Time to read [7 minutes]

Takeways

- Tariffs are a tax on Americans, driving inflation and keeping mortgage rates elevated

- The Supreme Court is expected to overturn the administration’s tariffs as unconstitutional, which could help lower mortgage rates in a struggling US economy

- Tariffs have reduced housing affordability, yet their implementation lacked a tangible strategy

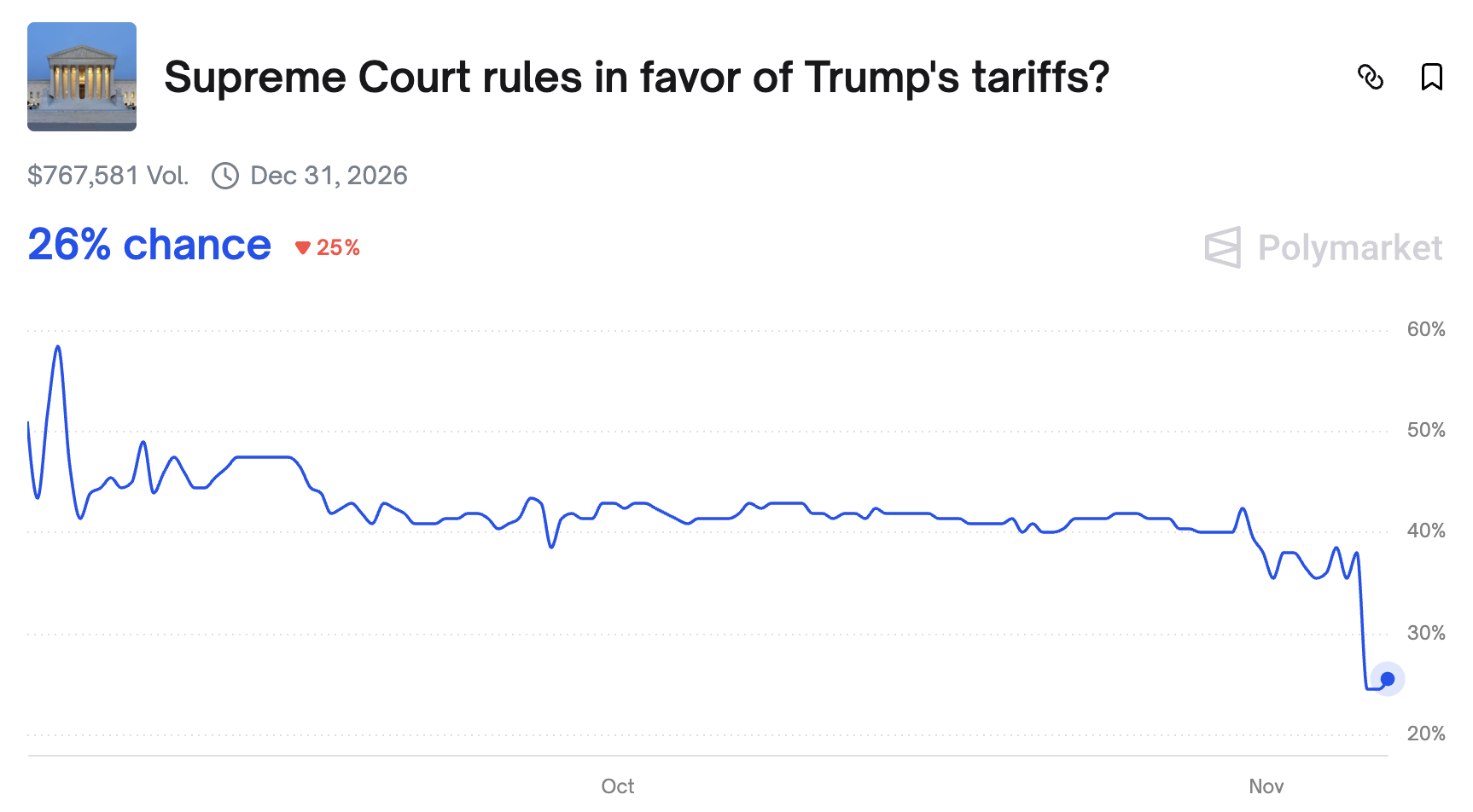

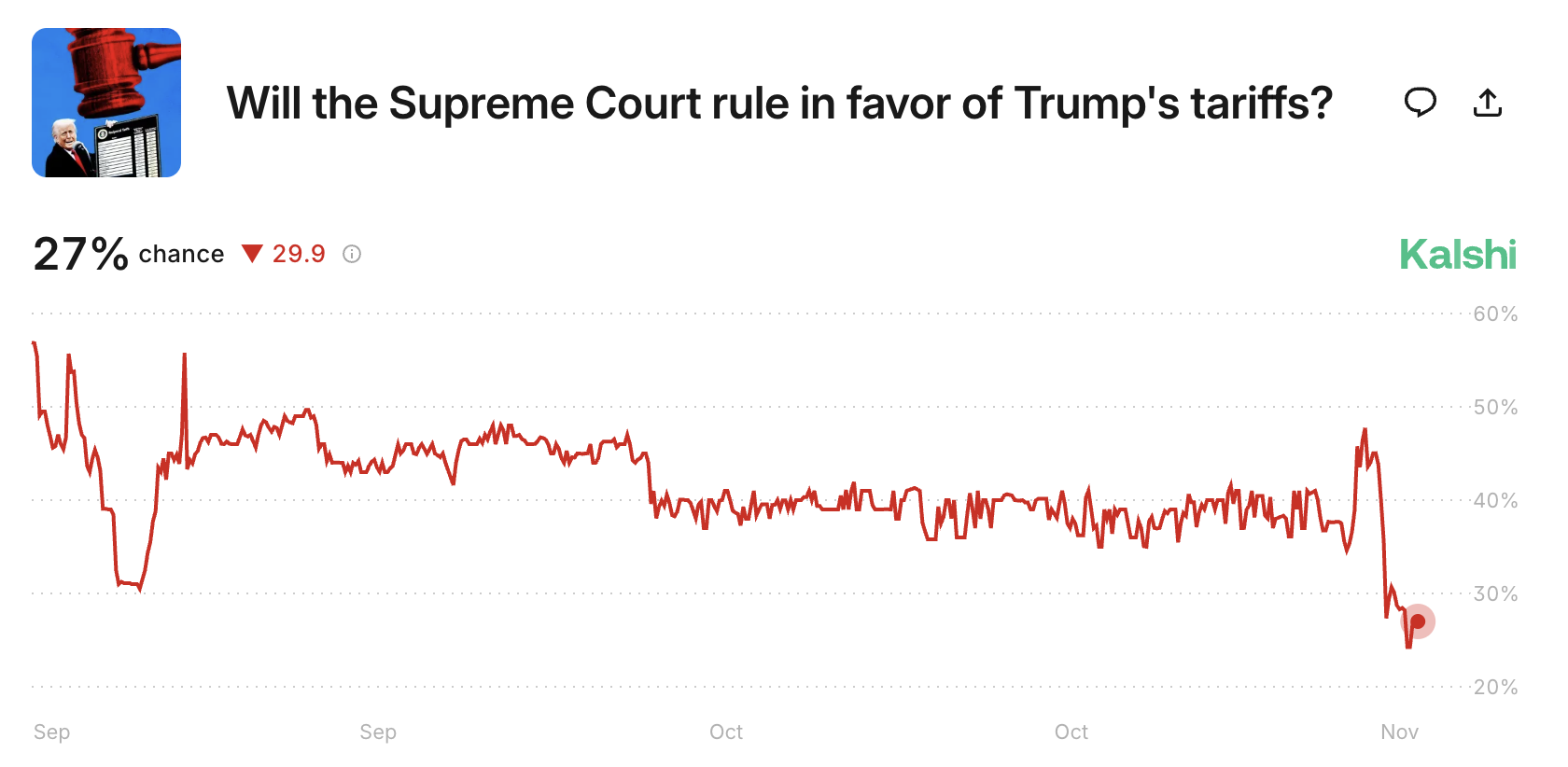

My friend Barry Ritholtz just published a great read over at the Big Picture: Tariffs Likely To Be Overturned… which really got me thinking. I’ve been grousing about tariffs even before Liberation Day last April. In fact, I’ve written about tariffs at least ten times this year. Tariffs are inflationary because they are a tax on the American consumer. I’ve shared the following example before, but because it is so clear, it is worth repeating. One of my sons works at a firm that orders fabric from China for its products. The individual shipping containers full of fabric cost about $400,000 each. The tariffs add another $250,000 to the cost and will be passed on to consumers in the form of higher prices. That’s a clear example of why tariffs are inflationary. The country of origin generally doesn’t pay the tariff. Because tariffs function as a tax, the US Constitution says that only Congress has the authority to issue them to prevent the very thing that is happening now. Betting markets suggest there is a better-than-even chance the Supreme Court upholds the lower court’s ruling against the administration’s tariff policy.

It Is Not “Political” To Talk About Tariffs

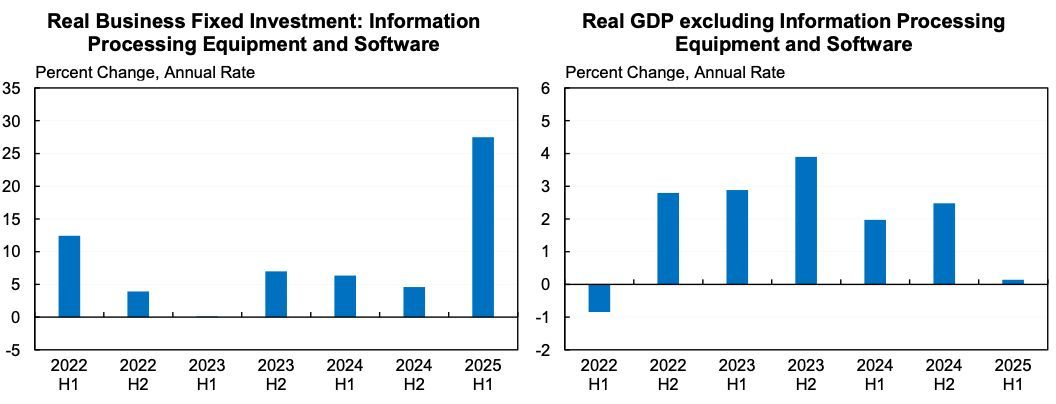

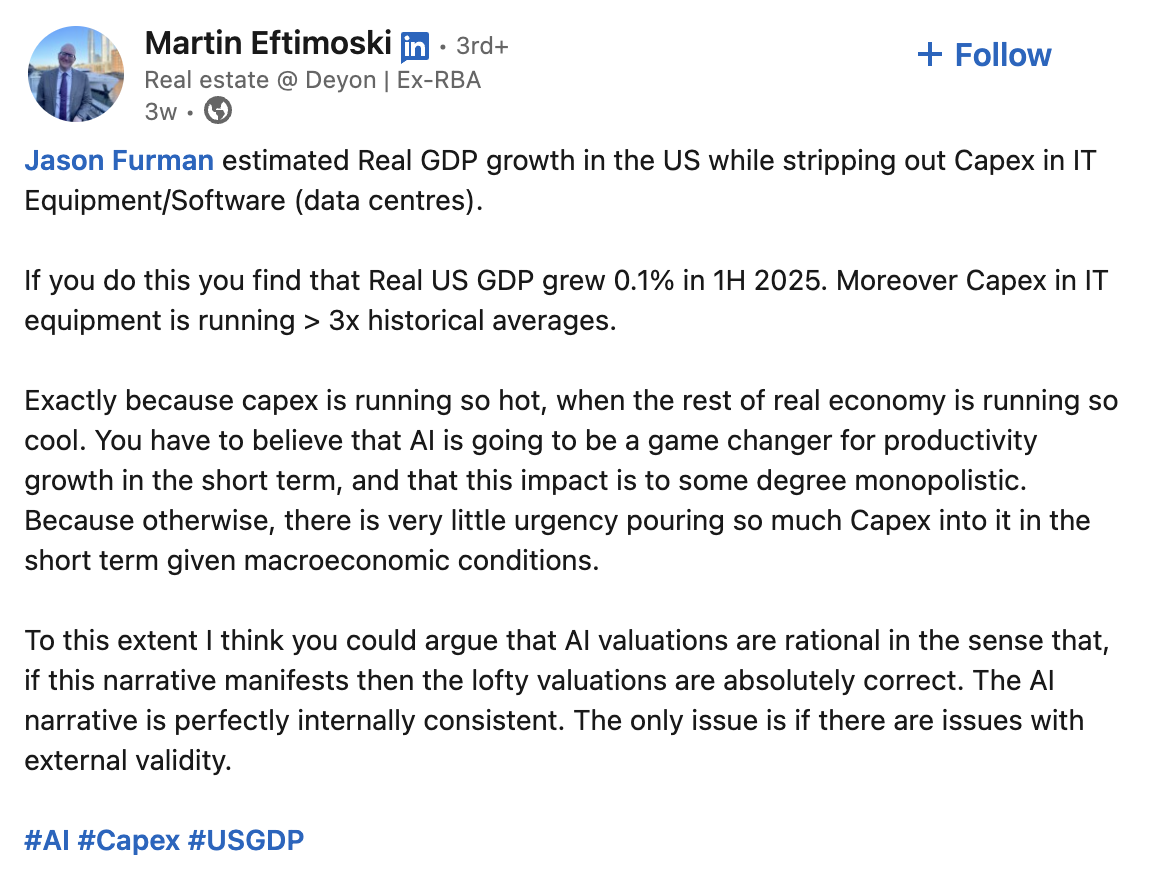

When I initially broached the subject of tariffs earlier this year, I had a few readers asking me not to be so “political” by discussing them, despite the adverse economic impact on the housing market, higher interest rates, and damage to the supply chain. While I appreciate a few readers sharing their thoughts, I plowed ahead. I’m only writing about tariffs again because the Supreme Court will likely affirm the Appellate Court’s decision: tariffs in their current form are unconstitutional. But that’s not even considering the significant damage tariffs have already inflicted on the economy. According to The Tax Foundation, tariffs have added $1,300 in costs per household in 2025 and will nearly double to $2,000 in 2026. Removing AI investment from the economy paints a more accurate picture of the economy’s health and makes a stronger case for lower interest rates, which the Fed is grappling with now.

Oh By The Way, The Current Tariffs Are Unconstitutional

When Chief Justice John Roberts asked who ultimately pays the tariffs, U.S. Solicitor General, D. John Sauer, appointed by the current president, responded that Americans do pay 30% to 80% of the tariffs but said there is no empirical basis to say Americans entirely bear the tariffs; instead, the cost is shared between foreign producers and American consumers, suggesting a “mix” of who pays. However, some justices challenged this view, arguing that tariffs are taxes that extract money from Americans’ pockets and deposit it into the U.S. Treasury, a power constitutionally reserved to Congress. The administration has sold the tariff concept as a way to pay down the federal deficit and eliminate income taxes, yet that would contradict the rationale for claiming they have emergency powers and can take authority from Congress.

Tariffs Influence Home Mortgage Rates Higher

…or keep them from falling as much…

Tariffs as applied worldwide are inflationary and have made the Federal Reserve’s job more difficult. Since Liberation Day, the US economy has nearly stalled. As I mentioned earlier, in the first half of 2025, GDP grew by only 0.1% if AI Capex (investment in AI) was excluded from the economy’s calculations, as noted above in the charts. In other words, the economy is slowing quickly, but tariffs are also putting inflationary pressure on it.

Unlike during the pandemic, the inflationary pressure is now cost-based, not revenue-based, which makes it even worse. The latter was experienced during the period coming out of the pandemic, when employers could justify paying workers more because they had more revenue coming in to offset higher costs. Now the costs are higher without a revenue increase, an unforced economic error devoid of any tangible strategy.

If that decision is made, mortgage rates could fall below current levels, crossing below the 6% threshold. There could be a tremendous uptick in housing demand from pent-up demand alone, just from the symbolism of falling below the threshold.

Mortgage Rates Are Stuck For Now

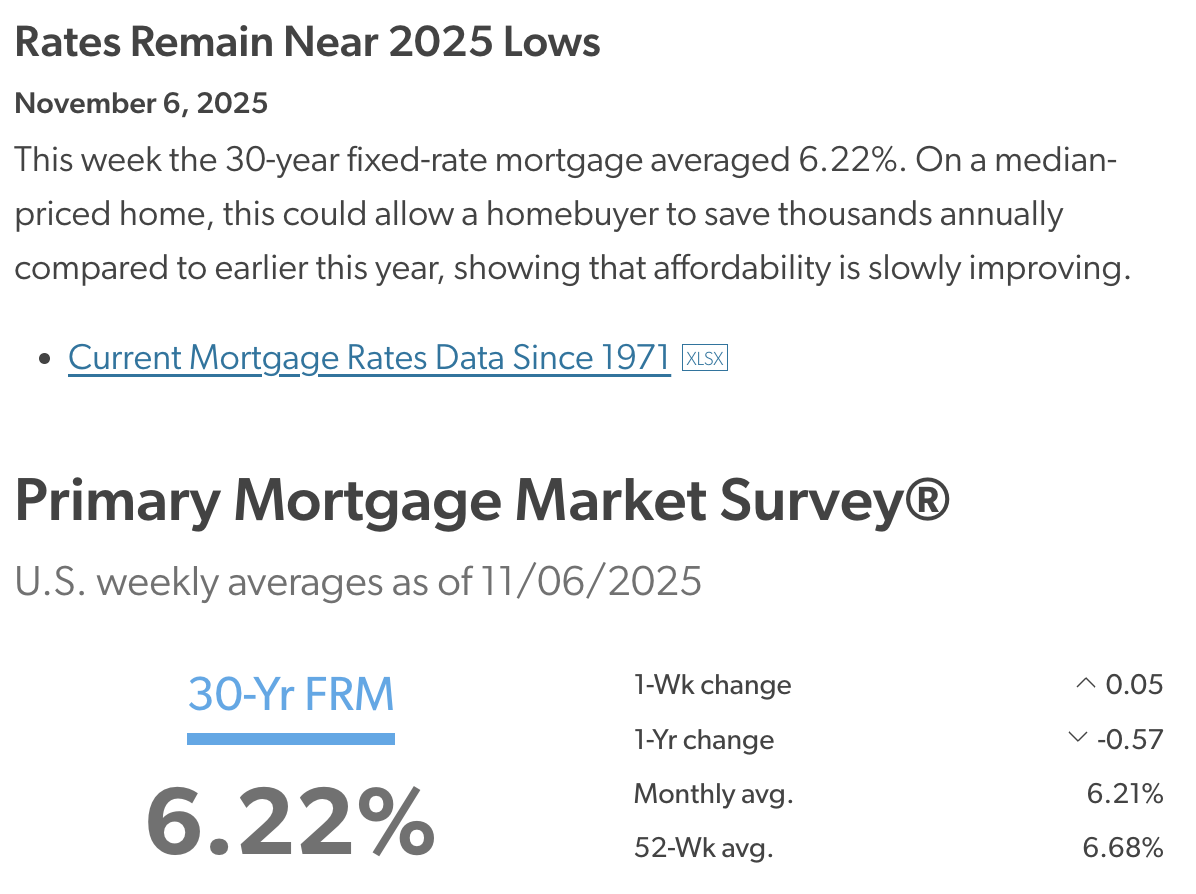

Freddie Mac announces the national average for mortgage rates every Thursday. It is easy to forget that GSEs Freddie and Fannie (I go by these nicknames because I feel connected to them, hah) are in the business of promoting mortgages, which you can see in the headline below: Rates Remain Near 2025 Lows.” Freddie describes rates as falling when the numbers go down a few tenths, yet remain vague when they go up by a similar amount, like we saw this week:

Yet mortgage rates increased this week for the first time in four weeks, as reported by Bloomberg. The difference in messaging is significant. As I tell my grad students all the time, the source of information is just as important as the information itself.

Final Thoughts

The Supreme Court appears ready to overturn current tariff policies as unconstitutional, reinforcing that tariff authority belongs to Congress, not the president. However, there are no guarantees, and rescinding tariffs at the current scale would be unprecedented. The tariffs have increased inflation, raised mortgage rates, and dampened economic growth, with the potential for rates and housing demand to improve if the court strikes down the current tariffs.

If tariffs are ruled unconstitutional, the government may have to pay back the money it collected illegally. Imagine the litigation and class action lawsuits that would follow. Wow.

What’s maddening about all of this is that there was never a fundamental understanding of what a tariff is by the administration and there was no central strategy. A reminder that tariffs are always a tax on the American consumer.

I hope the Supreme Court does not disappoint us, indirectly enabling lower mortgage rates to reinvigorate the housing market.

The Actual Final Thought – Something that needed to be said about affordability besides tariffs.

Home Value Lock, Powered By StreetMatrix

The StreetMatrix housing index platform that we have created powers the Home Value Lock product that Josh Altman talked about today. We are fortunate to have Josh join our team.

StreetMatrix Arrives In California

Here’s the latest newsletter with links to all our resources. More specifics on this effort to come!

Did you miss the previous Housing Notes?

Housing Notes Reads

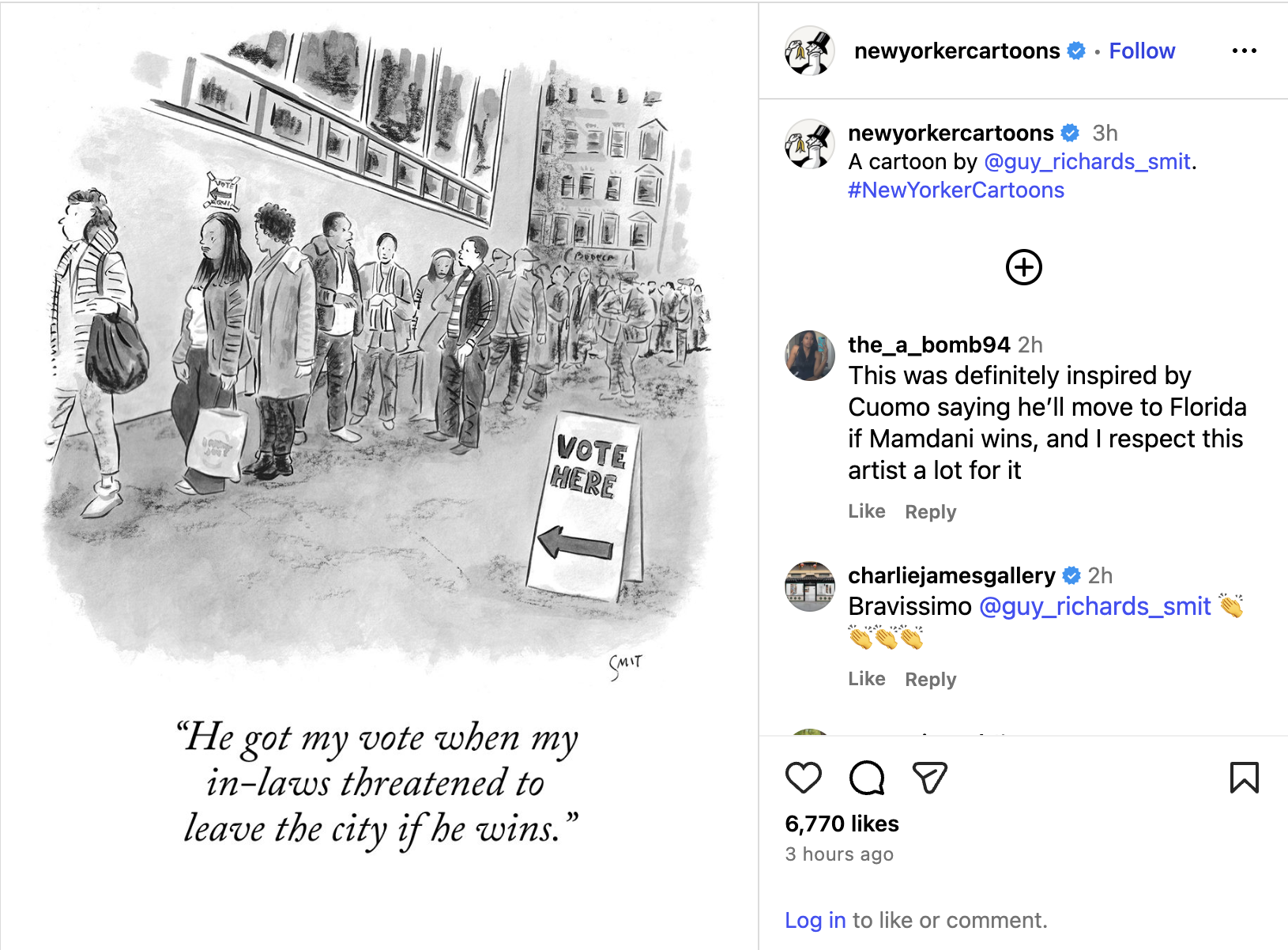

- No, 1 in 11 New Yorkers will not move if Mamdani wins [pbump.net]

- Big Spenders Are Keeping the Party Going in NYC [WSJ]

- The battle for New York [The Economist]