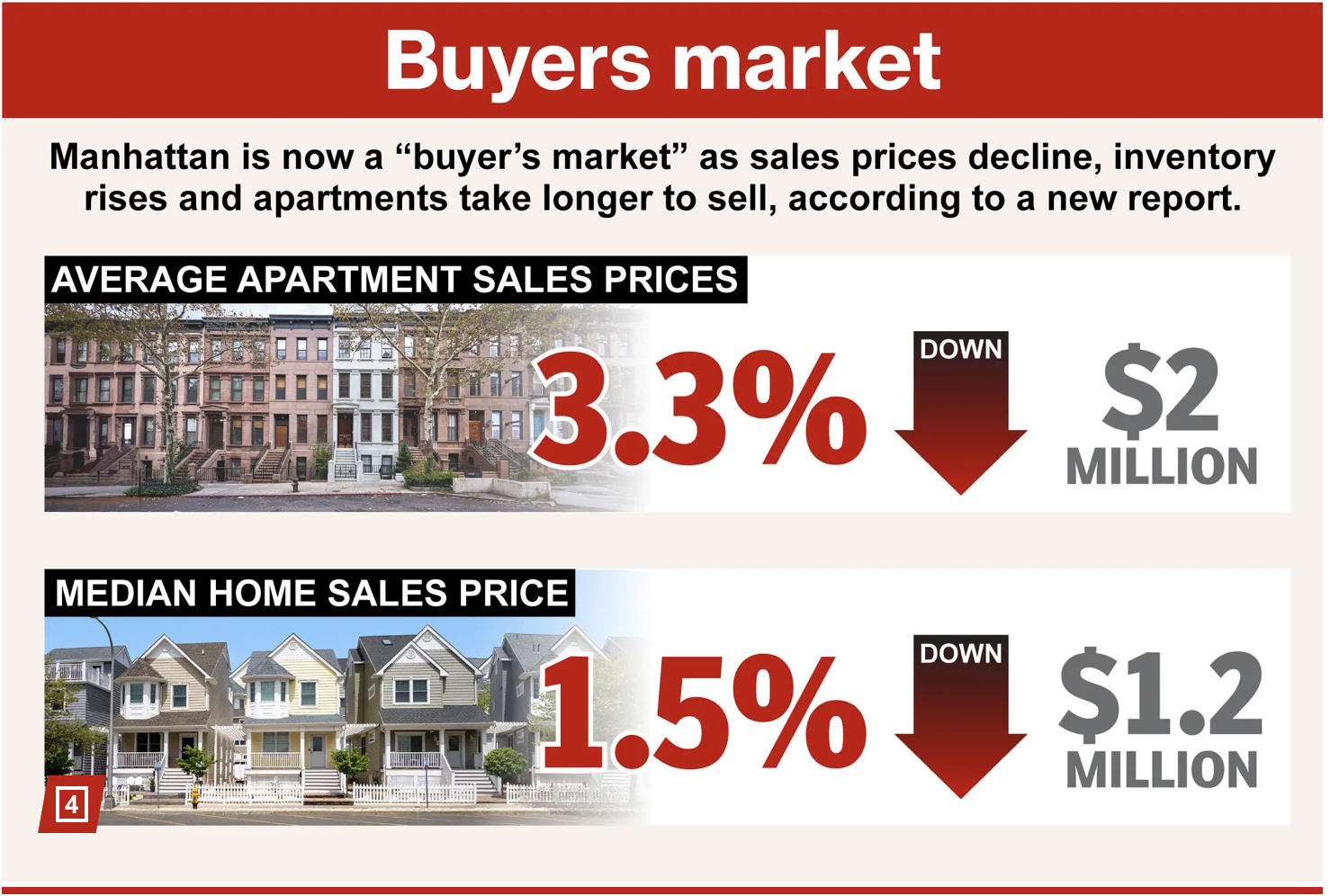

• One-fifth of $4.7 trillion in outstanding commercial mortgages will come due in 2024.

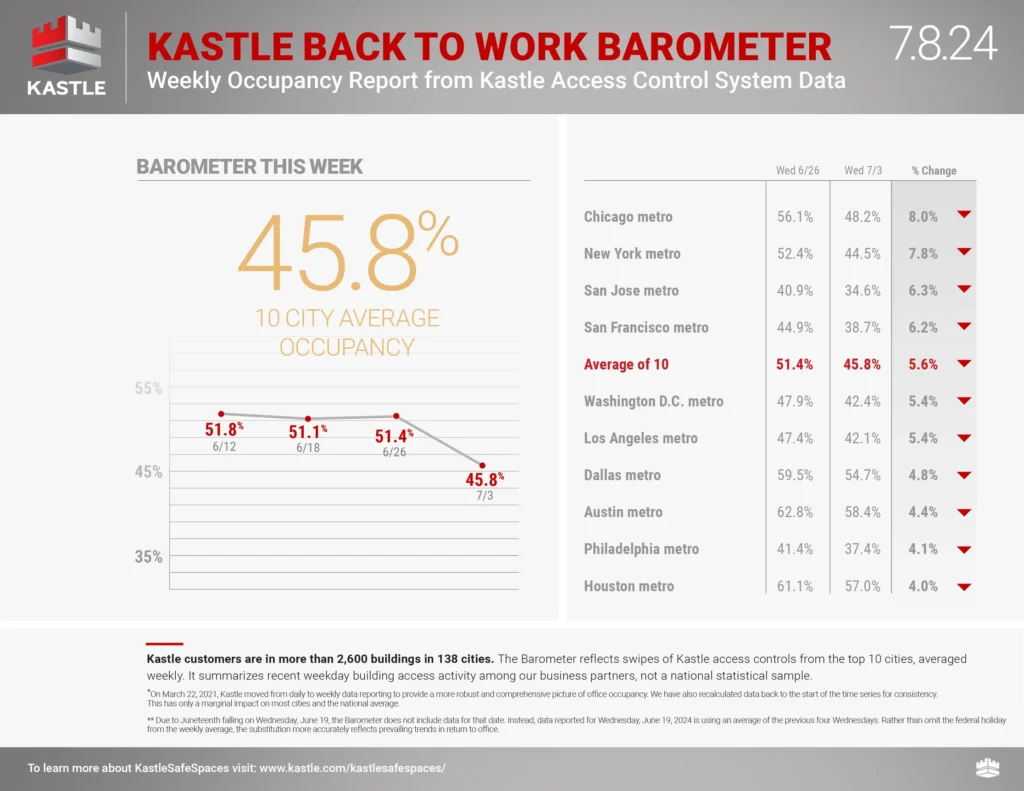

• Tracking office vacancies wildly understates the amount of empty office space.

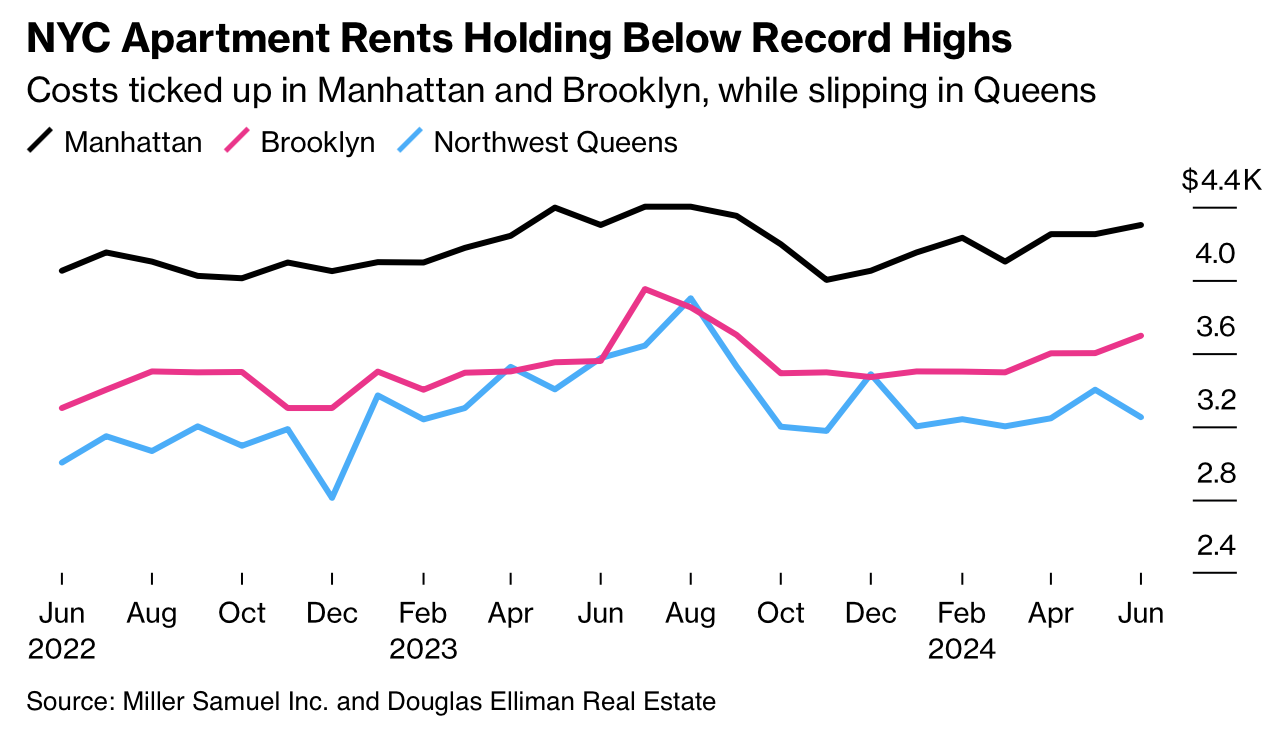

• NYC’s City of Yes plan removes antiquated regulations preventing conversions.

![Orange County Average v. Median Sales Price [Single Family, Condo]](https://millersamuel.com/files/2024/04/2Q24OC-avgMED-1200x794.jpg)