- The Tariff Tantrum Is Pushing Mortgage Rates Higher

- Higher Mortgage Rates Push Rental Prices Higher

- Higher Economic Risk Restrains The Upswing In Housing Demand

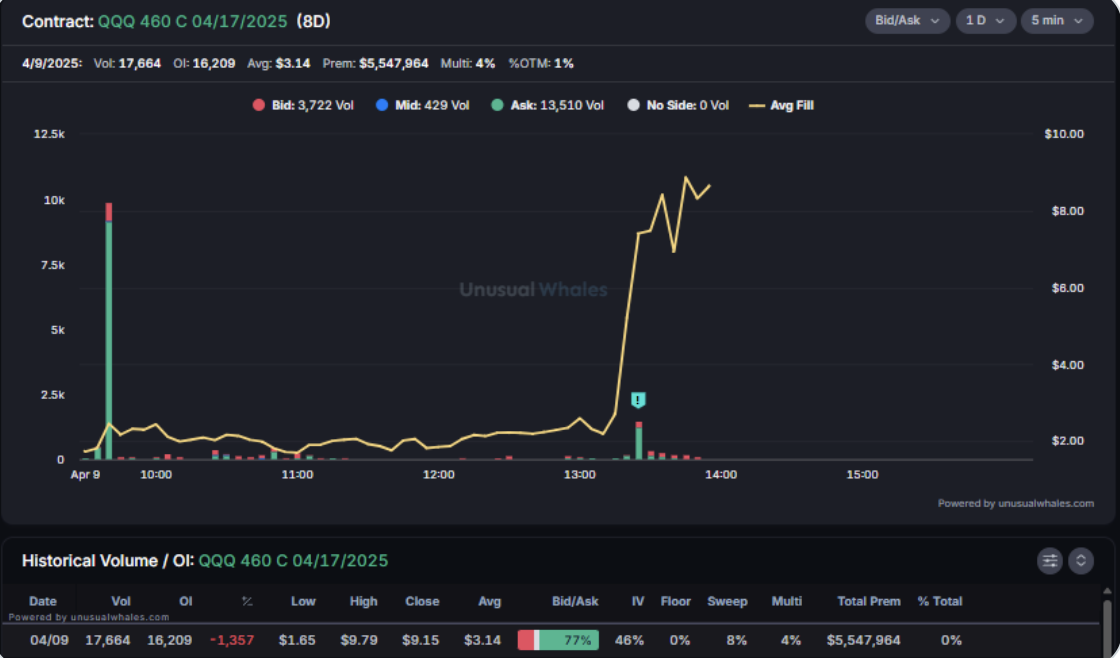

Over the last couple of days, even the uncertainty about the economy has uncertainty. It’s the incredible volatility that is causing the damage; not how much the financial markets may rise or fall in a day. It’s become evident that there is no strategy behind the tariffs other than saber-rattling, and THAT is the issue. We have formerly entered the era of dumb. I had lunch yesterday with some investment sales brokers, and we discussed this very thing. Right after lunch, I got an alert that the tariffs were delayed by 90 days, and the financial markets surged. For all those who think that is a sign that the Tariif Tantrums are good, recognize the the market has already fallen 2.5% this morning as I write this. Incidentally, NASDAQ surged just before the delay announcement was made. Oops. Chaos and anger ensued [free link].

Since There Is No Plan How Are Consumers Reacting?

There’s a great piece in Curbed: The Tariffs Have Come for New York City Real Estate with a great quote: “Agents are telling me that their clients are holding off — no one knows what’s going to happen,” says Bess Freedman, the CEO of Brown Harris Stevens. “One of them was a $10 million buyer: They said, ‘We’re taking a pause.’ It doesn’t necessarily mean they won’t go back into the market. But consumer confidence is in the toilet.” I’m not seeing anything in the housing markets I cover yet although there have been a handful of stories of consumers “de-listing.” Still, those instances seem on the margin – it’s just too soon. It’s the “red light” theory – de-listing happens all the time, but those catch your attention, not the “green lights.”

I’d love to find out if that $10 million buyer changed their mind after the financial markets surged almost 10% yesterday’s 90-day tariff delay announcement.

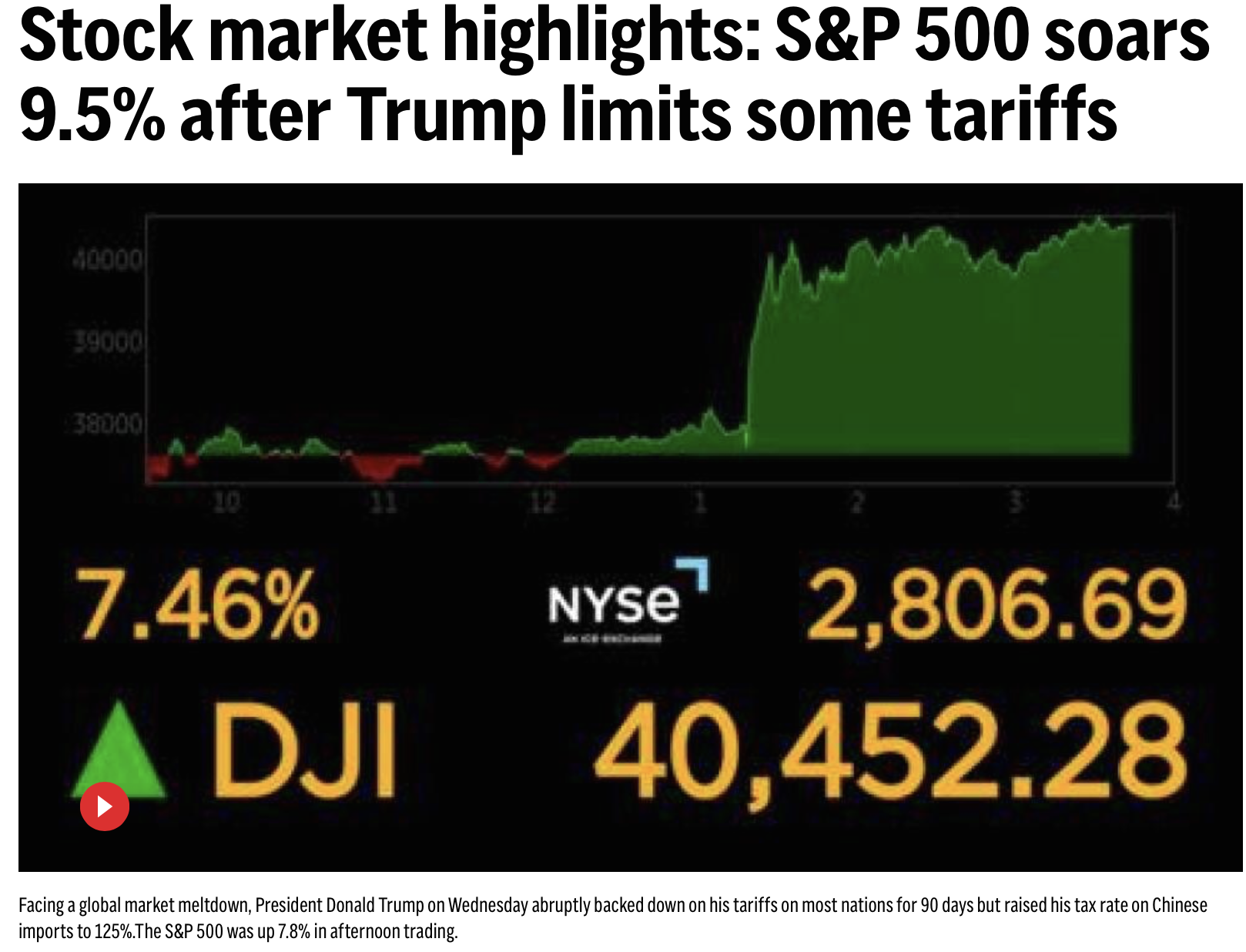

Stock Market Soared After Most Tariffs Delayed 90 Days

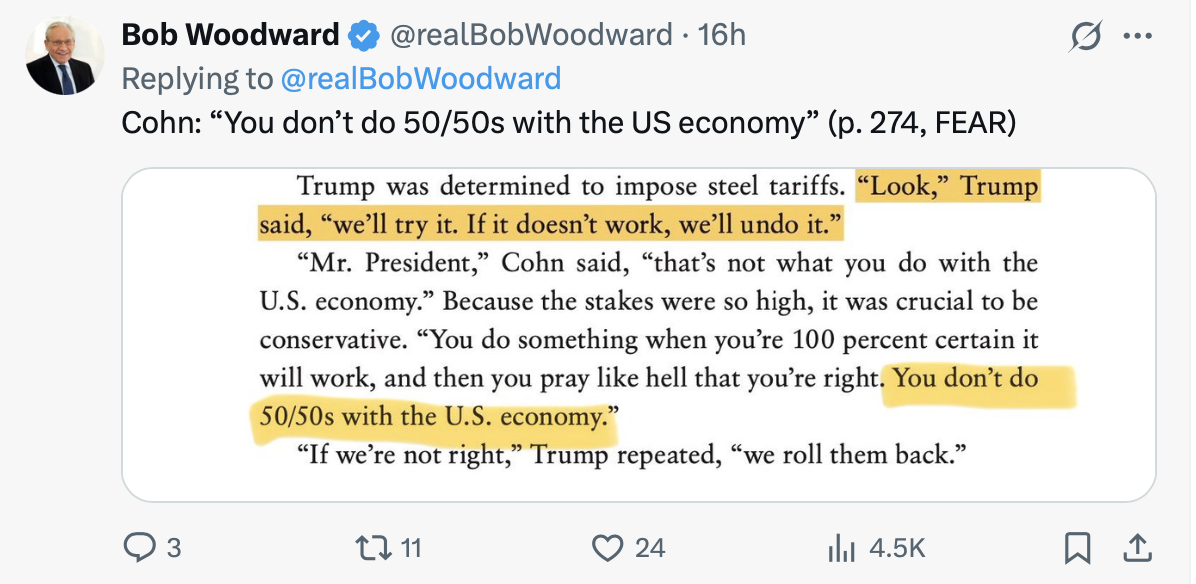

Gary Cohen, Trump I’s chief economic advisor warned the president about not understanding the impact of tariffs:

The financial markets soared yesterday afternoon on the news of the tariff delays. There really is no apparent plan or strategy that is apparent so that uncertainty will drive interest rates higher. Here’s a timeline of tariff announcements since the inauguration.

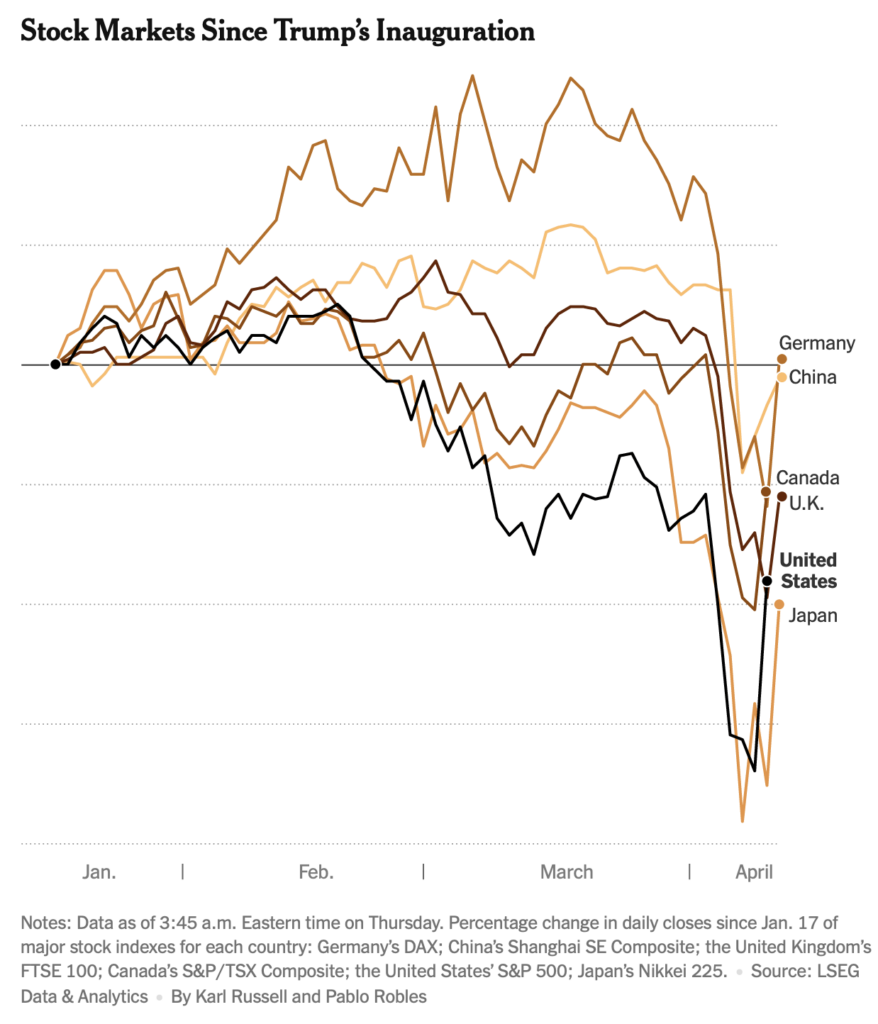

Even after yesterday’s surge, the US financial markets are well below the levels seen at the beginning of the year. The markets are falling again this morning as I write this.

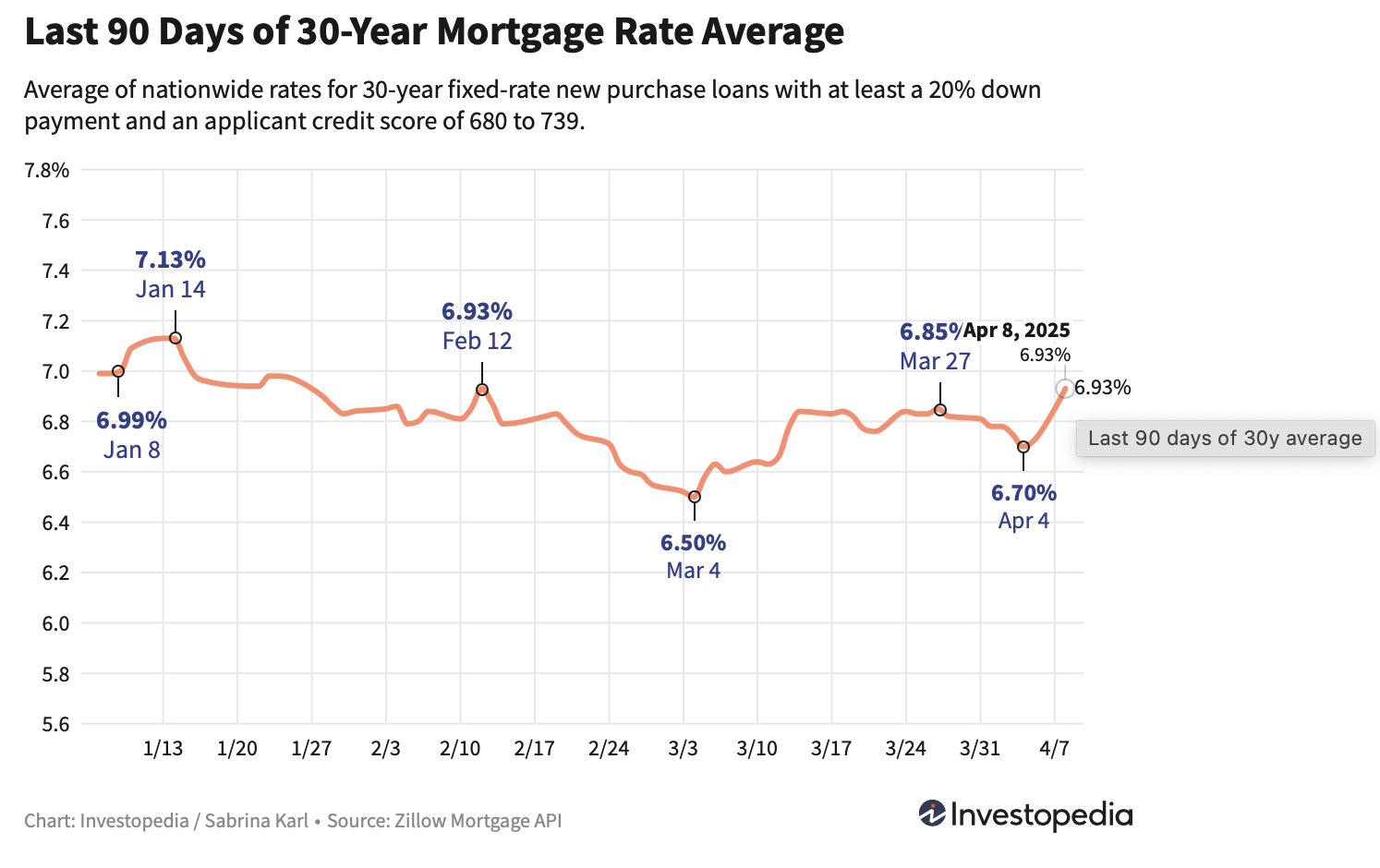

The result of all this chaos is that mortgage rates are rising, which is detrimental to a housing recovery. The fact that the bond market was falling as the stock market was falling is what caused Trump to pause the tariffs.

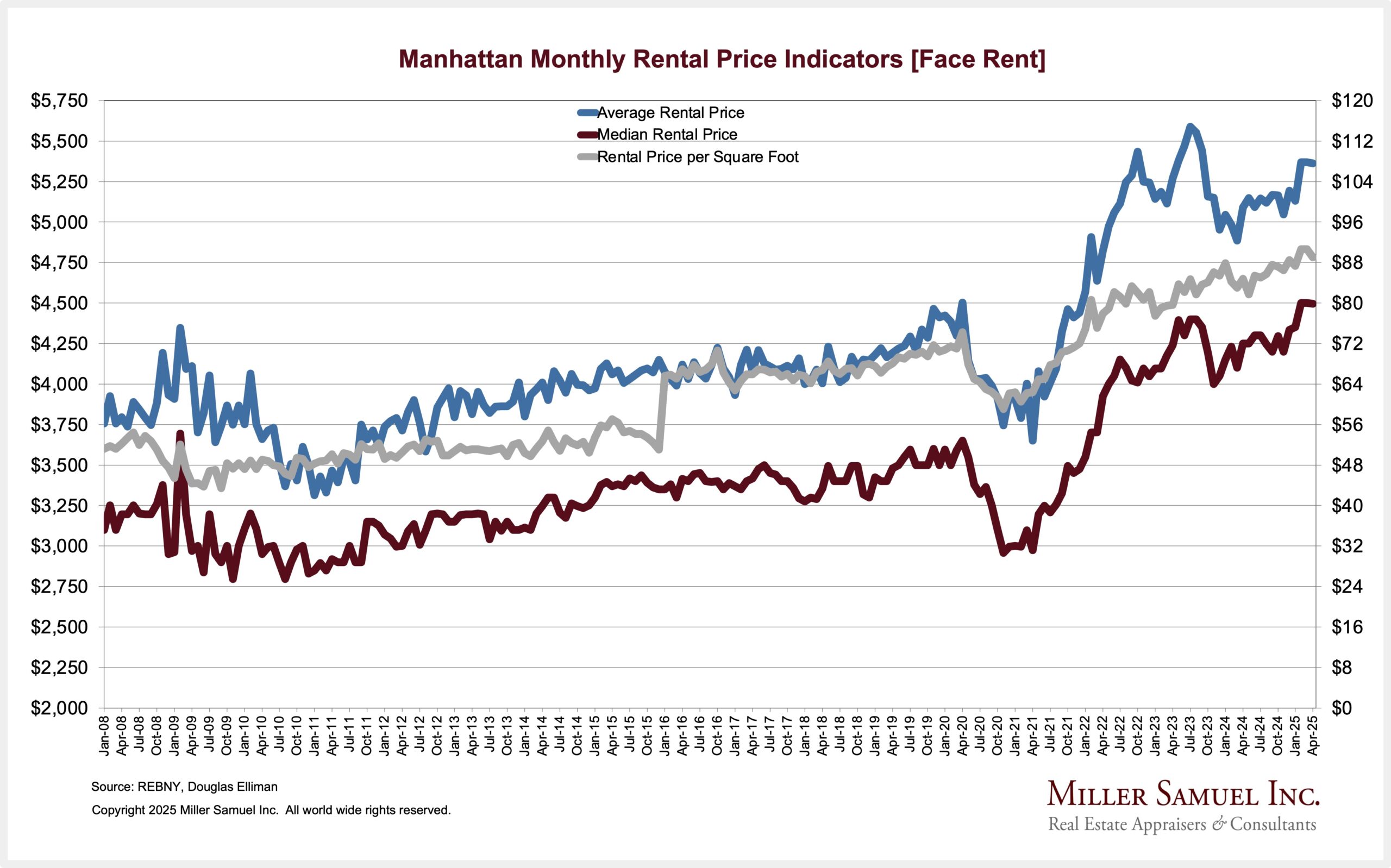

Uncertainty Is Great For Rentals

Our NYC rental research was published today, and new records were set, much like the results in February. In February, the median rent reached a new high of $4,500, and this month, it dropped by $5 to the second highest in history, effectively remaining at the same record level. Rents are up 10% year over year in Manhattan. “Trump, who has been teasing hefty tariffs since taking office in January, last week announced a baseline 10 percent tariff on nearly all nations, then tacked on reciprocal tariffs for 60 countries. Chaos ensued: Wall Street freaked, the S&P 500 suffered a correction, and mortgage rates and projections of recession risk resultingly surged.”

When mortgage rates rise, there is more upward pressure on rents. This is happening nationally right now.

Final Thoughts

With the 90-day delay in implementing the tariffs, the American consumer will be left in limbo, just as they felt yesterday morning. I suspect that we will still experience an active spring market for sales but not up to its full potential, given the drama the world is being subjected to by one person. The tariff game isn’t eight-dimensional chess. It’s just checkers. Yesterday’s financial market surge didn’t undo the tariff damage, but rather, it reflected a relief that more significant damage would not occur. That is why the markets are falling again this morning. There literally is no plan or strategy to all of this, which gets reflected in higher interest rates and rising layoffs as companies are unable to plan or chart a course for the remainder of the year. This is all so dumb. It really is so incredibly reckless and dumb. The cost of losing our global leadership to China is against our best interests and that point is being lost in the conversation.

Here is some relief – tomorrow’s post won’t mention tariffs.

The Actual Final Thought – The credibility of information hangs on how you present it – here’s a reminder.

Did you miss the previous Housing Notes?

April 8, 2025

Tariff Insanity Won’t Bring The End Of The Housing Economy As We Know It, And I Feel Fine.

Image: Gemini

Housing Notes Reads

- Trump's tariffs go into effect, with huge levies on China and other countries [Axios Media]

- Live updates: S&P 500 soars 7% after Trump announces 90-day pause on tariffs, raises taxes on China [Associated Press]

- Wall Street Bursts With Anger as Trump Tariffs Cause Wild Stock Market Swings [New York Times]

- The Tariffs Have Come for New York City Real Estate [Curbed]

Market Reports

- Elliman Report: Florida New Signed Contracts 3-2025 [Miller Samuel]

- Elliman Report: New York New Signed Contracts 3-2025 [Miller Samuel]

- Elliman Report: Manhattan Sales 1Q 2025 [Miller Samuel]

- Elliman Report: Manhattan, Brooklyn & Queens Rentals 2-2025 [Miller Samuel]

- Elliman Report: Florida New Signed Contracts 2-2025 [Miller Samuel]