- Creating More Affordable Housing Is A Shared Policy Plank

- Voter Perception Of The Candidates Seem Split On The Economy

- Tariffs, Taxes, And Federal Land Comprise The Bulk Of Policy Initiatives

Clearly, the housing-related policies of the two presidential candidates have been an afterthought because of the smack-down nature of this election. This race has not been about policy and likely won’t be about policy up through election day. However, I was recently interviewed for an article on this topic, and I thought it was an excellent format to map out. In a few days, I’ll also be sharing an article about a small housing/election research project I completed as a follow-up to this post.

The Mansion Global piece called “What a Trump or Harris Presidency Could Mean for Luxury Real Estate” dived into the landmine of actual policy discussion on housing. Admittedly, the piece focused on luxury housing because that’s what the outlet covers, but it was refreshing to read.

They cited a UBS September report, just after the Fed’s 50-basis point rate cut. UBS interviewed 500 U.S. business owners making ≥$1 million annually and 971 U.S. investors with $1 million of investible assets and found this:

- Wealthy US investors and business owners split on which US presidential candidate is best for the economy

- Some 57% of wealthy investors plan to vote for Vice President Kamala Harris, while 43% favor former President Donald Trump; 47% of business owners favor Harris with 53% likely to vote for Trump

- Some 84% of investors and 83% of business owners consider the U.S. economy as the main election issue followed by social security

- Investor optimism about portfolio returns in the next 6 months is higher than in 2020

Now that I have that out of the way let’s look at some economic policy ideas with a vital disclaimer – presidential candidates often can’t achieve what they promise when elected.

Investors in the financial markets are optimistic about the future – the financial markets are the playground of our wealthier citizens, and it’s always important to remember that the stock market is NOT a proxy for the economy.

Feedback on Policy Issues Being Discussed

POLICY: Opening Federal Lands to Development To Build More Housing – Proposed by Harris and Trump

Lance Lambert of ResiClub on building more housing:

“The federal government owns about 28% of land in the U.S., amounting to more than 615 million acres including 80% of Nevada and 63% of Utah. However, only a small portion of the total land is actually suitable for development.”

The mantra from now on should be about building more housing and doing it intelligently – I realize that’s a cop-out answer until I explore “how” to build more housing intelligently, but that will be another blog post.

POLICY: Deport Undocumented Immigrants – Proposed by Trump

Aside from the lack of humanity in such an action, this will be inflationary. Bess Freedman, CEO of brokerage Brown Harris Stevens:

“A good chunk of undocumented immigrants are doing the work, including construction, that [Americans] won’t do,” she said.

POLICY: Add Significant Tariffs – Proposed by Trump

Tariffs are super inflationary because the U.S. consumer pays for them directly, and they will likely drive prices and mortgage rates quite a bit higher, which will slow home sales even further.

More inflation would affect the financial markets, noted Jonathan Miller of real estate appraisal firm Miller Samuel. “Titans of industry and the affluent are very focused on financial markets, and Fed policy has a significant impact on the financial markets,” he said. Ultimately, the tariffs are “not good for housing.”

POLICY: Ending The SALT Tax Earlier – Proposed by Trump

The Tax Cut and Jobs Act of 2017, also known as the SALT (state and local tax, not strategic arms limitation treaty), capped the standard deductions of the combination of property taxes and SALT taxes to $10,000. This has been a significant real estate issue in the Northeast and California, where taxes are higher, driving migration to the Sunbelt states. The law is due to expire in 2025. The expiration of the tax will take some of the wind out of the sales of excess housing demand that shifted to Sunbelt states like Florida and Texas once it expires.

POLICY: Raise The Capital Gains Tax From 20% to 28% – Proposed by Harris

Lance Lambert of ResiClub on the higher tax:

If Harris’s proposed increase goes into effect, “a lot of normal people won’t get hit but the wealthy, who have expensive homes, will get hit,” Lambert said.

Final Thoughts

Both candidates want to improve housing affordability by creating more housing. The question really is (if voters can impossibly consider policy differences and push the election toxicity aside): Which candidate will the voters believe can get any of these policies in place, do they understand the implications, and is it even possible to get any of them done?

If you think this election is polarizing, imagine this house in an HOA.

Broker Only Event: October 16, 2024, 10 am ET 53West53, Manhattan

You can confirm by clicking on the image or sending an email.

Did you miss Friday’s Housing Notes?

October 14, 2024

The Detroit Housing Market Has Transformed Into A Midwestern Brooklyn

Image: ChatGPT

Housing Notes Reads

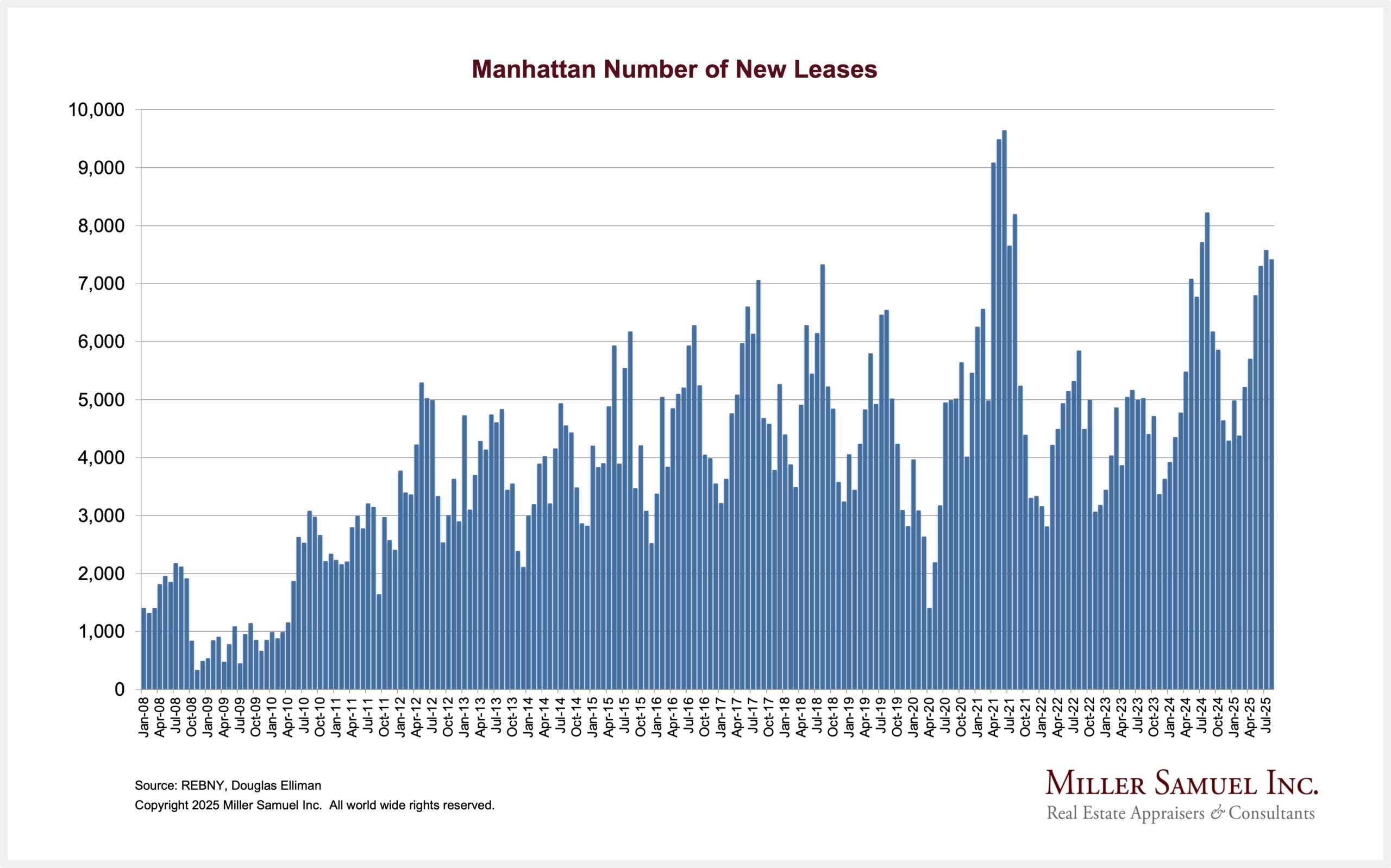

- NYC renters got some relief in September as median rents drop again [Brick Underground]

- What a Trump or Harris Presidency Could Mean for Luxury Real Estate [Mansion Global]

- UBS Investor Watch: U.S. investors and business owners divided on the presidential candidate best suited to manage the economy; majority of investors looking for portfolio adjustments before elections [UBS Global]

- 🌀Milton and Milestones [Highest & Best]

![[Podcast] Episode 4: What It Means With Jonathan Miller](https://millersamuel.com/files/2025/04/WhatItMeans.jpeg)