- Implementation Of Tariffs Potentially Push The Dollar Higher

- The Dollar Has Risen Since 2007 As International Demand For U.S. Housing Fell

- International Housing Demand Replaced By Domestic Migration Demand

After nearly 40 years of appraising residential property in Manhattan, I’ve observed that there is a demand baseline of about 15% international buyers, but their concentration can triple when the U.S. dollar (USD) weakens as “currency play” kicks in. Condos tend to dominate purchases because co-ops are a form of ownership that is not universally understood outside of the U.S. And 1-3 family houses are a high-end niche market that only represents about 2% of Manhattan residential sales. A strong USD means that international buyers see much less of a discount (currency play) in their U.S. purchases, holding back demand. And tariffs have the potential to reduce international demand by helping make the USD stronger. Incidentally, my pal Barry Ritholtz once told me that placing the term “gold” in a blog title is SEO “gold,” so I just did. Of course, I’ve been in Manhattan residences with a lot of gold leaf trim, but that’s not the gold I’m talking about. More on that later.

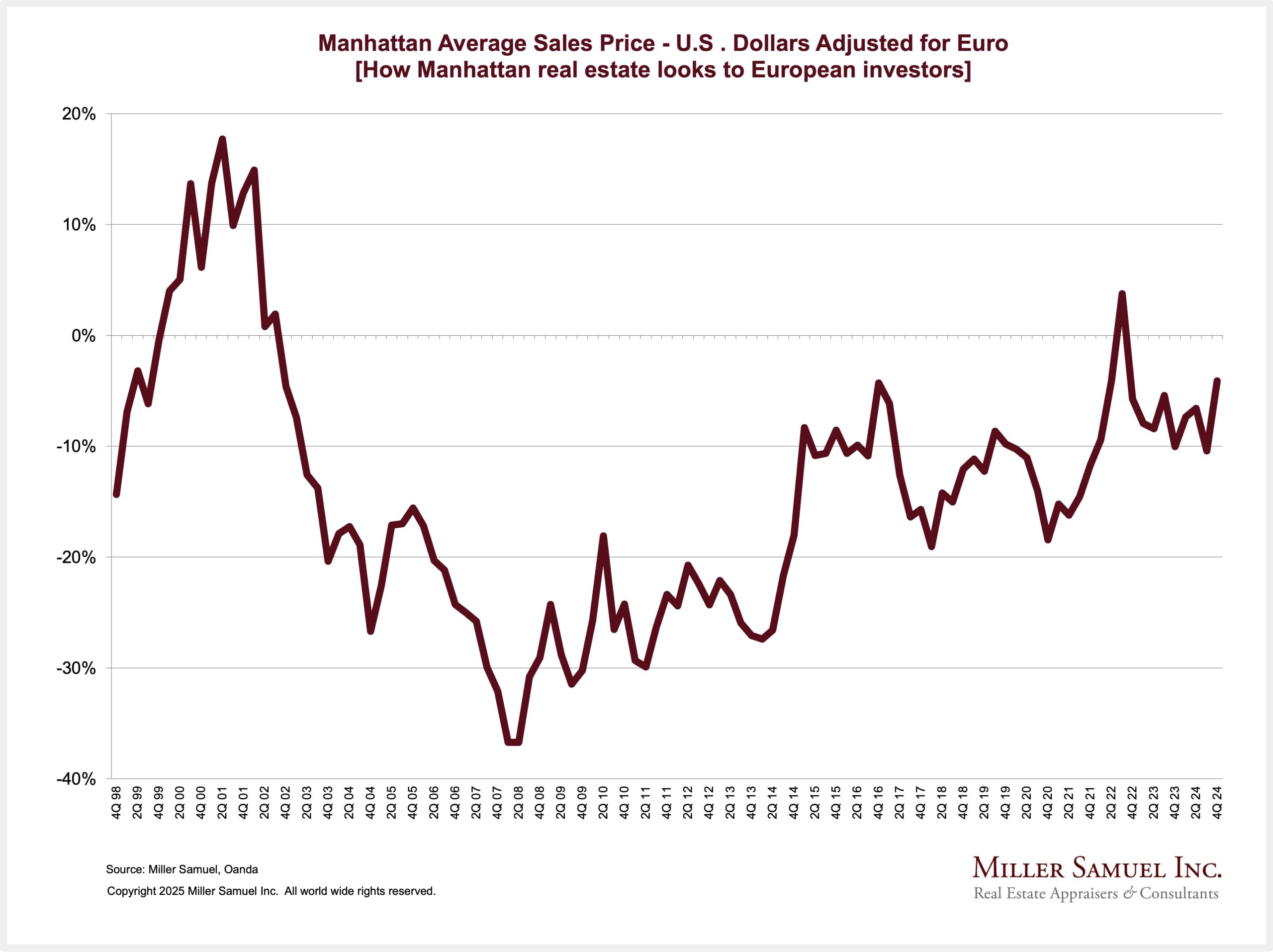

The above chart shows how much of a discount (currency play) a European buyer of a Manhattan property would enjoy. Simplistically it follows that the bigger the currency play the higher the international purchase volume. Manhattan international purchase demand was at its last peak about 2003 to 2014 when discounts were at their highest levels. However the USD has been trending higher ever since and the new administration is relying on tariffs as their centerpiece of economic policy which should push the USD even higher.

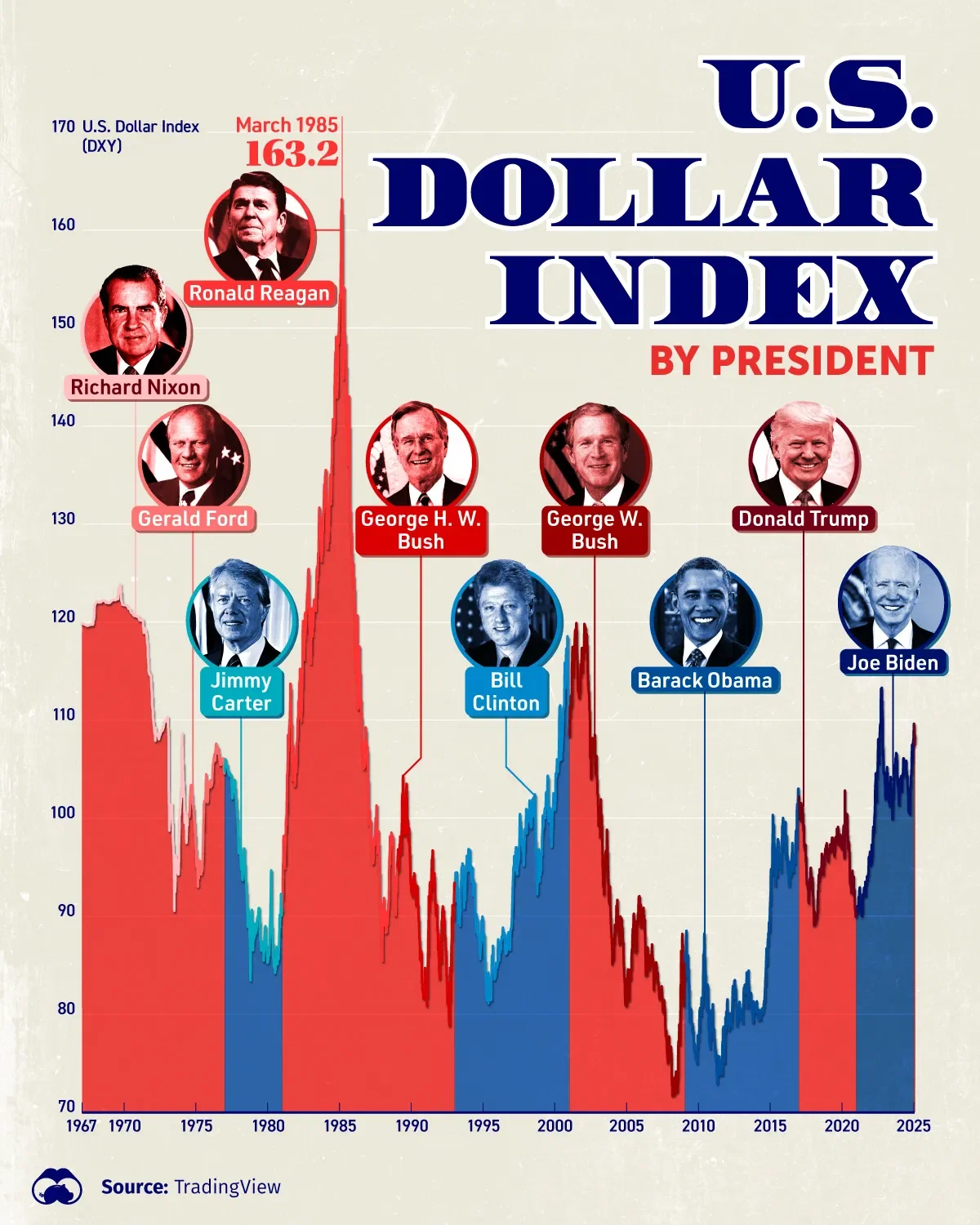

I stumbled into the above chart recently. We didn’t launch our appraisal firm until 1986, at one of the highest periods of the USD’s relative economic strength to the rest of the world (but who knew?!?!). But by the early 1990s the USD weakened significantly and then fell even further by 2007. International demand dominated the U.S. real estate conversation back then.

Irish Carpenter Syndrome

I wrote about the Irish Carpenter Syndrome last fall but with the proliferation of new tariffs in the new year, I wanted to explore what this might do to USD and subsequently the impact on U.S. residential real estate sales by international buyers. Be sure to check out my discussion in that post about the Manhattan Centria condo that looks directly at the Christmas tree in Rockefeller Center.

but I digress…

Regional markets that I cover in my U.S. market report series that were once known as favorite targets of international demand include Manhattan and Miami. Both are not seeing excess international demand right now because of the strength of the USD is removing any currency play (you’ve noticied by now that I love saying that phrase). Domestic migration seems to be the story coming out of the pandemic. In fact, I call New Yorkers the new “foreign buyers” of Florida real estate. Yet that has nothing to do with the USD and everything to do with the “SALT” tax and WFH.

Short-Term Vs. Long-Term Tariff Impacts

Admittedly the following conversation is a little beyond my comfort level but in the short-term, tariffs are expected to strengthen the USD and potentially weaken it later on. I’ve written about tariffs before and their threat to the housing market (higher interest rates). Tariffs have their purpose, but not when there is an overall expressed desire to lower mortgage rates. This is because tariffs tend to stimulate inflation, keeping interest rates elevated. As proof, inflation expectations have already increased since the beginning of the year. The constant threat of tariffs made against other countries will shift capital into short-term U.S. assets for safety. That’s why there has been a regurgitation of gold talk for the last couple of years – and there is a lot of related crazy talk. When a country is targeted for tariffs by the U.S. they tend to see their currency weaken. Maybe it is time for U.S. investors to think about buying second homes in Mexico or Canada?

International Demand Of Residential Real Estate

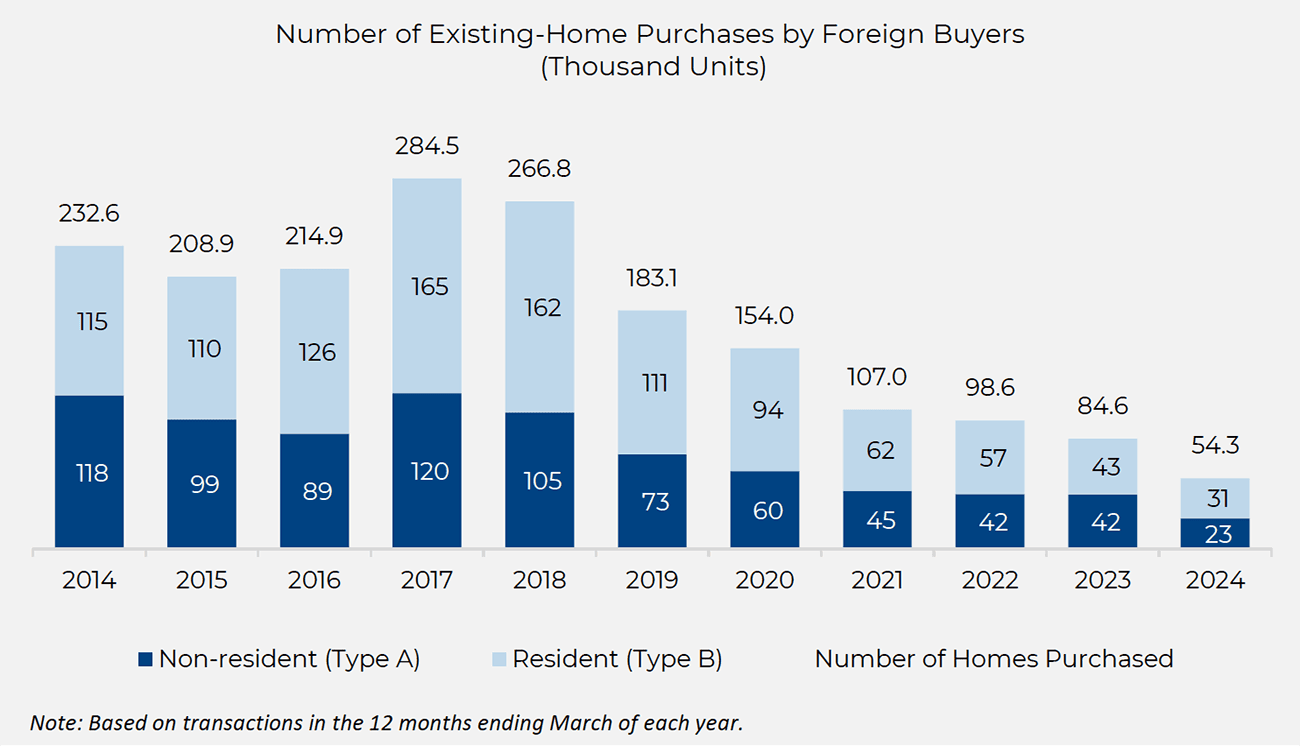

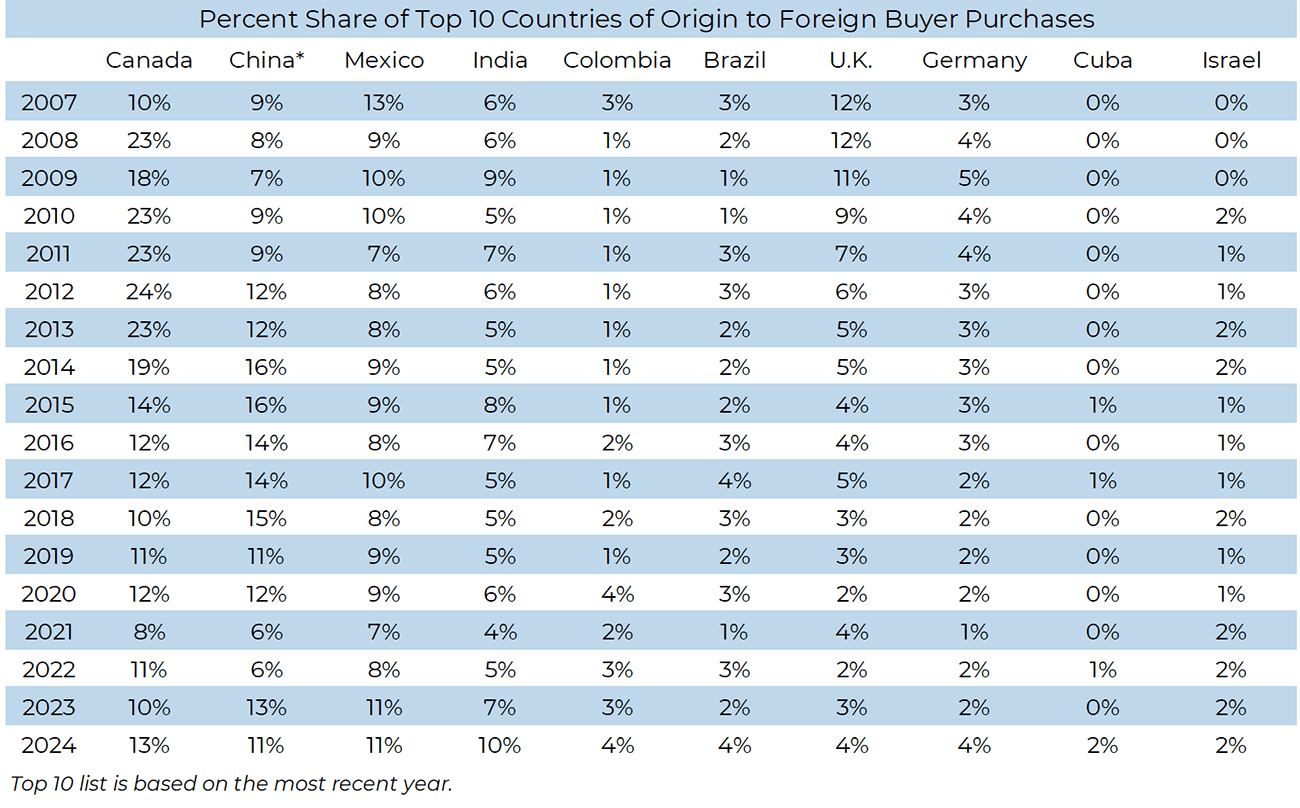

NAR publishes one of the only periodic annual studies on international demand of U.S. real estate but we all know that surveys are lame, credibility-wise. The USD bottomed in 2007 so I assume NAR got the idea to track it shortly thereafter in 2009 thinking it would be another source of happy housing news. But unfortunately for NAR the USD has been rising every year since, restraining international demand of US properties nearly every year. The most recent report was issued last summer and it showed that annual foreign investment is the lowest since NAR began the survey in 2009. That’s been largely my anecdotal experience in Manhattan and Miami as well.

The above chart suggests that international demand for U.S. residential properties will be lower in 2025 as the USD strengthens further. There are a couple of report details I found interesting:

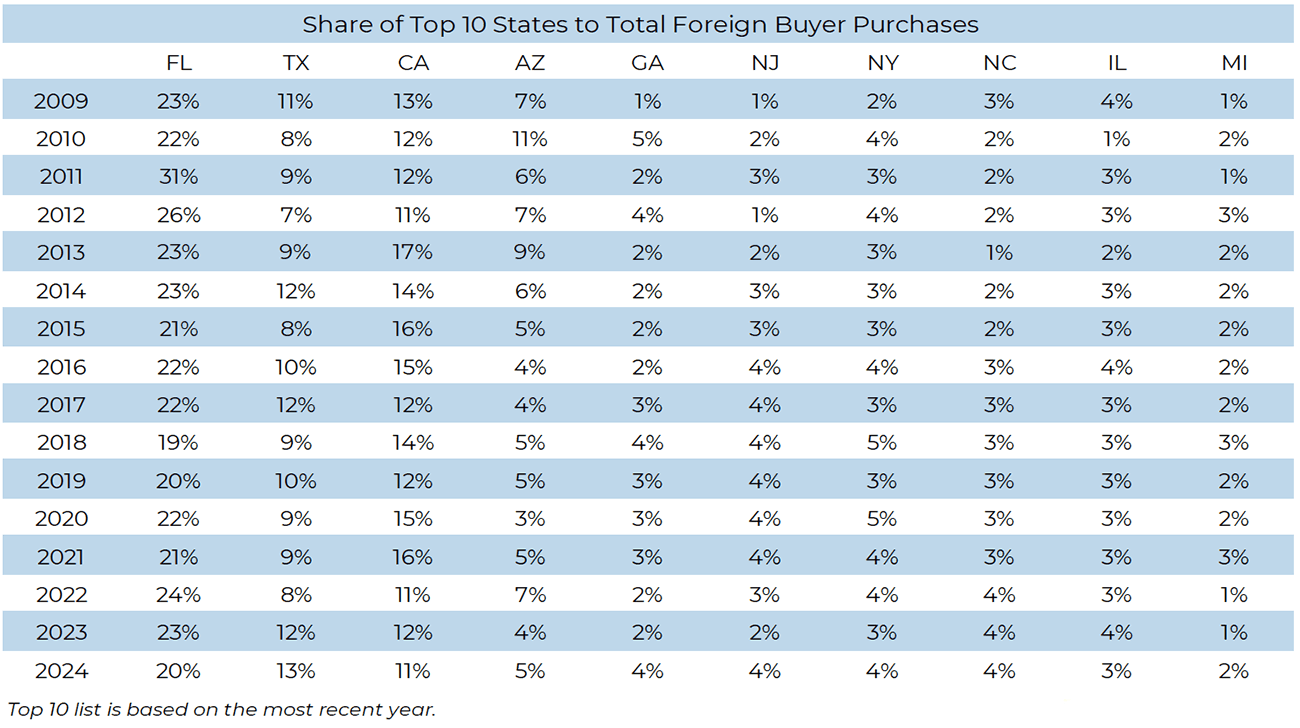

-NAR’s list of top ten states with the highest share of foreign buyer purchases. Florida is the biggest recipient of foreign buyer purchases. Incidentally, I believe NAR has very limited data on Manhattan housing so it surprised me how low their percentages are in the context of the U.S. market (REBNY is not a member of NAR).

-NAR’s study lists Canada as the number one source of international buyer but demand is slipping already (and so is Mexico). A tariff war will probably reduce their demand for our real estate. Why does this matter? U.S. sales over the past three years, since the steep ascent of interest rates, have fallen well below long-term normal levels.

Final Thoughts

This has been a thought exercise on the relationship between the rising USD and international demand of residential real estate. Foreign demand of U.S. residential real estate has been falling since 2009 and I’m not suggesting that the story is all about tariffs. I’m making the point that tariffs make an already weak trend for U.S. real estate even weaker.

Its fairly simple:

- The USD has been rising since 2014 after bottoming from 2006-2014 and is expected to rise further in 2025 due to anticipated tariff policies.

- The higher the USD against other currencies lowers the demand for U.S. residential real estate by international buyers because the effective discount is sharply reduced. U.S. demand by international investors has been falling since at least 2009 per NAR.

- The long term impact of heavy reliance on tariffs has the potential impact of damaging the U.S. economy that will lead to job loss. The CEO of Ford already anticpates layoffs with the possible April 5 implementation of auto industry tariffs with Canada.

The Actual Final Thought – step back and think like this man does. He is able to clearly differentiate between knowledge and wisdom. And yes, tomatoes are technically a fruit and only through an act of Congress are they legally a vegetable.

Monday Mailboxes, Etc. – Sharing reader feedback on Housing Notes.

There were a lot of great insights shared by my dear readers this week. Thanks!

February 19, 2025: Housing Didn’t Crash At The DMV

- I’m actually seeing fewer active listings now compared to the beginning of the month. We might eventually see the surge in sellers but for now it looks like uncertainty might be causing people to pause on big decisions.

- Good commentary. The truth is getting harder and harder to uncover and now that federal government won’t be keeping actual statistics, 80 years of numbers will be out the window with a big black hole in the middle. And that’s it we ever come back to it. Keep the faith. I’m trying hard, too.

- This week, all cash buyers (retired) in the $4M price range who I’ve been working with since June, just told me yesterday that the current chaotic climate is making them reconsider a purchase. They may continue to rent.

February 17, 2025: Werewolves Of High-End Housing: You’ve Already Let ‘Em In

- The top 1% predominantly own equities because there’s only so much “scale” to real estate investing and equities are also more liquid and lower overhead. Over the long term, equities are a better investment so rich people only buy as much real estate as they need.

Did you miss the previous Housing Notes?

Housing Notes Reads

- Tracking Manhattan Apartment Prices: It Comes Down to Condos vs. Co-ops [NY Times]

- Is Anyone Using Their Tiny Balconies? [Curbed]

- [Terra Logic] Understanding The Value of Manhattan Apartment Outdoor Space [Miller Samuel Real Estate Appraisers & Consultants]

- Manhattan Terraces Analysis [Miller Samuel]

- Bridgehampton Estate With Putting Green Sells for $16.65M [27 East]

- 7 Areas Where Probabilities of Errors Are Rising [The Big Picture]

- Annual Foreign Investment in U.S. Existing Homes Sales Decreased 21.2% to $42 Billion [NAR]

Market Reports

- Elliman Report: Manhattan, Brooklyn & Queens Rentals 1-2025 [Miller Samuel]

- Elliman Report: Florida New Signed Contracts 1-2025 [Miller Samuel]

- Elliman Report: New York New Signed Contracts 1-2025 [Miller Samuel]

- Elliman Report: Manhattan Decade 2015-2024 [Miller Samuel]

![[Podcast] Episode 4: What It Means With Jonathan Miller](https://millersamuel.com/files/2025/04/WhatItMeans.jpeg)