Racing A Ferrari In The Fog

Takeways

A government shutdown and the resulting data blackout may delay the next Fed rate cut.

Luxury housing markets are thriving despite the slowdown, as affluent buyers, driven by stock wealth, not mortgage rates, speed up high-end home purchases.

Areas like the Hamptons and NYC remain strong magnets for the rich, showing robust activity and little sign of a millionaire exodus, despite ongoing political and economic anxieties.

Data blackouts like the one caused by the performative federal government shutdown will “slow down” the time it takes the Fed to cut rates. Fed Chair Powell clearly made that point yesterday, noting that a December rate cut was no longer a sure thing. Right now, that cut has a 65% chance, down from near-certainty at 90%. Mortgage rates dipped just beforeyesterday’s Fed announcement, then rose immediately afterward. The data blackout adds to the existing uncertainty and will continue to influence consumers, leading them to take longer to make decisions, including home purchases. Betting markets give high odds to a shutdown continuation through mid-November.

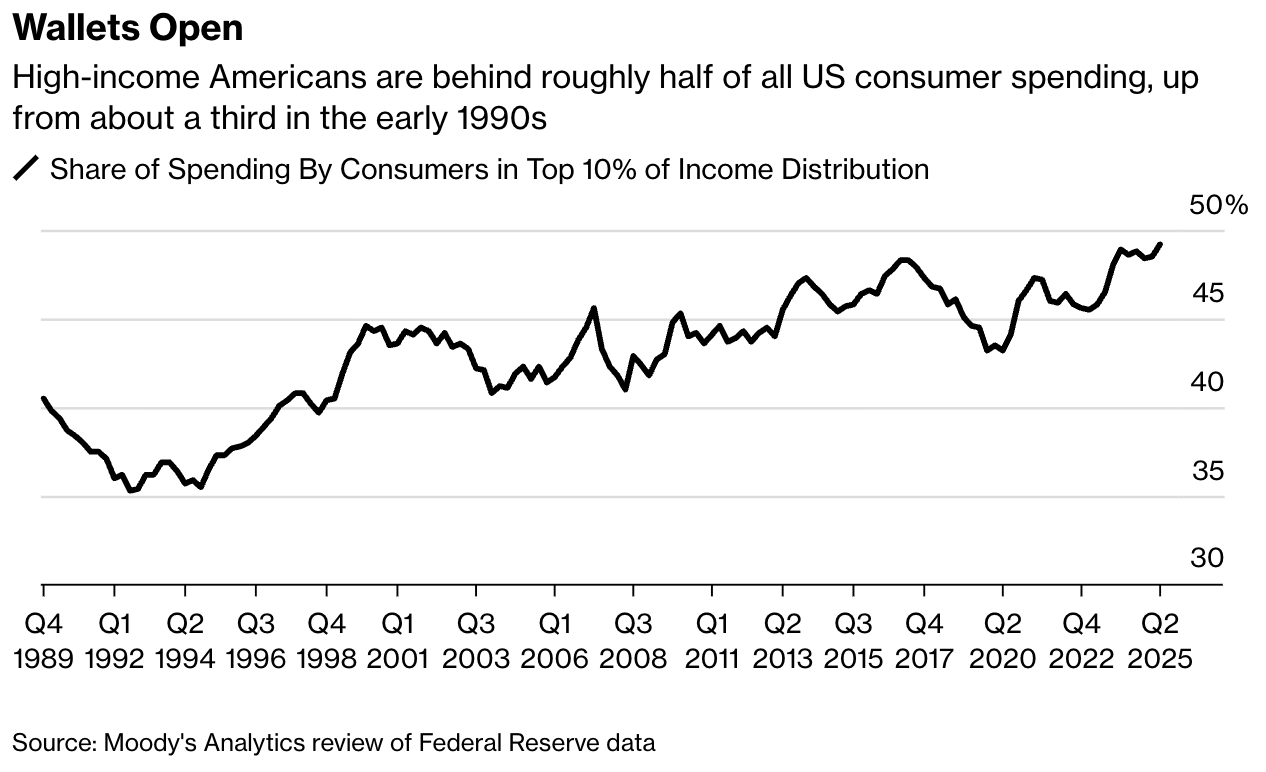

An exception to the moribund housing market pace is the more affluent. The wealthy are less dependent on mortgage rates and more dependent on stock market performance. In fact, the top ten percent of Americans account for nearly half of consumer spending. As a natural result, high-end homes are moving faster across the US.

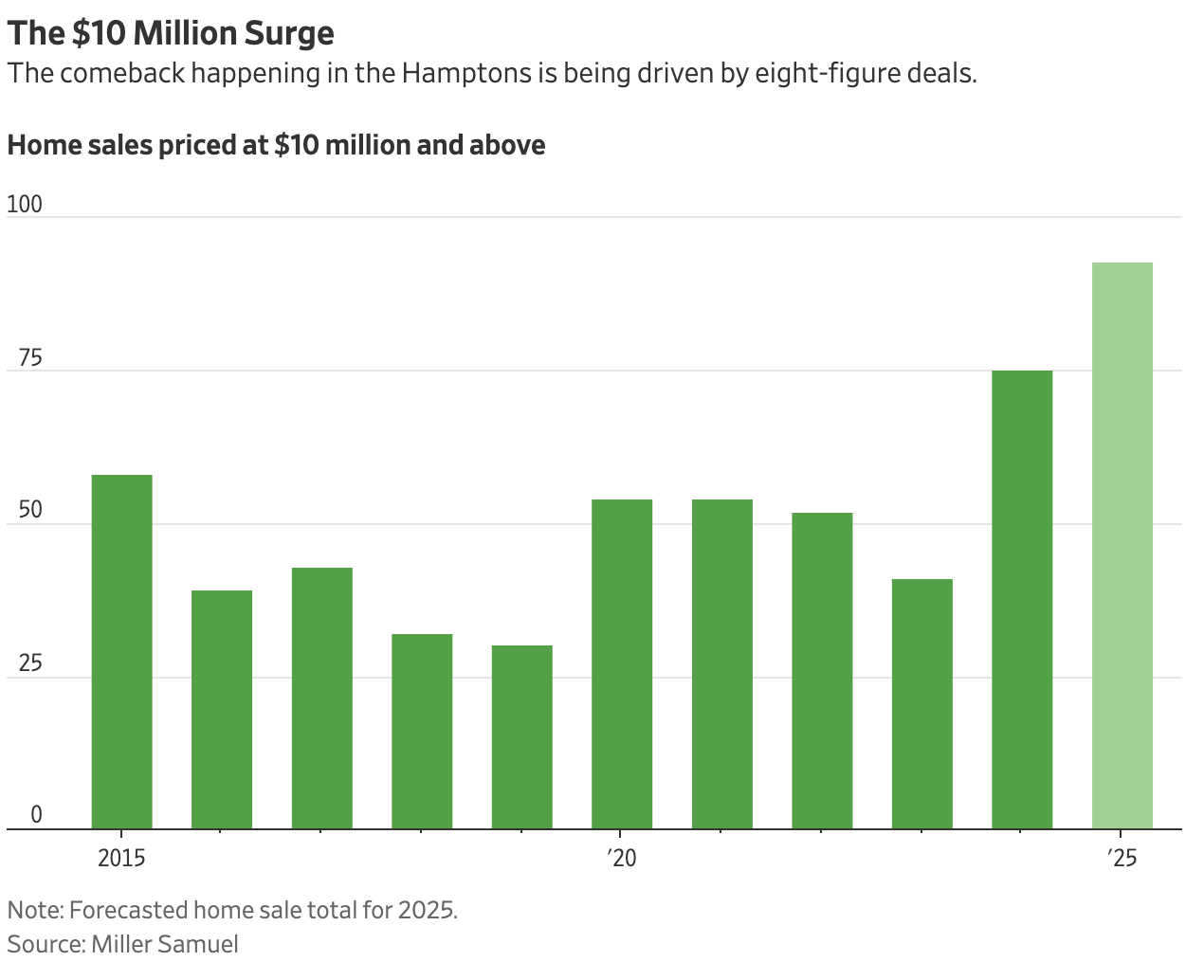

The Hamptons Sees No Fog

I can see this first-hand in the markets I cover. The Hamptons housing market continues to see heavy high-end market activity. The Wall Street Journal just published a banger: The Hamptons Luxury Housing Market Is Staging a Comeback for the Ages [gift link] based on our data capture of $10,000,000+ homes over the past couple of decades. And of course, charts are always my favorite part of any article…

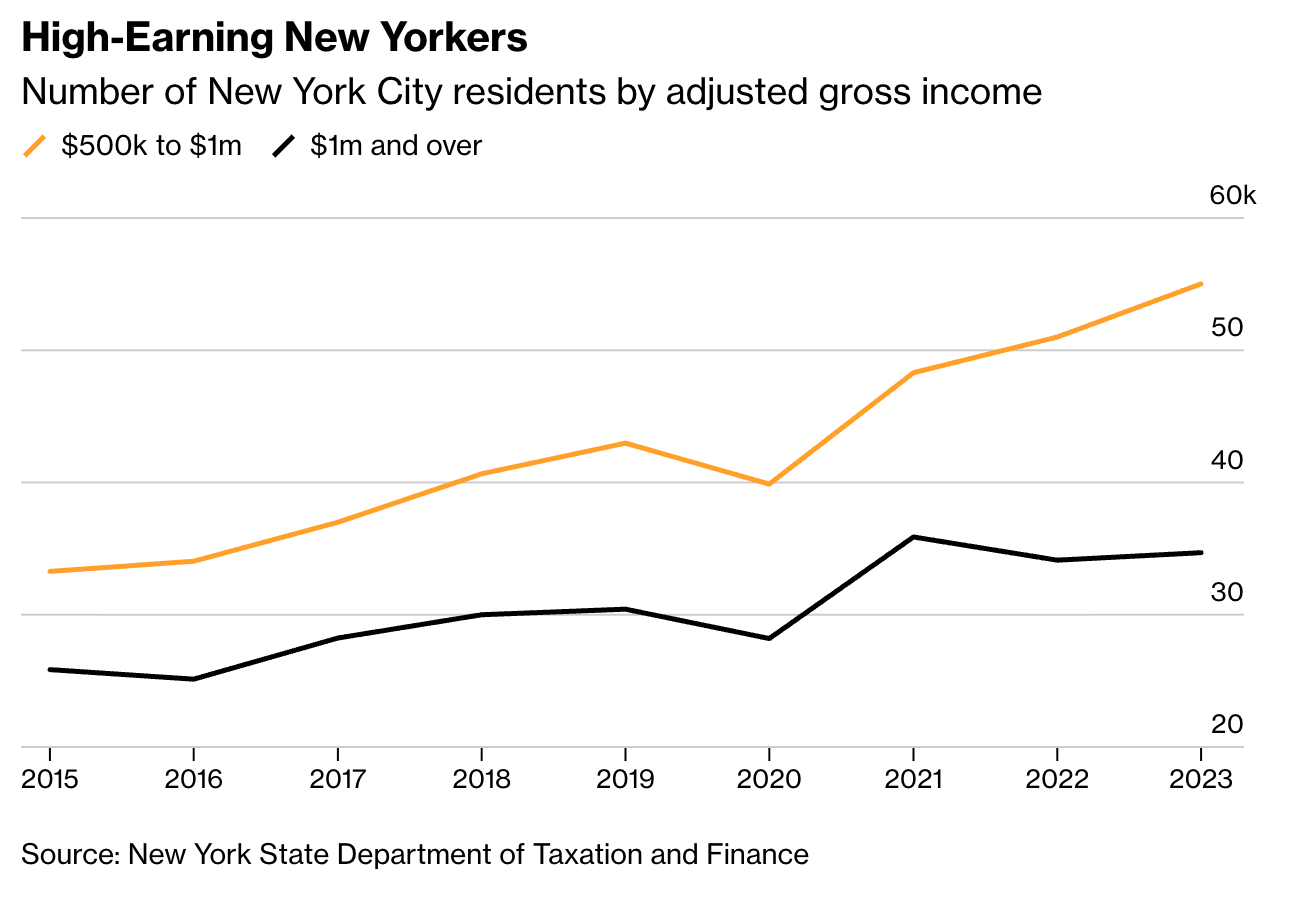

New York City Sees No Fog

I’ve just written about the misinformation concerning NYC’s likely next mayor and the fog surrounding NYC’s future fortunes. Thankfully, Bloomberg just came out with a significant piece on how the city is crushing it: New York’s Golden Handcuffs: Why the City Has a Special Hold on the Rich: Don’t bet on a millionaire exodus if Mamdani wins the mayorship. [gift link] The influx of wealth is not fully understood.

Final Thoughts

Recent data blackouts triggered by the federal government shutdown have slowed the pace at which the Federal Reserve can cut rates, making a December cut much less certain. And uncertainty from the shutdown and missing economic data continues to delay consumer decisions, including home purchases. Despite this overall market slowdown, high-end housing is bucking the trend: affluent buyers, who are less sensitive to mortgage rates and more dependent on stock market performance, are moving quickly, accounting for nearly half of all consumer spending and driving rapid sales in luxury markets nationwide. The Hamptons, for example, is experiencing a historic comeback in the $10M+ segment. At the same time, New York City’s appeal remains strong among wealthy residents, regardless of political uncertainty, with no sign of a millionaire exodus even as the next mayoral race injects new anxieties.

The Actual Final Thought – The housing market needs be freed from its current restraints which makes me want to use some WD-40.

Home Value Lock, Powered By StreetMatrix

The StreetMatrix housing index platform that we have created powers the Home Value Lock product that Josh Altman talked about today. We are fortunate to have Josh join our team.

StreetMatrix Arrives In California

Here’s the latest newsletter with links to all our resources. More specifics on this effort to come!

[Podcast] What It Means With Jonathan Miller

The How Retail Follows, Not Fuels, Housing episode is just a click away. The podcast feeds can be found here:

Apple (Douglas Elliman feed) Soundcloud Youtube