April 8, 2022

Housing Has Become Short, Brutish & Nasty

This week’s title refers to this (I prefer my order of terms). Here’s a good take on real estate brokers’ market experience today versus 2016:

@skeathley1 Real Estate market hits different these days, but I’ll get you through it one bottle at a time! #GameTok #SmellLikeIrishSpring #UnsealTheMeal #InstaxChallenge #fyp #foryoupage #BridgertonScandal #DeserveADrPepperDuet ♬ original sound – Sarah Elizabeth

But I digress…

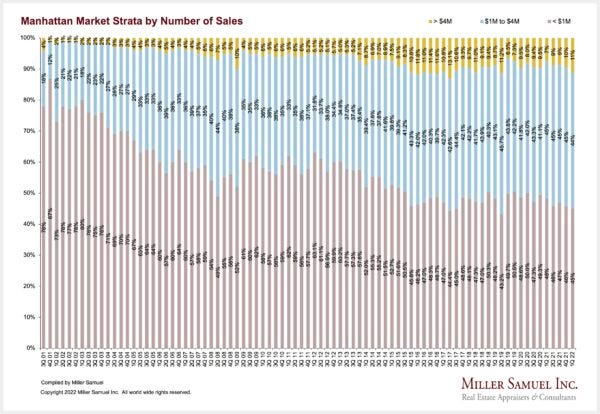

Manhattan Housing Market Pace Is Not As Frenzied But Still Blistering

That was my word salad this week on the state of the Manhattan residential housing market. I’ve been providing independent market research on Manhattan for Douglas Elliman since 1994 and that particular report has morphed into an expanding series of U.S. housing research across more than forty markets they operate in. A bunch more new market reports will be added over the coming months.

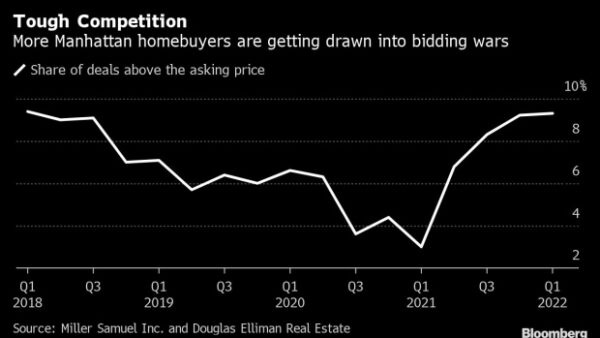

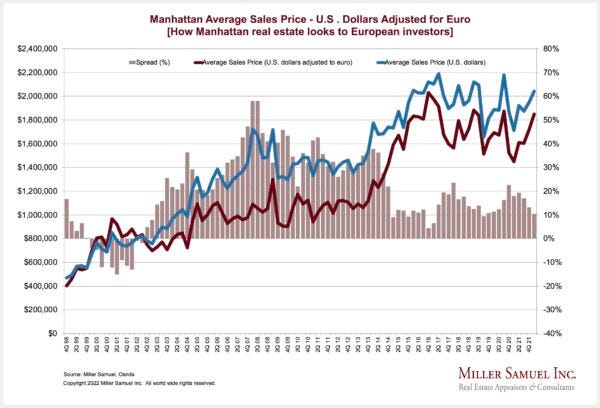

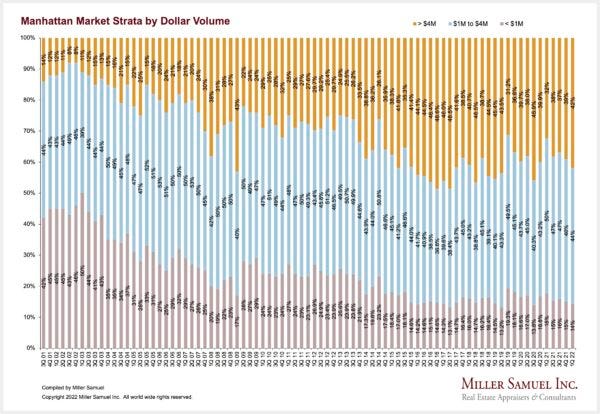

Bloomberg coverage of the Q1-2022 Manhattan report yielded a cool chart (2 versions):

______________________________________________________

MANHATTAN SALES MARKET HIGHLIGHTS

Elliman Report: Q1-2022 Manhattan Sales

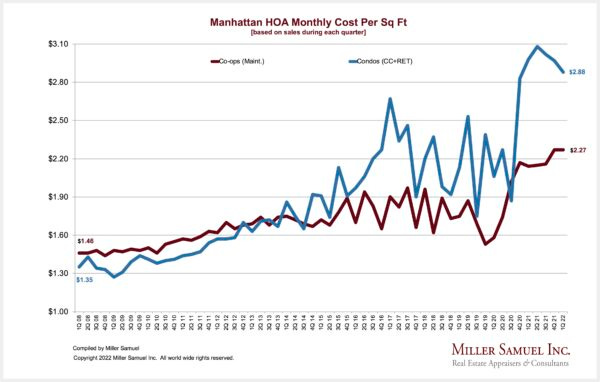

Co-ops & Condos

“Sales continued on a tear, setting records for the third straight quarter as the market catches up with the region.”

– The quarter saw the highest number of sales for a first quarter in thirty-three years of tracking

– Overall price trend indicators were higher than in the same period before the pandemic

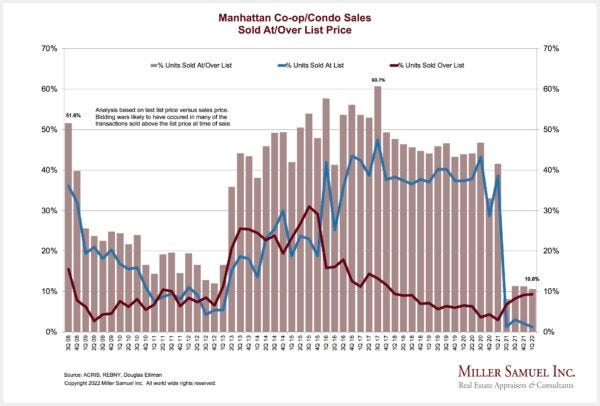

– Bidding war market share rose for the fourth straight quarter to the highest level in four years

– Co-op median sales price posted significant annual gains for the fifth straight quarter and was higher than pre-pandemic levels

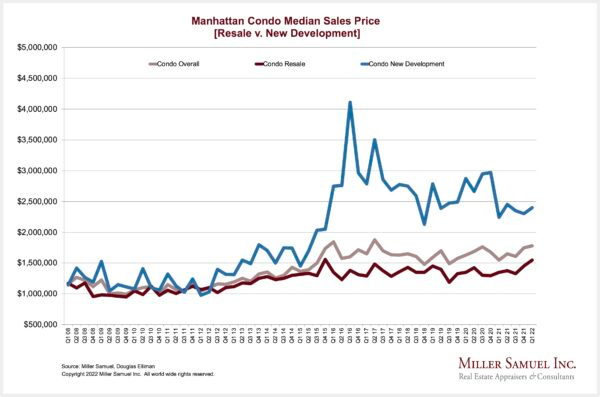

– Condo sales were up annually by more than fifty percent to reach the most first-quarter sales in fifteen years of tracking

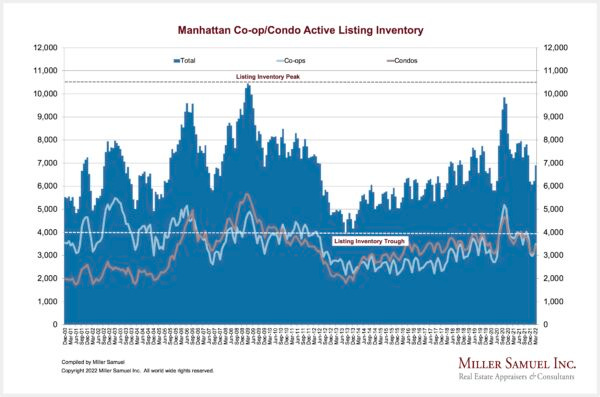

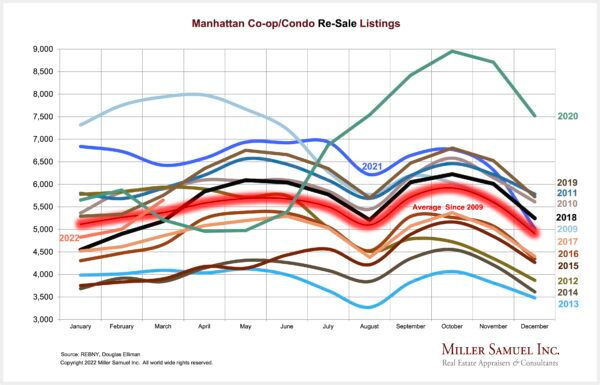

– Luxury listing inventory fell annually for the third straight quarter and remained below pre-pandemic levels

– The luxury market saw the second-highest market share of bidding wars in five years of tracking

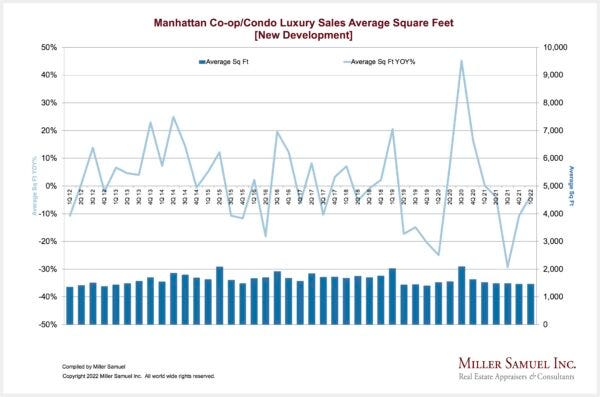

– New development price trend indicators continued to remain well below pre-pandemic levels

– New development sales were nearly double year-ago levels, the fourth straight quarter of significant annual increases

______________________________________________________

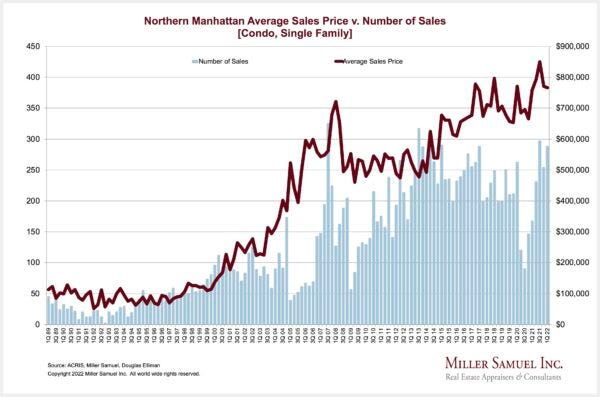

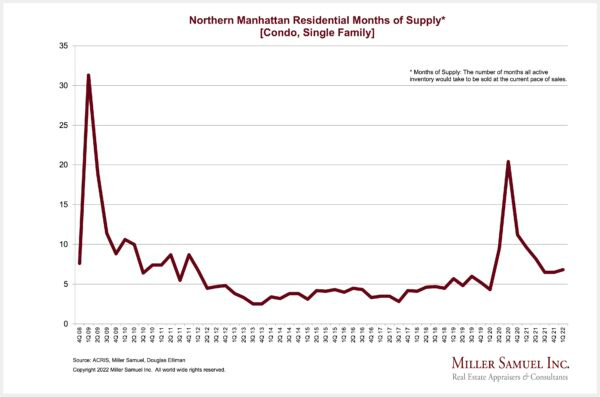

NORTHERN MANHATTAN SALES MARKET HIGHLIGHTS

Elliman Report: Q1-2022 Northern Manhattan Sales

“Sales rose much faster than listing inventory resulting in the continuation of a fast-paced market.”

Co-ops & Condos

– Median sales price rose year over year for the fourth consecutive quarter but fell short of pre-pandemic levels

– Sales nearly doubled from the prior-year quarter and were more than double pre-pandemic levels

Townhouses

– The average sales size continued to fall after peaking at the end of 2020, skewing price trend indicators lower

– Falling months of supply suggested the fastest market pace in more than a year and much faster than pre-pandemic

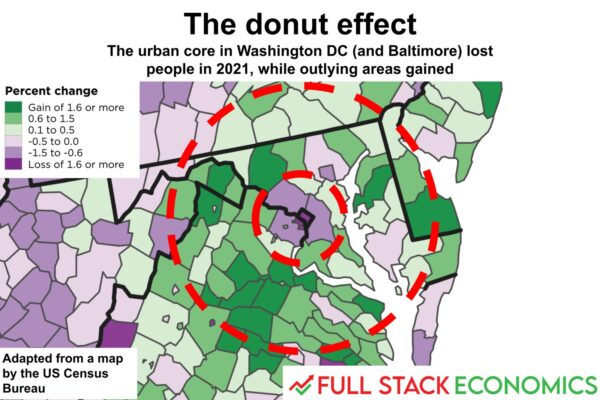

We Should All Be Thinking Of Donuts (To Describe Metro Area Post-Pandemic Progression)

Not this way:

coffee culture has officially gone too far

Dunkin' has a new makeup collection with e.l.f. Cosmetics inspired by donuts and coffee https://t.co/nvbjDXEZ5u via @usatoday

— Jason Zweig (@jasonzweigwsj) April 2, 2022

But this way:

[click image for article]

Although I still contend that it is wildly early to see this pattern as permanent. The resetting of the relationship between home and work will take several more years. One of the most glaring reasons remains: Landlords’ asking rents have not gone nearly as low as they need to be in order to entice new tenants to populate central business districts with renters. And that’s problematic after considering how much debt is placed against office buildings as collateral.

For Some Homeowners, Price Isn’t Everything

With the Masters tournament upon us, I love the idea of this 2016 holdout story: Masters 2016: The house that Augusta National’s millions can’t buy

An entire neighborhood once sat across from Gate 6-A at the Masters. The golf club spent more than $40 million to bulldoze it into a free parking lot, and now all that remains is the simple three-bedroom house at 1112 Stanley Road that Herman and Elizabeth Thacker built in 1959.

[click image for the story]

The Fed Uses “Wild Talk” About Housing

In a recent FRED blog, Is the housing market as wild as it seems?

Yes (saved you some time).

While they look at Days on Market as the panacea, I think this research actually points to the collapse in listing inventory. Days on market are falling simply because supply has been exhausted.

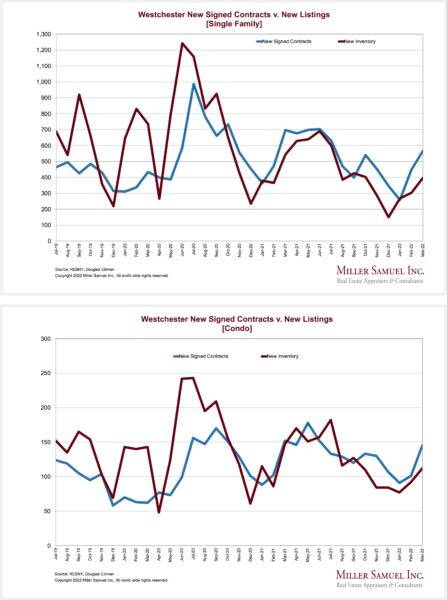

Axios Markets just created a chart using our data on the Westchester County inventory situation. Douglas Elliman is publishing our fresh research on Westchester next Thursday for Q1-2022.

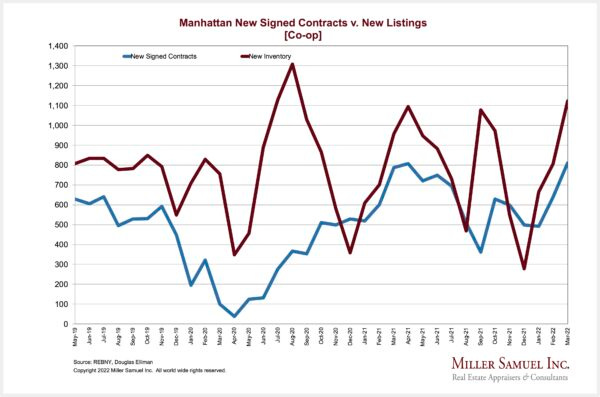

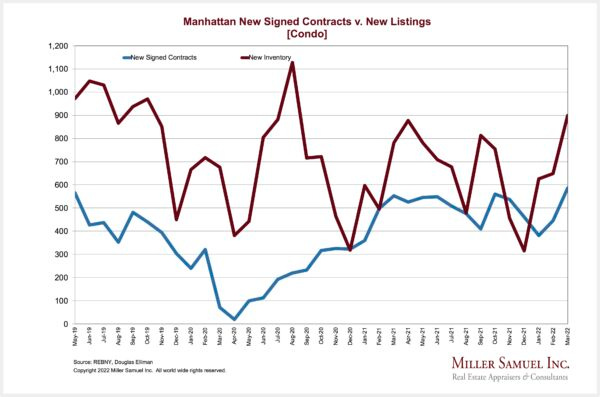

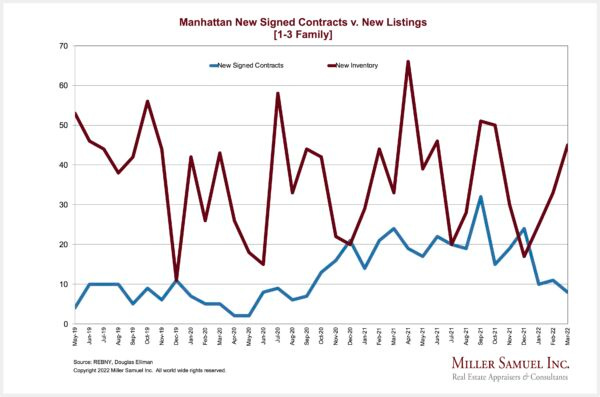

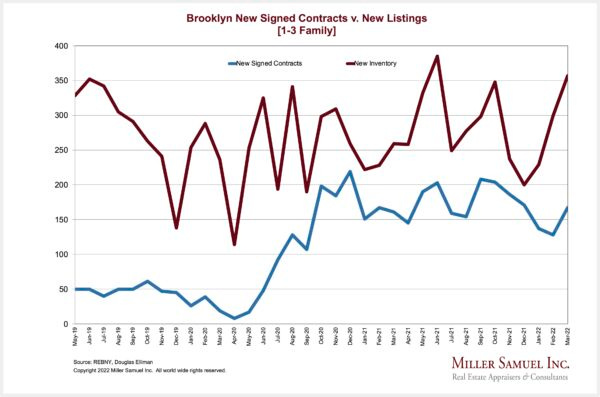

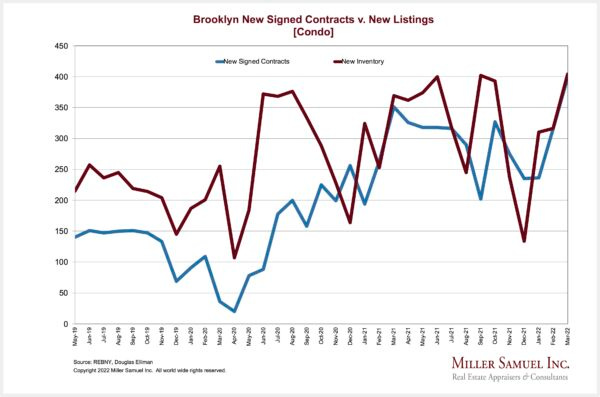

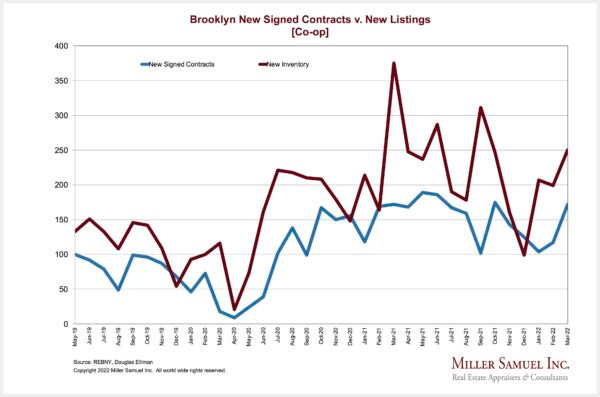

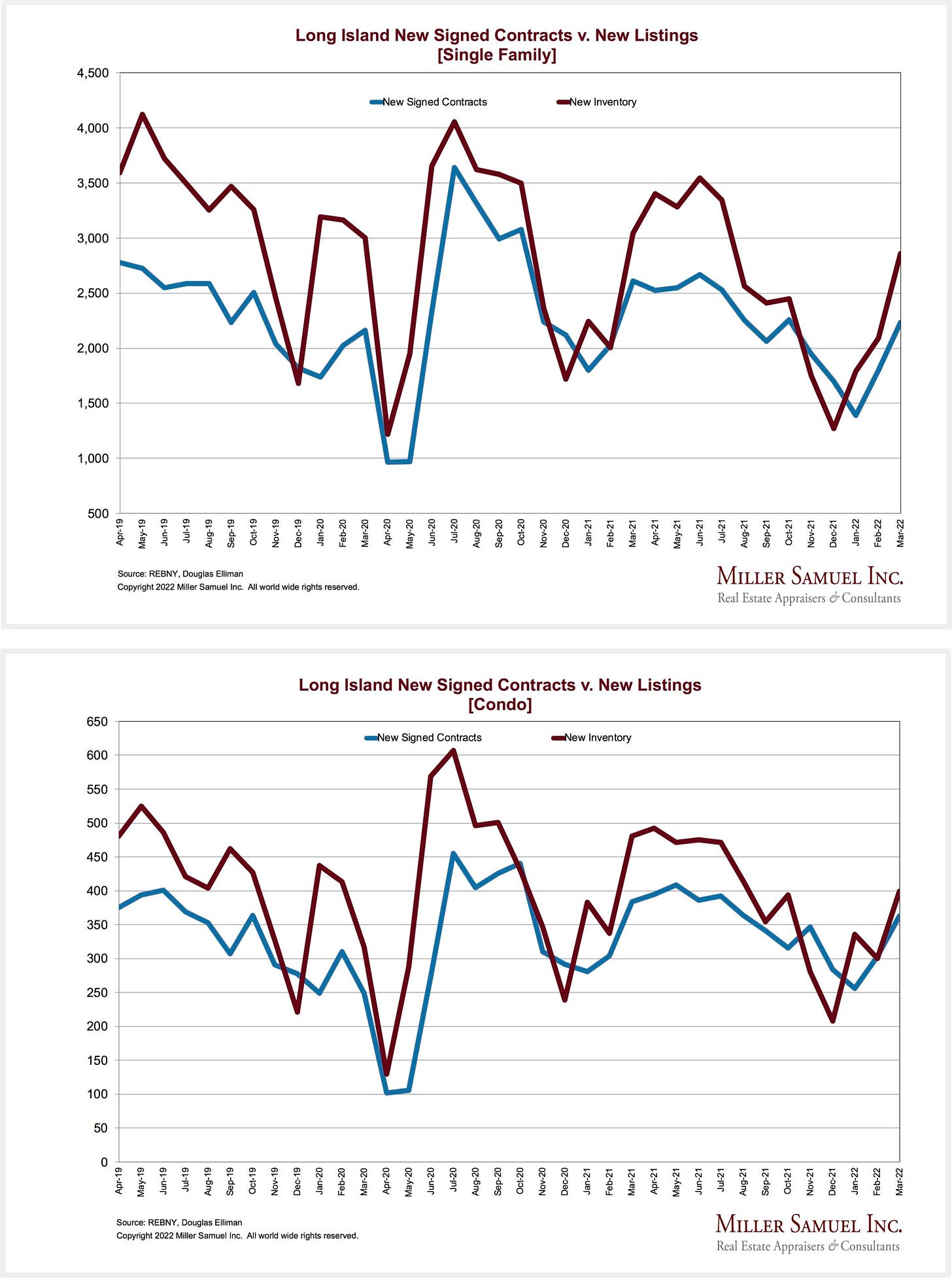

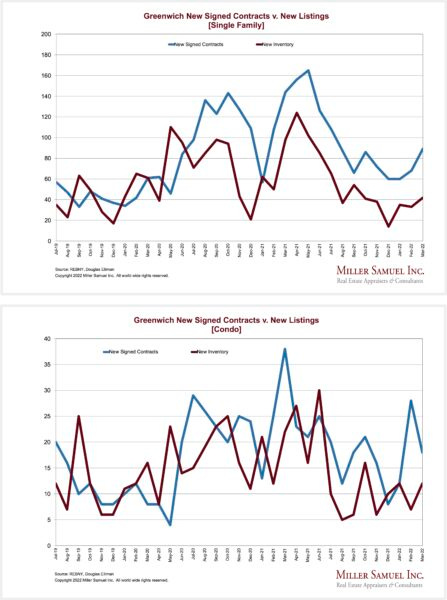

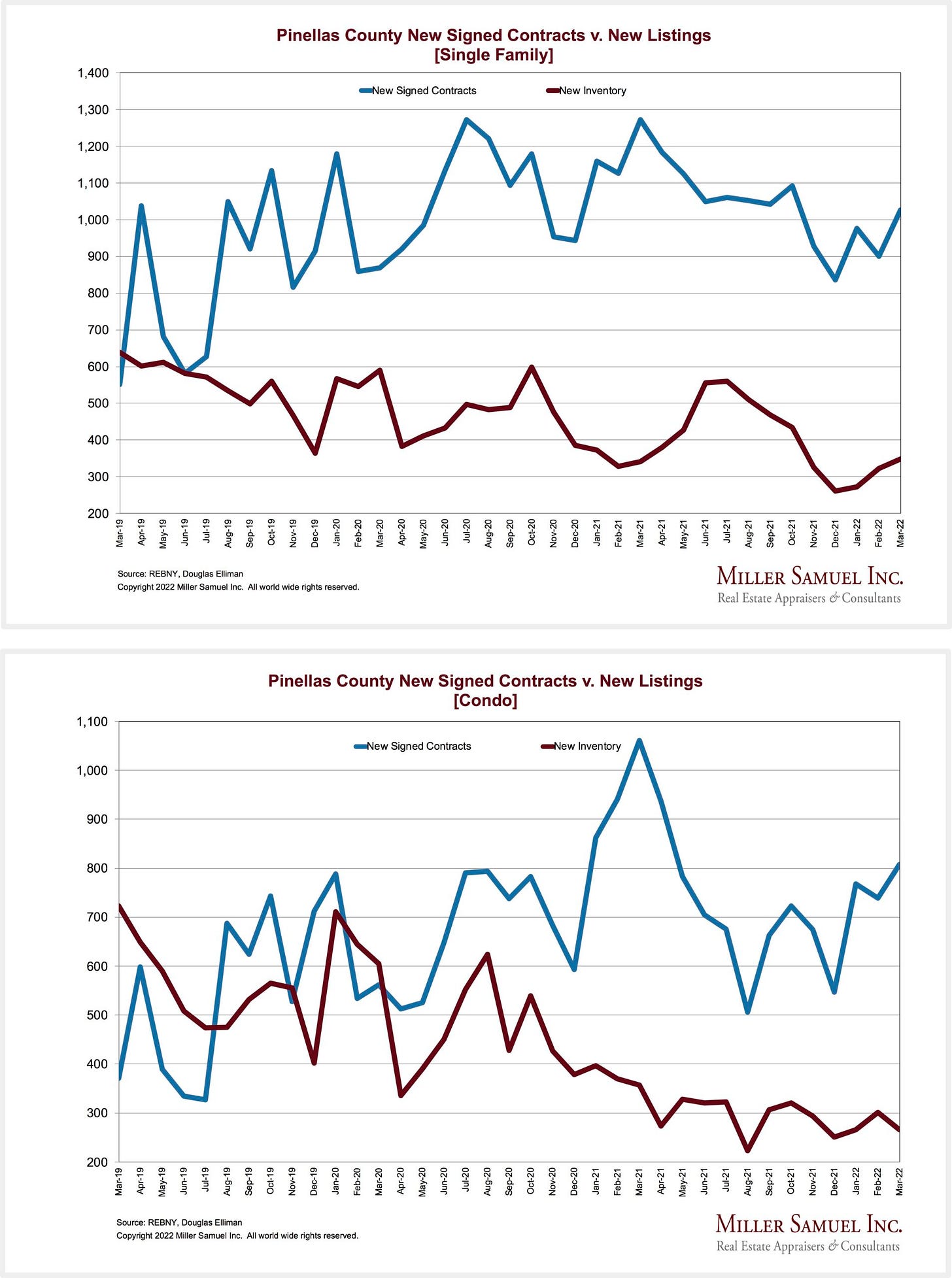

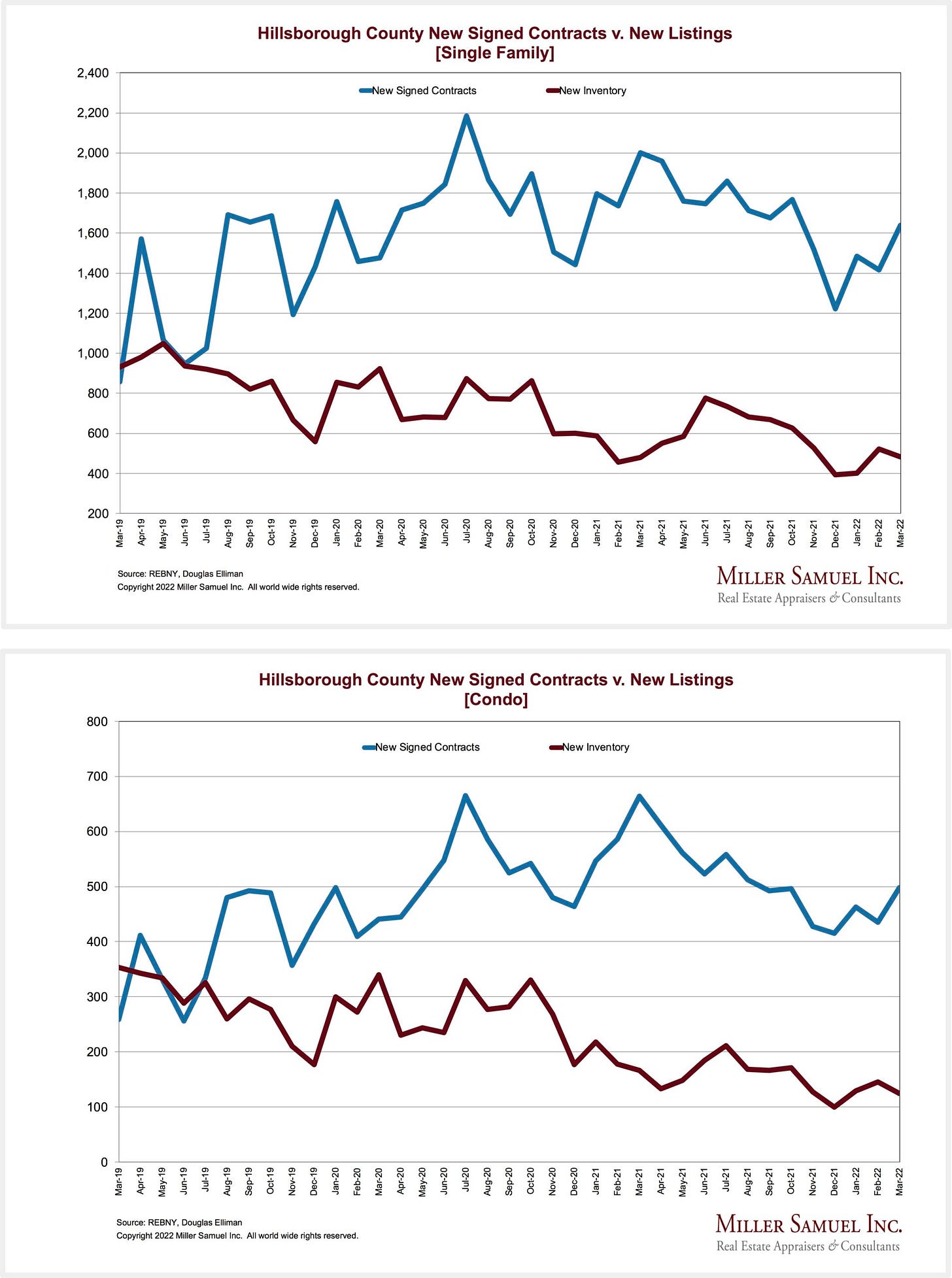

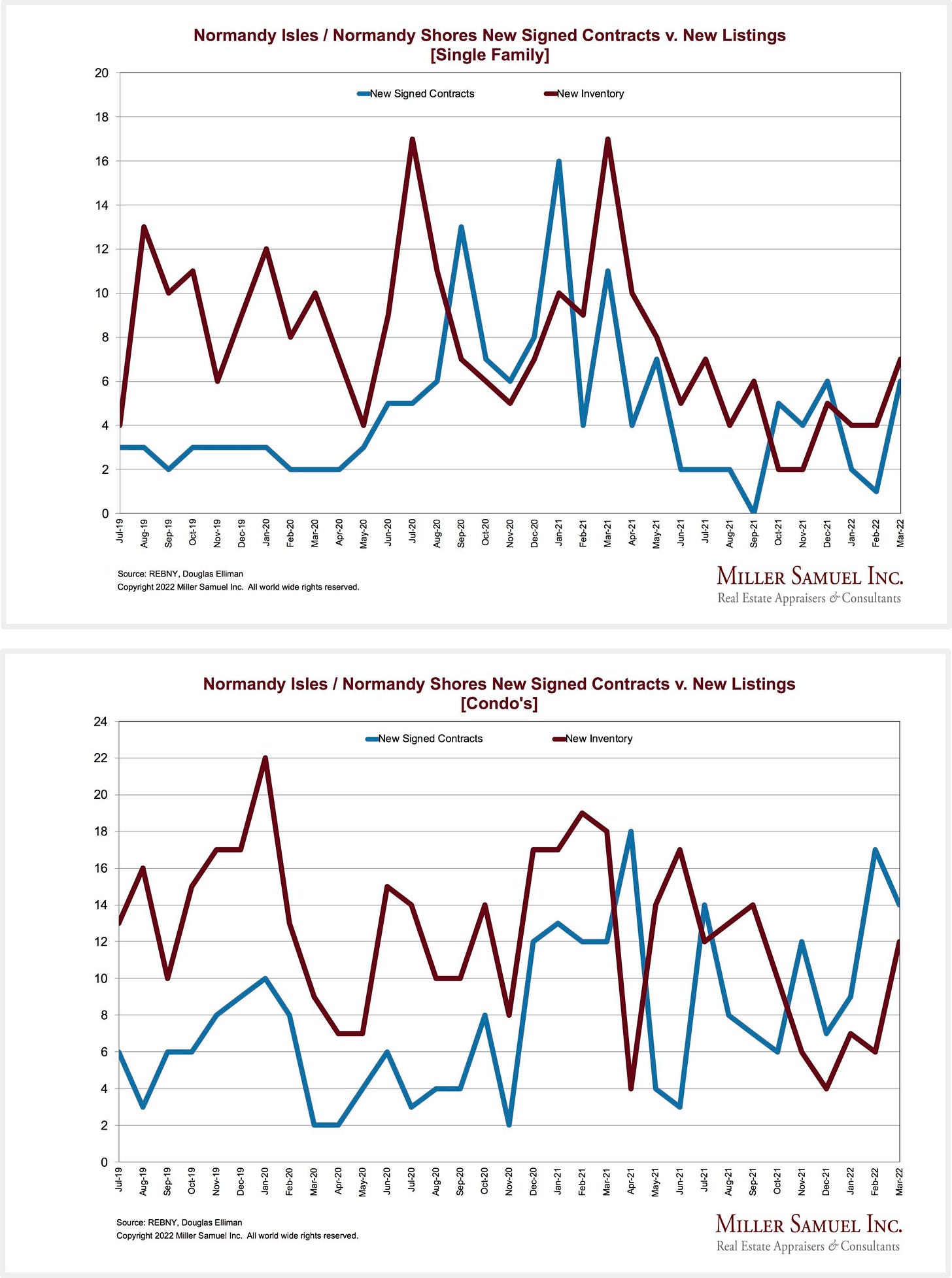

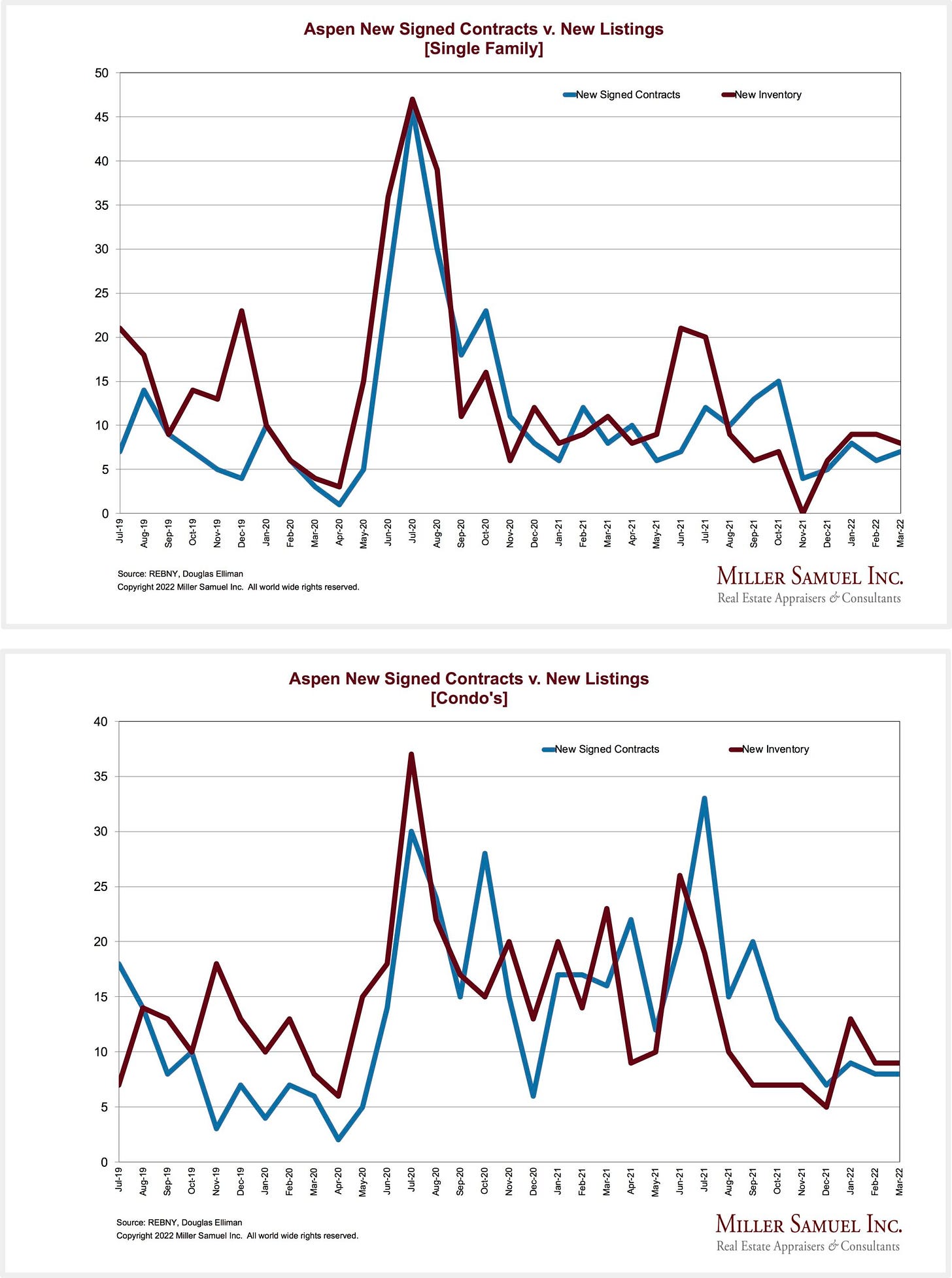

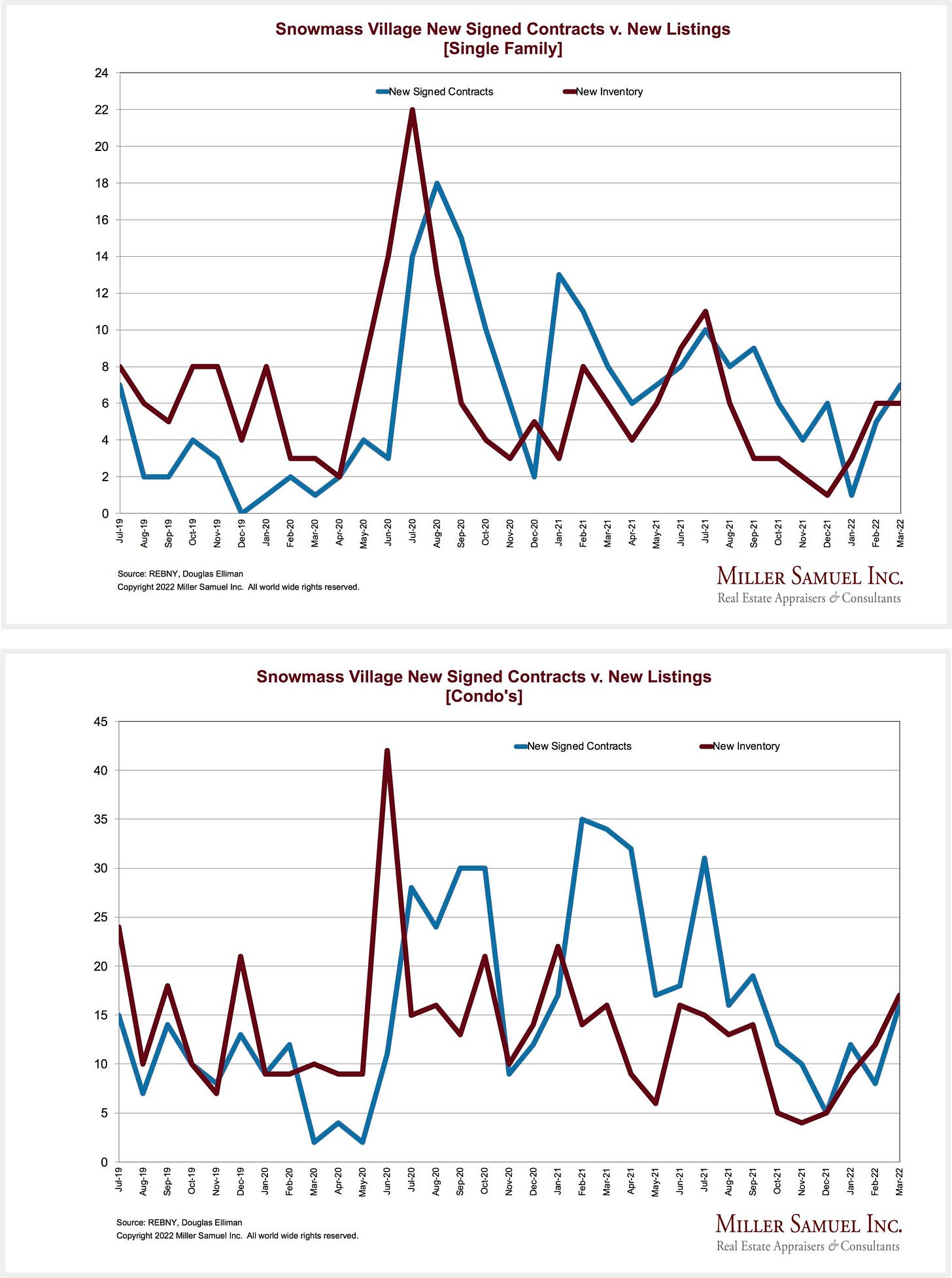

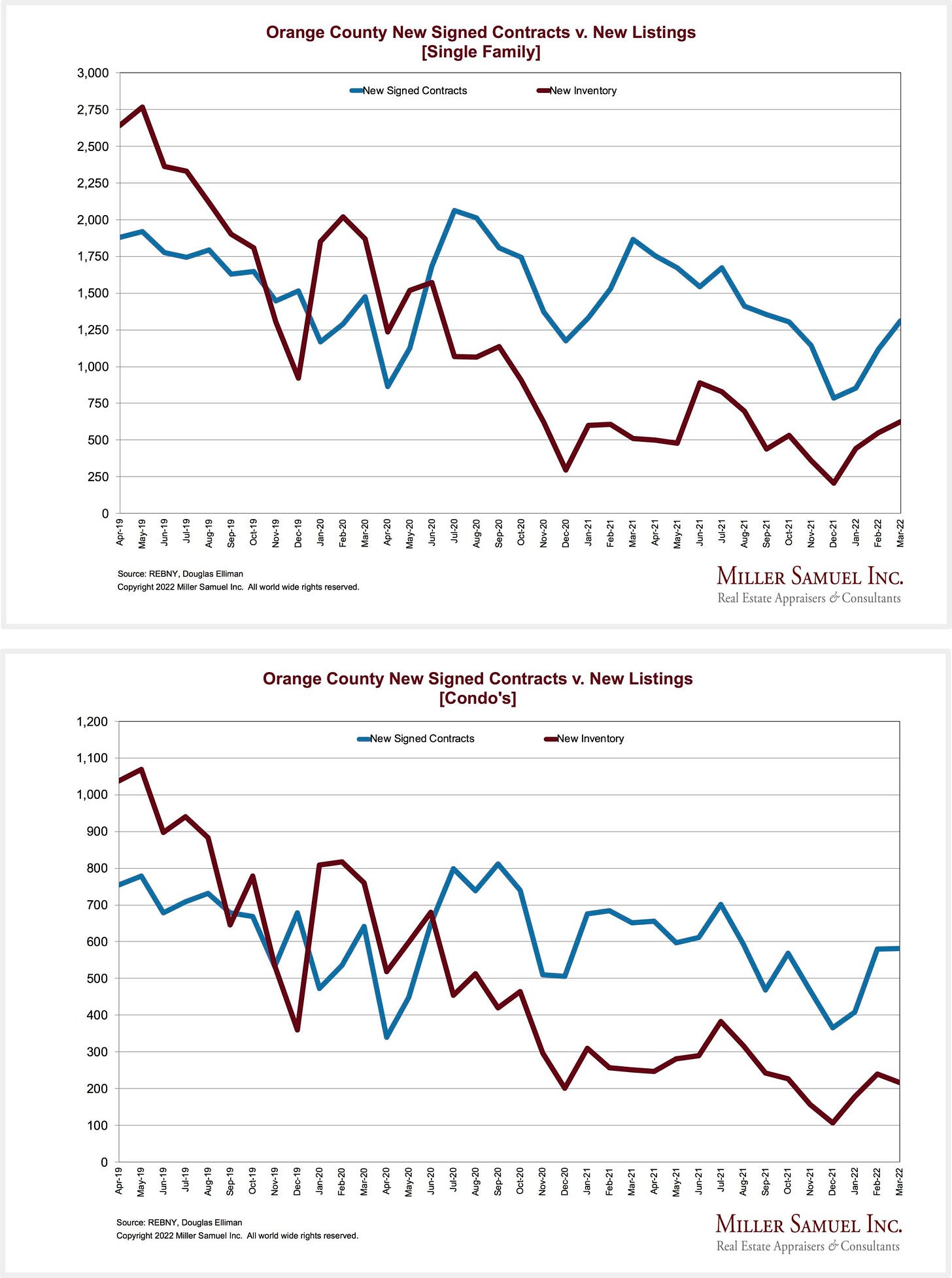

Our New Signed Contracts Reports Reveal Nothing ‘New” Since Lack New Inventory Remains ‘The Problem’

We’ve been presenting these reports via Douglas Elliman since the early days on the pandemic. They reflect the intersection of supply and demand for the month reported since the numbers pertain to the activity of that month, not cumulative. We produce them in four regions:

UPDATE: Due to a production lag, I appended the NSC charts for each region about two hours after Housing Notes went live.

_____________________________________________________

New York New Signed Contracts Report

– The New York report attached covers Manhattan, Brooklyn, Long Island, Hamptons, North Fork, Westchester County, Fairfield County, and Greenwich, CT.

Elliman Report: March 2022 New York New Signed Contracts

______________________________________________________

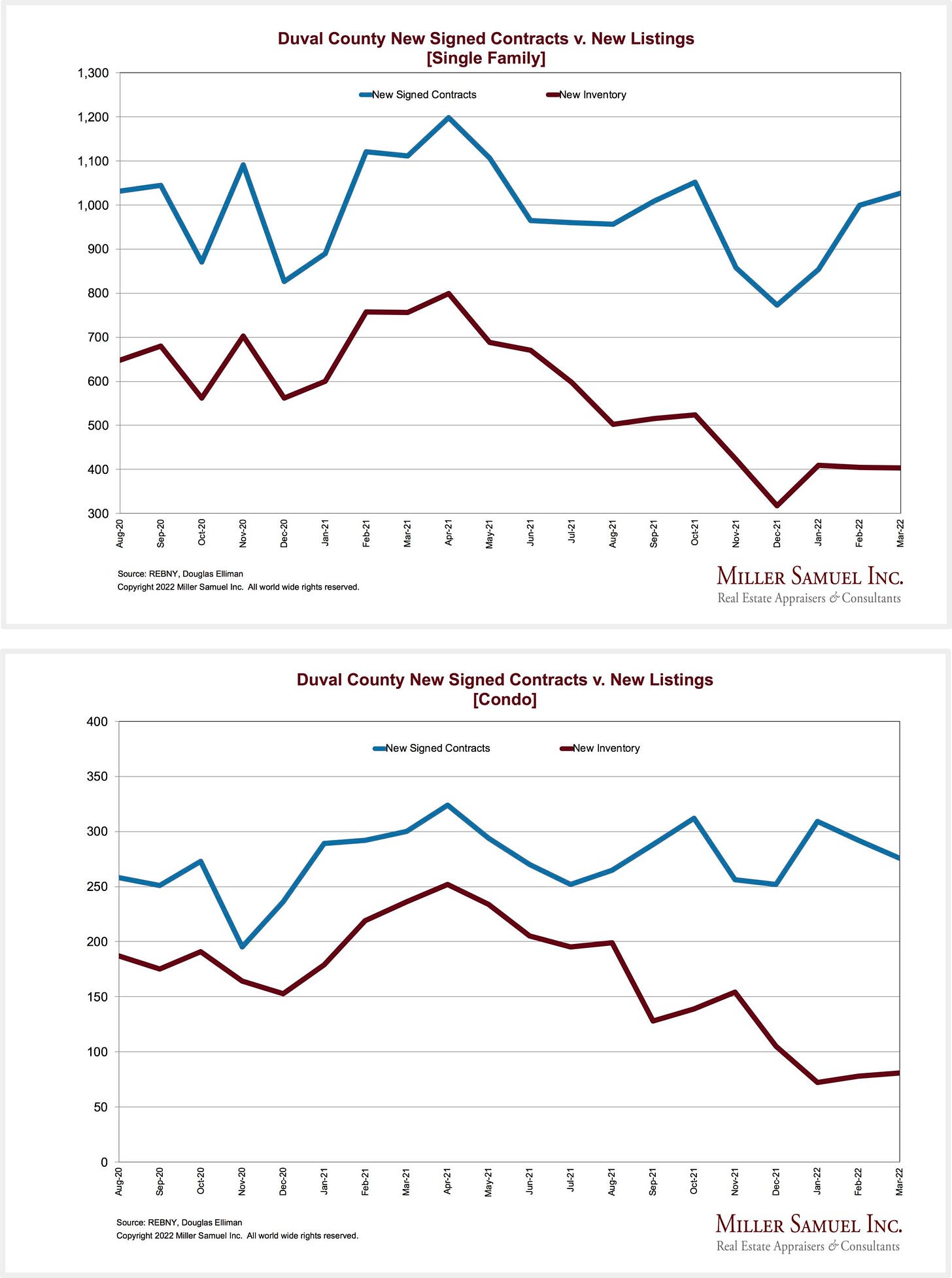

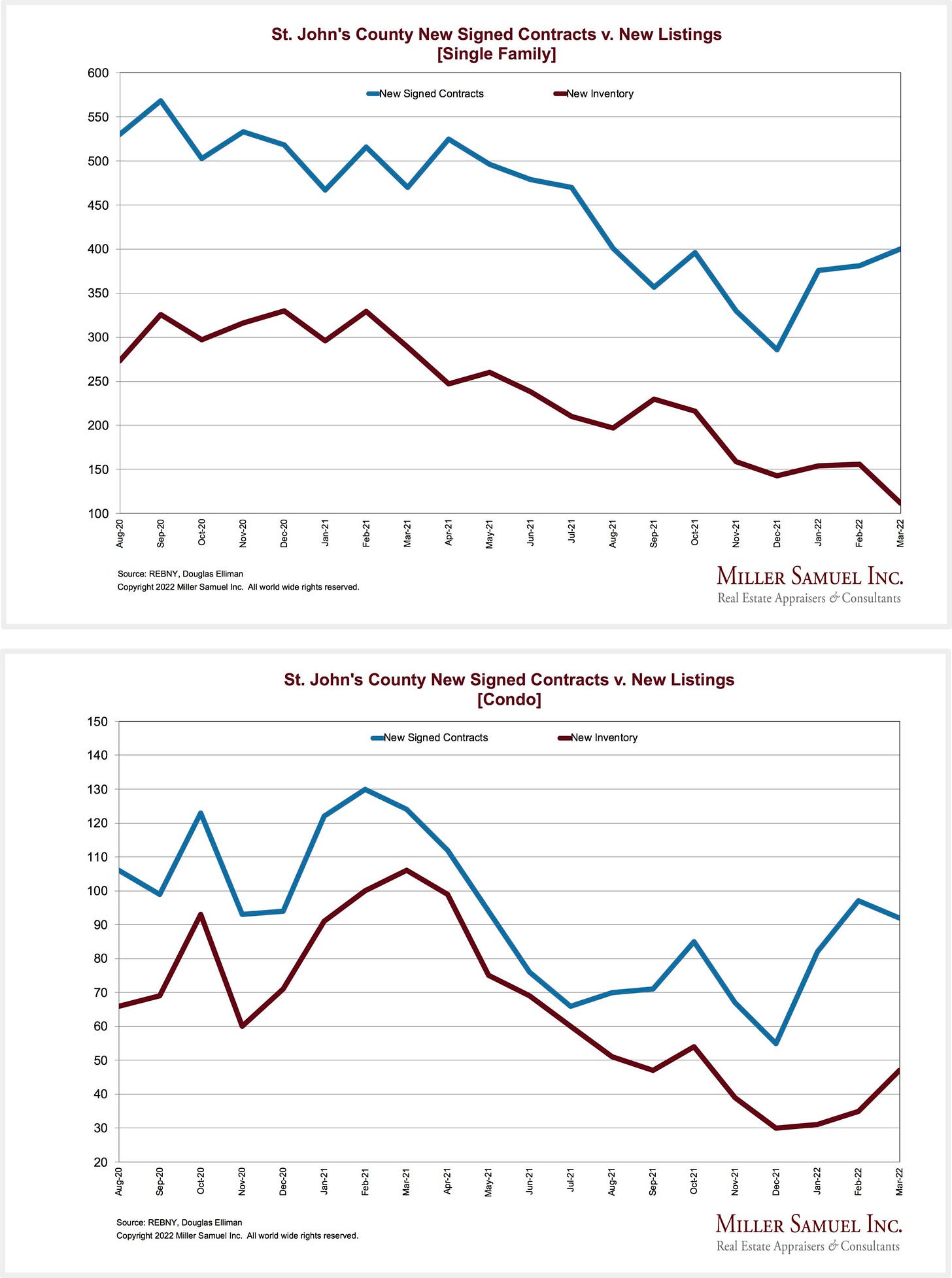

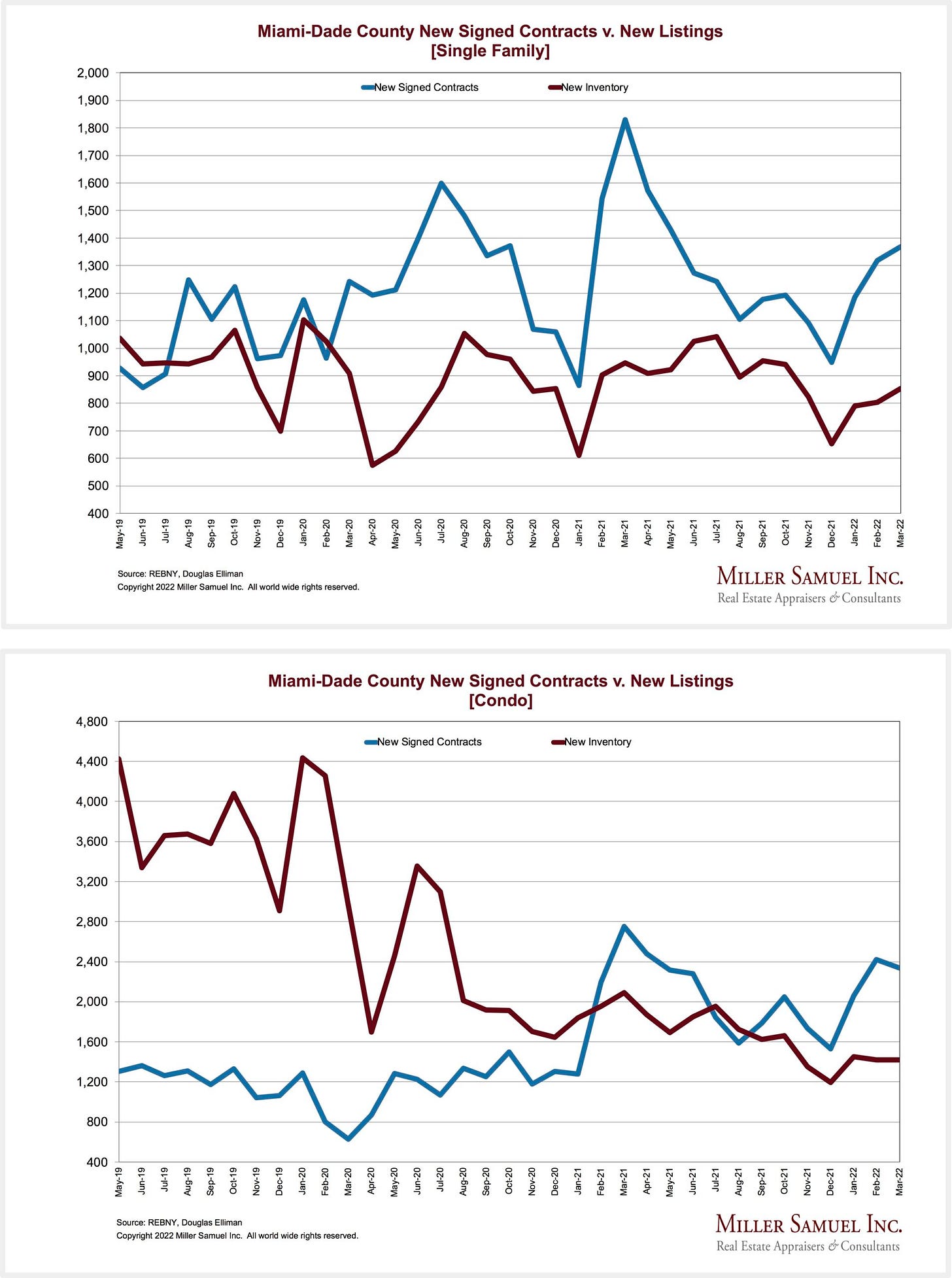

Florida New Signed Contracts Report

– The Florida report includes the counties of Duval, St. Johns, Miami-Dade, Broward, Palm Beach, Pinellas, Hillsborough, and Collier.

Elliman Report: March 2022 Florida New Signed Contracts

______________________________________________________

Colorado New Signed Contracts Report

– The Colorado report covers Aspen and Snowmass Village.

Elliman Report: March 2022 Colorado New Signed Contracts

______________________________________________________

California New Signed Contracts Report

– The California report contains the counties of Los Angeles, Orange, and San Diego.

Elliman Report: March 2022 California New Signed Contracts

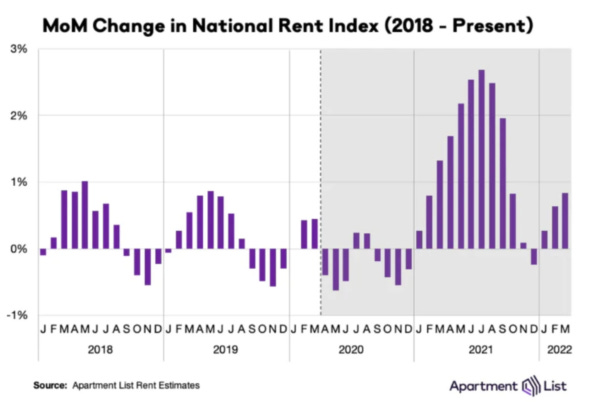

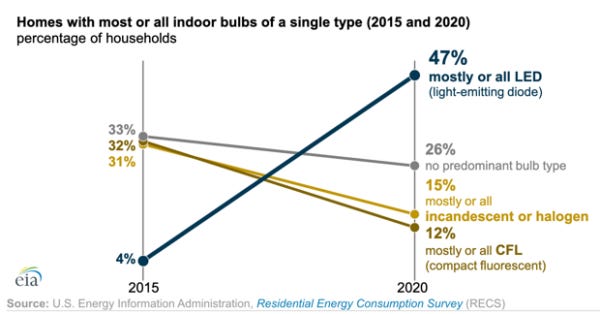

Rising Rents Is Creating Future Oversupply of New Construction

Zelman & Associates warned us about this in their Cradle to Grave white paper. The idea that we are not building enough rental housing is misguided (that recent 60 Minutes segment was the poster child for that misguided belief).

In other words, the vacancy rate will eventually rise…a lot. Here’s a good thread:

Rent growth isn't popular of course, but here's one benefit: LOTS of new apartment construction to meet the tidal wave of demand, and hopefully boost vacancy / availability. New completions will top 400k units for the first time in 40+ years in 2022 — and even more in '23. (1/6) pic.twitter.com/Z2Z5j3Mw3r

— Jay Parsons (@jayparsons) April 5, 2022

More on this from Calculated Risk:

Kleptocracy In Real Estate Is Alive And Well

Money laundering continues to be more efficient in real estate than in other asset classes because a large deal size makes the process more efficient.

There was an excellent article in The Real Deal about this phenomenon: Wash, rinse, repeat: How money launderers exploit real estate. Plus, who can resist that old shampoo trope?

It’s hard to overstate the recent growth of private equity, hedge funds, alternative lenders and other private capital in real estate. They have exploded in popularity since the Great Recession, writing bigger checks and raising massive funds overseas with minimal government oversight.

I have been fascinated with the topic for years, especially when the Towers of Secrecy piece from the NYT came out in 2015 as the Manhattan housing boom was dying from massive overbuilding. I contended at the time it was impossible to discern between the market slowdown and whether stepped-up oversight from the UST (Fincen) was really making a difference in reducing money laundering from kleptocrats. I suspect it was both.

The Real Deal piece exposed me to a fascinating report: Acres of Money Laundering: Why U.S. Real Estate is a Kleptocrat’s Dream:

What do the Iranian government, a fugitive international jeweler, and a disgraced Harvard University fencing coach have in common? They have all used U.S. real estate to launder their ill-gotten gains. In Acres of Money Laundering: Why U.S. Real Estate is a Kleptocrat’s Dream, Global Financial Integrity (GFI) dives into the murky world of global money laundering and demonstrates the ease with which kleptocrats, criminals, sanctions evaders, and corrupt government officials choose the U.S. real estate market as their preferred destination to hide and launder proceeds from illicit activities.

JP Morgan’s Super Bland But Interesting Video: Housing “Rapid Price Increases Don’t Mean A Correction Will Happen”

I’m not sure if a big bank has much credibility on this topic after the Housing Bubble fiasco more than a decade ago, but here’s their 4-minute take (warning: super bland)…

In a new video series, J.P. Morgan breaks down complex topics across the industry. In four minutes, get a solid understanding of what it is, how it works and why it matters.

[click on image to play housing video]

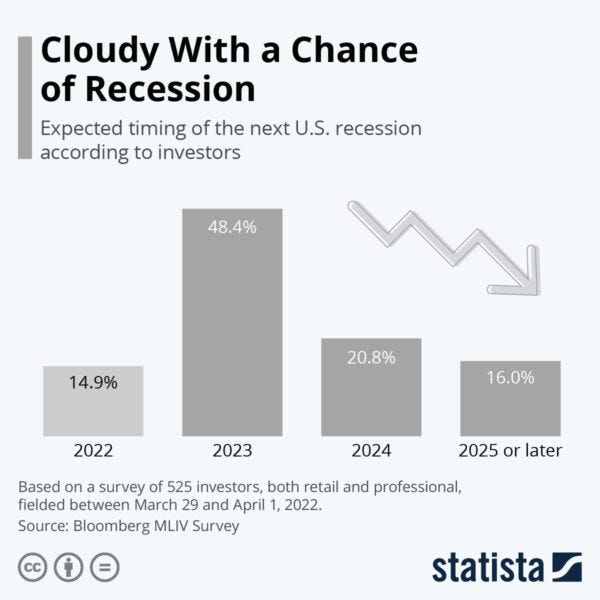

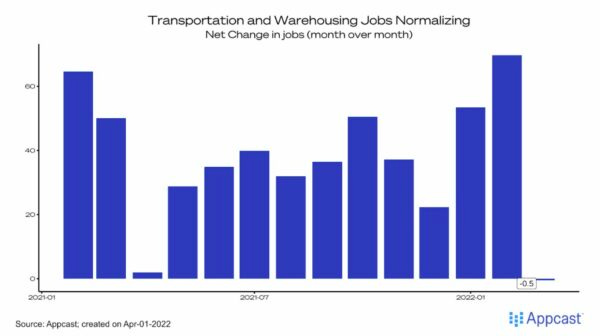

Inflationary Inflation Talk And How The Projections Actually Look

Here’s an interesting read on the recent jobs report and inflation, plus this:

UBS is calling the peak in #inflation after March's reading next week. Will they be right? I have no clue, but I made a chart of their estimates…gotta love charts. pic.twitter.com/RnNYWboLgn

— Will Daniel (@WillBDaniel) April 6, 2022

As home listings dwindled, the median asking price for a home advanced twice as fast as median income did from February 2019 to February 2022, according to a @realtordotcom analysis. Home price growth outstripped income growth in many of the nation’s most populated metros. pic.twitter.com/lLqtiDUN3P

— Barron's (@barronsonline) April 1, 2022

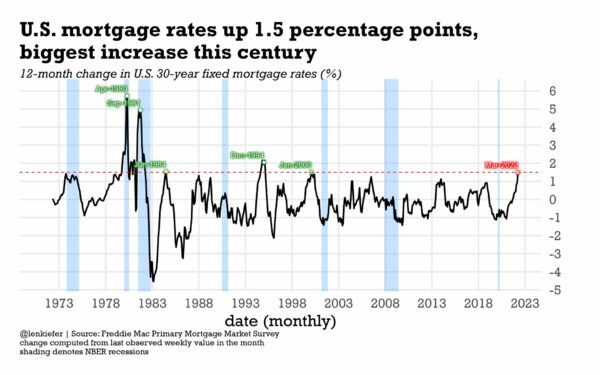

And then there is an excellent post in Ben Carlson’s A Wealth of Common Sense: Interest Rates Are Getting Weird which suggests (to me) that current inflation is somewhat temporary:

It’s rare for the inflation rate to be higher than the 30 year treasury rate.

Going back to the 1970s, the highest inflation has gone over the 30 year yield was the last time inflation was this high — in the early-1980s. In the spring of 1980, inflation was running at more than 4% higher than the 30 year treasury. Of course at that time inflation was almost 15% while long-term government bonds were yielding more than 10%.

Getting Graphic

My favorite charts of the week of our own making

My favorite charts of the week made by others

Number of U.S. business locations increased in nearly 3/4 of U.S. counties over 2 years thru September 2021 per data from @InnovateEconomy … fastest growth was in Southeast and inland western regions

@Bloomberg pic.twitter.com/I4ynu2OexX— Liz Ann Sonders (@LizAnnSonders) April 7, 2022

Biggest spread since 2007 on cost of owning home vs. renting home nationally. pic.twitter.com/c5tHJByxRU

— Rick Palacios Jr. (@RickPalaciosJr) April 4, 2022

Len Kiefer‘s Chart Handiwork

Appraiserville

(For earlier appraisal industry commentary, visit my old clunky REIC site.)

NAR’s Letter to PAVE Confirms TAF’s Pay-To-Play Model

To be clear, I appreciate NAR’s Real Property Valuation Committee, the high caliber nature of their appraiser members, and the work they do for mainstream appraisers. It’s essential, needed work.

However, it is also imperative to understand that NAR is a trade group operating for the exclusive benefit of real estate agents and brokers. That is their mission. NAR’s interests don’t always align with appraisers, which is reflected in this note from NAR on the PAVE report.

Think of this from the context of doing BPOs for banks. NAR is for that, even though it means pushing appraisers away for that work.

In short, the NAR letter says that NAR wants to keep the current governance of TAF and worries that by addressing diversity, PAVE will reduce the quality of appraisals. Given that TAF governance has played a crucial role in the lack of diversity, this is a significant misstep in NAR strategy to navigate the TAF minefield.

The key reason is that the existing TAF governance structure is primarily why the appraisal industry is dead last in diversity.

According to BLS, the appraisal industry has become even less diverse over the past year! Appraisers are now 97.7% white (up from 96.5% a year ago). The TAF diversity council – not led by a person of color – didn’t help turn the direction of diversity for the better this year. Good grief.

This NAR opinion letter on being happy with the current governance seems contradictory with their support of greater diversity. Remember that NAR is an affiliate sponsor of TAF, paying $7,500 per year for access to TAF leadership (Dave & Kelly) to influence them on behalf of their agent/broker members. NAR seeks access to the people that wrote the bat-shit crazy letter.

These memberships are like having access to a private club to provide influence against the interests of appraisers and therefore contradict the whole point of TAF’s reason for being. I speak from experience, having paid for my firm to be a member of IAC until I understood what it meant.

I would encourage leadership at NAR to look at TAF’s current governance more closely. For example, the TAF mentoring system and the arbitrary rules being made and unmade by appraisers on TAF boards (comprised mainly of FODs) every two years, with little to no legal review, is terrible governance defined. TAF is already a massive government overreach through a private not-for-profit without accountability, marketing itself as aligned with Congress, bilking appraisers unnecessarily to pay for USPAP books/classes, and exposing them to greater legal risk to achieve TAF’s stated goal to be financially independent.

C’mon, NAR, with all your exposure risk from DOJ on diversity issues; you can do better than this.

OFT (One Final Thought)

Moving TV from black and white to color in real time:

Brilliant Idea #1

If you need something rock solid in your life (particularly on Friday afternoons) and someone forwarded this to you, or you think you already subscribed, sign up here for these weekly Housing Notes. And be sure to share with a friend or colleague if you enjoy them because:

– They’ll be shorter;

– You’ll be more brutish;

– And I’ll try not to be nastier.

Brilliant Idea #2

You’re obviously full of insights and ideas as a reader of Housing Notes. I appreciate every email I receive and it helps me craft the next week’s Housing Note.

See you next week.

Jonathan J. Miller, CRP, CRE, Member of RAC

President/CEO

Miller Samuel Inc.

Real Estate Appraisers & Consultants

Matrix Blog

@jonathanmiller