Time to read [7 minutes]

- US iBuyer Market Share Is Probably Around 1% As Some Local Markets Are 5%

- iBuyer Hype Falsely Besieged The Brokerage Industry A While Back

- Billions Of Investment Isn’t Necessarily A Guarantee Of Success, Just FOMO

The year 2021 was “peak iBuyer” when many real estate brokers probably thought that 50% of their industry was going to go in this direction, and they would be out of a job. Of course it is not helpful when an iBuyer misleads its investors on its accuracy. As an Apple advocate with an iPhone who helped build a company with Macs, I initially thought the “i” stood for “Internet” rather than “instant.” Despite all the hype, US iBuyers accounted for less than 2% of all sales at their peak and are probably closer to 1% today. However, in markets with homogeneous housing stock like Atlanta and Phoenix, the share is probably closer to 5%. Still a far cry from a 50% perception. And Fear of Missing Out (FOMO) was a big part of the hype as many big real estate companies came into the market just before the pandemic, quite reluctantly and late, like Zillow Offers (2018) and Redfin (2017) to compete with the early adopters like Opendoor (2014) and OfferPad (2015). The newbies quickly assimilated into the iBuyer industry by being massively unprofitable. Zillow Offers rang up near crippling losses and left the space in 2021, and Redfin happily left in 2022. Zillow Offers definitely proved how unreliable Zestimates were once and for all by losing $881 million in 2021 just by using their own product. As far as I can tell after lots of Internet searches, OfferPad and Opendoor have probably never been profitable after more than a decade of operations.

Types Of Tech Investment In Housing

Automated Valuation Models (AVMs) – think Zestimates but on the banking side – are already replacing appraisers in banking despite being wildly inaccurate – tech doesn’t care about that. There is an efficiency appeal to pressing a button to get a number, rather than dealing with a human being to inspect the interior of the property if no one cares about the quality of the valuation.

There are lots of ongoing AI integration that all have potential:

- Predictive Analytics

- Document Management

- Lead Generation

- Preventative Maintenance and ioT integration

- Fraud Detection

- Housing Policy

- Efficiency

But I digress…

Losing Billions Can Be Profitable

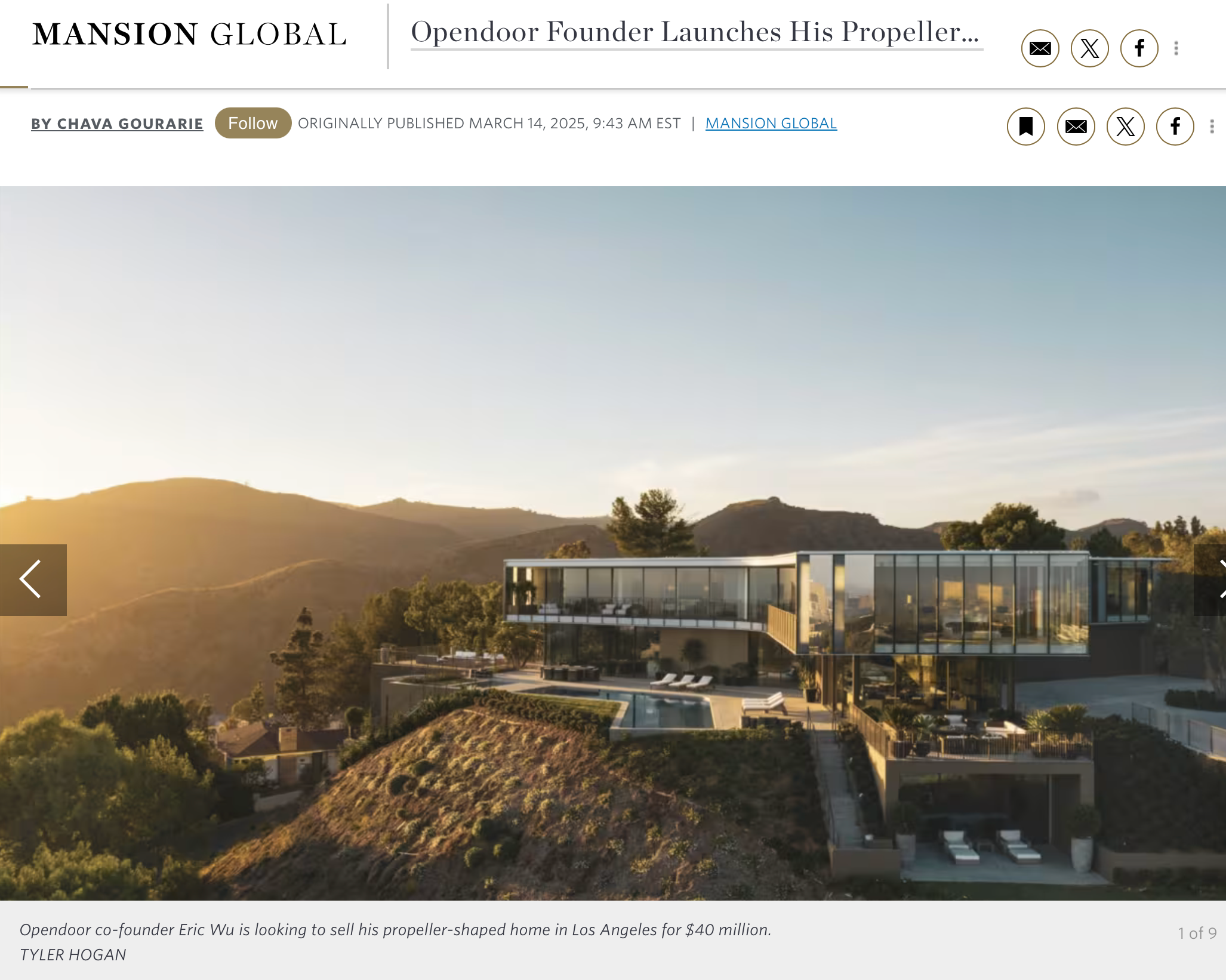

Before the pandemic, representatives of Opendoor spoke at RAC, an appraisal organization of some of the best residential appraisers in the US, to explain how the sausage was made. It was highly informative, but admittedly felt like a future threat to my appraisal profession. It also came across as a necessary service for a small niche of homeowners who want to sell quickly. I recall thinking about that presentation when Eric Wu, a cofounder of Opendoor, purchased a $32.25 million mansion in Bel-Air in 2022. He is attempting to resell it for $40 million in 2025. I doubt he used his Opendoor platform. Ha.

Tech Investment And The FOMO They Create

We’ve been taught that billions of dollars of investments and billions of losses in tech will lead to eventual big profits (look at Amazon). Americans have an incredible belief system in big spending on technology. Real estate just went through this in the iBuyer frenzy just before and just after the pandemic lockdown. We are going through this with AI right now, and are probably already past the peak of the AI hype cycle. AI companies have already run out of stuff to steal (violating copyrights and ignoring technical efforts to stop their scraping). The AI hype cycle is explained in an excellent podcast, On The Media: Inside the Artificial Intelligence Hype Cycle.

A parallel universe to the iBuyer seems to be rideshare companies like Uber, which was founded in 2009, and Lyft, which was founded in 2012. It’s taken billions of investments and losses over 14 years to finally make a profit for Uber, and 12 Years for Lyft. Whenever I visit Chicago and have to take a yellow cab, the city forces them to display a “Vomit Clean-up Fee” which I like to document. I love the rideshare concept and hope they are able to stick around. Understanding the current flavor of AI which has been around for a long time is largely misunderstood. The current hyped versions like ChatGPT, Claude, Grok and Gemini are LLMs or “Large Language Models” which are inherently not smart, just good at predicting the next words in a sentence. They’ve been marketed as Artificial Intelligence but they are really not compared to earlier efforts but calling them AI makes it easier to raise a lot of money.

Final Thoughts

Based on the timeline and nothing else, the iBuyers models might be getting near the point of profitability but remain at a very small marketshare. The iBuyer model serves a specific market niche that I maintain is probably needed, but was never needed at the scale inferred during the hype cycle of about 4-5 years ago.

The real estate tech industry tech experiences periods where FOMO is prevalent, leading to assumptions that billions spent on technology are a sure sign of future success, even when it may not be the case. I’m no Luddite, but there was a time when I loved to update the software on my Mac and iPhone. With experience, I’ve become more hesitant about living and working on the bleeding edge.

The Actual Final Thought – Tech can make us Dazed & Confused.

[CRE] Lessons Learned: 5 Years After The Pandemic

I’m looking forward to participating in this one – it should be a great discussion, especially with Jonathan Schein as moderator.

[Podcast] What It Means With Jonathan Miller

The latest episode [Manhattan’s Big Beautiful Market] is just a click away. The podcast feed can be found for all three platforms we use are here:

Apple (Douglas Elliman feed) Soundcloud Youtube

Monday Mailboxes, Etc. – Sharing reader feedback on Housing Notes.

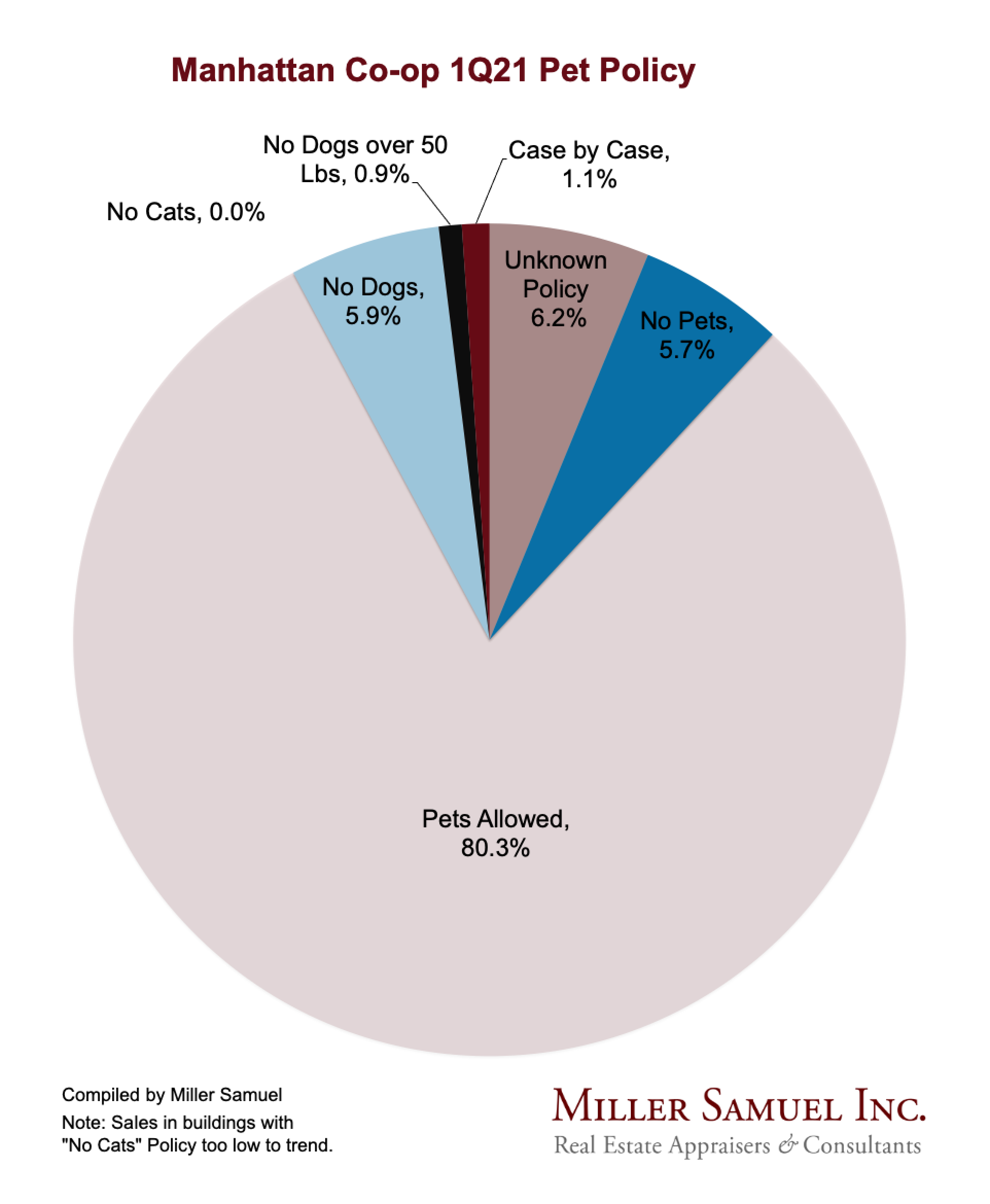

July 11, 2025: Multifamily Living Has Gone To The Dogs (And Cats)

- I’d be curious to know what these numbers would look like in the a nassau and Suffolk markets. It’s definitely a desire of many buyers and I usually have to be the bearer of bad news when they ask about pets. I wonder if some of the large co-op management companies like Alexander Wolf have any thoughts on this

- I shared your article with the president of a co-op…and he didn’t think it was a big deal because everybody just gets their pet approved as a service animal or emotional support animal.

- Do you have insight to the luxury market in the Hamptons and what’s your over all thoughts of the Hamptons market.

- What I am seeing in the rental market is that MONTHLY rents are up about 10%-15% because of FARE, but the tenant is NOT paying the usual and customary brokerage commission of 10-15% based upon the TOTAL YEARLY rent.

July 10, 2025: Is The NYC Rental Market A FARE Game?

- Spot on as usual. Thanks.

July 8, 2025: Our Big, Beautiful Housing Market

- Is it true the OBBB removes federal tax liability on Social Security benefits paid to us senior citizens?

- I disagree with the negative feedback you’ve received. You’re one of the few with backbone to speak truthfully. Keep it coming.

Did you miss the previous Housing Notes?

Housing Notes Reads

- Opendoor reaches $39M settlement in pricing algorithm suit [Inman]

- 💸 Another One Buys the Dust [Highest & Best]

- Hot Rent Summer — West Side Prices Hit New Highs, But the Market May Be Cooling [W42ST]

- Trump administration 'effectively disbands' the PAVE task force [Housingwire]

- Job loss fears, mortgage rates weigh on housing sentiment [Inman]

Market Reports

- Elliman Report: Manhattan, Brooklyn & Queens Rentals 6-2025 [Miller Samuel]

- Elliman Report: Queens Sales 2Q 2025 [Miller Samuel]

- Elliman Report: Brooklyn Sales 2Q 2025 [Miller Samuel]

- Elliman Report: Manhattan Sales 2Q 2025 [Miller Samuel]

- Elliman Report: Florida New Signed Contracts 6-2025 [Miller Samuel]