The MRED PLN Is Different Than Compass Exclusives

Takeways

MRED’s Private Listing Network gives all member agents internal access, keeping listings hidden from public consumer sites that still promotes transparent price discovery but limits referral fees.

Compass restricts listing access exclusively to its own agents, raising anti-competitive risks and reducing transparency for buyers in its dominant markets.

Industry debate heats up as Zillow enforces strict anti-private listing policies while Compass and MRED battle to control access and competition.

With all the Zillow/Compass legal jujitsu, I read a report about Chicagoland’s MRED Private Listing Network (PLN) with great interest, especially given how they extolled its benefits for agent members. MRED is fighting Zillow, and Compass is fighting Zillow about the handling of private listings. To be clear, the MRED private listing network (PLN) means all member agents and brokerages that are members of the MLS have full access to those listings, but NOT outside services like Zillow, Trulia, or Realtor.com. The MRED private listings enable reasonable price discovery. MRED public listings include those shared with external services such as Zillow, Trulia, and Realtor.com. However, the core difference between Compass Private Exclusives and MRED’s PLN is that, although both are called ‘private,’ only Compass agents have direct access to Compass private listings. In my meeting with Compass CEO Robert Reffkin, he explained that any agent outside of Compass can call a Compass agent to ask whether there are any listings in a submarket the agent’s customer is interested in, but that’s a forced step (therefore the listing is not transparent to anyone but a Compass agent). With MRED, there is agent competition, which lubricates the price discovery process across competitors in a large market. With the Compass approach, only Compass agents experience actual transparency. As a reminder, my commentary is focused on their business model, not personnel.

What Is MRED’s Private Network?

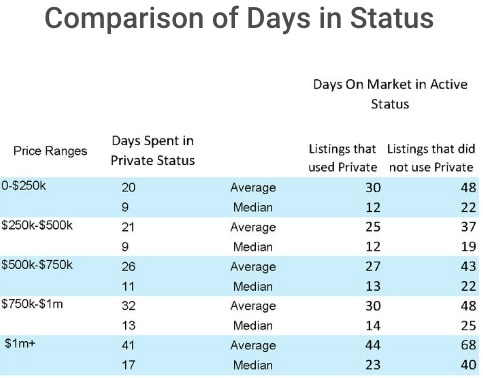

MRED’s private network has actually been around for about a decade, and this white paper has been around since 2019. The white paper is updated every few years, and I’ve been following it over time. If listings in all price ranges sell faster than public listings, why are only 16% of PLN private? Somehow the idea of only 16% of the MRED listings go private but the metrics seem better, begs the question, “why wouldn’t all listing in that market go PLN?” What am I missing?

I find myself in a weird middle ground: I have been critical of the Compass private listings plan, here, here, and here, so I must be on Team Zillow yet I’m not. I’m team less. Ha. The PLN key points are as follows:

Agents can pre-market properties to peers or manage listings that require privacy, upgrades, or phased marketing.

The agents can keep their listings private indefinitely and do not accrue Days on Market; after public marketing begins, they must transition to standard MLS status.

Sellers must sign disclosures acknowledging the limited exposure and potential trade-offs of using the PLN.

PLN listings are not displayed publicly (not sent to Zillow et al or seen by consumers) and can’t be sent via auto-searches or third-party portals.

The system supports privacy, such as high-profile or sensitive transactions and strategic “coming soon” marketing.

Zillow restrictions against private listings:

Homes publicly marketed in any form outside the MLS must be listed on an MLS within one business day, or Zillow will remove the listing.

This rule covers social media, brokerage websites, flyers, and any consumer-facing materials.

Office exclusives and “Coming Soon” listings are permitted only if they meet NAR guidelines and are submitted to the MLS appropriately; however, Zillow does not recognize most NAR exemptions and treats any public promotion as triggering mandatory MLS inclusion.

The ban does not apply to FSBO (For Sale By Owner) listings, rentals, or new construction sold directly by the builder.

Listings marketed through private brokerage networks and advertised to consumers are also prohibited on Zillow unless entered into the MLS.

Agents receive warnings, and repeated violations result in their listings being blocked from Zillow entirely.

Wild Leeks And Chicago Market Dominance

MRED has a significant motivation to be cooperative with Compass since Compass acquired @Properties in 2024, one of Chicago’s largest brokerage firms. With the recent acquisition of Christie’s and the pending Anywhere deal, Compass will absolutely dominate Chicago’s real estate market. Incidentally, when I lived in Chicagoland during my first three years out of college, I absolutely loved the city. I even learned where the name “Chicago” came from when I was there: “in the late 1600s. The area was populated by the Miami – Illinois tribes, part of the larger Algonquian language group… It’s most commonly seen representing the wild leeks that grew along the riverbanks. This plant gave off a distinctive scent with a garlic-like odor.” Hardly anyone in Chicago seems to know this, which probably tells you how transient the population is or they don’t like leeks or wild onions.

Reducing Referral Fees Is Probably MRED’s PLN Goal

Currently, MRED private listings comprise about 16% of their listing inventory. MRED is pushing their PLN because it cuts out a chunk of those 20%-50% referral fees when a listing sells through Zillow et al. Reducing referral fees makes MRED look great to its agent and brokerage members.

Moral Hazard And Likelihood Of A Compass Private National MLS

Early this year, the media reported that 35% of Compass listings were private and 94% of those listings ultimately sold in the public market. One-third of the listings of the largest real estate brokerage firm in the US, and even bigger after the Anywhere merger is complete next year, are fully transparent only to Compass agents, which should be a genuine concern to buyers and sellers. I find it interesting that the vast majority of them are eventually sold on the MLS.

Because of the scale of SoftBank’s financial backing for Compass, they have been able to dominate housing markets, which has been nothing short of impressive. The Chicago market share of Compass after the Anywhere deal is approved next year is a great example. I’ve long referred to Compass as a “disrupter by capital,” which has enabled their market dominance.

Private = Anti-Competitive

By keeping private exclusives transparent only to Compass agents, and given their growing US dominance, anti-competitive market forces may expand even if that hadn’t crossed their mind or been part of their strategy. Because Compass Exclusives strategically limit competition and because of their largess, unlike MRED’s PLN version, they will have a significant impact on market competitiveness. Lots of moral hazards are being planted here, whether intended or not. And so is the likely uptick in “digital redlining” by the way.

During the financial crisis, I observed moral hazard firsthand from the perspective of banks. Lenders took crazy risks because they always figured the government would bail them out. And they did. I saw Washington Mutual Bank fail in real time. The moral hazard in the Compass private listings version is the lack of price discovery it creates, and the bad behavior some of its agents will eventually engage in due to their market dominance of their brokerage. Through scale, they will likely accumulate a large share of listings from the eventual acquisition of Anywhere next year. By placing a large swath of listing inventory in the hands of one company that keeps them private, price discovery will go to hell, and buyers won’t have the information they need to make a reasonable offer and worse, won’t know they don’t have it.

Final Thoughts

Compass and MRED both offer private listing models, but their transparency differs sharply. MRED’s Private Listing Network (PLN) lets all member agents access private listings, promoting internal competition and helping price discovery, while keeping these listings off public sites like Zillow. Compass’ exclusives, by contrast, are fully visible only to Compass agents, which restricts transparency, limits market competition, and raises concerns about anti-competitive practices. With Compass’s growing market dominance, this lack of transparency could worsen moral hazard and market fairness issues.

God help home buyers in this environment. They seem to be an afterthought yet they are needed for every transaction.

The Actual Final Thought – Speaking of hidden and private, He was one of the best talents you’ve never heard of. My parents had a housekeeper when I was young and her husband supposedly was a very early drummer for him (not in the video).