October 20, 2023

The Proper Way To Go Pick Up A Pizza On A Friday Night In A Tight Housing Market

Imagine being Ken Block’s drivers ed teacher when he was a teenager? I always cringe when I see him land a jump, wondering what my back would feel like. My lower back is the only reason why I don’t launch my daily driver over canals.

——————————————-

Did you miss last Friday’s Housing Notes?

October 13, 2023: The Housing Market Has Been Something To Cry About

But I digress…

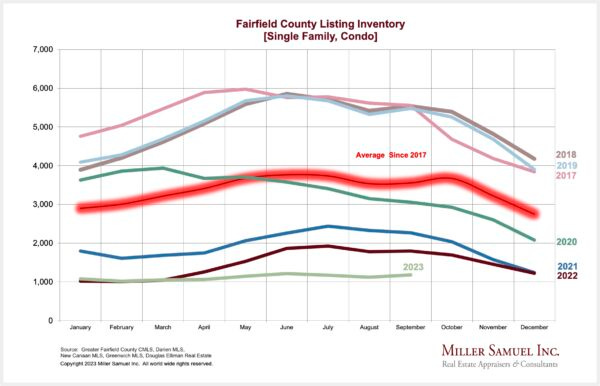

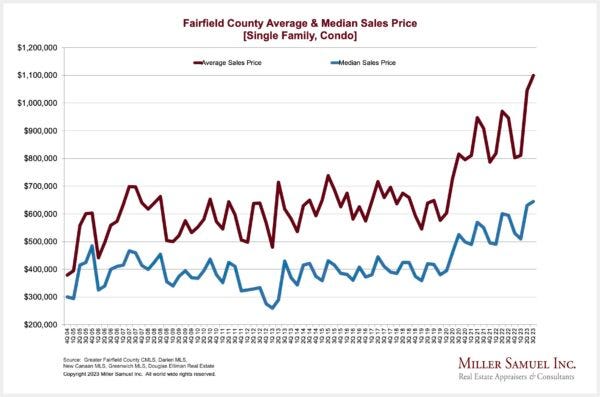

Connecticut Housing Markets See Plenty Of Nutmeg, But Still Short ON Listing Inventory

I’ve been the author of the expanding series of housing market reports for Douglas Elliman since 1994 and since I live in Connecticut, I’m always fascinated by what the numbers show versus how the market feels on the ground. Thankfully, they’re always in sync! DE’s CT footprint tends to be in Fairfield County to the north of New York City, where I’ve lived since 1990.

________________________________________________

FAIRFIELD COUNTY SALES HIGHLIGHTS

Elliman Report: Q3-2023 Fairfield County Sales

“All price trend indicators expanded again to new records as listing inventory continued to drop.”

– All price trend indicators rose to new highs for the second straight quarter

– Sales fell annually for the ninth consecutive quarter as nearly two-thirds of all sales went to bidding wars

– Listing inventory fell annually for the seventeenth time in eighteen quarters

– All luxury price trend indicators rose to new highs for the second straight quarter

– Luxury listing inventory fell annually for the second straight quarter

________________________________________________

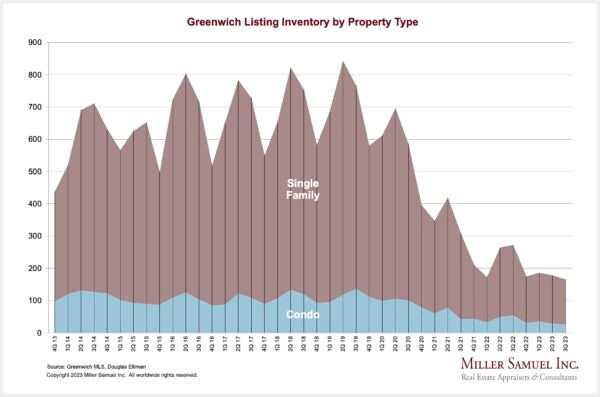

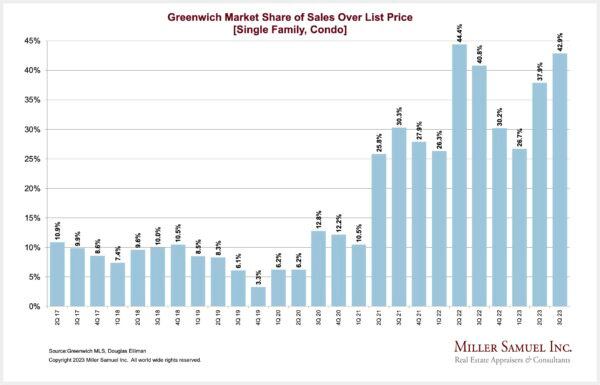

GREENWICH SALES HIGHLIGHTS

Elliman Report: Q3-2023 Greenwich Sales

“Listing inventory continued to fall, pressing prices higher.”

– Single family median sales price increased year over year for the sixteenth quarter

– Single family listing inventory fell sharply annually for the second straight quarter

– Condo listing inventory fell by half, while sales rose for the third time in fourth quarters

– Luxury median sales price rose surged annually for the second straight quarter

– Luxury listing inventory fell sharply annually to a record low

________________________________________________

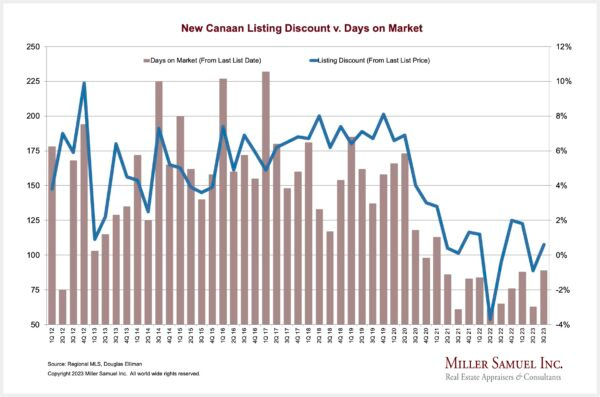

NEW CANAAN SALES HIGHLIGHTS

Elliman Report: Q3-2023 New Canaan Sales

“The market share of bidding wars exceeded half of all sales.”

– Single family median sales price increased year over year for the second time in three quarters

– Single family listing inventory fell year over year for the second straight quarters

– Condo average price per square foot rose to a new high as listing inventory fell annually for the third time

Apollo’s Torsten Slok’s Take On The Housing Market

He’s always been one of my favorite housing economists because he is clear and understandable. Here’s a bunch of charts on the US market in aggregate. I have other charts by him down at the bottom, but these are more specific to housing.

Why Does Barbara Corcoran Broadcast Questionable Real Estate Opinions To Get Attention?

From the “Department Of Good Grief!”

Fortune Magazine – ‘Shark Tank’ star Barbara Corcoran insists now is ‘the very best time’ to buy a house despite interest rates hitting a 23-year high

She was a marketing genius at the time she was running her eponymous firm. She moved on to be a TV star on the CNBC show Shark Tank. She did many innovative things during her real estate brokerage world days (she created the real estate market report genre that I play in), bent the line on marketing, and made a brand that thrives today long after she was bought out.

I’ve never met her in person, although I’ve been on a radio show where we both called in. Every time she says something like this, it confirms that she was a marketing guru and never needed to understand the real estate market. And she’s proved that formula repeatedly by all her well-earned success. I wish she would stop saying these things now because it’s embarrassing and unnecessary. And I mean that with the highest respect for her legacy in the real estate industry. Please stop.

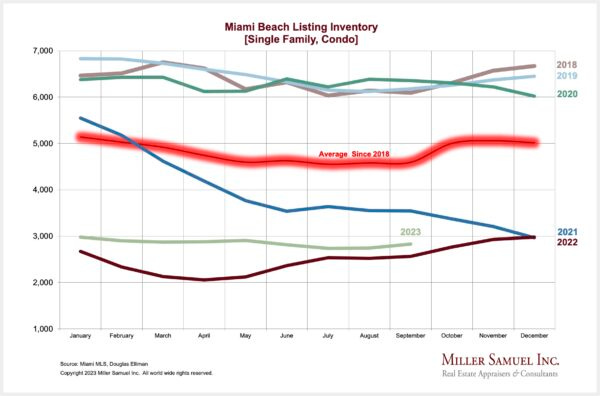

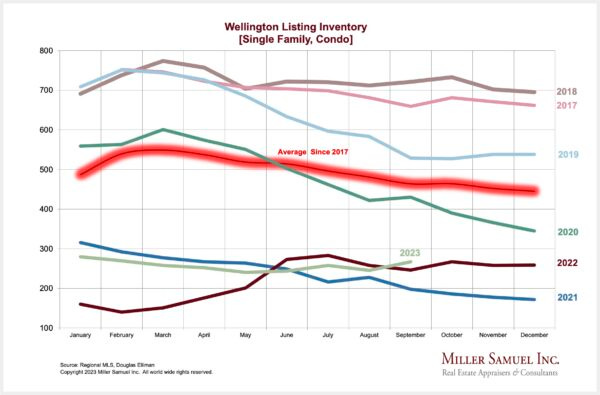

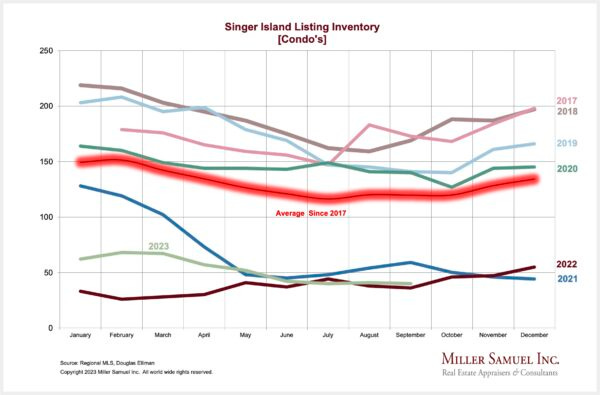

Florida Housing Prices Continue To Boom As Lack Of Supply Remains The Big Challenge

I’ve been covering the Florida housing market for about a decade now, and Douglas Elliman’s footprint over the market has significantly expanded.

____________________________________________________________________________

MARKETS [alphabetical order]

Elliman Report: Q3-2023 Boca Raton

Elliman Report: Q3-2023 Coral Gables

Elliman Report: Q3-2023 Deerfield Beach

Elliman Report: Q3-2023 Delray Beach

Elliman Report: Q3-2023 Fort Lauderdale

Elliman Report: Q3-2023 Jupiter/Palm Beach Gardens

Elliman Report: Q3-2023 Lighthouse Point

Elliman Report: Q3-2023 Manalapan

Elliman Report: Q3-2023 Miami Beach

Elliman Report: Q3-2023 Miami Mainland

Elliman Report: Q3-2023 Naples

Elliman Report: Q3-2023 Palm Beach

Elliman Report: Q3-2023 Pompano Beach

Elliman Report: Q3-2023 St. Augustine

Elliman Report: Q3-2023 St. Petersburg

Elliman Report: Q3-2023 Tampa

Elliman Report: Q3-2023 Vero Beach

Elliman Report: Q3-2023 Wellington

Elliman Report: Q3-2023 West Palm Beach

Elliman Report: Q3-2023 Weston

____________________________________________________________________________

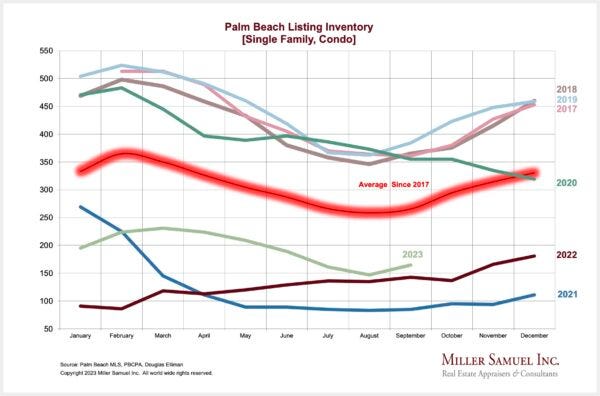

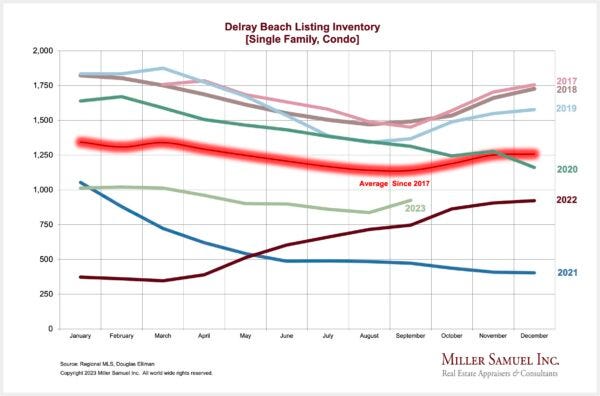

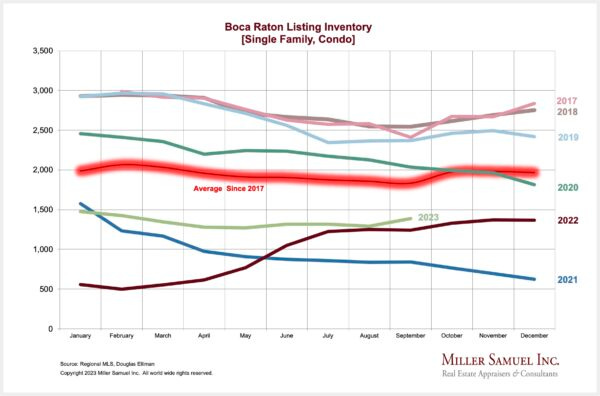

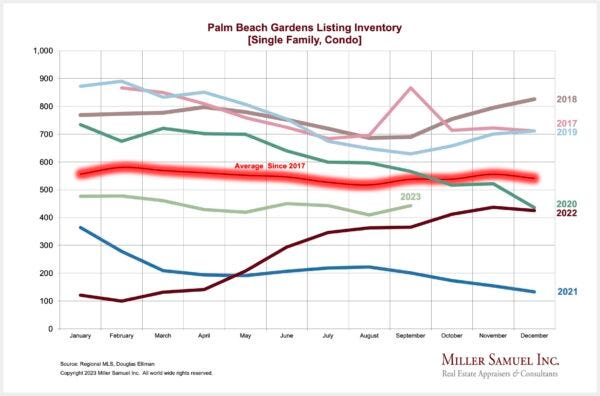

FLORIDA REGIONAL HIGHLIGHTS

Most Q3-2023 Florida markets we cover are seeing the following results:

– Listing inventory is up modestly year over year but remains ~ 30% to 50% below pre-pandemic levels

– Higher mortgage rates and chronic lack of supply have kept sales lower than stabilized levels

– Price trends continue to rise year over year and remain significantly higher than pre-pandemic levels (~ up 40% to 80%)

– Bidding wars are down from a year ago but are still a significant phenomenon in the market due to steady demand and limited supply

– Days on market and listing discount has expanded slightly from the year-ago boom that distorted the metrics but remained lower than pre-pandemic levels

Here are some random charts from the Florida market releases. For more charts, go here

It’s Not Just Mortgage Rates, HOA Fees Are Rising Faster Than Inflation

Bloomberg did a much-needed piece on the rising cost of monthly fees for homeowners: NYC Homeowner Costs Are Rising at Three Times the Inflation Rate

“When you put it all together, we’re going to end up being a city of the very rich and the very poor,” said Mary Ann Rothman, executive director of the Council of New York Cooperatives and Condominiums. The people in the middle who “want to make a commitment to the city by buying into co-ops and condos are going to be pushed out.”

[Source: Bloomberg – click on image for story]

– Bloomberg NYC Homeowner Costs Are Rising at Three Times the Inflation Rate

– NY Post NYC homeowner costs rise nearly three times the inflation rate

Highest & Best Newsletter: Miami’s Office Bizarro World

I continue to love this new Florida newsletter: Highest & Best from Oshrat Carmiel, formerly of Bloomberg News.

Miami’s Office Bizarro World – Plus: Bahamas after work? Take the chopper.

“New product is leasing at a much higher velocity than legacy product,” Gonzalez said.

The Miami market, he said, has matured — from a place where Latin American firms might set up a temporary office to a city that’s drawing in companies seeking premium space for new headquarters.

Price Discovery For Sellers: What Doesn’t Happen When You Believe Your Own Press Releases

You don’t sell.

The premise of ‘aspiration pricing’ is safety in numbers – if your pricing is on par with everyone else nearby, that must be the market! Except when it isn’t… per this Dallas real estate agent. Price discovery occurs when a listing goes on the market whose value range hasn’t yet been established. Relying on other listings can be wildly misleading.

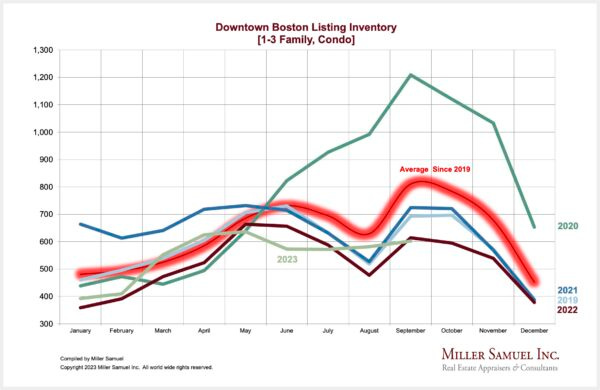

Boston Continues To See A Price Boom

Our market report for Downtown Boston continued to show price growth with lower sales and a lack of supply.

______________________________________________________

DOWNTOWN BOSTON SALES HIGHLIGHTS

Elliman Report: Q3-2023 Downtown Boston Sales

CONDO

“The average price per square foot reached its highest level on record.”

– Average price per square foot reached a record high, remaining sharply above pre-pandemic levels

– Sales rose year over year for the first time in seven quarters

– Listing inventory declined annually for the ninth time in ten quarters

1-3 FAMILY

“The median sales price set a new record and remained significantly above pre-pandemic levels.”

– Median sales price rose to a new high while average price per square foot reached the second-highest on record

– Sales declined year over year for the fifth straight quarter

– Listing inventory increased annually for the second time in three quarters

Getting Graphic

My favorite housing market/economic charts of the week made by others

Apollo’s Torsten Slok‘s amazingly clear charts.

Kastle card swipe data charts

Remember that Kastle charts are overstating occupancy* because their pre-pandemic occupancy benchmark was 100%, which is simply incorrect (*measures card swipe activity as a proxy for occupancy).

My favorite random charts of the week made by others

Appraiserville

Fleecing 101: The USPAP Grift Continues On The Backs Of Appraisers

The Appraisal Foundation (TAF) continues the grift. For the uninitiated, TAF is the organization that wrote the bat-shit crazy letter, the chickenshit letter and is the subject of an active investigation by HUD on whether USPAP promotes a lack of diversity in the appraisal profession (400th out of 400 occupations according to BLS in 2021).

While there is no longer an end date to USPAP, appraisers must take the 7-hour course every two years. Appraisers must now pay $110 for USPAP and the Advisory Opinions/FAQs. The latter provides interpretations of USPAP and now it’s a forced payment.

Many real estate appraisal boards will ask an appraiser defending a complaint, “Did you abide by the advice in the AOs and FAQs?” In many ways, those supportive documents are just as important as USPAP. So the $110 fee.

Yet, if no change occurs for six years, every appraiser must take the class 3 times and spend $330 for nothing. That’s the grift.

And why is the digital version of USPAP the exact cost as the hard copy? The electronic should be far less expensive. That’s another fleecing.

Well, not for nothing. This financial burden on appraisers creates a beautiful lifestyle for Dave. He just went to Paris on all appraisers’ dime and no one learns what Dave learns on these boondoggles. This has been going on for years! Shouldn’t a requirement of TAF be a webinar or paper on what Dave learns on these trips and how it is relevant to TAF’s functions? I’ll bet he understands absolutely nothing on these trips. After all, as he always says, “I’m not an appraiser.”

TAF Hires A Search Firm To Make Kelly Davids As Replacement For Dave

They hired the firm for the optics. Because of TAF’s complete lack of operational transparency, how can we assume KD will not become the Queen of the monarchy?

The Appraisal Institute hired a search firm after JA was driven out politically. They found the perfect candidate in Cindy Chance. One of her first acts was to fire former FOJ c-suiters that contained much toxicity.

Unlike AI, TAF is still the Dave monarchy and will exert absolute control over this process. Please don’t have any doubts about this. Kelly will carry the torch for Dave for decades, and TAF will miss its opportunity to break free of the 30+ year stranglehold of the Bunton Legacy. Despite being personally anointed by Dave himself, I hope the Board of Directors invokes their organizational responsibility beyond being resume padders and takes control of this process. Dave reports to the board, yet the board doesn’t act like it since he installed them.

To the BOD: This is a once-in-a-lifetime moment to make the change, so don’t let it pass you by and clear the deck of the Bunton legacy. It’s your responsibility as BOD members. Got it?

The Former C&W Appraiser Denies He Did The Valuations In Question

I haven’t met Doug Larson in person or know him. I haven’t worked with him or seen his work. But I have it on good authority that he, the appraiser testifying at the current civil trial in Manhattan is an honest man who some might call “honest to a fault” and is an excellent appraiser, and very sharp technically. The media handling of this so far gave the impression (to me) that he must have been a “hit the number” guy, and now that he’s on the stand, it sure doesn’t sound like it because there is no evidence of the existence any of these reports per current reporting.

He “told the New York judge overseeing the fraud trial that he actually never evaluated several of the buildings in question.” Now it makes sense why the NYS AG was going so hard after the appraisal group at C&W to get all the internal paperwork. AG James was looking for any documentation or evidence of those “appraisal reports” and presumably could not find them. Wow.

OFT (One Final Thought)

I gave a PowerPoint presentation this week to a bunch of Wall Streeters. I’m well known for my disdain for the medium, but I use it for my grad school lectures. Mine contain a nominal amount of text but a lot of charts and graphics. I live by this resource: THE COGNITIVE STYLE OF POWERPOINT: PITCHING OUT CORRUPTS WITHIN

Here is how not to do Powerpoint:

Brilliant Idea #1

If you need something rock solid in your life (particularly on Friday afternoons at 2 p.m.) and someone forwarded this to you, , or you think you already subscribed, sign up here for these weekly Housing Notes. And be sure to share with a friend or colleague if you enjoy them because:

– They’ll drive slowly for pizza;

– You’ll order your pizza for the delivery;

– And I’ll have lots of pizza pictures on my PowerPoint deck.

Brilliant Idea #2

You’re clearly full of insights and ideas as a reader of these Housing Notes. Please share them with me early and often. I appreciate every email I receive, as it helps me craft the following week’s Housing Note.

See you next week!

Jonathan J. Miller, CRE, Member of RAC

President/CEO

Miller Samuel Inc.

Real Estate Appraisers & Consultants

Matrix Blog

@jonathanmiller