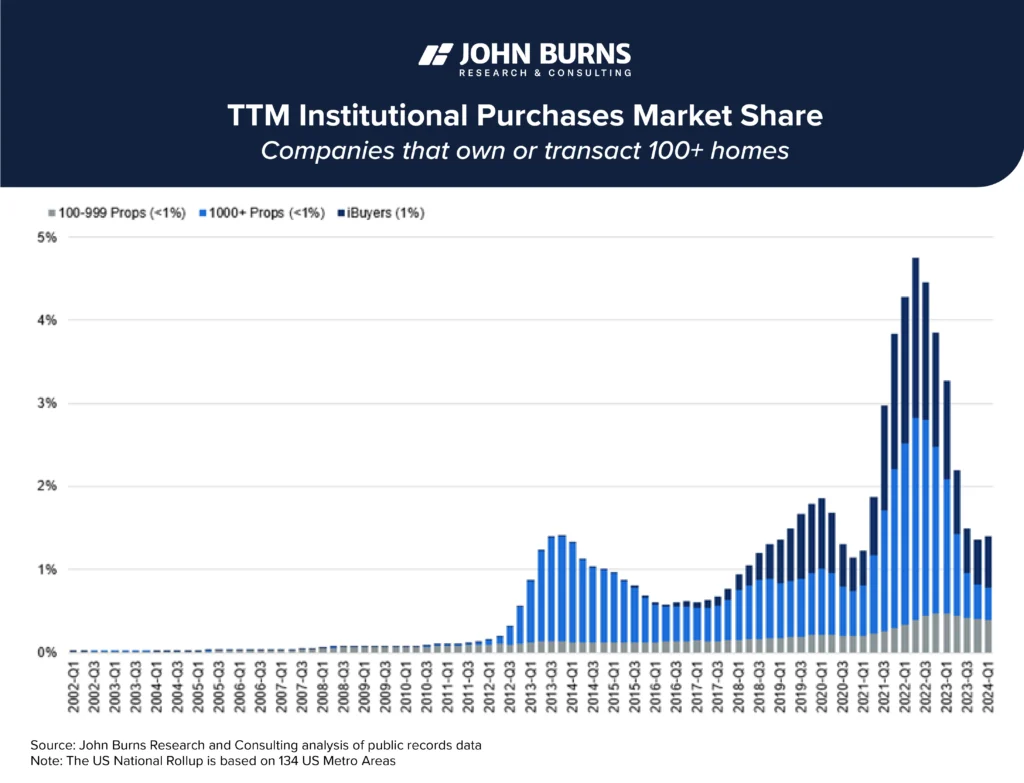

- Wall Street Accounts For ±1% Of Single Family Purchases

- Listing Inventory Remains Challenged As Rates Were Held Too Low For Too Long

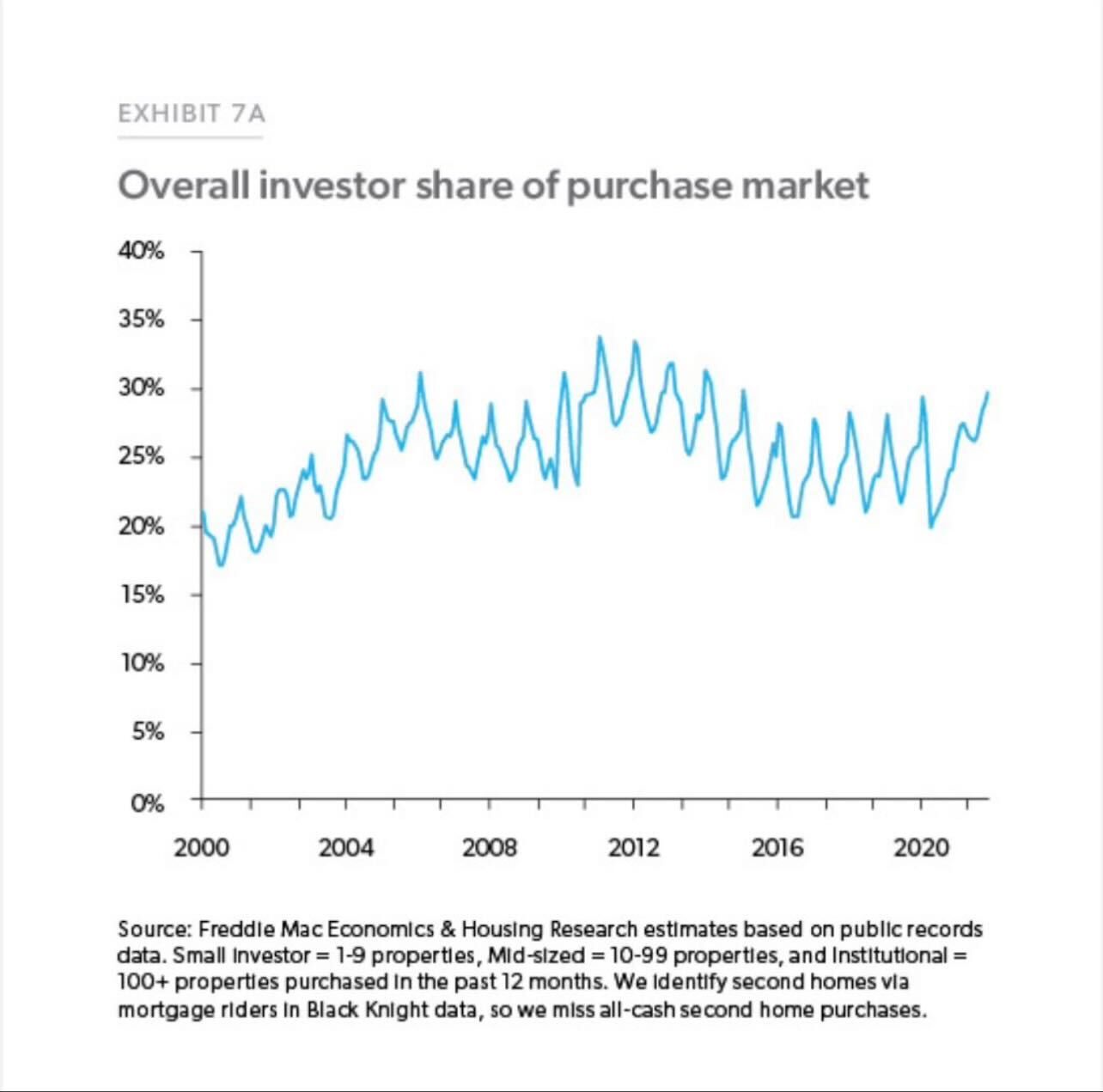

- Overall Investors Account For Less Than One-Third Of All Home Sales

Before the housing bubble burst around 2006, prices didn’t bottom until 2012, and Wall Street had already begun entering the single-family investors at scale. There was a lot of coverage of the phenomenon during the foreclosure crisis to the point where many housing market participants thought Wall Street was the dominant single-family player. In reality, institutional investors are an impactful segment of the market but have a surprisingly small footprint. Why does this matter?

With the chronic listing inventory shortage, it has been assumed that Wall Street’s entrance into the single-family rental market over the past decade has siphoned off a big chunk of supply, causing prices to rise to record levels. In reality, Wall Street hasn’t been the inventory-stealing boogeyman we all thought they were. The hard fact is that the Federal Reserve kept mortgage rates too low for too long during the pandemic, burning off existing supply and keeping prices elevated. Supply was eviscerated during the pandemic as we learned that too low mortgage rates made housing a lot less affordable for that very reason.

Doing The Math: Percentages Of Percentages

Part of the reason for the assumption of Wall Street’s massive presence in the single-family market is that total investors comprise less than one-third of home purchases. Many confuse these investors as representative of the Wall Street footprint in the single-family market. They’re not.

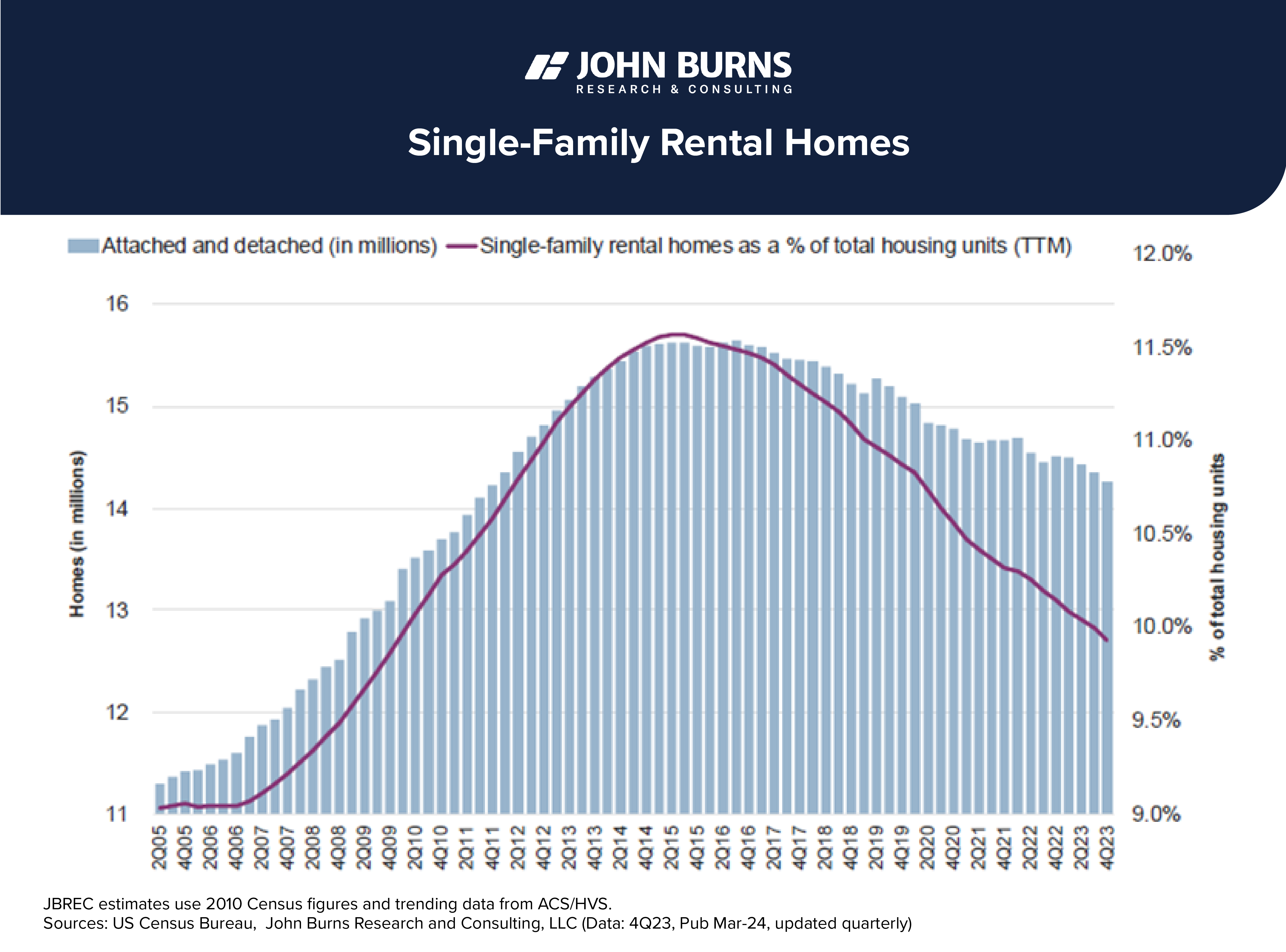

Roughly ten percent of U.S. single-family homes are rented.

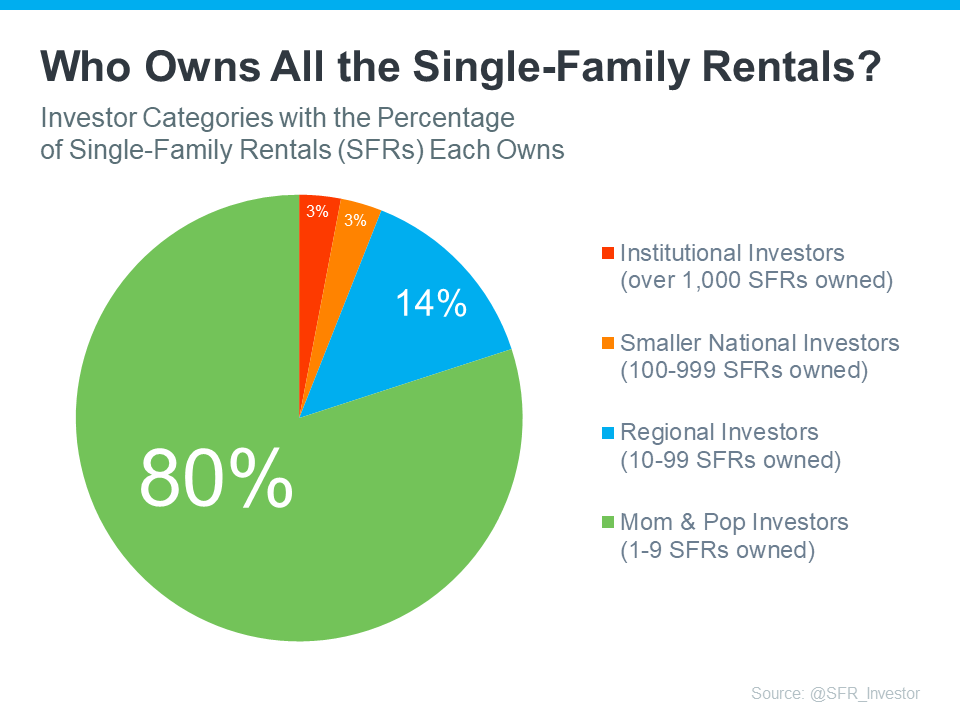

However, roughly 80% of the 10% of single-family rentals mentioned above are comprised of “mom-and-pop” investors. In comparison, institutional investors comprise only about 3% of that 10%, and that estimate might be on the high side.

Some housing market research suggests that institutional home buyers (Wall Street) could be less than 1% of single-family home purchases, possibly 1.5%.

Final Thoughts

Whatever it is, Wall Street is a low single-digit single-family rental market participant and not the boogeyman largely responsible for the lack of single-family inventory, making Main Street life more difficult (less affordable). That’s a whole other topic.

Last week, I got to speak with Jonathan Ferro and Lisa Abramowicz on Bloomberg Television, speculating on the inventory versus sales dilemma after Fed rate cuts kick in. Always fun to speak with them.

Did you miss Friday’s Housing Notes?

Housing Notes Reads

- Rent Going Up? One Company’s Algorithm Could Be Why. [ProPublica]

- Landlords Used Software to Set Rents. Then Came the Lawsuits. [NY Times]

- How RealPage transformed the apartment rental market [AXIOS]

- RealPage lawyer denies collusion with landlords to raise rents, 'open to solutions' to resolve DOJ lawsuit [USAToday]

- DOJ alleges RealPage helped landlords inflate rents [Roll Call]

Market Reports

- Elliman Report: Manhattan, Brooklyn & Queens Rentals 7-2024 [Miller Samuel]

- Elliman Report: Florida New Signed Contracts 7-2024 [Miller Samuel]

- Elliman Report: New York New Signed Contracts 7-2024 [Miller Samuel]

![[Podcast] Episode 4: What It Means With Jonathan Miller](https://millersamuel.com/files/2025/04/WhatItMeans.jpeg)