Time to read [4 minutes]

Takeways

- The recent decline in mortgage rates means that today’s expected Fed rate cut is already priced into the market, and any impact may be muted, or rates could even briefly rise.

- Confusion abounds as inflation—driven by tariffs and surging grocery prices—is a major concern, yet policymakers push rate cuts while the job market softens and new listing inventory growth declines.

- Housing prices are likely to climb or stabilize due to lower rates and slower inventory growth, but outlook remains uncertain amidst questionable tariff policy and economic unpredictability.

UPDATE Yes, the Fed cut happened 5 minutes after Housing Notes went out today – a 25 basis point cut.

We’re “tense and nervous, and [we] can’t relax.” Yesterday I spoke at a REBNY Market Pulse event, and there was a surprising amount of agent discussion on the topic of inflation, rather than an obsession about rate cuts. With the Fed expected to cut interest rates today (odds were 94% this morning) by 25 basis points, most of the audience felt that the recent decline in mortgage rates meant that today’s expected Fed rate cut was already baked into the financial markets. I agree. Mortgage rates have fallen about 50 basis points since August 1st. Another confusing issue was the idea that the economy is weakening significantly on the job front, justifying the cuts, yet tariffs are inflationary. Many goods, especially groceries, are seeing rapidly rising prices. How can we be discussing rate cuts when the primary economic policy coming out of Washington is inflationary? It’s weird, right?

.

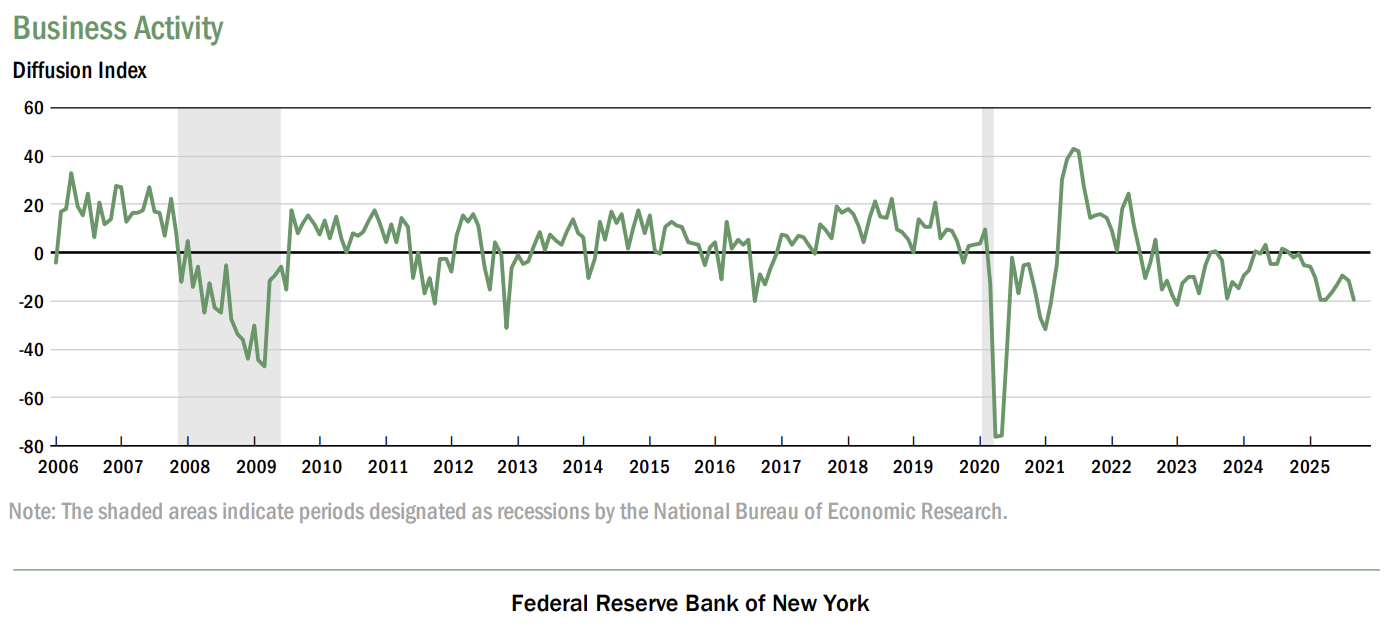

Championing The Wrong Kind Of Inflation

There is a problem with tariff policy coming out of Washington. The administration lacks core economic competence and a profound misunderstanding of how tariffs work. The economy is slowing – we can see that in New York in the chart above. The big difference today in the US economy versus the pandemic inflation surge is what the added costs represent. Today’s inflation represents higher costs to the consumer. During the pandemic, inflation represented higher prices to the consumer, so employers were able to justify higher wages back then. Wages are still keeping up with inflation, and the financial markets are predicting up to three rate cuts (including today’s expected cut). We may see slightly lower mortgage rates after today’s announcement, but really, who knows? Mortgage rates today are the lowest in nearly a year, but could even rise a little bit after the Fed cut today.

New Listing Inventory Is Pulling Back

The uncertainty about the economy is at full capacity these days, and as a result, the growth of new listings entering the market is slowing. The rate of new listing growth has fallen for the past four months. Sellers have been less willing to enter the housing market until they are able to wrap their arms around the economic chaos.

Where Do Prices Go From Here?

Up.

With increased demand from lower mortgage rates and slowing inventory growth, housing prices will either rise or stop sliding, depending on each local market, as sellers get a little firmer in their positions.

Final Thoughts

With mortgage rates falling about 50 basis points since August 1st, today’s rate cut is already built into the market, and we are likely to see a lot more downward motion in the near term. In fact, we may see slightly higher mortgage rates in the short term. All bets are off if the administration’s controversial tariff policy is reaffirmed as unconstitutional with the Supreme Court – it’s tough to say which way they will eventually rule, given their recent decisions despite the black and white nature of the constitution. What a bizarre time we are living in.

The Actual Final Thought – I remember this song blasting at a college dorm party circa 1979 before I hiked back to my dorm in a pitch black evening of sub-zero Michigan weather. Wow, time flies.

Upcoming Presentations

• September 18, 3 pm ET / Zoom ====================================

• September 29 / In-Person ========================================

HGAR’s IMPACT: The Member Experience

I’m excited to speak at IMPACT: The HGAR Member Experience on September 29. I’ll be joining real estate professionals from across the region to explore what’s next in the housing market, economic opportunities and building community. Join me and be part of the conversation that’s shaping what’s next. Learn more and register.

[Podcast] What It Means With Jonathan Miller

The Ugly Signs Can Be A Good Thing episode is just a click away. The podcast feeds can be found here:

Apple (Douglas Elliman feed) Soundcloud Youtube

Did you miss the previous Housing Notes?

Housing Notes Reads

- EQUITY ANALYSIS [Econ70]

- Business Leaders Survey Business Leaders Survey [NY Fed]

- Sales don’t always become comps [Sacramento Appraisal Blog]

- She Found a New Way to Sell High-End Houses: Mock the Rich [NY Times]

![[Podcast] Episode 4: What It Means With Jonathan Miller](https://millersamuel.com/files/2025/04/WhatItMeans.jpeg)