Move Sues Costar: When A Lawsuit Signals You’re A Threat

Move, owner of Realtor.com, filed a trade secret lawsuit against CoStar

CoStar making bold moves into the residential data space from commercial

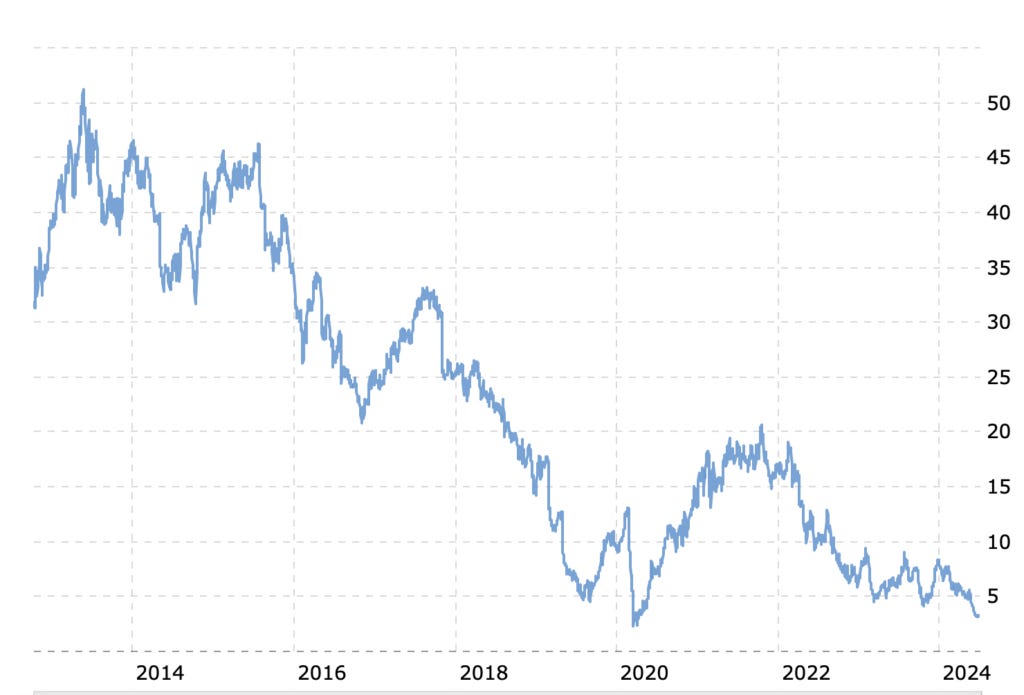

Data aggregator values have soared while the data providers have tanked

Costar dominates the commercial data world and has a well-earned highly litigious reputation for protecting its turf. Move, the parent company of Realtor.com, just sued Costar for stealing trade secrets. This trade secret lawsuit echoes a decade-ago dustup when Move sued Zillow. Zillow settled the suit for $130 million with no admission of guilt.

As we watch this play out, remember that data aggregators like CoStar are amassing power over data providers like Realtor.com with soaring valuations.

Data Provider Valuations Are Being Crushed By Data Aggregators

The real estate information space is ripe for disruption as the providers of data, like real estate brokers, are seeing their valuations fall while those of aggregators surge. A data provider generates data such as a real estate brokerage firm while a data aggregator is someone who re-packages it for another use such as CoStar, CoreLogic, etc.

Anywhere Advisors‘ (formerly Realogy) valuation direction is decidedly down despite their $176,229,465,000 sales volume in 2023 as the number 2 ranked US brokerage firm by volume.

CoStar‘s valuation direction has trended decidedly up over the last decade.

The Cast of Characters Circling Data Space

First, let’s talk about Move, the parent company of Realtor.com. They are not part of the National Association of Realtors, but they have licensed the REALTOR® trademark from NAR since November 26, 1996. No NAR membership dues go to operate the Realtor.com website. It is a completely separate company.

News Corp acquired Move on November 14, 2014. Within a few months, News Corp cleaned up the unbelievably awful Realtor.com website. Before the sale, Move was so full of duplicates and was missing many current listings making it unusable. I believe Move’s inept management enabled Zillow and Trulia to grow faster than they would have otherwise. In 2023, News Corp considered selling a large share of their real estate business to CoStar as CoStar was entering the residential data space.

Besides its litigious reputation, its CEO, who started the business in his parent’s basement, was portrayed as quite quirky in this Daily Mail piece, allegedly pointing a gun at his Zoom screen guest. Here’s a screenshot from the former communications director.

He also got into a legal feud with a fired employee over his critical Instagram account (the page has since been taken private).

Business Insider described the CEO as building a culture of fear in 2022:

Last year, 1,546 of the firm’s 4,200 US employees resigned or were fired, its largest exodus ever, in absolute terms — and the second highest on a percentage basis in the last seven years, behind only 2018, when CoStar had fewer total employees

As Costar successfully saturated the commercial data space, the next logical move was to expand to residential. In 2020 they acquired Homesnap. Since I work in the residential data world, it caught my attention when CoStar struck a deal with the Real Estate Board of New York (REBNY) in 2021 to power a Streeteasy Killer known as Citysnap, presumably powered by Homesnap’s technology.

REBNY and its members remain livid with the charges Streeteasy (Zillow) required after the brokerage community got complacent with the free service. When member broker websites went unused, the investment in them stopped and Streeteasy started charging for services on the once-free site. They used the same playbook as Zillow did with the brokerage community – win over the consumer and the revenue will follow from the brokerage industry. However, I was skeptical about the Citysnap deal since CoStar didn’t appear to have residential expertise and residential is a different world. Well, it’s been three years and Citysnap hasn’t caught on.

At about the same time the Citysnap deal was made with REBNY, CoStar acquired Homes.com, a great domain name but largely unheard-of listing brand in the space dominated by Zillow, Trulia, and Realtor.com. Since then, CoStar has been investing real marketing dollars into the Homes.com brand, spending $35 million in Superbowl advertising along with Apartments.com, the rental website they acquired in 2014.

Although CoStar purchased Apartments.com a decade ago, I have seen the ads but still hadn’t thought of the website as a go-to destination until I started seeing their published monthly economic and rental analysis and noticed them in recent Homes.com ads.

The Move Against CoStar Lawsuit

Move filed a lawsuit against CoStar last week, claiming that an employee went over to CoStar and brought trade secrets with him. The case is Move Inc v. CoStar Group Inc, U.S. District Court for the Central District of California, No. 2:24-cv-05607.

Some thoughts on the lawsuit:

The CoStar CEO called the lawsuit a ‘PR Stunt’ and given his litigation experience, he comes across like this litigation doesn’t worry him.

“Effectively, you create a bogus story and you use a relatively junior person as a pawn and you get a story out there,” Florance said. “And the question is why? What is their strategy with that?

I believe the Homes.com brand boost from their advertising spend has got Move worried but not in the extreme sense inferred by the CoStar CEO. After all, Move ended up getting $130 million for their efforts a decade ago when they sued Zillow for the same thing.

The Costar CEO claimed that Homes.com has 156 Million unique monthly visits while Realtor.com has 72 million. Using Semrush to look up traffic counts, Zillow had 295 million unique monthly users (Trulia only had 28 million) in May. Yet Realtor.com had 107 million and Homes.com only had 52 million. I’m not sure of CoStar’s traffic resource the CEO uses, but regardless, either website is either a distant second or third from Zillow for now.

As CoStar Seeks Residential Data Dominance, Will The Consumer Benefit?

The stakes are getting a lot higher for the data players in the residential data space. The residential market has a lot of big and getting bigger players like Black Knight, Reonomy, ATTOM, and CoreLogic, as Costar moves into what was settled territory. Initially, this could help consumers with more and higher quality data choices but I worry about the expected consolidations and the higher cost of these services in the future.

Did you miss Friday’s Housing Notes?

July 5, 2024