Time to read [5 minutes]

Takeways

- Seller Leverage Dwindles, Especially In Texas and Florida

- Surging Cancellations Tied To 2022 Rate Hikes And Uncertainty

- “Record” Rate Claim By Redfin Only Spans Nine Years

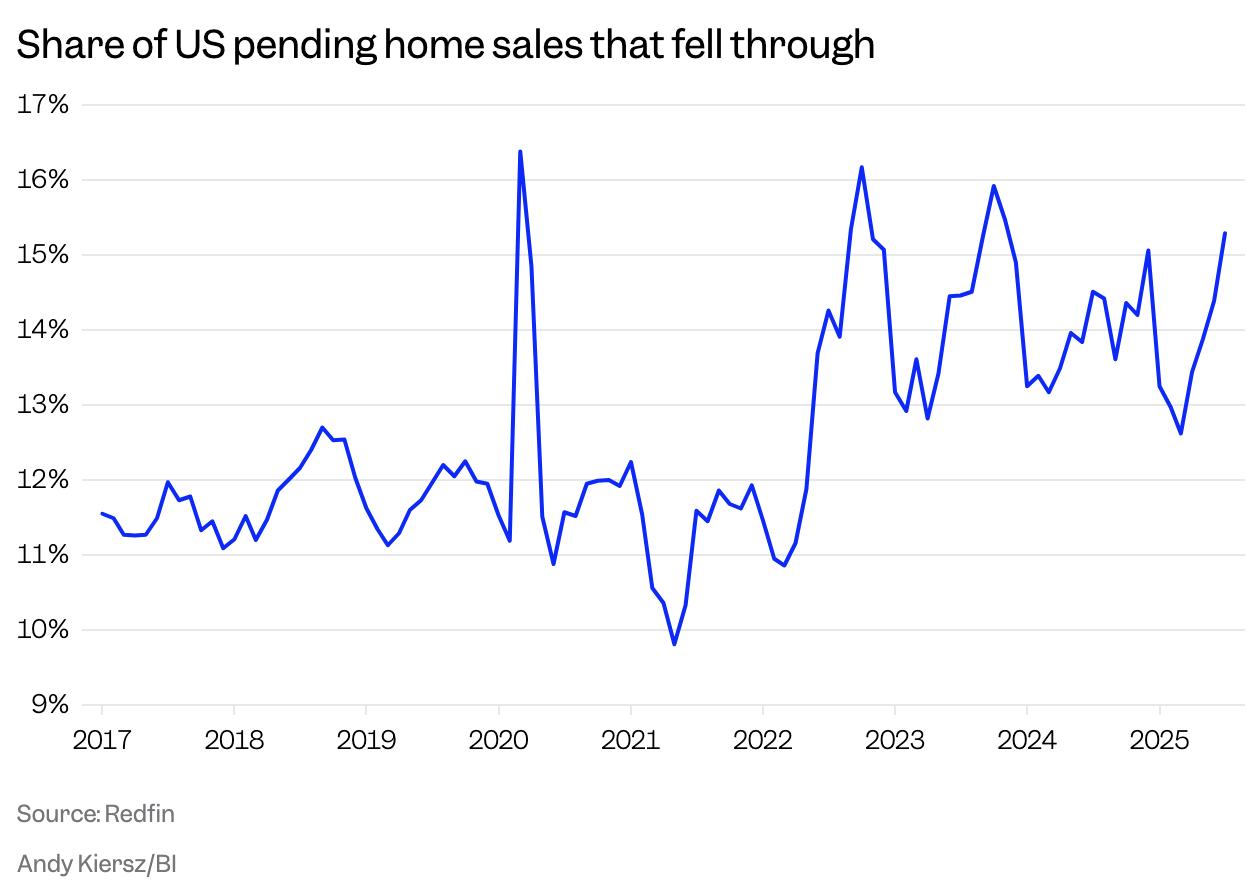

Business Insider has a good story on sales that fall through: Seller Beware. As inventory expands, sellers are losing their dominance in the transaction, and those slow to react to more competition will be disappointed. Nowhere is this more prevalent than in the Sun Belt, specifically Florida and Texas, which are now awash in a surplus of supply. What’s fascinating about the Redfin chart below is how the number of deals falling through correlates with the beginning of higher mortgage rates in 2022. Sellers had been enjoying complete control for years with unusually low mortgage rates. Also note my observation in this week’s What It Means Podcast titled “The Lowest or Highest on Record” that a lot of Redfin data history begins in 2017, so be wary of phrases in their previous press releases like “the highest in history,” or “the lowest in history,” or at a “Record Rate.” The latter references a 9-year window, so the term “Record” is being misused. Still, they’ve provided a valuable analysis to enhance our understanding of the current market within regions experiencing a greater supply.

Most Cancellations Found In Texas And Florida

About 15.3% of July home sales were cancelled in the US, but this figure is significantly higher in Sun Belt markets, such as San Antonio, Texas, with 22.7%, and Jacksonville, Florida, with 21.3%. Yet markets like Phoenix, which have a long, rich history of overbuilding, actually saw a 2.4% drop in cancellations year over year. Huh.

More Uncertainty Means More Deal Deaths

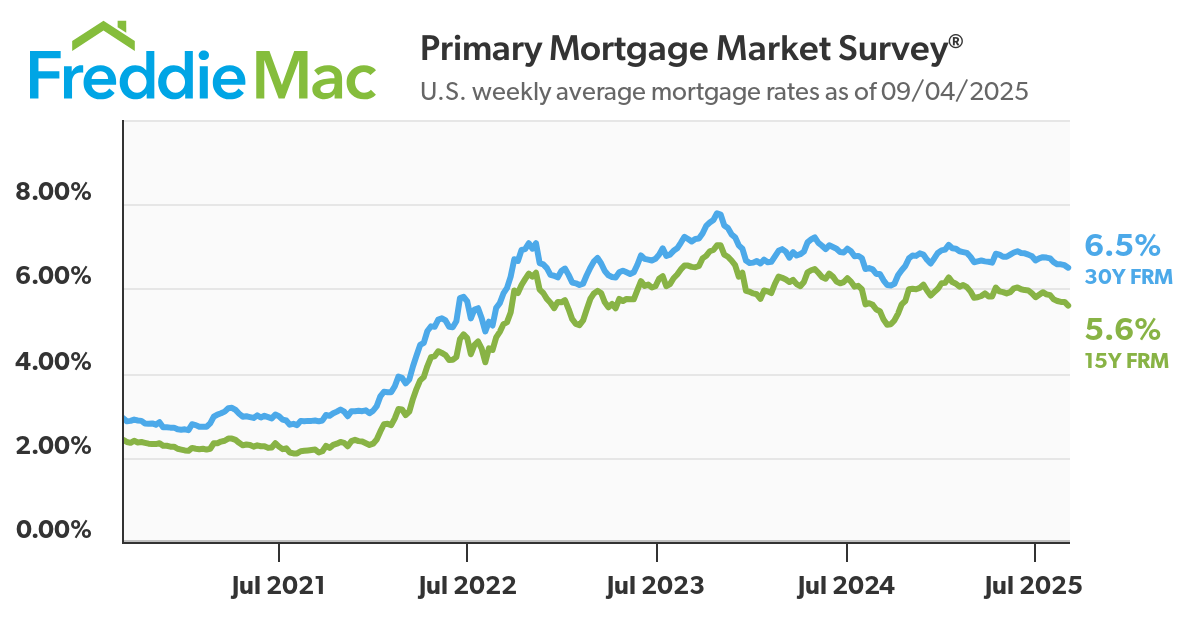

More uncertainty brings more deal cancellations. In other words, shifting market conditions are conveyed to participants at different speeds. With tariffs tantrums resulting in a higher cost of living and mortgage rates stuck with only a slight hope of modest declines after the projected Fed cut this month, no wonder deal cancellations are elevated.

Deal Cancellation Rise Equivalent To Flipping A Switch

In the nomenclature describing the higher amount of sales blowing up, rising mortgage rates don’t directly correlate with rising deal cancellations; otherwise, we would have seen cancellations rise as mortgage rates increased from 2022. The increase in mortgage rates “flipped a switch,” and deal cancellations rose from about 11.5% to the next plateau of roughly 14%.

Final Thoughts

When buyers face new uncertainties, it takes them time to process and get their arms around them. Often, the seller doesn’t receive the “memo” right away about the change in market conditions, such as a spike in mortgage rates. The more uncertainty a buyer and seller face, the more likely it is that there will be a greater challenge to keep the deal alive. I have many friends in the real estate brokerage business, and they say they are working harder than ever to maintain steady deal flow. Uncertainty is more important than “location, location, location” these days.

The Actual Final Thought – In the aftermath of a buyer trying to hold a home purchase of their dreams together, it falls through on their way to a family reunion. What would the buyer say at the reunion? Then imagine MTV trying to play the song “Family Reunion” with censorship in place. And there are a lot of theories where the Blink-182″ reference came from – here’s my favorite.

Upcoming Presentations

• September 16, 11 am ET / In-Person =================================

• September 18, 3 pm ET / Zoom ====================================

• September 29 / In-Person ========================================

HGAR’s IMPACT: The Member Experience

I’m excited to speak at IMPACT: The HGAR Member Experience on September 29. I’ll be joining real estate professionals from across the region to explore what’s next in the housing market, economic opportunities and building community. Join me and be part of the conversation that’s shaping what’s next. Learn more and register.

[Podcast] What It Means With Jonathan Miller

The Lowest or Highest on Record episode is just a click away. The podcast feeds can be found here:

Apple (Douglas Elliman feed) Soundcloud Youtube

Did you miss the previous Housing Notes?

Housing Notes Reads

- Bad Mortgage Loans in Baltimore Send Wall Street a Warning [Bloomberg gift link]

- Devo Frontman Mark Mothersbaugh on the Double Meaning of ‘Whip It’ [Wall Street Journal]

- News | Often first to react to market corrections, multifamily capitalization rates are stabilizing [CoStar]

- Jonathan Miller: Stigma of a 666 Street Address? [Candy's Dirt]

- Un prix médian de 4.700 dollars: à Manhattan, les loyers progressent à un rythme affolant depuis le début de l'année [BFMTV]

- Why a Landmark Settlement on Realtor Fees Hasn’t Cut Costs [Wall Street Journal]