Rental Trends Are Incremental, Yet New Policies May Be Incidental If Not Accidental

Time to read [5 minutes]

While NYC Rental Prices Gains Have Been Significant, The Gains May Not Last

The Significant Drop In Jobs Leading To A Near-Certain Rate Cut

The Key Will Be Whether Mortgage Rates See Meaningful Decline After Fed Move

Vacation Week Note

We are at the beach! I grew up in Rehoboth Beach, DE, the “nation’s summer capital,” and try to make the pilgrimage every summer. We took the kids here regularly, and now they are bringing their kids. Perhaps that’s why three of my four sons proposed on beaches (Ocean City, NJ, Wildwood, NJ, and Chile)? My dad was a developer here in the late 1960s, before we moved to DC, when many of the roads were still dirt. It’s fully developed now and impressive. I plan to power through the week and write these Housing Notes.

Testing A Summer Hypothesis: Human beings are actually able to survive for a week on pizza and salt water taffy while reading under a large umbrella on sand.

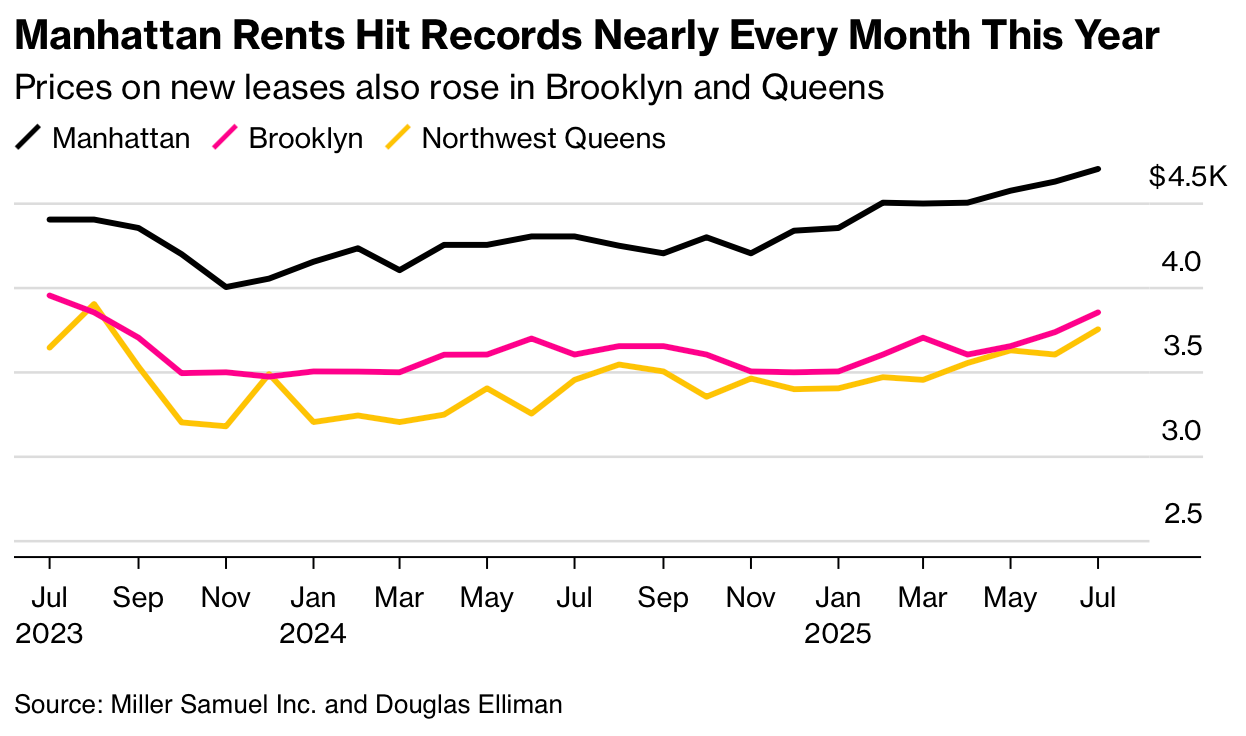

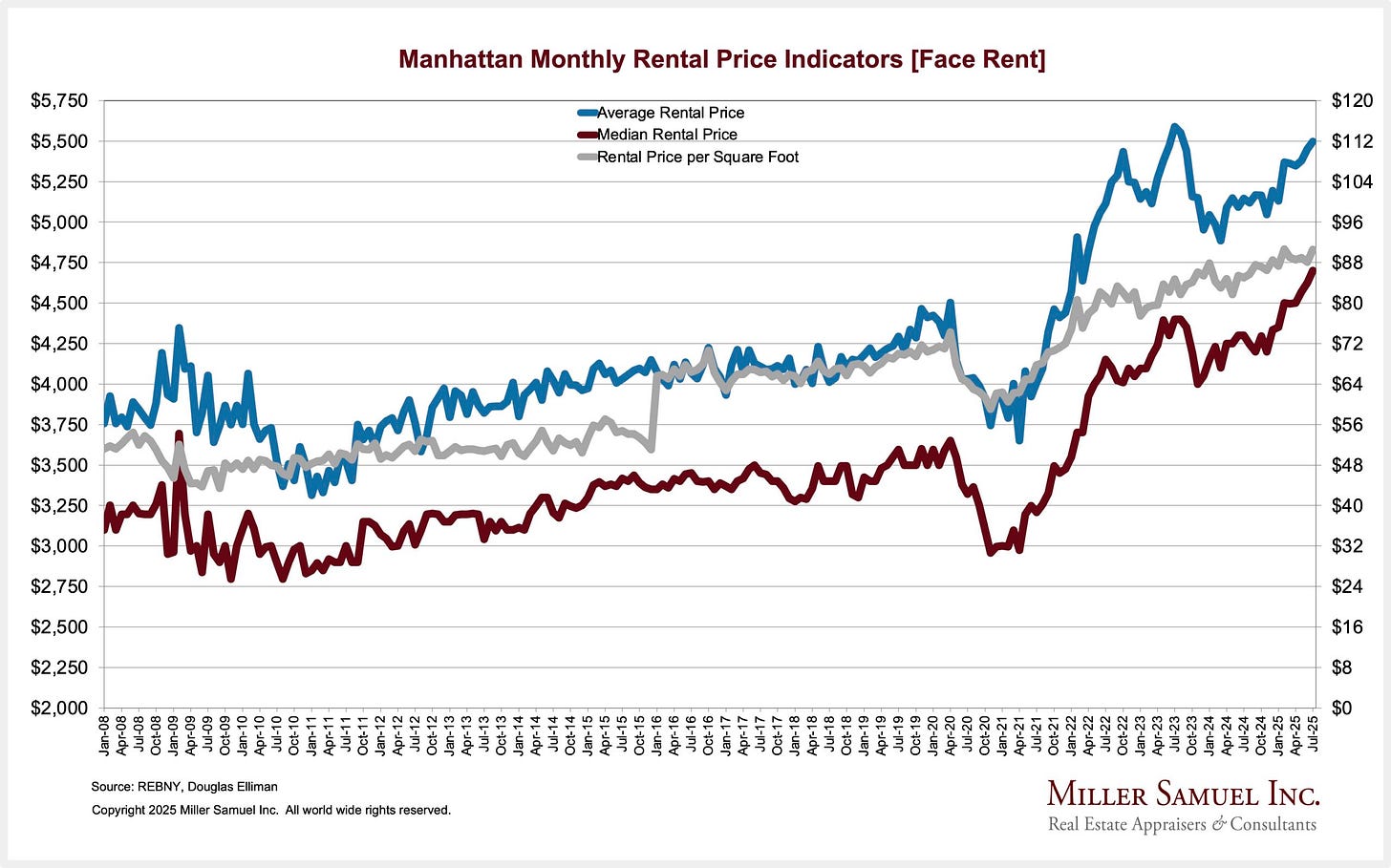

I usually pick the words “mental” or “dental” to rhyme with a “rental” post, but this time I went transcendental. Our NYC rental research was published yesterday, and for rent record enthusiasts [gift link], the results did not disappoint. Rental prices in Manhattan continued to reach new highs, a trend that has become the standard pattern since the beginning of 2025. Median rent has reached a new high in five of the past six months (since February). A monthly rent of $4,700 can get you a 700-square-foot 1-bedroom apartment in a building with an attended lobby and views of the building across the street (and the ability to buy strawberries at 3 am). But with the economy being thrashed by tariff policy, as evidenced by significant downward job report revisions (poor enough to disrupt the narrative of the administration to replace the long-time independent head of stats with someone without experience or professional credibility), the outlook for rental price trends might be weaker this fall if the sales market takes off.

Tariff Damage Leads To Rate Cuts Leads To Weaker Rent Growth

The severe drop in jobs after revisions were made for last May and June, after the tariff policy began in April, created collective concern that the economy was already weakening. The odds of a rate cut in September have surged. A cut may pull some demand from the rental market back into the sales market if mortgage rates continue to slide. Mortgage rates have slipped nominally over the last few weeks.

According to the CME, a Fed rate cut is a near certainty for September (92.6%). But the real question is whether a cut will push mortgage rates lower. Following the poor jobs report that correlated with the launch of tariff policy in April, lower mortgage rates appear more likely. The Fed’s efforts are complicated by inflationary economic policy coming out of Washington. Ultimately, lower mortgage rates mean more sales and weaker rental price growth.

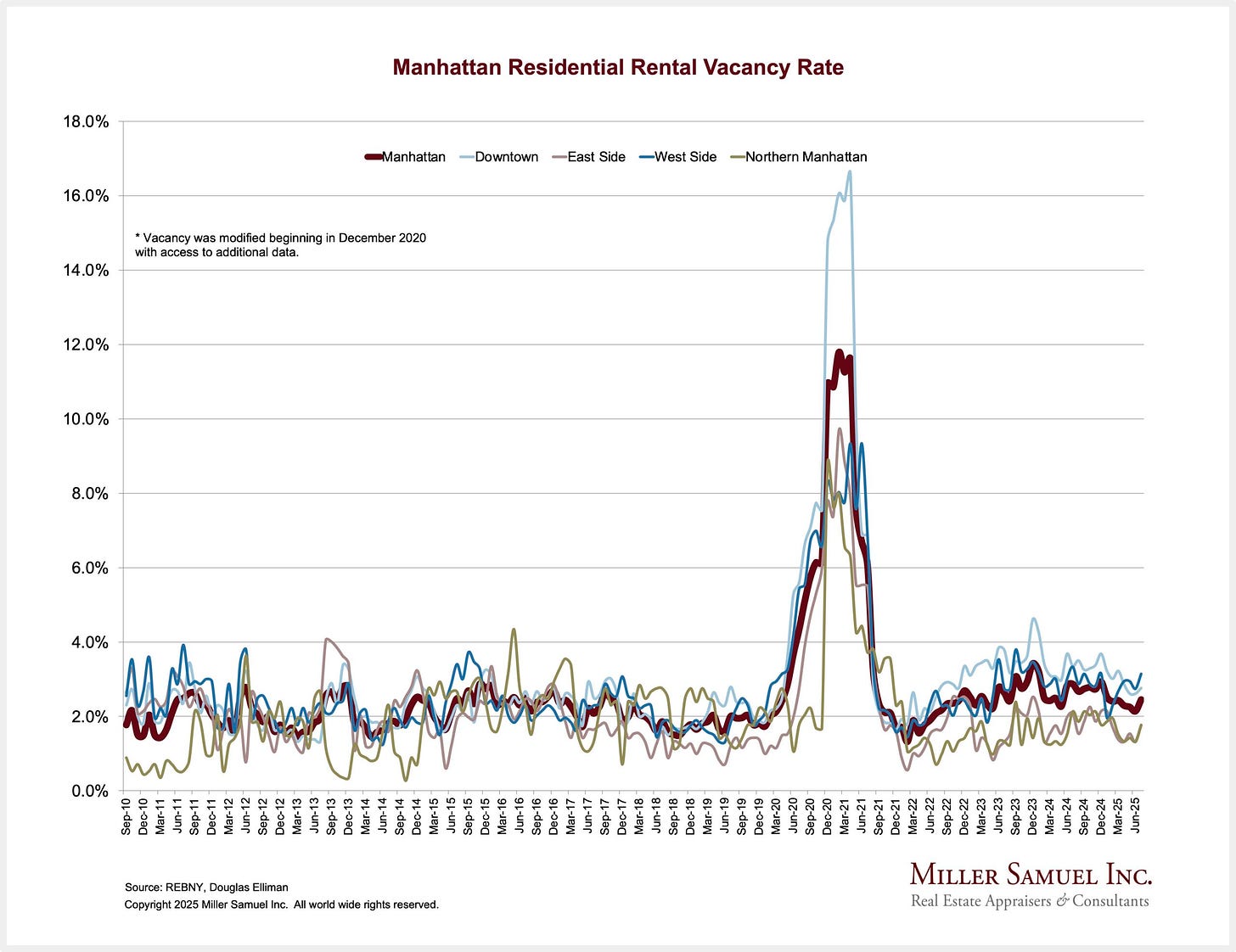

Vacancy Doesn’t Seem To Rate These Days

The Manhattan vacancy rate was 2.45% in July, a little lower than the 2.89% decade average for the month. The average for every month over the decade was 2.90%.

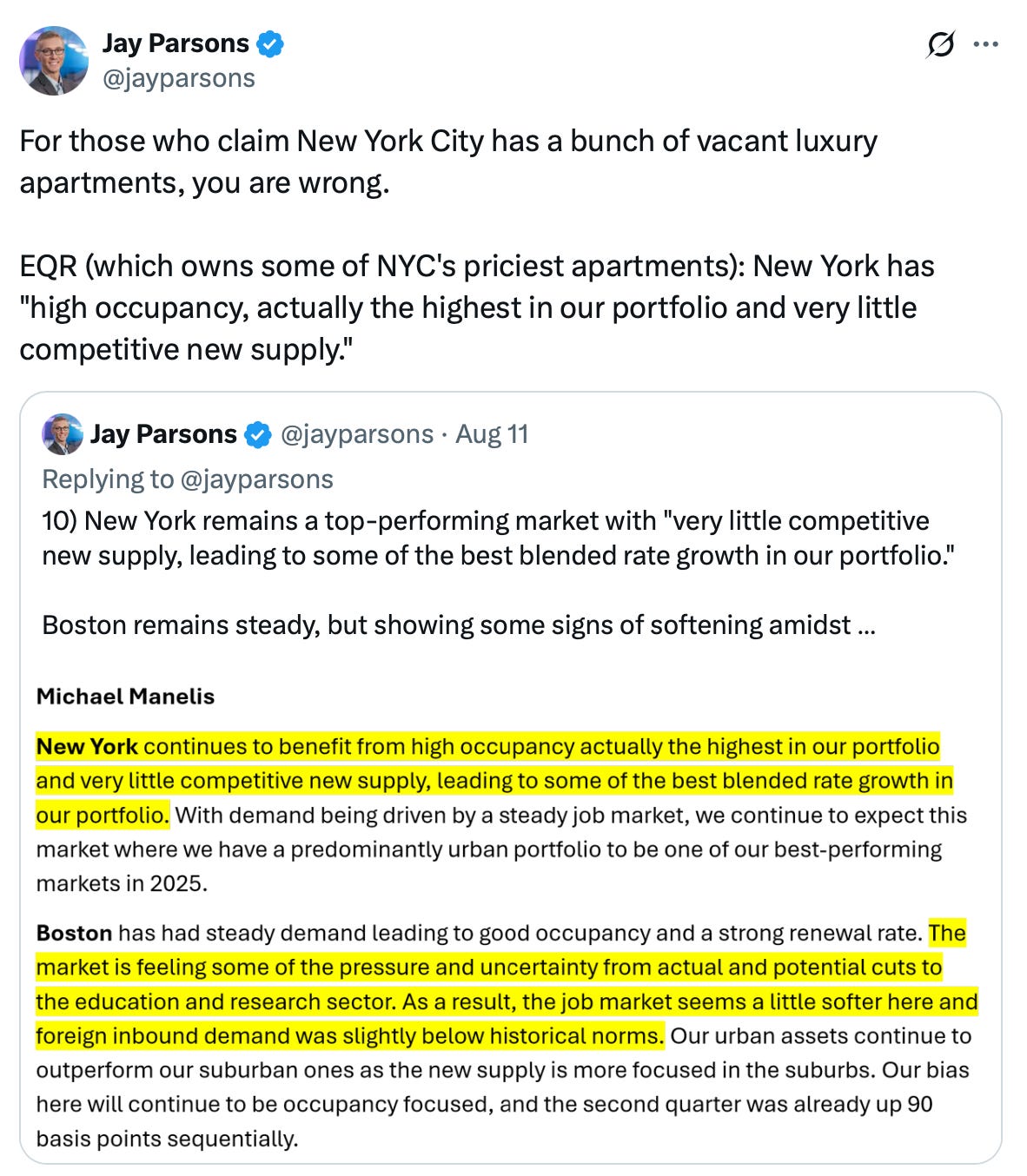

And this takeaway by a noted rental economist is consistent with our findings that vacancy is normal if not a little tight.

Final Thoughts

We are seeing bigger Manhattan rental price gains in the “non-luxury” market (excludes the top 10%) than in the luxury market. In fact, all segments of the rental market are seeing price gains, but the most stressed are the studio and one-bedroom markets, which experienced new highs for median rent. And that’s probably because the upper half of the sales market is seeing more activity with all-time highs for cash buyers as they bypass higher mortgage rates. The real growth in sales is probably going to occur in the lower half of the sales market if mortgage rates see a meaningful decline.

The Actual Final Thought – In other words, reckless and irresponsible tariff policy may help the housing market with more sales by bringing down mortgage rates. You might even say it could open the door to a mini-revival in the sales market.

HGAR’s IMPACT: The Member Experience

I’m excited to speak at IMPACT: The HGAR Member Experience on September 29. I’ll be joining real estate professionals from across the region to explore what’s next in the housing market, economic opportunities and building community. Join me and be part of the conversation that’s shaping what’s next. Learn more and register.

[Podcast] What It Means With Jonathan Miller

The My Implicit Guarantee episode is just a click away. Podcast feeds can be found here:

Apple (Douglas Elliman feed) Soundcloud Youtube

Did you miss the previous Housing Notes?

August 13, 2025

Mortgage Amounts Relative To Housing Values Are Lowest Since Elvis

Image: Bespoke Investments