Tell Me Why: Old Enough To Repaint But Young Enough To Sell (Cement)

JCHS Says Home Remodeling Is Expected To Begin Rising In 2025

The Pandemic Housing Frenzy Made Remodeling Frenzied And Unsustainable

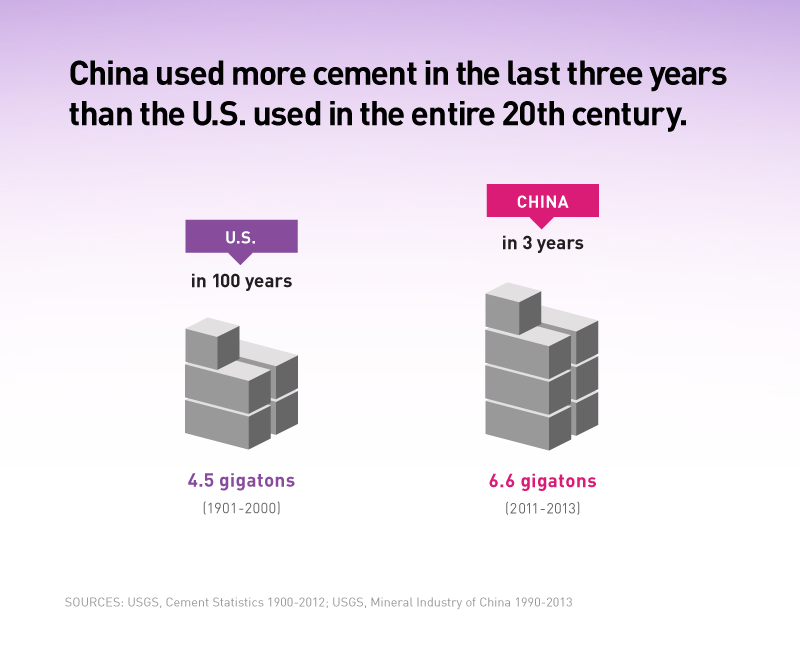

China Cement Use Moderating, Using As Much In 3 Years As The US Did In 100

Like the decline in home sales, the amount spent on home remodeling has been declining since the Fed Pivot in 2022. That makes sense because that’s what the spike in interest rates was meant to do. Slow the economy down. The Joint Center for Housing Studies of Harvard (JCHS) is forecasting the beginning of a remodeling uptick in 2025. The pandemic drove remodeling activity to a frenzied and unsustainable pace and then fell with the spike in mortgage rates. With supply chain and inflation issues not as significant as a few years ago, remodeling activity is expected to normalize next year.

Considering the rising cost of housing, I would think that an expected uptick in remodeling, despite higher mortgage rates, makes sense:

Economic uncertainty and continued weakness in home sales and the sale of building materials are keeping a lid on residential remodeling, although many drivers of spending are starting to firm up again. After several years of frenzied activity during the pandemic, owners are now making upgrades and repairs to their homes at a steadier and more sustainable pace.

Thinking Heavy About Cement Construction

As I was considering the normalization of home remodeling, I saw a Bloomberg article that the usage of cement in China building construction was normalizing too: Bloomberg’s China’s Cement Boom Is Over. We Can All Breathe Easier and BBC’s The environmental cost of China’s addiction to cement.

Back in 2016, when I headed to China to present at a real estate conference, my wife and I took a high-speed rail from Beijing to Shanghai. The following photo was essentially the view for the 5-hour trip. It was hard to comprehend the amount of residential construction there was between these two cities let alone the rest of the country.

Just before my 2015 and 2016 trips to China, I read some research that was hard to comprehend – China used more cement in three years than the U.S. had used in 100 years.

The world was running out of sand (not the beach kind)! Only after I watched the construction outside my train window for 5 hours in 2016 could I begin to comprehend that statistic. No wonder a large swath of China’s urban markets is sinking.

Lyrical Adjustment

I’m fairly sure I’ve translated Neil Young’s song lyrics for “Tell Me Why” in the title of this post incorrectly by substituting “repay” with “repaint” – But I can’t “unhear” “repaint” and I think it proves there is a real estate angle on every item in the news. In that 2006 Bloomberg piece teasing my knack for converting any news story to a real estate-related story, is behind their paywall. They were citing my 2006 blog post “I Must Not Think Bad Thoughts: Plane Crashes Into Manhattan Condo” now, barely legible, because it is full of obsolete HTML code as I wrote that piece 18 years ago!

All three YouTube video versions of the Neil Young song are worth watching in their entirety:

Neil Young: Tell Me Why (Official)

Neil Young: Tell Me Why (Live at Massey Hall 1971)

Neil Young: Tell Me Why (Norah Jones Tribute)

Did you miss yesterday’s Housing Notes?

July 22, 2024

Not Updating Your OS since 1993, like Super Low Mortgage Rates, Really Pays Off

Image: Chat & Ask AI