Some Critical Thinking About The Great American Mortgage Corporation’s Implicit Guarantee

Time to read [9 minutes]

The Administration Did An About-Face And Plan To Have A GSE IPO In The Fall

A Reduction Or Elimination Of Implicit Guarantee Will Raise Interest Rates

Consolidation Of The GSEs Is Probably Good, But Not During Peak Uncertainty

Let’s do some critical thinking for fun – but I need to warn you. Because this is a Washington, DC-directed post, it is chock full of acronyms. Fannie Mae and Freddie Mac, also known as the government-sponsored entities (GSEs), have been under conservatorship since 2008. They both got into trouble and were taken over during the housing bubble by the federal government to help stabilize the housing market. Last weekend, the president teased a potential GSE IPO in November to raise funds to offset the trillions of new debt brought about by the One Big Beautiful Bill (OBBB). I was confused by this sudden switch since the head of their regulator, the Federal Housing Finance Agency (FHFA), suggested back on July 25th that the GSEs would “likely” remain in conservatorship during the current administration. Why should whiplashed Housing Notes readers care about a sudden reversal at this moment? Because such a move could push mortgage rates 0.5% to 1% higher, with the potential loss of the “implicit guarantee” (IG). If the IG is removed or weakened, mortgage rates could rise because lenders would demand higher returns to compensate for the increased risk of lending without government backing after the GSEs move to the private sector. The administration is trying to thread the needle to keep the IG in place. Good luck.

Fannie Mae, The Bully

The Federal National Mortgage Association, nicknamed Fannie Mae or FNMA, was founded in 1938 as part of FDR’s “New Deal” program to help pull the US economy out of the depression. The creation of Fannie Mae served to stabilize the mortgage market by purchasing or guaranteeing mortgages. By letting a lender sell the mortgage paper to Fannie Mae, it could free up capital to issue more mortgages, which would help the economy and increase home ownership. I think of housing as local and mortgages as national. The federal government privatized Fannie Mae in 1968 and expanded its involvement in mortgage-backed securities.

Fannie Mae had and still has an especially aggressive corporate culture despite a series of scandals beginning with one in 1992 that led to the creation of a regulator known as OFHEO. I chuckle whenever I recall the transition to the current regulator FHFA from OFHEO, since the only initial change to their website at the time was swapping out the OFHEO logo with the FHFA logo overnight. However, FHFA does have expanded powers but I still found it humorous. Ha. The current head of FHFA is Bill Pulte, the grandson of the founder of Pulte Homes, one of the nation’s largest homebuilders.

There were more Fannie Mae scandals in the early and mid-2000s. When I started blogging on the Matrix in 2005, I learned that Fannie Mae had hired virtually every public relations firm in Washington, DC, presumably to insulate their bad behavior from the public conversation. In 2008, control of both Fannie Mae and Freddie Mac was taken into conservatorship by the federal government when they failed during the housing bubble. During this period, Fannie Mae needed about $119 billion to become solvent and to date has paid that back plus an additional $62 billion. The problem leading up to their collapse is that Fannie Mae served two masters, the US taxpayer and their shareholders, an inherent conflict of interest.

Despite being under government conservatorship, I find them reckless within my appraisal profession, specifically, pushing to get rid of appraisers by placing outsized reliance on automated valuation models (AVMs) – think Zestimates – and creating data cancer. They aim to reduce appraisers to mere data collectors, leaving valuation to AVMs, an inaccurate valuation tool dependent on the quality of local public record. AVMs are better at estimating probabilities than generating specific valuations. There is a lot more to this story.

Freddie Mac, The Weaker Fannie Mae

In 1970, Congress thought it was a good idea to create a competitor for Fannie Mae, but it only created an adoring cousin that copies nearly every move Fannie Mae makes. As proof of their redundancy, the recent GSE IPO idea would likely merge Fannie Mae and Freddie Mac into one entity. In 2008, during the Great Financial Crisis (GFC), Freddie Mac almost collapsed and was pulled into conservatorship with Fannie Mae. Freddie Mac required approximately $75 billion in bailout funds, but has provided the US Treasury with about $128 billion while under conservatorship. I’ve long asked, what do we need Freddie Mac for if they’re not really a competitor to Fannie Mae?

The Implicit Guarantee

This phrase is crucial to the housing market. A government backstop equals lower interest rates. In other words, if an institution collapses like one of the GSEs, the federal government will bail them out. What happens when the GSEs move to the private sector and there is no government backstop?

The Implied Guarantee as discussed on Wikipedia:

“GSE securities carry no explicit government guarantee of creditworthiness, but lenders grant them favorable interest rates, and the buyers of their securities offer them high prices. This is partly due to an “implicit guarantee” that the government would not allow such important institutions to fail or default on debt. This perception has allowed Fannie Mae and Freddie Mac to save an estimated $2 billion per year in borrowing costs. This implicit guarantee was tested by the subprime mortgage crisis, which caused the U.S. government to bail out and put into conservatorship Fannie Mae and Freddie Mac in September, 2008.”

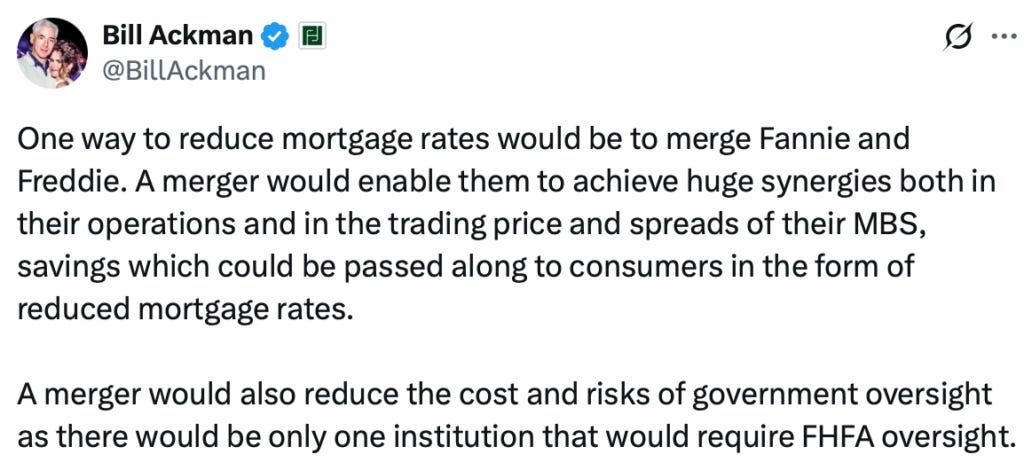

Here’s a contrarian take on the loss of an implicit guarantee from Bill Ackman, a billionaire Wall Streeter who is always shilling something he is investing in via social media. Disclosure: This made him a billionaire while I am not.

He says that this new entity will reduce mortgage rates. He’s in the minority and is describing the end result of the IPO as a regulated utility. Here’s what Grok says on Twitter (I know, I know).

“Privatization would pivot Fannie and Freddie from a public mission of ensuring mortgage liquidity and affordability to profit maximization for shareholders. This could lead to riskier investments, higher fees, and reduced support for low-income borrowers, potentially raising rates by 0.5-1% per analysts. However, retained government guarantees might mitigate some shifts, preserving stability if executed carefully.”

Final Thoughts: Why The Proposed GSE IPO Pushes Mortgage Rates Higher

I don’t understand why the administration would introduce further uncertainty into an already chaotic economic policy landscape at this moment. The move doesn’t serve the public good. Switching to privatization mode and consolidating the GSEs across a multi-trillion dollar bond market seems reckless at a moment when the economy is quite vulnerable. Here are some thoughts on why this IPO, if it happens this fall, could raise mortgage rates 0.5% to 1%. This happens if the implicit guarantee is softened or removed because lenders would demand higher returns to compensate for the increased risk of lending without government backing. Here is what could result after the GSE IPO:

Weakening or removal of the “implicit guarantee”

Uncertainty around the government’s role in the new private entity

Higher cost of capital for the new entity

Tighter lending standards will result without implicit backing of the federal government

Will probably need to have higher buffers of capital to raise

I’m not against the IPO in principle, or consolidating the two GSEs into one, but the timing is bad. The removal or weakening of the implicit guarantee will cause rates to rise and probably create a lot more volatility in the housing market. The following items skew interest rates and inflation higher:

The GSE IPO

OBBB

Tariff Policy

Daily Policy Uncertainty

For an administration hell bent on pushing interest rates lower to reduce the impact of the OBBB, they keep taking actions that seem to do the opposite.

The Actual Final Thought – We also need to do this in NYC. I’d get a lot out of it. If that doesn’t work, try an oldie but a goodie.

HGAR’s IMPACT: The Member Experience

I’m excited to speak at IMPACT: The HGAR Member Experience on September 29. I’ll be joining real estate professionals from across the region to explore what’s next in the housing market, economic opportunities and building community. Join me and be part of the conversation that’s shaping what’s next. Learn more and register.

[Podcast] What It Means With Jonathan Miller

The Think about ‘Trading Places’ But With Lower Mortgage Rates episode is just a click away. The podcast feeds can be found here:

Apple (Douglas Elliman feed) Soundcloud Youtube

Did you miss the previous Housing Notes?

August 8, 2025

The LA Palisades Market Is On Fire (Not Literally)

Image: Wikipedia