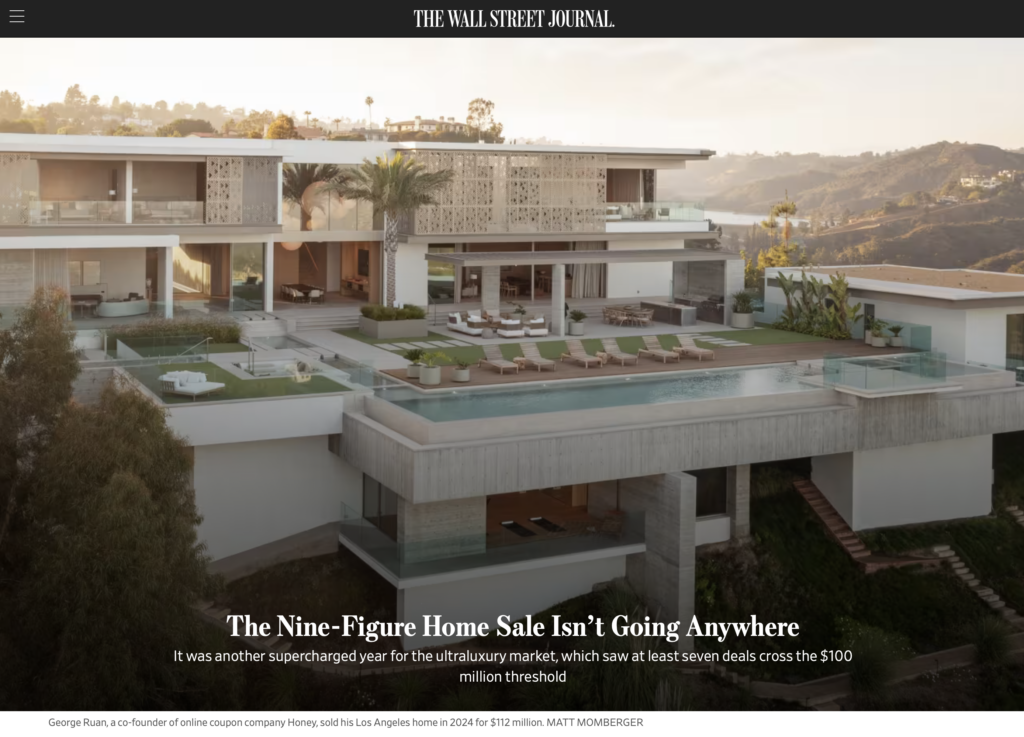

Wall Street Journal – The Nine-Figure Home Sale Isn’t Going Anywhere

Across the U.S., 2024 was one of the slowest years for home sales since the 1990s. But it was a banner year for the ultrahigh end of the market, where buyers are so wealthy that interest rates or market fluctuations have little impact.

Bloomberg Pursuits – There Seems To Be No Limit To How Expensive US Homes Can Get

“Of the 31 houses that sold for more than $50 million this year (thus far), prices on average increased about 7% from a year earlier”

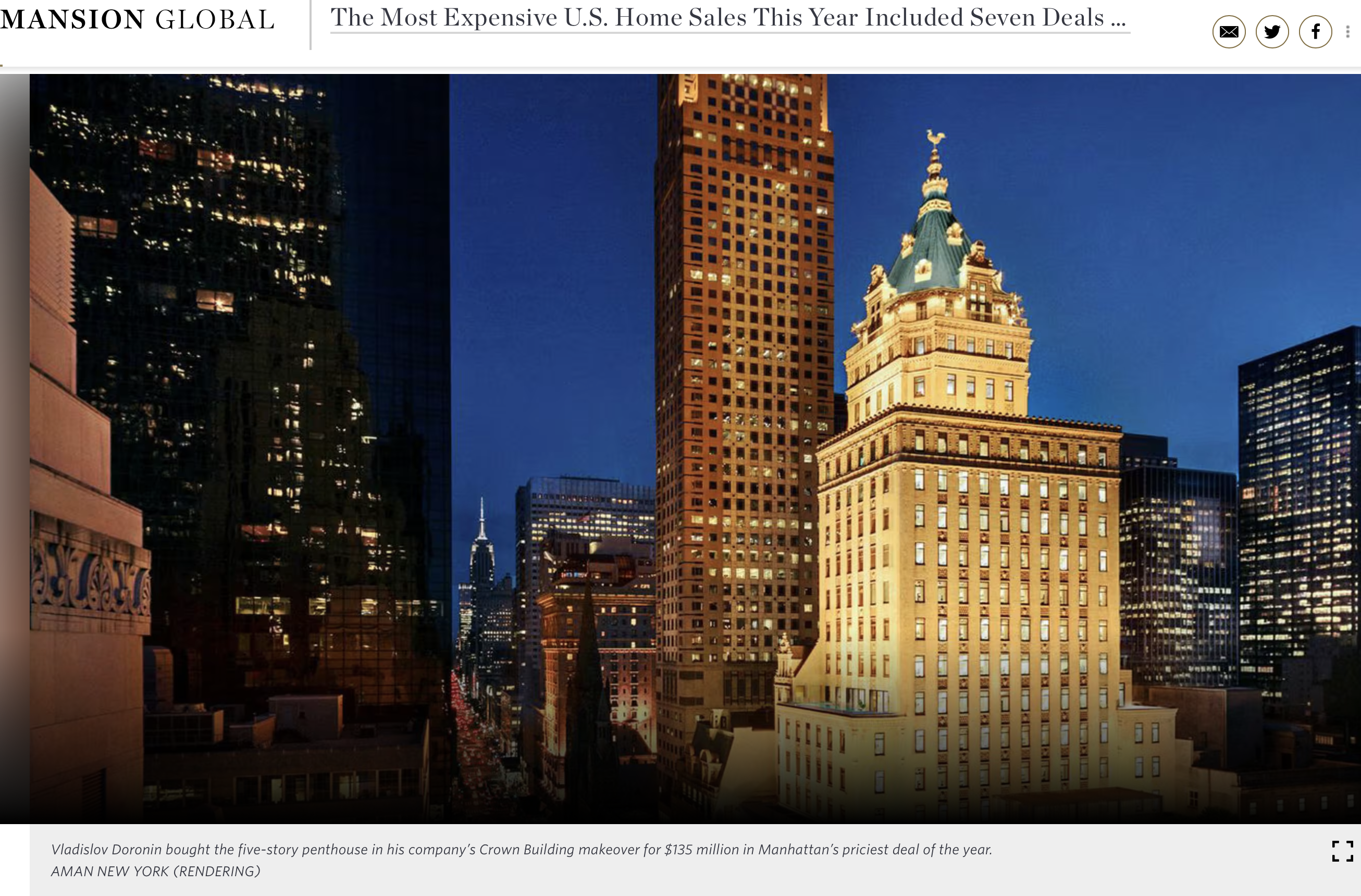

Mansion Global – The Most Expensive U.S. Home Sales This Year Included Seven Deals Over $100 Million

“Since 2011, when the $100 million threshold was first crossed, there have been close to 45 homes sold at that price or above in the U.S., and the pace is accelerating: 30 of those estates have been purchased since 2020”

Newsday – Hamptons real estate deals: Top 10 most expensive home sales of 2024

“The number of mega deals of at least $50 million in the Hamptons was down to just one in 2024, according to Newsday’s analysis. That is down from four deals of at least $50 million in 2023 and is the lowest number since there were no deals of that size from 2017 to 2019”

Final Thoughts

I’ve often said that we as a society are way too obsessed with the uber-wealthy, assuming that they figured out life and we mere mortals haven’t been able to. Yet their purchase behavior in the housing market is still worth following. It is always important to note that these sales have little if nothing to do with the performance of the local housing market but are a distinct submarket and, therefore, worth tracking. They are a collection of one-offs that define a national or a global market. The 2024 U.S. total of sales at or above the $50 million threshold was the fourth highest in history, and the $100 million sales total was the second highest in history. The price averages in aggregate for 2024 continued to rise.

These prices are rounding errors in most of the buyers’ portfolios and are often not their primary residences. In other words, it’s not reality for 99.99% of us. I think of this market as somewhat dependent on the performance of the financial markets, whose buyers are weirdly influenced by the wealth effect.

Of course, this super luxury housing market segment represents a tiny sliver of the housing stock yet garners 90% of the media coverage. Their existence is somehow aspirational to many of us. While I’ve been appraising in Manhattan for nearly 39 years, it took me about 15 years not to feel bad after I walked out of a $25 million townhouse with gold-plated ceilings and several Van Goghs and learned it was only one of five homes they owned. Yet I have a lot to be thankful for in my own life that I would never trade places, so it’s essential to compartmentalize their reality from mine by not taking it too seriously.

Rolling into 2025, packing a punch…

Did you miss the previous Housing Notes?

Housing Notes Reads

- Bezos’ Miami neighbour seeks $271 million for empty lot [The Straits Times]

- 2025 could finally be the year the residential market resets [Crain's New York]

- Floyd Mayweather Jr. rents Midtown apartment for $100K a month [The Real Deal]]

- Most expensive Hamptons home sales of 2024 [Newsday]

- 2025 NYC real estate forecast: Buyers and sellers tango, renters hold their breath [Brick Underground]

- A Conversation with Jonathan Miller, President & CEO of Miller-Samuel – Market Conditions: Where We’ve Been & Where We’re Going [Cooperator News]

- What will happen in 2025? 20 design industry leaders weigh in [Business of Home]

- New Estimates of the Stock Market Wealth Effect [National Bureau of Economic Research]

- The Nine-Figure Home Sale Isn’t Going Anywhere [The Wall Street Journal]

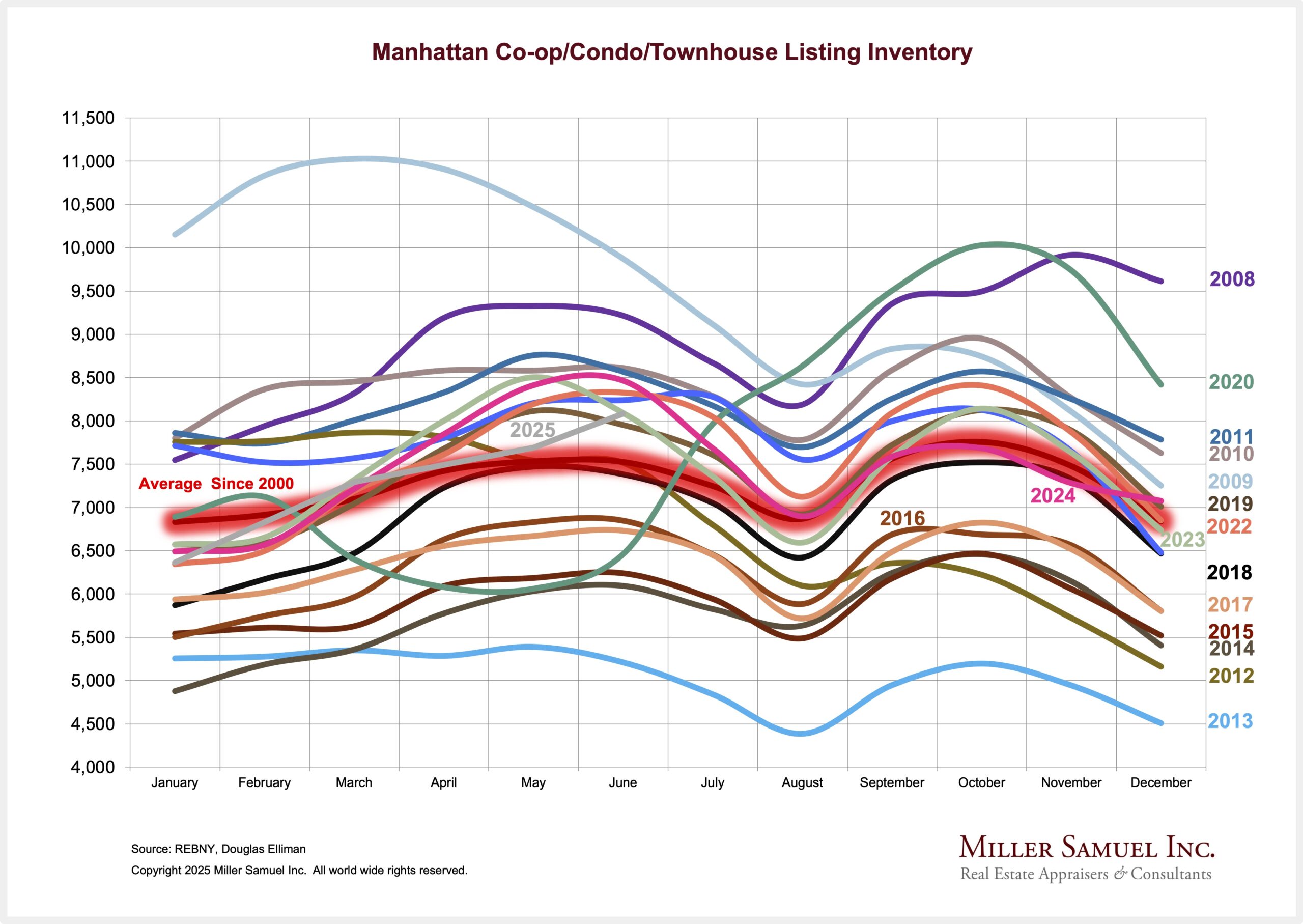

- Median sales price for Manhattan new condos jumped nearly 20 percent in the fourth quarter [Brick Underground]

- NYC’s resi market closed 2024 on a high note [The Real Deal ]

- Manhattan’s Luxury House Hunters Came off the Sidelines in the Fourth Quarter [Mansion Global]

- Palm Beach: Sky-High Prices, Record Deals [Behind The Hedges]

- The Median US Home Is 40 Years Old [Apollo Academy]

- Top Posts – Considering Housing Inventory: Why Both New and Existing Supply Matters [NAHB]

- Every Dollar Counts: The Top 5 Liberty Street Economics Posts of 2024 [Liberty Street Economics]

- New York’s tourist count reaches 97% of its record level pre-pandemic [Costar]

![[Podcast] Episode 4: What It Means With Jonathan Miller](https://millersamuel.com/files/2025/04/WhatItMeans.jpeg)