Time to read [10 minutes]

Takeways

- Starchitect branding shifted from niche reference to essential luxury condo amenity.

- Robert A. M. Stern’s pre-war–style towers like 15 CPW and 220 CPS reset Manhattan super-luxury pricing.

- Name-brand architects, past and present, now add distinct value and cachet to high-end residential projects.

Post WWII, the term ‘Starchitect‘ initially applied to celebrities who designed their own homes. By the late 1980s and 1990s, the reference switched to the profession. By the 2000s, amid an oversupply of new condo development, it became a vital amenity for distinguishing a building from the crowd. Admittedly, I haven’t written about the topic in nearly two decades. Luxury real estate has continued to pull further away from the rest of the market in terms of price. The moniker became an essential marketing tool in the condo space. It almost felt like a new building wasn’t “luxury” unless it was associated with a Starchitect. The passing of Robert A. M. Stern reminded me how important he was in the new development space (gift link). He was a conventional architect who designed condo buildings that appealed to a broader range of consumers. As the NYT headline suggested, he built new buildings with pre-war aesthetics. It’s challenging to count accurately, but he was responsible for more than 20 significant condo buildings in Manhattan.

The Developers Of 15 Central Park West And 220 Central Park South Both Used Stern

Do Starchitects Add Value To New Condos? Yes, they do. These days, a Starchitect usually needs to be associated with a super-luxury condo project to be considered in that submarket.

Stern worked with the Zeckendorf family to create 15 Central Park West, also known as the “Limestone Jesus” or “The Hedge Fund Building.” The values quickly soared, as evidenced by double and triple flips, in a manner not seen elsewhere. The Robert Stern look was a conservative look for high-end condo new development. A look that many perceived wouldn’t seem “dated” a decade from now. Vornado and the Clarett Group developed a nearby building, 220 Central Park, also designed by Stern and also fronting Central Park. Both buildings are known as having the best condos in Manhattan. The latter was part of the Billionaires Row phenomenon and was one of the few condos to see a significant price increase over the past decade.

The Active Starchitect List

This list is not all-inclusive, but this is who I think of when the topic of active Starchitects comes up:

- Frank Gehry

- Santiago Calatrava

- Tadao Ando

- Norman Foster

- Jeanne Gang

- Steven Holl

- Christoph Ingenhoven

- Rem Koolhaas

- Daniel Libeskind

- Michael Maltzan

- Herzog & de Meuron

- Rafael Moneo

- Jean Nouvel

- William Pedersen (Kohn Pedersen Fox)

- Christian de Portzamparc

- Rafael Viñoly

- Bjarke Ingels (BIG)

Of the many Starchitects who have passed or retired, some of the more notable include:

- Le Corbusier

- Michael Graves

- Philip Johnson

- Ludwig Mies van der Rohe

- I. M. Pei

- Eero Saarinen

- Frank Lloyd Wright

- Zaha Hadid

- Charles Gwathmey

- César Pelli (Pelli Clarke Pelli)

- Helmut Jahn

Humble Interactions With Former Starchitects

One day, famed architect Paul Rudolph, who was also chair of the School of Architecture at Yale, called me when he was terminally ill, asking me to appraise a townhouse at 23 Beekman Place. The penthouse apartment of the building featured an internal plexiglass design, a favorite material of his 1960s legacy, in addition to his well-known Brutalist architectural style. Eventually, he asked me to appraise the facade of the Smithsonian display of his works. He passed before I was able to move forward.

At one point, Richard Meier, winner of the Pritzker Architecture Prize, called me to appraise a property. We got to talking, and I asked him what he did, curious about his name. I had heard of a Long Island appraiser with the same name. He said he was an architect in an understated way, so I thought no more about it. Later, I learned that he was the architect for the Getty Center Museum in Los Angeles and the famous 171/176 Perry Street, which cracked the Manhattan condo $2,000 per square foot threshold for the first time, and whose condo units were primarily purchased by California-based designers, celebrities, and tech giants who followed him cross-country. He was later taken down by the #MeToo movement and retired.

Final Thoughts

Post–World War II, “starchitect” described celebrities who designed their own homes; by the late 1980s and 1990s it referred to star architects whose names carried marketing power. Luxury condo developers in the 2000s used starchitect branding as a core differentiator in an oversupplied market, helping push prices further beyond the mainstream.

Robert A. M. Stern played a central role, adapting prewar aesthetics for new towers that attracted a broad buyer base while signaling prestige. His Manhattan projects, including 15 Central Park West and 220 Central Park South, use limestone facades that supported rapid value growth.

The Actual Final Thought – Being ahead of your time is tough is limited to a few.

6-7 Edition: Thanksgiving Jumpstarts Christmas

Who knew that a selected Christmas tree between 6′ and 7′ would be meme-worthy as well as NFL games over the holiday?

Monday Mailboxes, Etc. – Sharing reader feedback on Housing Notes.

- I must say, as someone that writes a weekly macro note to our investors, I love your weekly takes. So great.

- Happy Thanksgiving! To you and your family!!!

- I would love to see a historical chart of the profit margins that developers make on their projects. Of course it is complicated now as there are various tranches of investor etc all of which add to the initial cost of the financing which eats into the spread. Things have changed from when the developers put up the capital themselves, had nobody else to answer to and no bankers to pay fees to for arranging financing. Supply is the key to affordability. Just like with health insurance although that is hampered by cross State border limitations which distort pricing as well

- Several years ago, perhaps ten, …We noticed that the NAR figures were way off, sometimes 10% above actual, sometimes more. So we put together the actual figures and set up a meeting with Lawrence Yun and his research team and we showed them the data. We learned that they did not do a complete census approach but rather a sampling approach, and so they admitted their data was a sample grossed up. Lawrence said he would look into improving his report. We said we would feed the data into NAR if they wished since accuracy was important to the country. But NAR was afraid it would make them look bad since the initial adjustment would be quite significant. So they never followed up with us, and as far as we know they still use a sampling technique. They are not bad people, but they are clearly stuck in their ways. We decided not to embarass them and so we dropped it, but I know their figures were biased and inaccurate.

- I am not sure NAR will survive? But they could do a better research job if they wished and be useful. Losing the MLS tie to membership will result in them losing 75% of their members or more – don’t you think?

- Just got home from the convention — why I wasted my time is a story for another day — but I said to a close friend … “in a world of iPhones, NAR continues to be a BlackBerry … “

- I really appreciate the NYC centric content! It’s great to get evidence-based data that reflects the actual marketplace without the political noise. As with CA, as goes NYC so goes much of the rest of country metro areas. That may not be 100% but as we continually hear political noise about the mass CA exodus – the economy continuous to expand – now the 4th largest on the globe. With global NYC and CA markets having affordability headwinds, any fresh ideas to enable more residents to stay or come and enjoy new opportunities are worth consideration and pursuit, regardless of the political labels and noise! I always appreciate your info, data, and evidence-based perspectives.

- Not able to track commission percentages in central NC, below survey from my subscribers matches national trends.

- Jonathan: I don’t agree!! I am for the tariffs!! Also, I don’t like it that you are pushing this idea! President Trump has done a wonderful job establishing these tariffs!! Stop spreading this propaganda!

- Hi Jonathan, that was a good, refreshing post. As a Miami (and NY) licensed broker I’ve been beating the Miami drum because I’d definitely like some more buyers to move down here but NY definitely isn’t going out of style anytime soon. I just hope they don’t make it even harder for real estate owners to operate buildings by passing even more regulation and control…

- Great housing notes. All the chatter about the potential of this new mayor coming in reminds me of a long time ago after 9:11. There was a lot of chatter about people fleeing New York City and moving out to the Hamptons. I do remember, enrollment in schools went up but they never arrived there wasn’t a big departure from NYC that many assumed.

- I remember during Covid one of my customers telling me that it’s tough spending the winter out in the Hamptons. I was told that if Covid was around the following winter that they would move back to Manhattan and take their chances. Not much to do out here in the non-summer months.

- workers like WFH. It’s nice to throw in a load of laundry or run to a doctor’s appointment without someone looking over your shoulder. You can play with your dog or cat during the workday and it’s very calming. Workers feel better. It’s terrible for corporations though.

Did you miss the previous Housing Notes?

November 26, 2025

Many Made The Wrong Election Call Predicting The End Of NYC’s High-end Housing Market

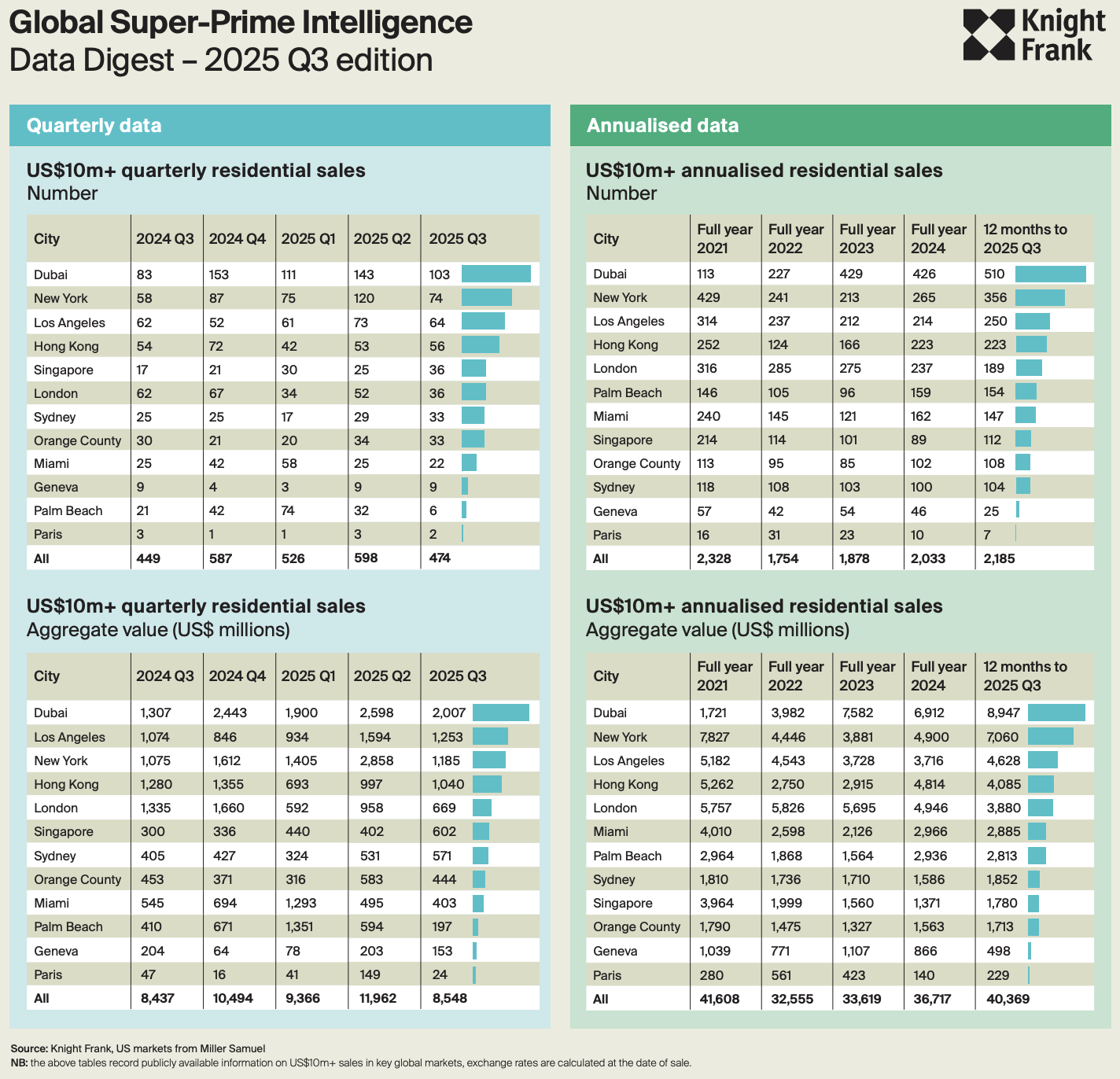

Image: Knight Frank

Housing Notes Reads

- [Video] Why Manhattan Condos Are Selling At A Loss [CNBC]

- Are the rich fleeing Mamdani’s Manhattan? Not according to the data. [USA Today]

- Intelligence Talks: Will Mayor [Podcast] Mamdani sink the luxury New York housing market? [Knight Frank]

- Global Super-Prime Intelligence [Knight Frank]

Market Reports

- Miller Samuel New York City Market Brief 3Q 2025 (3 Year Comparison) [Miller Samuel]

- Elliman Report: Manhattan, Brooklyn & Queens Rentals 10-2025 [Miller Samuel]

- Elliman Report: Florida New Signed Contracts 10-2025 [Miller Samuel]