- The Second Home Market Is Not As Bad As The Sales Drop Suggests

- The Fed Decided Not To Cut Rates But Possibly Two Later This Year

- LA Lot Sales May Tell The Story Of Normalizing Through The Smoke

There is a lot going on, and I couldn’t decide on a specific housing-related topic to focus on. Perhaps its more about my excitement, heading to Detroit tomorrow. So here’s a collection of the things I was zeroed in on today.

Is The 2nd Home Market Normalizing? (ATM Podcast)

I got to visit with my friend Barry Ritholtz to talk about the housing market and specifically the second home market on his second podcast series, At The Money (ATM). Always fun.

When taking the title literally, “Buying a Vacation Home with Jonathan Miller,” I hope a lot of people want to buy a second home with me. I’m quirky but lovable. Ha.

The Fed Held Rates Firm

Click to hear Fed Chair Powell’s explanation of the rate decision.

The Fed decided to hold rates with the expectation of two cuts later in the year. They expect the impact of the Tariff Tantrums to hit soon, but with the high uncertainty, they don’t want to make a move now. The Fed Chair noted that it takes time for the tariffs to weave their way through the chain of distribution.

Even if the Fed opts to cut rates in the back half of the year (we’re almost in the back half), it is not assured that mortgage rates will actually fall. Remember what happened last September after a 50-basis point Fed rate cut?

Wondering If The LA Housing Story Has Been Written Yet

There was an interesting piece in the LA Daily News: Lottery winner, investors snatch up homesites in LA fire zones. The article conveyed that the recent activity suggests there may be a lot more sales in the future. While this is certainly possible, I found that the real estate agents who were interviewed seemed a lot more negative than the non-agents. I observed this in NYC first-hand after a crisis like 9/11, The GFC, and COVID. It’s mainly because agents are in the business of transactions, and the future uncertainty is a threat to future sales volume. Incidentally, the 6% figure cited seems low to me to suggest a sales run on lots. In a normalized market, I expect about 5% to 10% of the housing stock (in this case, home lots) to turnover every year. If we assume that only half of these units ever close, that’s only about 3%.

Incidentally, the investor that bought The One just bought a $32 million LA home for cash. This acquisition certainly sends a mixed message about the future of the LA housing market.

The $50 Million Market Just Saw Another Sale

I was surprised to read that the infamous Oren Alexander was able to sell his Miami Beach home for $51.5 million. Located at 2135 Lake Avenue, they paid $10 million in 2020 and built a new home in its place. The buyers reportedly also viewed his brother Tal’s house while searching. This sale confused me since dwellings that would be associated with such a person would exist under a cloud of market stigma. Such stigma in a market often earns a discount for a buyer, but that doesn’t appear to be the case on its surface. And who gave the buyer’s title insurance? I don’t know enough about this topic, but I would be worried. Despite the weird PR stunt of a $500 million lawsuit by Oren & Tal against The Real Deal, it was The Real Deal’s journalist who broke today’s story and was one of the award-winning journalists who also broke the story of their initial arrest.

Final Thoughts

This has been a heck of a chaotic weak for housing, making it hard to focus.

The Actual Final Thought – If we end up having a recession, it could be a doozy.

Public Speaking

Positioned at the intersection of housing and economics, I cut through the out of context factoids to provide an easy and entertaining way to understand various topics on the housing market narrative. I have extensive experience as a keynote speaker, moderator and panelist at conferences, seminars and corporate events throughout the U.S. and Canada. Call 212-768-8100 x112 or Richard Haggerty the CEO of OneKey MLS, which is owned by the Hudson Gateway Association and Long Island Board of Realtors, asked me to present at the LIBOR Education Day Conference.

Douglas Elliman – I just attended a fun rooftop BBQ in FiDi with real estate agents. The light rain pushed the event indoors but not before I got to enjoy a terrific square cheeseburger.

[Podcast] What It Means With Jonathan Miller

The latest episode [Finding Certainty] is just a click away. The podcast feed can be found for all three platforms we use are here:

Apple (within the Douglas Elliman feed) Soundcloud Youtube

Did you miss the previous Housing Notes?

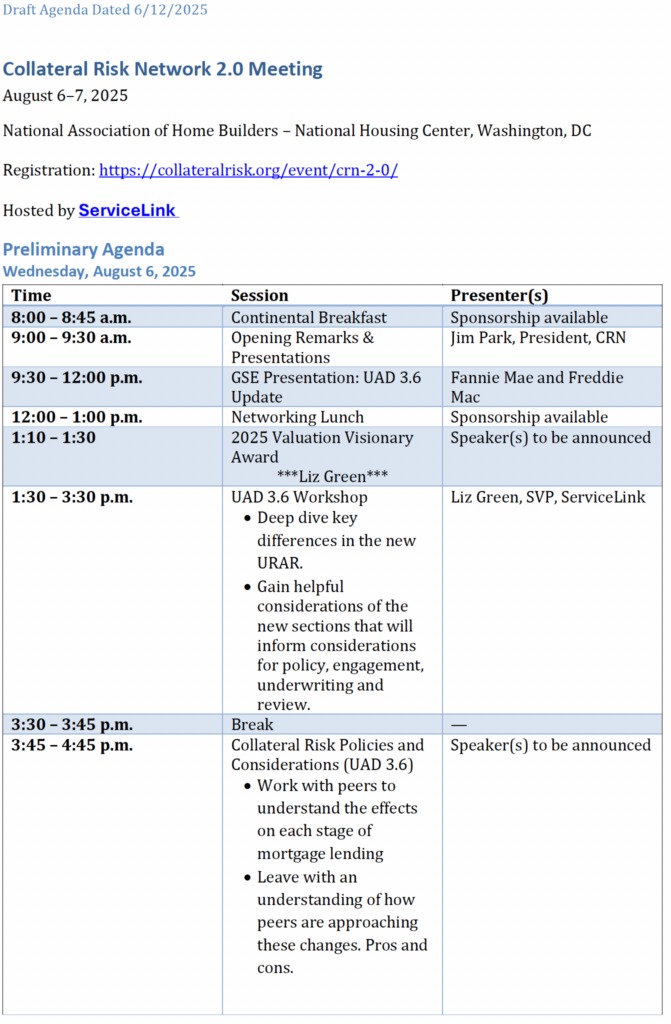

Collateral Risk Network 2.0 Meeting August 6-7, 2025

My friend, colleague and former director of the Appraisal Subcommittee, Jim Park, is bringing his talents to revitalizing the Collateral Risk Network (CRN). For more information on CRN, you can go here. He asked me to share this event announcement with my readers. The event is being held this summer in Washington, DC at the NAHB HQ. Here is the meeting agenda:

Housing Notes Reads

- Shuttered NY College Has Alumni Fighting Over Its Future [Bloomberg]

- Lottery winner, investors snatch up homesites in LA fire zones [Daily News]

- 30-Year Fixed-Rate Averaged 6.81% – Mortgage Rates Creep Lower [Cooperator News]

- Bloomberg At The Money: Vacation Homes [Bloomberg]

- Richard Saghian, Owner of ‘The One’ in Bel Air, Buys Another Los Angeles Home [Wall Street Journal]

Market Reports

- Elliman Report May 2025 Manhattan, Brooklyn and Queens Rentals [Douglas Elliman]

- Elliman Report: Florida New Signed Contracts 5-2025 [Miller Samuel]

- Elliman Report: New York New Signed Contracts 5-2025 [Miller Samuel]

![[Podcast] Episode 4: What It Means With Jonathan Miller](https://millersamuel.com/files/2025/04/WhatItMeans.jpeg)