BEFORE WE GET STARTED TODAY, Housing Notes has been a constant in a rapidly changing real estate world. I’ve been publishing it weekly on Fridays since March 2015. Today, we start with a cleaner, easier-to-read interface that’s mobile-friendly. The behind-the-scenes interface is quite different, so it will take me a little time to adjust and improve your reading experience. Happy reading (and Happy Thanksgiving!!!) – JM

The real reason people go to stores like The Home Depot…

——————————————-

Did you miss last Friday’s Housing Notes?

November 10, 2023 | Be Curious About Housing, Not Judgmental

But I digress…

The Housing Sky Is Falling

h/t @ritholtz

Bloomberg TV – Yes. We Are In A Housing Crisis

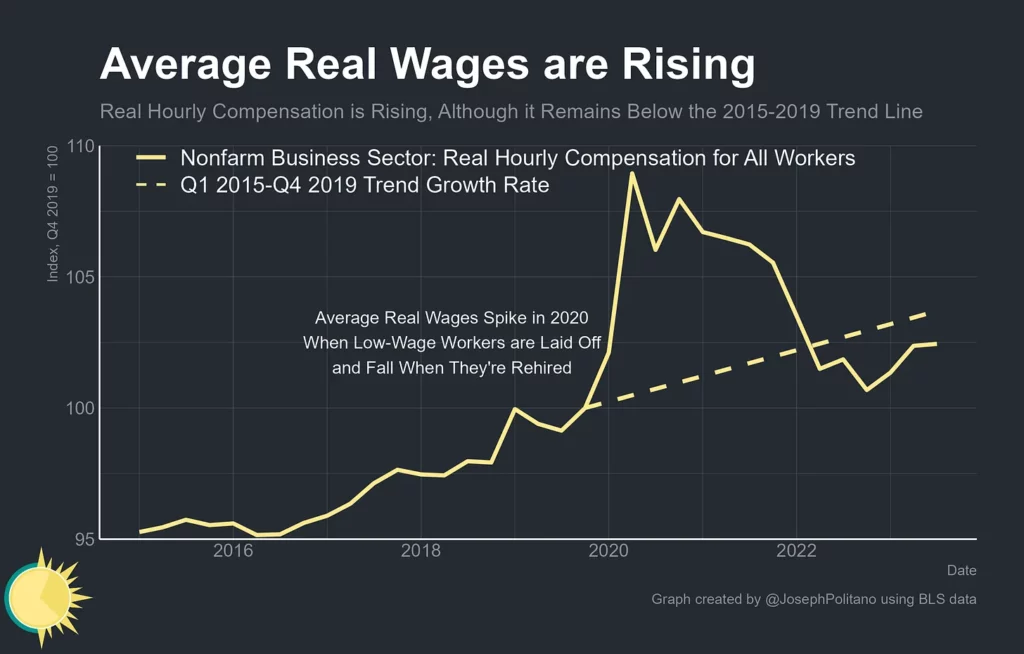

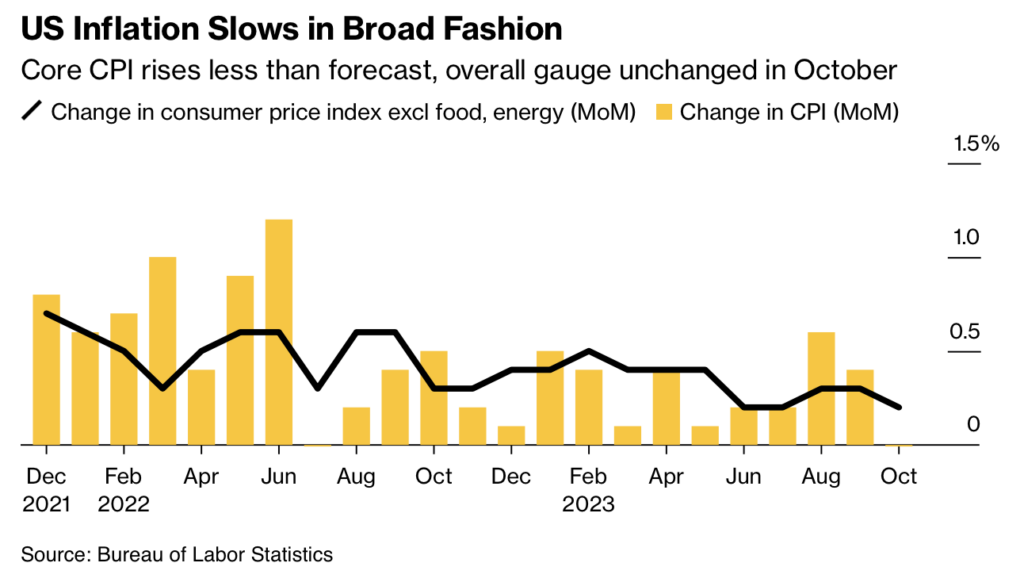

I got to join the gang at Bloomberg Surveillance on Tuesday morning. Always fun and smart. The focus seems to be figuring out what the exit of this era of tight housing inventory looks like and when rents will come down since inflation is tangibly falling.

My journey to the city for the Bloomberg interview: catching the 5:49 am train – waiting in the green room – and working my way up the guest list to go on.

Lisa Abramowicz pens a recap of her show’s morning guests covering inflation (which guides fed policy), which is really worth a read: Surveillance: Wall Street Exults ‘We’re Going to Win This Thing’

Wait for my complaint/joke at the end with Tom. Fun.

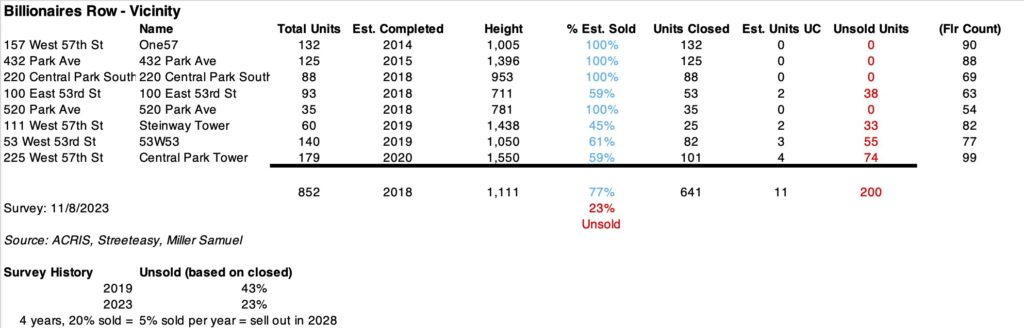

[Curbed] Ashes To Ashes, Dust To Dust, Manhattan Trophy Properties Are Not Selling

Back in 2019, I did an analysis for the New York Post that showed an unsold market share of 43%. It’s a little comical looking back at it, as several developers took the opportunity to criticize me. Given that NYC has some of the dirtiest transaction data, I thought my 2019 results were reasonably accurate. The developer comments in this Curbed article were the same theme. Ha.

Manhattan’s Trophy Apartments Are Gathering Dust

There just aren’t enough billionaires, and no one wants to live in Hudson Yards.

Based on these two efforts, this sub-market is selling about 5% per year for the past four years, moving from 43% to 23%. A 5% rate is more typical for re-sales than the concentrated marketing effort of a new project. The sales rate suggests Billionaires Row has another five years until all the sponsor sales are sold.

Bloomberg’s Justin Fox On Our Shrinking Office Space Per Worker

Justin Fox is one of my favorite writers at Bloomberg, especially on real estate. His piece shows how office space use is not normalizing:

Why Your Office Space Continues to Shrink

Despite more than a billion square feet of empty office space in the US, a return to roomier layouts and private offices does not seem to be in the cards.

But while remote-work percentages seem to have more or less stabilized, the office space squeeze continues. “We’ve seen for the past year a pretty consistent trend of average lease sizes being 20% lower than in the five years before the pandemic,” said Phil Mobley, national director for office analytics at commercial real estate data provider CoStar Group

In other words, even as commercial leasing costs have plummeted during the new Work From Home era, the amount of space leased per employee keeps shrinking. One would expect the sharp drop in leasing rates would enable the space per employee to expand. Yet, just the opposite is occurring. This is another sign that the office market will not revert to pre-pandemic leasing patterns.

[WNBC-TV] NYC Rents Are Down, But Not That Much

Highest & Best Newsletter: Beaches and Billionaires

I love this new Florida newsletter: Highest & Best from Oshrat Carmiel, formerly of Bloomberg News…

Beaches and Billionaires

Miami’s future as a money capital. Plus: Is Bezos paddleboarding?

Manhattan Move-Outs Brought $2.9 billion to Miami in 2021

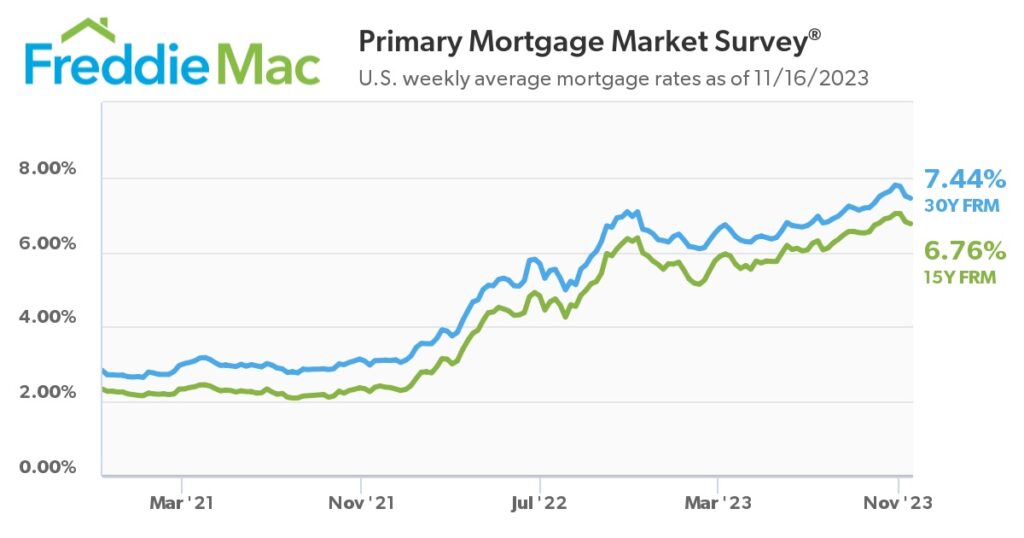

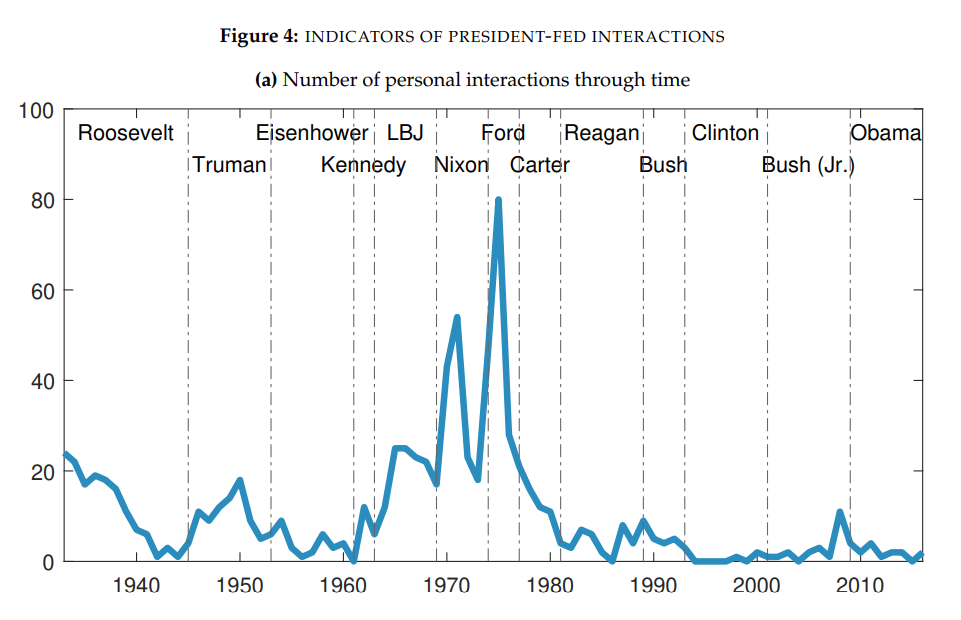

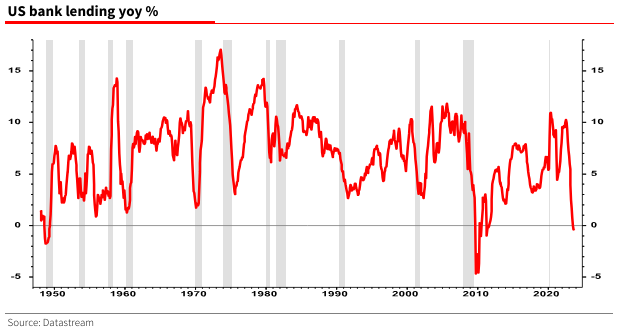

The Fed Forces Us To Cut A New Door To Get Out Of Our House

My friend Dan Alpert, managing partner of Westwood Capital, an investment bank, wrote a piece on the Fed’s impact on the housing market. In my view, they kept rates too low for too long during the pandemic and unleashed a housing frenzy that obliterated listing inventory. As a result, prices are rising despite mortgage rates more than doubling.

The Fed Has Put Our Housing Market in Jeopardy [NY Times]

Unfortunately, some of the actions taken by the Fed look increasingly like those of the guy who has painted the floor of his house starting at the door. We need to cut a new door to get out.

[A Price Theory] The Impact On Housing Prices From The Growing Number Of Class Action Litigations Against NAR, REBNY, And A Laundry List Of Brokerages

As legal counsels across the U.S. try to determine the impact on their real estate brokerage and MLS clients in the aftermath of the Case of Burnett v. NAR et al. decision, I have a theory on its eventual impact on housing prices. I am caveating this because I don’t know how the compensation part will play out. Pundits within the industry are reluctant to go out on a limb to speculate what will happen to the broker participation in the home buying process because no one knows, and many cases are coming to many courtrooms very soon.

I’m not interested in the nuances of the broker compensation line of discussion. I want to look at housing prices themselves using logic.

As I understand it, the recent decision in the Update in Case of Burnett v. NAR et al. class action was in favor of the seller not paying the commission of the buyer’s agent through the listing agent because the seller did not vet the buyer’s agent who usually works against their interest. So, let’s create an example scenario to illustrate how this could play out in the real world with what we know now. So here we go.

- By not paying the buyer’s agent commission, the seller saves $50,000 in this example.

- The buyer now pays the agent $50,000 (3%) as a commission (seems unlikely) but will likely offer $50,000 less than the seller would have otherwise collected at closing. The seller nets out the same with a lower price because of the lower commission paid.

- The property closes for $50,000 less, which is reflected in public records.

- Brokers and appraisers use public records with lower sales prices based on the change in commission methodology.

- Whether or not there is a buyer’s agent or the buyer pays any or no amount to a buyer’s agent, the buyer knows that the seller is not paying a $50,000 commission to the buyer’s agent and will offer a lower price.

- There will be a two-year gray area where the market transitions from the old way to whatever the new method.

This seems plausible to me. What do you think?

Closing Credits: An Unethical Way To Distort Pricing In The Market

This is mandatory reading for readers of Housing Notes – Brick Underground’s Closing credits seal the deal but can mislead the next buyer. This phenomenon occurs mostly in co-ops with ground leases or very high maintenance and becomes more problematic when the market slows.

Co-op boards that think a sale is too low and turn down the purchase are damaging shareholder equity under the guise of protecting the prices. When a property has been adequately exposed to the market, that’s the likely reasonable value. When a board turns down a legitimate sale often enough, the building develops a bad reputation as an unrealistic board, and sales agents take their clients elsewhere. Some buildings actively work around this by giving a closing credit – a needed dollar amount – to show higher prices in the building and essentially try to fool incoming buyers into offering more to prop up prices. I don’t understand how this is legal. It seems like a form of consumer fraud, no?

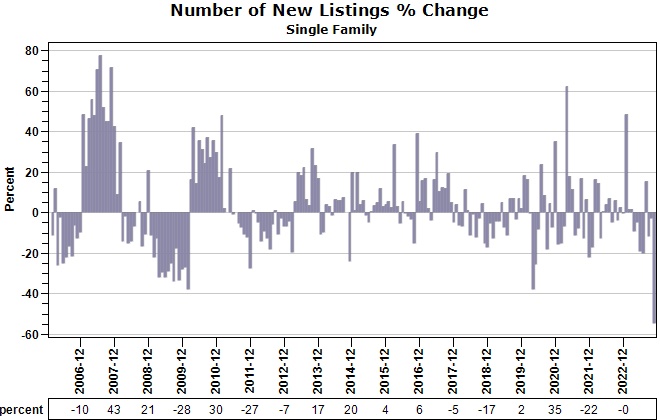

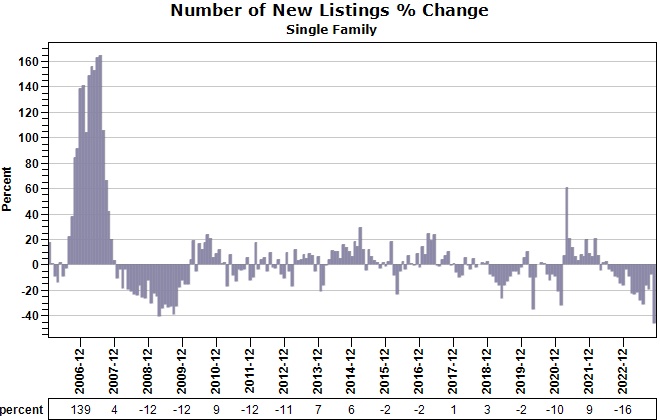

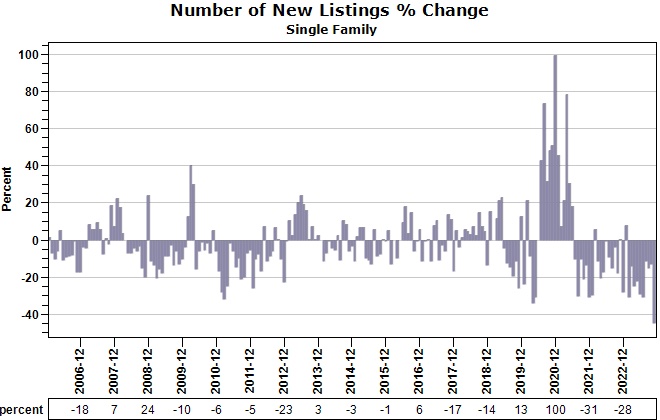

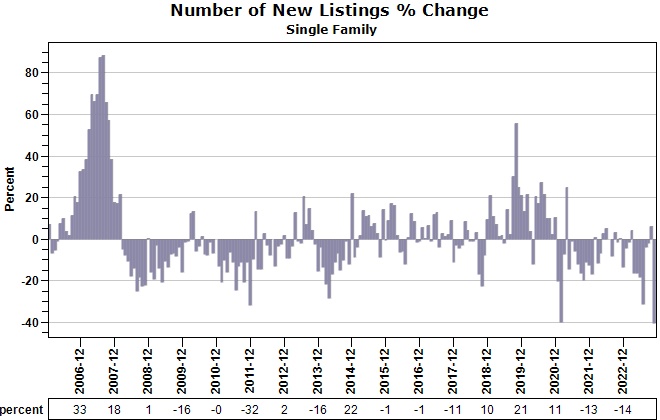

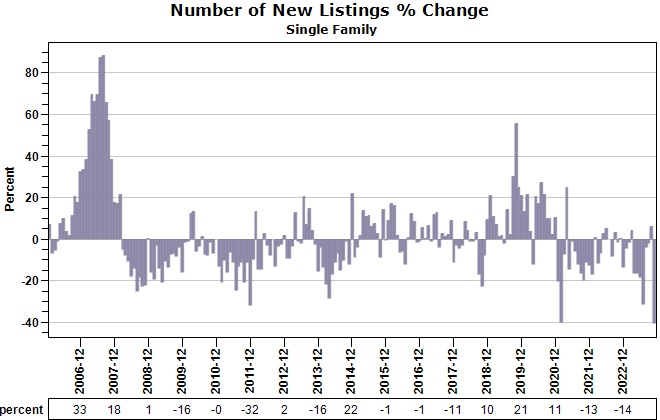

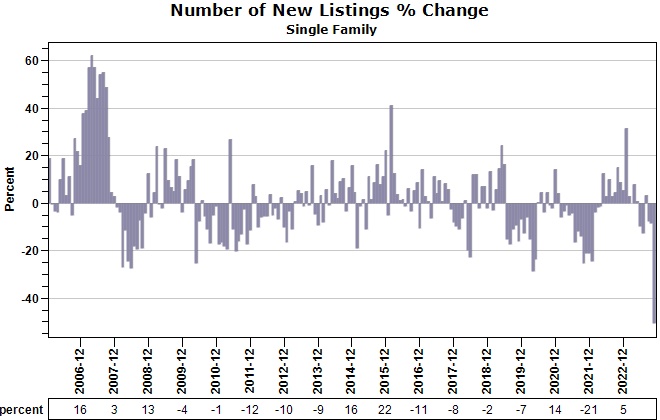

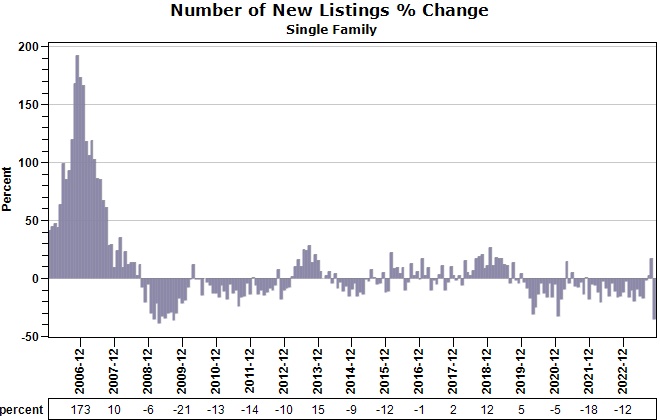

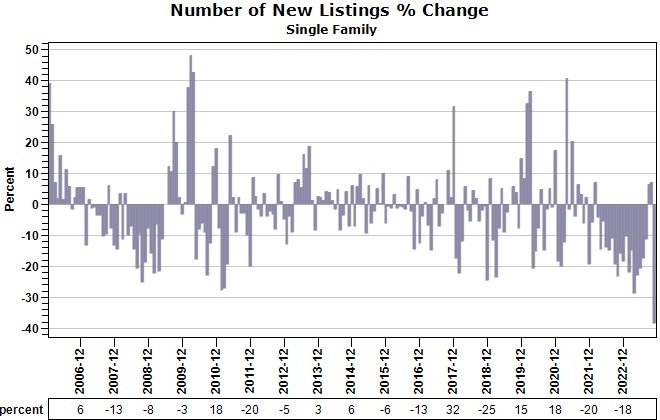

[ICE HomePrice Trends®] New Listings Are Tumbling

ICE Mortgage Technology has generously provided access to HomePrice Trends® so I can share the most up-to-date housing market trends across the U.S.

Now, my Housing Notes readers can send me chart requests, and I will try to create one that echoes it (If it interests me – remember, I make the rules here). So think big and send your chart ideas.

As I familiarized myself with their software, I looked at some mid to large cities for their annual percent change in new listings. Notice the last year on each chart – new listings are down quite a bit. This is keeping housing prices from correcting.

Bloomberg’s At The Money Podcast (ATM): The Best Way To Buy A House

I joined my friend Barry Ritholtz on his new podcast, At The Money (or cleverly, ATM). Masters in Business is still going strong, but he had a new idea – create a really good personal finance-focused show. We recorded this on Tuesday – it’s currently located in the Master in Business podcast feed but will be available in its own feed everywhere on January 1.

Crosby Stills Nash & Young’s ‘Our House‘ as the intro music!

At the Money Podcast: The Best Way to Buy a House

Reader Feedback: Bad Bunny

Last week’s Housing Notes referred to a $150K Bad Bunny rental. One of my readers had an issue with the price. Full disclosure: I have never listened to a full Bad Bunny song.

“Todo es superficial, nada real / Nada raro que el dinero no pueda comprar / Penthouse con vista al mar / Es lo único que tengo pa’ poder pasar.”

A reader shares his math…

If Bad Bunny is paying $150,000 for that apartment, he’s getting ripped off big time.

The apartment is currently on the market asking $18.5M. Let’s assume that’s what it’s worth. The cap rate math is easy –

$150,000 rent – $11,253 taxes – $7,654 common charges = $131,093 net rent.

$131,093 x 12 / $18.5M = 8.5% cap rate and that’s assuming the asking price. Chop the value to a realistic level and it’s even higher.

To put that in comparison, #4S in the building sold earlier this year for $3.95M and #3S (same layout) rented for around $18,000. Do the same math there and you get a cap rate of about 3.5%. Mid to high 3s is what I’ve been seeing in the market lately.

Either Bad Bunny is paying $150,000 which is way, WAY too much or, hopefully for him, he’s not.

Best,

James

james@yoreevo.com

www.yoreevo.com

Getting Graphic

My favorite housing market/economic charts of the week made by others

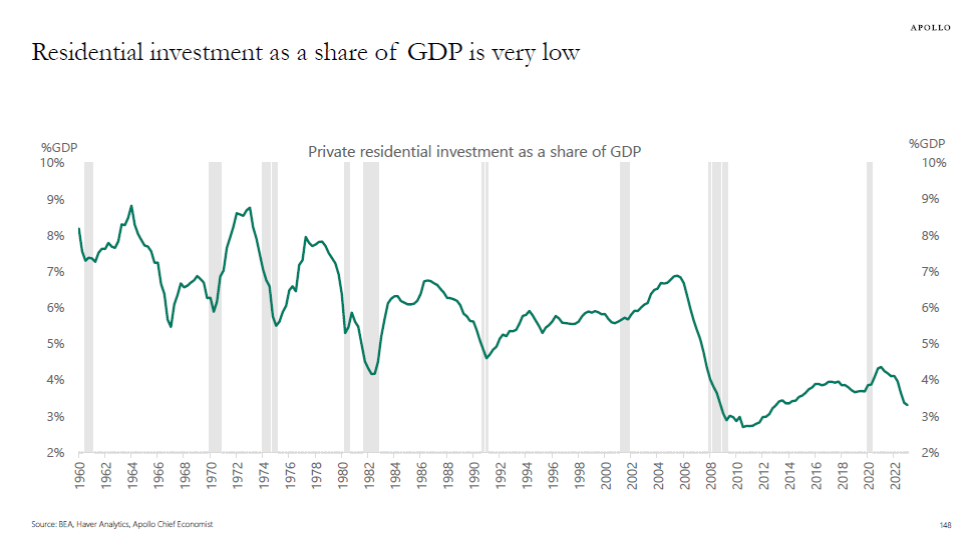

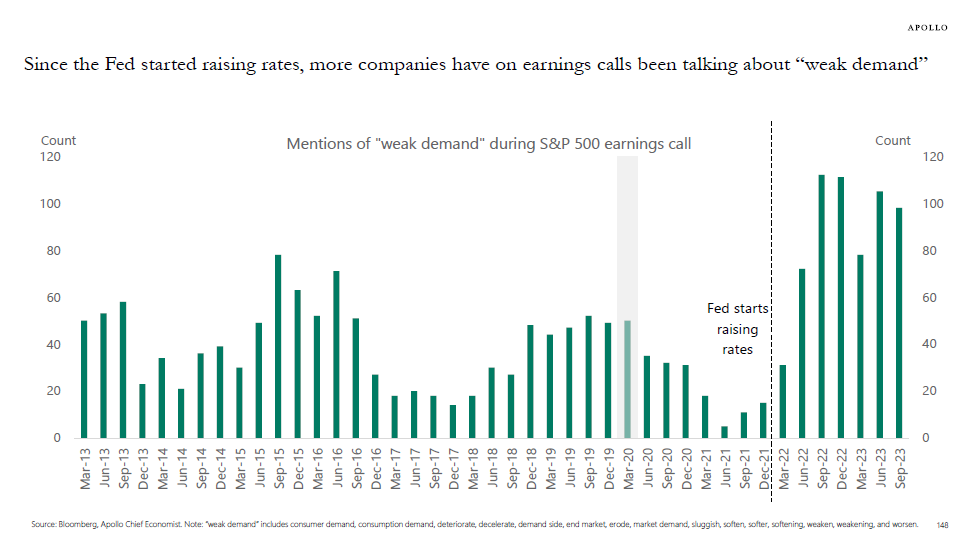

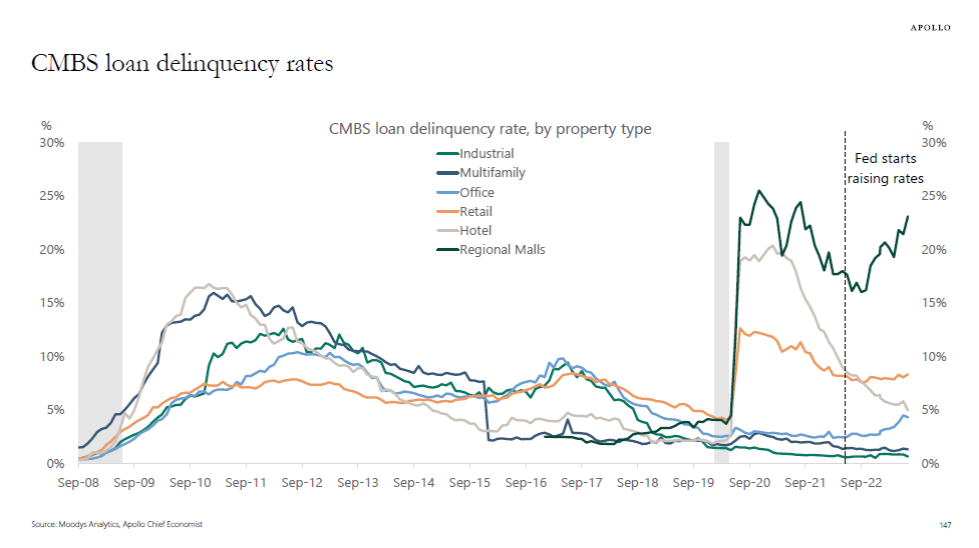

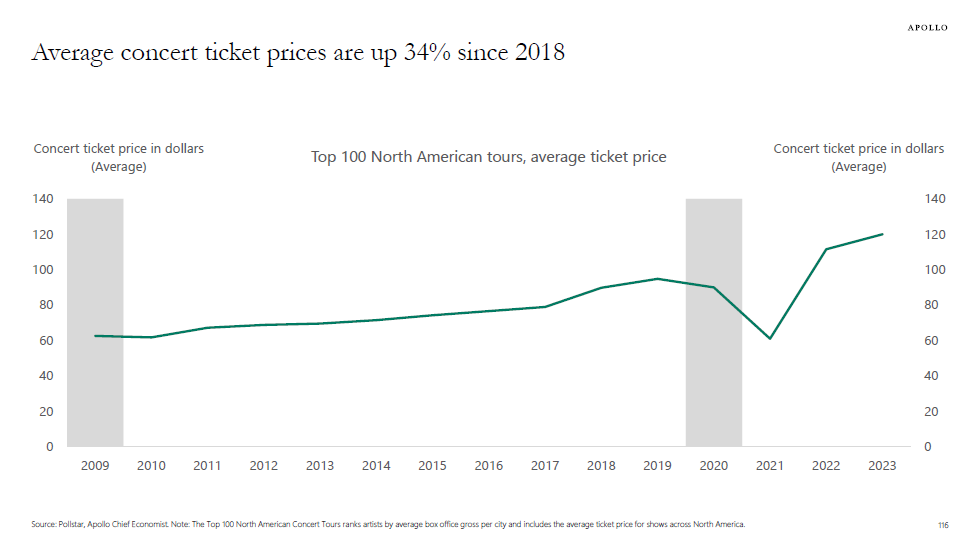

Apollo’s Torsten Slok‘s amazingly clear charts

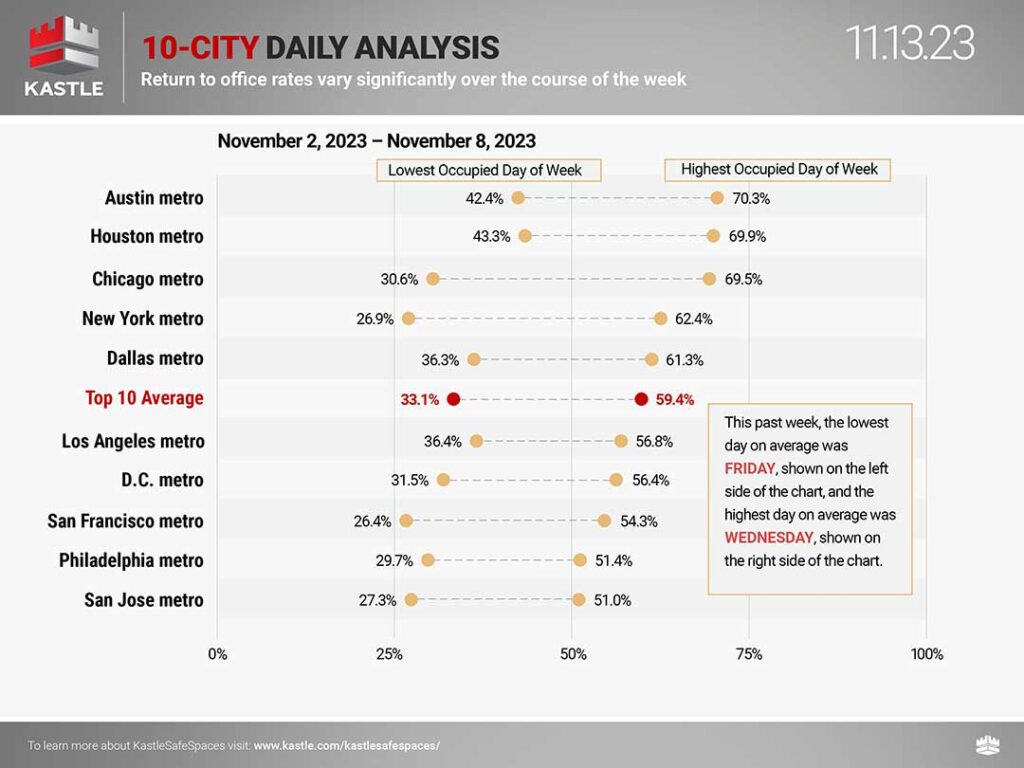

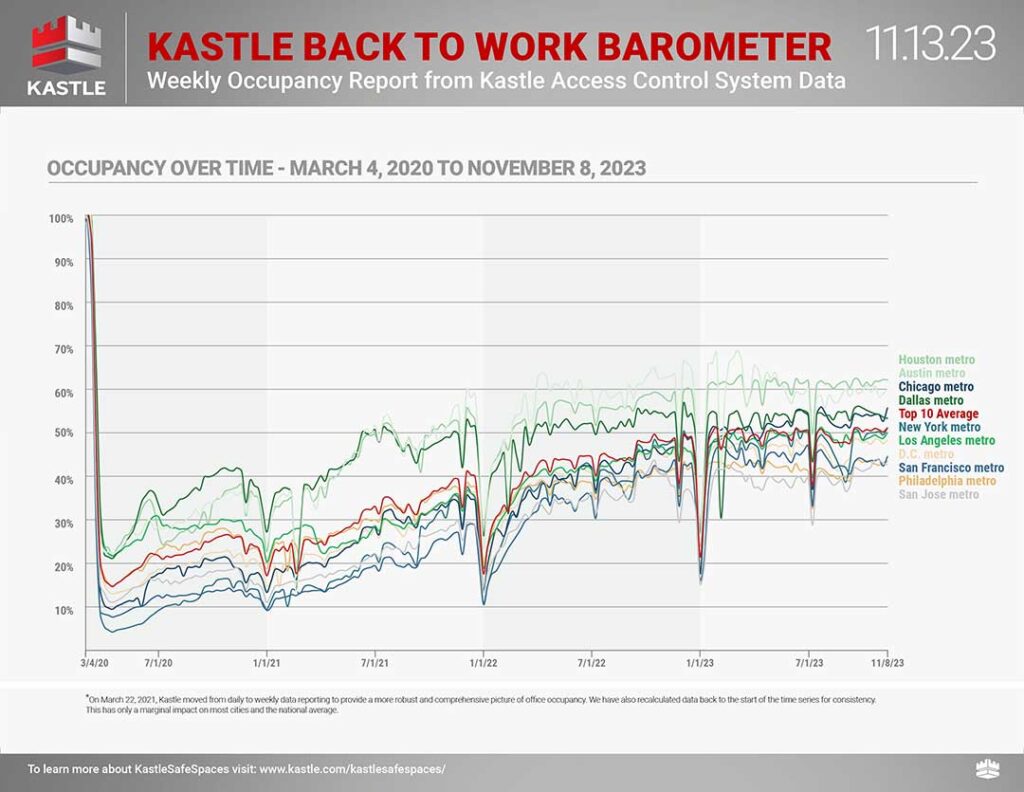

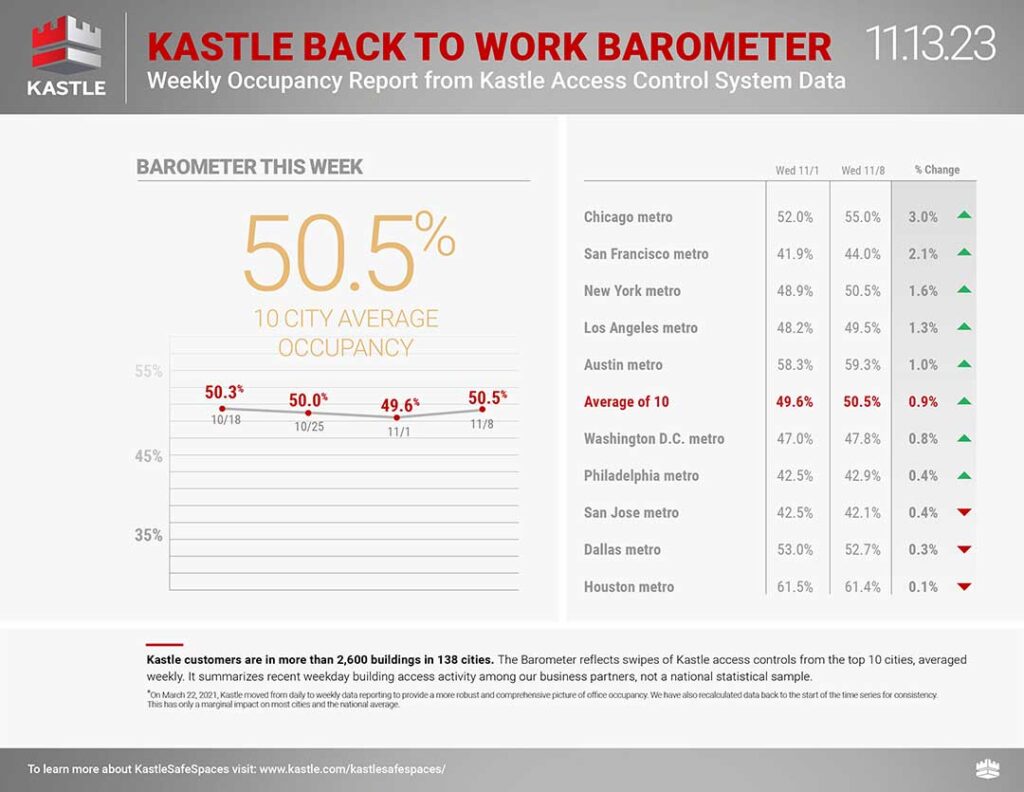

Kastle card swipe data charts

Remember that Kastle charts are overstating occupancy* because their pre-pandemic occupancy benchmark was 100%, which is incorrect (*measures card swipe activity as a proxy for occupancy).

My favorite random charts of the week made by others

Appraiserville

Sitting In Judgement Of Appraisers

Two agencies on the Appraisal Subcommittee (ASC) must get their ‘house’ in order (Pun Intended). Without real oversight, agencies can run amok, as the following cases illustrate.

Since Washington, D.C., is a regulatory environment that thrives on acronyms, here are some updates with my suggested acronym meanings:

- TAF (Taking Advantage Freely) has no oversight, allowing bad financial behavior like board meetings in Palm Springs and the president’s trips to exotic locations like Paris and Dubai, all paid for by hard-working appraisers who get no return on their investment in the industry. The ASC can only “monitor and review” TAF and was not given enforcement powers by Congress; instead, oversight was to come through grants ASC provided to TAF for funding. TAF figured out a workaround to be self-funded through the 7-hour bogus USPAP course appraisers are forced to take every two years, whether or not USPAP was materially updated (only 15 minutes of updates are probably needed, if any). This needs to change. For the uninitiated, TAF is the organization that wrote the bat-shit crazy letter, the chickenshit letter, and is the subject of an active investigation by HUD on whether USPAP promotes a lack of diversity in the appraisal profession (400th out of 400 occupations according to BLS in 2021).

- NCUA (Not Counting ‘Ur Attendance) got into trouble just before the pandemic, as noted in the attached inspector general report on the agency: Misuse of Official Time, Illegal Drug Use, Time and Attendance Fraud. They are generally pro-appraisers.

- FDIC (Facilitates Drinking Intoxication Club) is generally anti-appraiser and is now engulfed in a full-fledged scandal that broke this week. The Wall Street Journal has all the details in Strip Clubs, Lewd Photos and a Boozy Hotel: The Toxic Atmosphere at Bank Regulator FDIC Employees say sexual harassment, misogyny pervade federal agency tasked with ensuring stability of nation’s banks, driving women to leave

You can’t bury the lede from WSJ:

A male Federal Deposit Insurance Corp. supervisor in San Francisco invited employees to a strip club. A supervisor in Denver had sex with his employee, told other employees about it and pressed her to drink whiskey during work. Senior bank examiners texted female employees photos of their penises.

All of the men remained employed at the agency.

And there’s more from The Wall Street Journal:

FDIC Chair, Known for Temper, Ignored Bad Behavior in Workplace

FDIC Chairman Denies Being Investigated, Then Changes Testimony

‘What the Hell Is Going On at the FDIC?’ Lawmakers Grill Agency Chairman

Working for an agency while ruling over appraisers in D.C. sounds much more interesting than doing appraisals for a living.

OFT (One Final Thought)

A reminder to be nice.

Post by @psycohousecatView on Threads

Brilliant Idea #1

If you need something rock solid in your life (particularly on Friday afternoons at 2 p.m.) and someone forwarded this to you, you can easily, sign up here for these weekly Housing Notes. And be sure to share with a friend or colleague if you enjoy them because:

– They’ll get important life-changing advice at Home Depot;

– You’ll want to give advice at a Home Depot;

– And I’ll be nice.

Brilliant Idea #2

You’re clearly full of insights and ideas as a reader of these Housing Notes. Please share them with me early and often. I appreciate every email I receive, as it helps me craft future Housing Notes.

See you next week!

Jonathan J. Miller, CRE, Member of RAC

President/CEO

Miller Samuel Inc.

Real Estate Appraisers & Consultants

Matrix Blog

@jonathanmiller

Reads, Listens and Visuals I Enjoyed

- The Case for Two Fed Rate Cuts in Early 2024 Is Building [Bloomberg]

- The Share of Americans Who Are Mortgage-Free Is at an All-Time High [Bloomberg]

- Why does it cost so much to sell a house? [The Week]

- Mortgage Rate Buy Down – New Homes for Sale in Colorado [Lennar]

- FDIC Chair, Known for Temper, Ignored Bad Behavior in Workplace

- FDIC Chairman Denies Being Investigated, Then Changes Testimony

- ‘What the Hell Is Going On at the FDIC?’ Lawmakers Grill Agency Chairman

- How Two of America’s Wealthiest Vacation Spots Are Fighting to Free Up Homes for Locals

- NYC Mansion of Notorious Socialite Scammer Lists for Discounted Price of $55 Million

- The Clearest Sign Yet That Commercial Real Estate Is in Trouble

- 'A Bloodbath': The Reckoning For Rent-Stabilized Apartment Owners Is Starting To Set In

- What the $2 Billion Realtor Lawsuit Means for Homebuyers and Sellers

- The Crash to Come | Jonathan Mingle [NY Books]

- How Real-Estate Brokers Are Reacting to the Historic Commission Verdict [Wall Street Journal]

- Why Your Office Space Continues to Shrink [Bloomberg]

- Opinion | The Fed Has Put Our Housing Market in Jeopardy [NY Times]

- The Average U.S. Home Buyer Now Needs a Six-Figure Income [Mansion Global]

- Survey of Consumer Expectations [New York Fed]

- Chain Link Fences Separates Apartment Dwellers From Homeowners In Orlando, Residents Are Finally Tearing Them Down [Jalopnik]

My New Content, Research and Mentions

- 🏖️ Beaches and Billionaires [Highest and Best]

- Detroit’s Luxury Housing Market Is Revving Its Engines. Here’s Where to Buy. [Mansion Global]

- Sky may no longer be the limit for New York penthouses [The Times]

- ‘Zen’ Is at the Center of This $45 Million Los Angeles Spec Home [Mansion Global]

- Housing Finance Outlook Q4 2023 [The Institutional Risk Analyst]

- New York City Is in a Housing Crisis: Miller Samuel [The Global Herald]

Recently Published Elliman Market Reports

- Elliman Report: Manhattan, Brooklyn & Queens Rentals 10-2023 [Miller Samuel]

- Elliman Report: California New Signed Contracts 10-2023 [Miller Samuel]

- Elliman Report: Florida New Signed Contracts 10-2023 [Miller Samuel]

- Elliman Report: New York New Signed Contracts 10-2023 [Miller Samuel]

- Elliman Report: San Diego County Sales 3Q 2023 [Miller Samuel]

- Elliman Report: Orange County Sales 3Q 2023 [Miller Samuel]

- Elliman Report: Los Angeles Sales 3Q 2023 [Miller Samuel]

- Elliman Report: North Fork Sales 3Q 2023 [Miller Samuel]

- Elliman Report: Hamptons Sales 3Q 2023 [Miller Samuel]

- Elliman Report: Long Island Sales 3Q 2023 [Miller Samuel]

That One Big Thing

Appraisal Related Reads

- The housing market feels like leftovers [Sacramento Appraisal Blog]

- My Top 8 Search Criteria For Finding The Best Comps [Birmingham Appraisal Blog]

- Strip Clubs, Lewd Photos and a Boozy Hotel: The Toxic Atmosphere at Bank Regulator FDIC [Wall Street Journal]

- “Naked, Unarmed, and Alone?” [Appraisal Buzz]

- The housing market during a presidential election year [Sacramento Appraisal Blog]

- Bill outlawing home appraisal bias passes in Prince George's County [WUSA 9]

Extra Curricular Reads

- Evacuation Day, New York City's Forgotten November Holiday [Untapped New York]

- Has New York finally found a solution to its rat problem? [The Guardian]

- Man on Led Zeppelin IV Cover Identified 52 Years After Album’s Release [Pitchfork]

- Opinion | Space junk is out of control. Here’s why — and what to do about it. [Washington Post]

![[Podcast] Episode 4: What It Means With Jonathan Miller](https://millersamuel.com/files/2025/04/WhatItMeans.jpeg)