‘Stop Buying Lattes’ As The Path To Homeownership And Other Myths

Takeways

Homeownership hurdles are far higher for Millennials and Gen Z than for prior generations: Housing prices have outpaced wage growth, raising the average age of first-time buyers and making small expense cuts (like skipping lattes) largely irrelevant to the broader affordability crisis.

Popular solutions like 50-year mortgages aren’t effective fixes: Longer loan terms mean higher lifetime interest, slower wealth accumulation, and riskier terms for buyers, not real progress on affordability.

Broader effects and responses: Parental assistance is increasingly important (“Bank of Mom & Dad”), building more housing helps make the market accessible, and surging costs are linked to wider societal shifts, including lower fertility rates.

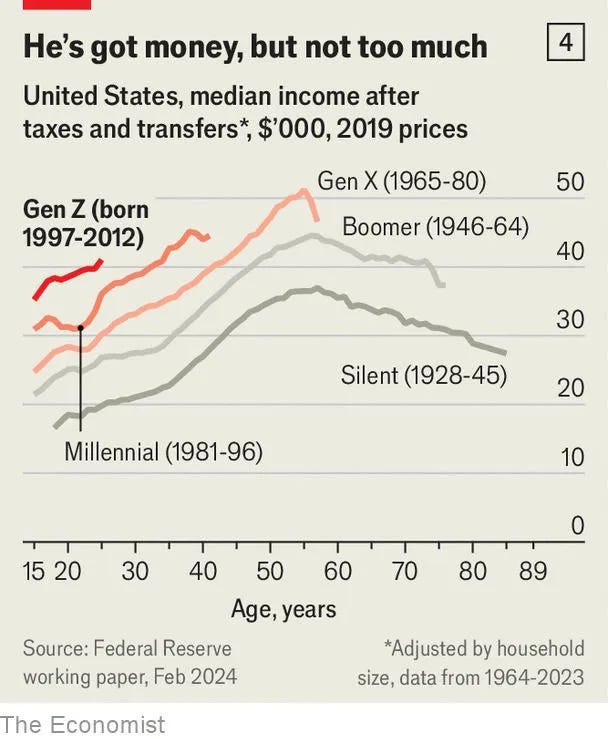

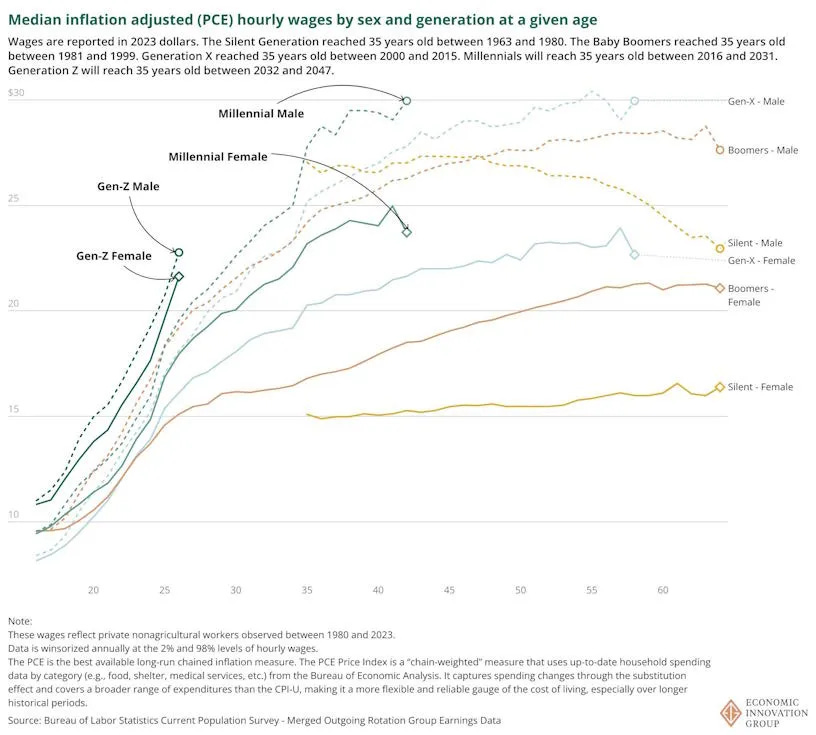

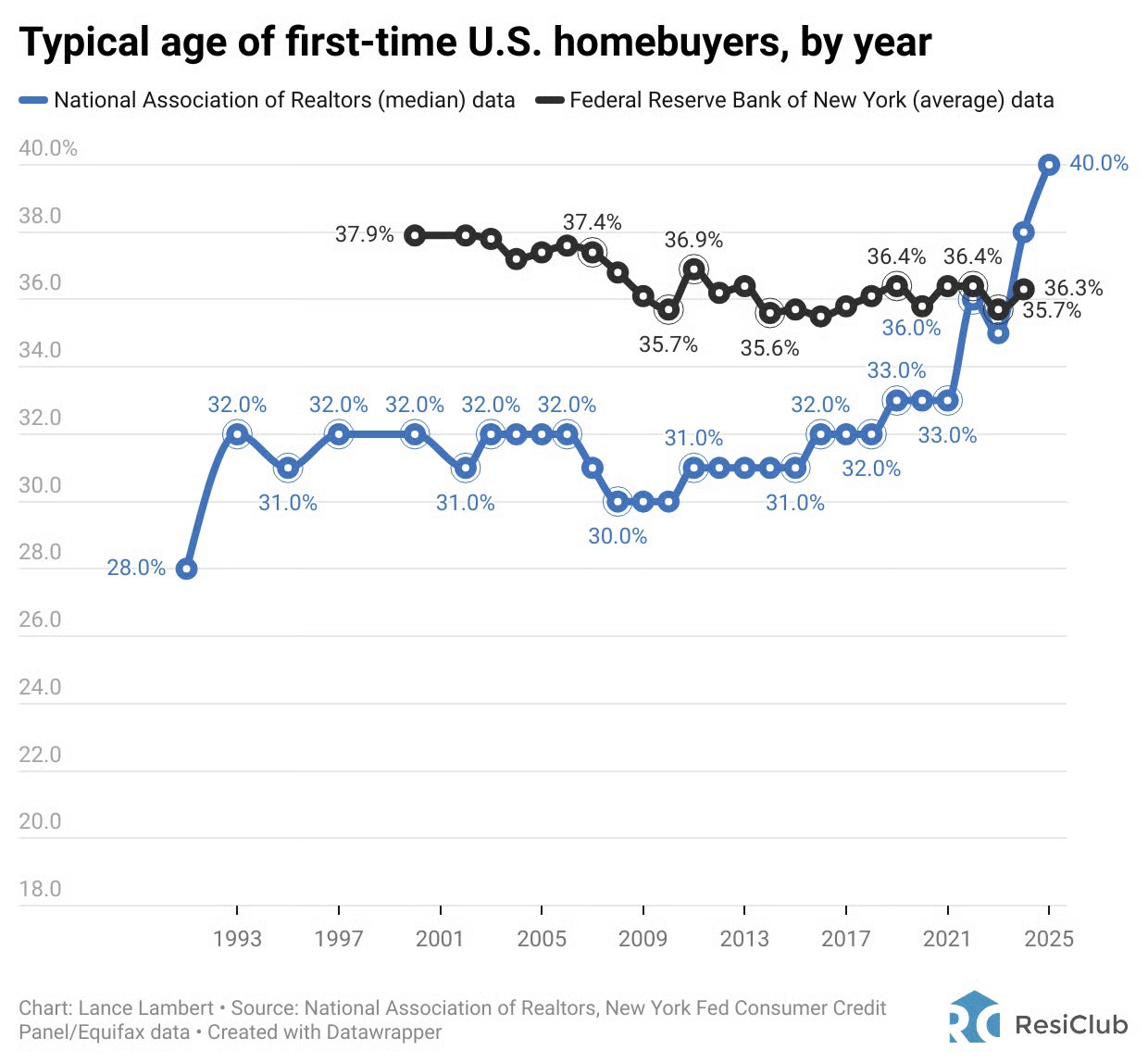

A few years ago, I ran across this piece as mortgage rates were surging. Yet, Millennials and Gen Z know how to save money. Stop buying lattes or avocado toast was the refrain. It reminded me of the embarrassing disconnect a US Senatorhad about the minimum wage, inferring that because they worked for $6 an hour in their youth (it would be $23 an hour today adjusted for inflation), the new generation is soft. It is not. My friend recently got the same vibe, suggestingthat many in industry leadership don’t understand affordability. First-time buyers now have a median age of 40, up from 30 in 1990 (if you believe the source – see below for a deeper dive). The rising price of housing has outpaced wage gains at a significant rate, worsened by the pandemic, when the Fed kept interest rates too low for too long. Yet Gen Z and Millennials are making a lot more money now than their predecessors did at the same age. We are living in a reality distortion field at present. The high bar set for homeownership these days is no longer just about having the grit and determination to save. There has been a massive disconnect between housing prices and wages. Today is not a repeat of the youth of Gen X, Boomers, and the Silent Generation.

I stumbled across the following cool chart (I already knew about the above chart) in a regular must-read Noahopinion’s Substack, which shows the same trend in a little more detail. Wow.

First Time Homebuyers Are Getting Older?

NAR released a first-time buyer study that seemed to go viral, with the SEO-friendly title: “First-Time Home Buyer Share Falls to Historic Low of 21%, Median Age Rises to 40.” I subscribe to Resiclub, a spectacular resource on the housing market, which is critical of the NAR analysis: NAR says the median age of first-time homebuyers was 40 this year, up from 28 in 1992—but can we trust the data?

Short Answer? Probably not. The Fed study uses credit data, a larger, actual dataset, while the NAR methodology relies on surveys. The NY Fed reported a median age of 38 for first-time buyers, slightly lower than NAR’s. But if you want to be more confused, instead of median, the average first-time buyer age is around 36 and is DOWN over the past 25 years. First time buyers have not gotten older since 2000!

Why A 50 Year Mortgage Is Not A Solution

Bill Pulte, who leads FHFA, the regulator of Fannie and Freddie, pitched the idea of a 50-year mortgage to the White House, and the public panned it immediately. Why?

The average borrower would only save around $300 on a $3,000 mortgage payment

They would pay another $550,000 in interest than a 30-year mortgage

The interest rate would be higher for a longer-term mortgage

These mortgages would often extend into retirement

Like we learned during COVID, lower payments result in higher home prices

Slower rate of wealth accumulation

Likely to have much tougher terms than 30-year mortgages because of higher risk

The US is the only developed nation where fixed-rate mortgages dominate

This 50-year concept seems super dumb to me.

Build More Housing

Generally speaking, building more housing, even if it skews to the higher end, melts the oversupplied tranche into the next lower layer, which lowers prices in that next layer. Think about the first Alien movie, where the acidic blood of the alien falls through multiple internal levels of the spaceship.

Despite Higher Wages Of The Younger Generation, More Parents Are Helping Their Kids

There was a good NY Times article, “They Cashed In. Now, They’re Helping Their Kids” [gift link], about this phenomenon. During my career, this phenomenon has been called “The Bank of Mom & Dad.” The thing is, kids can’t count on this. My wife & I helped our kids, not much with cash, but by letting each couple live rent-free in our house to save money quickly, and it really worked as a strategy.

Surging Housing Costs Drive Lower Fertility

Something I never thought of before, but in this white paper, we learn that high housing costs are associated with low fertility rates. One of their techniques is to use proximity to railroads to represent a lower-priced housing class. Amazing.

Here is the white paper with the best title ever: Build, Baby, Build: How Housing Shapes Fertility

Final Thoughts

Millennials and Gen Z are often told that cutting small luxuries like lattes will help them afford homes. Still, this advice ignores larger economic trends: home prices have far outpaced wage growth, first-time homebuyer ages have probably expanded, and survey-based stats sometimes conflict with more complex credit data. Despite younger generations earning more than their predecessors at the same age, homeownership hurdles today are far higher, reflecting a profound disconnect from the experiences of older generations who are doling out obsolete advice. Extended mortgage terms, such as 50-year mortgages, aren’t a real solution—payments may drop slightly, but buyers pay much more interest over time, build wealth more slowly, and face tougher loan terms.

With record housing costs and slower wage-to-home price growth, more parents are helping their adult children through gifts or free housing—though this “Bank of Mom & Dad” isn’t available to everyone. Building more housing, even luxury units, tends to ease prices for lower market segments, highlighting the importance of new supply. Additionally, high housing costs are now linked to reduced fertility rates, illustrating the broad societal impact of affordability challenges beyond just homeownership.

The Actual Final Thought – When I think of my boomer generation explaining how to navigate the housing affordability crisis to more recent generational population cohorts like cutting back on lattes, I think of the title of this song.