- Detroit’s Population Increased Last Year For The First Time Since 1957

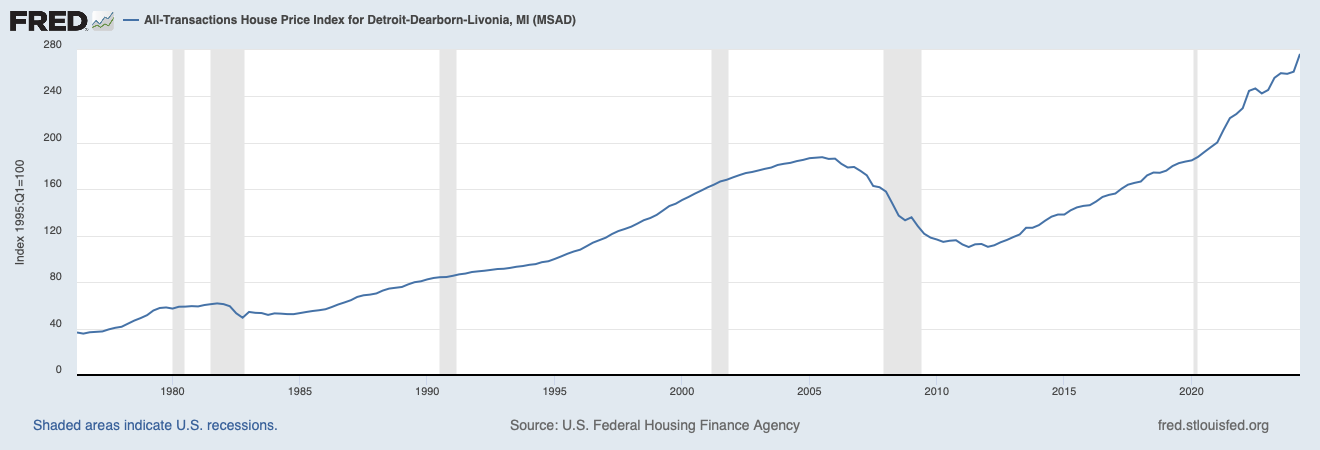

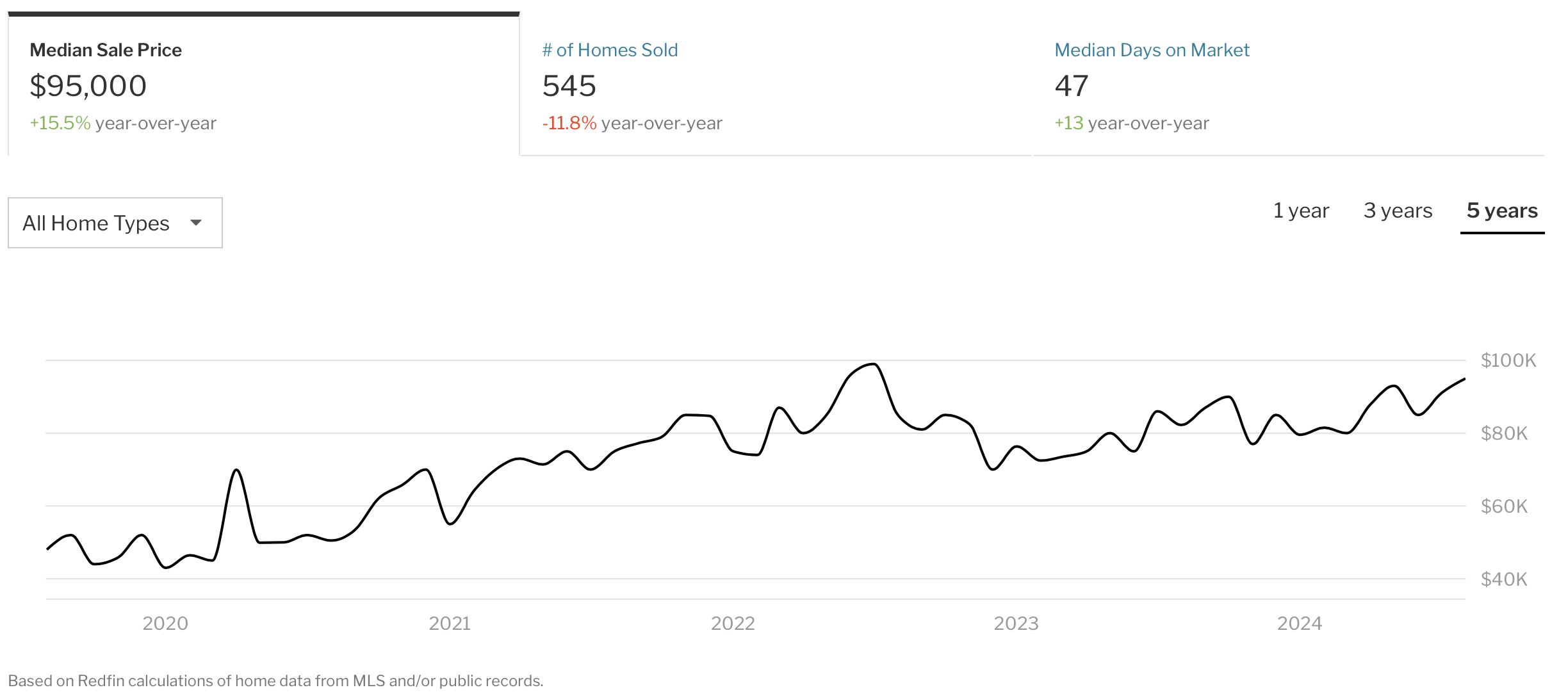

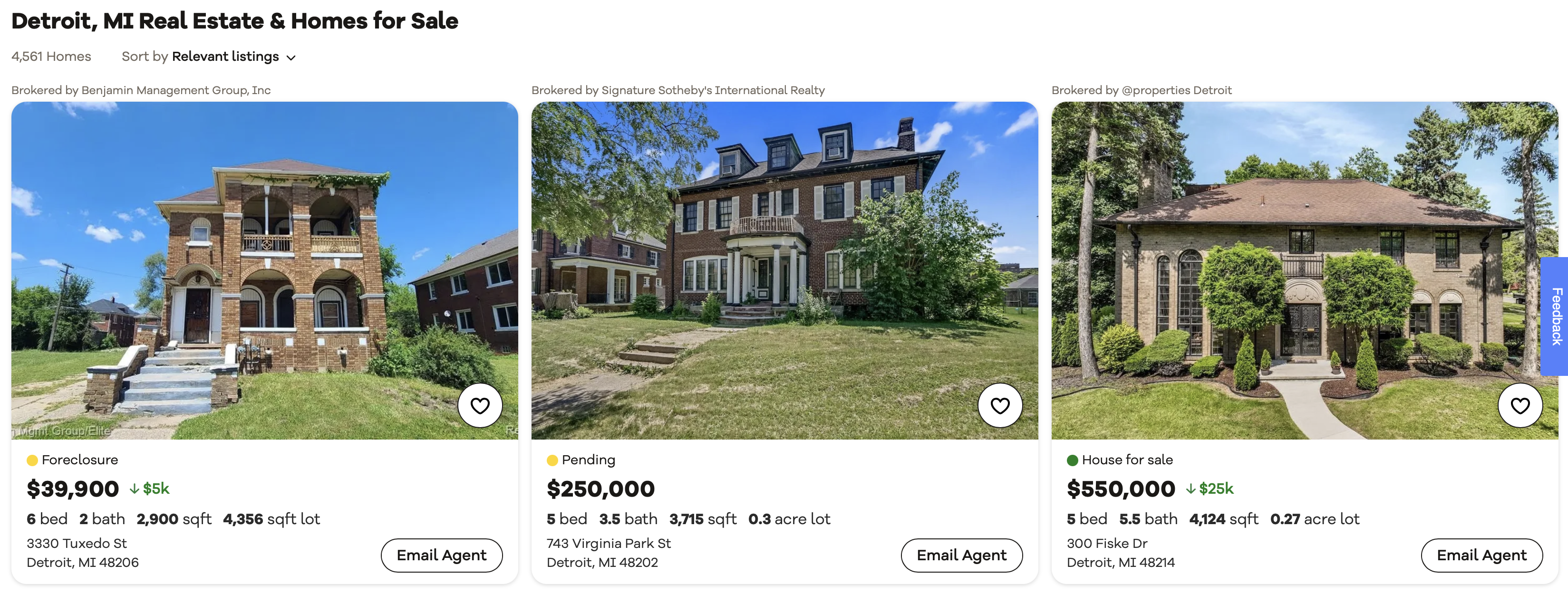

- Housing Prices Remain Low As The City Strives To Reinvent Itself

- A Lot Of Green Vacant Space Exists As City Shrinks From Its Manufacturing Start

One of my favorite books of the past decade was “Detroit: An American Autopsy,” which chronicled the wildly optimistic population growth projections of the 1960s to mayoral corruption and the fragile rebirth driven by the founder of Quicken Loans and other billionaires. I went to college in the state during the mid-1980s and attended Detroit Lions football games at the Pontiac Silverdome and Detroit Tiger games at the old stadium. We got our marriage license across from the Renaissance Center envisioned by Henry Ford II. We saw The Police/Joan Jett at the old Joe Louis arena surrounded by tall, abandoned buildings. It was hard to imagine Detroit’s rebirth as a possibility back then. Detroit’s population grew in 2023 for the first time since 1957. Tearing down abandoned houses in Detroit to create vacant green space has been an obsession, and I read somewhere that it now equals the footprint of Boston. In fact, there have been many attempts to use sheep to graze on the green space in the region.

The city’s population peaked in the 1950s at around 1,850,000 and has dropped to about one-third of that in 2020 to around 639,000. Housing prices remain pretty inexpensive.

Emphasis On Residential Support Services

The auto industry in Detroit is a shadow of its former self; schools are underfunded, and there remains a tremendous amount of urban blight. The focus has been on job creation as well as cultural services and green space, but a lot of infrastructure investment remains to be made. I also have grown tired of Detroit being a punching bag for housing studies. This 2024 study from FAU names Detroit as the most overpriced housing market in the U.S., passing Atlanta. But studies like this don’t understand the structural change and base their conclusions largely on long term trends. They missed the pivot.

Final Thoughts

The city’s rebound seems natural and improving. The recent change in a positive direction is the entire point that is missed in the FAU research. Back in 1960, the Detroit population was forecast to be 2.8 million and that moment was literally just after it began to fall, not seeing its first annual increase until 2023. Perhaps the low housing prices will continue to attract interest from national companies to bring employees there as the city continues to grow. From the NY Times piece, Led by Believers in the City’s Future, Detroit Is on the Rebound:

“I’ve lived my whole life in the city, and this is amazing,” Mr. Chuney said with a loud laugh. “I never thought I’d see that — in Detroit!”

Baltimore is next!

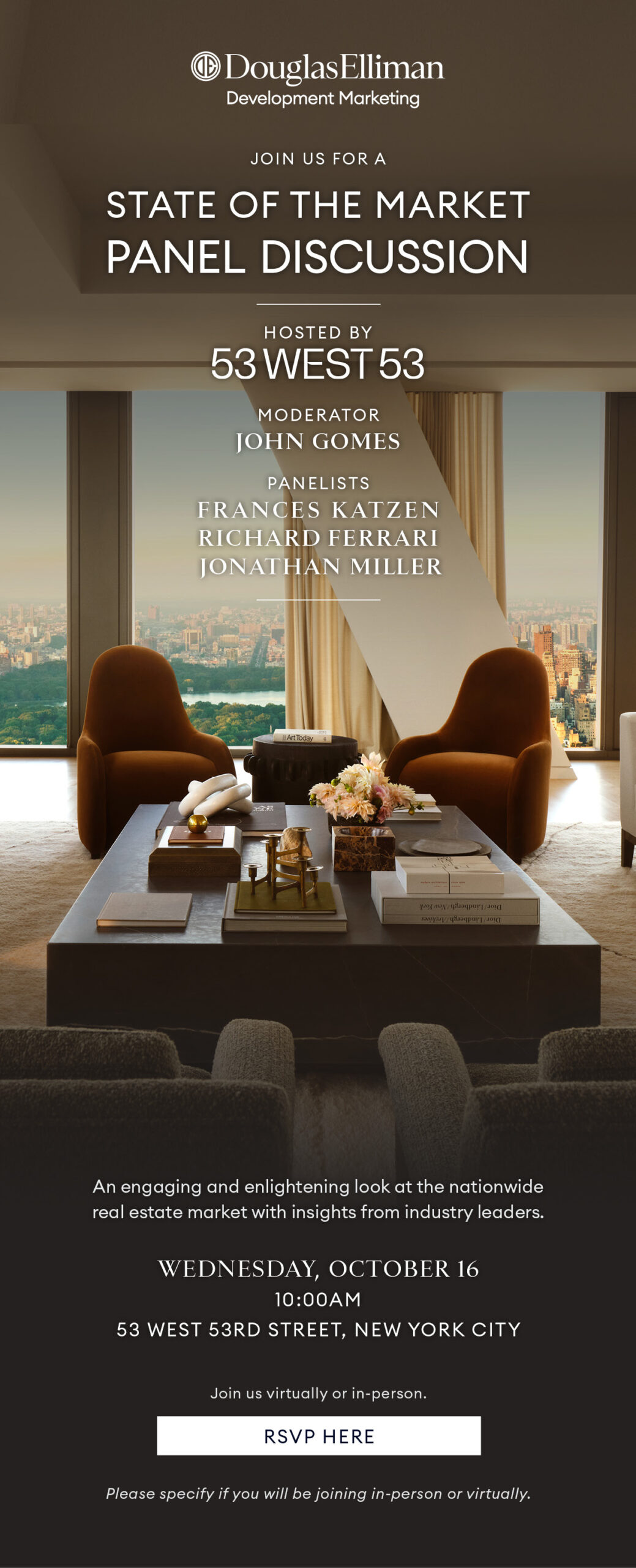

Broker Only Event: October 16, 2024, 10 am ET 53West53, Manhattan

You can confirm by clicking on the image or send an email.

Monday Mailboxes, Etc. – Sharing reader feedback on Housing Notes.

October 6, 2024, When $20 Million List Price Adjustments Are Easily Made

- They can probably skip the estimated payment and get prequalified link on $35mm listings!

October 11, 2024, Hurricane-Proof Construction Will Further Polarize Florida’s Housing Stock And Housing Values

- Timely and on point. California, Louisiana and Texas are bedfellows in this ongoing meteorological maelstrom.

- I look forward to your daily quippy clips. Engaging, data driven, relevant with an ode to the 70’s. Familiar. My main market is the USVI. We have been contending with finding new normals in the insurance industry for some time now. At times, there is no insurance aggregate available at all, for pre-existing wood frame and mixed construction homes. We are no strangers to natural disasters here, but when the insurance industry offers zero coverage for pre-existing properties, it’s no longer “rinse, lather, repeat”. Fingers crossed that current policy holders continue to be offered renewals, because lenders don’t want to hear “uninsurable” or “zero aggregate available”. Then it will be forced placed or foreclosed.

- You are absolutely right.

- A friend was looking at buying in Margaritaville in Daytona in early 2020. I looked at the homes and was impressed with the construction which meets or exceeds state requirements for hurricane protection. I was able to see the construction which included reinforced masonry on other construction materials. Prices started in the $200,000s. While there are cheaper homes in the area, most were older and not built to withstand hurricanes (and not in a planned development). You mentioned in your article today that the hurricane improvements would tend to be in the luxury segment. However, at least some builders are delivering good quality homes that are not “luxury” homes.

Did you miss Friday’s Housing Notes?

October 11, 2024

Hurricane-Proof Construction Will Further Polarize Florida’s Housing Stock And Housing Values

Image: ChatGPT

Housing Notes Reads

- The damage caused by Hurricane Milton in maps, photos and videos [Washington Post]

- Florida Building Code [Florida DBPR]

- The Quest for a Hurricane-Proof House [Wall Street Journal]

- Shouting Fire in a Crowded Theater – The Big Picture [Ritholtz]

![[Podcast] Episode 4: What It Means With Jonathan Miller](https://millersamuel.com/files/2025/04/WhatItMeans.jpeg)