- NYC Rental Prices Have Peaked And Rents Remain High But Are Drifting Lower

- National Rental Price Trends Are Still Rising But At A Lower Rate

- The Decline In Mortgage Rates And Expectation Of More Cuts Is Restraining Rental Prices

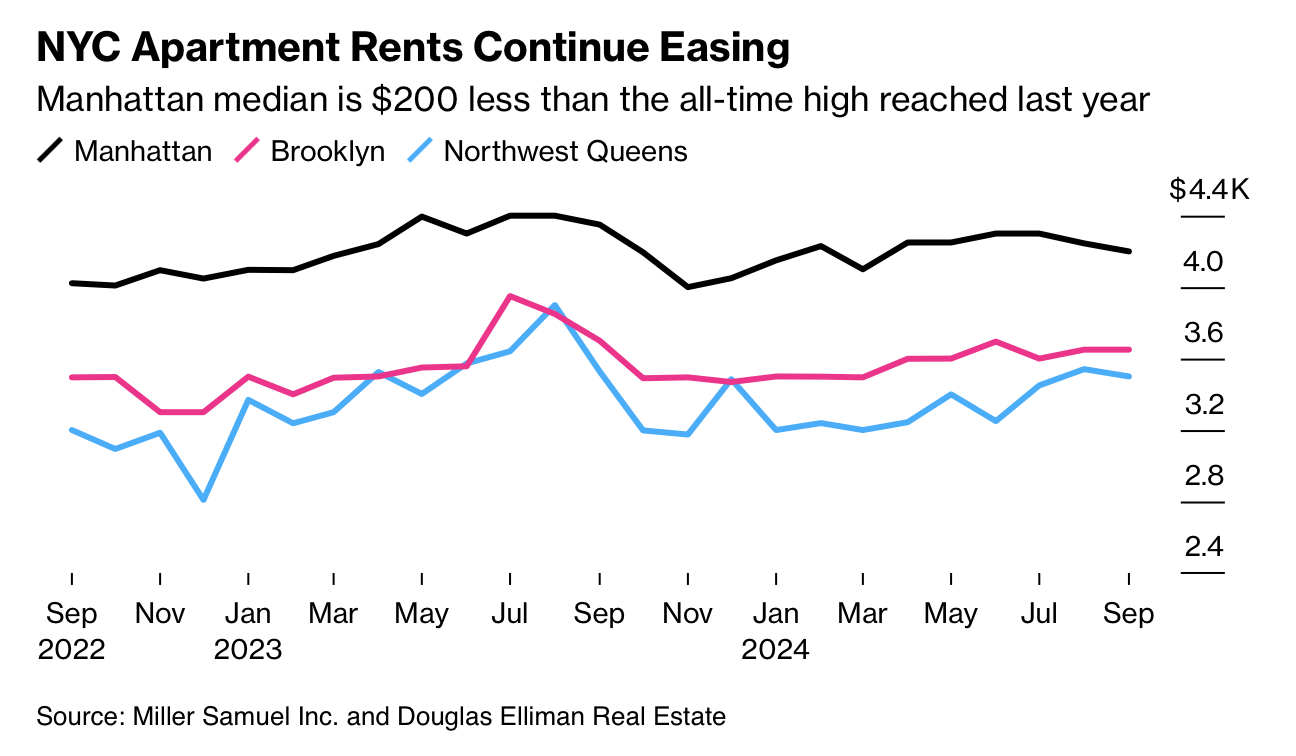

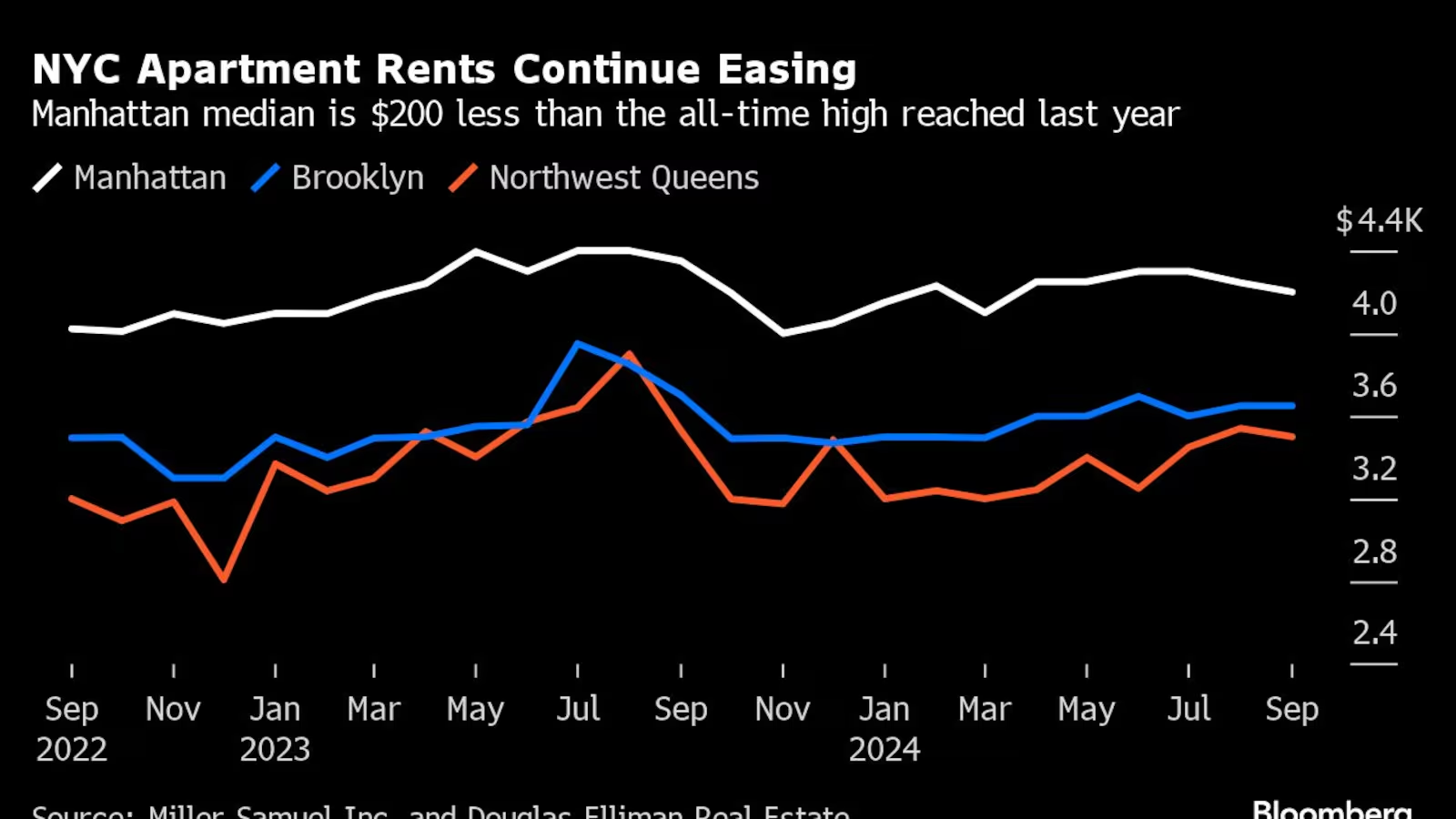

I’ve been in California for a while, helping launch our start-up (more on that soon). It’s been a five-year effort, so it was exciting to see it actually go live and show some early success. I also got to catch up with some good appraiser friends out here, but I’m tired and ready to head back to New York tomorrow. All my friends in Florida weathered (sorry) Milton, thankfully. It was quite fun to publish our Manhattan, Brooklyn, and Queens Rental report for September today. The rental market messaging remained mixed. Year over year, rents slipped but remained elevated, even though bidding wars were still a thing. I keep wanting to say that the rental market is normalizing, but really, after the five-year rental market roller coaster, who knows what normal is anymore? The vacancy rate is in line with the long-term average for September, while inventory rose at a much lower rate than new lease signings. The weakness in rents continued to be influenced by the decline in mortgage rates over the summer, which resulted in a surge in newly signed contracts. Essentially, lower rates are pulling would-be buyers back into the purchase market and taking some of the pressure off rentals. Bloomberg’s coverage of our research stated it best: NYC Apartment Renters Get a Break But Bargains Remain Elusive. And they’ve got the chart in two colors!

But I digress…

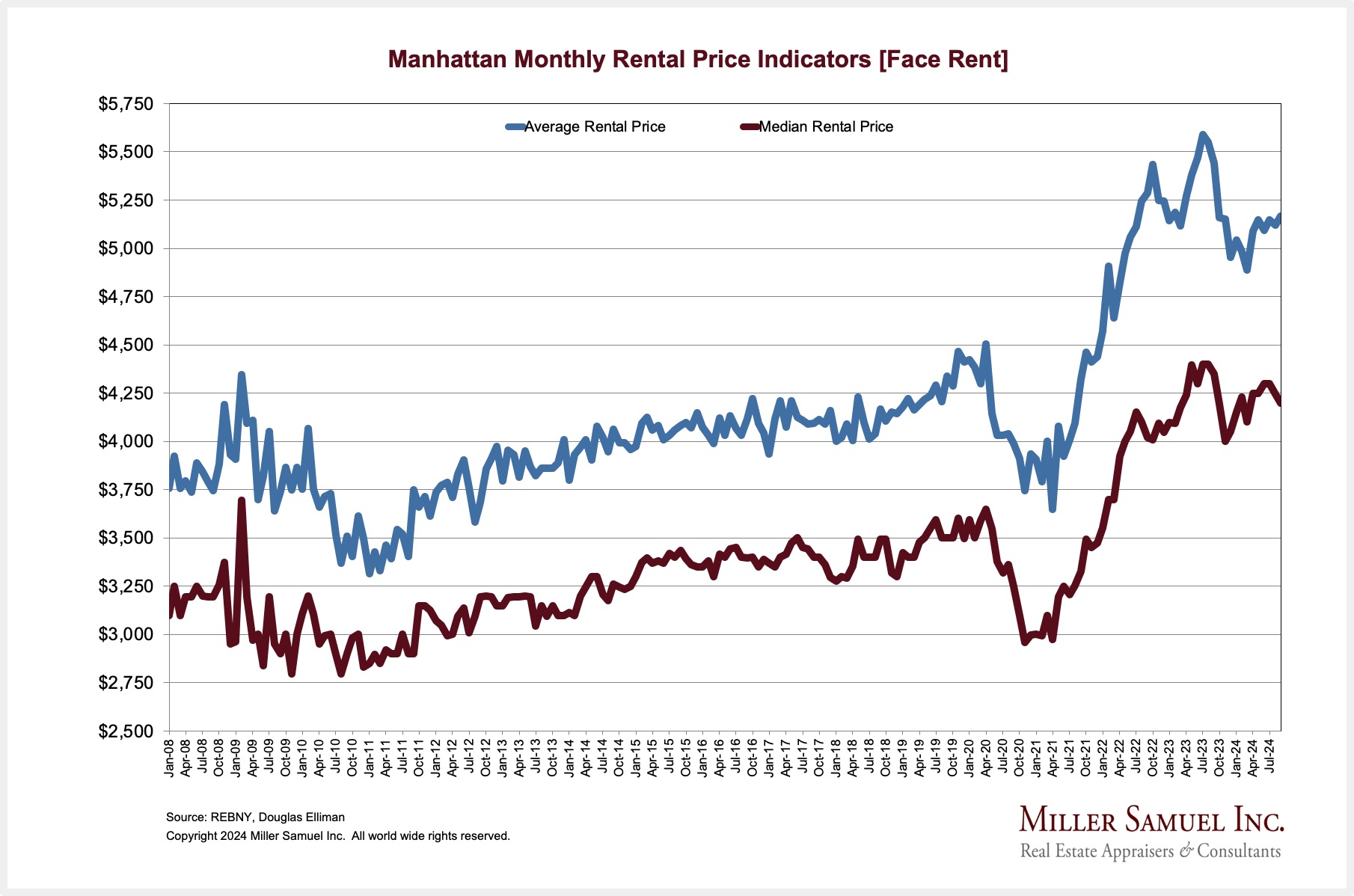

Charting The NYC Rental Market Is Nearly Up And To The Right

Pricing is off from peak but remains well above pre-pandemic levels.

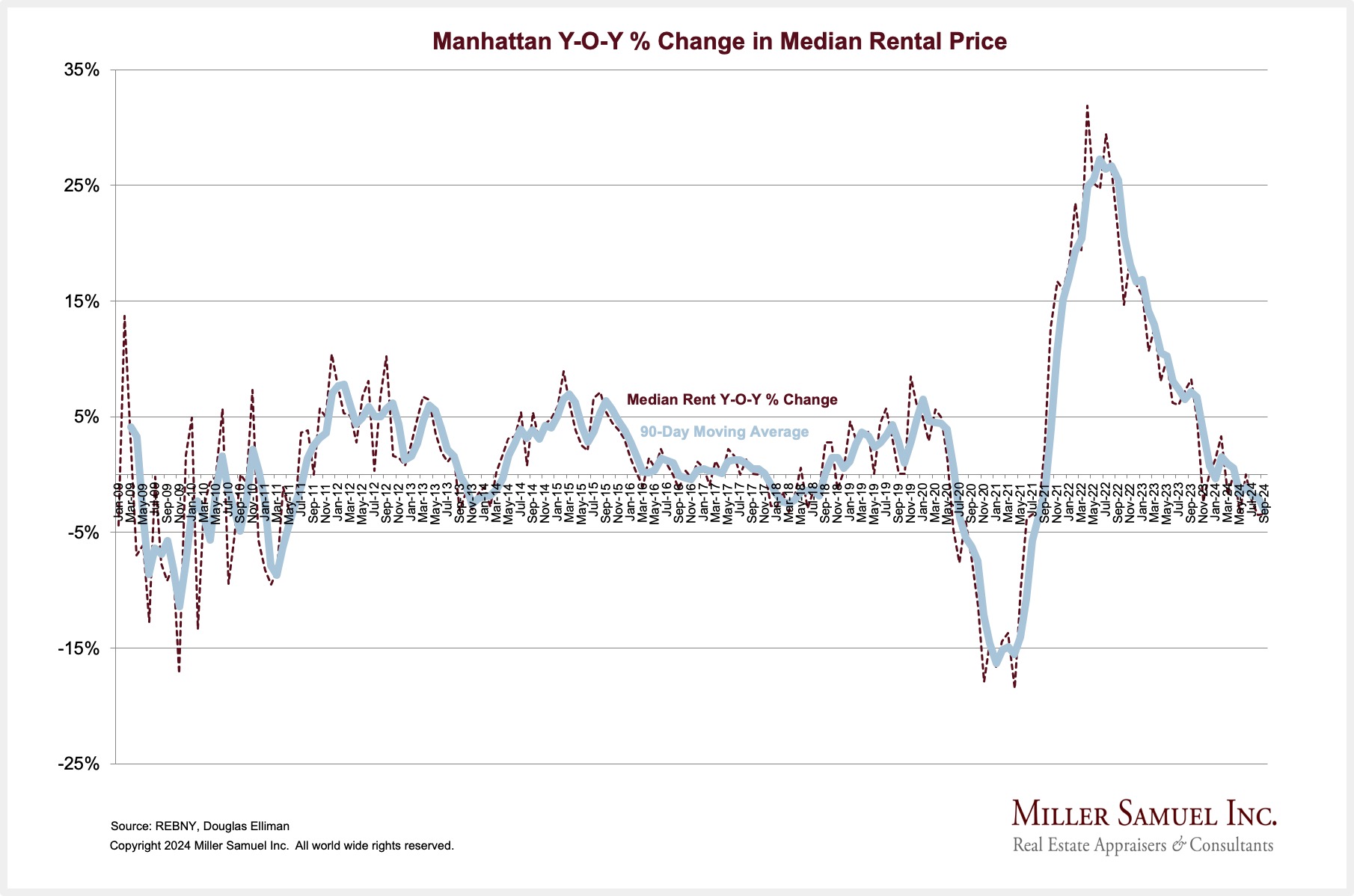

Price growth has stopped.

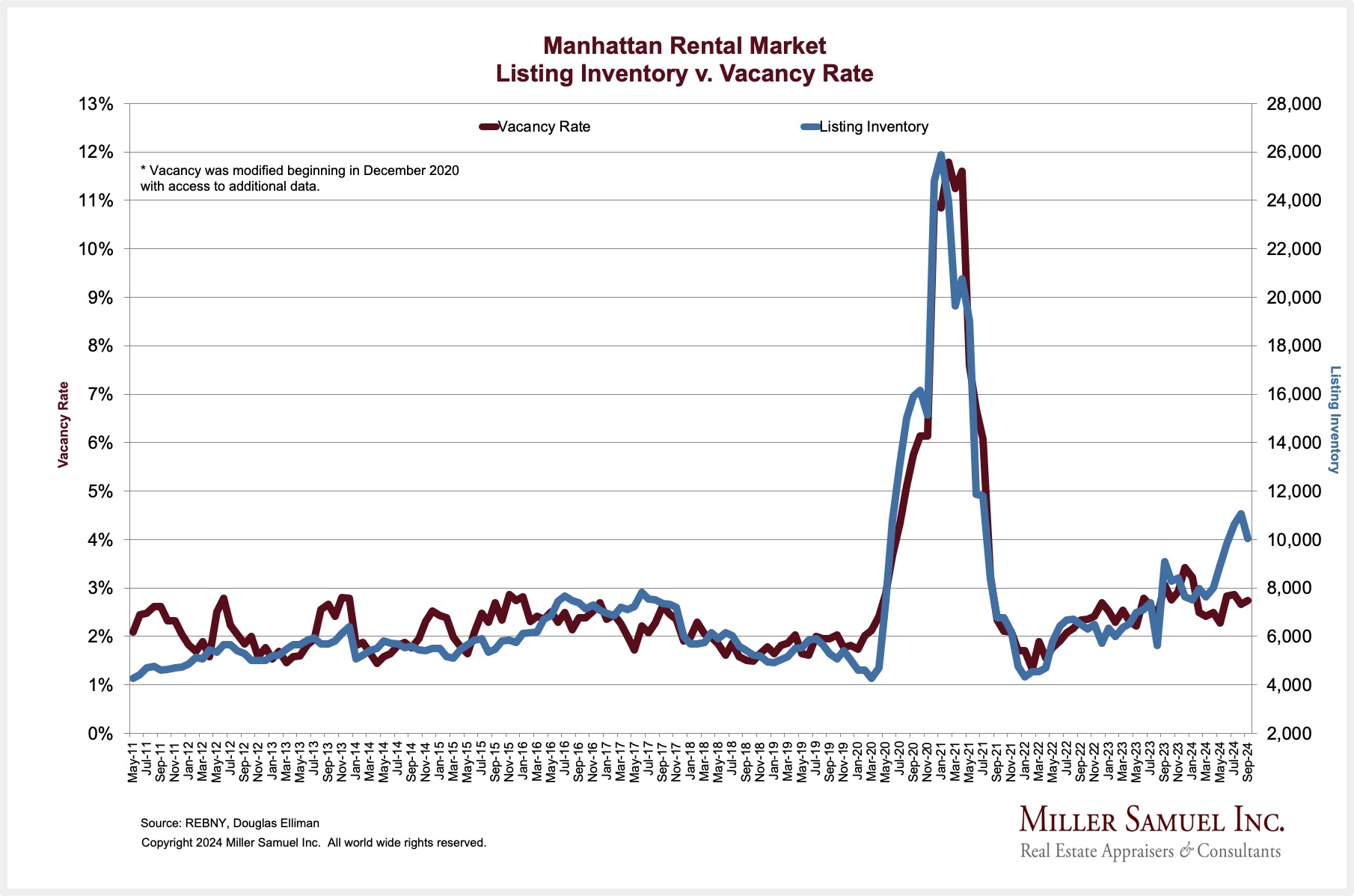

The vacancy rate and listing inventory are slightly above pre-pandemic levels but relatively normal.

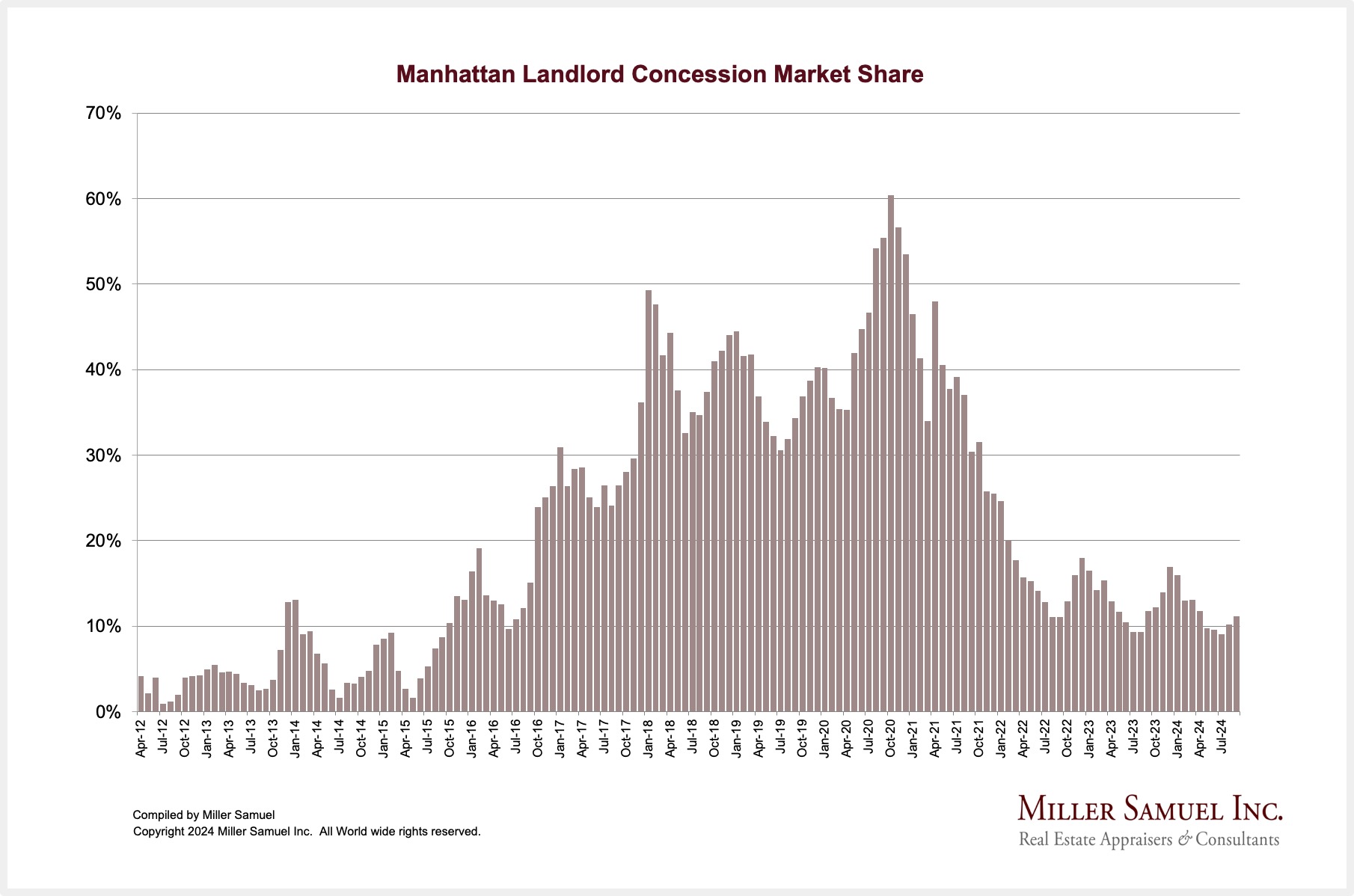

Concessions offered by landlords remain very low.

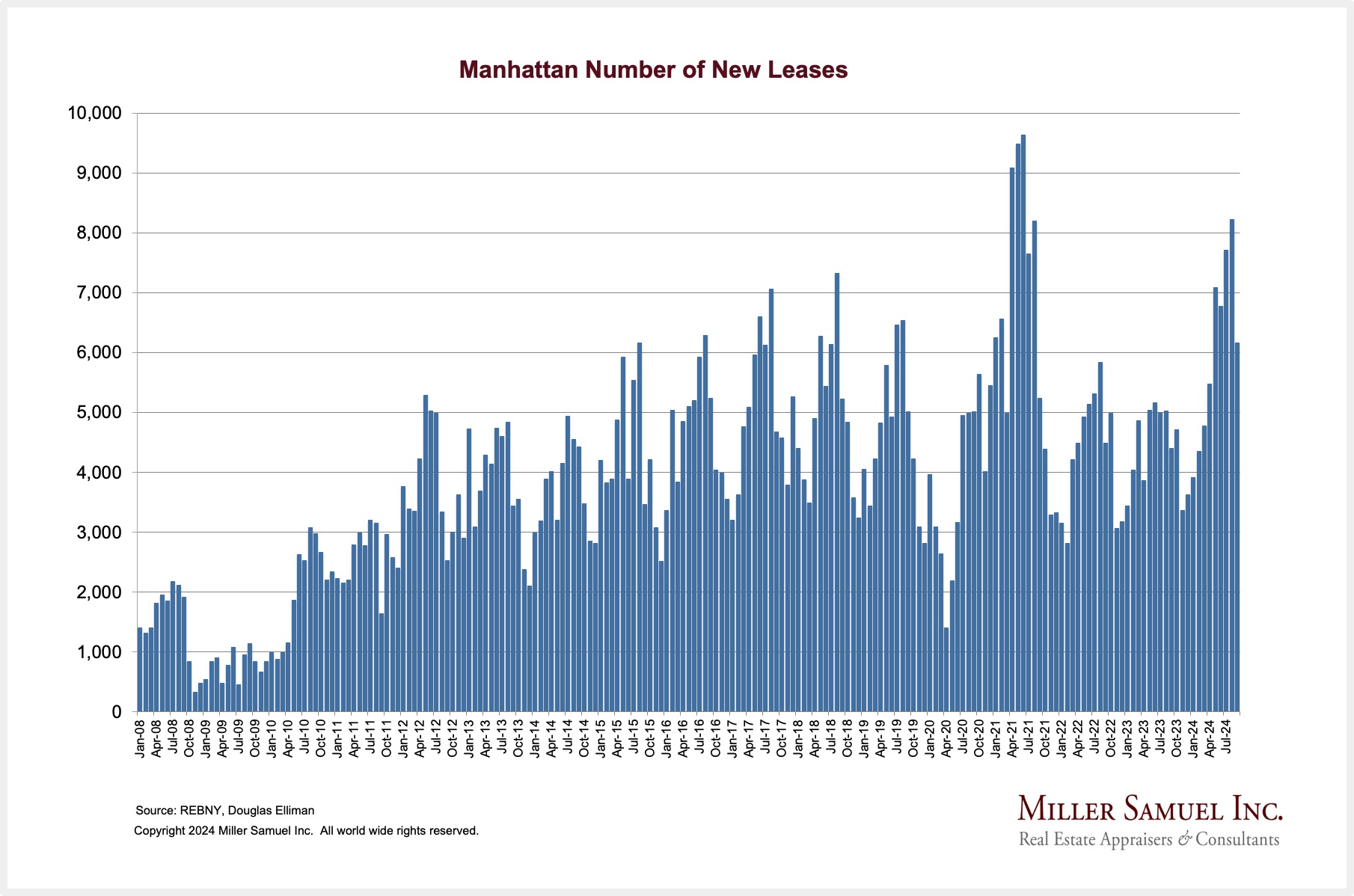

And new lease signings remain high as the market continues to see a lot of churn. I suspect landlords are still too aggressive at the time of lease renewal, which is pushing tenants out to find better deals and sign new leases.

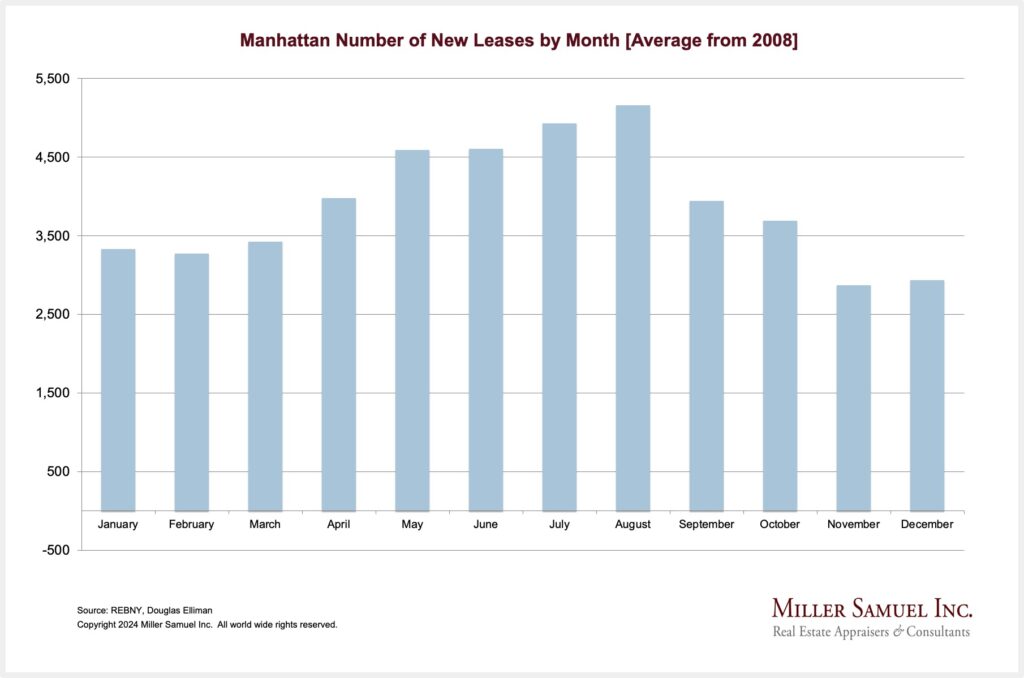

The 25% month-over-month drop in new lease signings in September is consistent with the average 23.5% August to September drop since 2008. Seasonality, baby.

Final Thoughts

National trends show rising rents but at a much lower rate. Apartments.com had a 0.9% annual growth rate. Rental price trends in NYC peaked in July, and price growth is going negative. Whether we are speaking about slowing rents or declining rents, the slide in mortgage rates is the key reason, as some consumers are shifting towards the purchase market again.

Did you miss yesterday’s Housing Notes?

Housing Notes Reads

- Average Rent in the US – Rental Market Trends [Apartments.com]

- NYC Apartment Renters Get a Break But Bargains Remain Elusive [Bloomberg]

- Rents drop slightly in September, but market remains tough for tenants [Crain's New York]

- Brooklyn sales “push the envelope” on pricing, cash deals [The Real Deal]

![[Podcast] Episode 4: What It Means With Jonathan Miller](https://millersamuel.com/files/2025/04/WhatItMeans.jpeg)