- One-fifth of $4.7 trillion in outstanding commercial mortgages will come due in 2024.

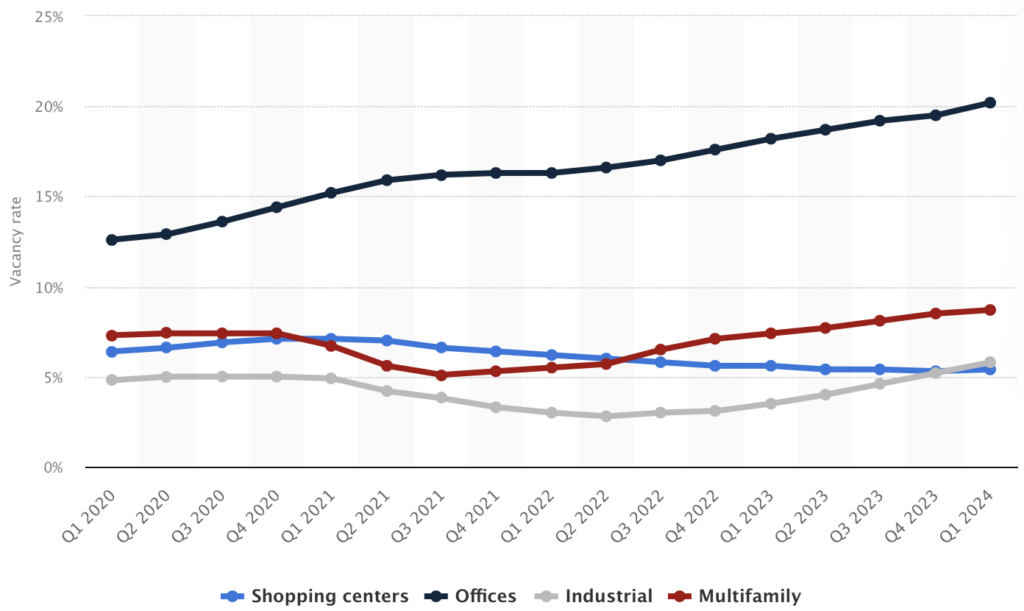

- Tracking office vacancies wildly understates the amount of empty office space.

- NYC’s City of Yes plan removes antiquated regulations preventing conversions.

We’ve got the perfect real estate storm right now: An affordability challenge in residential housing and a glut of unused office space. Work from home (WFH) changed our relationship with the office and how near our home needed to be. We’re not going back to the days of yore. But as the saying goes, “It’s complicated.“

In the early days of the pandemic, after Zoom became ubiquitous in the first 24 hours of the lockdown, lots of conversations immediately occurred about office-to-residential conversions, and the phrase killing two birds with one stone, which sounds absolutely awful after seeing the phrase written down. I remember getting many calls from journalists back then inquiring about the potential and also talking to several developers and converters about it, most of whom were negative about the viability. This was a very hazy period of my life, as I opted to do 7-8 one-hour Zoom calls nearly every business day early in the early months of the pandemic. I couldn’t say “no.” Many organizations and individuals were starving for clarity and any credible information they could get a hold of. Besides New York, I was talking to groups based in Chicago, Baltimore, and others. It truly was a soul-draining couple of months.

Time has passed. Ideas on the conversion process have evolved and we are starting to see early signs of progress.

Here’s a recent news clip on a gigantic office-to-residential conversion in Manhattan. I’ve walked by this massive office building seemingly dozens of times because there is a very cool bike shop just up the hill in the Tudor City neighborhood.

There was a great article that just came out in Crain’s New York about the residential conversion of the former Pfizer headquarters on East 42nd Street in Manhattan. Here’s what the Manhattan Borough president had to say about it. A lot of the success of future conversions appears to hinge on New York City’s “City of Yes” plan that removes or updates antiquated regulations such as the requirement that office-to-residential conversions can only be done to buildings completed on or before 1961 (Pfizer’s was built in 1961). This new proposed plan pushes that date forward to 1990. The developers hope to keep the cost of this 1,500-unit former Pfizer building under $1 billion.

Why Is Office-To-Residential So Hard To Do?

I thought I would explore all the reasons why keeping office-to-residential conversions is so difficult.

More Time Needed – It takes longer to convert an office building to a residential use than to create one by ground-up construction. Since interest rates are now significantly higher than a few years ago, and time means more money, additional costs make financing more challenging.

Construction Costs Are Higher – The conversion of office space is more expensive than new builds. For many developers, it’s an at-first-glance deal killer.

Large Floorplates Are Often Not Feasible – When floorplates are very large, they can require cuts to meet light and air requirements. If no cuts were made, an apartment might be 20×300 with two windows on one end, which is not optimal.

Most Municipalities Can’t Afford To Subsidize – Cities tended to lose population after the pandemic and their associated tax revenue.

Zoning Variances And Community Approvals – There is often a lengthy process to allow residential zoning in a commercial business district.

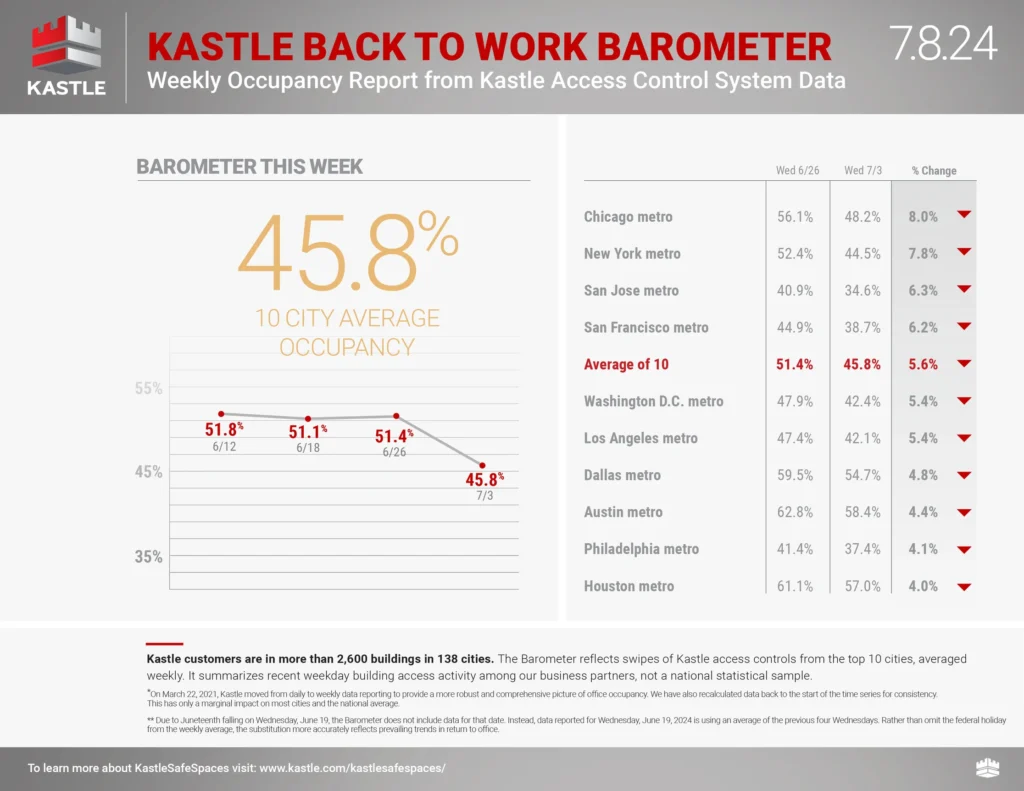

Vacancy Rates Are Misleadingly Low – When comparing the vacancy with office use, vacancy includes space that is leased but may or may not be used. Card swipe data from Kastle shows use through card-swipe security card data. Last year when I gave a deposition of a conference room on a very large office floorplate downtown, other than the office receptionist, only the half dozen of us in the conference seemed to be in their office. That office would show that it was occupied, but the card scan data, if they use the Kastle system, would show it was hardly used.

Office Debt Tsunami Is Coming Office debt is coming due. Manhattan is one of the largest markets with $19.8 billion of loans due in 2024. Think about that for a minute. It is unlikely that most of the refinance attempts will be successful because the collateral valuations have collapsed. After all, commercial leasing rates have collapsed. Much of this activity will result in defaults. Many landlords can’t negotiate down to current market rates because they wouldn’t be able to pay their debt service.

One-fifth, or $929 billion, of the $4.7 trillion of outstanding commercial mortgages held by U.S. lenders and investors will come due in 2024, according to the Mortgage Bankers Association (MBA)’s 2023 Commercial Real Estate (CRE) Survey of Loan Maturity Volumes.

Yahoo! Finance

What Is Favorable for Office-to-Residential Conversions?

The demand is real and there is a lot of office space that is obsolete and needs an adaptive reuse. Specifically, NYC, through its City of Yes initiative is thinking about the things that have to change, to enable more conversions to occur.

The Time Is Now – The zeitgeist is focused on this growing trend.

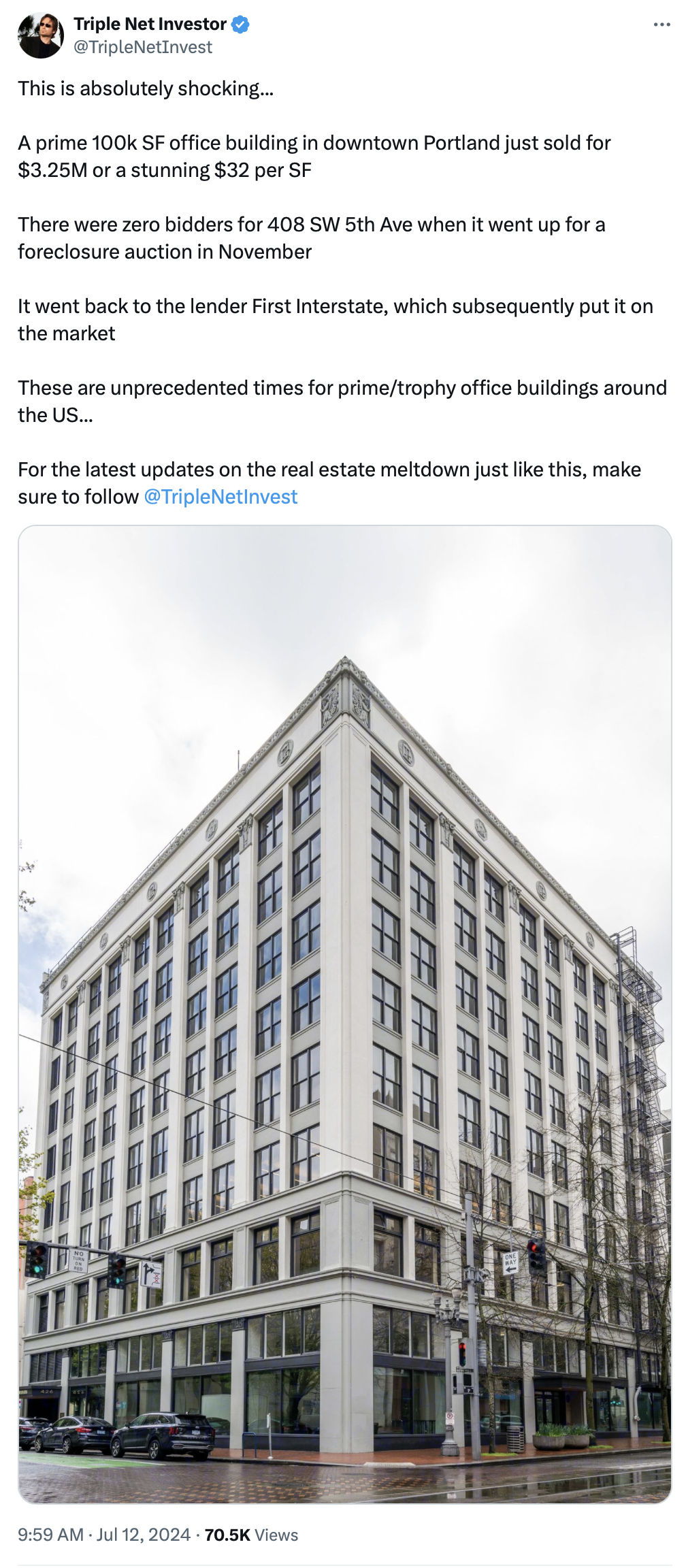

Foreclosures Will Help Fill Up Empty Offices – Once the excessive debt service is removed from many commercial office buildings, a new cohort of demand will be able to upgrade their spaces because landlords will be able to lower rents to the current market rate. I suspect the new demand will be for smaller footprints and smaller businesses that used to be priced out. I’ve shared these posts before because I love how they illustrate the price corrections being experienced in commercial real estate.

Final Thoughts

I’ve watched the movie classic “Office Space” dozens of times – it does a good job telling the story of the potential awfulness of office culture.

That Swingline red stapler could be the answer to all our problems…

Did you miss yesterday’s Housing Notes?

Housing Notes Reads

- Former Pfizer HQ apartment conversion to kick off this summer [Crain's New York]

- City of Yes: Overview [DCP]

- Spotlight: New York City’s Office Market [NYC Comptroller]

- Office Vacancy Crisis Deepens as Albany Mulls Easing Conversions to Apartments [The City]

Market Reports

- Elliman Report: Brooklyn Sales 2Q 2024 [Miller Samuel]

- Elliman Report: Manhattan, Brooklyn & Queens Rentals 6-2024 [Miller Samuel]

- Elliman Report: Florida New Signed Contracts 6-2024 [Miller Samuel]

- Elliman Report: New York New Signed Contracts 6-2024 [Miller Samuel]

- Elliman Report: Manhattan Sales 2Q 2024 [Miller Samuel]

![[Podcast] Episode 4: What It Means With Jonathan Miller](https://millersamuel.com/files/2025/04/WhatItMeans.jpeg)