Time to read [6 minutes]

Takeways

- The Pierre’s penthouse, owned by the US Commerce Secretary, has remained empty for eight years, reflecting ultra-wealthy property holding power despite the steep costs.

- A proposed $2B building sale would evict all shareholders after compensation, fueling backlash and highlighting co-op owner vulnerabilities.

- The Pierre represents a rare co-op hotel model in Manhattan, combining luxury amenities with high fees and strict liquidity demands.

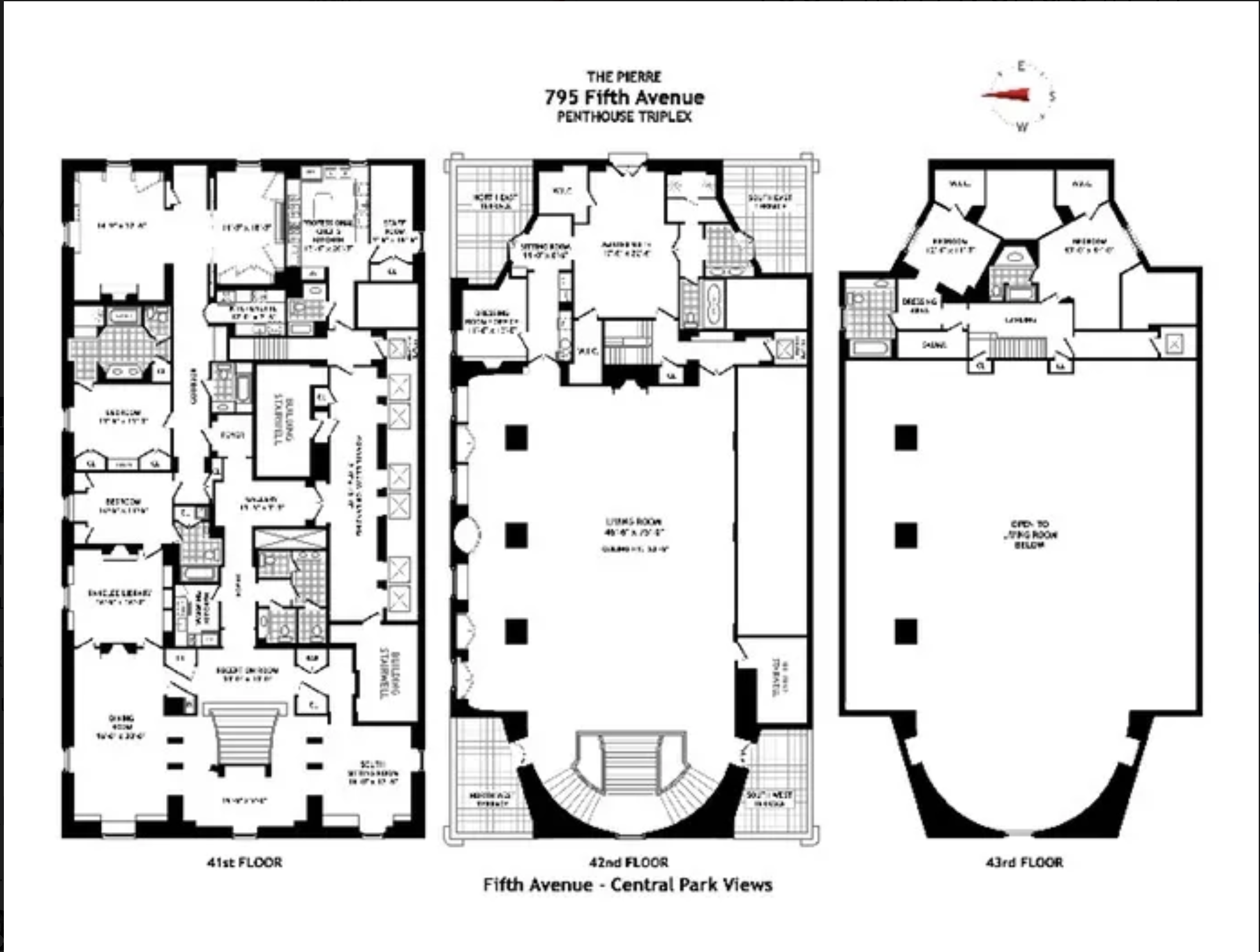

Let’s go down the rabbit hole in the sky together. One of the benefits of being in the appraisal profession for four decades is that I get to see some cool stuff, including a lot of Manhattan penthouses. One of the penthouses that has eluded me sits atop The Pierre, located at 795 Fifth Avenue, which the US Commerce Secretary currently owns. His $44 million co-op purchase (it was listed for $125 million at the time) has remained empty since he acquired it in 2017. The fact that it can sit empty for eight years perhaps explains the disconnect between Lutnick’s tariff sales pitch and lives of typical US citizens. With a monthly maintenance (HOA plus real estate tax) of $51,840 in 2017 (excluding the time value of money for the purchase price), it is a reasonable assumption the holding costs are likely much higher today. Being able to keep this penthouse empty for so long is real wealth. I’ve been in many Pierre co-op apartments owned by prominent individuals, and the Central Park views are spectacular. For those who aren’t familiar with co-op apartments, which account for roughly 75% of Manhattan residences, there is a subset that offers hotel services (along with very high monthly fees). As I write this, I am curious whether the 2017 penthouse purchase was part of a long-game that only billionaires can play. Here’s the story: The Commerce Secretary, a Gilded Hotel and Claims of a Secret Plan [gift link].

The Penthouse

The penthouse has three levels – the 41st, 42nd and 43rd floors, 360 degree views, sixteen rooms as well as a private elevator.

The Plan

According to The New York Times, a buyer is willing to pay $2 billion for the entire building. If the shareholders are able to reach a supermajority to vote for the deal, all the residents would “lose” their homes, but presumably be paid their pro-rata share of the purchase price, net expenses, and consideration of liabilities. Judging from the last board meeting, the residents that want to stay appear to be quite upset.

Unlike a condominium, this situation shows how co-op shareholders face an additional vulnerability due to some of the rights they give up to the board in this form of ownership. I co-authored a published white paper with the NYU/Furman Center a while back that explored the value difference between co-ops and condos, assuming all other differences were equalized except for ownership type. When all amenities are made equal, condos achieve higher prices than co-ops in Manhattan.

The Building

The Pierre was built in 1930 and is located near the southeast corner of Central Park. My friend “Max” wrote on Streeteasy about The Pierre: “Fast-forward to 2005 when the hotel was acquired by Taj Hotels and Resorts who carry on the storied tradition to this day and injected $100 million for renovations prior to the grand re-opening in 2009. Now part Co-op (77 units) and part hotel (140 rooms and 49 suites) you can own a piece of history and take full advantage of all the restaurants and services the hotel has to offer including the decadent twice daily maid service, elevator attendants, an on-call Physician 24/7 and much much more. Those who seek to buy here need plenty of cash as financing your purchase is not permitted and the Co-op board looks to make sure that you have sufficient liquid assets even after you “write the check” for the apartment.”

Other Manhattan co-op hotels in this particular market subset that my firm and I have appraised include the Sherry-Netherland, Hampshire House, The Carlyle, and The Lombardy.

High Monthly Fees

When I read the New York Times piece and then thought about the condition of the common areas I’ve observed in person, I was surprised by the overwhelmingly negative take on the condition in the piece by residents. Of course, I’m not a billionaire, and I’m not saying the existing condition isn’t rough around the edges, but I was surprised at the harshness of the tone, almost like the people being interviewed were trying to make the deal happen and were pushing the criticism very hard.

The monthly maintenance per square foot of an apartment in The Pierre we appraised last year at was $6.05 per square foot, about three times the Manhattan average of $2.45 per square foot.

Final Thoughts

Imagine a slew of bold-faced names losing their homes against their will (but being compensated for them) [gift link]. That’s the potential situation here at The Pierre, and Lutnick’s name is being mentioned in the coverage, along with his giant penthouse, which has sat empty for eight years, incurring enormous carrying costs. Per the coverage, he has more shares than anyone else and stands to benefit more than anyone else. It’s hard to get your arms around this scale of deal – it is clearly a much different world for these masters of the universe than it is for mere mortals like myself and presumably most of my readers. Imagine being forced out of your home that you love at the height of your success but being compensated. Now imagine being forced out of your home for financial reasons. It is not the same feeling, I’m sure.

The Actual Final Thought – This song came out just after we closed on our house (two houses ago) in the mid-90s, and I played it continuously as we were unpacking. Now it makes me think of the members of The Pierre board who don’t want this sale to happen. It is indeed a bittersweet symphony.

StreetMatrix Is Coming Soon

[Podcast] What It Means With Jonathan Miller

The You Don’t Need A Compass To Go Anywhere episode is just a click away. The podcast feeds can be found here:

Apple (Douglas Elliman feed) Soundcloud Youtube

Did you miss the previous Housing Notes?

Housing Notes Reads

- The Commerce Secretary, a Gilded Hotel and Claims of a Secret Plan [NY Times]

- Tory Burch, Art Garfunkel, Michael Eisner, and More May Be Forced Out of Their NYC Homes [Vanity Fair]

- Residents at the Pierre revolt against Howard Lutnick over $2B sale plan [The Real Deal]

- Zillow wants to further question Compass CEO in listings case [Real Estate News]

- A Wave of New Apartment Buildings Are Set to Take Over Midtown Manhattan [Bloomberg]