Taking Inventory Of 2025: Despite High Mortgage Rates, Housing Prices (And Sales) Expected To Rise

Most Housing Analysts Think Home Prices Are Going Up In 2025

Big Banks And Wall Street Are The Most Bullish On Housing Prices

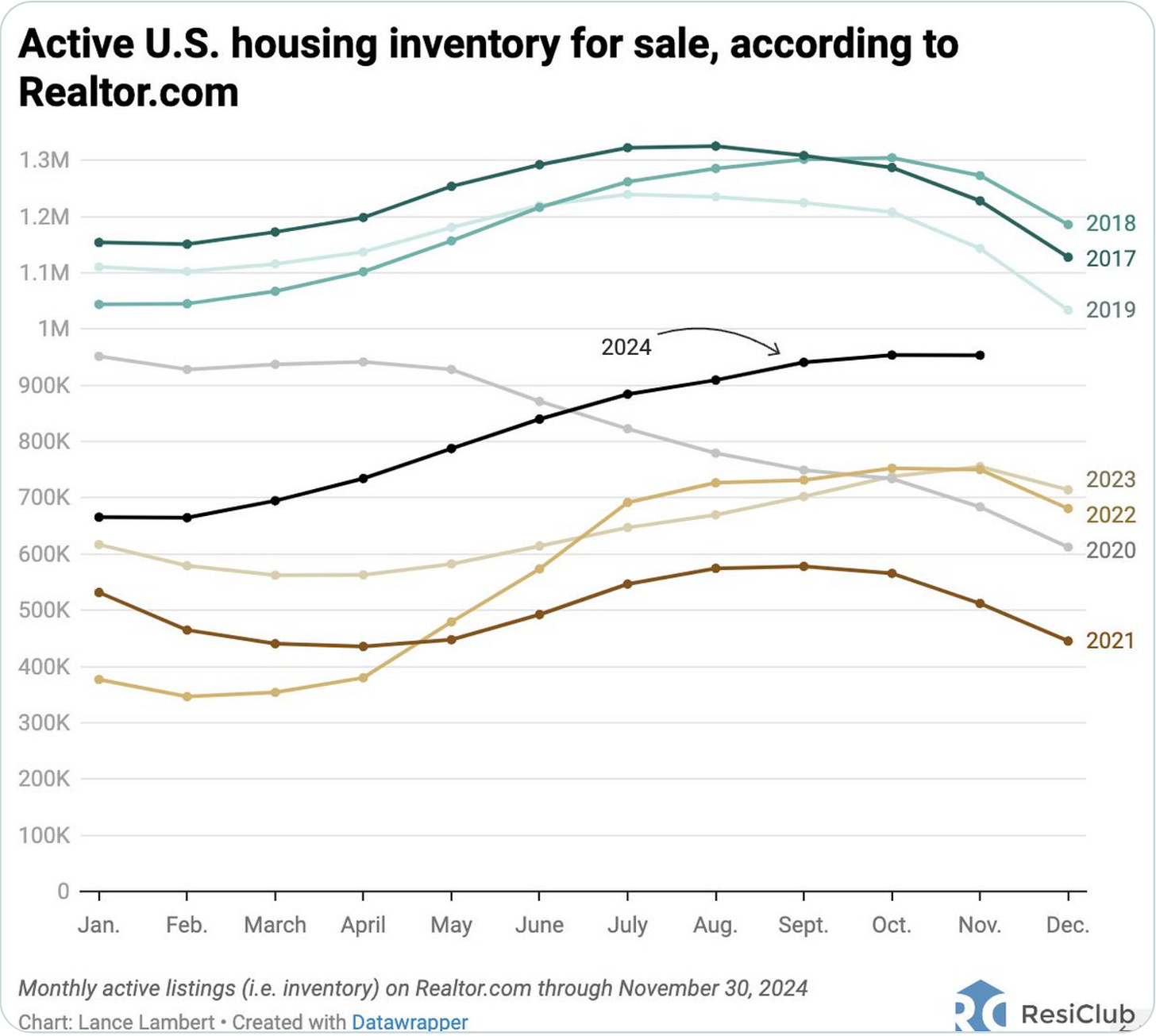

Inventory Continues To Be A More Powerful Price Influencer Than Mortgage Rates

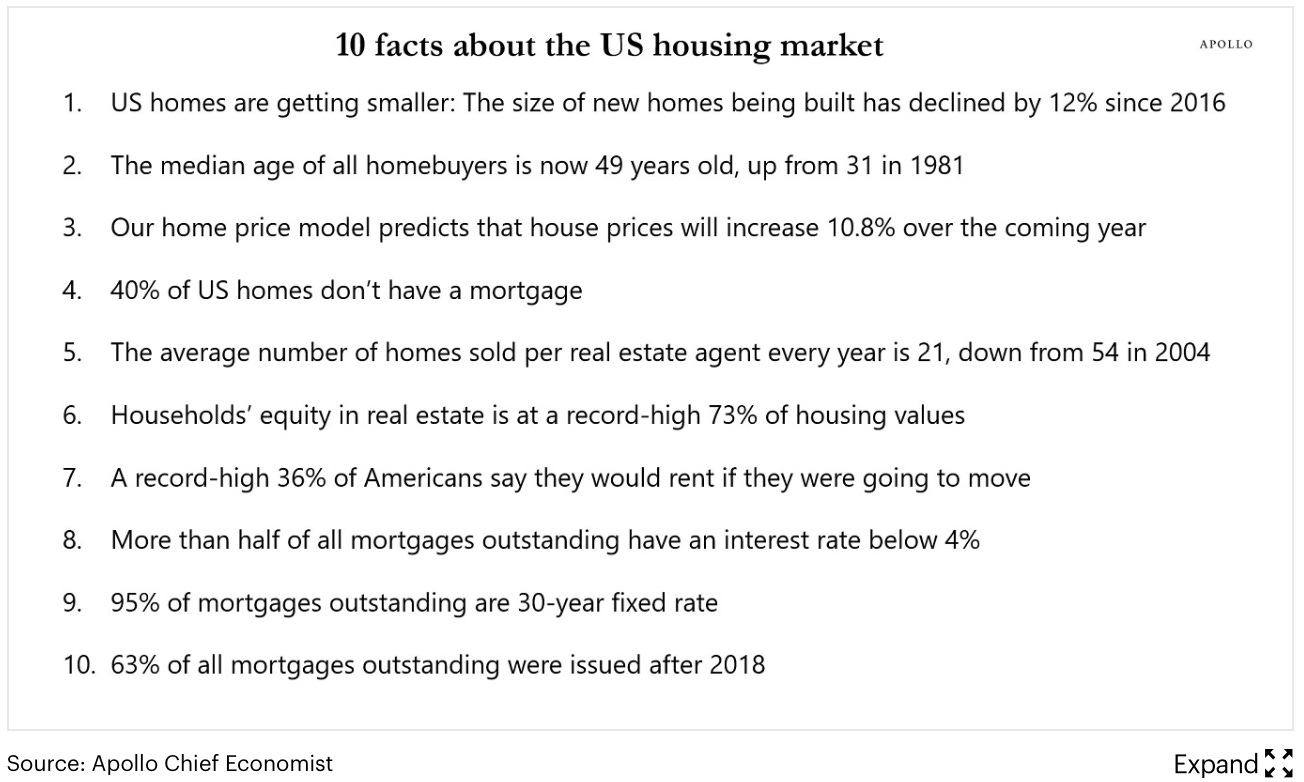

Lance Lambert of ResiClub – one of the best residential housing market analysts around – dug in and found a bunch of housing price forecasts for 2025. The bottom line is that all major economic commentators except Moody’s think next year will see higher home prices (the U.S. aggregate). As it turns out, higher-than-expected mortgage rates continue to take a back seat to continued listing inventory challenges. Apollo’s Slok was the most bullish on housing prices with a 10.8% forecast. I thought it was weird that Redfin avoided a formal forecast after crushing Zillow with real estate market analysis coverage in 2024, especially as Zillow continues to do this. The home price forecast results are helpfully summarized below:

Thinking About Why Big Banks Are Bullish On 2025

Freddie Mac emphasized listing inventory in their November “Economic, Housing and Mortgage Outlook.” They shared this fascinating chart, showing how much mortgage rates have climbed since the first 50-basis cut in September, inferring a more robust economy is anticipated in 2025.

I grouped most of the above forecast list to provide another way to look at them:

Big Banks +4.8%

Wall Street +6.07%

Trade Groups +1.75%

GSEs +2.1%

Data +3.6%

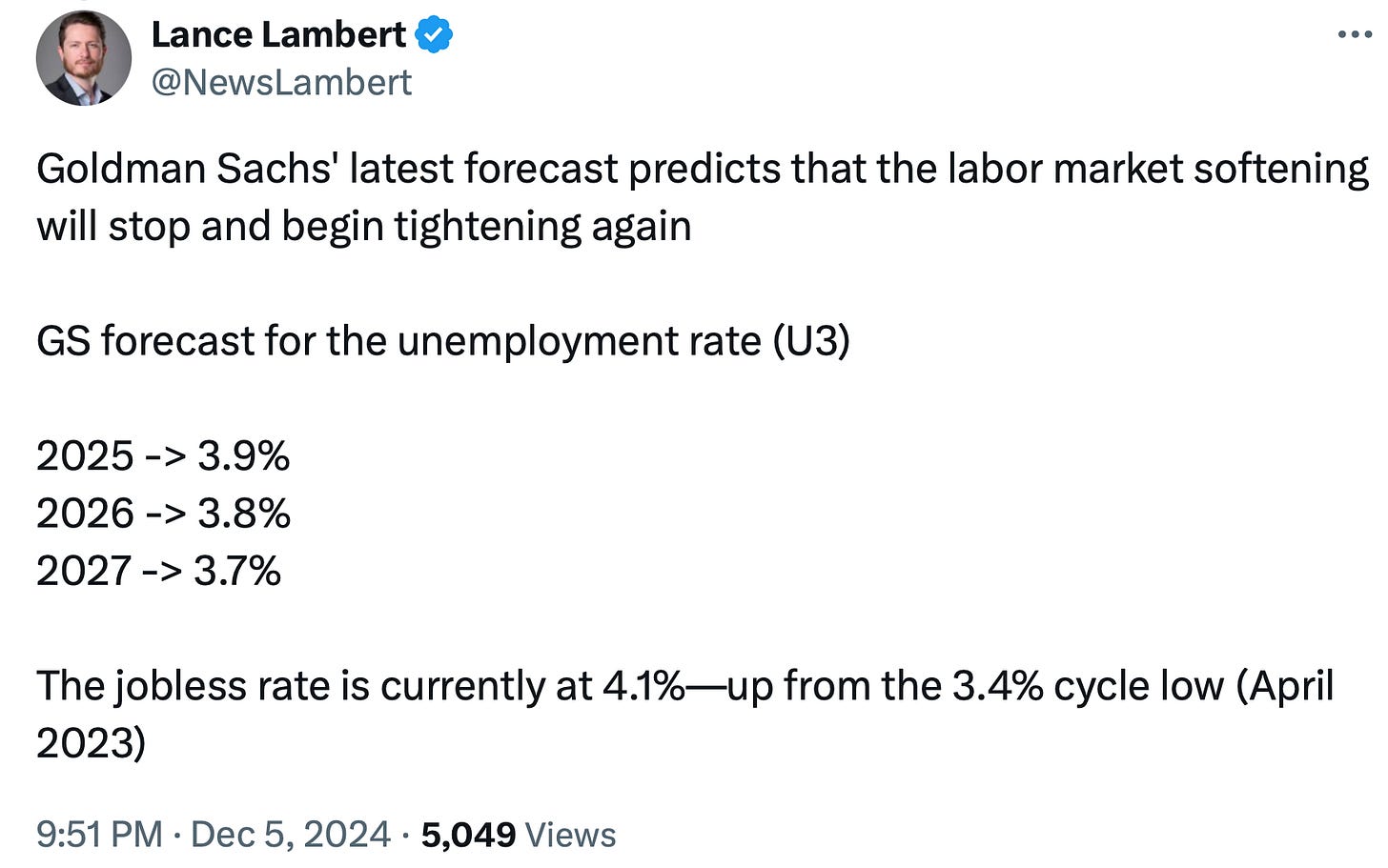

Big banks and Wall Street see much more housing prices upside than the remainder of the prognosticators next year. This is likely because recession fears have waned and a soft landing is happening right now. This may be the reason banks seem more optimistic in their commentary about lower mortgage rates next year, which would mean more sales and upward pressure on housing prices. They don’t seem as concerned about the expected widespread use of inflationary tariff policy as the cornerstone of the new presidential administration’s economic policy.

Apollo Sees Big Jump In Housing Prices For 2025

Torsten Slok is also one of my favorite housing market analysts. Slok pumps out a lot of analysis in his free newsletter – here’s something to ponder.

Goldman Thinks Labor Market Will Tighten Again

Tightening labor will keep wages elevated, and improve the odds that demand for housing will rise in 2025.

And listing inventory is expanding which should enable more home sales. But the state of listing inventory can be a bit complicated as talked about by The Real Deal in Does NYC actually have a housing shortage, or just a lack of good inventory?

Final Thoughts

I said this at a recent real estate event and while nobody really knows what “normal” means in the context of living in today’s world, I stand by my Goldilocks depiction of 2025 (for now).

Of course, when you dig into the numbers, Zoom isn’t always reliable.

Did you miss the previous Housing Notes?

December 4, 2024

Tiny Homes Are Affordable When The Land Is Free

Image: Grok