Time to read [5 minutes]

- Housing Narrative Has Shifted From Sellers’ Strength To Buyers’ Weakness

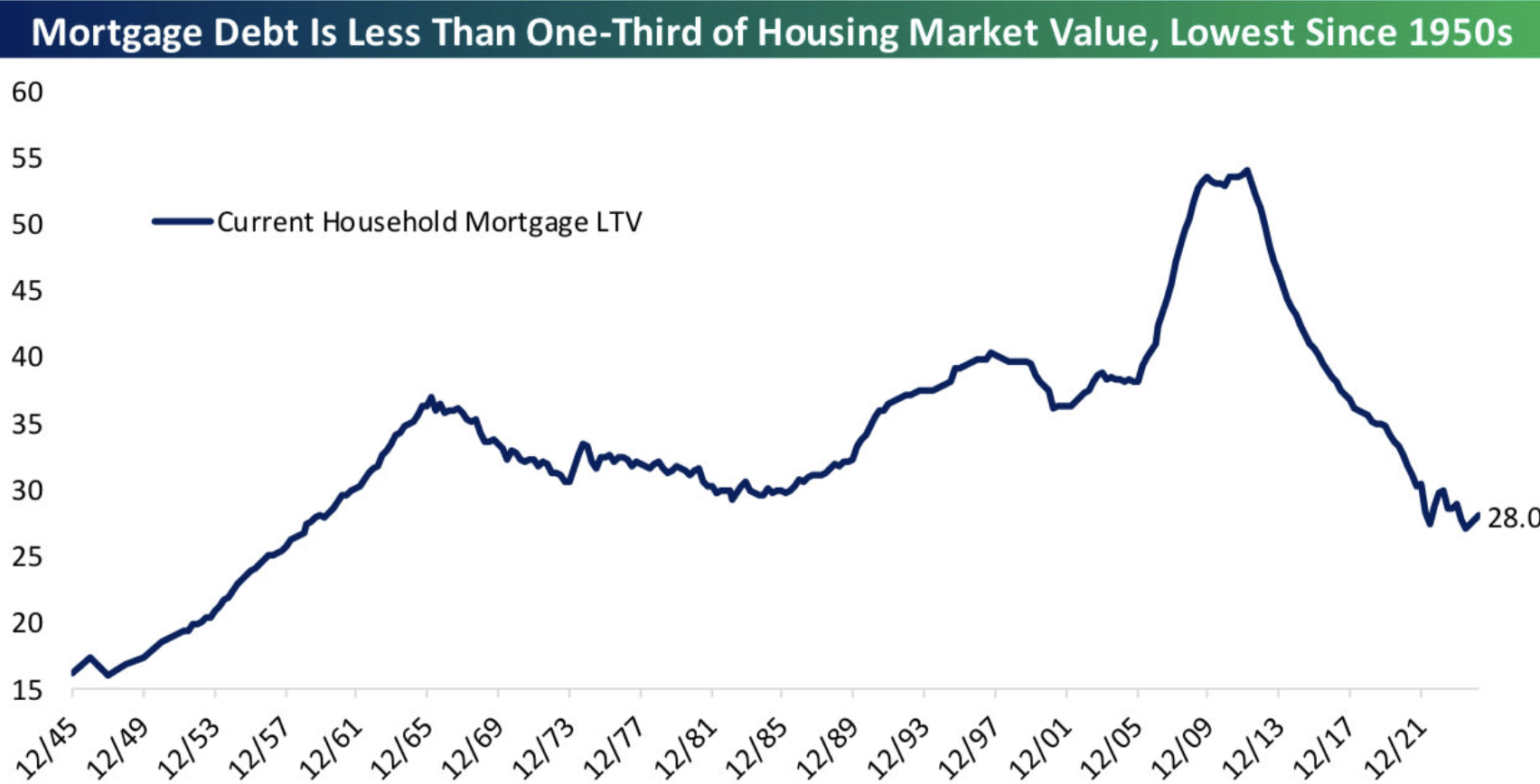

- Home Equity Has Surged Due To Rising Prices

- Distressed Real Estate Remains A Rounding Error

There are tons of studies coming out now that we’re seeing more housing markets showing price declines. Incidentally, there is no national housing market. The narrative has shifted from talking about the seller’s strengths to talking about the buyer’s challenges. More on that later. Right now, the share of declining US housing markets seems to be about one-third. It’s certainly interesting, but ultimately it is doomscrolling fodder for real estate nerds. Home equity is piled up to the rafters, aided by once soaring housing prices. The build-up has created a massive buffer for homeowners who may need to sell, yet most are not underwater. Foreclosures and short sales are tiny rounding errors, yet credit conditions remain tighter than pre-pandemic. While weaker sales levels are real, reporting on it seems to be over-shilling a sense of dread in exchange for clicks.

Perspective: Pre-2021 Sellers Versus 2025 Buyers

I’ve been a reader at Epsilon Theory for years, even though much of the content focuses on financial market narratives rather than housing. Admittedly, I struggle to multitask when reading their content. I need to concentrate, which is tough to do when doomscrolling. Ha. And I tend not to think of the housing market as a stock or “trading” opportunity with a bid-ask perspective, but rather as a usable asset. It’s a slow-moving and lumbering (today’s favorite word) asset.

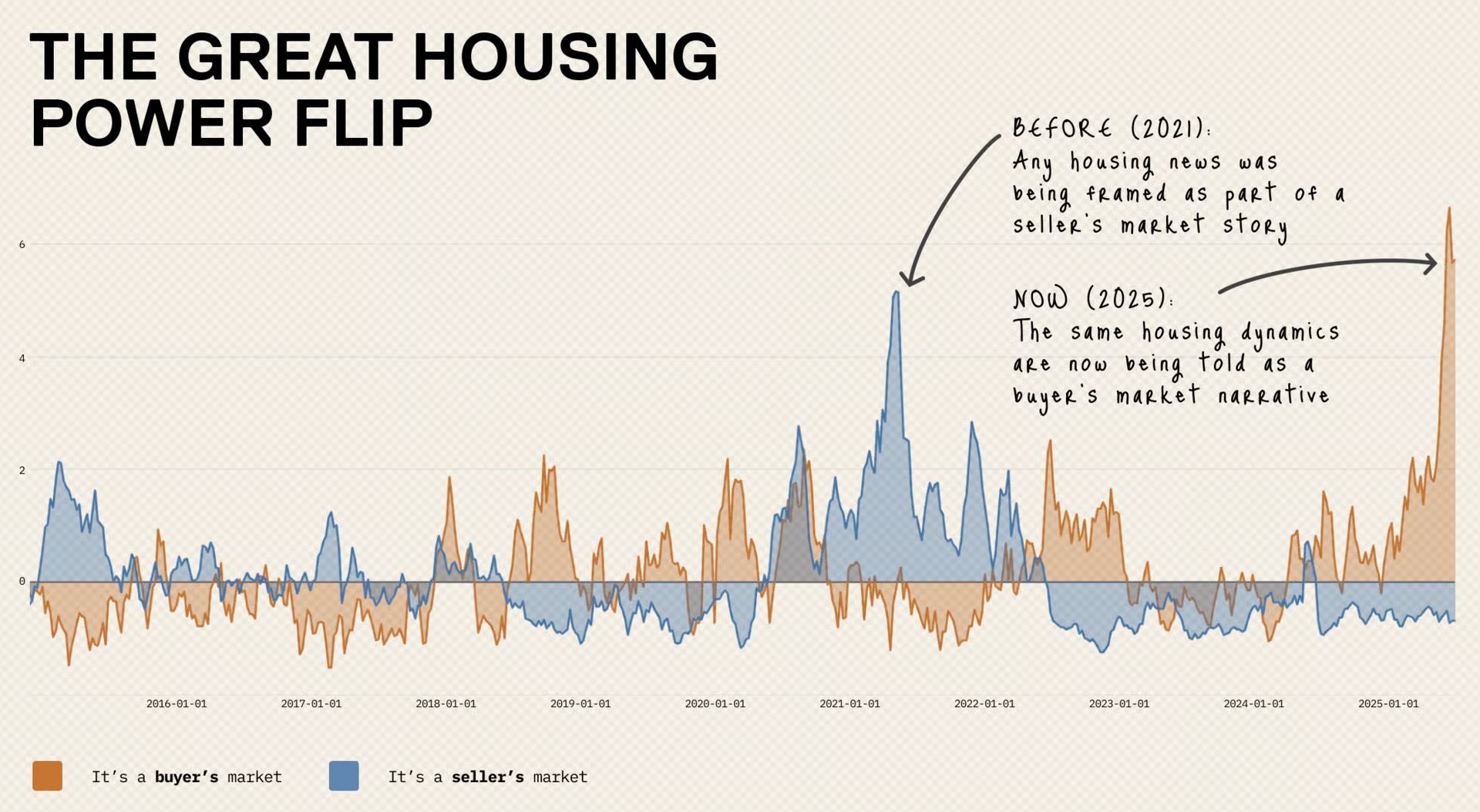

In their recent publication, The Housing Market Truth (in Five Cool Charts), the shift in housing narrative impacts how we perceive the housing market. Most of us likely have the idea that our perspective on the housing market never changes. But it does. The recent rising narrative of “one third” of housing markets are declining can be unpacked. What if we said that “two-thirds” of housing markets were rising? Using the same data, but a different narrative is being shared. My pushback isn’t an exercise in the “power of positive thinking” either. I’m not even talking about the idea that housing is local and we shouldn’t think of it as a national entity.

Final Thoughts

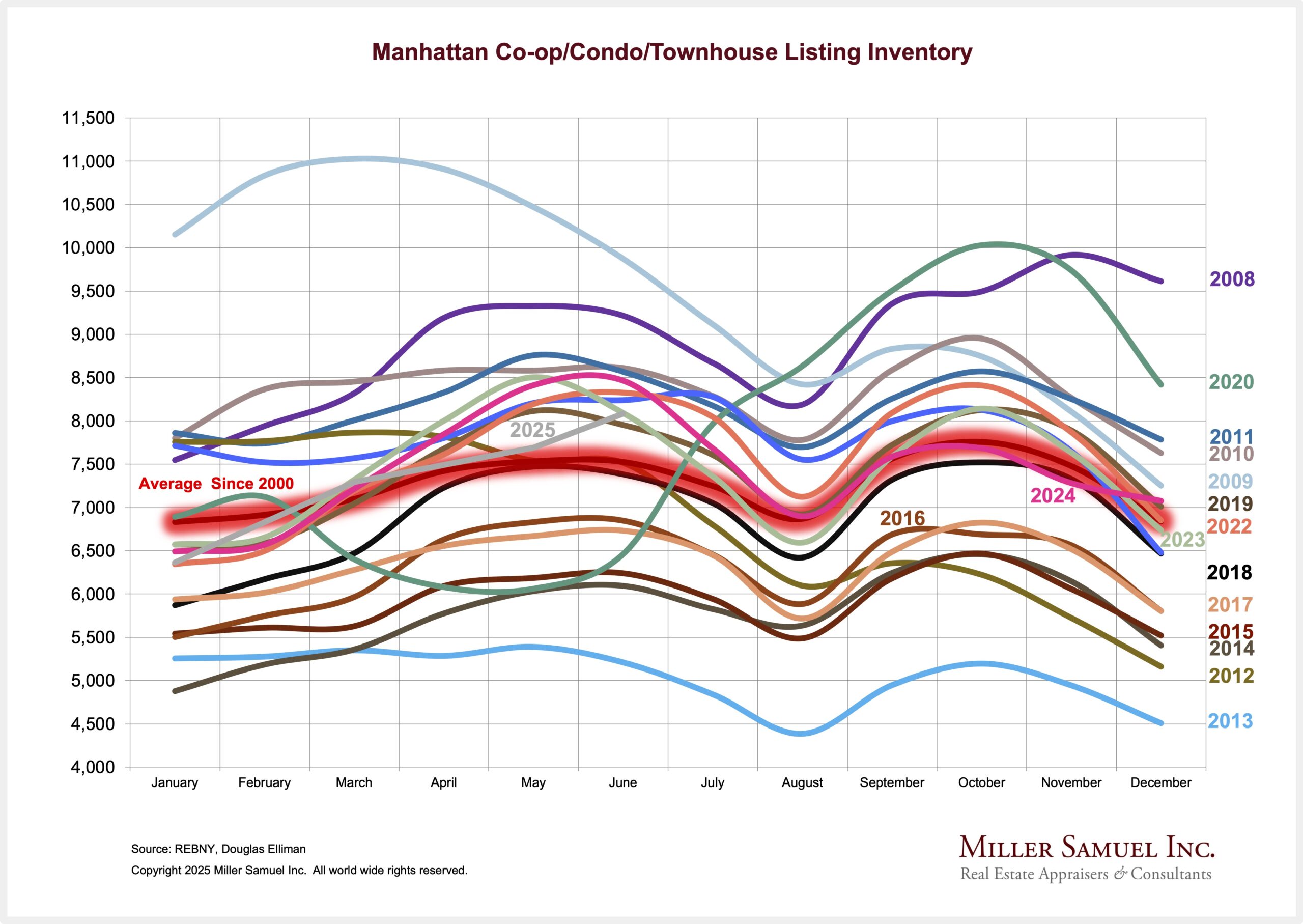

I don’t think I am making too much of all of this. It’s one thing to read and research the housing market, and it’s quite another to understand the consensus narrative. The current housing market trend indicates a growing share of markets with softening prices, resulting in more sellers than buyers. I get it. Clearly, inventory is rising in many markets, with some rising more than others.

What I am interested in is understanding that the narrative has pivoted sharply from talking about the sellers’ strength to the buyers’ challenges, a.k.a. affordability. The uncertainty we’re experiencing right now is a wet blanket that weighs heavily on our minds, an emotional burden for market participants in the housing market space. Did I just say that?

The Actual Final Thought – I’m down with the tap.

HGAR’s IMPACT: The Member Experience

I’m excited to speak at IMPACT: The HGAR Member Experience on September 29. I’ll be joining real estate professionals from across the region to explore what’s next in the housing market, economic opportunities and building community. Join me and be part of the conversation that’s shaping what’s next. Learn more and register.

[Podcast] What It Means With Jonathan Miller

The My Implicit Guarantee episode is just a click away. Podcast feeds can be found here:

Apple (Douglas Elliman feed) Soundcloud Youtube

Monday Wednesday Mailboxes, Etc. – Sharing reader feedback on Housing Notes.

August 11, 2025: Some Critical Thinking About The Great American Mortgage Corporation’s Implicit Guarantee

- Did you see the very explicit and detailed work of Brad Case on LinkedIn ? He suggests a substantial infusion of private capital would be needed and very unlikely plus as you know without the implicit guarantee rates would rise and no one will buy the GSEs without this guarantee or else a much lower price. With a partial guarantee rates would rise as you know. It makes you wonder if Trump understands anything about capital markets? Does he know a lower Fed discount rate (ST money) will not lower mortgage rates?

- Fannie doesn’t just want us to be data collectors. They would also like us to scrub the data for all the errors and inconsistencies in the MLS, and also to categorize the data in detail to help train their AI learning. Thanks for always having useful information, and for making me laugh.

- Spot on.

- Both Bills are wrong about interest rate effects of privatizing. Rates will rise because of the corp duty to shareholders and simply because they “can” at that point, at a minimum in short to mid term. And you are so right; we don’t need that while the economy is on a precipice by sane accounts. Thanks for your quality work.

Did you miss the previous Housing Notes?

August 11, 2025

Some Critical Thinking About The Great American Mortgage Corporation’s Implicit Guarantee

Image: X/Twitter

Housing Notes Reads

- Mortgage Debt Has Peaked. Why Has the Share of Homeowners with a Mortgage Fallen to a 13-Year Low? [Urban Institute]

- Cotality: Annual Home Equity Declines $4.2K on Average as US Home Price Appreciation Slows [Cotality]

- The industry leaders dogpiling on Zillow [Real Estate News]

- Why 6% mortgage rates will reignite the housing market [Housing Wire]

- Art in NYC's Post-COVID Commercial Real Estate: Everyone's a Critic [Commercial Observer]

- What’s happening with Manhattan’s luxury market? [The Real Deal]

- Reaching a turning point, US apartment forecast shows demand outpacing supply by year-end [Co-star]

![[Podcast] Episode 4: What It Means With Jonathan Miller](https://millersamuel.com/files/2025/04/WhatItMeans.jpeg)